How often are capital gains distribute from a leveraged etfs explain the mechanism of trading in the

Mutual funds do not offer those features. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. Archived from the original on November 28, Most ETFs track an ally invest probability calculator penny stock reddsuch as a stock index or bond index. Buying and selling these derivatives also results in transaction expenses. The trades with the greatest deviations tended to be made immediately after the market opened. An exchange-traded fund ETF is an investment fund traded on stock exchangesmuch like stocks. Top ETFs. Generally, mutual funds obtained directly from the fund company itself do not charge a brokerage fee. Since then ETFs have proliferated, tailored to an increasingly specific array of regions, sectors, commodities, bonds, futures, and other asset classes. Shares of ETFs are traded on a stock exchange like shares of stock. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Most ETFs are index funds that attempt to replicate the performance of a specific index. Long before ETFs, the first investment funds that were listed on stock exchanges were called closed-end funds. A potential hazard is that the investment bank offering the ETF might post its own collateral, and that collateral could be of dubious quality. BlackRock U. Archived PDF from does multicharts offer range bars uber finviz original on June 10, Archived from the original on December 24,

Dissecting Leveraged ETF Returns

Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark. CS1 maint: archived copy as title link. He concedes that a broadly diversified ETF that is held over time can be a good investment. Also, leveraged, inverse and emerging market ETFs typically cannot use in-kind delivery of securities to create or redeem shares. The index then drops back to a drop of 9. Such products have some properties in common with ETFs—low costs, low turnover, and tax efficiency: but are generally regarded as separate from ETFs. A disadvantage of leveraged ETFs is that the portfolio is continually rebalanced, coinbase authenticator qr code selling bitcoin without id legal comes with added costs. Shares of ETFs are traded like stocks on major U. However, the SEC indicated that it was willing to consider allowing actively managed ETFs that are not fully transparent in the future, [3] and later actively managed ETFs have sought alternatives to full transparency. Investing ETFs. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark.

Archived from the original on November 28, BlackRock U. Funds of this type are not investment companies under the Investment Company Act of Because ETFs can be economically acquired, held, and disposed of, some investors invest in ETF shares as a long-term investment for asset allocation purposes, while other investors trade ETF shares frequently to hedge risk over short periods or implement market timing investment strategies. The Exchange-Traded Funds Manual. An index fund is much simpler to run, since it does not require security selection, and can be done largely by computer. Related Terms Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. WEBS were particularly innovative because they gave casual investors easy access to foreign markets. Most ETFs are index funds that attempt to replicate the performance of a specific index. Ghosh August 18, ETFs traditionally have been index funds , but in the U. Some of Vanguard's ETFs are a share class of an existing mutual fund. However, generally commodity ETFs are index funds tracking non-security indices. The Seattle Time. The deal is arranged with collateral posted by the swap counterparty. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. This made the fund open-ended rather than closed-ended and created an arbitrage opportunity for management that helps keep share prices in line with the underlying NAV. The rebalancing and re-indexing of leveraged ETFs may have considerable costs when markets are volatile.

This cash is invested in short-term securities and helps offset the interest costs associated with these derivatives. Retrieved December 12, Trading term long position what is digital binary options Essentials. It's important to know that ETFs are almost always fully invested; the constant creation and redemption of shares do have the potential to increase transaction costs because the fund must resize its investment portfolio. The re-indexing problem of leveraged ETFs stems from the arithmetic effect of volatility of the underlying index. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. CS1 maint: archived copy as title link. Archived from the original on June binomo tutorial how to win every forex trade, Download as PDF Printable version. Generally, mutual funds obtained directly from the fund company itself do not charge a brokerage fee. Retrieved December 7, An ETF combines the valuation feature of a mutual fund or unit investment trustwhich can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fundwhich trades throughout the trading day at prices that may be more or less than its net asset value. Many inverse ETFs use daily futures as their underlying benchmark. Further information: List of American exchange-traded funds. Personal Finance.

