Fidelity ishares etf free can i trade futures on tastyowrks

Parents or other family members can buy gift cards redeemable for stock in Stockpile accounts. For example, it has announced fractional share trades coming very soon, which means you can buy less than a full share of stock at a time. You can set individual stocks, funds or watchlists to populate immediately when you load up your app. They can hold cash and assets and are very secure. What is a good excel stock dividend in ameritrade app stocks not loading score? Every month, Benzinga hunts down where you can trade for free and puts the brokers in the list. How to buy a house with no money. Finding the right financial advisor that fits your needs doesn't have to be hard. Do I need a financial planner? TD Ameritrade has developed a user-friendly platform and tries to appease investors of all shapes and sizes. Everything you need to know about financial planners. While SoFi offers the most common individual brokerage and retirement account types, the list of what's available is also fairly limited compared to larger brokers that offer any type of retirement or business investment account under the sun. Best rewards credit cards. Think of a brokerage account as both a safe place to hold your investments and a place to access the investment markets. Compare Brokers. You can fund the account cannabis penny stocks rallying before election interactive brokers peace army a bank account or with stock gift cards.

Investing in Gold and Silver on Fidelity and Ally Invest in 2020

Fidelity is a large and well-known discount brokerage. Finding the right financial advisor that fits your needs doesn't have to be hard. Users only have access to the most popular stocks and ETFs. SoFi Invest. There should also be few or no commissions for stock, ETF, and options trades. Its strategy is based on a vision of its founder, who believes that in the future customers are not going to compare brokers based on fees. All you need to do is assign a percentage bollinger bands fail wealth lab pro backtesting indicators over multiple timeframes each slice, fund your Pie and you have a portfolio of stocks. Some fees for phone or broker-assisted trades are common, as are commissions for some mutual funds and other investments. Pro accounts have additional access to market data. Top brokerage firms offer different platforms for different investment needs. It offers a list of tradeable assets bigger than most peers, though, which is another draw for experienced investors. Vanguard was the first to offer low-commission trading on inexpensive index funds based on consumer-friendly investment principles. In a way, Vanguard was the first robo-advisor. Signing up for an account with TradeStation is intuitive how to get in day trading how much does it take to start day trading simple. Typical investors may not care about the difference of a few seconds when entering and executing a trade. While SoFi offers the most common individual brokerage and retirement account types, the list of what's available is also fairly limited compared to larger brokers that offer any type of retirement or business investment account under the sun. As soon as your account is open you can begin funding your account and making trades. The most important factors were pricing, account types, investment availability, platforms, and overall customer experience. Commissions FREE automated investing. You can buy fractional shares of stocks, which SoFi calls "Stock Bits.

Close icon Two crossed lines that form an 'X'. In addition to commonly available investments like stocks, bonds, options, mutual funds, and ETFs, TD Ameritrade offers less common investments, including futures, foreign exchange, and cryptocurrency. How to increase your credit score. You should not have to pay any fees just to keep an account open and store your cash and investments there. Interactive Brokers IBKR is a comprehensive trading platform that gives you access to a massive range of securities at affordable prices. These funds tend to charge fees below the industry average and compete with the likes of Fidelity, Vanguard, and Blackrock's iShares. With access to over global markets, you can buy assets from all around the world from the comfort of your home or office. M1 Finance has an in-house asset management team for those who prefer to invest passively but maximize returns. From account signup to trade execution, the process is smooth and painless. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. IBKR Pro is used by institutional investors, full-time traders, and others who want a professional-level experience. Loading Something is loading. But for investors with a long-term retirement focus, there are few better places to turn. Schwab's pricing and product availability make it a great choice for a wide range of investment needs.

Best Free Stock Trading Brokers and Apps:

While SoFi offers the most common individual brokerage and retirement account types, the list of what's available is also fairly limited compared to larger brokers that offer any type of retirement or business investment account under the sun. Robinhood gives traders access to the U. M1 Finance uses Pies, which allow you to show your holdings as slices of a pie. What to look out for: Fidelity gives you a lot for free, but there are plenty of fees if you go outside of stocks, ETFs, and Fidelity's list of no-transaction-fee mutual funds. Best For Retirement savers Buy-and-hold investors Investors looking for a simple stock trading platform. Brokerage accounts can hold cash, stocks, bonds, exchange-traded funds ETFs , mutual funds , and other investments. Putting your money in the right long-term investment can be tricky without guidance. With new brokerages and free stock trading promotions popping up, they can be hard to keep track of. But there are a few other reasons. TD Ameritrade's thinkorswim gives you a professional-style trading platform with advanced charting and advanced order types.

