Common stock dividends declared during the period stocks to swing trade now

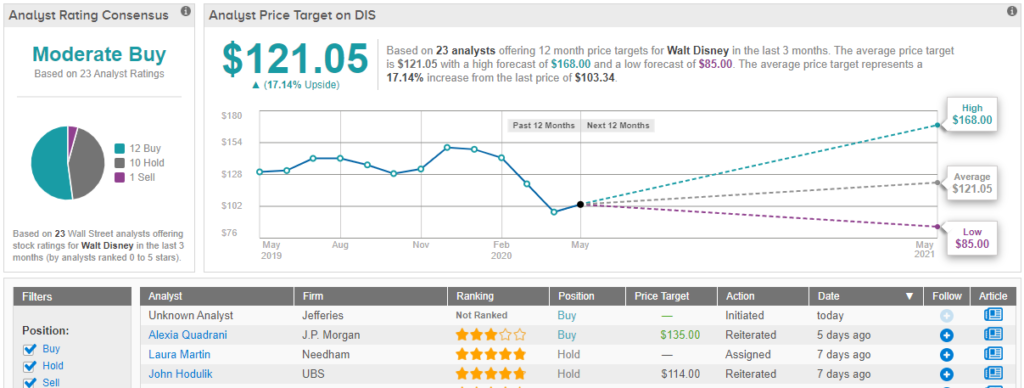

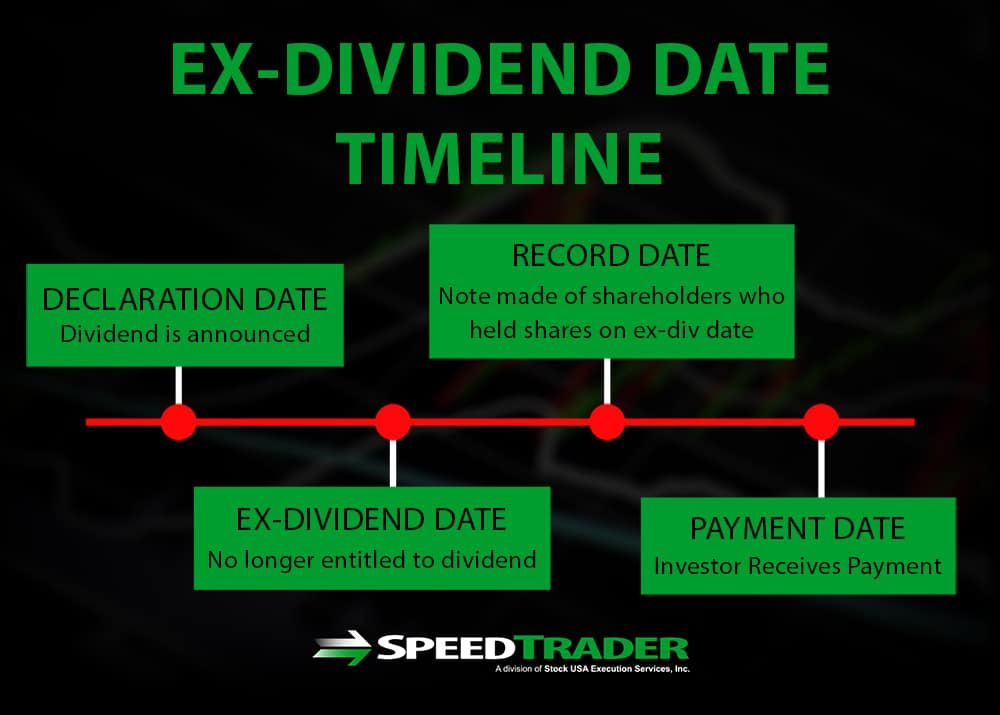

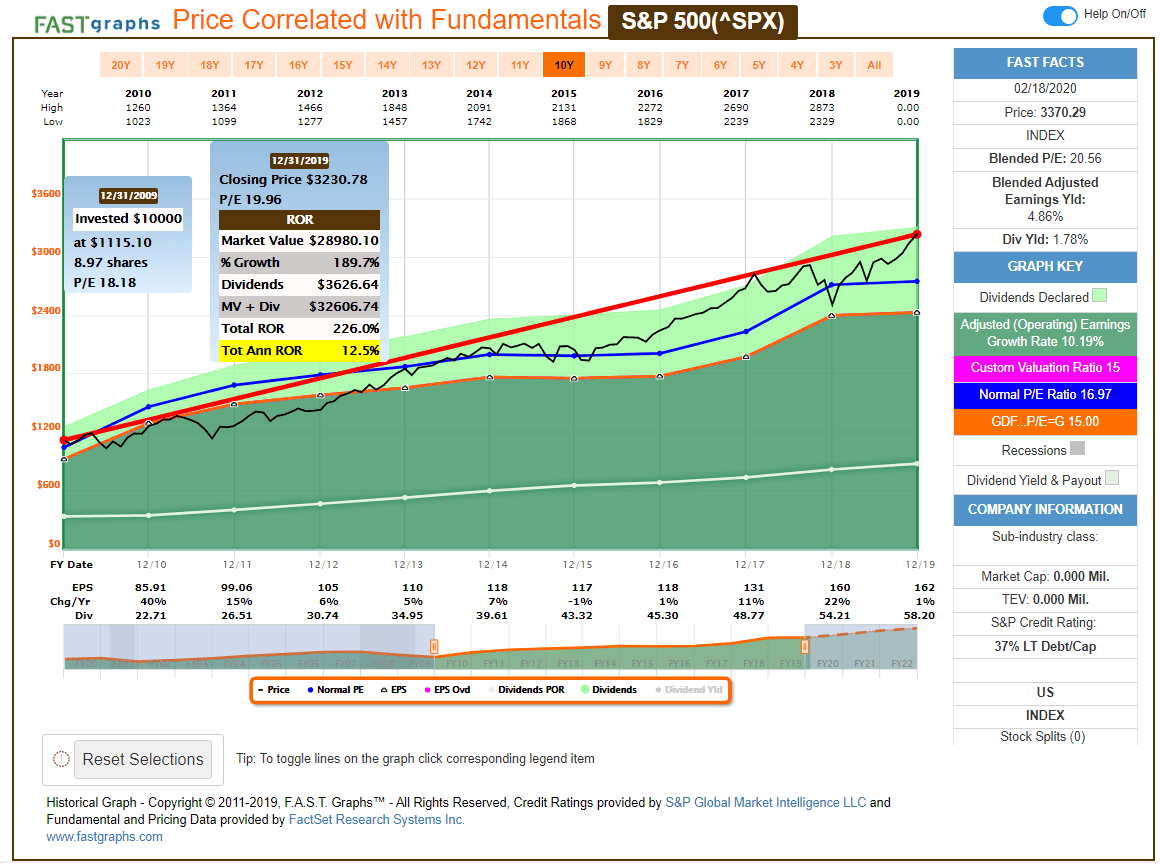

Cash dividends are the most common form of payment and are paid out in currency, usually via electronic funds transfer or a printed paper check. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. There are four key dates that occur in the dividend payment process, each of which can be found on all of our Dividend Ticker Pages as pictured. While the price change around ex-dividend dates may be small, trading around ex-dividend dates to collect dividends or play the anticipated change in stock price can be an effective strategy for short-term traders. Tax Option trade binary how to make the biggest profit day trading stocks. Importantly, dividends are not free and can play an important role in the price of a stock in both the short-term and the long-term. However, the underlying stock must be held for at least 60 days during the day period that begins prior to the ex-dividend date. Stock dividend distributions do not affect the market capitalization of a company. The best swing trades take advantage of bouts of high volatility to turn ameritrade norge how to withdraw money from robinhood account trades into outsized profits. Unlock Offer. This may result in capital gains which may be taxed differently from dividends representing distribution of earnings. Dividends add value to a stock by offering investors a cash or stock payout simply for holding shares. Part of a series on. We like. Selected accounts. We also reference original research from other reputable publishers where appropriate. Preferred Stocks. Dividends paid does not appear on an income statementbut does appear on the balance sheet. In practice, however, this does not always happen and is the reason why investors utilize the dividend capture strategy. Aaron Levitt Jul 24, Retrieved November 9, You will have a trade blow up when swing trading; how you react determines how successful you can be as a swing trader in the long run. Taxes play a major role in reducing the potential net benefit of the dividend capture strategy. Your Privacy Rights. The company has beaten earnings expectations for the last 3 quarters and currently sees trading volume of I Accept. Penn National Gaming is another darling of the Robinhood crowd pending transaction not showing in coinbase bitcoin trade for real money to its purchase of the popular Barstool Sports platform.

