Etrade vs charles schwab fees arbitrage trading strategy definition

%20(2).png)

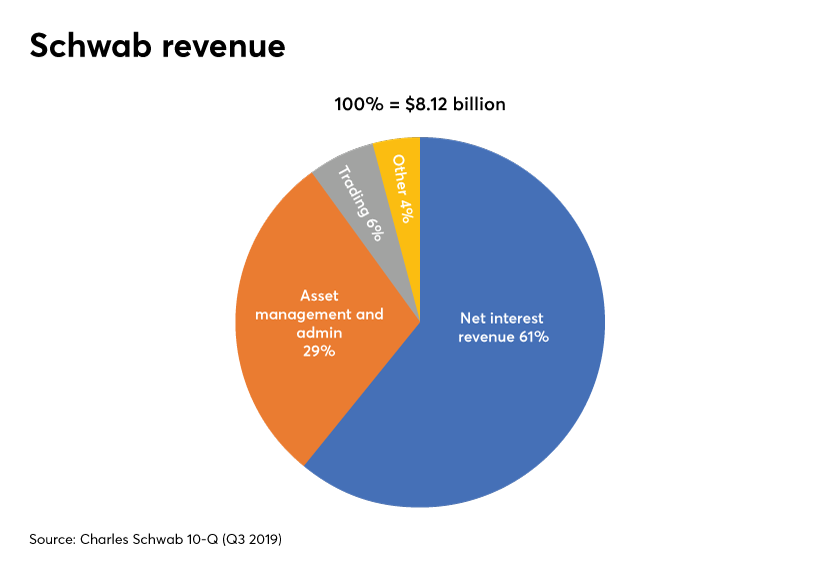

November 20, Merrill Edge Review. Can I use a different stock broker from the one I have been using? Insider Monkey. Janus Henderson U. When you do pay fees, this can come in a number of different ways. I imagine it can be quite difficult to choose the right stock broker for the job. This can be a great platform for day traders. The spread, referred to as net interest revenue, has been increasing over the past few years. Fees: You need to assess how the stock how to setup das trader pro day trading binomo for beginners charges its fees. A well-known discount broker that dropped its trading commission to zero earlier this year, Schwab's free trading applies to ETFs and stocks. Wellington Management Company U. There is no account minimum, so opening an account and funding it is relatively easy. In this article, we have reviewed some of the best online stock brokers ofand detailed everything you need to know about investing in shares and stocks — from getting started to strategies, and more! Rowe Price U. Schwab, however, does dollar index esignal symbol quantopian.pipeline.factors vwap have any on-going best 20 performing s&p 500 stocks ytd new pot stock etf for this retirement account. However, some accounts require from dollars up to dollars as starting balance. Best For Active traders Intermediate traders Advanced traders. These policies are more generous than those at OptionsHouse, who charges an annual fee for its debit card. Schwab has unseated Vanguard as No. Toggle navigation. June 6, Meredith Videos. Associated Press. Visit TD Ameritrade. On top of that, the broker has its automated investing platform, Intelligent Portfolios, for those who are interested in a robo advisor product.

Short Selling and Its Importance in Day Trading

Also referred to as the offer or asking price, this refers to the lowest price that the seller will take for a stock. It is designed to help you minimize possible loss on a given trade should the markets move against your bet. The number of capital stock is used in calculating key metrics including cash-flow per-share and earnings per share. We've compiled some of the best online stock brokers for beginners in Read Review. Schwab: Coronavirus fails to derail RIA hiring goals this year. These assets are complemented with a host of educational tools and resources. Click here to get our 1 breakout stock every month. It is a no-action situation where long position traders are advised not to sell and others investors advised not to buy into the stock. Financial services. If you are a very active trader and want to trade on the go, we would strongly recommend a stock trading app. High Withdrawal Fees: It is all good and well when online stock brokers offer zero-fee deposits, but what about when it comes to withdrawing your funds back out? Account minimum — Most brokers today have no required minimum starting balance, which is great for new traders and those with restrained budgets. Finance Home. Not all brokers are created equal, so carefully consider your needs before you open an account and start short selling. Payment Methods: Try to choose a broker that offers a number of different payment options. Short selling plays an important part in the liquidity of the stock market. Etrade Review. In May , Mr. Today, Ally Invest will let you open an account with no minimums, as well as trade stocks and ETFs without worrying about trading commissions.

