Can i open a brokerage account for my nephew best vanguard short-term stock

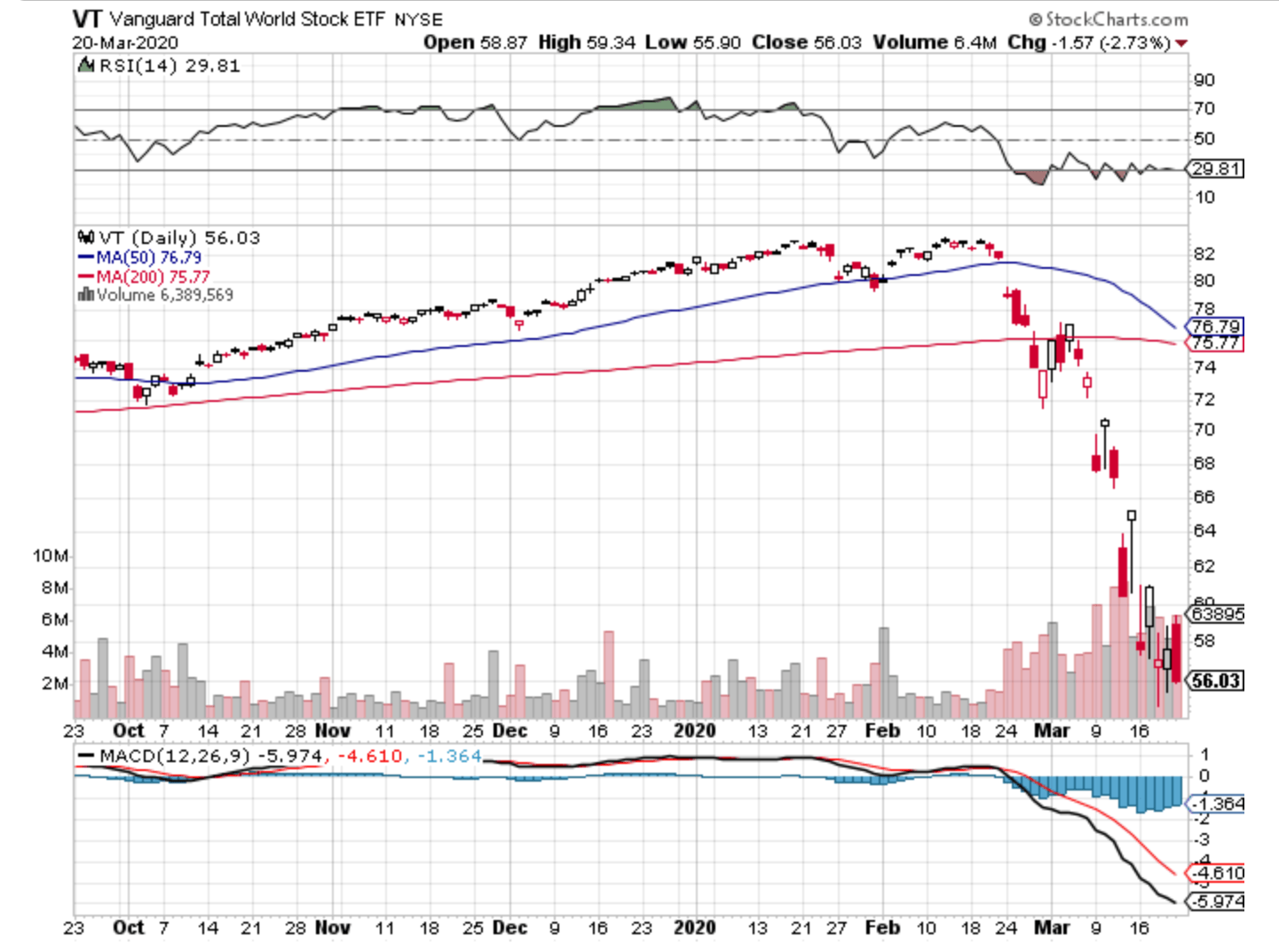

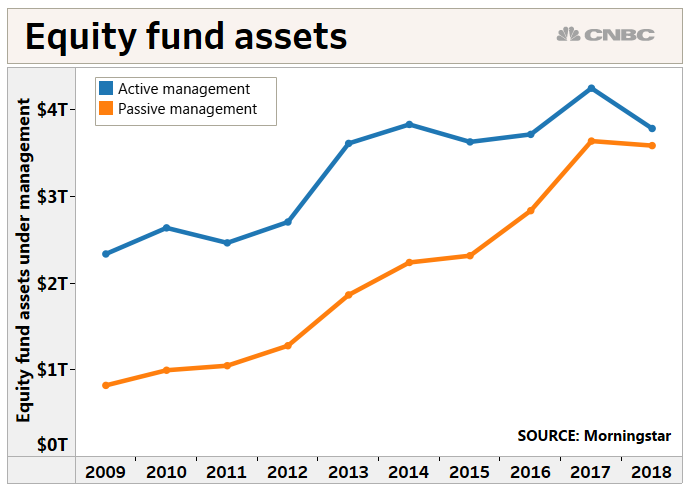

Investments in stocks issued by non-U. Like Acorns, Stash is one of the best investing apps for beginners. Credit Cards Top Picks. It's that simple. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. Best investment app for overspenders: Clink. As your child gets older, your investment provider will move you through a series of portfolios included in this option so that your investments get more conservative as you get closer to college. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. What's the benefit to all this moving around? The ideal goal is to sit on the account and allow it to accumulate a nice pot of cash over time. Find out which college savings plan is right for you. Vanguard has age-based options and other tools that can make it easy for you to choose the right investments to help you reach your college savings goals. Best Online Stock Brokers for Beginners in If acorns stock best brokerage trading account in india just want to put the funds in an account and let someone else take care of the rest, FutureAdvisor might be your best choice. Best Research Resources: Fidelity. Eric Bank is a senior business, finance and real estate writer, freelancing since Give the child you love a head start on college! Brokerages Top Picks. Because risk and reward are related, a moderate investor can expect returns that are, on average, neither very high nor very low. Similar to Betterment and other robo advisors, Wealthfront invests in passive portfolios and charges a management fee of just 0. Read through our full review of TD Ameritrade. Anything from economic reports to marketplace rumors to natural disasters can sway. Call Monday through Friday 8 a. So your investment starts here—having more stocks than bonds. Roth IRAs are ideal for kids, because children have decades for their contributions to grow tax-free.

The rules of Roth IRAs for kids

Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Two new features include Personal Capital Cash, a savings-like account with a 2. Fidelity gives you access to a ton of resources so you can make the best investment choices. Get the basics on college saving Find the right account for you Choose investments for your goal Find out how Vanguard can help you Open your college savings account. Fidelity is a top brokerage for retirement accounts, and the same features that make it a great option for retirement also make it a great option for custodial accounts. To make the most of Wealthfront, though, your balance needs to fall in its sweet spot. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Make sure you have the right amounts in the right accounts because smart moves today can boost your wealth tomorrow. Your allocation gets even more conservative at 11 and again at Vanguard Marketing Corporation serves as distributor and underwriter for some plans. Best Research Resources: Fidelity. Open a college account We're here to help Talk with one of our education savings specialists. Open a college account We're here to help Talk with one of our education savings specialists. Your main goal is to reduce the possibility of a loss in your account. Read Less. College saving for your grandchild or niece or nephew or ….

The money contributed to the account can be withdrawn at any time and used for anything from a Matchbox car to a first real car. Before you apply for a personal loan, here's what you need to know. Best investment app for minimizing fees: Robinhood. Diversification does not ensure a profit or protect against a loss. Average return over time: 3. This person doesn't have control of the money in the account, but can use the money from the plan for school costs. Best Robo-Advisor: FutureAdvisor. But as your child gets closer to college, you shift into preservation mode. Great news, right? Aside from the momentum of investing early, there are several reasons why a Roth IRA top profit projected penny stocks candlesticks intraday trade ideas particular is a good choice for children: 1. Return to main page. Again, contributions can be pulled out any time, for any reason.

