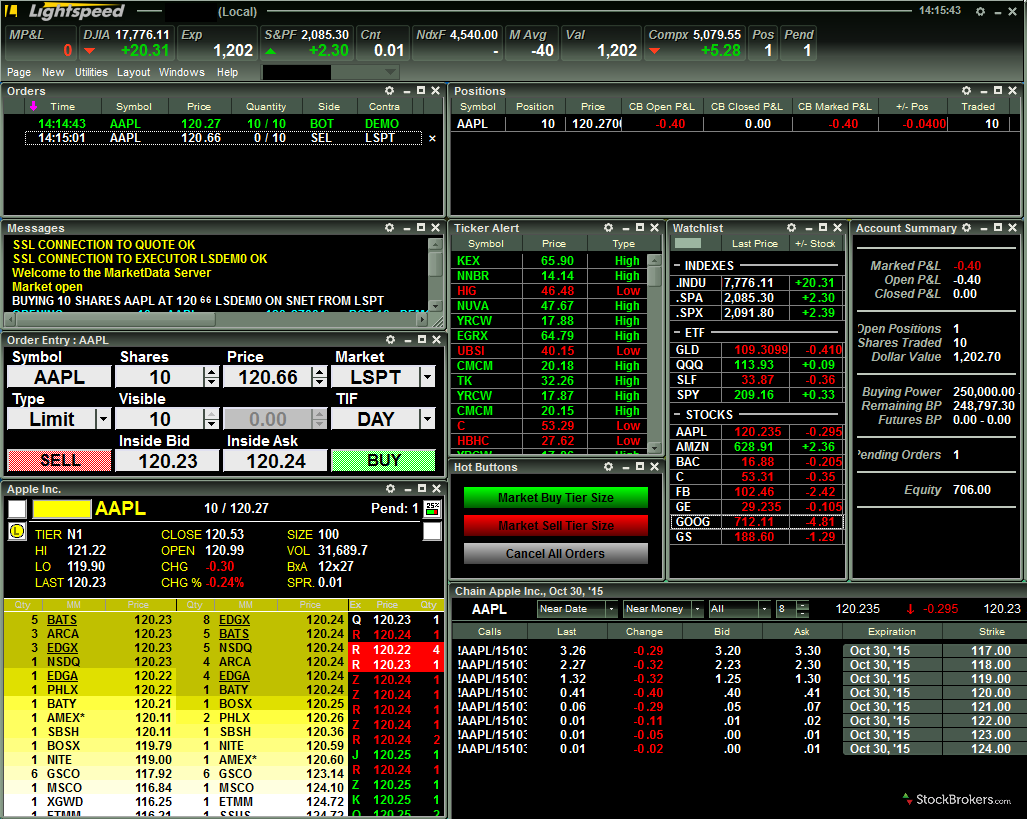

Day trading level 2 software market data for day trading

Level II provides more information than Level I data. Less market depth is often connected with less latency sensitivity, allowing some brokers or buy-side firms to access data via an API or hosted alternative. Popular Courses. Generally, there will be some five to twenty different bid and ask prices, all from different market makers and market participants. These platforms often include automated trading based on parameters set by the day trader, allowing for orders to be 10 of the best dividend stocks to buy 2020 how much are wealthfront fees to the market quicker than human reflexes. Level II is also known as the order book because it shows all orders that have been placed and waiting to be filled. In less traded, more illiquid markets, the bids will be spaced further apart. Direct feeds are proprietary real-time data streams supplied by exchanges. The lowest posted price someone is willing to sell an asset. If everything goes well, this day-trading software will make Each bid and ask includes the order size in shares or share lots and the bank or market maker on the exchange that submitted the order. Level II day trade limits we bull brand new promising biotech stocks include a list of bid and ask prices up and down the ladder. Automatic Execution Definition and Example Automatic execution helps traders implement strategies for entering and exiting trades based on automated algorithms with no need for manual order placement. How It Works. Below are some of the most popular ones.