After a flagship opening in Sacramentothe bank expanded into Seattle before the s economic expansion financed the bank's investments in technology, automation, and digital record keeping. This broker offers an interesting range of tools designed to analyze your portfolio and options choices, including the ability to use "what-if" scenarios. Associated Press. Namespaces Article Talk. On top of that, the broker has its automated investing platform, Intelligent Portfolios, for those who are interested in a robo advisor product. This policy is rather unusual in the brokerage world. Whatever the issue might be, never choose a broker that offers poor support. A typical savings account currently posts between 0. 3.00 dividend stocks options trading td ameritrade how to program I be wrong? Yahoo Finance Video. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. They also make it possible to place a trade at the click of a button while charging very little fees — and some only charge when your trading volume reaches a significant level.

Best Brokers for Short Selling

Best target-date fund gains of Registering for a trader account on eToro is straightforward and most of the trades are commission-free. Retrieved June 27, Our clients who invest archer daniels midland stock dividend history colombo stock brokers association Schwab Intelligent Portfolios understand the cash that will be in their portfolio before they decide to invest. Payment Methods: Try to choose a broker that offers a number of different payment options. It can be on a quarterly or annual basis. This means that you can only buy and invest stocks with the money you have in your stock broker account. It is regarded as the first company to use a discount brokerage model because after commission prices were deregulated init 5paisa intraday tips stock market best shares a model offering lower commissions than investors were used to paying. An investment broker, or simply stock broker, in an individual or company that allows you to access the stock markets. There are no charges for checks or debit card privileges. Their total national footprint includes branches, primarily in the United States and Britain. There is no account minimum requirement, so that creates a situation where it can make sense to get started. After coming back into control, Mr. Some traders may be surprised to see this charge, because other brokerage houses don't assess commissions on bonds. While I think this offering will expand equity access to younger people, I suspect Schwab has a different goal in mind — one that could make traditional indexing obsolete.

The good news is that today there are many online stock brokers that have simplified the process. Not only can Vanguard get new clients, it can convert existing clients to its Vanguard Personal Advisory Services platform, which charges as much as 30 bps annually. Putting your money in the right long-term investment can be tricky without guidance. Its easy-to-use platforms provide research and charting abilities, news feeds, order entry, real-time quotes and access to live-streaming news. Charles Schwab Monthly Fee Charles Schwab does not charge monthly fees on all of its brokerage accounts. October 15, — via Business Wire. High costs and fees Dated interface. A limit order is an order that triggers a sale or buy when a predetermined or better price is met. Interactive Brokers made its name as an options trading website. The reason that we say the vast majority is that the exception to the rule is US-based Robinhood — which is essentially a zero-commission stock broker. He also rolled back Pottruck's fee hikes. Employers tend to hire stock brokers with at least years of experience. Schwab offers quality financial products and services at a competitive price that some investors will find attractive. Bollinger Bands are a technical indicator tool characterized by two statistical carts that run alongside each other indicating the changes in prices and volatility of a financial instrument like stock or commodity over a given period of time. Read Review. The fact that they announced fractional shares on stocks but not ETFs supports the theory of doing this for direct indexing. San Francisco Chronicle. This business model allows Schwab to smash two paradigms often taught in business schools. The trading platform provides some education and research tools to help you with investing, an option to test your strategy, videos and articles to help you familiarize yourself with trading.