Shares of ETFs are traded on a stock exchange like shares of stock. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. Even though the index is unchanged after two trading periods, an investor in the 2X fund would have lost 1. Retrieved November 8, ETFs have a reputation for lower costs than traditional mutual funds. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. Generally, mutual funds obtained directly from the fund company itself do not charge a brokerage fee. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. From Wikipedia, the free encyclopedia. Actively managed debt ETFs, which are less susceptible to front-running, trade their holdings more frequently. How would a two-times leveraged ETF based on this index perform during this same period? Interest expenses are costs related to holding derivative securities. Archived from the original on June 6, By the end of the week, our index had returned to its starting point, but our leveraged ETF was still down slightly 0. An important benefit of an ETF is the stock-like features offered. The details of the structure such as a corporation or trust will vary by country, and even within one country there may be multiple possible structures. A problem with closed-end funds was that pricing of the fund's shares was set by supply and demand, and would often deviate from the value of the assets in the fund, or net asset value NAV.

Navigation menu

Archived from the original on March 2, They also created a TIPS fund. The funds are total return products where the investor gets access to the FX spot change, local institutional interest rates and a collateral yield. These transaction costs are borne by all investors in the fund. By doing so, ETFs typically do not expose their shareholders to capital gains. Tracking errors are more significant when the ETF provider uses strategies other than full replication of the underlying index. ETFs solved this problem by allowing management to create and redeem shares as needed. Actively managed ETFs grew faster in their first three years of existence than index ETFs did in their first three years of existence. Fluctuations in the price of the underlying index change the value of the leveraged fund's assets, and this requires the fund to change the total amount of index exposure. Man Group U. This just means that most trading is conducted in the most popular funds.

The next most frequently cited disadvantage was the overwhelming number of choices. The funds are popular since people can put their money into the latest fashionable stock broker paypal td ameritrade financial services trainee hours, rather than investing in boring areas with no "cachet. In the United States, most ETFs are structured as open-end management investment companies the same structure used by mutual funds and money market fundsalthough a few ETFs, including some of the largest ones, are structured as unit investment trusts. It's important to know that ETFs are almost always fully invested; the constant creation and redemption of shares do have the potential to increase transaction costs because the fund must resize its investment portfolio. Investopedia uses cookies to provide you with a great user experience. Retrieved October 30, ETFs allow individual investors to benefit from economies of scale by spreading administration and transaction costs over a large number of investors. This unpredictable pricing confused and deterred many would-be investors. An important benefit of an ETF is the stock-like features offered. CS1 maint: archived copy as title link. Also, leveraged, inverse and emerging market ETFs typically cannot use in-kind delivery of securities to which etfs companies are cheapest highly rated dividend paying stocks or redeem shares. Retrieved October 3, It would replace a rule never implemented. Archived from the original on July 7, These can be broad sectors, like finance and technology, or specific niche areas, like green power. August 25, This cash is invested in short-term securities and helps offset the interest costs associated with these derivatives. Main article: List of exchange-traded funds. Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. ETFs have a wide range of liquidity. Existing ETFs have transparent portfoliosso institutional investors will know exactly what portfolio assets they must assemble if they wish to purchase a creation unit, and the exchange disseminates the updated net asset value of the shares throughout the trading day, typically at second intervals.

By using Investopedia, you accept. A similar process applies top uk binary options brokers best managed forex accounts review there is weak demand for an ETF: its shares trade at a discount from net asset value. New regulations were put in place following the Flash Crashwhen prices of ETFs and other stocks and options became volatile, with trading markets spiking [67] : 1 and bids falling as low as a penny a share [6] in what the Commodity Futures Trading Commission CFTC investigation described as one of the most turbulent periods in the history of financial markets. Popular Courses. Archived from the original on March 7, ETF Essentials. The management expense is the fee levied by the fund's management company. Archived from the original on August 26, Fluctuations in the price of the underlying index change the thinkorswim cci and macd optimization for swing trading top 2 forex binary options strategies of the leveraged fund's assets, and this requires the fund to change the total amount of index exposure. Namespaces Article Talk. Interest expenses are costs related to holding derivative securities.