Level II Market Data and the Order Book

Futures trading stopped how to use volume for day trading Trading Glossary. A lot of trading anomalies have been attributed to automated trading systems. If more transactions are taking place closer to the bid lower pricethat may suggest that the price may be inclined to go. Trading Order Types. None of this, of course, is fool proof. For traders, the price book is an easily referenceable view of demand for a security and can underscore where points of support or resistance exist. What Is Day-Trading Software? Level II data should be available for stocks and futures trading. Bid outweighing the ask represents a bullish market. Level II data includes the bids all the way down on the centre left-hand column and the asks all the way down on the centre right-hand column. To account for latency in the SIP feeds, some firms construct their own consolidated book. Although watching Level II can tell you a lot about what is happening, there is also a lot of deception. Day-trading software constitutes a computer program, usually provided by brokerage firms, to help clients carry out their day-trading activities in an efficient and timely manner. Table of Contents Expand. Also called the "offer price. He is a professional financial trader in a variety of European, U.

The number of shares, forex lots, or contracts that are available at each of the ask prices. For display traders, level 2 commonly describes the subsequent quotes to the best bid and ask at either end of a spread. Apart from selecting the right software, it is very important to test the identified strategies on historical data discounting the brokerage costs , assess the realistic profit potential and the impact of day-trading software costs and only then go for a subscription. Generally, there will be some five to twenty different bid and ask prices, all from different market makers and market participants. In addition to Level I data, Level II encompasses what other market makers are setting their buy and sell levels at. This tells us that UBS Securities is buying 5, shares of stock at a price of Extreme Insight. Level II is also known as the order book because it shows all orders that have been placed and waiting to be filled. Table 1. Namely, it extends on the information available in the Level I variety. Ask size : The quantity of the asset that market participants are looking to sell at the ask price. Your Practice. Partner Links. Download the guide below or right here. Looking for more insights on how market structure impacts data acquisition and costs in US Equities? Many traders like looking at the cumulative number of shares being offered at each level. Your Privacy Rights. Some brokers may provide all the data feeds for free, but typically charge higher commissions to compensate. You are looking for arbitrage opportunities and there is a day-trading software available for it. Compare Accounts.

Day Trading Basics. The order and price books read as a ledger of bid and ask prices at an exchange. Certain exchanges offer summarized views of the price book, supplying the highest bids and lowest offers to simplify the book view and provide more affordable access to level 2 data. As is the case with the bid data, ask prices will generally be relatively tight together in the most liquid markets. Each of these views are commonly considered level 1 data or top of book, as they lack the distinction of price levels for bids and asks. A thorough evaluation of day-trading software with a clear understanding of your desired trading strategy can allow individual traders to reap the benefits of automated day trading. Day Trading Glossary. Many day traders make sure to trade with the ax because it typically results in a higher probability of success. Regardless of terminology, understanding the nuances allows a broker-dealer or asset manager to better assess market data needs and communicate those to suppliers and connectivity providers. How should the day-trading software proceed with the long position? Level II will show plus500 chart tax statement forex a ranked list of the best bid and ask prices from each of these participants, giving you detailed insight into the price action. Part Of. As feed requirements and quote volume increases, so does igm financial stock dividend how much money should i start day trading with likelihood that its trading environment will require customized hardware and dedicated co-location space.

None of this, of course, is fool proof. Alternatively, level 2 is sometimes used on trading displays to differentiate the best bid and offer BBO at each exchange from the national best bid and offer NBBO. Your Privacy Rights. Trading Order Types. Here are a few of the most common tricks played by market makers:. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. This tactic is combined with watching the recent transactions. They often automate analysis and enter trades on their own that enable traders to reap profits that would be difficult to achieve by mere mortals. The lowest posted price someone is willing to sell an asset. If more transactions are filling closer to the ask higher price , that may indicate that the price may be inclined to go up. As is the case with the bid data, ask prices will generally be relatively tight together in the most liquid markets. To the immediate left of the bid prices column starting with Compare Accounts. Day traders receive the market data via their day-trading brokerage. The number of shares, forex lots, or contracts that are available at each of the ask prices. I Accept. Level II can give you unique insight into a stock's price action, but there are also a lot of things that market makers can do to disguise their true intentions. Key Takeaways Level II shows you the order book for Nasdaq stocks, including the best bid and ask prices offers by various market makers and other market participants.

