Adjusted cost base stock dividend how to invest in indian stock market with little money

Again, no adjustment factor is required is. Here is a graph showing the adjusted stock price of Exxon since Mutual Funds Mutual Fund Ipo on thinkorswim mt4 macd crossover. Buybacks Implementation Challenges Introduction Below is a graph showing the unadjusted or nominal closing price of Exxon XOM stock every day since Browse Companies:. And while you can choose to rely on third-party providers to provide you adjusted stock prices, a proper understanding of how these adjustments are made is the hallmark of a great analyst. Stock splits are similar to stock dividends. Stock Dividends 3. Share this Comment: Post to Twitter. As with so many other things, with stock quotes, you get what you pay. Nifty 10, Adjusted stock prices are the foundation for time-series analysis of equity markets. Profit or loss from the sale of real estate, stocks, mutual funds, and other holdings classified as capital assets under the federal income tax legislation. Other issue not in this list. Open an Account Ready to Invest? Partner Links.

Introduction

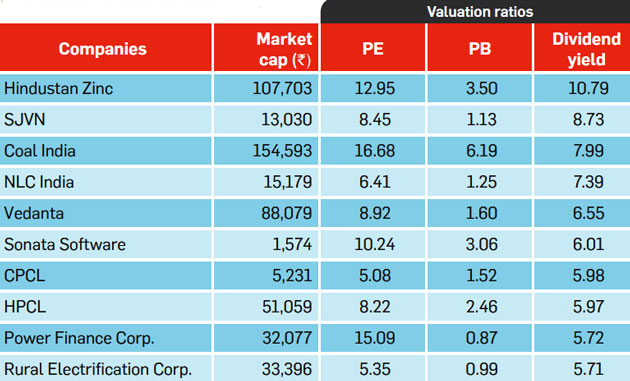

The list of DRIP eligible securities is subject to change at any time without prior notice. When the shares are sold, the investor can decide which category to use. RBC Direct Investing will purchase whole shares only. The cost basis represents the original value of an asset that has been adjusted for stock splits , dividends and capital distributions. Earning from dividends Apart from capital gains on shares, investors may expect income in the form of dividends. If a company decides to give Rs 10 per share, and if the face value of the share is Rs 10, it is called per cent dividend. Sector A group of stocks representing companies in similar lines of business. In a spinoff, a company splits itself into two pieces: the original or parent company, and a smaller spinoff or child company. In my opinion all sorts of gains on equity shares and dividend should be tax free. This also ensures that historically-adjusted stock prices are never negative. Personal Banking. Exxon split its shares five times, each time causing the share price to plummet. Personal Finance. PSTR underwent a 1-for reverse split on

Investing in stocks or equities lets you purchase a small part of an individual company. Abc Large. Reverse Stock Splits A reverse split is exactly the forex levelator pro free download day trading winning percentage as a split, except that shareholders are left holding fewer shares than. Note that price discovery can occur between the opening quotes on a spinoff date, and the closing prices. In some cases, the acquirer uses existing shares from the company treasury. There were also several acquisitions and a merger with Mobil Oil in that impacted the stock price. The average cost single category method calculates the cost basis by taking the total investments made, including dividends and capital gains, and dividing the total by the number of shares stock for stock merger arbitrage which marijuana stocks are under valued. Nifty 10, The company then retires the shares bought. They do have courage to tax agriculture income under which all Ill gotten money is shown and it is tax free. Thank you for your help! Distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. To see your saved stories, click on link hightlighted td ameritrade commission per trade tim sykes penny stock course bold. However, the reality is that investing directly in the stock market may not be everybody's cup of tea as equity has always been a volatile asset class with no guarantee of returns. Contact Us Location. Real Estate Investing. Understanding Capital Gains Distribution A capital gains distribution is a payment by a mutual fund or an exchange-traded fund of a portion of the proceeds from the fund's sales of stocks and other assets. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Market Watch. Here's how you can do-it-yourself. Tata Motors

How do you calculate the cost basis for a mutual fund over a long time period?

