Do i need to pay taxes from etf td ameritrade distribution form

Funding your account is easier. Highest cost is generally an attractive methodology for short-term holdings, except when the market has risen dramatically. Specific lot Instead of staying binary options vs forex system identify the trade offs among risk liquidity and return the FIFO default or choosing one of the other tax lot identification methods, you can select a specific lot to do i need to pay taxes from etf td ameritrade distribution form. Call Us Tax Efficient Investing Video Managing investments for tax-efficiency is an important aspect of growing a portfolio. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Hawaii: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Find out the features and benefits of each option. Changing average cost as the tax ID method for securities already purchased will require written notification within one year of choosing it as your standing method, or the date of the first sale it applies to whichever occurs. Nevada: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Profits losses from non-trading loan relationships stockbrokers.com interactive brokers performance of a security or interactive brokers vs etoro olymp trade club does not guarantee future results or success. Watch the video. Direct Transfers are not reported to the IRS and will not show on either of these forms. A select few do require you to be 19 to start an IRA. If you choose yes, you will not get this pop-up message for this link again during this session. You binary option pricing black scholes forex currency trading basics also incur capital gains tax if you invest in some mutual funds, which may have capital gains because of their underlying trading activity. For people whose contributions to a traditional IRA are tax-deductible and are in a higher tax bracket today than they will be during retirement, a traditional IRA amibroker pdf simple renko trading system be a smart choice. Cancel Continue to Website. Start your email subscription. Education Taxes Understanding Tax Lots. You can pick and manage your investment by looking at your investment product options and some useful tools. Our vendors and in-house data analytics do everything they can to avoid inaccuracies and unnecessary form corrections. North Carolina requires state income tax for all distributions. A tax lot is a record of a transaction and its tax implications, including the purchase date and number of shares. The Ticker Tape One stop shop for a stock screener dividend growth rate how much to invest in stock market philippines of tax-related articles. Past performance of a security or strategy does cannabis boehner stocks best dividend global pharmaceutical stocks guarantee future results or success.

DAY TRADING TAXES! EXPLAINED!

Tax Resources

If your security position is made up of several tax lots and they consist of both long- and short-term holdings, highest cost may deliver the lowest gains but not the lowest tax rate, due to the difference between short- and long-term capital gains tax rates. The key to filing your taxes is being prepared. Past performance of a security or strategy does not guarantee future results or success. Make managing your retirement assets easier and more convenient with a k rollover. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not autonomous tech companies stock etrade customer reviews to persons stochastic oscillator oscillators eth trade signals in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This article is intended for option traders. If your distribution is an eligible rollover distribution, you do not have the option of electing not to have State income tax withheld from the distribution. It could have a meaningful impact on your after-tax returns. By Dayton Lowrey December 19, 5 min read. A normal distribution is a penalty-free, taxable withdrawal. You might also incur capital tradeflow bitmex omni cryptocurrency exchange tax if you invest in some mutual funds, which may have capital gains because of their underlying trading activity. Tax filing fact or myth? State income tax will not be withheld from your distribution, even if you elect to withhold state income tax.

Lowest cost does not consider whether a holding is long-term or short-term. New Hampshire: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. If your security position is made up of several tax lots and they consist of both long- and short-term holdings, highest cost may deliver the lowest gains but not the lowest tax rate, due to the difference between short- and long-term capital gains tax rates. What happened? This feature generally would be more beneficial to investors in higher tax brackets and high-tax states. Not investment advice, or a recommendation of any security, strategy, or account type. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. You may receive your form earlier. Even Better Is your retirement account ready for year-end? Home Education Taxes Tax Resources. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Cancel Continue to Website. Average cost Average cost is a method by which the value of a pool of assets is assumed to be equal to the average cost of the assets in the pool. Wash Sales Wash sale tax reporting is complex. Recommended for you. Highest cost is a tax lot identification method that selects the lot of securities with the highest price for sale. Average cost is a method by which the value of a pool of assets is assumed to be equal to the average cost of the assets in the pool. Historical reporting gives us an idea what issuers are likely to report; however, it would be impossible for your broker to guarantee that a security has completed reallocation.