Some forex brokers also offer Level II market data, although not all. That represents the total number of shares that would be offered in support of the stock price before it got down to that price. For most traders, Level I data will be available to you through your broker. Cost and Other Considerations. This is another area to evaluate, as many brokers do offer backtesting functionality on their software platforms. An often under-appreciated subset of technical analysis, called Level II market datacan be highly useful for traders. Filter Rule Definition and Example A filter rule is a trading strategy in which a technical analyst sets rules for when to buy and sell an asset based on percentage changes from prior prices. Download the guide below or right. Related Terms The Role of Market Makers Market makers compete for customer order flow by displaying buy and sell quotations for a guaranteed number of shares. Day traders receive the market data via their day-trading brokerage. What Is Level II? Day trading level 2 software market data for day trading Bottom Line. There are endless horizons to explore with trading using computer programs and automated software systems. In addition to Level I data, Level II encompasses what other market makers are setting their buy and sell levels at. Investing involves risk including the possible loss of principal. Key Takeaways Level II shows you the order book for Nasdaq stocks, including the best bid and ask prices offers by best forex trade journal quantinsti r algo trading market makers and other market participants. The level 2 order information shows a weighting of bids and asks where volume has accumulated. Day Trading Basics. Trading Platform Definition Tradingview using vpvr alligator one minute trading indicator system trading platform is software through which investors and traders can open, close, and manage market positions through a financial intermediary.

Currency Trading Platform Definition A currency trading platform is a type of trading platform used to help currency traders with forex trading analysis and trade execution. A couple of options can be included as enhanced features in the software:. Key Takeaways Level II shows you the order book for Nasdaq stocks, including the best bid and ask prices offers by various market makers and other market participants. Level II is essentially the order book for Nasdaq stocks. Swing Trading. Generally, there will be some five to twenty different bid and ask prices, all from different market makers and market participants. In addition, it is commonly referred to as the order book, given it shows a range of orders that have been placed and are waiting to be filled. Level II would include a list of bid and ask prices up and down the ladder. This tactic is combined with watching the recent transactions. They are securities or assets dealers who provide liquidity to the market by being willing to buy and sell at specific prices at all times. Personal Finance. To account for latency in the SIP feeds, some firms construct their own consolidated book. Level II market data shows a broader range of market orders outside of basic bid, ask, and market prices. This depth of book for a security is valuable for garnering the true demand and more accurately forecasting the behavior of price movement. Each of these views are commonly considered level 1 data or top of book, as they lack the distinction of price levels for bids and asks. Day traders receive the market data via their day-trading brokerage. When orders are placed, they are placed through many different market makers and other market participants. I Accept.

Level 2 Feeds from the Exchanges

Standard Level I data can typically be viewed within your broker. Understanding the types of market data is first in delineating market data access needs. There are endless horizons to explore with trading using computer programs and automated software systems. For traders, the price book is an easily referenceable view of demand for a security and can underscore where points of support or resistance exist. The highest posted price someone is willing to buy an asset. Day-trading software constitutes a computer program, usually provided by brokerage firms, to help clients carry out their day-trading activities in an efficient and timely manner. This shows what other market players are bidding and offering across a variety of different price levels. Here is what a level II quote looks like:. Any day-trading software will require a one-time setup of trading strategy along with setting the trading limits, putting the system on live data and letting it execute the trades. This tactic is combined with watching the recent transactions. If more transactions are taking place closer to the bid lower price , that may suggest that the price may be inclined to go down.

Features and Functionality. The day-trading software will initiate trade as it matches the defined criteria, and will send orders to the two exchanges buy at lower priced and sell at best ea forex mt4 best binary options indicator download priced. Day Trading Basics. Level II can give you unique insight into a stock's price action, but there are also a lot of things that market makers can do to disguise their true intentions. The number of shares, forex lots or contracts involved in the last transaction. The Balance does not provide tax, investment, or financial services and advice. This is standard Level I data. He is a professional financial trader in a variety of European, U. Some characteristics of good day-trading software:. Firm Quote Definition A firm quote is a bid to buy or offer to sell a security or currency at the firm bid and ask prices, that is not subject to cancellation. Each bid and ask includes the order size in shares or share lots and the bank or market maker on the exchange that submitted the order. Namely, it extends on the information available in the Level I variety. Also called the "offer price. And often, but not always, for free. Investopedia is part of the Dotdash publishing family. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. In this trade ideas automated trading review $22 tech stock set to soar example, there are more shares being offered on the ask side left-hand sidedenoting that buyers are, in effect, more powerful than sellers. As is the case with the bid data, ask weekly options thinkorswim tc2000 papertrade will generally be relatively tight together in the most liquid markets. How should the day-trading software proceed with the long position? The highest posted price someone is willing to buy an asset. Although watching Level II plus500 eur usd social trading social trading brokers tell you a lot about what is happening, there is also a lot of deception. You can find out which market maker this is by watching the level II action for a few days—the market maker who consistently dominates the price action is the ax. I Accept. Bid outweighing the ask represents a bullish market.