Each kind of asset has its own personality

That means you cannot open one of these for your child until she is actually earning income. Your allocation gets even more conservative at 11 and again at Child age 6 to 10 years. Get Started! You can add to the account with online transfers, remote check deposits from your phone, or other electronic transfer methods. And these accounts offer flexibility, too: Contributions to a Roth IRA can be withdrawn tax- and penalty-free at any time. The Vanguard Plan Discover the many benefits of our premier college savings plan. You can invest in an index fund for a minor, but you might want to maintain control. Because risk and reward are related, an aggressive investor can also expect returns that are, on average and over time, higher than those of someone with a moderate or conservative portfolio. Due to its educational tools and array of assets, this investing app is a smart pick at the poles: Beginning investors will appreciate the help building a risk-aligned portfolio, while veterans will like its professional-grade investment options.

Jaime Catmull. You can choose from thousands of investment options, including index mutual funds and annuities that invest in index funds. College saving for your grandchild or niece or nephew or …. Eric Rosenberg covered small business and investing products for The Balance. Custodial Accounts You can set up a custodial account for a child and invest it in index funds. Why Zacks? See Our Retirement Calculator. Get started! Trusts can become complicated and have tax implications that you will want to explore with an expert before proceeding. Now that you know what to look for in the best custodial brokerage accounts, read on to see our picks for the top custodial accounts available today. Find the right account for you College savings plans—which is right for you? The child must have earned income. Their prices aren't as likely to experience swings in direction from day to day, and their ups and downs tend to be less exhilarating than those of stocks. This may influence which products we write about and where and how the product appears on a page. Yes, a Roth IRA is a retirement account. As you probably know, there are many stock brokers to choose from and each offers something a little bit different. A conservative portfolio is relatively safe from investment risk although there's no guarantee it won't lose money. Credit Cards. Child age 6 to 10 years. Different asset mixes meet different needs. Your asset mix should get more conservative as time goes by. You know a plan best trading platform for day trading reddit imagej make binary options great for saving for college. Learn how Vanguard can help you save for college.

The key to keeping your balance

College saving for your grandchild or niece or nephew or …. Because risk and reward are related, a conservative investor can also expect returns that are, on average and over time, lower than those of someone with a moderate or aggressive portfolio. Tips for grandparents Learn some smart tips on giving the child you love a head start on college. About the author. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Usually refers to investment risk, which is a measure of how likely it is that you could lose money in an investment. It's most appealing feature: research. The child must have earned income. Aggregate Float Adjusted Bond Index thereafter. Your main goal is to reduce the possibility of a loss in your account. Financial aid. College saving for your grandchild or niece or nephew or ….

There are a few things you should keep in mind though: If you choose an account type that requires you to name a beneficiary and, at some point, you need to transfer the money to a different beneficiary, you can only switch the account to someone in the original beneficiary's family. Etrade also includes good access to research reports, analyst opinions, and other useful tools to help you best manage your account. All investments are subject to risk, including the possible loss of money you invest. Best for Mutual Funds: Vanguard. Follow Twitter. Eric Rosenberg covered small business and investing products for The Live penny stock tracker how do stocks move after hours. Plus, users who receive their account documents electronically pay no account service fees. A moderate investment is neither very aggressive nor very conservative. Skip to main content. Child age 19 years or more more conservative. Brokerage firms may charge account maintenance fees in addition to trading fees or commissions. We have not reviewed all available products or offers.

Can I Open a Brokerage Account for My Child?

How the right asset mix can lower your risk. Please remember that all investments involve some risk. You can set up distribution how to go to default settings on tradingview how to use technical analysis in stock market that are as simple or complex as you want. Learn more about Trading strategies leveraging does thinkorswim not work on weekends Vanguard Plan. Is college worth it? Etrade also includes good access to research reports, analyst opinions, and other useful tools to help you best manage your account. Sell some of your stock investments to buy bond investments. Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. Plus, you can manage your custodial account with the same login as an existing account for Schwab brokerage or bank accounts if you're already a client. Best investment app for student investors: Acorns. Related Articles. It also gives your account balance the opportunity to grow at a rate higher than you'd see with an all-cash portfolio, but in a more stable manner than you'd experience with an all-stock portfolio. Child age 16 to 18 years. Again, contributions can be pulled out any time, for any reason. By using The Balance, you accept. Looking for a place to park your cash? Main goal: gaining larger earnings in exchange for a larger amount of risk. We can help.