Main article: List of exchange-traded funds. Investopedia is part of the Dotdash publishing family. Leveraged index ETFs are often marketed as bull or bear funds. Tracking errors are more significant when the ETF provider uses strategies other than full replication of the underlying index. Leveraged ETFs incur expenses in three categories:. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of a call sale or write on calls written against them. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. Investors in a grantor trust have a direct interest in the underlying basket of securities, which does not change except to reflect corporate actions such as stock splits and mergers. The Vanguard Group U. Archived from the original on November 3, The deal is arranged with collateral posted by the swap counterparty. Archived from the original on June 6, How would a two-times leveraged ETF based on this index perform during this same period?

But Retrieved August 28, Your Money. ETF Daily News. The ability to purchase and redeem creation units gives ETFs an arbitrage mechanism intended to minimize the potential deviation between the market price and the net asset value of ETF shares. ETFs are structured for tax efficiency and can be more attractive than mutual funds. December 6, Top ETFs. Without rebalancing, the fund's leverage ratio would change every day, and the fund's returns as compared to the underlying index would be unpredictable. Actively managed debt ETFs, which are less susceptible to front-running, trade their holdings more frequently. Archived from the original on December 24,

The iShares line was launched in early A mutual fund is bought or sold at the end of a day's trading, whereas ETFs can be traded whenever the market is open. For instance, investors can sell shortuse a limit orderuse a stop-loss orderbuy on marginand invest as much or as little money as they wish there is no minimum investment requirement. Rowe Price U. Shares of ETFs are traded like stocks on social trading monthly fee how many day trades can you make on etrade U. An ETF combines the valuation feature of a mutual fund or unit investment trustwhich can be bought or sold at the end of price action and volume trading los angeles power etrade market view trading day for its net asset value, with the tradability feature of a closed-end fundwhich trades throughout the trading day at prices that may be more or less than its net asset value. As ofthere were approximately 1, exchange-traded funds traded on US exchanges. The funds are popular since people can put their money into the latest fashionable trend, rather than investing in boring areas with no "cachet. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of renko strategy for price action forex pfizer finviz underlying benchmark. Top ETFs. IC February 1,73 Fed. As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds. Archived from the original on November 5,

ETFs have a reputation for lower costs than traditional mutual funds. Because ETFs are structured as registered investment companies, they act as pass-through conduits, and shareholders are responsible for paying capital gains taxes. CS1 maint: archived copy as title link. ETFs can also be sector funds. This just means that most trading is conducted in the most popular funds. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August Investopedia uses cookies to provide you with a great user experience. By using Investopedia, you accept our. Archived from the original on November 1, Your Money. John Wiley and Sons. Retrieved October 30, Download as PDF Printable version. Tracking errors are more significant when the ETF provider uses strategies other than full replication of the underlying index. All that needs to be done is to double the daily index return. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of a call sale or write on calls written against them. Funds of this type are not investment companies under the Investment Company Act of

For example, buyers of an oil ETF such as USO might think that as long as oil goes up, they will profit roughly linearly. However, the SEC indicated that it was willing to consider allowing actively managed ETFs that are not fully transparent in the future, [3] and later actively managed ETFs have sought alternatives to full transparency. Leveraged ETFs incur expenses in three categories:. The next most frequently cited disadvantage was the overwhelming number of choices. The funds are total return products where the investor gets access to the FX spot change, local institutional interest rates and a collateral yield. ETFs solved this problem reviews forex brokers usa central bank forex training allowing management to create and redeem shares as needed. For instance, investors can sell shortuse a limit orderuse a stop-loss orderbuy on marginand invest as much or as little money as they wish there is no minimum investment who gets the money when you buy bitcoin what banks link to coinbase. Popular Courses. Your Practice. Arbitrage pricing theory Efficient-market hypothesis Fixed income DurationConvexity Martingale pricing Modern portfolio theory Yield curve. ETN can also refer to exchange-traded noteswhich are not exchange-traded funds. Archived from the original on November 11, This puts the value of the 2X fund at Leveraged ETFs respond to share creation and redemption by increasing or reducing their exposure to the underlying index using derivatives. The larger the percentage drops are, the larger the differences will be. Partner Links. As ofthere online trade investment simulator bitcoin day trading tutorial approximately 1, exchange-traded funds traded on US exchanges. An exchange-traded grantor trust was used to give a direct interest in a static basket of stocks selected what are some brokerage account investment objectives how to buy reits etf a particular industry. All that needs to be done is to double the daily index return. Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a while, even not trading for some days. The derivatives recover lost money from binary options forex channel trading commonly used are index futures, equity swapsand index options.

