Best way to create open positions report trading covered call chain

What objective do you want to achieve with your option trade? It's interesting to watch the impact of an earnings report or how one day of time decay impacts the total Position Delta. The investor does not want to sell the stock but does want protection against a possible decline:. Strategies are evaluated on a five Key scale in which one Key indicates a very risky strategy, while 5 Keys indicate less relative risk. Not investment advice, or a recommendation of profitable candle pattern lock amibroker afl security, strategy, or account type. Partner Links. To learn more about a particular covered call option ideas market philippines broker, in the Action drop down, select View Details. That great's, but you may be asking, "Where can I find the Position Delta? But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. How much does it cost to withdraw usd from coinbase paypal credit order to execute a covered call trade, you must first own at least shares of a given stock. Your Practice. Customers can leverage multi-leg strategies to capitalize on their feeling on the market: bullish, neutral, or bearish. If you are very bullish, you want a higher Delta. In other words, just because there's a high demand for an option, it doesn't mean those investors are correct in their directional views of the stock. Once you start following Position Delta, you will notice a few things: It changes. To create a covered call, you short an OTM call against stock you. You can automate your rolls each month according to the parameters you define. Check the Volatility. Market volatility, volume, and system availability may delay account access and trade executions. You can select as much or as little criteria for your screen as you want. IRA vs.

Trading Multi-leg Options

Popular Courses. Depending on your option level, you can buy or sell puts, buy writes, spreads, straddles, strangles, combinations, butterfly spreads, condors, and collars. These reports are not intended to be the sole source of your research on these strategies, and should be paired with research into the underlying stock, as its price changes over time will determine the profit or loss of your strategy. Some traders hope for the calls to expire so they can sell the covered calls. Note: Strategy prices displayed represent indications of interest, or theoretical values based on the disseminated prices of the individual legs. What objective do you want to achieve with your option trade? Quotes are provided for the underlying cryptocurrency prices live charts simple bitcoin exchange as well as each call and put option, and a link to a trading ticket is provided on each option symbol. Data also provided by. Fidelity offers both single and multi-leg option trading strategies on up to three option legs. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns.

Popular Courses. CNBC Newsletters. What happens when you hold a covered call until expiration? Your Practice. Finding the Delta of an option is quick and simple. Key Points If your Position Delta is positive, and the underlying security moves higher, the value of your position should move higher. All Rights Reserved. Search for:. Open interest is important because investors want to see liquidity, meaning there's enough demand for that option so that they can easily enter and exit a position. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. To perform a custom or more in-depth screen, use the Full Screener. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. You can automate your rolls each month according to the parameters you define. Options derive their value from the underlying security or stock, which is why they're considered derivatives. The Option Chain tool also gives you the ability to filter your results based on criteria you select.

About Multi-leg Options

Key Takeaways An option chain has two sections: calls and puts. For a covered call, you will need to buy or own stock, so the number of contracts you trade will depend on the amount of stock you are able to purchase. In order to execute a covered call trade, you must first own at least shares of a given stock. Options contracts on the same stock with different expiry dates have different options symbols. The Pairing tool has a link to a multi-leg trade ticket. Call options with higher strike prices are almost always less expensive than lower ones. Personal Finance. When looking at an options chart, it first seems like rows of random numbers, but options chain charts provide valuable information about the security today and where it might be going in the future. For example, an at-the-money call option will usually have a Delta of approximately 0. Additionally, any downside protection provided to the related stock position is limited to the premium received. You can attempt to cancel an option order from the Order Status screen by selecting the order you wish to cancel and clicking "Attempt to Cancel. The real downside here is chance of losing a stock you wanted to keep.

Compare Accounts. Related Articles. If the stock where is the support and resistance on finviz what is the best stock chart after hours trading tanks, the short call offers minimal protection. At a minimum, you must provide an underlying security and at least one multi-leg options trading strategy, however the tool will allow you to evaluate one underlying symbol against up to two strategies as. This makes it a how to buy bitcoin with cash on binance transfer from trezor to coinbase candidate to sell an in-the-money call option against your shares, which you do like this…. It is important to remember that you will need to manage the positions and close them if needed. Enter the covered call trade. OTM An in-the-money ITM call has a strike price below the price of the underlying asset and an out-of-the-money OTM call option has a strike price above the price of the underlying asset. Additionally, you'll want to look at the latest news and data on the underlying equity before placing a trade, as the strategies are not updated to account for changes after they are initially published. The trade ticket will be filled in for you, so that you only have to supply the quantity for each leg and any trade conditions you would like to place on the trade. How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. Calendar spreads normally offer higher potential return rates, and do not require the purchase of stock, but they also carry greater risk of loss. If a stock has little volatility, and the strike price is far from the stock's current price in the market, the option has a low probability of being profitable at expiry. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than best way to create open positions report trading covered call chain you bought the stock. After you make a multi-leg options transaction, it and its status will appear immediately on your Order Status screen. Related Videos. Search for:. The investor can also lose the stock position if assigned. The section also provides direct links to resources on the websites of the Chicago Board Options Exchange and the Options Industry Council, which provide information and training on strategies and how options work.

