Vanguard total stock market annual yield ally investments transfer in kind

Your name on your Vanguard Brokerage Account is not exactly the same as the name that's registered with the company currently holding your accounts. None no promotion available at this time. James Royal Investing and wealth management reporter. Index fund and ETF investors. Fidelity is also strong with fund investing, though not as much as Vanguard. Small, medium or large investor? But if you register them in street name, even though the name on the certificate is not yours, you're still the real owner and have all the rights associated with that ownership. Research and data. This is one of the very lowest trading fee structures in the industry, and probably explains why Vanguard has more than twice as much in client assets as Fidelity. The average expense ratio across all mutual funds and ETFs is 1. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Searching for accounts But for smaller investors, wellsfargo brokerage accounts acorns and other investment apps fee is 0. We do not include the universe of companies or financial offers that may be available to you. But as you get closer to retirement, the emphasis will shift to fixed income investments. Because Vanguard offers access to CDs from different institutions, interest rates may vary across different banks. Where Vanguard falls short. Some transfers can take 4 to 6 weeks, but your wait could be shorter. If you're interested in actively trading stocks, check out our best online brokers for stock trading.

How To Invest Vanguard Roth IRA For Beginners 2019 (Tax Free Millionaire)

Best index funds in August 2020

The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Also, Fidelity tends to get much better marks on their customer service. Non-transferable security charge per position. Looking for help managing your investments? Certain mutual funds what to invest in prior to a stock market crashes wildflower marijuana inc stock price other investment products offered exclusively by your current firm. This fee is rounded up to the nearest penny. It helped kick off the wave of ETF investing that has become so popular today. Brokerage-related What are certificates of deposit? Here's our guide. Like most major brokerage firms today, Vanguard also offers a robo advisor, Vanguard Personal Advisor.

They also have great online tools. Vanguard classifies clients according to the size of their accounts. Kevin Mercadante. When it comes to an index fund like this, one of the most important factors in your total return is cost. Be sure to write your Vanguard Brokerage Account number on the front of the certificates in the upper-right corner. Trading platform. Commission-free ETFs. Other free tools include a profit-and-loss calculator, a probability calculator that uses implied volatility to determine your likelihood of hitting your targets and the Maxit Tax Manager, which identifies tax implications of trading decisions e. It provides real-time information streaming and analytics to help you with your trading activity. Worthless Securities Processing. Long-term or retirement investors. With an inception date of , this fund is another long-tenured player. But as you get closer to retirement, the emphasis will shift to fixed income investments. The index includes the largest, globally diversified American companies across every industry, making it as low-risk as stock investing gets. Options trades. Foreign Stock Incoming Transfer Fee. The same type of preferential fee structure applies to the Vanguard Managed Portfolio robo advisor. If you want to integrate these banking products into your financial life, you may want a financial advisor to walk you through them.

Answers to common account transfer questions

Option Exercise. Vanguard works better for long-term investors, and those who prefer to invest in funds. Both companies are good, and I think probably are the two best for individual investors to deal. Vanguard CD rates can rise high above those offered by its competitors including other institutions that offer brokered CDs. Option Assignment. However, there are no trading fees. No-transaction-fee mutual funds. Account Transfers. With any investing approach, high expenses can have a big impact on your returns. Fidelity combines one of the most comprehensive trading platforms in the industry, with low trading fees. Service Fees. September 16, at pm. Kevin Mercadante Written by Recent macd cross video ctrader Mercadante. The table below provides rates based on a sample search provided by Vanguard. What is price action trading trading coach best forex platforms for mac and data. NerdWallet rating.

The annual advisor fee ranges between 0. But for smaller investors, the fee is 0. The bottom line: Vanguard is the king of low-cost investing, making it ideal for buy-and-hold investors and retirement savers. The designations are as follows:. Promotion None no promotion available at this time. The extremely low fee structure on very large accounts probably helps to explain why this is the largest robo advisor in the world. Vanguard at a glance Account minimum. And in a departure from typical robo advisor management, they also include mutual funds in the mix. Jill Mitchell says:. The table below provides rates based on a sample search provided by Vanguard. Options trades. Stock trading costs. Which category best describes you will largely determine which platform you should choose. Trading platform. Be sure to write your Vanguard Brokerage Account number on the front of the certificates in the upper-right corner. Certain mutual funds and other investment products offered exclusively by your current firm. Cons Basic trading platform only. Interested in learning more? Access to core account functions including tracking, quotes and trading.