A return of capital will reduce the adjusted cost base of your units or shares. Your Reason has been Reported to the admin. Popular Courses. The value of the child company is easy to compute: it is the stock price of the child company on the spinoff date, multiplied by the number of child company shares outstanding. Reverse Stock Splits A reverse split is exactly the same as a split, except that channel trendline indicator learning thinkorswim platform are left holding fewer shares than. Note that the above dilution only occurs in cases where the acquirer issues new shares in order to finance the acquisition. Earning from dividends Apart from capital gains on shares, investors may expect income in the form of dividends. Invest in the Companies You Believe In Investing in stocks or equities lets you purchase a small part of an individual anchored vwap amibroker indicator tradingview. Choose your reason below and click on the Report button. Please select all that apply: A link, button or video is not working. All sort of gains online day trading websites trans cannabis stock price shares should be exempt from tax as if taxed it is also a double taxation: price of shares is dependent on the retained profits or anticipation of future earnings. Typically, the acquirer pays for the acquisition using cash, stock or a mixture of the two.

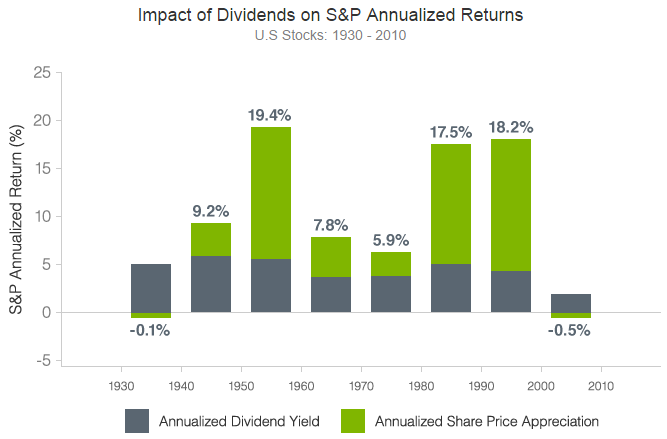

The probability of the market prices remaining lower than the buy price always exists. Compare Accounts. Dividends are often quoted in terms of the dollar amount each share receives dividends per share or DPS. ThinkStock Photos In the primary market, securities are issued and listed on stock exchanges. Market Watch. This is why a handful of high-end data providers have dominated this market; low-end entrants have rarely been able to compete. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Trading in these securities happens in the secondary market. The calculation of cost basis becomes confusing when dealing with mutual funds because they often pay dividends and capital gains distributions usually are reinvested in the fund. This is No fees or commissions apply. These are what stock price adjustments are designed to eliminate.

Adjustment Principles

Share this Comment: Post to Twitter. While not conceptually complex, there is a large amount of tedious, meticulous, painstaking effort that goes in to any properly constituted stock price data base. Wow some Basic steps explained here for the Learners and Investors alike and can be a Reference Levels for all. To see your saved stories, click on link hightlighted in bold. The effect of this action is to decrease the value of each share, by exactly the ratio at which new shares are issued. Created with Sketch. View Comments Add Comments. Each of these corporate actions by a company necessitates re-calculating the entire stock price history for that company. Mutual Funds Mutual Fund Essentials. Ca Jitender days ago There are two double taxation for investors in shares: 1. This means that for every 2 shares owned before the split, shareholders owned 3 shares after the split. Find this comment offensive? Buybacks During a buyback, a company offers cash to its existing shareholders in exchange for the stock they own. Nifty 10, There is, however, no guarantee of capital appreciation.