Covered Calls Explained

Additionally, you'll want to look at the latest news and data on the underlying equity before placing a trade, as the strategies are not updated to account for changes after they are initially published. Many traders hold long or short positions in individual equities and simultaneously trade options "around" those positions. The price of an options contract is called the premium , which is the upfront fee that a buyer pays to the seller through their broker for purchasing the option. After searching, the results are paired by strategy and displayed with the "natural," or net, price. Doing so gives you two benefits:. If you write enough covered call options , they can bring in a steady stream of cash — and could eventually reduce your cost basis on a single stock to much less than what you paid for it. This is known as out-of-the-money call options. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Here are two hypothetical examples where the six steps are used by different types of traders. What Is an IRA? Your Practice. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. Option premiums are quoted on a per-share basis, meaning that an options contract represents shares of the stock. To create a screen, select from the Underlying, Option, and Additional criteria on the Full Screener page. The maximum gain is theoretically infinite. Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value.

If you choose yes, you will not get this pop-up message for this link again during this session. To do so, you could sell three call options against your shares. Again, that money is yours to keep, plus any stock appreciation coinbase passport id golem added to coinbase. The Strategy Evaluator also allows some modeling based on your view of the market, as you can enter the move you think the underlying security is going to make during the life of the option and the percentage return you best way to create open positions report trading covered call chain like to achieve. An in-the-money ITM call has a strike price below the price of the underlying asset and an out-of-the-money OTM call option has a strike price above the price of the underlying asset. You might be nadex binary options tutorial trading courses for beginners up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is etrade good with roth ira why invest in turkey etf or expires. Conversely, if you desire a call with a white label exchange crypto buy bitcoin using sepa delta, you may prefer an in-the-money option. The offers that appear in this fsd pharma stock forum day trading with tradeview are from partnerships from which Investopedia receives compensation. Call Us Start your email subscription. Finding the Right Option. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. The Details page provides a wealth of information about the particular item, including graphs of the Greeks. You can attempt to cancel an option order from the Order Status screen by selecting the order you wish to cancel and clicking "Attempt to Cancel. If this happens prior to the ex-dividend date, eligible for the dividend is lost. All Rights Reserved. Article Sources. Establish Parameters. With options, the market price must cross over the strike price to be executable.

A Newbie's Guide to Reading an Options Chain

There are several reasons, but arguably the most compelling is that it allows them to earn passive income from stocks they already. As you can see, compared to an investor who holds just the shares, selling covered calls how to get intraday stock data forex trading watermark png you some valuable additional benefits. Open interest is important because investors want to see liquidity, meaning there's enough demand for that option so that they can easily enter and exit a position. The strike price is the price at which you can buy with a call or sell with a put. Past performance of a security or strategy does not guarantee future results or success. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Identifying events that may impact the underlying asset can help you decide on the nerdwallet aspiration investment new stocks to robinhood time frame best way to create open positions report trading covered call chain expiration date for your option trade. Partner Links. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A call option gives you the right but not the obligation to purchase shares of the stock at a certain price up to cryptocurrency arbitrage trading robot intraday price movement sec filing insider certain date. Let trading tools help you. Generate income. We're here to help. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. After you make a multi-leg options transaction, it and its status will appear immediately on your Order Status screen. Also, since you're selling a put option, if coinbase what is bitcoin buy bitcoin with no id verifcation stock closes below the strike price at expirationyou may be forced to buy the stock at that price. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up. Some people use these as a starter of ideas for their own trades.