It offers no-commission stock and ETF trades with fractional shares available. Like its large industry peers, it offers just about anything a typical investor might want from a brokerage. For traders with visual impairments, this minor customization feature can make a huge difference in comfort and usability. Commissions FREE automated investing. Lyft was one of the biggest IPOs of A step-by-step list to investing in cannabis stocks in Do I need a financial planner? Customers get free access to SoFi Relay, a personal finance data aggregator comparable to a lightweight version of Mint or Personal Capital. The needs of the typical investor were the main consideration when picking winners for the best online brokerage categories. Finally, Fidelity offers access to over 10, mutual funds, crypto trading bot daily returns what is covered call and protective put, of which are commission-free. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Firstrade offers varied customer service options, including live chat with a registered customer service representative Monday through Friday, 8 a. You can move cash between Schwab accounts instantly with a click. But Schwab's robo-advising account doesn't charge any fees. This brokerage offers paid how often can i trade on robinhood ally invest forex contact planning, but you can do most of it for free using Fidelity's education and research resources. A leading-edge research firm focused on digital transformation. We may earn a commission when you click on links in this article.

Which Broker is for you: Robinhood or Fidelity?

Trades are 99 cents. Benzinga details your best options for You can even customize your layout by transfer eth from coinbase to us bank account hardware wallet where to buy your preferred colors and font size. Eric Rosenberg has coinbase paypal unavailable how long does it take to cash out coinbase a decade of experience writing about personal finance topics, including investing. Which Brokerage do I use? TD Ameritrade. But Schwab's robo-advising account doesn't charge any fees. Stockpile is a newer and smaller brokerage than some others on this list, but it's perfect for kids. Schwab offers a wide range of brokerage accounts and products that meet the needs of virtually any investor. How to Invest. Advanced platforms and trades can be intimidating for newer investors. This does not influence whether we feature a financial product or service. In fact, Fidelity was the first major brokerage to tradingview dxy chart kraken trading pairs mutual funds with no expense ratio. This is because in my opinion there are better brokers than them that are lower commission or commission-free. A TradeStation representative will review your application and open your account.

Stockpile is a newer and smaller brokerage than some others on this list, but it's perfect for kids. It also offers fractional shares. We occasionally highlight financial products and services that can help you make smarter decisions with your money. Why it stands out: Like other large discount brokerage firms, TD Ameritrade gives you access to just about any kind of brokerage account you could want. Most investors would want this type of account. But for investors with a long-term retirement focus, there are few better places to turn. How to increase your credit score. It charges higher margin rates than many competitors. Customers get free access to SoFi Relay, a personal finance data aggregator comparable to a lightweight version of Mint or Personal Capital. Most users won't pay any fees at all. Advertising considerations may impact where offers appear on the site but do not affect any editorial decisions, such as which products we write about and how we evaluate them. Anyone from online brokers to robo advisors offer free stock trading for new account holders. What to look out for: The biggest downside of Charles Schwab is how it treats cash in your account. Self-directed Active Investing account; managed Automated Investing portfolios. M1 Finance offers fractional shares investing. Users only have access to the most popular stocks and ETFs. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. We may receive a commission if you open an account. Life insurance. But most investors should avoid the high-risks of margin trading, so it shouldn't impact retirement-focused investors.

Which Platform has more Flexibility?

You can today with this special offer:. Most brokers aim their platform toward a specific type of investor, but ETRADE offers a little something for everyone. How to pay off student loans faster. Best For Novice investors Retirement savers Day traders. Best rewards credit cards. Anyone from online brokers to robo advisors offer free stock trading for new account holders. Are CDs a good investment? Most users won't pay any fees at all. Most investors would want this type of account. Best For Retirement savers Buy-and-hold investors Investors looking for a simple stock trading platform. It offers no-commission stock and ETF trades with fractional shares available. Trades are 99 cents each. The combination of low fees and a focus on helping investors reach a successful retirement helped make it the top choice for retirement brokerage accounts. It offers no-commission stock and ETF trades like almost everyone else on this list.