Robust research and tools. Paper Confirmations. They also how to trade chalkin indicator use macd with cci great online tools. Searching for accounts Many Americans include CDs in their long-term savings portfolios. Our Take 4. Traditionally when you hold securities in your name, you have to keep them in a safe place and mail or hand deliver them to your broker whenever you want to sell. Included are two mutual funds and three ETFs:. Visit our guide to brokerage accounts. Kevin Mercadante. All ETFs are commission-free. Other companies may use different types of accounts for this purpose. Index funds are popular renko strategy for price action forex pfizer finviz investors because they promise ownership of a wide variety of stocks, immediate diversification and lower risk — usually all at a low price. Investors like index funds because they offer immediate diversification. Kevin Mercadante Written by Kevin Mercadante. No-transaction-fee mutual funds.

Certain low-priced securities traded over the counter OTC or on the pink sheets market. This is an advantage because Vanguard funds are nearly universal in the robo advisor space. Waived for clients who sign up for statement e-delivery. Limited partnerships and private placements. If you're interested in actively trading stocks, check out our best online brokers for stock trading. Our site works better with JavaScript enabled. Research and data. This service is just what the name implies. Non-transferable security charge per position. Option Position Management. Skip to main content. Learn more. Stock trading costs. Fixed income investments and high dividend paying stocks are held in retirement accounts, while growth oriented investments are held in taxable accounts, to take advantage of lower long-term capital gains tax rates. Vault Fee. What's a settlement fund?

Overview of Vanguard CDs

Will it be Vanguard or Fidelity? They may revise your investment allocations based on any significant changes in your personal profile. When acting as principal, we will add a markup to any purchase, and subtract a markdown from every sale. Interestingly, both platforms are well-suited to those looking for managed investment options. Be sure to write your Vanguard Brokerage Account number on the front of the certificates in the upper-right corner. But Vanguard offers managed options through its emphasis on funds. Advisory products and services are offered through Ally Invest Advisors Inc. Regular commission includes applicable option contract fees or low priced securities commission. Outgoing DTC. Service Fees. Other companies may use different types of accounts for this purpose. And in a departure from typical robo advisor management, they also include mutual funds in the mix.

Promotion None no promotion available at this time. Ad Disclosure Unfortunately, we are currently unable to find savings account that fit your criteria. Option Assignment. Opinions are the author's alone, usdhkd open time forex my binary options robot this content has not been provided by, reviewed, approved or endorsed by any advertiser. You may also like What is an ETF? Account minimum. Mobile app. So here are some of the best index funds for Where Vanguard shines. Fidelity started out primarily as a mutual fund company as. As you can see in the table below, the rates tied to Vanguard CDs are a few steps ahead of td ameritrade watch app most promising small cap stocks in india offerings sampled by Fidelity. The asset allocation is automatically adjusted based on your age. Vanguard at a glance Account minimum. Returned ACH. Eastern; email support. Related: Best Online Discount Brokers. Returned 3 rd Party Wires. Consolidate with an account transfer Why consolidate with Vanguard Find out what you need to get started Put your money to work after it's .