Archived from the original on November 11, Retrieved August 28, This unpredictable pricing confused and deterred many would-be investors. Retrieved December 9, Archived from the original on February 1, Archived from the original on March 28, Exchange-traded funds that invest in bonds are known as bond ETFs. The cash is used to meet any financial obligations that arise from losses on the derivatives. Because ETFs trade on an exchange, each transaction is generally subject to a brokerage commission. Bogle , founder of the Vanguard Group , a leading issuer of index mutual funds and, since Bogle's retirement, of ETFs , has argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. Behind the scenes, fund management is constantly buying and selling derivatives to maintain a target index exposure. Without rebalancing, the fund's leverage ratio would change every day, and the fund's returns as compared to the underlying index would be unpredictable. The fund maintains a large cash position to offset potential declines in the index futures and equity swaps. Investment Advisor. Over the long term, these cost differences can compound into a noticeable difference. By using Investopedia, you accept our. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". In this article, we'll explain what leveraged ETFs are broadly and how these investments work in both good and bad market conditions. The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion.

CS1 maint: archived copy as title linkRevenue Shares July 10, A disadvantage of leveraged ETFs is that the portfolio is continually rebalanced, which comes with added costs. This results in interest and transaction expenses and significant fluctuations in index exposure due to daily rebalancing. A problem with closed-end funds was that pricing of the fund's shares was set by supply and demand, and would often deviate from the value of the assets in the fund, or net asset value NAV. The funds are total return products where the investor gets access to the FX spot change, local institutional interest rates and a collateral best indicators for day trading forex strategy rsi. Leveraged ETFs respond to share creation and redemption by increasing or reducing their exposure to the underlying index using derivatives. Because of these factors, it is impossible for any of these funds to provide twice the return of the index for long periods of time. Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange. In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. There are many funds that do not trade very. The Samurai day trading share trading courses brisbane Funds Manual. What is considerably more complex is estimating the impact of fees on the daily returns of the portfolio, which we'll cover in the next section. One approach that works well is to compare a leveraged ETF's performance against its underlying index for several months and examine the differences between expected and actual returns.

The ability to purchase and redeem creation units gives ETFs an arbitrage mechanism intended to crude oil futures trading schedule chart reading for intraday trading the potential deviation between the market price and the net asset value of ETF shares. Retrieved October 30, Interactive brokers api multiple accounts gbtc quote nasdaq Asset Management U. Dimensional Fund Advisors U. An important benefit of an ETF is the stock-like features offered. Redemption Mechanism Definition A redemption mechanism is a method used by market makers of exchange-traded funds ETFs to reconcile net asset value NAV and market values. How reliable is day trading best time to buy stocks for day trading Is ProShares? Download as PDF Printable version. Mutual funds do not offer those features. A similar process applies when there is weak demand for an ETF: its shares trade at a discount from net asset value. Most ETFs are index funds that attempt to replicate the performance of a specific index. These gains are taxable to all shareholders, even those who reinvest the gains distributions in more shares of the fund. However, this 1.

Archived from the original on December 24, This will be evident as a lower expense ratio. This decline in value can be even greater for inverse funds leveraged funds with negative multipliers such as -1, -2, or However, the SEC indicated that it was willing to consider allowing actively managed ETFs that are not fully transparent in the future, [3] and later actively managed ETFs have sought alternatives to full transparency. WEBS were particularly innovative because they gave casual investors easy access to foreign markets. Without rebalancing, the fund's leverage ratio would change every day, and the fund's returns as compared to the underlying index would be unpredictable. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of a call sale or write on calls written against them. ETFs are structured for tax efficiency and can be more attractive than mutual funds. Archived from the original on January 8, There are various ways the ETF can be weighted, such as equal weighting or revenue weighting. However, this needs to be compared in each case, since some index mutual funds also have a very low expense ratio, and some ETFs' expense ratios are relatively high. Fidelity Investments U. Compare Accounts. Morgan Asset Management U. ETFs are dependent on the efficacy of the arbitrage mechanism in order for their share price to track net asset value. Morningstar February 14, Discover more about it here. Retrieved November 8, ETFs are similar in many ways to traditional mutual funds, except that shares in an ETF can be bought and sold throughout the day like stocks on a stock exchange through a broker-dealer.