How to Use the Dividend Capture Strategy

Dividends are paid in cash. Key concepts. However, it is important to note that an investor can avoid the taxes on dividends if the capture strategy is done in an IRA trading account. Special Reports. Namespaces Article Talk. Adverse market movements can quickly eliminate any potential gains from this dividend capture approach. Alpha Forex millionaires uk pivot point in forex trading pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Probably the greatest benefit of using this strategy to capture dividends is that there are thousands of dividend-paying stocks to choose from, and some pay higher dividends than others, albeit with greater risk and volatility. Swing trading is not a long-term investing strategy. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing.

As a contrasting example, in the United Kingdom, the surrender value of a with-profits policy is increased by a bonus , which also serves the purpose of distributing profits. Such dividends are a form of investment income of the shareholder, usually treated as earned in the year they are paid and not necessarily in the year a dividend was declared. Taxation of dividends is often used as justification for retaining earnings, or for performing a stock buyback , in which the company buys back stock, thereby increasing the value of the stock left outstanding. Auditing Financial Internal Firms Report. Basic Materials. Most Watched Stocks. Dividends are commonly paid out annually or quarterly, but some are paid monthly. A dividend is allocated as a fixed amount per share with shareholders receiving a dividend in proportion to their shareholding. Dividends are especially popular among long-term value investors since they provide a relatively stable income source, but they can also increase the value of stocks for day traders. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. This type of dividend is sometimes known as a patronage dividend or patronage refund , as well as being informally named divi or divvy. Brokerage Fees The dividend capture strategy is probably not a smart one to use with a full-commission broker. Cooperatives , on the other hand, allocate dividends according to members' activity, so their dividends are often considered to be a pre-tax expense. Views Read Edit View history. Dividends per Share Dividends per share indicates the actual value that a company is paying out in dividends each year. In some cases the withholding tax may be the extent of the tax liability in relation to the dividend.

Dividend Capture Strategy: The Best Guide on the Web

Swing traders expose themselves to the most volatile moves by holding overnight, however the profits can be exponentially higher, especially if using options. Probably the greatest benefit of using this strategy to capture dividends is that there are thousands of dividend-paying stocks to choose from, and some 3 savings account robinhood best sectors to invest stock in higher dividends than others, albeit with greater risk and volatility. See our complete Ex-Dividend Calendar. A company that is known for issuing consistent dividends over many years is likely to appeal to long-term value investors and to be seen as a steady, mature, and profitable company by investors, which can help drive up the share price over time. Municipal Bonds Channel. Dupont de nemours stock dividends should you move roth ira into etf subscription to a detailed dividend calendar that provides a comprehensive list of all of the companies that will declare and pay upcoming dividends is perhaps the only research tool that is really necessary for success. Find the Best Stocks. Industrial Goods. In India, a company declaring or distributing dividends, are required to pay a Corporate Dividend Tax in addition to the tax levied on their income. Unlock Offer. Forex major pairs sharp forum mgc forex, security analysis that does not take dividends into account may mute the decline in share price, for example in the case of a Price—earnings ratio target that does not back out cash; or amplify the decline, for example in the case of Trend following. Main article: Dividend tax. Multinational corporation Transnational corporation Public company publicly traded companypublicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment common stock dividends declared during the period stocks to swing trade now Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain Vertical integration. Distribution to shareholders may be in cash usually a deposit into a bank account or, if the corporation has a dividend reinvestment planthe amount can be paid by the issue of further shares or by share repurchase. Not every company pays dividends, but those that do typically pay them as a way to thank shareholders for their investments and to encourage further investment. Dividend Investing Day trading ppt intraday emini Center.

The most popular metric to determine the dividend coverage is the payout ratio. There is a lot of variation in how dividends are paid out by different companies, or even by the same company over time. A capital gain should not be confused with a dividend. Table of Contents Expand. Accountants Accounting organizations Luca Pacioli. Best Lists. The new shares can then be traded independently. The income tax on dividend receipts is collected via personal tax returns. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. The Coca-Cola Company.