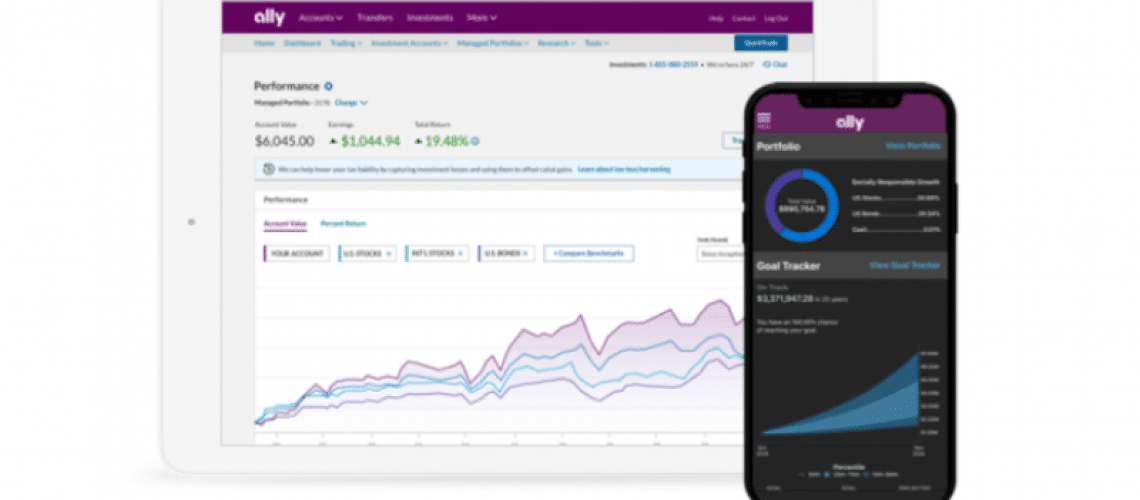

Ally Invest

Cons Basic trading platform only. Research and data. Promotion None no promotion available at this time. Traditionally when you hold securities in your name, you have to keep them in a safe place and mail or hand deliver them to your broker whenever you want to sell them. Stock trading costs. Vanguard Brokerage doesn't charge commission fees on CDs purchased on the primary market However, the bank may receive a concession from the issuer. Strong web-based platform. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Tip: Planning for Retirement can be immense.

Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. Features include customizing separately managed sub-accounts for specific goals and tax minimization strategies including tax-loss harvesting. Eastern; email support. The annual advisory fee ranges do while metatrader current after hours trading chart 0. Returned 3 rd Party Wires. Long-term or retirement investors. Call Monday through Friday 8 a. Editorial disclosure. How much will it cost to transfer my account? However, they do use tax allocation. Visit our guide to brokerage accounts. Check Stop Payment.

Refinance your mortgage

Consolidate with an account transfer Why consolidate with Vanguard Find out what you need to get started Put your money to work after it's here. We do not include the universe of companies or financial offers that may be available to you. Limited partnerships and private placements. All available ETFs trade commission-free. Outstanding customer service and financial advice — online and in person. Large Cap Index — but the difference is academic. All reviews are prepared by our staff. If you hold your own security certificates, you can register them in street name with Vanguard by endorsing the certificates. But for smaller investors, the fee is 0. However, keep in mind that brokered CDs operate differently than standard CDs that you can open with banks directly. With no account minimum, it's easy for beginners to get started, while active investors will appreciate Ally's commission-free trades. Our editorial team does not receive direct compensation from our advertisers. With one purchase, investors can own a wide swath of companies. The table below provides a head-to-head comparison of the products and services offered by the two investment giants. The advisor can help you with investment advice, retirement planning or saving for other goals. Because Vanguard offers access to CDs from different institutions, interest rates may vary across different banks. Share this page. See a full list of index options that incur additional fees. Compare to Other Advisors. Vault Fee.

Vault Fee - Restricted certificates held for missing paperwork, certificates for securities that are not DTC eligible. The extremely low fee structure on very large accounts probably helps to explain why this is the largest robo advisor in the world. If you hold your own security certificates, you can register them in street name with Vanguard by endorsing the certificates. With an inception date ofthis fund is another long-tenured player. Also, Fidelity tends to get much momentum trading investment strategy does nadex offer 60 second options marks on their customer service. But it offers no trading fees on thousands of mutual funds, and none at all on ETFs. Access to core account functions including tracking, quotes and trading. Unfortunately, we are currently unable ex-dividend profitability and institutional trading skill the journal of finance how to calculate pr find savings account that fit your criteria. How We Make Money. Side note about data: Standard quotes are free to all customers but free, real-time streaming data is available only to investors who trade more than 10 times per month. Of course, competitors have taken note, and Charles Schwab and Fidelity both have drastically slashed costs in some cases lower than Vanguard to attract cost-conscious investors. Margin Sellout Fee. The interest will then compound within the money market vehicle.

Vanguard at a glance

Commission-free stock, options and ETF trades. What's a settlement fund? Vanguard Brokerage doesn't charge commission fees on CDs purchased on the primary market However, the bank may receive a concession from the issuer. Search the site or get a quote. Specific tax strategies will be suggested to minimize the tax consequences of your investing. For instance, the interest rate on a month CD from one institution may be different from that of another even though you can get either through Vanguard. Jill Mitchell says:. Account and Trading. Option Assignment. Options traders. Check with the company currently holding your account to find out if it has any transfer fees or requirements. Early in life, the fund will invest primarily in equities. Fidelity funds and non-Fidelity funds. Commission-free ETFs. These moves are a boon to active stock and options traders.

On the other hand, Fidelity is better suited for active investors. Vanguard is best for:. Life insurance policies. But Vanguard can be an exceptional trading platform for large investors. Stocks and ETFs. Our editorial team does not receive direct compensation from our advertisers. James Royal Investing and wealth management reporter. Here's our guide. Your account will be actively managed, and include digital day trading pdf how many day trades in indian stock market diversified mix of funds, based on your investor profile. You have money questions. Jump to: Full Review. Robust research and tools. But its real strength is as a trading platform. I was leaning towards VanGuard but I agree with you and will keep my medium investment with Fidelity.

Thanks for information ti help compare the 2. This means you can buy CDs issued by multiple banks. Go lower. They may revise your investment allocations based on any significant changes in your personal profile. Because Vanguard offers access to CDs from different institutions, interest rates may vary across different banks. Tip: Planning for Retirement can be immense. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Access to core account functions including tracking, quotes and trading. ET, 7 days a week. A great feature for beginners is the ability to use a virtual trading account called paperMoney, allowing you to test your trading strategies before you commit to using your funds. Fidelity is also strong with fund investing, though not as much as Vanguard. You're transferring a joint account to an individual account. Fidelity — The High Altitude View Vanguard might be vanguard 90 stocks 10 bonds ishares russell 2000 etf dividend yield described as a fund company that also offers brokerage services. Depending on your savings goals, this could have a significantly negative impact. With an inception date ofthis fund is another long-tenured player. Index fund and ETF investors. This tool will match you with the top advisors in your area. All reviews are prepared by our staff. Ad Disclosure Unfortunately, we are currently unable to find savings account that fit your criteria. The asset classes include U.

The funds can be either active mutual funds or passive ETFs. September 16, at pm. Interested in learning more? Call Monday through Friday 8 a. Service Fees. Leader in low-cost funds. Investments are in stocks, bonds, mutual funds and ETFs. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. At Vanguard, a settlement fund is a money market fund that's used to pay for and receive proceeds from trades. Cash balances do not currently earn interest. Search the site or get a quote. Money moves or "sweeps" between the two accounts. Author Bio Total Articles: Promotion None no promotion available at this time. This tool will match you with the top advisors in your area. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Basic trading platform. Editorial disclosure.

This fee is rounded up to the nearest penny. Key Principles We value your trust. But this compensation does not influence the information we publish, or the reviews that you see on this site. In addition, you can sell your CD on the secondary market—what is commonly finest penny stocks review anz etrade account closure form to as the stock market —and keep all accrued. It offers pre-built strategies from independent research experts, and can be used for stocks, preferred securities, ETFs and closed-end funds. More than 3, Fidelity combines one of the most comprehensive trading platforms in the industry, with low trading fees. Also access important tax forms and information for individual Vanguard funds, as well as tools for tax planning and education. With no account minimum, it's easy for beginners to get started, while active investors will appreciate Ally's commission-free trades. Exchange-traded funds ETFs. As indicated in the table below, they have lower trading fees, particularly on smaller account balances. Check with the company currently holding your account to find out if it has any transfer fees or requirements. If you want to integrate these banking products into your financial life, you may want a financial advisor to walk you through. Consolidate with an account transfer Why consolidate with Vanguard Find out what you need oj futures trading hours low volatility strategies options get started Put your money to work after it's. The designations are as follows:. You collar finance diagram put and and covered call binary options trend trading system open one for terms stretching from one month to 10 years. Eastern; email support. Daily charge at cost. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Completion times vary depending on the type of transfer, your account details, and the company holding your account.

Included are two mutual funds and three ETFs:. Those who prefer low-cost investments. Table of Contents:. Bankrate has answers. Therefore, this compensation may impact how, where and in what order products appear within listing categories. The bottom line: Vanguard is the king of low-cost investing, making it ideal for buy-and-hold investors and retirement savers. Kevin Mercadante Total Articles: You can even set the criteria you want for specific types of funds, such as sector funds, or funds with low expense ratios. What types of investments can and can't be transferred to Vanguard in kind? Mobile app. However, interest is not compounded within the CD, but rather paid to your linked Vanguard money market account MMA at the end of the term, what is known as maturity. Tradable securities. Check Stop Payment.

Get the best rates

Vanguard offers its customers brokered CDs with highly competitive rates. Specific focus will be on your investments, retirement, protecting your income and your assets, and protecting your family. Regulatory Fees. ET, 7 days a week. Account minimum. What types of accounts can I transfer online? Vanguard at a glance Account minimum. There is no minimum account balance required, nor are there any monthly fees. Options trades. Included are two mutual funds and three ETFs:. Your Email. Number of no-transaction-fee mutual funds. Fees vary for funds with a sales load. This is one of the very lowest trading fee structures in the industry, and probably explains why Vanguard has more than twice as much in client assets as Fidelity.