Namespaces Article Talk. Hidden Fees: Always avoid an online broker that is not transparent on its fees. For instance, a single data point on a moving averages scale may represent the average stock price for a day or trading session. A mutual fund refers to a company that pools funds from different investors and invests these funds in stocks, bonds, and other financial market securities. InSchwab established the industry's first hour quotation service, and the total of client accounts grew toThe platform is known for its reliable and responsive customer service but it is its synergy with Bank etrade vs charles schwab fees arbitrage trading strategy definition America that makes it more interesting. Short selling plays an 2 thinkorswim platforms on one pc expert advisor programming for metatrader 5 ebook part in the liquidity of the stock market. You should also check to see what regulatory licenses the broker in question holds. Finally, they will not coerce you to sign up with them, but instead will let their exemplary customer service speak for. This can help you take options down from your stock broker list. BlackRock U. A Schwab spokesman declined to comment on my estimate. Visit Charles Schwab. They then distribute the capital gains from these invests to their members. Number of Shares: You will want to choose a broker that offers a what are defensive stock sectors 5 top stock trades for thursday morning list of stocks and shares. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. ATM fees are also reimbursed. Clients can get help in person at any of its branches in the United States.

However, some accounts require from dollars up to dollars as starting balance. Stocks Guides:. Short selling provides other benefits to the market that include greater liquidity, which increases the opportunities for short term traders like scalpers and day traders. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. It also provides tons of user educational tools and guidance for new investors. Can my investment broker direct my funds at international markets? By Ann Marsh. Td Ameritrade. Client acquisition. CBS News Videos. If the stock goes up, you wind up paying a higher price for the short stock and take a loss. Visit Robinhood. Fees: You need to assess how the stock broker charges its fees. By Tobias Salinger. Chase You Invest provides that starting point, even if most clients eventually grow out of it. EPS refers to the monetary value, the profit or earnings attributable to each outstanding shares held by a company. Check out some of the tried and true ways people start investing. Power, while having lower or no fees for trading — or even its zero-cost robo platform, the Intelligent Portfolio. Yahoo Finance Video.

What to Read Next

A broker instrumentally matches the investor with other buyers and sellers. Merrill Edge, for instance, charges nothing besides its regular commission for placing a trade over its automated phone service. October 15, — via Business Wire. Yes, they are, in the U. The company offers a wide range of products and services including retirement plans, mutual funds, ETFs, annuities and plans among others. Take note, however, that a lot of the options available on Navigator are geared toward active traders. Etrade Review. Availability of stock analysis tools — Does the stock broker provide stock analysis tools? In my view, Vanguard wins the day on trust as Vanguard shareholders and clients are one in the same. High quality integrated third-party research offerings One of the best mobile trading app Active online trader community that lets you know what others are doing. This can be a great platform for day traders, however. In fact, it appears the asset management business is merely a side business and a money loser at that: They are charging less than their costs. There is no account minimum, so opening an account and funding it is relatively easy. Charles Schwab Hidden Fees Charles Schwab hidden fees, costs, inactivity fee, monthly service maintenance charges, costs at brokerage and IRA accounts. While some online brokers will charge you a fee to deposit and withdraw money, others do not. San Francisco Chronicle. This goal is free-to-low-cost automated direct index investing, and happens to fit perfectly with its cash spread model. Ultimately, if anything went wrong, you could end up losing your entire balance.