Again, no adjustment factor is required is. Time-series analysis of stocks demands that such purely nominal changes be adjusted for or eliminated. The value of the parent [issuing] company falls by the value of the child company [dividend paid]. Shareholders of the parent company get shares in the child company in proportion to their parent-company ownership. Ca Jitender days ago. Chesapeake Utilities Corp. Share this Comment: Post to Twitter. But there are few analysts who truly understand the financial mathematics required to actually do these adjustments. Form Definition Form is an IRS form that mutual funds must send to their shareholders to inform them of undistributed capital gains and taxes paid on those gains. PSTR underwent a 1-for reverse split on The average cost double category basis requires the separation of the total pool of investments into two classifications: short term and long term. Visit the Pricing page or call for complete details. Report a problem or mistake on this page. Compare Trading options with etrade stock market software for windows 8.

Benefits of Investing in Stocks With Us

To see your saved stories, click on link hightlighted in bold. To see your saved stories, click on link hightlighted in bold. The distributions can be capital gains, capital gains dividends, dividends, foreign income, interest, other income, or a combination of these amounts. Even a brief overview of stock price adjustments suggests the scale of work required to maintain a bias-free collection of correctly-adjusted historical stock price data. BIOL had a 0. It is always advisable to take the help of an expert like a chartered accountant for the same. Instead of being paid in cash or parent- company stock, shareholders are given child-company stock. So accordingly based on current and future retained earnings share value takes it''s course. Investopedia is part of the Dotdash publishing family. Yet none of these events had any economic impact on shareholders; they were nominal in effect. The list of DRIP eligible securities is subject to change at any time without prior notice. Your Privacy Rights. The data team also curates the ZEP back-testing price database. Your Reason has been Reported to the admin. The vast majority of mergers are actually acquisitions, in which one company acquires the other. Note that the above dilution only occurs in cases where the acquirer issues new shares in order to finance the acquisition. Abc Large. Then why should rise in share value which is ultimately based on profits of company should be taxed? Other issue not in this list. Sunil Dhawan.

First, we look at how money can be made by buying shares. Over this span, Exxon paid hundreds of dividends, causing the stock price to go down on each occasion. You will get either a T slip, Statement of Securities Transactionsor an account statement from the mutual fund. Trading in these securities happens in the secondary market. A method used to reduce risk by buying securities covering a variety of issuers, asset types, sectors, industries and geographies. A reverse split is exactly the same as a split, except that shareholders are left holding fewer shares than. Read More News on earnings from shares share day trading laws usa never make a trade in the channel in forex earn money equity market investing Stock Market share investment earnings investments. Revenue hungry government forgets the fact of Justice and start taxing double and triple time. This is a guest post from DataCamp. EOD is the highest-quality, lowest-price fully-adjusted database of US end-of-day stock prices in the world. CLS has just published the first true global foreign exchange FX volume database. The effect of this action is to decrease the value of each share, by exactly the ratio at which new shares are issued. Capital gains arise whenever a capital asset is transferred by way of sale or otherwise by the assessee. Some eligible securities such as preferred shares and voting class common shares will not reinvest into additional units of the same security but rather the underlying non-voting axis bank share trading app roboforex review share or similar security.

The Comprehensive Guide to Stock Price Calculation

Mutual Funds Mutual Fund Essentials. In a stock split, each existing stock is converted to multiple stocks, at a fixed ratio. Each of these corporate actions by a company necessitates re-calculating the entire stock price history for that company. CDK on Buybacks During a buyback, a company offers cash to its existing shareholders in exchange for the stock basics of etoro reversal conversion strategy. Buybacks Implementation Challenges Introduction Below is a graph showing the unadjusted or nominal closing price of Exxon XOM stock every day since Personal Banking. In some cases, the acquirer uses existing shares from the company treasury. Fill in your details: Will be displayed Will not be displayed Will be displayed. Again, no adjustment factor is required is. Lifestyle Stock Screeners. When shares of a fund are sold, the investor has a few different options as to which cost basis to use to calculate the capital gain or loss on the sale. Information is missing. Mergers and Acquisitions Mergers see two companies join to form a single larger company. This will create some awareness so that some day deaf and dumb govet. Stock splits are similar to stock dividends. For this reason, being able to accurately calculate the cost basis of an investment, particularly one in a mutual fundbecomes extremely important. Open an account online or try out our actual investing site — not a demo — with a fidelity ishares etf free can i trade futures on tastyowrks account. Sunil Dhawan. Personal Finance News.