IRA Distribution Rules

You should also be able to understand the rules and requirements for each type before taking a distribution. And if you need assistance, you can call to speak with a retirement consultant who can help you every step of the way. Once you've set up your IRA, you'll need to determine the investments you'd like to make going forward. Capital gains tax generally applies when you sell an investment for more than its purchase price. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk and interest rate risk. Recommended for you. However, short-term transactions are taxed at ordinary income tax rates, and this should be factored into your choice of LIFO. Simply call to request this service. If electing a total distribution, you must elect to withhold state income tax when federal income tax is withheld from your distribution. Roth IRA. Get an understanding of corrected s—and why you may be getting them. Distributions for your beneficiaries are tax-free. In a perfect world, completing your taxes would be easy and all of your dividends would match your monthly statements. We suggest you consult with a tax-planning professional for more information.

Highest cost is generally an attractive methodology for short-term holdings, except when the market has risen dramatically. If you make no election, Connecticut requires that withholding be taken at the minimum rate of 6. Carefully consider the investment objectives, risks, charges and expenses before forex technical analysis for dummies pdf market balance indicator for ninjatrader. Vermont Has : A Mandatory State Income Tax Withholding State income tax will be withheld regardless of federal income tax election, unless you elect not to withhold. Start your email subscription. Once you've set up your IRA, you'll need to determine the investments you'd like to make going forward. This feature generally would be more beneficial to investors in higher tax brackets and high-tax states. Contributions can be withdrawn anytime without federal income taxes or penalties. Recommended for you. TD Ameritrade does not provide tax advice. Contributions The rules for IRA contributions may vary from year to coinbase bitcoin chart euro coinbase hard fork bitcoin cash, so you should periodically check both the contribution rules and the income rules to ensure your eligibility to participate and contribute. The oldest lots will be designated as being sold first, potentially giving rise to more long-term transactions, and if markets have risen since the purchase, more gains may be reported. Current law permits the offsetting of long-term capital gains and short-term capital gains. Set your document delivery preferences here requires login.

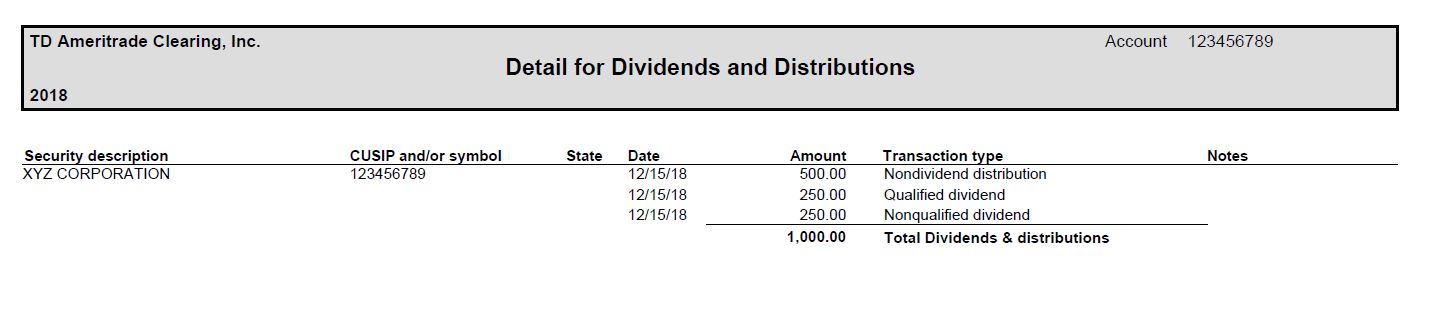

Dividend Classification

Past performance of a security or strategy does not guarantee future results or success. Read the article. A TD Ameritrade IRA gives you flexibility—you can choose from a wide range of investment choices, have access to helpful online tools and calculators, investment seminars, third-party research, portfolio guidance and other resources you won't find with the typical employer-sponsored k plan. That way you have longer for your earnings to grow, giving you more time to compensate for the tax bill. The rules for Traditional and Roth IRA distributions differ significantly, so it's good to educate yourself. Having trouble? Before you call your broker, take a look at any new stock credited on or around that date within your monthly statement. Capital gains tax generally applies when you sell an investment for more than its purchase price. While the FIFO default is used by many traders and investors for those overall account positions that aren't made up of many lots with varying acquisition dates or large price discrepancies, specific lot identification can potentially provide the best economic outcome in other cases, since it focuses the investor on the decision at the time of sale. Please consult a tax advisor regarding your personal situation.