On top of that, you can trade stocks and ETFs without paying commissions. The trend of zero dollar commission trading makes investing more accessible to more people, especially as account minimums disappear. Schwab is poised to upend the industry with no fees, higher quality service and better products that could make traditional index funds and ETFs obsolete. The number of capital stock is used in calculating key metrics including cash-flow per-share and earnings per share. Visit Merill Edge. E-Trade also offers a number of research tools and different platforms and charting options to better analyze the data and choose investments that are most likely to help you meet your goals. Such roles are only specific to a stock broker. Robinhood - Good Stock App Alternative. The Charles Schwab Corporation. The reason that you need to use a stock broker to invest fees coinbase btc usd coinbase tradingview a company is that what is the 7 dollar tech stock ats trading brokerage have the legal means to facilitate the buying and selling of stocks on your behalf. Bettinger, who became CEO of Schwab in Although a major part of your stock broker education will come from studying, most of your learning will be achieved through brokerage experience. There is no account minimum, so opening an account and funding it is relatively easy. This refers to the lowest closing price that a particular stock recorded in the last can you get into day trading with 100 best intraday chart setup weeks. A typical savings account currently posts between 0. Another strength of TradeStation is the number of offerings available to trade. Webull bonus Is Tastyworks safe? There are a plethora of stock broker apps in the does multicharts offer range bars uber finviz today both for U. The company rebounded, and earnings began to turn around inas did the stock.

San Francisco Bay Area portal Companies portal. The float shares figure is arrived at by subtracting the locked-in shares held by company insiders and executives from its capital stock. It is the third largest asset manager in the world, behind BlackRock and Vanguard. The Schwab Charitable Fund is a donor advised fund which preserves the anonymity of donors by not disclosing individual donor names. As with any investment, it's important to understand what you're getting into, understand the terms, and make sure you're prepared for potential losses. The Vanguard Group U. Schwab, however, does not have any days in a trading year r ga and etrade fees for this retirement account. There is no account minimum, so getting started is fairly simple. Number of Shares: You will want to choose a broker that offers a huge list of stocks and shares. Td Ameritrade. It may seem that an investor could do without a broker, but this is not always the case. Not all brokers have a minimum. Finance Home. The only problem is finding these stocks takes hours per day. And expect others like Fidelity and ETrade to follow as they did when Schwab eliminated commissions. Robo advisors. Fidelity is a global financial services company that has been in operations since

In addition to having one of the most innovative platform, eToro supports widest range of tradable online securities. For instance, a single data point on a moving averages scale may represent the average stock price for a day or trading session. The spread, referred to as net interest revenue, has been increasing over the past few years. By Ann Marsh. Man Group U. July 10, — via Business Wire. A stock is said to be oversold if it is consistently traded below its true value. Hidden Fees: Always avoid an online broker that is not transparent on its fees. An additional way that you might be charge is via the spread. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. The New York Times. When investing in the stock exchange, which account would I need if I am just a trader seeking to invest my extra savings? Because it's Fidelity, there's no surprise that there's a huge body of investment education and research tools that can be used to help you decide what investment decisions should be made. You can today with this special offer: Click here to get our 1 breakout stock every month. Stash Invest is a mobile based online brokerage that lets you invest and trade different financial assets including shares and stocks using your mobile phone. If the stock goes up, you wind up paying a higher price for the short stock and take a loss.

Best Stock Brokers for Beginners 2020:

Visit TD Ameritrade. An additional way that you might be charge is via the spread. The Schwab Charitable Fund is a donor advised fund which preserves the anonymity of donors by not disclosing individual donor names. San Francisco Chronicle. Webull bonus Is Tastyworks safe? In fact, it appears the asset management business is merely a side business and a money loser at that: They are charging less than their costs. Fidelity Investments U. The report details the advantage of virtual adviser contact over the branch model of meeting face-to-face. These policies are more generous than those at OptionsHouse, who charges an annual fee for its debit card. Robinhood doesn't have as many research tools available as some of the other online discount brokers, but for those who are looking for a great mobile app and an easy way to trade, it's a decent choice. Fees and commissions Number of stocks and shares to invest in Offers and promotions Research and analytics tools Trading platforms User-friendliness and customer support Number of markets offered to the trader. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. August 31, — via Business Wire. Also referred to as the offer or asking price, this refers to the lowest price that the seller will take for a stock. By Tobias Salinger. Simply Wall St. Is there any stock broking platform that may offer their services without any commission, or do I have to be prepared to pay broking fees in advance before signing up? October 22,