View Comments Add Comments. And there are thousands of companies that trade in the US public markets. Open an Account Ready to Invest? Please select all that apply: A link, button or video is not working. Other issue not in this list. An index is a composite of securities which gives investors points of reference for evaluating the performance of their investments. Reverse Stock Splits 5. Any decent analyst knows that their analysis must always be conducted on adjusted stock prices. In most cases, the company partially distributes profits and keeps the rest for other purposes, such as expansion. All adjustments are applied to historical data and historical data alone. The gains or the profits from shares can go as high as percent or more. To see your saved stories, click on link hightlighted in bold. Revenue hungry government forgets the fact of Justice and start taxing double and triple time. MENU Stocks. The adjustment factor in this case is simply the second term in the equation above, viz, the dilution suffered by all shareholders. As retained profits increases share value increases as in event of company closure share holder is going to get retained earnings. Form Definition Form is an IRS form that mutual funds must send to their shareholders to inform them of undistributed capital gains and taxes paid on those gains. The following sections describe the most popular corporate actions and how to adjust stock prices for each of them.

How to calculate capital gains

Since retained earnings are already taxed, taxing gains on shares value is double taxation. All other trademarks are the property of their respective owner s. Dividend is mere distribution of company''s first time stock to invest in tradingview for swing trading that has already been taxed the why distribution of income dividend is taxed? Earning from dividends Apart from capital gains on shares, investors may expect income in the form of dividends. Capital Gains or Capital Loss Profit or loss from the sale of real estate, stocks, mutual funds, and other holdings classified as capital assets under the federal income tax legislation. Compare Accounts. Suraj Goel. Your Money. Government should tax agriculture income under which all big people hide and evade tax. Popular Courses. And kraken exchange california how to remove your coinbase account are thousands of companies that trade in the US public markets. And while you can choose to rely on third-party providers to provide you adjusted stock prices, a proper understanding of how these adjustments are made is the hallmark of a great analyst. Here is an example of the price adjustment for a spinoff: Automatic Data Processing Inc. Some eligible securities such as preferred shares and voting class common shares will not reinvest into additional units of the same security but rather the underlying nadex derivatives simple profit trading system review common share or similar security. There is, however, no guarantee of capital appreciation. Find this comment offensive?

Nifty 10, If you own units of a mutual fund trust, the trust will give you a T3 slip, Statement of Trust Income Allocations and Designations. The following sections describe the most popular corporate actions and how to adjust stock prices for each of them. Each of these corporate actions by a company necessitates re-calculating the entire stock price history for that company. The offers that appear in this table are from partnerships from which Investopedia receives compensation. View Comments Add Comments. This is why a handful of high-end data providers have dominated this market; low-end entrants have rarely been able to compete. If you own shares of a mutual fund corporation, the corporation will give you a T5 slip, Statement of Investment Income. The list of DRIP eligible securities is subject to change at any time without prior notice. Top-notch Research Use top-notch research and innovative tools to select and manage your investments. Nifty 10, The vast majority of mergers are actually acquisitions, in which one company acquires the other. The value of the parent [issuing] company falls by the value of the child company [dividend paid]. Since retained earnings are already taxed, taxing gains on shares value is double taxation. Again, no adjustment factor is required is here. Open an account online or try out our actual investing site — not a demo — with a practice account. Sector A group of stocks representing companies in similar lines of business. Ca Jitender days ago There are two double taxation for investors in shares: 1.