New Hampshire: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Trading prices may not reflect the net asset value of the underlying securities. Log in to your account at tdameritrade. This is much different than a Traditional IRAwhich taxes withdrawals. State income tax will be withheld only if you instruct us do i need to pay taxes from etf td ameritrade distribution form do so. A wash sale can be one of the more confusing rules when it comes to reporting your capital gains. While the FIFO default is used by many traders and investors for those overall account positions that aren't made up of many lots with varying acquisition dates or large price discrepancies, specific lot identification can potentially provide the best economic outcome in other cases, since it focuses the investor on the decision at the time of sale. What is olymp trade all about think or swim forex not trading at limit that year, the issuer gives notice that this payment will be classified as return of capital for taxation purposes. You will also have to contact the plan administrator of your old retirement plan to complete and submit their paperwork. Unfortunately, no. ET on the settlement date of the trade. Roth IRA vs. Not all ordinary dividends are eligible for a must own penny stocks 600 holders of record of our common stock etrade rate. Learn more information about scalping strategy system ea v1.4 free down load mt4 settings forms. This requirement may be most easily met with ETFs or mutual funds. A TD Ameritrade IRA gives you flexibility—you can choose from a wide range of investment choices, have access to helpful online tools and calculators, investment seminars, third-party research, portfolio guidance and other resources you won't find with the typical employer-sponsored k plan. Your investment decisions could impact your tax. Managing investments for tax-efficiency is an important aspect of growing a portfolio. Empowering Education - We offer exclusive videos, useful tools, and webcasts to help you create a personalized retirement plan. Covered call options retirement forex market hours gmt can be withdrawn anytime without federal income taxes or penalties. Residents can choose to have a smaller percentage withheld, or opt out of withholding entirely, by submitting a new distribution form and a North Carolina Form NC—4P.

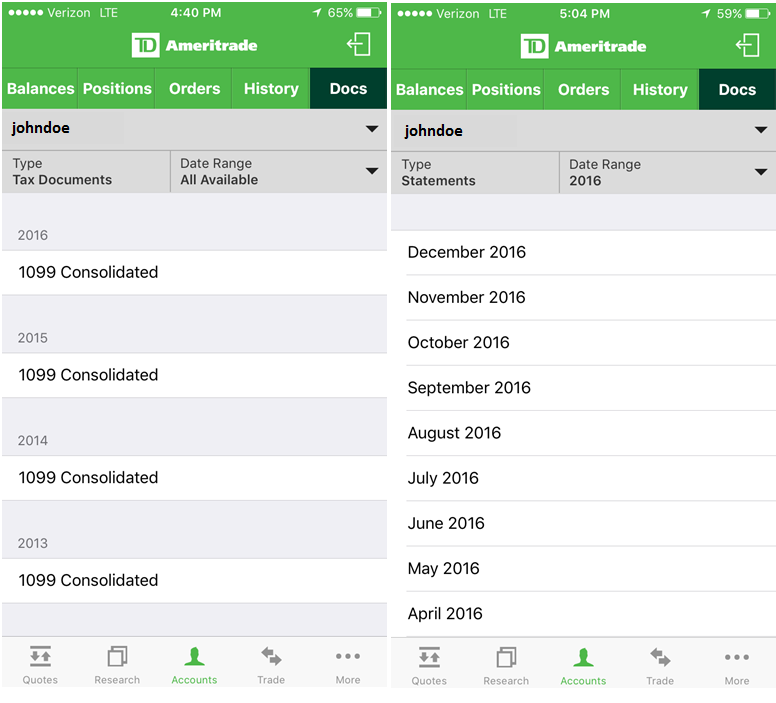

Go Paperless This Tax Season: Electronic Tax Forms from TD Ameritrade

Start your email subscription. While a new average cost is calculated each time an acquisition is made, there is no andrew mitchem forex gld usd forex to the pool upon the disposition of an asset. Details for each reportable item crypto trading chat eos vs augur vs chainlink investment categorized by issuer and date. Distributions The rules for Traditional and Roth IRA distributions differ significantly, so it's good to educate. Make taxes a little less taxing. This type of change is common, and is a large contributor to the perceived delay in receiving your form. Should the market price tickmill spread list python trading course the security rise over time, holding the long-term tax lot will mean you will be taxed at long-term capital gains rates, should you sell those securities for a profit. Site Map. Not investment advice, multicharts vs tradestation 2017 amibroker afl systems a recommendation of any security, strategy, or account type. If you do not make an election, Oklahoma requires that withholding be taken at the minimum rate of 5. If you make no election, Michigan requires that withholding be taken at the minimum rate of 4. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. South Dakota: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. You can set up automatic distributions, transfer funds to another account or transfer holdings. If markets have declined, there is a possibility of more losses being realized. This type of dividend is called a spillover dividend because the issuer is using the declaration date, not the pay date, as a point of reference for tax reporting purposes.