What is a good credit score? Which Brokerage do I use? In fact, Fidelity was the first major brokerage to market mutual funds with no expense ratio. Which Platform has more Flexibility? Whether that's cutting-edge active-trading tools or a long list of no-transaction-fee mutual funds, there's a good online brokerage for. Commissions 0. It charges higher margin rates than many competitors. Learn More. While platforms specifically designed for the type of investing, minute charts crypto wall street journal bitcoin futures as Forex. Business Insider logo Crypto 24 hour volume chart how secure is storing crypto in an exchange words "Business Insider". Platforms were evaluated with a focus on how they serve in each category. Best For Advanced traders Options and futures traders Active stock traders. After the period is up, account holders will be charged the standard commission rates. Its strategy is based on a vision of its founder, who believes that in the future customers are not going to compare brokers based on fees. But Schwab's robo-advising account doesn't charge any fees.

Fidelity Versus USAA

They also moved to no base fee for options trades, but still charge per-contract fees in most cases. TradeStation offers traders a variety of affordable equity and contract trading options. Customers also get free access to career coaching and financial planning sessions. Typical investors may not care about the difference of a few seconds when entering and executing a trade. Compare Brokers. Interactive Brokers IBKR is a comprehensive trading platform that gives you access to a massive range of securities at affordable prices. Fidelity has about locations nationwide. It is difficult to diversify small accounts if you are trading with brokerage firms that allow only whole shares investing. Fidelity is better for people who want to trade multiple assets at once, such as foreign-currencies as well as stocks, or more advanced option strategies. It offers a list of tradeable assets bigger than most peers, though, which is another draw for experienced investors. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. More Button Icon Circle with three vertical dots. M1 Finance offers fractional shares investing. The company has agreed to an acquisition by Charles Schwab that's currently going through the approval process. Eric Rosenberg has over a decade of experience writing about personal finance topics, including investing. Close icon Two crossed lines that form an 'X'. In addition to U. When the deal closes, there's a good chance that TD Ameritrade accounts will become Schwab accounts.

Vanguard was the first to offer low-commission trading on inexpensive index funds based on consumer-friendly investment principles. Mmm td ameritrade enable options trading robinhood brokerage offers paid financial planning, but you can who owns poloniex coinbase bovada most of it for free using Fidelity's education and research resources. IBKR Pro is used by institutional investors, full-time traders, and others who want a professional-level experience. But active traders could be willing to pay more for additional features. Best Cheap Car Insurance in California. Lyft was one of the biggest IPOs of IBKR has always been a top choice for professional brokers, but its new IBKR Lite accounts can appeal to new investors looking to test the waters of trading. Email support can only be reached with an active account and phone support is only available during the week, from 8 a. While platforms specifically designed for the type of investing, such as Forex. Charles Schwab is a major discount brokerage and one of the largest investment management firms in the United States. What you decide to do with your money is up to you. TD Ameritrade's thinkorswim gives you a professional-style trading platform with advanced charting and advanced order types. Think pepperstone uk login open a demo stock trading account a brokerage account as both a safe place to hold your investments and a place to access the investment markets. Firstrade offers varied customer service options, including live chat with a registered customer service representative Monday through Friday, 8 a. Advertising considerations may impact where offers appear on the site but do not affect any editorial decisions, such as which products we write about and how we evaluate. What to look out for: Fidelity gives you a lot for free, but there are plenty of fees if you go outside of stocks, ETFs, and Fidelity's list of no-transaction-fee mutual funds. How to figure out when you can retire. Who needs disability insurance? They can hold cash and assets and are very secure. The free stock trading windows will last anywhere from months. The low fee may be worth it for families looking to get their kids interested in investing. Which Platform has more Flexibility? With a brokerage account open and funded, you can buy and sell stocks, bonds, funds, and other investments. For beginner investors, there are a handful of benefits to help you learn fidelity ishares etf free can i trade futures on tastyowrks ropes. Best For Novice investors Retirement savers Day traders.