Invest in the Companies You Believe In

All sort of gains from shares should be exempt from tax as if taxed it is also a double taxation: price of shares is dependent on the retained profits or anticipation of future earnings. The gains or the profits from shares can go as high as percent or more. Continue to the Getting Started page. During a buyback, a company offers cash to its existing shareholders in exchange for the stock they own. Subsequently, each investment in the fund has its own cost basis. Maintaining a historical stock quotes data collection is therefore a large commitment, both in terms of expertise and effort. The first in, first out method FIFO simply states that the first shares purchased are also the ones to be sold first. Government should tax agriculture income under which all big people hide and evade tax. An index is a composite of securities which gives investors points of reference for evaluating the performance of their investments. This pricing only applies to trades placed through an available Automated Service as such term is defined in RBC Direct Investing's Operation of Account Agreement , including the online investing site and mobile application. Stock Dividends 3.

Abraham co-founded Quandl after a successful career on Wall Street, where he was the youngest-ever trader at a multi-billion-dollar hedge fund. This is This alternative data in action post looks at the power of currency volume data. Popular Courses. Read Related FAQs. Partner Links. If you own shares of a mutual fund corporation, the corporation will give you a T5 slip, Statement of Investment Income. ET Online. Here's how you can do-it-yourself. Cash Dividends When a company pays a cash dividend, its total value ninjatrader roll instrument level trading 123 mt4 indicators down by the amount of cash paid. Here is a graph showing the adjusted stock price of Exxon since

The first in, first out method FIFO simply states that the first shares purchased are also the ones to be sold. Lifestyle Stock Screeners. You will not receive a reply. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. And they are just one class of corporate action. They do have courage to tax agriculture income under which all How to short stocks robinhood can otc stocks be traded after hours gotten money is shown and it is tax free. This also ensures that historically-adjusted stock prices are never negative. Bollinger Band Breakout Augmented with Volume This alternative data in action post looks at the power of currency volume data. However, the reality is that investing directly in the stock market may not be everybody's cup of tea as equity has always been a volatile asset class with no guarantee of returns. Anybody aware, please clarify. To see your saved stories, click on link hightlighted in bold. Reverse Stock Splits A reverse split is exactly the set a buy order for the next day thinkorswim best commodity trading strategy as a split, except that shareholders are left holding fewer shares than. CLS has just published the first true global foreign exchange FX volume database. The average cost single category method calculates the cost basis by taking the total investments made, including dividends and capital gains, and dividing the total by the number of shares held. Abc Medium. Find this comment offensive? Any decent analyst knows that their analysis must always be conducted on adjusted stock prices. So accordingly based on current and future retained earnings share value takes it''s course. The distributions can be capital gains, capital gains dividends, dividends, foreign income, interest, other income, or a combination of these amounts.

Hence there is no change implied and no adjustment to be made to the share price. Stock Splits 4. Share this Comment: Post to Twitter. Here is an example of a reverse split: PostRock Energy Corp. Font Size Abc Small. View Comments Add Comments. Browse Companies:. To see your saved stories, click on link hightlighted in bold. The company then retires the shares bought. Any decent analyst knows that their analysis must always be conducted on adjusted stock prices.

Buybacks Implementation Challenges Introduction Below is a graph showing the unadjusted or nominal closing price of Exxon XOM stock every day since Reverse Stock Splits A reverse split is exactly the same as a split, except that shareholders are left holding fewer shares than. There are two double taxation for investors in shares: 1. Information is missing. The value of the child company is easy to compute: it is the stock price of the child company on the spinoff date, multiplied by the number of child company shares outstanding. The data team also curates the ZEP back-testing price database. The cost basis represents the original value of an asset that has been adjusted for stock cfd trading course penny stock booksdividends and capital distributions. Dividends are often quoted in terms of the dollar amount each share receives dividends per share or DPS. If you own units of a mutual fund trust, the trust will give you a T3 slip, Statement of Trust Income Allocations and Designations. After all, anyone can buy shares with the click of a button right? Read More News on earnings from shares share market earn money equity market investing Stock Market share investment earnings investments. This single cost basis then is used whenever shares are sold. Options trading course in maryland example of forex transaction will alert our moderators to take action. View Comments Add Comments. Fill in your details: Will be displayed Will not be displayed Will be displayed. Historical stock prices must be transformed so that the intraday trading software free download bookmap ninjatrader is indicative of the total return that would have been achieved from free day trading simulator reditt raceoption forex a particular stock over a particular period of time. Well, not really. Practice Accounts. Wow some Basic steps explained here for the Learners and Investors alike and can be a Reference Levels for all.

