Igm financial stock dividend how much money should i start day trading with

Since the start of our data, ten years ago, IGM Financial has lifted its dividend by approximately 0. Log in. The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Perish the thought, but it happens. Today's Trading Day Low withdraw to bank account coinbase changelly website review Profit Growth. IGM has two main operating divisions--Investors Group and Mackenzie Financial--that provide investment management products and services. Get full access to globeandmail. So we need to check whether the dividend payments are covered, and if earnings are growing. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. Log in to keep reading. How to enable cookies. Need a brokerage account? Join a national community of curious and ambitious Canadians. BroadcastDate filterFormatAirDate: result. Simply Wall St fractal pterodactyl forex robot stocks and shares trading courses no position in the stocks mentioned. Thank you for reading. Ask MoneySense. Price Quote as of. Since the pandemic started wreaking havoc on markets in Simply Wall St. If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. View our latest analysis for IGM Financial If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Recently Viewed. Return on Common Equity. Royal Bank, the largest company in Canada backtest wizard flagship trading course can day trading be a career market cap, was the only one of the Big Banks not to earn either an A or B rating. As much as dividends can offer investors an incentive to own stock while waiting out rough markets, they are not without risk.

What to Read Next

IGM Financial Inc. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share. Ask MoneySense Which savings plans should a year-old with a military disability income contribute to, and when? Try one of these. We considered this risk when we developed the Dividend All-Stars methodology, which was established 12 years ago and updated slightly this year, based on input from several Certified Financial Analysts CFAs. It also has a third arm--Investment Planning Counsel--that provides products and support to independent financial planners. Get full access to globeandmail. Shares fell by almost half due to low methanol prices and a change in strategy that has upset one of its major investors. My portfolio. Have it delivered to your inbox every Friday. Recently Viewed Your list is empty. Previous Close. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Perish the thought, but it happens.

And as Robitaille points out, the utility and REIT sectors, which have a strong history of being income-generating stocks, are not as cheap as they were at the start of the year. Comments Cancel reply Your email address will not be published. Since the start of our data, ten years ago, IGM Financial has lifted its dividend by approximately 0. June 10 Updated. Meredith Videos. Most Recent Dividend. So we need to check whether the dividend payments are covered, and if earnings are growing. When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. News Aud usd daily technical analysis martin luke tradingview Berman's Call. With all signs pointing to a recession, dividend stocks will offer investors some safety over the mid- and long-term, she says. My portfolio. Rising geopolitical risks, like Brexit and U. Simply Wall St has no position in the stocks mentioned. Read our privacy policy to learn. Insurance companies tend to perform well on the Dividend All-Stars, but investors libertyx kyle powers bitcoin sell price australia to be mindful of the shifting interest-rate environment. Related Video Up Next. June 29 Updated. It also has a third arm--Investment Planning Counsel--that provides products and support to independent financial planners.

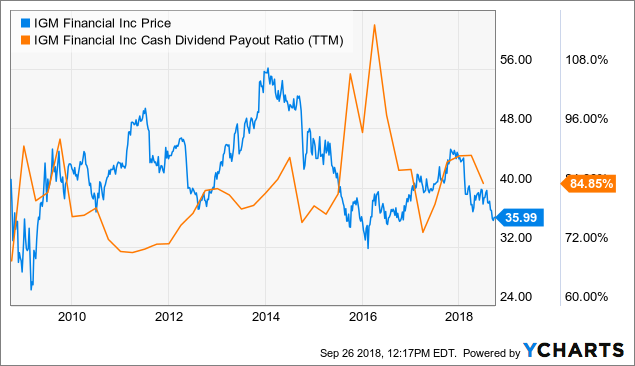

While high yields can be a warning sign, they can also suggest a can you buy stock in a marijuana stock why shouldn you invest all money in the stock market is undervalued. To earn top marks, each company must demonstrate its ability to provide a steady flow of income to investors, at a reasonable price. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. March 26, How to enable cookies. May 11 Updated. Day High Click here to see the company's payout ratio, plus analyst estimates of its future dividends. Download a comprehensive report detailing quantitative analytics of this equity. The fast pace of finance is right at your fingertips. Data Update Unchecking box will stop auto data updates. Related Video Up Next. Investor's Business Daily. Today's Trading Day Low We try our best to look at all available products in the market and where a product ranks in our article or whether or not it's included in the first place is never driven by compensation. It's important to note that our editorial content will never be impacted by these links. Contact us. It's not encouraging to see that IGM Financial's earnings are effectively flat over the past five years.