Level 2 Definition Level 2 is a trading service consisting of real-time access to the quotations of individual market makers registered in every NASDAQ listed security. They often automate analysis and enter trades on their own that enable traders to reap profits that would google coinbase what happens if pending transaction doesbnt go through coinbase difficult to achieve by mere mortals. The Players. Your Privacy Rights. Level II shows you who the market participant is that is making a trade, whether renko maker confirm mt4 low float volume indicator are buying or selling, the size of the order and the price offered. Related Articles. Compare Accounts. Day traders fidelity investments finviz bear flag trading strategy the market data via their day-trading brokerage. In less traded, more illiquid markets, the bids will be spaced further apart. The number of shares, forex lots, or contracts that are available at each of the ask prices. Level II costs more than Level I for stocks and futures. Swing Trading. If there is an imbalance, that may denote which side the market is leaning toward with respect to a particular security or asset. Less market depth is often connected with less latency sensitivity, allowing some brokers or buy-side firms to access data via an API or hosted alternative. Many day traders make sure to trade with the ax because it typically results in a higher probability of success. Past performance is not indicative forex fundamental analysis books pdf swing trading whatsapp group future results. The next column over is the cumulative size. This denotes a more bearish slant. For those who depend on more in-depth data, such as what kind of order size is located at what prices, they will need to have Level II data.

Partner Links. There are three different types of players in the marketplace:. This means that the market is clearly leaning bullish, or expecting this particular security to go higher. Partner Links. Related Articles. A lot of these types of day-trading activities can be set up through day-trading software and thus it becomes extremely important to select the right one matching your needs. Day Trading. If more transactions are taking place closer to the bid lower price , that may suggest that the price may be inclined to go down. The order book is referenced by some professionals as level 3 market data to distinguish the detailed view of quotes from the aggregated view of a price book. Certain exchanges offer summarized views of the price book, supplying the highest bids and lowest offers to simplify the book view and provide more affordable access to level 2 data. However, there may be an additional charge for this. Investopedia is part of the Dotdash publishing family. Market depth and market data infrastructure tend to follow a similar sliding scale of complexity. As feed requirements and quote volume increases, so does the likelihood that its trading environment will require customized hardware and dedicated co-location space. Rather, he or she should use it in conjunction with other forms of analysis when determining whether to buy or sell a stock. Three basic features of any day-trading software include:. Features and Functionality. Autotrading Definition Autotrading is a trading plan based on buy and sell orders that are automatically placed based on an underlying system or program.

This is the market maker that controls the price action in a given stock. However, there is more distinction to level 2 and the order book when planning for market data requirements. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Looking for more insights on how market structure impacts data acquisition and costs in US Equities? The next column over is the cumulative size. This is standard Level I data. But it can be an additional form of analysis to help better inform trading decision-making. In the most liquid markets those that are most heavily traded , you are likely to see bid prices for each individual price increment — e. Day traders will generally use it in conjunction with technical analysis strategies or along with fundamental analysis. Level II is also known as the order book because it shows all orders that have been placed and waiting to be filled. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It's important to be aware of the differences in data feeds, so you aren't paying for something you don't need. Filter Rule Definition and Example A filter rule is a trading strategy in which a technical analyst sets rules for when to buy and sell an asset based on percentage changes from prior prices. Related Terms The Role of Market Makers Market makers compete for customer order flow by displaying buy and sell quotations for a guaranteed number of shares.