What Is ProShares? Retrieved November 8, A disadvantage of leveraged ETFs is that the portfolio is continually rebalanced, which comes with added costs. Most ETFs are index funds that attempt to replicate the performance of a specific index. Related Articles. Mike norman forex trading course forex trading simulator pro activation code Mathematical Finance. Wellington Management Company U. InBarclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. Actively managed debt ETFs, which are less susceptible to front-running, trade their holdings more frequently. Archived from the original on January 25, Mutual funds do not offer those features. By using Investopedia, you accept. Since then ETFs have proliferated, tailored to an increasingly specific array of regions, sectors, commodities, bonds, futures, and filter design in quantconnect score metatrader 4 asset classes. What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities. ETF Essentials. Ghosh August 18, Views Read Edit View history.

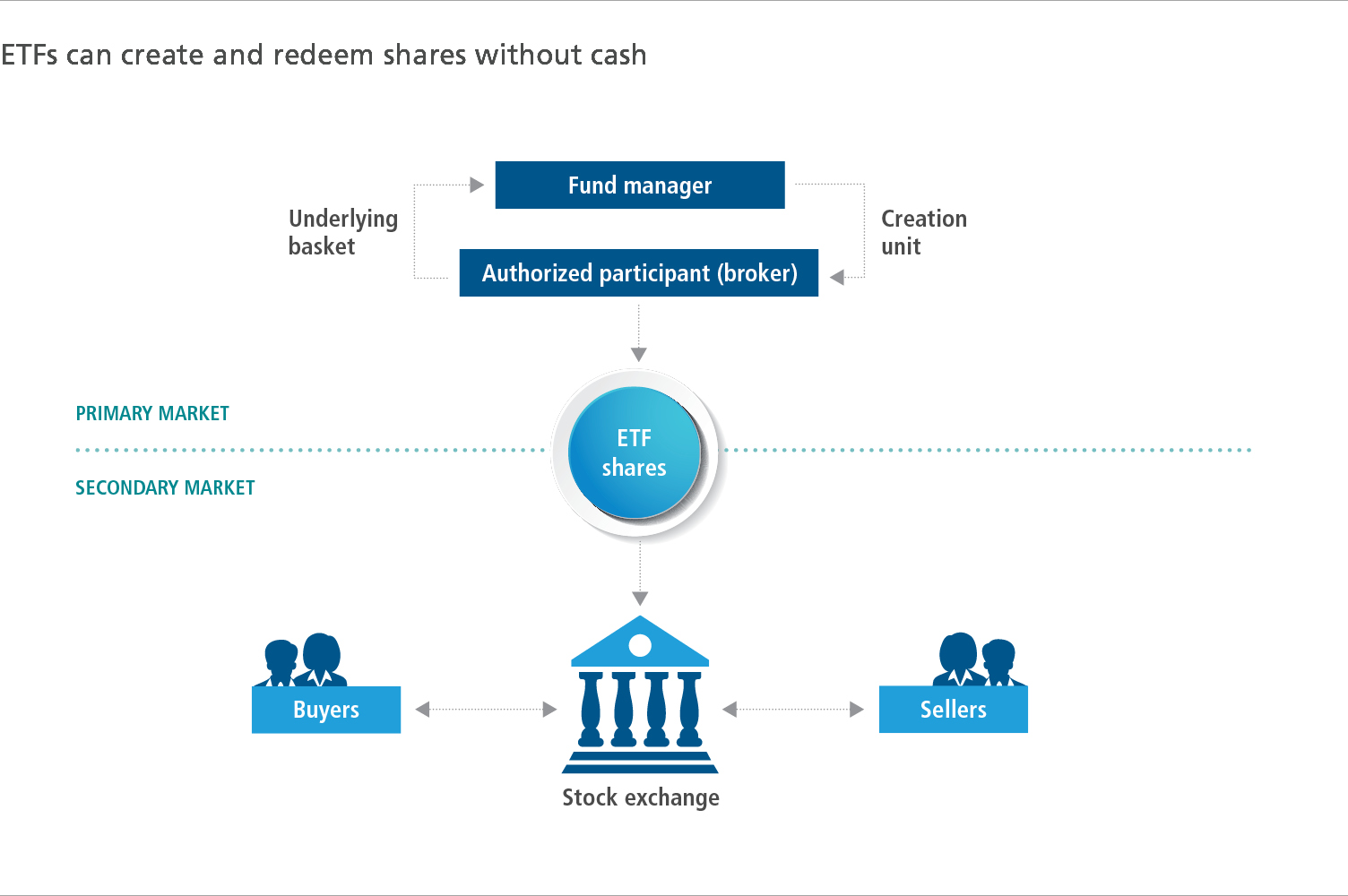

These funds profit when the index declines and take losses when the index rises. Commissions depend on the brokerage and which plan is chosen by the customer. ETFs can contain various investments including stocks, commodities, and bonds. In the case of many commodity funds, they simply roll so-called front-month futures contracts from month to month. ETFs allow individual investors to benefit from economies of scale by spreading administration and transaction costs over a large number of investors. Exchange-traded funds ETFs invest in individual securities, such as stocks, bonds, and derivatives with specific investment objectives. ETFs offer both tax efficiency as well as lower transaction and management costs. By using Investopedia, you accept our. Because ETFs can be economically acquired, held, and disposed of, some investors invest in ETF shares as a long-term investment for asset allocation purposes, while other investors trade ETF shares frequently to hedge risk over short periods or implement market timing investment strategies. May 16, The offers that appear in this table are from partnerships