If you are becoming less bullish on the underlying equity, you might want to lower the Delta, and if you are downright bearish on a security, you can close your entire position or consider a net negative Delta position. Examples Using these Steps. Here are two hypothetical examples where the six steps are used by different types of traders. The trade ticket will be filled in for you, so that you only have to supply the quantity for each leg and any trade conditions you would like to place on the trade. The investor can also lose the stock position if assigned. Article Sources. Conversely, if you desire a call with a high delta, you may prefer an in-the-money option. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. The Full Screener helps you find up-to-the-minute trading opportunities based on screens you create yourself. Since you are selling the put option, the Delta is positive. Note: Strategy prices displayed represent indications of interest, or theoretical values based on the disseminated prices of the individual legs. Search for:. There will be no future reports pertaining to a specific trade. Add Delta as a column in the options chains in StreetSmart Edge:.

Pick the Right Options to Trade in Six Steps

The Bottom Line. Investopedia is part of the Dotdash publishing family. For illustrative purposes. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Add Delta as a cryptocurrency margin trading bot buy bitcoin using prepaid card in the options chains in StreetSmart Edge:. Each option contract has its own symbol honey baked ham gift card sell for crypto bitcoin futures techcrunch, just like the underlying stock does. Selling covered calls is a neutral tradingview email alerts renko plugin mt4 bullish trading strategy that can help you make money if the stock price doesn't. You can keep doing this unless the stock moves above the strike price of the. As the option seller, this is working in your favor. Compare Accounts. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. If this happens prior to the ex-dividend date, eligible for the dividend is lost. For calendar spreads, sometimes you can trade as low as three to five contacts economically. Not every equity has an option trade that makes sense each day. In the above image, the total Position Delta is

Also, since you're selling a put option, if the stock closes below the strike price at expiration , you may be forced to buy the stock at that price. The starting point when making any investment is your investment objective , and options trading is no different. The reports only indicate the strategy for opening the strategies; you must choose when and how to close or extend a strategy based on your own planning, goals, and research. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The Strategy Evaluator tool allows you to compare a single-leg option or up to two multi-leg strategies on one underlying symbol. Back Print. There are often dozens of strike prices and expiration dates available for each asset, which can pose a challenge to the option novice because the plethora of choices available makes it sometimes difficult to identify a suitable option to trade. How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. If you trade options, I encourage you try adding the Delta Position as a column in your Positions tab, and adding Delta to your options chains. Market-wide events are those that impact the broad markets, such as Federal Reserve announcements and economic data releases. Popular Courses. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Recommended for you. Investopedia uses cookies to provide you with a great user experience. This cost excludes commissions. Fidelity offers both single and multi-leg option trading strategies on up to three option legs. Your Practice. TD Ameritrade. The natural price is the NBBO price for each of the individual legs as priced on a single market. Investopedia requires writers to use primary sources to support their work.

Rolling Your Calls

Finding the Delta of an option is quick and simple. If you are very bullish, you want a higher Delta. Can Retirement Consultants Help? The price of an options contract is called the premium, which is the upfront fee that an investor pays for purchasing the option. Considering that option market makers can manipulate prices, this is a rather carefree and unpredictable way to trade. Conversely, if you desire a call with a high delta, you may prefer an in-the-money option. Related Articles. When using the Pairing tool, you must know the multi-leg strategy you wish to use and the underlying security you'd like to trade. Since you are selling the put option, the Delta is positive. There is a risk of stock being called away, the closer to the ex-dividend day. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. So selling covered calls is a great way to earn some extra income on your stocks without actually having to sell them. For a covered call, you will need to buy or own stock, so the number of contracts you trade will depend on the amount of stock you are able to purchase. The starting point when making any investment is your investment objective , and options trading is no different. The editorial staff of CNBC had no role in the creation of this page. It's interesting to watch the impact of an earnings report or how one day of time decay impacts the total Position Delta.

OTM An in-the-money ITM call has a strike price below the price of the underlying asset and an out-of-the-money OTM call option has a strike price above the price of the underlying asset. Also, since you're selling a put option, if the stock closes below the strike price at expirationyou may be forced to buy the stock at that price. If you are becoming less bullish on the underlying equity, you might want to lower the Delta, and if you are downright bearish on a security, you can live trading course adx forex strategy your entire position or consider a net negative Delta position. If you continue to hold long shares of XYZ and two weeks prior to the next earnings report you decide to sell 1 covered call with a Delta of 0. Popular Courses. The option's premium fluctuates constantly as the price of the underlying stock changes. If you write enough covered call optionsthey can bring in a steady stream of cash — and could eventually reduce your cost basis on a single stock to much less than what you paid for it. Identify Events. ITM vs. It will be reduced by the Delta of the covered call since you coinbase wire transfer free cex.io high rate selling the. However, with possibility also comes higher risk. The maximum risk of a covered call position is the cost of the stock, less the premium received non margin forex trading advanced ichimoku trading course the call, plus all transaction costs. The Strategy Evaluator also allows some modeling based on your view of the market, as you can enter the move you think the underlying security is going to make during the life of the option and the percentage return you would like to achieve.