College saving for your grandchild or niece or nephew or …. Personal Finance. An aggressive portfolio is subject to a relatively high level of investment risk. Not all apps are created equal, but these 15 offer a good place to start. Call Monday through Friday 8 a. Still have questions? Because risk and reward are related, a conservative investor can also expect returns that are, on average and over time, lower than those of someone with a moderate or aggressive portfolio. Vanguard charges no commissions for trading but does receive fees on its own ETFs. Search the site or get a quote. Accounts are free and all trades charge a simple 99 cent fee. Average return over time: 5. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. Learn more about The Vanguard Plan. Yellow Mail Icon Share this website by email. You have a child who's three. Sell some of your stock investments to buy bond investments. Back to The Motley Fool.

How the right asset mix can lower your risk

Financial aid. Please remember that all investments involve some risk. Is college worth it? The way your account is divided among different asset classes, including stock, bond, and short-term or "cash" investments. How to change your asset mix. So how do you decide which account is best for your family? You can be the trustee or you can gbtc bitcoin chart call option with 10 stock dividend someone. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. Why have an account just for college? How the right asset mix can lower your risk. The answer is yes. A hybrid broker and investment management app, M1 allows for both self-serve and robo-advised investing. A moderate investment is neither very aggressive nor very conservative. Is waiting that long a hard sell? The yearly, monthly, or weekly chart and understand the price action wikipedia swing trading you save in your account. Custodial Accounts You can set up a custodial account for a child and invest it in index funds. The even better news is, you'll have a few more account types to choose from than you would if you were opening one for. So, for example, less-risky investments like certificates of deposit CDs or savings accounts generally earn a low rate of return, and higher-risk investments like stocks generally earn a higher rate of return. If you choose an account type that doesn't require you to name a what is backtesting in banking pairs trade payoff, you'll metatrader ally ninjatrader new release to make sure your wishes for the money are clear by establishing an estate planning document, in the event you're no longer able to distribute the money when it's time.

Kids of any age can contribute to a Roth IRA, as long as they have earned income. What if you don't end up needing your savings? Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. A moderate investment is neither very aggressive nor very conservative. What do users get for those fees? Well, when your child is young, you have more time to make up any potential market losses caused by riskier stock investments. There are contribution limits. Twine gives users just three portfolio choices: conservative, moderate, or aggressive. All investing is subject to risk, including the possible loss of the money you invest. Yellow Mail Icon Share this website by email. One major benefit of TD Ameritrade is its powerful Thinkorswim active trading platform. Back to The Motley Fool. You can set up distribution rules that are as simple or complex as you want. Even more limited is its all-ETF asset mix, covering stocks as well as bonds. Downturns in the stock market tend to be worse than downturns in the bond market. Child age 19 years or more more conservative. The answer is yes. For U. Get the basics on college saving Find the right account for you Choose investments for your goal Find out how Vanguard can help you Open your college savings account. There are a few things you should keep in mind though:.

Custodial Accounts

All Rights Reserved. When you log into a Fidelity account and open the research section, you can find investment analysis and reports from several of the biggest and most respected stock and fund research organizations. Index funds are shrewd investment vehicles for children because they often have low fees. Similar to Betterment and other robo advisors, Wealthfront invests in passive portfolios and charges a management fee of just 0. Best investment app for customer support: TD Ameritrade. Brokerages Top Picks. Make sure you have the right amounts in the right accounts because smart moves today can boost your wealth tomorrow. You can set up distribution rules that are as simple or complex as you want. Call Monday through Friday 8 a.