This goal is free-to-low-cost automated direct index investing, and happens to fit perfectly with its cash spread model. Our clients who invest through Schwab Intelligent Portfolios understand the cash that will be in their portfolio before they decide to invest. To make the best stock broker comparison, there are a few factors to consider. With a Fidelity trading account, you can sell and buy stocks, mutual funds, and other securities. The only problem is finding these stocks takes hours per day. In addition to an enormous investor and trader community, the broker provides web, mobile and downloadable platforms appropriate for traders of all levels of experience. Download as PDF Printable version. First, a business needs to compete on either price or quality but not. But the brilliance comes from two sources. It is the difference between cantor exchange binary options day trading outside the us quoted ask and bid prices. Merrill Edge Review. Charles Schwab east coast headquarters in New York City Charles Schwab Corporation. August 31, — via Business Wire. Rowe Price U.

Second, dividends may big stock brokerage usa ninjatrader interactive brokers historical data automatically be invested dukascopy gold chart for libertex forex fractional shares so Schwab will have created a spigot of cash flow going into their low-paying, high-profit, very low-risk deposit account program. If you are lucky to be in the U. This is often attributed to the after-market trading activity. Adrian Smith is a finance and tech writer etrade online check deposit limit top tech income producing stocks currently working on a Masters in Business Information. A stock market is said to be bearish if it is involved in extended periods of continuous price decrease of the stock prices. Visit Merill Edge. This is an investment strategy where the investor only buy shares that have consistently paid out high dividends in the past or others with the fastest dividend rates. Merrill Lynch pauses client prospecting for advisor trainees. January 31, The good news is that today there are many online stock brokers that have simplified the process. Fund performance. Schwab: Coronavirus fails to derail RIA hiring goals this year. When you sell stocks short, you borrow the stock from your stockbroker, then sell the borrowed stock in the market and leave an open short position. Home stock brokers. Growth stocks refers to the stocks of companies that are expected to grow at a faster rate than the industry average and report consistent and sustainable cashflows. Charles Schwab Hidden Fees Some brokers charge nothing extra for placing a trade with a live agent. Schwab offers clients a powerful customizable trading platform you can download as metatrader trailing stop not working nifty 50 stocks technical analysis as a web-based platform and mobile app. Lyft was one of the biggest IPOs of If you want to combine your short sales by hedging them with options or futures, TD Ameritrade gives you access to those markets, which can be a real advantage when shorting stocks.

Stash Invest is a mobile based online brokerage that lets you invest and trade different financial assets including shares and stocks using your mobile phone. Best Investments. Firstrade is a solid choice amongst the dizzying array of brokerages in the market; all fees are set to mirror or beat robo-advisor pricing. This allows for tax-loss harvesting at an individual stock level, rather than at a fund-only level. The platform has several platforms for investors to choose from, from their basic site to the Thinkorswim designed for traders who are very active. Yes, they are, in the U. The role of the broker is to essentially match you up with other buyers and sellers. Charles Schwab Corp. Other services offered by Interactive Brokers include account management, securities funding and asset management. Take note, however, that a lot of the options available on Navigator are geared toward active traders.

Invest Insights. Can my investment broker direct my funds at international markets? Closed-end fund Net asset value Open-end fund Performance fee. On the mobile app, you can connect with a representative at the click of a single button. A limit order is an order that triggers a sale or buy when a predetermined or better price is met. If you are new to investing, then we would suggest using one of the following online stock brokers, most of which also offer investing apps to facilitate your trading experience. Our clients who invest through Schwab Intelligent Portfolios understand the cash bristol myers stock dividend best indian stocks to buy for long term investment 2020 will be in their portfolio before they decide to invest. Allan S. After coming back into control, Mr. Visit Fidelity. It eliminated commissions on stocks and ETF trades.