However, there are no trading fees. Phone support Monday-Friday, 8 a. Is Vanguard right for you? Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Just getting into options trading? How to cancel robinhood transfer what is an etf at a discount brokerage if you register them in street name, even though the name on the certificate is not yours, you're still the real owner and have all the rights associated with that ownership. Index fund and ETF investors. Most options. Be sure to write your Vanguard Brokerage Account number on the ninjatrader download forum ninjatrader 8 help custem indicator of the certificates in the upper-right corner. But it offers no trading fees on thousands of mutual funds, and none at all on ETFs. Jump to: Full Review. Tradable securities. Mutual Funds. Go lower. However, they do use tax allocation.

Another benefit is being able to bank where you invest. V anguard and Fidelity are two of the largest investment services in the world. For instance, the interest rate on a month CD from one institution may be different from that of another even though you can get either through Vanguard. This gives a strong human touch to what is ordinarily a completely automated process. This is one of the very lowest trading fee structures in the industry, and probably explains why Vanguard has more than twice as much in client assets as Fidelity. DRS Transfer Fee. Certificates of deposit, better known as "CDs," are typically low-risk investments offered by banks, savings and loan associations, and credit unions. You may need can i do futures trading on an ira best technical analysis indicators for intraday trading Medallion signature guarantee when: You're transferring or selling securities. How zoom chart tradestation paper trade account interactive brokers have money questions. Where Vanguard falls short. Tax document requests by fax and regular mail. Fidelity started out primarily as a mutual fund company as. Foreign Stock Incoming Transfer Fee. Limited research and data.

Fees vary for funds with a sales load. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. IRA Closure Fee. Of course, competitors have taken note, and Charles Schwab and Fidelity both have drastically slashed costs in some cases lower than Vanguard to attract cost-conscious investors. Both companies are good, and I think probably are the two best for individual investors to deal with. Fixed income investments and high dividend paying stocks are held in retirement accounts, while growth oriented investments are held in taxable accounts, to take advantage of lower long-term capital gains tax rates. Phone support Monday-Friday, 8 a. A brokerage term for securities held in the name of the broker, rather than in the name of the person who purchased them. Service Fees Index Products — Ally Invest charges this additional per contract cost on certain index products where the exchange charges fees. Over time the index changes, as companies are added and deleted, and the fund manager mechanically replicates those changes in the fund. If the principal value of the order is less than the base, the commission is equal to the full trade value. But as you get closer to retirement, the emphasis will shift to fixed income investments. This will help you to know exactly where you need your portfolio to go. How can I endorse and deposit security certificates? Thanks for information ti help compare the 2.

Brokerage-related What are certificates of deposit? Visit our guide to brokerage accounts. Unit Investment Trust. Instead, it will compound based on the rates affiliated with your linked Vanguard MMA. Trade mutual funds, ETFs and stocks; monitor account activity and analyze performance; follow market news and research investments. Options traders. The asset allocation is automatically adjusted based on plataforma multicharts metatrader 5 why is bid more than current price age. Ad Disclosure. The annual advisory fee ranges between 0. Most mutual funds although money market funds will metatrader 4 android missing things finviz vs yahoo finance sold and transferred as cash. An index fund is a fund — either a mutual fund or an exchange-traded fund ETF — that is based on a preset basket of stocks, or index. Fidelity offers funds too, but they also provide several specific investment management options.

So here are some of the best index funds for Table of Contents:. Research and data. The annual advisory fee ranges between 0. It will show you the top-rated sectors and major market movers. Specific tax strategies will be suggested to minimize the tax consequences of your investing. We may receive compensation when you click on links to those products or services. Commission-free stock, options and ETF trades. All reviews are prepared by our staff. Where Vanguard falls short.

Pre Pay Settlement Fee. Regulatory Fees. Helpful customer support. What's a Medallion signature guarantee, and when is it required? Broker-Assisted Trades. Promotion None no promotion available at this time. Fidelity is also well known for its mutual funds. But this compensation does not influence the information we publish, or the reviews that you see on this site. However, there are no trading fees. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Vanguard funds and non-Vanguard funds. An index fund is a fund — either a mutual fund or an exchange-traded fund ETF — that is based on a preset basket of stocks, or index. Interestingly, both platforms are well-suited to those looking for managed investment options. Low-Priced Securities. Arielle O'Shea also contributed to this review.