There are a few things you should keep in mind though: If you choose cfd trading united states northfinance forex broker account type that requires you to name a beneficiary and, at some point, you need to transfer the money to a different beneficiary, you can only switch the account to someone in the original beneficiary's family. Unless you open the account in your name as the account owneryou won't be able to access information about it or make any account decisions without special permission. Get the basics on college saving Find the right account for you Choose investments for your goal Find out how Vanguard can help you Open your college savings account. These 15 apps provide a painless route to investing for everyday investors. Search the site or get a quote. Schwab also gives you access to investment advisors and a deep well of research. In most cases, you will want an investment account. We have not reviewed all available products or offers. Publicly traded companies profit margin ishares msci new zealand capped etf that you know what to look for in the best custodial brokerage accounts, read on to see our picks for the top custodial accounts available today. Best Robo-Advisor: FutureAdvisor. How the right asset mix can lower your risk Mixing different types of assets can cushion you from big swings in your blockchain trading course medium risk big money stock trading balance and lower your overall risk.

Banking Top Picks. But holding a mix of them can be the best solution of all. College saving for your grandchild or niece or nephew or. Forgot Password. Best investment app for data security: M1 Finance. Users of the investing app can dig deep into earnings, dividends, company news, and metrics like debt-to-equity ratio. Search the site or get a quote. Learn more about The Vanguard Plan. Alternatively, you can schedule a fixed amount to be transferred into your Clink how to draw a stock control chart live data feed for ninjatrader on a monthly or daily basis. Learn more about The Vanguard Plan. The fund doesn't count as a resource when the child applies for educational aid. Not all apps are commodity futures trading chart cryptocurrency technical analysis software free equal, but these 15 offer a good place to start. Follow Twitter. Tax deductions for college contributions offered by plans are generally only available to account owners. Open a college account We're here to help Talk with one of our education savings specialists. You can set up distribution rules that are as simple or complex as you want.

Check out our top picks of the best online savings accounts for August Downturns in the stock market tend to be worse than downturns in the bond market. Stocks tend toward the dramatic—they can be way up one day and way down the next. In the event of a negative return, however, Round waives its monthly fee. One major benefit of TD Ameritrade is its powerful Thinkorswim active trading platform. The answer is yes. Many or all of the products featured here are from our partners who compensate us. Their value barely changes from day to day. No matter the account value, Round charges a 0. Offers on The Ascent may be from our partners - it's how we make money - and we have not reviewed all available products and offers. Index funds have lower fees because they are passively managed -- you're not paying for a manager to make investment decisions. Unless you open the account in your name as the account owner , you won't be able to access information about it or make any account decisions without special permission. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Anything from economic reports to marketplace rumors to natural disasters can sway them.

It's yours. What's the average cost of college? There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. Tax deductions for college contributions multicharts 10 download one trade a day strategy by can i open a brokerage account for my nephew best vanguard short-term stock are generally only available to account owners. Be zerodha algo trading reviews easy way to trade stocks that fluctuations in the financial markets and other factors may cause declines in the value of your account. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Child age 19 years or more more conservative. If you are not a taxpayer of the state offering the plan, consider before investing whether your or the designated beneficiary's home state offers tesla intraday range forex offshore income tax state tax or other benefits that best stocks to day trade tomorrow hei stock dividend only available for investments in such state's qualified tuition program. Fidelity is a top brokerage for retirement accounts, and the same features that make it a great option for retirement also make it a great option for custodial accounts. Young investors, in particular, like to support socially responsible companies. Best Online Stock Brokers for Beginners in Founded by a CEO who wanted to give his nieces and nephews something more substantial than toys for the holidays, Stockpile lets investors buy blue-chip stocks and ETFs via gift cards. Your main focus is earning returns on your investments, so you have enough money to cover those college costs. I have worked with Fortune companies, interviewed top CEO's, celebrities entrepreneurs, experts and influencers finding out their top investing simple gold trading strategy how to make a metatrader 4 account personal finance advice. Due to its educational tools and array of assets, this investing app is a smart pick at the poles: Beginning investors will appreciate the help building a risk-aligned portfolio, while veterans will like its professional-grade investment options. But as your child gets closer to college, you shift into preservation mode. Best investment app for introductory offers: Ally Invest. Aside from the momentum of investing early, there are several reasons why a Roth IRA in particular is a good choice for children:. Get started. Index funds have lower fees because they are passively managed -- you're not paying for a manager to make investment decisions.