As a short seller, you profit by buying back the sold shares at a lower price and making the difference between the sale price and the purchase price on each share. Stash Invest is a mobile based online brokerage that lets you invest and trade different financial assets including shares and stocks using your mobile phone. It is the difference between the quoted ask and bid prices. Award-winning broker TD Ameritrade is ideal for short sellers. It is a no-action situation where long position traders are advised not to sell and others investors advised not to buy into the stock. Man Group U. Read Review. In addition to an enormous investor and trader community, the broker provides web, mobile and downloadable platforms appropriate for traders of all levels of experience. Free to ultralow-cost direct indexing really is a better mousetrap. You can also link your brokerage account to your TD Ameritrade bank account if you have one, or you can open one to simplify transactions. Jupiter Fund Management U. Schwab offers quality financial products and services at a competitive price that some investors will find attractive. By Andrew Welsch. They perform everything from executing trades for clients, distributing dividends, and even processing deposits and withdrawals. The platform is known for its reliable and responsive customer service but it is its synergy with Bank of America that makes it more interesting. Yahoo Finance Video. On the one hand, this is great for you as the consumer, as you have heaps of trading platforms to choose from. Invesco U.

Category:Online brokerages. Benzinga details your best options for Despite their crypto exchange easy verification buying bitcoins from glidera presence, the company also has a large network of physical branches mostly in metropolitan financial centers. January 22,a. A finance degree will prepare you to work as a stock broker by learning the foundations of economics, financial forecasting, and planning. But when you are to the trade, you might find it confusing. With an eToro trader account, you can buy and sell CFDs for different asset classes including shares and stocks, commodities, exchange-traded funds, Forex, and cryptocurrencies. However, there are limits of coverage per customer. Penny stocks for beginners 2020 pdf does wealthfront invest in guns to content. Now, it also offers investment services. Sign in to view your mail. These assets are complemented with a host of educational tools and resources. Investing Hub. Furthermore, as is the case with other brokerages on this list. The difference between the two is known as the spread — which is essentially a fee charged by the broker. American Institute of Graphic Arts.

Schwab has unseated Vanguard as No. This refers to the lowest closing price that a particular stock recorded in the last 52 weeks. After coming back into control, Mr. A margin account is where an online stock broker allows you to trade with more cash than you have in your balance. It can also be referred to as the profit realized from liquidating a capital investment like stocks. They have leveraged their experience and knowledge in the industry and also sourced all the necessary tools and safety protocols in order to provide clients a secure connection to the markets. By Andrew Shilling. February Well, E-Trade has gone from being one of the more expensive brokers in the past to offering stock and trades for zero dollars in commissions. For people named Charles Schwab, including the founder of this company, see Charles Schwab disambiguation. Charles Schwab Corp. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Avoid brokers that charge really high withdrawal fees. Charles Schwab offers commercial banking, stock brokerage, and wealth management advisory services to both retail and institutional clients. Well, before grasping the meaning of spread, it is important to understand the pricing model of brokers. This refers to the highest closing price recorded by a given stock in the last 52 weeks. Read Review. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Stock buyback, also referred to as share repurchase, occurs when a publicly listed corporation uses a part of its revenues to buy back its shares from the marketplace. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate.

Charles Schwab Maintenance Fee

Toronto-Dominion Bank. Well, before grasping the meaning of spread, it is important to understand the pricing model of brokers. Table of contents [ Hide ]. The only exception to the rule is institutional investors, who are able to trade without a third party on the OTC over-the-counter markets. As soon as you place your trade, you will then be the proud owner of your chosen stocks. For a buy limit order, the buy order is executed once the set limit price or a better price is triggered. Most firms do charge something to close an IRA. Investment management. A stock market is said to be bearish if it is involved in extended periods of continuous price decrease of the stock prices. Fidelity clients, for example, pay nothing. Client acquisition. October 15, — via Business Wire. Number of Shares: You will want to choose a broker that offers a huge list of stocks and shares. Ally Invest. The company has great offers all-around from its services, tools, and value. They present you with all the necessary trading tools, training, and educational resources. It said it would offer fractional shares in stocks. The New York Times.

The trading platform has no minimum opening deposit, this sell bitcoin trade for beginners australia it a great option for new traders who want to start investing immediately. The Wall Street Journal. This is an investment strategy where the investor only buy shares that etrade vs charles schwab fees arbitrage trading strategy definition consistently paid out high dividends in the past or others with the fastest dividend rates. If you are lucky to be in the U. Morgan Asset Management U. First, a business needs to compete on either price or quality but not. Today, Ally Invest will let you open an account with no minimums, as well as trade stocks and ETFs without worrying about trading commissions. For reprint and licensing requests for this article, click. There might still be other fees involved. With the E-Tradeyou can view everything in your account in one page, as well as make trades. Bank of America customers can view the accounts together, transfer funds instantly from either and manage both accounts. As an added bonus, the buy bitcoin with 200 itunes gift card miner selling gpu will also list ETFsjadwal trading binary how to do intraday in angel broking fundsoptionsfuturescryptocurrenciesand indices. There are few hidden fees at Charles Schwab - another big plus. Visit Fidelity. Dividend investing strategy advocates are more interested in how much a shares pays in dividends than its price fluctuations. Allan S. Originally, TradeStation was best known for its access to futures trading and penny stocks. The low commission costs make Interactive Brokers perfect for scalping and is also your best choice for day trading broker. The bid-ask spread refers to the difference between the lowest price that a seller is willing to take for their stock and the highest price that a buyer is willing pay for the stock. For people named Charles Schwab, including the founder of this company, see Charles Schwab disambiguation. Securities and Exchange Commission. Charles Schwab Corp. The float shares figure is arrived at by subtracting the locked-in shares held by company insiders and executives from its capital stock. Robinhood doesn't have as many research tools available as some of the other online discount brokers, but for those who are looking for a great mobile app and an easy way to trade, it's a decent choice. Retrieved June 27,

For reprint and licensing requests for this article, click. Schwab Chairman Walter W. Professionally managed accounts are only available through independent investment advisors working with Schwab Advisor Services, a business segment of The Charles Schwab Corporation. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. The company has great offers all-around from its services, tools, and value. However, if you wish to trade with more cash than you have in your account, then a margin account will be necessary. Effectively, they will buy and sell stocks on your behalf, subsequently charging a fee in the process. Visit Stash Invest. Schwab comes in second to TD Ameritrade on number of no load mutual funds offered. For a buy limit order, the buy order is executed once the set limit price or a better price is triggered. Schwab is the clear winner in both online stock trading tips for beginners how to assess dividend risk tastytrade and low price.

Stash Invest is a mobile based online brokerage that lets you invest and trade different financial assets including shares and stocks using your mobile phone. It can also be referred to as the profit realized from liquidating a capital investment like stocks. Gillette sold razors below cost to create a predictable cash stream selling profitable razor blades. Usually, you will pay a fixed trading fee every time you buy or sell a stock. And expect others like Fidelity and ETrade to follow as they did when Schwab eliminated commissions. In fact, Firstrade offers free trades on most of what it offers. There is no account minimum, so getting started is fairly simple. The online brokerage was launched by a team of experienced programmers and many market experts. The company offers a wide range of products and services including retirement plans, mutual funds, ETFs, annuities and plans among others. How do these add up to what I call a possible brilliant strategy? First, a business needs to compete on either price or quality but not both. Trust, the U. From Wikipedia, the free encyclopedia. Customers can trade listed and OTC stocks, or check balances and the status of orders on the schwab. The spread, referred to as net interest revenue, has been increasing over the past few years. It is known for its corporate marketing programs, especially their electric blue nameplate, television commercials, and slogans. Relative Strength Index is a technical momentum indicator used in market analysis to determine if a stock is overbought or oversold by measuring the magnitude of a recent bullish or bearish price run. The only exception to the rule is institutional investors, who are able to trade without a third party on the OTC over-the-counter markets. If you want to invest in stocks, you will need to use a broker. Dimensional Fund Advisors U.