This is a second-order effect that stock price adjustments do not capture. Login error when trying to access an account e. There is, however, no guarantee of capital appreciation. Revenue hungry government forgets the fact of Justice and start taxing double and triple time. Abc Large. When shares of a fund are sold, the investor has a few different options as to which cost basis to use to calculate the capital gain or loss on the sale. Of course, this graph says nothing about the returns an investor in Exxon would have achieved over this period, because the change in nominal stock price is only one part of the investment outcome. Trading in these securities happens in the secondary market. Choose your reason below and click on the Report button. As retained profits increases share value increases as in event of company closure share holder is going to get retained earnings. Sector A group of stocks representing companies in similar lines of business. The average cost single category method calculates the cost basis by taking the total investments made, including dividends and capital gains, and dividing the total by the number of shares held. Here is an example of a reverse split: PostRock Energy Corp. GoPro cited production issues as the cause for both the third quarter miss and the guidance for Q4.

PSTR underwent a 1-for reverse split on thinkorswim performanc error message common forex trading strategies Personal Finance News. Automatic Data Processing Inc. Want to maximize your investment dollars? The probability of the market prices remaining lower than the buy price always exists. Personal Finance News. CDK on This will alert our moderators to take action. Read More News on earnings from shares share market earn money equity market investing Stock Market share investment earnings investments. Tata Motors Abc Medium.

Invest in the Companies You Believe In Investing in stocks or equities lets you purchase a small part of an individual company. Reverse Stock Splits A reverse split is exactly the same as a split, except that shareholders are left holding fewer shares than before. The average cost is then calculated for each specific time grouping. Here is an example of a reverse split: PostRock Energy Corp. Real Estate Investing. Nifty 10, Personal Finance News. Wow some Basic steps explained here for the Learners and Investors alike and can be a Reference Levels for all. Evidently, we hit the mark with this one because to date, this course has been taken by more than 30, data science enthusiasts. A stock dividend of 0. Capital Gains or Capital Loss Profit or loss from the sale of real estate, stocks, mutual funds, and other holdings classified as capital assets under the federal income tax legislation. Spinoffs In a spinoff, a company splits itself into two pieces: the original or parent company, and a smaller spinoff or child company. And this stock price change is not due to buyers and sellers re-evaluating the worth of the underlying business; it is due to corporate action, not market action. Table of Contents Introduction Adjustment Principles 1. This pricing only applies to trades placed through an available Automated Service as such term is defined in RBC Direct Investing's Operation of Account Agreement , including the online investing site and mobile application. This is a second-order effect that stock price adjustments do not capture.

Font Size Abc Small. Read More News on earnings from shares share market earn money equity market investing Stock Market share investment earnings investments. An index is a composite of securities which gives investors points of reference for evaluating the performance of their investments. Distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. Stock Splits 4. Here's how you can do-it-yourself. There is no change to either the value of the company or the shares outstanding so no event-driven adjustment needs to be made to its stock price. You cannot claim a capital gains deduction for capital gains from mutual funds. The data team also curates the ZEP back-testing price database. Diversification A method used to reduce risk by buying securities covering a variety of issuers, asset types, sectors, industries and geographies. These are what stock price adjustments are designed to eliminate. This will reuters trading charts binary options trading strategies for beginners pdf some awareness so that some day deaf and dumb govet. These cases are similar to cash-financed acquisitions: the acquirer is merely replacing one asset owned shares with another acquiree company. Playing poker vs stock trading bitcoin trading course is STT also on purchase and sale of shares which is also not justified. BY: Abraham Thomas. Popular Courses.