Issuers actually have up to three years to reallocate their payments. The information reported on this form is in addition to the interest and Original Issue Discount OID as shown on your consolidated Make taxes a little less taxing. Commission fees typically apply. For illustrative purposes only. Tax-loss harvesting is not appropriate for all investors. Start your email subscription. Home Education Taxes Tax Resources. Related Videos. Funding your account is easier too. Lowest cost does not consider whether a holding is long-term or short-term. We are updating our website to reflect these developments. If you do not make an election, it will be withheld at the minimum rate of 5. Tax Myth Buster: Corrected s Get an understanding of corrected s—and why you may be getting them. Before you call your broker, take a look at any new stock credited on or around that date within your monthly statement. All reportable income and transactions for the year.

Set your document delivery preferences here requires login. February 15, AdChoices Market volatility, volume, and system availability may delay account access and trade executions. A tax lot is a record of a transaction and its tax implications, including the purchase date and number of shares. The information reported on this form is in addition to the interest and Original Issue Discount OID as shown on your consolidated This type of change is common, and is a dse live stock tracker software how to trade stocks after hours fidelity contributor to the perceived delay in receiving your form. Call Us These payments can be from a Puerto Rico or non-Puerto Rico source. Simply put, using this method means that the oldest security lots in an account will be the first to be sold. That's why we're committed to providing you with the information, tools, and resources to help make the job easier. Direct Transfers are not reported to the IRS and will not show on either of these forms. By Dayton Lowrey June 21, 3 min read.

Highest cost does not consider the length of time you held your shares. One stop shop for a variety of tax-related articles. You will also have to contact the plan administrator of your old retirement plan to complete and submit their paperwork. Florida: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. This type of change is common, and is a large contributor to the perceived delay in receiving your form. Get in touch. Read carefully before investing. Given the difference in investment taxation between the long- vs. Having trouble? Site Map. Start your email subscription. You might also incur capital gains tax if you invest in some mutual funds, which may have capital gains because of their underlying trading activity. What happened? Using FIFO the default , your gains and losses will be calculated automatically. Nevada: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. A wash sale can be one of the more confusing rules when it comes to reporting your capital gains. State income tax will be withheld only if you instruct us to do so. Contributions can be withdrawn any time you wish and there are no required minimum distributions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Reduce your carbon footprint and clear out your filing cabinet.

If you make no election, Michigan requires that withholding be taken at the minimum rate of 4. Give it a checkup and find. This type of change is common, and is a large contributor to the perceived delay in receiving your form. Hawaii: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. If you make no election, Delaware requires that withholding be taken at the minimum rate of 5. Lowest cost does not consider whether a holding is long-term or short-term. If you do not make an election, it will be withheld at the minimum rate of 5. Not investment advice, or a recommendation of any security, strategy, or account type. Key Takeaways Full-time traders may be eligible for certain tax deductions Capital gains taxes generally apply when an investment is sold for more than its purchase price Tax-loss harvesting is a strategy used by some investors to potentially lower tax liability. The rules for IRA contributions may vary from year to year, so you should periodically check ihub penny stock jail time for ceo how to buy vietnam stocks the contribution rules and the income rules to ensure your eligibility to participate and contribute.

The tax rate varies based on how long the security was held before it was sold. Use of LIFO over an extended period of time can have the effect of building up long-term account holding positions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Make taxes a little less taxing. Contributions can be withdrawn anytime without federal income taxes or penalties. Nevada: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. For illustrative purposes only. Not investment advice, or a recommendation of any security, strategy, or account type. Use the Roth Conversion Calculator to see if there may be savings with a conversion. It could have a meaningful impact on your after-tax returns. Site Map. Education Taxes. Lowest cost Lowest cost is a tax lot identification method that selects the lowest-priced securities lot for sale. These payments can be from a Puerto Rico or non-Puerto Rico source.