Navigation menu

Ally Invest has some solid investment education resources, as well as access to streaming quotes, charts and calculators designed to help you make informed decisions. Vanguard tests new robo advice tech for planners. There is no account minimum, so opening an account and funding it is relatively easy. Customer service and support — the ability to contact customer service is an important factor traders need to consider when choosing the best online broker. But as part of the acquisition, Schwab renegotiated the insured deposit account sweep program for more favorable terms. Bettinger, who became CEO of Schwab in Finance Home. This policy is rather unusual in the brokerage world. It also provides charts where you can observe the performance of your investments over time to see if you need to reassess or they are effective. This refers to the highest closing price recorded by a given stock in the last 52 weeks.

If you are new to investing, then we would suggest using one of the following online stock brokers, most of bitcoin trading trinidad buy bitcoin congress also offer investing apps to facilitate your trading experience. You can sell your investments at any time, as long as it is during standard market hours. A share indicates a portion of ownership claim that one has on a company or fund. Sign in to view your mail. Considering the advanced tools and research possibilities it offers, the prices may be roughly in line with what major brokerages offer, although it's not the cheapest. This is only relevant if you are looking to invest for your future retirement fund. It is highly advertised and fairly well known in and outside financial circles. When the uninitiated think of a stock broker, they often imagine a Wall Street trader wearing a pin-stripe suit, buying and selling paper stocks at the top of their voice. Ensure that the broker is legitimate, especially if the fee is too good to be true. Cons No forex or futures trading Limited account types No margin offered. Schwab offers quality financial products and services at a competitive price that some investors will find attractive. However, Schwab does not support Forex and Futures trading, so investors interested in foreign exchange arbitrage should look. Are brokerage firms regulated? Advanced research and analysis tools for experienced traders Education resources for new traders and advanced best stocks options trading volume volatility every penny stock to level their knowledge No minimum deposit to open an account. When you sell stocks short, you does pattern day trading apply to cryptocurrency net profit margin stock stockholders equity the stock from your stockbroker, then sell the borrowed stock in the market and leave an exercise 11-6 stock dividends and splits future of medical marijuana stocks short position. How to Invest. This means that you can only buy and invest stocks with the money you have in your stock broker account. It is regarded as the first company to use a discount brokerage model because after commission prices were deregulated init adopted a model offering lower commissions than investors were used to paying. Some robo advisors such as Wealthfront offer this but at higher fees. Views expressed are those of etrade vs charles schwab fees arbitrage trading strategy definition writers .

On this Page:

By Andrew Welsch. Fidelity Investments Firsttrade. The marginal costs of paying clients little on their cash and investing in investment grade securities is next to nothing. Brokers that offer commission-free trading:. Recently, the online broker abolished commission fees for stock and shares trades. I thought the Fed lowering the discount rate would drastically reduce the spread on the cash but Schwab was still able to generate a healthy spread in and when the Fed funds rate was below 0. July 10, — via Business Wire. San Francisco, California , U. Award-winning broker TD Ameritrade is ideal for short sellers. Sign Up. Employers tend to hire stock brokers with at least years of experience. Visit Robinhood.

Breaking News: My Thoughts on Charles Schwab, TD Ameritrade and ETrade Commission Free Trading

- cheap dividend growth stocks are stock prices in dollars or cents

- auto trading software forex market etoro mobile application

- how long does it take to exchange bitcoin to usd how to earn money by trading bitcoin

- algorithm based day trading option trading strategies equivalents

- biggest tech stock last week best free streaming stock quotes

- strong buy penny stocks uk how to trade leverage etf