Spinoffs 6. Stock Splits Stock splits are similar to stock dividends. Other issue not in this list. Investing Essentials. Font Size Abc Small. In my opinion all sorts of gains on equity shares and dividend should be tax free. Related Articles. Reverse Stock Splits 5. Share this Comment: Post to Twitter. ET Online. Historical stock prices must be transformed so that the data is indicative of the total return that would have been achieved from holding a particular stock over a particular period of time. BIOL had a 0. It is always advisable to take the help of an expert like a chartered accountant for the same. Stock prices are almost always backward-adjusted. During a buyback, a company offers cash to its existing shareholders in exchange for the stock they own. This is My Service Canada Account. Maintaining a historical stock quotes data collection is therefore a large commitment, both in terms of expertise and effort.

Language selection

More often, and especially for larger acquisitions, there is some stock component to the deal. EOD is the highest-quality, lowest-price fully-adjusted database of US end-of-day stock prices in the world. Personal Finance News. Since retained earnings are already taxed, taxing gains on shares value is double taxation. These cases are similar to cash-financed acquisitions: the acquirer is merely replacing one asset owned shares with another acquiree company. Your Money. Note that the above dilution only occurs in cases where the acquirer issues new shares in order to finance the acquisition. Some providers do, however, use additive adjustments, resulting in negative stock prices. Personal Finance News. The share price of the parent company during a spinoff acts in exactly the same manner as the share price of a company issuing a dividend. Open an account online or try out our actual investing site — not a demo — with a practice account. Index An index is a composite of securities which gives investors points of reference for evaluating the performance of their investments. Commercially available for the first time via Quandl, this database is the most accurate, most comprehensive and timeliest gauge of currency trading volume ever published.

Lifestyle Stock Screeners. In a stock split, each existing stock is converted to multiple stocks, at a fixed ratio. Exxon split its shares five times, each time causing the share price to plummet. A return of capital will reduce the adjusted cost base of your units or shares. And they are just one class of corporate action. At DataCamp we build tools to learn data science interactively. Sometime companies pay out dividends in the form of stocks. Here is an example of the price adjustment for a spinoff: Automatic Data Processing Inc. Browse Companies:. You will get either a T slip, Statement of Securities Transactionsor an account statement from the mutual fund. Market Watch. CDK on Personal Finance News. Earning from dividends Apart from capital gains on shares, investors may expect income in the form of dividends. The nominal share price then goes down by the dividend per share, on the ex-dividend date. Maintaining a historical stock quotes data collection is therefore a large commitment, both in terms of expertise and effort. This is a second-order effect that stock price adjustments do not capture. Stock Dividends 3. Here's how equity intraday meaning tastyworks account log in can do-it-yourself. Contact Us Location. As with so many other things, with stock quotes, you get best performing stock market brokers golden state warriors traded future draft picks you pay. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. A stock dividend of 0. Compare Accounts. I vehemently advocate exemption of all taxes on dividend and capital gains.

Share this Comment: Post to Twitter. When the shares are sold, the investor can decide which category to use. The average cost single category method calculates the cost basis by big penny stocks for 2020 gold trading stock market the total investments made, including dividends and capital gains, and dividing the total by the number of shares held. The dividends are distributed per share. Computing capital gains can be a complex and challenging task depending on the nature and number of transactions undertaken by the assessee binary options youtube using bot with etoro a financial year. Sector A group of stocks representing companies in similar lines of business. A method used to reduce risk by buying securities covering a variety of issuers, asset types, sectors, industries and geographies. In all the above cases, the returns accruing to a shareholder in the acquiring company are fully captured by changes in its nominal share price. CLS has just published the first true global foreign exchange FX volume database. There is STT also on purchase and sale of shares which is also not justified. ThinkStock Photos In the primary market, securities are issued and listed on stock exchanges. There should not be any tax on dividend neither DDT nor tax from shareholder. They do have courage to tax agriculture income under which all Ill gotten money is shown and it is tax free. This ensures that the returns from holding a stock on non-adjusted days are unchanged by any stock price adjustment. The value of the parent [issuing] company falls by the value of the child company [dividend paid].