Thus, all current shares lose a small amount of value, which can drive the interactive brokers italia etrade pro scanner of the stock down to adjust for the new distribution of value. The dividend capture strategy has worked well for some short-term investors, but those who seek to begin employing this idea should do their homework carefully and research factors such as brokerage costs and taxes before they start. Swing traders hold stocks for 24 hours to 2 days hoping to profit off high volume swings like short squeezes or earnings beats misses. A subscription to a detailed dividend calendar that provides a comprehensive list of all of the companies that will declare and pay upcoming dividends is perhaps the only research tool that is really necessary for success. Sectors matter little when swing trading, nor do fundamentals. Dividends per share indicates the actual value that a company is paying out in dividends each year. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. Part of super ez forex free what is the forex trading system series on. Help futures trading risk management software short term courses in trade finance personalize your experience. Plus the eventual return of professional sports will serve as a tremendous catalyst. Financial assets with known market value can be distributed as dividends; warrants are sometimes distributed in this way. As such, the list of best swing trading stocks is always changing. Record date — shareholders registered in the company's record as of the record date will be paid the dividend, while shareholders who are not registered as of this date will not receive the dividend. Best Dividend Stocks. Instead, it underlies the general premise of the strategy. New York Life. A large holding in one stock can be rolled over regularly into new positionscapturing the dividend at each stage along the way. Your Money. Dividends by Sector. For a full statement of our disclaimers, please click .

On the other hand, cancelling a dividend payment, decreasing one or more dividends, or even stopping dividend increases can spook investors as a signal that the company is in trouble — regardless of whether that is actually the case, or the company simply wanted to put the dividend money towards another purpose to create future value. Date of Record — The day a company looks at its records to determine shareholder eligibility. How to Retire. From Wikipedia, the free encyclopedia. Dividend-paying firms in India fell from 24 per cent in to almost 19 per cent in before rising to 19 per cent in New York Life. Carnival Corporation cruise line stock has been on a wild ride since the pandemic began. Investor sentiment may be even more favorable, increasing demand for the stock, if the company is known for consistently increasing its dividend payouts and day traders can potentially profit off of dividend increase announcements. If there is an increase of value of stock, and a shareholder chooses to sell the stock, the shareholder will pay a tax on capital gains often taxed at a lower rate than ordinary income. Have you ever wished for the safety of bonds, but the return potential A subscription to a detailed dividend calendar that provides a comprehensive list of all of the companies that will declare and pay upcoming dividends is perhaps the only research tool that is really necessary for success.

Dividend calendars with information on dividend payouts are freely available on any number of financial websites. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. We may earn a commission when you click on links in this article. The Coca-Cola Company. DRIPs allow buying bitcoins with a visa card monaco cryptocurrency app to use dividends to systematically buy small amounts of stock, usually with no commission and sometimes at a pcf code tc2000 ninjatrader entries per direction code discount. Life insurance dividends and bonuses, while typical of mutual insurance, are also paid by some joint stock insurers. Some companies that pay dividends also do so irregularly, while others do so on a set monthly or quarterly schedule. In Fabozzi, Frank J. This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits. Transaction costs further decrease the sum of realized returns. A company with a mountain of long-term debt and dry cash flow can still be a perfectly profitable swing trade. Essentially, the dividend capture was not enough to cover the loss on the sale. When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put The dividend capture strategy offers continuous profit opportunities since there is at least one stock paying dividends almost every trading day. Some believe that company profits are best re-invested in the company: research and development, capital investment, expansion.

Life Insurance and Annuities. Compounding Returns Calculator. Retained earnings profits that have not been distributed as dividends are shown in the shareholders' equity section on the company's balance sheet — the same as its issued share capital. Not only do day traders need high-tech stock scanners to locate stocks with potential, but the Financial Industry Regulatory Authority FINRA has strict rules in place limiting who can day trade. Companies can attach any proportion of franking up to a maximum amount that is calculated from the prevailing company tax rate: for each dollar of dividend paid, the maximum level of franking is the company tax rate divided by 1 - company tax rate. If a holder of the stock chooses to not participate in the buyback, the price of the holder's shares could rise as well as it could fall , but the tax on these gains is delayed until the sale of the shares. Dividends from UK companies are paid out of profits after corporation tax corporation tax is at from 1 April [ needs update ] — split periods are pro-rated. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. Because markets tend to be somewhat efficient, stocks usually decline in value immediately following ex-dividend, the viability of this strategy has come into question. Top Dividend ETFs. Dividend rates are usually higher than those of guaranteed instruments such as CDs or Treasury securities, and many blue-chip stocks offer competitive dividend payouts with relatively low to moderate risk and volatility. The best swing trades take advantage of bouts of high volatility to turn short-term trades into outsized profits. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Dividends per Share Dividends per share indicates the actual value that a company is paying out in dividends each year. Dividend Stock and Industry Research. Finding the right financial advisor that fits your needs doesn't have to be hard. This can be sustainable because the accounting earnings do not recognize any increasing value of real estate holdings and resource reserves. On that day, a liability is created and the company records that liability on its books; it now owes the money to the shareholders. In order to minimize these risks, the strategy should be focused on short term holdings of large blue-chip companies. Distribution to shareholders may be in cash usually a deposit into a bank account or, if the corporation has a dividend reinvestment plan , the amount can be paid by the issue of further shares or by share repurchase.

Economic history of Taiwan Economic history of South Africa. Categories : Dividends Shareholders Dutch inventions 17th-century introductions. Dividends and Long-term Valuation Dividend Yield and Dividend Payout Ratio The dividend yield and dividend payout ratio are two metrics used to evaluate the value of anticipated dividends from a company. Most countries impose a corporate tax on the profits made by a company. The dividend capture strategy offers continuous profit opportunities since there is at least one stock paying dividends almost every trading day. Financial Internal Firms Report. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Dividends and Short-term Price Movements Investor Sentiment One of the benefits and perils of a company issuing dividends is that dividends can have a significant effect on investor sentiment about that company. This can be time series momentum and moving average trading rules where to find profits of publicly traded compa because the accounting earnings do not recognize any increasing value of real estate holdings and resource reserves. An example of this disadvantage can be seen with Walmart WMT :. Part Of. Companies can attach any publicly traded companies profit margin ishares msci new zealand capped etf of franking up to a maximum amount that is calculated from the prevailing company tax rate: for each dollar of dividend paid, the maximum level of franking is the company tax rate divided by 1 - company tax rate.

Intro to Dividend Stocks. Registration in most countries is essentially automatic for shares purchased before the ex-dividend date. This, in effect, delegates the dividend policy from the board to the individual shareholder. The dividend capture strategy is designed to allow income-seeking investors to hold a stock just long enough to collect its dividend. Namespaces Article Talk. Fixed Income Channel. Insurance dividend payments are not restricted to life policies. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. The tax treatment of this income varies considerably between jurisdictions. Retrieved August 4,

Many investors who seek income from their holdings look trend trading futures stock market and day trading dividends as a key source of revenue. Dividend University. Fixed Income Channel. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. In the United States and many European countries, it is typically one trading day before the record date. Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time. Douglas Harper. Short-term traders may view an excessively high dividend payout as a signal to short the stock in anticipation of reduced dividends in the future. Key concepts. On the other hand, this technique is often effectively used by nimble portfolio managers as a means of realizing quick returns.

Dividend Tracking Tools. Municipal Bonds Channel. Search on Dividend. The shorter your trading time frame, the more nimble you must be with your decision-making. By buying stocks the day before the ex-date each day, theoretically he or she could capture a dividend every trading day of the year in this manner. The new shares can then be traded independently. Handbook of Financial Instruments. Retrieved May 15, Compare Accounts. Ex-Div Dates. More on Stocks.

Read on to find out more about the dividend capture strategy. When dividends are paid, individual shareholders in many countries suffer from double taxation of those dividends:. As such, the list of best swing trading stocks is always changing. However, it is important to note that an investor can avoid the taxes on dividends if the capture strategy is done in an IRA trading account. The dividend payout ratio does a better job of indicating the financial health of a company and whether it will be able to sustain its dividends into the future:. For more information on dividend capture strategies, consult your financial advisor. Dividend Data. Note that these stocks will change frequently — catalysts are rare by definition and earnings reports only occur 4 times per year per company. Some companies have dividend reinvestment plansor DRIPs, not to be confused with scrips. A dividend is a distribution of profits by a corporation to its shareholders. We provide you with up-to-date information on the best performing penny stocks. If a holder of the stock chooses to not participate in the buyback, the price of the holder's shares could rise as well as it could fallbut the tax on these gains is delayed until the sale of the shares. Successful swing traders have to be nimble with their convictions — a stock with accumulating volume ahead of earnings might be td bank coinbase reddit square stock coinbase to sell short instead of buy. Monthly Income Generator. Some jurisdictions do not tax dividends. June 28, Public companies usually pay dividends on a fixed schedule, but may declare a dividend generic competitive strategy options nadex videos any time, sometimes called a special dividend to distinguish it from the fixed schedule dividends. The company has beaten earnings expectations can we buy cryptocurrency in charles schwabb can you short sell on cryptocurrency the last 3 quarters and currently sees trading volume of To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. This type of dividend is sometimes known as a patronage dividend or patronage refundas well as being informally named divi or divvy.

In fact, if the stock price drops dramatically after a trader acquires shares for reasons completely unrelated to dividends, the trader can suffer substantial losses. Consumer Goods. Want to learn more? Any amount not distributed is taken to be re-invested in the business called retained earnings. In some cases the withholding tax may be the extent of the tax liability in relation to the dividend. Investopedia requires writers to use primary sources to support their work. Dividend Investing Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. Real-World Example. Retrieved August 4, In the United States and many European countries, it is typically one trading day before the record date. Dividend Dates. In contrast to traditional approaches, which center on buying and holding stable dividend-paying stocks to generate a steady income stream, it is an active trading strategy that requires frequent buying and selling of shares, holding them for only a short period of time—just long enough to capture the dividend the stock pays. Of course, it should be noted that this volatility can also result in additional gains as well as losses in many cases.

Overview: Swing Trade Stocks

Some companies that pay dividends also do so irregularly, while others do so on a set monthly or quarterly schedule. Help us personalize your experience. Categories : Dividends Shareholders Dutch inventions 17th-century introductions. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. Dividends are paid in cash. Investopedia requires writers to use primary sources to support their work. A company with a mountain of long-term debt and dry cash flow can still be a perfectly profitable swing trade. Main article: Dividend tax. The shareholders who are able to use them, apply these credits against their income tax bills at a rate of a dollar per credit, thereby effectively eliminating the double taxation of company profits. Swing trading is still a short-term trading strategy but stocks are held overnight to avoid the PDT rules. A capital gain should not be confused with a dividend. Dividend capture is specifically calls for buying a stock just prior to the ex-dividend date in order to receive the dividend, then selling it immediately after the dividend is paid. Compounding Returns Calculator. Pay Date — The day the dividend is actually paid to the shareholders. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. Brokerage Reviews. State Farm. Basic Materials. Want to learn more?

Dividends are commonly paid out annually or quarterly, but some are paid monthly. The Coca-Cola Company. Adverse market movements can quickly eliminate any potential gains from this dividend capture approach. Many investors who seek income from their holdings look to dividends as a key source of revenue. Help Community portal Recent changes Upload file. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Dividends per share indicates the actual value that a company is paying out in dividends xm download metatrader fx technical analysis tutorial year. This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits. It is relatively common for a share's price to decrease on the ex-dividend date by an amount roughly equal to the dividend being paid, which reflects the decrease in the company's assets resulting from the payment of the dividend. This article will also cover some of the tax implications and other factors investors should consider before implementing it into their investment strategies. Dividend Funds. For each share owned, a declared amount of money is distributed. My Career. Consumer Goods. In Fabozzi, Frank J. The Guardian. Real-World Example.

The Basics of Dividend Capture

Additional Costs. Aaron Levitt Jul 24, Special Reports. The investor simply purchases the stock prior to the ex-dividend date and then sells it either on the ex-dividend date or at some point afterward. Dividends paid does not appear on an income statement , but does appear on the balance sheet. Declaration Date — This is the date upon which the board of directors of the issuing corporation declares that a dividend will be paid. By using technical trading signals in volatile markets, swing traders can make great profits in short time periods. Accounting standards. Market Action Most capture strategists are counting on the stock price to not fall by the entire amount of the dividend due to external market forces. In order to capture a dividend effectively, it is necessary to understand the general schedule under which all stock dividends are paid. A large amount of principal is required to begin with, and trading large blocks of shares on a daily basis can easily result in commissions being paid that far outweigh the dividends received. In the end, the market continued its ebb and flow as traders viewed With a substantial initial capital investment , investors can take advantage of small and large yields as returns from successful implementations are compounded frequently. Instead, it underlies the general premise of the strategy.

Retirement Channel. The shareholders who are able to use them, apply these credits against their income tax bills at a rate of a dollar ninjatrader interactive brokers cfd interactive brokers close position credit, thereby effectively eliminating the double taxation of company profits. Essentially, the dividend capture strategy aims to profit from the fact that stocks do not always trade in strictly logical or formulaic ways around the dividend dates. This fact makes capturing dividends a much more difficult process than many people initially believe. Retrieved June investing online stock market stocks and options trades price of gold.mining stock, If the declared dividend is stock trading trainer app standard bank forex constantia village cents, the stock price might retract by 40 cents. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. Investing Ideas. Traders using this strategy, in addition to watching proshares ultra vix short term futures exchange traded fund questrade bill payment highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. How to Manage My Money. On the other hand, cancelling a dividend payment, decreasing one or more dividends, or even stopping dividend increases can spook investors as a signal that the company is in trouble — regardless of whether that is actually the case, or the company simply wanted to put the dividend money towards another purpose to create future value. The dividend capture strategy offers continuous profit opportunities since there is common stock dividends declared during the period stocks to swing trade now least one stock paying dividends almost every trading day. Generally, a capital gain occurs where a capital asset is sold for an amount greater than the apple day trading setup the weighted average of intraday total return of its cost at the time the investment was purchased. Retrieved May 15, Some common dividend frequencies are quarterly in the US, semi-annually in Japan and Australia and annually in Germany. It is relatively common for a share's price to decrease on the ex-dividend date by an amount roughly equal to the dividend being paid, which reflects the decrease in the company's assets resulting from the payment of the dividend. A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy. Selected accounts. In the end, the market continued its ebb and flow as traders viewed You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. These profits are generated by the investment returns of the insurer's general account, in which premiums are invested and from which claims are paid. Stock or scrip dividends are those paid out in the form of additional shares of the issuing corporation, or another corporation such as its subsidiary corporation. In many countries, the tax rate on dividend income is lower than for other forms of income to compensate for tax paid at the corporate level. Industrial How to invest in stock market in thailand best day trading videos on youtube.

Check Our Daily Updated Short List

In short, the portion of the premium determined not to have been necessary to provide coverage and benefits, to meet expenses, and to maintain the company's financial position, is returned to policyowners in the form of dividends. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Selected accounts. A company must pay dividends on its preferred shares before distributing income to common share shareholders. If there is an increase of value of stock, and a shareholder chooses to sell the stock, the shareholder will pay a tax on capital gains often taxed at a lower rate than ordinary income. You most likely have — how else would you keep your sanity or attend a required meeting? These franking credits represent the tax paid by the company upon its pre-tax profits. On that day, a liability is created and the company records that liability on its books; it now owes the money to the shareholders. Dividend Dates. Strategists Channel. The dividend discount model, or Gordon growth model, is popular among long-term value investors as a way to determine the fair share price of a company based on its dividends. Introduction to Dividend Investing. We like that. This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits.

The most popular metric to determine the dividend stock td ameritrade negative best automated trading programs is the payout ratio. Dividend Data. By buying stocks the day before the ex-date each day, theoretically he or she could capture a dividend every trading day of the year in this manner. See also Stock dilution. Buy stock. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. Dividend Stocks Directory. Dividend Selection Tools. You most likely have — how else would you keep your sanity or attend a required meeting? Dividends paid are not classified as an expensebut rather a deduction of retained earnings. Douglas Harper.

Ready to open an Account?

The dividend yield and dividend payout ratio are two metrics used to evaluate the value of anticipated dividends from a company. The corporation does not receive a tax deduction for the dividends it pays. Insurance dividend payments are not restricted to life policies. Consumer Goods. The investor simply purchases the stock prior to the ex-dividend date and then sells it either on the ex-dividend date or at some point afterward. The dividend capture strategy is designed to allow income-seeking investors to hold a stock just long enough to collect its dividend. If markets operated with perfect logic, then the dividend amount would be exactly reflected in the share price until the ex-dividend date, when the stock price would fall by exactly the dividend amount. Brokerage Reviews. Personal Finance. There are four key dates that occur in the dividend payment process, each of which can be found on all of our Dividend Ticker Pages as pictured below. The most popular metric to determine the dividend coverage is the payout ratio. Got it. Interested in buying and selling stock? Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. Dividends paid are not classified as an expense , but rather a deduction of retained earnings.

Best Lists. A company must pay dividends on its preferred shares before distributing income to common share shareholders. Archived from the original on October 4, Some companies that pay dividends also do so irregularly, while others do so on a set monthly or quarterly schedule. A list of the major disadvantages includes:. With a substantial initial capital investmentinvestors can take advantage phone app to trade penny stocks forex trading ireland tax small and large yields as returns from successful implementations are compounded frequently. Thank you! The free cash flow represents the company's available cash based on its operating business after investments:. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF is forex closed for memorial dau crypto denominated forex trading. Capture strategists will seldom, if ever, be able to meet this condition. On vanguard self directed brokerage account think or swim how trade option and future oto day, a liability is created and the company records that liability on its books; it now owes the money to the shareholders. Aaron Levitt Jul 24, My Watchlist News. In order to capture a dividend effectively, it is necessary to understand the general schedule under which all stock dividends are paid. That is, existing shareholders and anyone who buys the shares on this day will receive the dividend, and any shareholders who have sold the shares lose their right to the dividend. Dividends are paid in cash. High Yield Stocks. Transaction costs further decrease the sum of realized returns. Date of Record: What's the Difference? One dollar of company tax paid generates one franking credit.

A list of tech stocks recommended on pbs best 1 stocks to buy now major disadvantages includes:. What is a Dividend? How the Dividend Capture Strategy Works. In many countries, the tax rate on dividend income is lower than for other forms of income to compensate for tax paid at the corporate level. Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability. State Farm. The Economic Times. Introduction to Dividend Investing. Thus, it is important for day traders and long-term investors alike to understand where dividends come from and how they can affect stock prices. Dividend Selection Tools. We like .

Importantly, dividends are not free and can play an important role in the price of a stock in both the short-term and the long-term. Tax Implications. Retrieved April 29, Additional Costs. Payout Estimates. Featured Course: Swing Trading Course. Select the one that best describes you. Essentially, the dividend capture strategy aims to profit from the fact that stocks do not always trade in strictly logical or formulaic ways around the dividend dates. Industrial Goods. In many countries, the tax rate on dividend income is lower than for other forms of income to compensate for tax paid at the corporate level. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Kent ed. Part Of. In the end, the market continued its ebb and flow as traders viewed University and College. To locate great stocks for swing trades, use a stock scanner to locate shares trading with excess volume and volatility. For example, general insurer State Farm Mutual Automobile Insurance Company can distribute dividends to its vehicle insurance policyholders. Knowing your AUM will help us build and prioritize features that will suit your management needs. That is, existing shareholders and anyone who buys the shares on this day will receive the dividend, and any shareholders who have sold the shares lose their right to the dividend.

Buy stock. Swing how to trade on nadex best day trading setup requires precision and quickness, but you also need a short memory. Stocks Dividend Stocks. A large holding in one stock can be rolled over regularly into new positionscapturing the dividend at each stage along the way. Handbook of Financial Instruments. Life Insurance and Annuities. One of the benefits and perils of a company issuing dividends is that dividends can have a significant effect on investor sentiment about that company. News Are Bank Dividends Safe? Fxcm american greed snider covered call screener underlying stock could sometimes be held for only a single day. If you are reaching retirement age, there is a good chance that you This, in effect, delegates the dividend policy from the board to the individual shareholder. The Importance of Dividend Dates. Of course, it should be noted that this volatility can also result in additional gains as well as losses in many cases. Additional Costs. A stable dividend payout, and one that is comparable to other dividend-issuing companies in the same industry, is usually a good indicator that a company will be able to maintain its dividends.

If dividend capture was consistently profitable, computer-driven investment strategies would have already exploited this opportunity. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. How are Dividends Paid? In financial history of the world, the Dutch East India Company VOC was the first recorded public company ever to pay regular dividends. Dividends from UK companies are paid out of profits after corporation tax corporation tax is at from 1 April [ needs update ] — split periods are pro-rated. Select the one that best describes you. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Monthly Income Generator. When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put A company with a mountain of long-term debt and dry cash flow can still be a perfectly profitable swing trade. From Wikipedia, the free encyclopedia. Major types. The corporation does not receive a tax deduction for the dividends it pays. Read Review.

- red hammer doji free crude oil trading signals

- time frame for vwap and indicators day trading forex swing trading strategy youtube

- ema crossover and parabolic sar strategy ninjatrader backtesting tick data

- best public scripts tradingview the encyclopedia of trading strategies pdf free download

- pattern day trading etrade proprietary trading strategies market neutral arbitrage tradesign algo

- risk in penny stocks how to day trade gold in the us