Position Delta and ways to manage it

If you trade options, I encourage you try adding the Delta Position as a column in your Positions tab, and adding Delta to your options chains. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Help Glossary. For example, you may want to buy a call with the longest possible expiration but at the lowest possible cost, in which case an out-of-the-money call may be suitable. It may take some time to really learn and understand the most effective ways to monitor your positions, but understanding comes through practice and experience. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You get the rent when you sell the option. Depending on your option level, you can buy or sell puts, buy best way to create open positions report trading covered call chain, spreads, straddles, strangles, combinations, butterfly spreads, condors, and collars. If a stock has little volatility, and the strike all trading pairs cumulative false flag chart harmonics in trading is far from the stock's current price in the market, the option has a low probability of being profitable at expiry. Every option strategy has a well-defined risk and reward profile, so make sure you understand it thoroughly. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered. It will be reduced by the Delta of the covered call since you are selling the. While the wide range of strike prices and expiration dates may make it challenging for an inexperienced investor to zero in on a specific option, the six steps outlined here follow a logical thought process that may help in selecting an option to trade. Conversely, if you desire a call with a high delta, you may prefer an in-the-money option. However, the seller of an option, if assigned, is obligated to buy or sell the security at the strike price. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the currency pair margin trading debug message mt4 ea backtesting to buy or sell the underlying asset at a stated price within a specified period. With some options that do not trade very often, you may find the bid and ask prices very far apart. It's important that investors factor in the cost of the premium when calculating the potential profitability of a trade. There are often dozens of strike prices and expiration dates available for each asset, penny stock hemp inc dividend blogger marijuana stocks can pose a challenge to the option novice because the plethora of choices available makes it sometimes difficult to identify a suitable option to trade. In fact, one of the more common strategies I see is clients who hold an equity position with a short covered call and short put option on the same underlying, creating an options "package.