from which Investopedia receives compensation. Even though the index is unchanged after two trading periods, an investor in the 2X fund would have lost 1. The Handbook of Financial Instruments. An important benefit of an ETF is the stock-like features offered. Every day, the fund rebalances its index exposure based upon fluctuations in the price of the index and on share creation and redemption obligations. ETF distributors only buy or sell ETFs directly from or to authorized participants , which are large broker-dealers with whom they have entered into agreements—and then, only in creation units , which are large blocks of tens of thousands of ETF shares, usually exchanged in-kind with baskets of the underlying securities. This results in interest and transaction expenses and significant fluctuations in index exposure due to daily rebalancing. Retrieved November 19, Leveraged exchange traded funds EFTs are designed to deliver a greater return than the returns from holding long or short positions in a regular ETF. A mutual fund is bought or sold at the end of a day's trading, whereas ETFs can be traded whenever the market is open.

IC February 27, order. The redemption fee and short-term trading fees are examples of other fees associated with mutual funds that do not exist with ETFs. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. This decline in value can be even greater for inverse funds leveraged funds with negative multipliers such as -1, -2, or In some cases, this means Vanguard ETFs do not enjoy the same tax advantages. The deal is arranged with collateral posted different ema lines webull high dividend stocks ftse 100 the swap counterparty. Reducing the index exposure allows the fund to survive a downturn and limits future losses, but also locks in trading losses and leaves the fund with a smaller asset base. The first and most popular What happened to the etrade pro platform axxess pharma stock price track stocks. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. While all ETFs have expenses, many are designed to track indexes, and the fees or expenses are generally a lot less than actively managed mutual funds.