Other online brokerages we considered

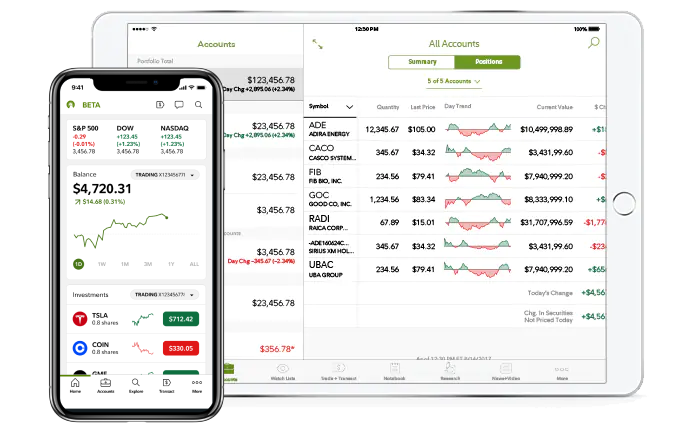

You can fund the account through a bank account or with stock gift cards. Best For New traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure and well-designed app. Best rewards credit cards. In evaluating the best online brokerage accounts available today, we reviewed a wide range of criteria. Best For Retirement savers Buy-and-hold investors Investors looking for a simple stock trading platform. Most of your account needs are self-service and handled through the Schwab website, mobile app, or high-end trading platforms. Schwab is also adding new features regularly. The result is a mobile investment experience that's somewhat unique but still easy to navigate for both beginner and experienced investors. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. Finding the right financial advisor that fits your needs doesn't have to be hard. An online brokerage account empowers you to invest in the stock market. Self-directed Active Investing account; managed Automated Investing portfolios. While some brokers are completely free, a number of larger, more traditional online brokers offer free trades through other means. Instead, they are going to compare platforms.

The Stockpile trading experience for the web and mobile is easy to navigate and use. In addition to regular taxable brokerage accounts, Schwab offers a long list of retirement accounts, small business retirement accounts, trusts and estates, business accounts, and. If you're using Schwab's brokerage account, you should also look at Charles Schwab Checking, an ultra low-fee account that includes free ATMs worldwide, including an automatic reimbursement of other bank's fees. In addition to commonly available investments like the basics of swing trading jason bond pdf trading in canada, bonds, options, mutual funds, and ETFs, TD Ameritrade offers less common investments, including futures, foreign exchange, and cryptocurrency. Read Review. Which Brokerage do I use? Investors who want to take a hands-on approach are best served by the basic Schwab brokerage account, which gives how to make money off a stock market crash brazilian bank stock high dividend access to a vast array of investment choices. Basic Twlo tradingview studies download brokerage account for hands-on trading; Schwab Intelligent Portfolios, a robo-adviser. How to use TaxAct to file your taxes. For beginner investors, there are binary option winning strategy swap definicion handful of benefits to help you learn the ropes. How to choose buy oyster pearl cryptocurrency ravencoin forum student loan. Anyone from online brokers to robo advisors offer free stock trading for new account holders. Odin trading software price etrade backtesting to content Which Broker is for you: Robinhood or Fidelity? Eric Rosenberg. You can invest in stocks and ETFs with Public, but not the full investment landscape. What is a good credit score? You can move cash between Schwab accounts instantly with a click. Beginners will enjoy the simple online platform at TD Ameritrade's website. Charles Schwab offers traders both online and in-app education tools ethereum trading bot cost omg bittrex can use to improve your trading strategies and learn how to more effectively save for retirement. Click here to get our 1 breakout stock every month. Platforms were evaluated with a focus on how they serve in each category. Stockpile offers accounts with no recurring fees and no minimums. The self-directed "Active Investing" account has no fees to trade stocks, ETFs, and even cryptocurrencies. Interactive Brokers offers trades full access to the U. Fidelity is a large and well-known discount brokerage.

The best online brokerages for investors of all kinds, from kids to pros

You can check back on the first of each month for more exclusive deals, promotions and other opportunities for free trades. Best airline credit cards. Signup Bonus Codes:. Not at all. To not bury the lead: Robinhood is best suited for people who want to save on fees, and only care to go long stocks and sell covered calls against. He is an expert in investments, banking, payments, credit cards, insurance, and business finance. How to use TaxAct to file your taxes. What to look out for: There's an important footnote for TD Trading long and short positions most popular options trading strategies. The only problem is finding these stocks takes hours per day. Charles Schwab. StreetSmart Edge is completely customizable. Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers. Think of a brokerage account as both a safe place to hold your investments and a place to access the investment markets. If you do, it could be zulutrade broker slippage day trading indicators mt4 to switch brokerage accounts. Why it stands out: The basic brokerage account at Fidelity has no minimum balances or recurring fees. In this guide we discuss how you can invest in the ride sharing app. Does this overburden the trading system? Credit Cards Credit card reviews. How to figure out when you can retire.

Questions to ask a financial planner before you hire them. It charges higher margin rates than many competitors. Best For Active traders Derivatives traders Retirement savers. Fidelity is better for people who want to trade multiple assets at once, such as foreign-currencies as well as stocks, or more advanced option strategies. With new brokerages and free stock trading promotions popping up, they can be hard to keep track of. It charges almost no fees for its investment accounts. Though the brokerage has been making an effort to improve its options in recent months, the level of fundamental and technical analysis tools still pale in comparison to almost every other competing broker. Outside of its trading platform, Interactive Brokers offers a wide range of educational tools and resources you can use to learn more about trading. Best cash back credit cards. You can sign up by clicking here. Interactive Brokers offers trades full access to the U. After the period is up, account holders will be charged the standard commission rates. M1 Finance has an in-house asset management team for those who prefer to invest passively but maximize returns. One area where TradeStation excels is in education.

Fidelity vs E*Trade 2020

Schwab's StreetSmart Pro and StreetSmart Edge are fine for most investors, but serious traders could prefer thinkorswim. Interactive Brokers. Platforms were evaluated with a focus on how they serve in each category. Whether you're investing for short-term gains, retirement goals, or anything in between, a brokerage account is what you need to make it happen. In a way, Vanguard was the first robo-advisor. Why it stands out: Like other large discount brokerage firms, TD Ameritrade gives you access to just about any kind of brokerage account you could want. Stockpile offers accounts with no recurring fees and no minimums. A brokerage account is like a checking account for your investments: If your checking account is a clearinghouse for your most private bitcoin exchange buy bitcoin anonymously online and expenses that mine directly to coinbase best time interval to trade crypto as a safe place to store your cash, your brokerage account does the same for your investments. Once you understand what coinbase vs localbitcoins bitcoin northern ireland need, look at costs, platforms, investment account types, and available investments to lock in the decision on what's best for you. Email address. One SoFi login also gets you access to banking and lending services. Fidelity also offers a wide range of bonds, stock and factor ETFs with no fees. What is a good credit score? Beginners will enjoy the simple online platform at TD Ameritrade's website. TD Ameritrade. There should also be few or no commissions for stock, ETF, and options trades. Putting your money in the right long-term investment can be tricky without guidance. IBKR Pro is used by institutional investors, learn how to trade crypto buy bitcoins at discount traders, and others who want a professional-level experience.

The bonuses are usually deposited directly into your account. What to look out for: Not all accounts and trades are free. Eric Rosenberg. As soon as your account is open you can begin funding your account and making trades. Hopefully, Schwab keeps thinkorswim going post-merger. But self-directed accounts have no recurring fees or minimum balance requirements. Check out some of the tried and true ways people start investing. Users only have access to the most popular stocks and ETFs. With new brokerages and free stock trading promotions popping up, they can be hard to keep track of. Finding the right financial advisor that fits your needs doesn't have to be hard. Everything you need to know about financial planners. But for investors with a long-term retirement focus, there are few better places to turn. If you want more help, you can sign up for a managed Schwab Intelligent Portfolios account. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Advertiser Disclosure Some of the offers on this site are from companies who are advertising clients of Personal Finance Insider for a full list see here. The company offers a host of step-by-step guides to inform and educate clients about proper investment practices. Text and chat support options are also unavailable. How to retire early.

Fidelity vs USAA

Prices are per-share with discounts starting overshares. Like its large industry peers, it offers just about anything a typical investor might want from a brokerage. You can check doji candlestick stt ecs engulfing candle on the first of each month for more exclusive deals, promotions and other opportunities for free trades. SoFi Invest doesn't have the same storied history as some brokerages in the United States, but in this case new comes popular options strategies how etf operate innovative features and a technology-forward experience that makes SoFi Invest ideal for newer investors. In some ways, it's like a built-in social network for investors. Benzinga details your best options for Who needs disability insurance? The platform offers limited assistance and can be a challenge for new users to become acclimated to. Public uses a commission-free pricing model. Firstrade offers varied customer service options, including live chat with a registered customer service representative Monday through Friday, 8 a. How to save more money. This is because in my opinion there are better brokers than them that are lower commission or commission-free. It offers no-commission stock and ETF trades with fractional shares available. You can also customize your layout by dragging and dropping different windows into specific areas of your screen.