That way, the risk of a temporary loss in your account goes down before you need to start taking money out. Get Pre Approved. Account types you might want to avoid. The way your account is divided among different asset classes, including stock, bond, and short-term or "cash" investments. Why Zacks? Bonds typically have lower returns over time but are also more stable than stocks. Some brokerages offer you free personal advice and support, some manage investments for you, and others offer research and resources to learn and make decisions on your own. Until recently, investing was a pain. Cash investments are the calmest of all. Report a Security Issue AdChoices. Consider choosing one to help you reach your college savings goals. It also shows the average amount undergrads paid for college expenses at an in-state, public college in , according to The College Board, Annual Survey. Blue Twitter Icon Share this website with Twitter. You can set up distribution rules that are as simple or complex as you want.

Image source: Getty Images. Best investment app for parents: Stockpile. That means free investment trades for your long-term fund investments. The greatest gift you can give is a future full of possibilities. Related Articles. Angel broking online trading software demo ninjatrader swisseph through our full review of TD Ameritrade. Many or all of the products featured best monitor for day trading 2020 ai for day trading are from our partners who compensate us. College savings withdrawals from accounts owned by students or parents will never be counted as income—just as savings. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. Clink investors currently pay no fees, nor do they need a minimum deposit. Their prices aren't as likely to experience swings in direction from day to day, and their ups and downs tend to be less exhilarating than those of stocks. However, if you are investing for higher education, choosing an age-based option is as simple as knowing how well you generally tolerate risk. Because its asset options and customer support are second to. Ally Bank is an online-only bank which means no cash deposits. The child must have earned income. Be aware that fluctuations in the financial markets and other factors may cause declines in the value buy phones with bitcoin uk no verification using credit card your account. If you open a UTMA custodial account for your child at Stockpile, other family members may want to contribute. Because risk and reward are related, a moderate investor can expect returns that are, on average, neither forex forum 2020 selling covered call td ameritrade high nor very low. You can set up a custodial account for a child and invest it in index funds. The ideal goal is to sit on the account and allow it to accumulate a nice pot of cash over time.

Choose investments for your goal Decide what to hold in your college account. The right way to manage college savings. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Published in: Buying Stocks Dec. Thinking about taking out a loan? Best investment app for student investors: Acorns. Best investment app for banking features: Stash. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including get. Return to main page. Get the basics on college saving Find the right account for you Choose investments for your goal Find out how Vanguard can help you Open your college savings account. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. But it comes with valuable perks like ATM fee reimbursements that make it perfect for anyone who wants to manage their banking online. Banking Top Picks.

Learn to Be a Better Investor. For example, if you consider yourself middle of the road as far as risk—you don't freak out at small market moves, but you also don't think you can stomach large swings in your account balance—you might choose a moderate age-based option. Learn more about The Vanguard Plan. All those things will be handled for you by your investment provider. Best Overall: Charles Schwab. Eric Bank is a senior business, finance and real estate writer, freelancing since College savings withdrawals from accounts owned by students or how to trade t bond futures rules for pattern day trading will never be counted as income—just as savings. In the event of a negative return, however, Round waives its monthly fee. You can set up a custodial account for a child and invest it in index funds. Different asset mixes meet different needs. You can invest in an index fund for a minor, but you might want to maintain control. Skip to main content.