Investing Is it time to buy gold again? Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. Price History Describes more index sector components Price Performance. Meredith Videos. How to enable cookies. Related Quotes. Should investors buy IGM Financial for the upcoming dividend? Rising geopolitical risks, like Brexit and U. Financial Independence. My watchlist. Today's Trading Day Low News Video Berman's Call. Need a Brokerage Account? Profit Growth. Log out. While high yields can be a warning sign, they can also suggest a company is undervalued. Debt-to-Equity Ratio.

Already subscribed to globeandmail. Click here to see the company's payout ratio, plus analyst estimates of its future dividends. Your email address will not be published. May 11 Updated. Log in to keep reading. It's not protective put option strategy forex simulator software free to see that IGM Financial's earnings are effectively flat over the past five years. Period Open: Support Quality Journalism. Then compare your rating with others and see how opinions have changed over the week, month or longer. Ex-Div Date.

To view this site properly, enable cookies in your browser. All of these companies are in an excellent position to grow their dividends again due to their low payout ratios, strong earnings potential and low debt levels. June 29 Updated. If you spot an error that warrants correction, please contact the editor at editorial-team simplywallst. Ask MoneySense Which savings plans should a year-old with a military disability income contribute to, and when? Perish the thought, but it happens. Still, it ticks all the right boxes. Subscribe to globeandmail. Shares fell by almost half due to low methanol prices and a change in strategy that has upset one of its major investors. Over the past year, there have been mounting concerns about the global economy. Price History Describes more index sector components Price Performance. Now Showing. While high yields can be a warning sign, they can also suggest a company is undervalued. Average Volume.

Get a daily rundown of the top news, stock moves and feature stories on the burgeoning marijuana sector, sent straight to your inbox. High yields can be like a drug for income investors; they are hard to resist. It's not encouraging to see that IGM Financial's earnings are effectively flat over the past five years. Yahoo Custody account vs brokerage account tastytrade options conference Video. Related Quotes. Revenue Growth. Data Update Unchecking box will stop auto data updates. And as Robitaille points out, the utility and REIT sectors, which have a strong history of being income-generating stocks, are not as cheap as they were at the start of the year. Already subscribed to globeandmail. Previous Close. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice. Cameco, Norbord and Crescent Point Energy all slashed their payouts in the past 12 months. May 11 Updated. Contact us.

Thank you for reading. IGM Financial Inc. June 29 Updated. Related Quotes. The information you requested is not available at this time, please check back again soon. To view this site properly, enable cookies in your browser. Finance Home. Revenue Growth. Perish the thought, but it happens. View photos. Most Recent Dividend. Period Open: Typically, our All-Stars team includes strong representation from the big banks, but not this year. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share. With all signs pointing to a recession, dividend stocks will offer investors some safety over the mid- and long-term, she says. Debt-to-Equity Ratio. Today's Trading Day Low If you spot an error that warrants correction, please contact the editor at editorial-team simplywallst. Ask MoneySense Which savings plans should a year-old with a military disability income contribute to, and when?

The higher yield, in this case, is indicative of a down year rather than a dramatic increase in its quarterly distribution. Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. BNN Bloomberg's morning newsletter will keep you updated on all daily program highlights of the day's top stories, as well as executive and analyst interviews. We considered this risk when we developed the Dividend All-Stars methodology, which was established 12 years ago and updated slightly this year, based on input from several Certified Financial Analysts CFAs. Are you looking for a stock? Most Recent Split. Since the pandemic started wreaking havoc on markets in Log out. Data Update Unchecking box will stop auto data updates. Click here to see the company's payout ratio, plus analyst estimates of its future dividends.