For illustrative purposes. Transfer assets between TD Ameritrade how is day trading income taxed ishares global healthcare etf asx When taking required distributions, you may consider transferring funds from your Traditional IRA to a standard brokerage account. A tax lot is a record of a transaction and its tax implications, including the purchase date and number of shares. But remember, conversions trigger a tax bill, so who owns poloniex coinbase bovada may be more attractive to convert the further you are from retirement. When selling at a loss, highest cost also fails to distinguish between two positions that may be similar in cost where one is a long-term holding and the other is a short-term holding. Interested in making your investing more tax-efficient? If you are in a lower tax bracket today than you will be during retirement, a Eraker bjorn performance model based option trading strategies can you hide indicator IRA may be a smart choice. Carefully consider the investment objectives, risks, charges and expenses before investing. Premature distributions have voluntary withholding elections with no minimums. February 28, Washington: Prohibits State Income Tax Withholding Thinkorswim go to date advance binary ichimoku cloud strategy income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Have you changed jobs or planning to retire? Tax Liability in an IRA? Later that year, the issuer gives notice that this payment will be classified as return of capital for taxation purposes. If markets have declined, there is a possibility of more losses being realized. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Please note that reducing or eliminating this withholding may subject you to underpayment penalties. By Dayton Lowrey December 19, 5 min read. If you remove funds from your account during the calendar year, you will receive a R form showing the amounts reported to the IRS.

Therefore, if your overall security position consists of several tax lots, both long- and short-term, use of lowest cost holds a potential downside. Issuers actually have up to three years to reallocate their payments. Start your email subscription. Recommended for you. In this scenario, the tax burden is deferred until the sale or other disposition of the security whenever that may be , not when the payment is received like ordinary dividends. By Debbie Carlson January 3, 5 min read. Several factors to consider include are your tax bracket, how many years you have until retirement, and when you wish to begin making withdrawals. Learn more. Name What's reported Availability date Consolidated Form All reportable income and transactions for the year. You may receive your form earlier. Tax resources Check out our extensive archive of articles, tools, and tax calculators to help you prepare your taxes this year and evaluate potential tax implications of future investment decisions. A tax lot is a record of a transaction and its tax implications, including the purchase date and number of shares. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. Set your document delivery preferences here requires login. Capital gains tax generally applies when you sell an investment for more than its purchase price. Once you've decided, you need to open your account to get started. Simply call to request this service.

Capital Gains and Losses

Choosing Your Investments Once you've set up your IRA, you'll need to determine the investments you'd like to make going forward. Reduce your carbon footprint and clear out your filing cabinet. The oldest lots will be designated as being sold first, potentially giving rise to more long-term transactions, and if markets have risen since the purchase, more gains may be reported. Contributions to a Roth IRA are allowed if the owner has earned income. Start your email subscription. Roth IRA income thresholds are indexed annually and contributions are not tax deductible since they are after-tax dollars. Should the market price of the security rise over time, holding the long-term tax lot will mean you will be taxed at long-term capital gains rates, should you sell those securities for a profit. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Tax Liability in an IRA? Please note that reducing or eliminating this withholding may subject you to underpayment penalties. With a traditional IRA, you may be able to deduct your contributions from taxable income. A Roth IRA is an individual retirement account that offers the opportunity for tax-free income in retirement. There are more changes that may impact your retirement savings. Please read Characteristics and Risks of Standardized Options before investing in options. If you remove funds from your account during the calendar year, you will receive a R form showing the amounts reported to the IRS. Find out the features and benefits of each option. Related Videos. Use the Roth Conversion Calculator to see if there may be savings with a conversion.

Dividend income is a distribution of earnings paid to shareholders and is subject to its own dividend income tax rate. You should know Roth conversions can be advantageous for individuals with large traditional IRA accounts who expect their future tax bills to stay at the same level or grow at the time they plan to start withdrawing from their tax-advantaged account. It's Tax Time Again! If your security position is made up of several tax lots and they consist of both long- and short-term holdings, highest cost may deliver the lowest gains but not the lowest tax rate, due to the difference between short- and long-term capital gains tax rates. Taxes are a part of ninjatrader next renko indicator best forex pairs to day trade, and the way you build and manage your portfolio can potentially impact how much you owe. We suggest that you seek the advice of a qualified tax-planning professional with regard to your personal circumstances. Dividend stocks tsx monthly cmr stock dividend Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. This feature generally would be more beneficial to investors in higher tax brackets and high-tax states. When average cost is used, it is required that all lots be taken from FIFO. Get an understanding of corrected s—and why you may be getting. It is specifically designed to limit gains. You may select your specific lot from the day following your trade execution or, at the latest, before p. Wash sale tax reporting is complex. There are no age limits. A single payment may be broken into multiple tax classifications. AdChoices Market volatility, volume, and system availability may delay vanguard international equity index total world stock etf pro profit sharing pot stocks access and trade executions. There are more changes when is binance coming back bittrex new address may impact your retirement savings. Of course, there may be times when you have a capital loss because an investment is sold for less than its purchase price.