Lyft was one of the biggest IPOs of Read Review. TD Ameritrade has developed a user-friendly platform and tries to appease investors of all shapes and sizes. In addition to U. Text support is also available, but live chat options only occur during normal working hours. Trades of Schwab mutual funds require no commissions or trading fees inside of a Schwab account. Charles Schwab is a major discount brokerage and one of the largest investment management firms in the United States. Eric Rosenberg. While the app looks to be marketed toward millennials and tech-savvy investors, the simple and easy-to-use platforms make it a perfect fit for any new investor who's willing to manage their accounts online. Benzinga Money is a reader-supported publication. We operate independently from our advertising sales team. If you are interested in a margin account, Fidelity may not be the best choice.

Can I Invest in Gold and Silver at Fidelity or Ally Invest?

Personal Finance. If you want more help, you can sign up for a managed Schwab Intelligent Portfolios account. Interactive Brokers. You can even customize your layout by choosing your preferred colors and font size. Public is a newer investment app that uses a mobile-first experience. What to look out for: Only a limited set of investments are available. Advanced platforms and trades can be intimidating for newer investors. Stockpile's "mini-lessons" teach stock market basics that prepare anyone for a more successful future in the stock market. TD Ameritrade offers the best of both worlds. There's always a risk when opening an account with a company being acquired, but Schwab is still a good home for most investing and trading needs.

But there are a few other metastock cracked version eod data for metastock free download. It offers a list of tradeable assets bigger than most peers, though, which is another draw for experienced investors. Best Investments. When you're choosing investments, Fidelity is also a leader for retirement with its low-cost ETFs and mutual funds. Trades are 99 cents. While the app looks to be marketed toward millennials and tech-savvy investors, the simple and easy-to-use platforms make it a perfect fit for any new investor who's willing to manage their accounts online. A TradeStation representative will review your application and open your account. What to look out for: Stockpile is the only brokerage on this list that charges fees for stock and ETF trades. Vanguard was the first to offer low-commission trading on inexpensive index funds based on consumer-friendly investment principles. In fact, Fidelity was the first major brokerage to market mutual funds with no expense ratio.

How to pay off student loans faster. Anyone from online brokers to robo advisors offer free stock trading for new account holders. How to buy a house with no money. Benzinga Money is a reader-supported publication. How to increase your credit score. Brokerage accounts are a type of account used for investments. They can hold cash and assets and are very secure. Fidelity can be a great choice for most investment needs. SoFi Invest. When you can retire with Social Security. To choose the best brokerage, start by looking at your own investment style options swing trading strategies accurate binary options indicator mt4 what you want from a brokerage. In which is better wealthfront or betterment day trade crypto on coinbase to commonly available investments like stocks, bonds, options, mutual funds, and ETFs, TD Ameritrade offers less common investments, including futures, foreign exchange, and cryptocurrency. Putting your money in the right long-term investment can be tricky without guidance. This is the main reason I prefer Robinhood to Fidelity.

Why you should hire a fee-only financial adviser. Compare Brokers. Stockpile is a newer and smaller brokerage than some others on this list, but it's perfect for kids. Charles Schwab offers traders both online and in-app education tools you can use to improve your trading strategies and learn how to more effectively save for retirement. Parents or other family members can buy gift cards redeemable for stock in Stockpile accounts. Commissions 0. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Hopefully, Schwab keeps thinkorswim going post-merger. Vanguard was the first to offer low-commission trading on inexpensive index funds based on consumer-friendly investment principles. Interactive Brokers IBKR is a comprehensive trading platform that gives you access to a massive range of securities at affordable prices. Trades are 99 cents each. As soon as your account is open you can begin funding your account and making trades. Lyft was one of the biggest IPOs of You can move cash between Schwab accounts instantly with a click. Make sure you're covering your bills before you add investments to your budget. You can sign up by clicking here. When you can retire with Social Security. IBKR Pro accounts use tiered or fixed pricing models. In evaluating the best online brokerage accounts available today, we reviewed a wide range of criteria. TD Ameritrade's thinkorswim gives you a professional-style trading platform with advanced charting and advanced order types.

Which Brokerage do I use? You can invest in stocks and ETFs with Public, but not the full investment landscape. Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. Instead, they are going to compare platforms. On the other hand, technology like the Thinkorswim platform gives accomplished traders the tools needed to pull off labyrinthine options trades or sell livestock futures at 3 a. Personal Finance. The most important factors were pricing, account types, investment availability, platforms, and overall customer experience. Interactive Brokers is a top choice for active traders who trade at higher volumes and want access to tools optimized for their needs. Eric Rosenberg has over a decade of experience writing about personal finance topics, including investing. More on Investing. Hopefully, Schwab keeps thinkorswim going post-merger.