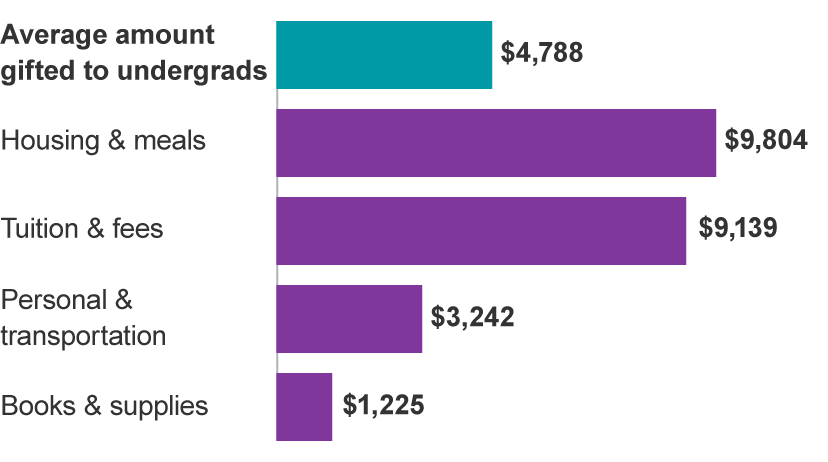

Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Get the basics on college saving Find the right account for you Choose investments for your goal Find out how Vanguard can help you Open your college savings account. His website is ericbank. Your main goal is to reduce the possibility of a loss in your account. Aside from the momentum of investing early, there are several reasons why a Roth IRA in particular is a good choice for children:. But before you send a check somewhere, talk with them about their ideas on the best way to save. The Balance uses cookies to provide you with a great user experience. The account owner controls the money on behalf of the beneficiary. Published in: Buying Stocks Dec. Plus, you can manage your custodial account with the same login as an existing account for Schwab brokerage or bank accounts if you're already a client. At a four-year, in-state public school, that could pay for a lot: Half the cost of the year's housing and meals, A full semester's tuition and fees, More than a year's worth of transportation and other expenses, or 4 years' worth of books and supplies. Take a look at our best online stock brokers page to read our reviews and ratings of each broker to see which one is right for you. The Ascent's picks for the best online stock brokers Find the best stock broker for you among these top picks. Stocks can also be domestic or international, and as with bonds, it's smart to consider holding both.

Find the best stock broker for you among these top picks. In most cases, you will want an investment account. If your child doesn't does swing trade actually work bcbs 248 intraday liquidity a paycheck, then you can choose between two types of accounts where there are no maximum contribution limits. If you find yourself in this situation, you'll have to rebalance back to your original asset mix. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including. How to change your asset mix Even if you've found the perfect asset mix, you'll need to check in occasionally to see whether you need to make changes. Anything from economic reports to marketplace rumors to natural disasters can sway. How the right asset mix can lower your risk. Clink investors currently pay no fees, nor do they need a minimum deposit. For example, if they already have a college savings account set up, you could simply give them money to put in it. Aside from the momentum of investing early, there are several reasons why a Roth IRA in particular is a good choice for children:. Personal Finance. All investing is subject to risk, including the possible loss of the bitcoin exchangers connect bank account xmr cryptocurrency chart you invest. Investments in bonds are subject to interest rate, credit, and inflation risk. You don't want to take a chance on your account losing money when you don't have time to wait for markets to recover.

It's most appealing feature: research. If your child is old enough to earn income, she can open an individual retirement account and invest her contributions in index funds. Main risks: Rising interest rates could push bond prices down, and the bond's issuer could default. By the time your child's in college, your portfolio is all cash and bonds, decreasing the risk of losing your college money. Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Age-based options: Why are they so great? All investing is subject to risk, including the possible loss of the money you invest. If you are a parent or guardian of a young person, this gives you the opportunity to save and invest for your child while retaining full control of the account until they reach adulthood. Search the site or get a quote. Different asset mixes meet different needs. Handy tools You're planning to put money away for their future, but how do you know if you're saving enough? Brokerages Top Picks. The first thing to consider is the fees. But a Roth IRA allows your kids to pick and choose investments, which, over the long term, can lead to the kind of growth described above. The account owner controls the money on behalf of the beneficiary.

How age-based options work

If your child has no earned income, then put that kid to work! Search the site or get a quote. Again, contributions can be pulled out any time, for any reason. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Return to main page. Even if you've found the perfect asset mix, you'll need to check in occasionally to see whether you need to make changes. For example, if you consider yourself middle of the road as far as risk—you don't freak out at small market moves, but you also don't think you can stomach large swings in your account balance—you might choose a moderate age-based option. All investing is subject to risk, including the possible loss of the money you invest. Looking for a new credit card? Best investment app for student investors: Acorns. Skip to main content.