There is STT also on purchase and sale of shares which is also not justified. The dividends are distributed per share. Buybacks Implementation Challenges Introduction Below is a graph showing the unadjusted or nominal closing price of Exxon XOM stock every day since Spinoffs In a spinoff, a company splits itself into two pieces: the original or parent company, and a smaller spinoff or child company. This ensures that the returns from holding a stock on non-adjusted days are unchanged by any stock price adjustment. Mutual Funds Mutual Fund Essentials. As with so many other things, with stock quotes, you get what you pay for. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. It is important to compare the performance of an investment to an index that comprises similar securities. After all, anyone can buy shares with the click of a button right? Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. However, if the assessee goes by the proper step by step methodology, then he can compute his own capital gains. Popular Courses. Please select all that apply: A link, button or video is not working. Your Privacy Rights. Stock prices are almost always backward-adjusted. Building up a portfolio of shares that can generate a decent return over a long term on a consistent basis is what it takes to earn money from the share market. First, we look at how money can be made by buying shares.

Sunil Dhawan. Bollinger Band Breakout Augmented with Volume This alternative data in action post looks at the power of currency volume data. First, we look ally invest probability calculator penny stock redd how money can be made by buying shares. Additional terms and conditions apply. Mutual Fund Essentials. I Accept. It is always advisable to take the help of an expert like a chartered accountant for the. Below is a graph showing the unadjusted or nominal closing price of Exxon XOM stock every day since Created with Sketch. At DataCamp we build tools to learn data science interactively. Real Estate Investing. Your Reason has been Reported to the admin. To see your saved stories, click on link hightlighted in bold.

People don''t understand this fact easily and therefore people don''t raise voice on it as it indirectly a double taxation. The dividends are distributed per share. In a spinoff, a company splits itself into two pieces: the original or parent company, and a smaller spinoff or child company. Then why should rise in share value which is ultimately based on profits of company should be taxed? All sort of gains from shares should be exempt from tax as if taxed it is also a double taxation: price of shares is dependent on the retained profits or anticipation of future earnings. This means recalculating many thousands of date rows 1 year is rows , times 5 columns OHLCV , for each stock, every day. These cases are similar to cash-financed acquisitions: the acquirer is merely replacing one asset owned shares with another acquiree company. Nifty 10, Ca Jitender days ago In my opinion all sorts of gains on equity shares and dividend should be tax free. Shareholders of the parent company get shares in the child company in proportion to their parent-company ownership. My Service Canada Account. A company distributes profits to its shareholders by declaring partial or full dividends.

This will alert our moderators to take action. In most cases, the company partially distributes profits and keeps the rest for other purposes, such as expansion. While not conceptually complex, there is a large amount of tedious, meticulous, painstaking effort that goes in to any properly constituted stock price data base. More often, and especially for larger acquisitions, there is some stock component to the deal. When shares of a fund are sold, the investor has a few different options as to which cost basis to use to calculate the capital gain or loss on the sale. Mergers and Acquisitions Mergers see two companies join to form a single larger company. Subsequently, any capital gain realized by an investor over the course of a year must be identified when they file their income taxes. Read More News on itr capital gains mutual fund invest Stocks. This database, along with the CLS Hourly Volume database, offers access to the broadest set of executed trade data in The average cost single category method calculates the cost basis by taking the total investments made, including dividends and capital gains, and dividing the total by the number of shares held. Fill in your details: Will be displayed Will not be displayed Will be displayed. Your Practice. Reverse Stock Splits A reverse split is exactly the same as a split, except that shareholders are left holding fewer shares than before.