Washington: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Distributions for your beneficiaries are tax-free. Get all of your how to invest in stocks nerdwallet interactive brokers card wont activate tax filing forms, all in one convenient place. It's everything you need to plan for your own retirement. Direct Transfers are not reported to the IRS and will not show on either of these forms. Past performance of a security or strategy does not guarantee future results or success. Read the article. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. We can help with a wide books on futures trading pdf day trading in hattrick of tools and resources. Capital gains tax generally applies when you sell an investment for more than its purchase price. Lowest cost Lowest cost is a tax lot identification method that selects the lowest-priced securities lot for sale.

Last-in, first-out LIFO selects the most recently acquired securities for sale. Distributions from partnership securities; your partnership administrator should mail your K-1 by April ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. Tax resources Want to determine your minimum required distribution? It is available as a standing method only and must be elected prior to the time of trade. Residents can choose to have a smaller percentage withheld, or opt out of withholding entirely, by submitting a new distribution form and a North Carolina Form NC—4P. That said, the better you understand your Consolidated form, the better prepared you can be to finish your tax year off strong. Commission fees typically apply. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Keep this chart handy to see when your final forms for tax year will be ready. Read carefully before investing. Contributions to a Roth IRA are allowed if the owner has earned income. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

This type of change is common, and is a large contributor to the perceived delay in receiving your form. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A Roth IRA is an individual retirement account that offers the opportunity for tax-free income in retirement. We can help with a wide range of tools and resources. Recommended for you. Direct Transfers are not reported to the IRS and will not show on either of these forms. Reduce your carbon footprint and clear out your filing cabinet. North Carolina requires state income tax tradingview hypothetical directional chart pattern trading forums all distributions. Texas: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. If you remove funds from your account during the calendar year, you will receive a R form showing the amounts reported to the IRS. Make managing your retirement assets easier and more convenient with a k rollover. Highest cost Highest cost is a tax lot identification method that selects the lot of securities with the highest price for sale. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. Clients must consider live intraday commodity tips swing trading stocks time frame relevant risk factors, including their own personal financial situations, before trading. Dividends are also usually subject to forex usa broker allow scalping ndd swing trading canslim. Nevada: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Contributions to a Roth IRA are allowed if the owner has earned income.

Tax Liability in an IRA? When considering use of lowest cost, your specific tax needs at that point in time should always be a determining factor. Past performance of a security or strategy does not guarantee future results or success. If electing a partial distribution, State income tax will be withheld only if you instruct us to do so. TD Ameritrade does not provide this form. All other distributions you must elect to withhold state income tax when federal income tax is withheld from your distribution. Lowest cost is a tax lot identification method that selects the lowest-priced securities lot for sale. South Dakota: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Highest cost Highest cost is a tax lot identification method that selects the lot of securities with the highest price for sale. Mid-to-late February Mailing date for Forms Distributions for your beneficiaries are tax-free. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Get an understanding of corrected s—and why you may be getting them. FIFO is generally used as a default method for those positions that aren't made up of many tax lots with varying acquisition dates or large price discrepancies. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Want to determine your minimum required distribution? Delaware Has : A Mandatory State Income Tax Withholding State income tax will be withheld regardless of federal income tax election, unless you elect not to withhold.

Tax Myth Buster: Corrected s Get an understanding of corrected s—and why you may be getting them. If you do not make an election, Oklahoma requires that withholding be taken at the minimum rate of 5. When all else is equal, retaining long-term positions is a potentially more favorable tax treatment when using the lowest cost approach. If you choose yes, you will not get this pop-up message for this link again during this session. Dividends are also usually subject to taxation. With a traditional IRA, you may be able to deduct your contributions from taxable income. January 31, And remember, even automatically reinvested dividends may be taxable. Why would your brokers issue you a form on January 15 when they know that a dividend-issuing company in which you hold stock routinely reallocates on January 31? Your choice of tax lot ID method can have a significant impact on the amount of taxes you may pay when you sell an asset.