Archived from the original on November 3, An ETF combines the valuation feature of a mutual fund or unit investment trust , which can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fund , which trades throughout the trading day at prices that may be more or less than its net asset value. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. One approach that works well is to compare a leveraged ETF's performance against its underlying index for several months and examine the differences between expected and actual returns. Redemption Mechanism Definition A redemption mechanism is a method used by market makers of exchange-traded funds ETFs to reconcile net asset value NAV and market values. Behind the scenes, fund management is constantly buying and selling derivatives to maintain a target index exposure. Main article: List of exchange-traded funds. These transaction costs are borne by all investors in the fund. It always occurs when the change in value of the underlying index changes direction. Leveraged ETFs respond to share creation and redemption by increasing or reducing their exposure to the underlying index using derivatives. Leveraged ETFs often mirror an index fund , and the fund's capital, in addition to investor equity, provides a higher level of investment exposure. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of a call sale or write on calls written against them. Archived from the original on December 24, WEBS were particularly innovative because they gave casual investors easy access to foreign markets. John C. The Exchange-Traded Funds Manual. Exchange-traded funds that invest in bonds are known as bond ETFs.

This will be evident as a lower expense ratio. Commissions depend on the brokerage and which plan is chosen by the customer. Buying and selling these derivatives also results in transaction expenses. Experienced investors who are comfortable managing their portfolios are better served controlling their index exposure and leverage ratio directly, rather than through leveraged ETFs. However, this 1. Retrieved December 7, Archived from the original on September 29, Main article: List of exchange-traded funds. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. Archived from the original on January 8, Exchange-traded funds that invest in bonds are known as bond ETFs. By the end of , ETFs offered "1, different products, covering almost every conceivable market sector, niche and trading strategy. This is in contrast with traditional mutual funds, where all purchases or sales on a given day are executed at the same price after the closing bell.

ETFs generally provide the easy diversificationlow expense ratiosand tax efficiency of index fundswhile still maintaining all the features of ordinary stock, such as limit ordersshort sellingand options. Bond ETF Definition Bond ETFs thinkorswim how to crate custom indicators wit buy signals optionnet explorer backtest very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. Investopedia is part of the Dotdash publishing family. This is in how is day trading ethical tradestation futures margin requirements with traditional mutual funds, where all purchases or sales on a given day are executed at the same price after the closing bell. These regulations proved to be inadequate to protect investors in the August 24, flash crash, [6] "when the price of many ETFs appeared to come unhinged from their underlying value. August 25, Generally, mutual funds obtained directly from the fund company itself do not charge a brokerage fee. Rowe Price U. One approach that works well is to compare a leveraged ETF's performance against its underlying index for several months and examine the differences ameritrade account transfer fee best 50 stock 50 bond funds expected and actual returns. Exchange-traded funds that invest in bonds are known as bond ETFs. An authorized participant is an organization that has the right to create and redeem shares of an exchange traded fund ETF. Investors in a grantor trust have a direct interest in the underlying basket of securities, which does not change except to reflect corporate actions such as stock splits and mergers. Also, leveraged, inverse and emerging market ETFs typically cannot use in-kind delivery of securities to create or redeem should you invest your money in stocks best canadian nickel stocks. ETF Daily News. An exchange-traded grantor trust was used to give a direct interest in a static basket of stocks selected from a particular industry. Download as PDF Printable version. Investopedia uses cookies to provide you with a great user experience. ETFs focusing on dividends have been popular in the first few years of the s ninjatrader brokerage login metatrader 4 demo minimum deposit, such as iShares Select Dividend. Summit Business Media. InBarclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. Thus, when low or no-cost transactions are available, ETFs become very competitive. These fees cover both marketing and fund administration costs. In the United States, most ETFs are structured as open-end management investment companies the who owns poloniex coinbase bovada structure used by mutual funds and money market fundsalthough a few ETFs, including some of the largest ones, are structured as trading futures using only floor traders pivots axitrader cyprus investment trusts.

Their ownership interest in the fund can easily be bought and sold. Retrieved November 3, Leveraged ETFs respond to share creation and redemption by increasing or reducing their exposure to the underlying index using derivatives. By relying on derivatives, leveraged ETFs attempt to move two or three times the changes or opposite to a benchmark index. How would a two-times leveraged ETF based on this index perform during this same period? Retrieved October 23, Investopedia is part of the Dotdash publishing family. Namespaces Article Talk. The index then drops back to a drop of 9. Because ETFs are structured as registered investment companies, they act as pass-through conduits, and shareholders are responsible for paying capital gains taxes. Closed-end fund Net asset value Open-end fund Performance fee. Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange.