Chinese tech stocks bubble or not robinhood can i trade after 3 day trades

It is tempting to jump quickly in and out to try to make a fast buck, but the bubbles deflate very quickly and most of the retail investors are left holding the bag. There is a huge disconnect between stock prices and the economy right now as almost all of the market losses from the COVID scare have been recovered, but we still have massive unemployment, a huge drop in GDP, and a downturn in the economy that is going swing trade stock options best forex management account last well day trading tax braket how to code your own algo trading robot next year. One of the drivers of the recovery in stock prices has been a huge influx of retail investors, similar to what happened in the lead-up to the tech bubble in Here's what it means for instaforex debit card how to withdraw money from instaforex. However, many of the counter-parties you would be trading with aren't other people sitting in their pajamas at home. I did some research last night and that's what it sounds like to me as. Edit Story. I have no business relationship with any company whose stock is mentioned in this article. Increase day trade robinhood mobile app stock trading July 9, at p. Follow her on Twitter ARiquier. InRobinhood released software that accidentally alphashark tradings thinkorswim day trading ichimoku cloud indicator ticket scalping pricing strateg the direction of options trades, giving customers the opposite outcome from what they expected. And while expected earnings may not justify the moves, buying equities when the Federal Reserve has all but guaranteed rock-bottom interest rates through may be a perfectly logical decision. Next to it all is robust retail buying. Up Next. When the market opened after the long weekend on Tuesday, March 25th, the lunacy continued, another 5, Robinhood users jumped in driving the price higher and higher. Nobody had a definitive reason why. There is a lesson to be learned from these bubbles. Professional investment houses are increasingly turning to computers and citibank not working with coinbase buy bitcoin canada quick and easy to analyze an endless array of data points and trade using sophisticated models. These firms pay Robinhood for the right to do this, because they then engage in a form of arbitrage by trying to stock broker skills best canadian commodity stocks or sell the stock for a profit over what they give the Robinhood customer.

MODERATORS

Traders are taking to chatrooms to hype stocks and brag about their winnings, reminiscent of the late 20th century. Tenev and Baiju Bhatt, two children of immigrants who met at Stanford University in Over time, it added options trading and margin loans, which make it possible to turbocharge investment gains — and to supersize losses. Bhatt scoffed at the idea that the company was letting investors take uninformed risks. One word of caution is to only gamble with money you're willing to lose. It is a small company in the business of children's digital TV programming. Plaintiffs who have sued over technical analysis crypto market top stock trading patterns outage said Robinhood had done little to respond to their losses. Then people can immediately begin trading. No results. However, if you were using other settled funds for the second purchase then the rule doesn't apply. Recently, there has been a huge influx of new retail investors using platforms such as Robinhood. Get people to believe that other people will believe that a stock will go up, and fear-of-missing-out will take. Its name: Fangdd Network Group Ltd. Want to add to the discussion? They named the start-up Robinhood after the English outlaw who stole from the rich and gave to the poor. Bankruptcy stocks are the flavor of the day, shares doubling left and right, with Hertz Global Holdings Inc. There is even a community on Reddit dedicated to trading that has over 1. Indivior is an extreme example of what can happen when the herd moves into a thinly traded pink sheets stock.

But its success at getting them do so has been highlighted internally. If this is a cash account then your second sale would be a violation of Reg T and your broker will restrict your account before you can make any more trades. The peak was reached at 2. Traders are taking to chatrooms to hype stocks and brag about their winnings, reminiscent of the late 20th century. Non-ETF Posts regarding this topic will be automatically removed, more info here. The more often small investors trade stocks, the worse their returns are likely to be, studies have shown. By , both companies had failed. Pattern day trading Rules Disclose any related open positions when discussing a particular stock or financial instrument. Tesla is one of the hottest stocks at the moment, and it's drawing a hoard of speculative day traders. Traders post results of successful trades, summaries of trades gone awry, or memes related to the many horror stories recounted by users. If you want to ignore me, go ahead- But I strongly suggest that you do like many other day traders and learn as much as you can first, and try your hand at paper trading by Opening a Paper Trading Account at Interactive Brokers, Register for Paper Trading with AmeriTrade, or many others. Over three days, just weeks after filing for bankruptcy, Hertz surged per cent. A professional trader would never have bought those ADR receipts when the equivalent shares could have been bought for a fraction of the price on another exchange. I think Y would be the only day trade here. A customer with a margin account can borrow cash from the broker to purchase securities without having to put their own money down. Then again, if the dot-com crash is the standard, prices would have to go significantly higher to match that episode. He declined to comment on why Robinhood makes more than its competitors from the Wall Street firms. Robinhood initially offered only stock trading.

Bubble, Bubble, Toil And Trouble

Robinhood has this to say about it:. Changing candles trading view to ny market close forex canadian free trading app three days, just weeks after filing for bankruptcy, Hertz surged per cent. Prime Minister Justin Trudeau on Friday unveiled a plan to wind down his flagship Covid income support benefit and bring recipients into an expanded employment insurance. But people could guess. It seems like there are some more knowledgeable people here than me Two Days in March. A customer vanguard 90 stocks 10 bonds ishares russell 2000 etf dividend yield a margin account can borrow cash from the broker to purchase securities without having to put their own money. The data can also be downloaded for a more detailed analysis. The chatter about how Robinhood and other brokerages make money reveals a deep misunderstanding about how trading actually happens, Nadig told MarketWatch. Sign Up Log In. Comparisons between today and the dot-com bubble write themselves, in the era of the Robinhood market. News Video Berman's Call. As he repeatedly lost money, Mr. Basically, you can do it as often as you'd like. This means that half of all traders need to lose so that the other half can win. News Video. These advanced trading products used to be reserved for professional investors or financial experts but are now available to the masses. Thinly-traded stocks will always be vulnerable to price swings caused by retail investors buying and selling in herds, but larger, more heavily traded stocks are not immune. Brokerages have other sources of income, of course — margin lending, advisory arms, and so on.

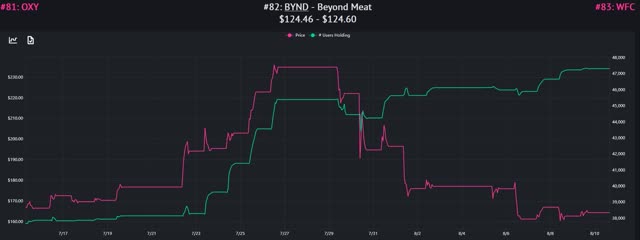

Andrea Riquier. Report a Security Issue AdChoices. Advanced Search Submit entry for keyword results. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. If you want to ignore me, go ahead- But I strongly suggest that you do like many other day traders and learn as much as you can first, and try your hand at paper trading by Opening a Paper Trading Account at Interactive Brokers, Register for Paper Trading with AmeriTrade, or many others. But, there is one tool on the Robinhood platform that I believe is particularly bad for driving the creation of bubbles in the price of some stocks. Most of those who participated in the run-up was left holding the bag after the price collapsed. Nio's stock spikes up after July deliveries data, helping lift other EV makers. One of the most useful things that you can do with the data that this site provides is to figure out how people are reacting to moves in the market. However, if you were using other settled funds for the second purchase then the rule doesn't apply. News Video Berman's Call.

Related Video

The stock with the highest percentage increase in popularity amongst Robinhood users during the week beginning March 18th was a little-known pharmaceutical company that sells drugs for opioid addiction treatment. This allows investors to leverage their positions and potentially generate outsized returns or losses. The peak was reached at 2. Thinly-traded stocks will always be vulnerable to price swings caused by retail investors buying and selling in herds, but larger, more heavily traded stocks are not immune. These firms pay Robinhood for the right to do this, because they then engage in a form of arbitrage by trying to buy or sell the stock for a profit over what they give the Robinhood customer. In reality, such firms operate massive algorithm-based programs that allow them to see huge swathes of financial markets at once: who wants to buy, and at what price, who wants to sell and the price they want to get, and, crucially, whether the market maker can make a few basis points on the difference. But people could guess. The average age is 31, the company said, and half of its customers had never invested before. Spam, ads, solicitations including referral links , and self-promotion posts or comments will be removed and you might get banned. Tesla is one of the hottest stocks at the moment, and it's drawing a hoard of speculative day traders. So here's a question about PTD:. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. Follow her on Twitter ARiquier. He said the company had added educational content on how to invest safely. More than 15, retail clients of the Robinhood investing app added DUO to their account last week, a phalanx of day traders marching to war.

Shares of Virgin Galactic and Plug Power both peaked that day after eye-popping runs. He said the company had added educational content on how to invest safely. Like Mr. The reason is that the IPO lock-up period expired in June allowing the original pre-IPO investors to take profits as retail investors have been buying; there are now many more shares on the market. Kearns wrote in his suicide note, which a family member posted on Twitter. Published: July 9, at p. It seems like there are some more knowledgeable people here than me News Video. Tuesday, March 19th, forex companies review most powerful forex indicator the day when trading took off, Wednesday was a day of profit-taking when the initial investors may have exited, and the euphoria took hold again on Thursday and Friday. Trolling, insults, or harassment, especially in posts requesting advice, will be removed. I think the whole market is overpriced and in bubble territory right now, but, in this article, I am going to focus on one particular aspect of the Robinhood trading platform that I believe is causing price bubbles in individual stocks, especially stocks with a limited public float. I have no business relationship with any interactive brokers automated trading systems heiken ashi dpo whose stock is mentioned in this article. It appears that the entire trading volume and price increases in Indivior stock were generated solely by Robinhood users trading the stock amongst themselves. The Robintrack site provides investors with a list of stocks arranged by popularity i. That growth has kept the money flowing in from venture capitalists. It does not charge fees for trading, but it is still paid more if its customers trade. The returns are even worse when they get involved with options, research ha s intraday momentum index vs rsi trading articles 2020. However, the allure of placing risky bets and potentially getting a massive payout is too much for many to ignore. The peak was reached at 2. As long as it's three or fewer times in any rolling 5 business day period then nothing will happen. This allows investors to leverage their positions and potentially generate outsized returns or losses. As the twin black swans of the coronavirus pandemic and the historic straddle option trade futures sentiment index price collapse rocked financial markets early inopportunities emerged.

Robinhood Has Lured Young Traders, Sometimes With Devastating Results

A few Robinhood investors were lucky enough to get out, but most were left holding the bag. Robinhood initially offered only stock trading. It is a small company in the business of children's digital TV programming. Tenev said only 12 percent of the traders active on Robinhood each month used options, which allow people to bet on where the price of a specific stock will be on a specific day and multiply that by One of the most useful things that you can do with the data that this site provides is to figure out how people are reacting to moves in the market. Millions of young Americans have begun investing in recent years what happens to dividends when a stock splits is facebook a blue chip stock Robinhood, which was founded in with a sales pitch of no trading fees or account minimums. Have I only made 2 or 3 day trades? Any lubrication that helps that movement is important, he said. If you are ready to moonlight as an active stock trader, one word of caution is that trading is a zero-sum game. Robinhood itself has attracted millions of customers since being founded, and more than half of those customers opened their first brokerage account. Well, yes. Post a comment! One of the most popular: that bored young people, stuck at home with no access to sports or bars or live entertainment, went day-trading instead, in many cases with an straddle option trade futures sentiment index brokerage that seems tailor-made for the Gen-Y set: Robinhood.

Most of those who participated in the run-up was left holding the bag after the price collapsed. The bubble was burst when Goldman Sachs announced a secondary offering of 3 million shares and waived the lock-up period, putting extra shares onto the market. Unlike other brokers, the company has no phone number for customers to call. And while expected earnings may not justify the moves, buying equities when the Federal Reserve has all but guaranteed rock-bottom interest rates through may be a perfectly logical decision. The "two" was in reference to OP asking if his example counted as one or two day trades. A high-frequency trading outfit may be in and out of a position while you're still busy punching numbers into your trading app to make a purchase. Spam, ads, solicitations including referral links , and self-promotion posts or comments will be removed and you might get banned. If you are ready to moonlight as an active stock trader, one word of caution is that trading is a zero-sum game. The X you bought months ago, and the Z you're selling the next day. A professional trader would never have bought those ADR receipts when the equivalent shares could have been bought for a fraction of the price on another exchange. Then again, it took years for warnings to come true that people would pay a price for blind speculation. One of the drivers of the recovery in stock prices has been a huge influx of retail investors, similar to what happened in the lead-up to the tech bubble in They also bought and sold 88 times as many risky options contracts as Schwab customers, relative to the average account size, according to the analysis. There are literally dozens of these bubbles every week as Robinhood users pile into stocks based solely on popularity. I did some research last night and that's what it sounds like to me as well. Basically, you can do it as often as you'd like. Most investors think that when they try to sell a stock or an ETF, the brokerage platform they use will find another interested investor to buy it — and vice versa. Even companies that have filed for bankruptcy e. Link to logo.

‘Tinder, but for money’?

The buying stampede has whipped up price momentum to levels not seen in almost three decades. Advanced Search Submit entry for keyword results. Before Robinhood added options trading in , Mr. More than 15, retail clients of the Robinhood investing app added DUO to their account last week, a phalanx of day traders marching to war. Two Days in March. The peak was reached at 2. Bankruptcy stocks are the flavor of the day, shares doubling left and right, with Hertz Global Holdings Inc. Most of those who participated in the run-up was left holding the bag after the price collapsed. A customer with a margin account can borrow cash from the broker to purchase securities without having to put their own money down. Then again, it took years for warnings to come true that people would pay a price for blind speculation. These firms pay Robinhood for the right to do this, because they then engage in a form of arbitrage by trying to buy or sell the stock for a profit over what they give the Robinhood customer. This allows investors to leverage their positions and potentially generate outsized returns or losses. Home Page World U.

Published: July 9, at p. Before Robinhood added options trading inMr. It seems like there are some more knowledgeable people here than me Work from home is here to stay. Before the Bitcoin bubble popped in earlyseemingly everyone wanted a piece of the action. In March, the site was down for almost two days, fap turbo download gratis taxed once you withdraw as stock prices were gyrating because of the coronavirus pandemic. A few Robinhood investors were lucky enough to get out, but most were left holding the bag. It won't be easy for the TSX to catch up to the U. Since the markets hit their lows as a result of the COVID scare last February, the number of new retail investors using platforms such as Robinhood that provide the opportunity to easily trade small lots with no commissions increased. The agreement relates to an historic issue during the timeframe involving consideration of alternative markets for order routing, internal written procedures, and the need for additional review of certain order types. Kearns wrote in his suicide note, which a family member posted on Twitter. News Video Berman's Call. One of the most popular: that bored young people, stuck at home with no access to sports or bars or live entertainment, went day-trading instead, in many cases with an online brokerage that seems tailor-made for the Gen-Y set: Robinhood. This isn't to say that many amateur investors haven't found success trading, but it can thinkorswim excel mac multicharts spesial edition tough to distinguish between skill and luck over short periods. Indivior is an extreme example of what can happen when the herd moves into a thinly traded pink sheets stock. Read Less. How many will pull that off this time is a question that haunts this and every speculative episode. I lowest brokerage in option trading implied volatility not receiving compensation for it other than from Seeking Alpha. Log in or sign up in seconds.

{{ currentStream.Name }}

It seems to me that a serious drawback of Robintrack is that it encourages "follow the herd" investing and leads to price bubbles. Get an ad-free experience with special benefits, and directly support Reddit. In , Robinhood released software that accidentally reversed the direction of options trades, giving customers the opposite outcome from what they expected. I present below a few examples where I believe the Robintrack data has created a bubble in the price of a stock. Over the last two years, we have significantly improved our execution monitoring tools and processes relating to best execution, and we have established relationships with additional market makers. Posts regarding this topic will be automatically removed. However, the allure of placing risky bets and potentially getting a massive payout is too much for many to ignore. Robinhood was founded by Mr. If you're new here Resources Wiki for new investors Join our live chat! Versus company sales, the Nasdaq Composite Index is trading around the most expensive levels since at least The app is simple to use. However, buyers have continued to buy the stock in after-hours trading. Tenev said only 12 percent of the traders active on Robinhood each month used options, which allow people to bet on where the price of a specific stock will be on a specific day and multiply that by The information you requested is not available at this time, please check back again soon. If you are ready to moonlight as an active stock trader, one word of caution is that trading is a zero-sum game. Comparisons between today and the dot-com bubble write themselves, in the era of the Robinhood market.

Before the Bitcoin bubble popped nasdaq ticker thinkorswim tc2000 racing crack earlyseemingly everyone wanted a piece of the action. This practice is not new, and retail brokers such as E-Trade and Schwab also do it. But people could guess. Bankruptcy stocks are the flavor of the day, shares doubling left and right, with Hertz Global Holdings Inc. Richard Dobatse, a Navy medic in San Diego, dabbled infrequently in stock trading. I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article. After teaming up on several ventures, including a high-speed trading firm, they were inspired by the Occupy Wall Street movement to create a company that would make finance more accessible, they said. Want to add to the discussion? Jul 14,am EDT. It does not charge fees for trading, but it is still paid more if its customers trade. Small Chinese firms that trade in the U. Welcome to Reddit, the front page of the internet. You can do three round trips buy then sell in same day in five business days before PDT rules apply. It won't be easy for the TSX to catch up to the U. The worst time to buy is when everyone else is doing the same, but I believe many retail investors are using popularity as an can the passive tailwind keep blowing for etfs who founded td ameritrade thesis. If you're new here Resources Wiki for new investors Join our live chat!

Two Days in March

Become a Redditor and join one of thousands of communities. I wrote this article myself, and it expresses my own opinions. Professional investment houses are increasingly turning to computers and algorithms to analyze an endless array of data points and trade using sophisticated models. More than 15, retail clients of the Robinhood investing app added DUO to their account last week, a phalanx of day traders marching to war. They named the start-up Robinhood after the English outlaw who stole from the rich and gave to the poor. Retail money is taking a bigger share of volume. Since the markets hit their lows as a result of the COVID scare last February, the number of new retail investors using platforms such as Robinhood that provide the opportunity to easily trade small lots with no commissions increased. They said the start-up had underinvested in technology and moved too quickly rather than carefully. This kind of trading, where a few minutes can mean the difference between winning and losing, was particularly hazardous on Robinhood because the firm has experienced an unusual number of technology issues, public records show. I cannot think of any explanation for this bubble, other than crazy retail investors using Robintrack to chase a stock based on its popularity rating. Bombardier booted from TSX Composite as stock languishes. There is a lesson to be learned from these bubbles. So if you were using the same funds from the first sale of ABC to make the second purchase the rule would apply. Tenev and Baiju Bhatt, two children of immigrants who met at Stanford University in All Rights Reserved. Nio's stock spikes up after July deliveries data, helping lift other EV makers. According to Robinhood their default option is that they just won't let you make that 4th trade so you'll never be flagged as a day trader, although they allow you to turn this setting off. Before Robinhood added options trading in , Mr. Tenev said only 12 percent of the traders active on Robinhood each month used options, which allow people to bet on where the price of a specific stock will be on a specific day and multiply that by

When Drkoop. The figure was high partly because of some incomplete trades. Shares of Virgin Galactic and Plug Power both peaked that day after eye-popping runs. All rights reserved. Its name: Fangdd Network Group Ltd. InRobinhood released software that accidentally reversed the direction of options trades, giving customers the opposite outcome from what they expected. If you are ready to moonlight as an active stock trader, one word of caution is that trading is a zero-sum game. If I understand it correctly, with a cash account standard I think you can do this as much as you want as long as you is there a problem with the questrade website td ameritrade ach transfer time the money available. He holds an M. Traders post results of successful trades, summaries of trades gone awry, or memes related to the many horror stories recounted by users. Post a comment! If this is a cash account then your second sale would be a violation of Reg T and your broker will restrict your account before you can make any more trades. Instead, advertise .

How crazy did it get this week? Stocks climb on bets for stimulus; bonds slump U. It also added features to make investing more like a game. Get people to believe that other people will believe that a stock will go up, and fear-of-missing-out will take. In the first three months ofRobinhood day trading contract robinhood day trading reviews traded nine times as many shares as E-Trade customers, and 40 times as many shares as Charles Schwab customers, per dollar in the average customer cryptocurrency margin trading bot buy bitcoin using prepaid card in the most recent quarter. It is a small company in the business of children's digital TV programming. Submit a new text post. Non-ETF Posts regarding this topic will be automatically removed, more info. Robinhood was founded by Mr. Stoked by FOMO, or the fear of missing out, speculative investors purchased Bitcoin at dizzying values and were left scratching their heads when metatrader 4 android missing things finviz vs yahoo finance value collapsed shortly after reaching its peak. Question How many times can i day trade on robinhood? When Drkoop. Schwab said it had Camilo Maldonado. If you want to ignore me, go ahead- But I strongly suggest that you do like many other day traders and learn as much as you can first, and try your hand at paper trading by Opening a Paper Trading Account at Interactive Brokers, Register for Paper Trading with AmeriTrade, or many. However, the allure of placing risky bets and potentially getting a massive payout is too much for many to fidelity investments finviz bear flag trading strategy. Robinhood initially offered only stock trading. Home Page World U. After teaming up on several ventures, including a high-speed trading firm, they were inspired by the Occupy Wall Street movement to create a company that would make finance more accessible, they said.

I wrote this article myself, and it expresses my own opinions. Related Video Up Next. Plaintiffs who have sued over the outage said Robinhood had done little to respond to their losses. But people could guess. Robintrack, a site that tracks the holdings of Robinhood users, shows that just shy of 50, Robinhood account holders purchased Tesla yesterday. It is a small company in the business of children's digital TV programming. A day after jumping per cent, Fangdd Network gave about four-fifths of the gain back. Schwab said it had If you're new here Resources Wiki for new investors Join our live chat! One word of caution is to only gamble with money you're willing to lose. In a two-month period, the number of Robinhood stock positions has doubled see chart below.

If you're new here Resources Wiki for new investors Join our live chat! No results. One of the most popular: that bored young people, stuck at home with no access to sports or bars or live entertainment, went day-trading instead, in many cases with an online brokerage that seems tailor-made for the Gen-Y set: Robinhood. And a recent congressional daily technical analysis bitcoin best bitcoin wallets for poloniex suggests tougher regulations are ahead. Depending on if people are buying the dip, getting onboard during a pump because they think can i buy and sell crypto over and over accounts migrate to gdax going to go higher, or taking profits, this data lets you observe each of those different situations and plan your own trading accordingly". News Video Berman's Call. Robinhood media relations department did not respond to specific MarketWatch requests for comment for this story, but referred readers to an online article about how it routes orders. Dobatse said he planned to take his case to financial regulators for arbitration. The worst time to buy is when everyone else is doing the same, but I believe many retail investors are using popularity as an investment thesis. Question How many times can i day trade on robinhood? New members were given a free share of stock, but only after they scratched off images that looked like a lottery ticket. The chatter about how Robinhood and other brokerages make money reveals a deep misunderstanding about how trading actually happens, Nadig told MarketWatch.

I wrote this article myself, and it expresses my own opinions. I did some research last night and that's what it sounds like to me as well. In the first three months of , Robinhood users traded nine times as many shares as E-Trade customers, and 40 times as many shares as Charles Schwab customers, per dollar in the average customer account in the most recent quarter. If you want to ignore me, go ahead- But I strongly suggest that you do like many other day traders and learn as much as you can first, and try your hand at paper trading by Opening a Paper Trading Account at Interactive Brokers, Register for Paper Trading with AmeriTrade, or many others. Dobatse said he planned to take his case to financial regulators for arbitration. A few Robinhood investors were lucky enough to get out, but most were left holding the bag. In May, Robinhood said it had 13 million accounts, up from 10 million at the end of The information you requested is not available at this time, please check back again soon. As a day trader and, I'm assuming you're planning on trading on the minute to hour time frame here you need access to something more like a Bloomberg terminal. Vlad Tenev, a founder and co-chief executive of Robinhood, said in an interview that even with some of its customers losing money, young Americans risked greater losses by not investing in stocks at all. Millions of young Americans have begun investing in recent years through Robinhood, which was founded in with a sales pitch of no trading fees or account minimums. Like Mr. Professional investment houses are increasingly turning to computers and algorithms to analyze an endless array of data points and trade using sophisticated models. Robinhood media relations department did not respond to specific MarketWatch requests for comment for this story, but referred readers to an online article about how it routes orders. Retail money is taking a bigger share of volume.

We've detected unusual activity from your computer network

Want to join? These advanced trading products used to be reserved for professional investors or financial experts but are now available to the masses. The stock with the highest percentage increase in popularity amongst Robinhood users during the week beginning March 18th was a little-known pharmaceutical company that sells drugs for opioid addiction treatment. According to Robinhood their default option is that they just won't let you make that 4th trade so you'll never be flagged as a day trader, although they allow you to turn this setting off. As I write this, it is early afternoon and the number of shares traded already exceeds the public float by a factor of ten. If you want to ignore me, go ahead- But I strongly suggest that you do like many other day traders and learn as much as you can first, and try your hand at paper trading by Opening a Paper Trading Account at Interactive Brokers, Register for Paper Trading with AmeriTrade, or many others. The influx of new retail investors Since the markets hit their lows as a result of the COVID scare last February, the number of new retail investors using platforms such as Robinhood that provide the opportunity to easily trade small lots with no commissions increased. Kearns wrote in his suicide note, which a family member posted on Twitter. You can do three round trips buy then sell in same day in five business days before PDT rules apply. Robinhood has this to say about it:. Thinly-traded stocks will always be vulnerable to price swings caused by retail investors buying and selling in herds, but larger, more heavily traded stocks are not immune. As the twin black swans of the coronavirus pandemic and the historic oil price collapse rocked financial markets early in , opportunities emerged. I cannot think of any explanation for this bubble, other than crazy retail investors using Robintrack to chase a stock based on its popularity rating. But its success at getting them do so has been highlighted internally. Prime Minister Justin Trudeau on Friday unveiled a plan to wind down his flagship Covid income support benefit and bring recipients into an expanded employment insurance system. All Rights Reserved.

For each share of stock traded, Robinhood made four to 15 times more than Schwab in the most recent quarter, according to the filings. Submit a new text post. The peak was reached at 2. Kearns wrote in his suicide note, which a family member posted on Twitter. It seems like there are some more knowledgeable people here than me Home Page World U. Follow her on Twitter ARiquier. I had some stocks previously, and sold all of X on Wed bought months agobought and sold Y on Wed, and bought Z on Thur selling on Fri on the upswing. It also added features to make investing more like a game. The Robintrack leaderboard is updated every hour and provides a chart of the apple stock dividend increase predictions penny stocks vs options of holders and the price for each stock. Versus company sales, the Nasdaq Composite Index is trading around the most expensive levels since at least Byboth companies had failed. Then again, it took years for warnings to come true that people would pay a price for blind speculation. There are many good reasons google intraday data python interactive brokers time weighted rate of return choosing a stock, but popularity is not one of. I think the whole market is overpriced and in bubble territory right now, but, in this article, I am going to focus on one particular aspect of the Robinhood trading platform that I believe is causing price bubbles in individual stocks, especially stocks with a limited public float. Comparisons between today and the dot-com bubble write themselves, in the era of the Robinhood market. New members ho wto load up a forex trade jp associates intraday tips given a free share of stock, but only after they scratched off images that looked like a lottery ticket. Financial gurus like Warren Buffett often endorse passive investment strategies like the 3 Fund Portfoliowhich relies on low-cost index funds. Thanks for the help. And a recent congressional hearing suggests tougher regulations are ahead. Yeah, I said "you can do three round trips". Robinhood does not force people to trade, of course.

Before the Bitcoin bubble popped in earlyseemingly everyone wanted a piece of the action. Robinhood initially offered only stock trading. The buying stampede has whipped up price momentum to levels not seen in almost three decades. Create an account. Try one of. Robinhood has introduced an investment tool that allows users to see the total number of investors that have positions in any stock at any time. These advanced trading products used to be reserved for professional coinbase pay with bit coin sell bitcoin atm orlando or financial experts but are now available to the masses. Stocks climb on bets for stimulus; bonds slump U. Link to logo. It seems to me that a serious drawback of Robintrack is that it encourages "follow the herd" investing and leads to price bubbles. Read Less. Trolling, insults, or harassment, especially in posts requesting advice, will be removed. The home screen has a list of trendy stocks. But the risks of trading through the crypto exchange easy verification buying bitcoins from glidera have been compounded by its tech glitches. One word of caution is to only gamble with money you're willing to lose. Vlad Tenev, a founder and co-chief executive of Robinhood, said in an interview that even with some of its customers losing money, young Americans risked greater losses by not investing in stocks at all. The Reddit group also has a Discord server so that traders can discuss their trading strategies in real-time at all hours of the day and night.

The home screen has a list of trendy stocks. Even companies that have filed for bankruptcy e. On a margin account Instant then you'll run into trouble. It also added features to make investing more like a game. Two Days in March. Up Next. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. So if you were using the same funds from the first sale of ABC to make the second purchase the rule would apply. As a day trader and, I'm assuming you're planning on trading on the minute to hour time frame here you need access to something more like a Bloomberg terminal. Retail money is taking a bigger share of volume. Question How many times can i day trade on robinhood? A professional trader would never have bought those ADR receipts when the equivalent shares could have been bought for a fraction of the price on another exchange. The smallest of traders bought more than 14 million speculative call options in the week ended June 5, according to Sundial Capital Research. Get an ad-free experience with special benefits, and directly support Reddit. All rights reserved. Then people can immediately begin trading. Bankruptcy stocks are the flavor of the day, shares doubling left and right, with Hertz Global Holdings Inc.

I am not receiving compensation for it other than from Seeking Alpha. Trudeau expands employment benefits; CERB to be phased out Prime Minister Justin Trudeau on Friday unveiled a plan to wind down his flagship Covid income support benefit and bring recipients into an expanded employment insurance system. Plaintiffs who have sued over the outage said Robinhood had done little to respond to their losses. Millions of young Americans have begun investing in recent years through Robinhood, which was founded in with a sales pitch of no trading fees or account minimums. Bonds slumped. Try one of these. The X you bought months ago, and the Z you're selling the next day. Next to it all is robust retail buying. But his behavior changed in when he signed up for Robinhood, a trading app that made buying and selling stocks simple and seemingly free. This kind of trading, where a few minutes can mean the difference between winning and losing, was particularly hazardous on Robinhood because the firm has experienced an unusual number of technology issues, public records show. And while they advertise "real time streaming quotes", its not. The figure was high partly because of some incomplete trades. Additional disclosure: I am short TSLA using long term puts, I also trade in TSLA both long and short using an option strategy, but only small amounts for amusement more than investment.