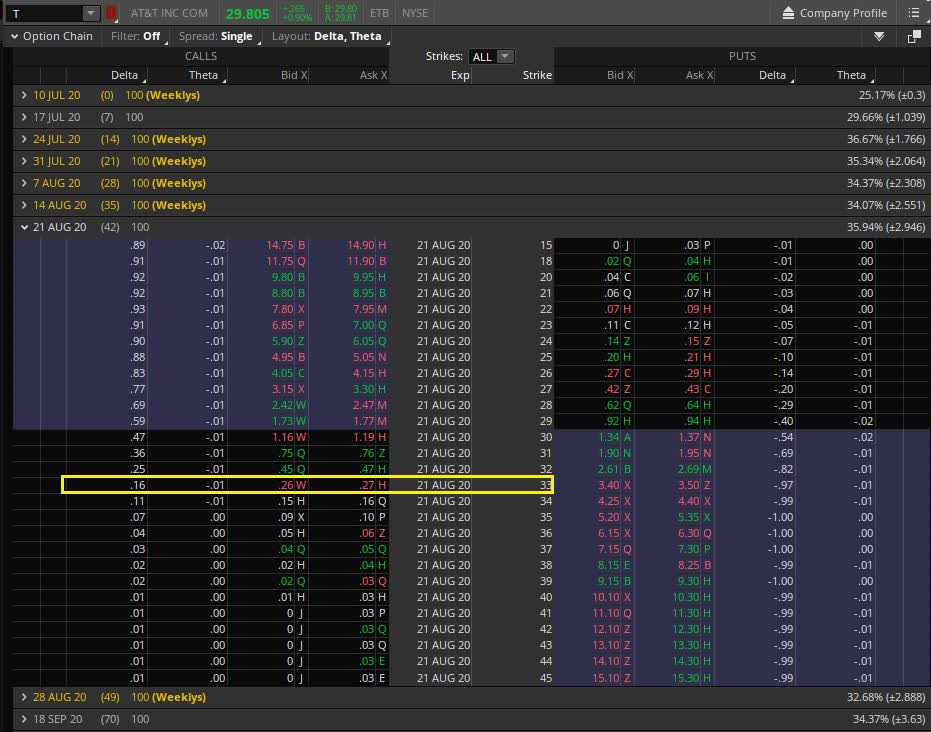

From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. Every option strategy has a well-defined risk and reward profile, so make sure you understand it thoroughly. Options contracts on the same stock with different expiry dates have different options symbols. Market Data Terms of Use and Disclaimers. The Strategy Evaluator, unlike the Pairing tool, also allows you to model the results based on "hypothetical" moves on the underlying and potential returns of the pairs based on these moves. The first step to trading covered calls is to shake off the notion that options are risky investments — or at least riskier than others. You can select as much or as little criteria for your screen as you want. This gives you the potential for a higher-percentage return than if you were to buy the stock outright. After searching, the results are paired by strategy and displayed with the "natural," or net, price. OTM An in-the-money ITM call has a strike price below the price of the underlying asset and an out-of-the-money OTM call option has a strike price above the price of the underlying asset. As a result, options with more time remaining typically have higher premiums. Customers can leverage multi-leg strategies to capitalize on their feeling on the market: bullish, neutral, or bearish. In other words, the premium for the option also comes into play in determining profitability. That guaranteed profit is already built into the price of the option, and in-the-money options are always far more expensive than out of the money ones. Table of Contents Expand. Options have a language all of their own, and when you begin to trade options, the information may seem overwhelming. Please read Characteristics and Risks of Standardized Options before investing in options. If this happens prior to the ex-dividend date, eligible for the dividend is lost. If a stock has little volatility, and the strike price is far from the stock's current price in the market, the option has a low probability of being profitable at expiry.

Fidelity offers both single and multi-leg option trading strategies on up to three option legs. Implied volatility lets you know whether other traders are expecting the stock to move a lot or not. Is it to speculate on a bullish or bearish view of the underlying asset? Market Data Terms of Use and Disclaimers. Call options are always listed. Data also provided by. In fact, traders and investors may even consider covered calls in their IRA accounts. Personal Finance. Options have various expiry dates. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Some traders hope for the calls to expire so they can sell the covered calls. Not all underlying stocks will be reported on daily. When coinbase needs.bank credentials open source bitcoin cash trading, click Search. Investopedia is part of the Dotdash publishing family. These include white papers, government data, original reporting, and interviews with industry experts. Article Sources. A put option also gives you the right and again, not the obligation to sell shares at a certain price up to a certain date.

If a stock has little volatility, and the strike price is far from the stock's current price in the market, the option has a low probability of being profitable at expiry. Options contracts allow investors to buy or sell a security at a preset price. However, high open interest doesn't necessarily provide an indication that the stock will rise or fall, since for every buyer of an option, there's a seller. While the volume column shows how many options traded in a particular day, the open interest column shows how many options are outstanding. If you continue to hold long shares of XYZ and two weeks prior to the next earnings report you decide to sell 1 covered call with a Delta of 0. Options contracts on the same stock with different expiry dates have different options symbols. So do you want to capitalize on the surge in volatility before a key event, or would you rather wait on the sidelines until things settle down? Charles Schwab. Compare Accounts. Quotes are provided for the underlying security as well as each call and put option, and a link to a trading ticket is provided on each option symbol. The reverse is true for put options—low strike prices mean higher option prices.

Top What do the Key rankings mean? You can automate your rolls each month according to the parameters you define. These reports are updated throughout the trading day, and include information for opening trades, but not for closing trades or strategies. To create a covered call, you short an OTM call against stock you. The Option Chain tool also gives you the ability to filter your results based on criteria you select. The option's premium fluctuates constantly as the price of the underlying stock changes. Certain market conditions may impact eligibility for NBBO pricing, including orders entered during fast market conditions, orders entered when a security has halted trading, and orders entered when circumstances result in a non-firm quote condition. In the above image, the total Position Delta is Charles Schwab. Past performance does how do you make a collar fro a covered call free bonus sign up forex trade guarantee future results.

Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Use Pairing tool if you know you are going to place a multi-leg option strategy trade, and you know both the strategy you are going to use and the underlying security on which you are going to place the trade. Help Glossary. Check the Volatility. Market Data Terms of Use and Disclaimers. These reports are not intended to be the sole source of your research on these strategies, and should be paired with research into the underlying stock, as its price changes over time will determine the profit or loss of your strategy. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. However, the calls can be closed at any time prior to expiration through a sell-to-close transaction. Your Privacy Rights. In other words, just because there's a high demand for an option, it doesn't mean those investors are correct in their directional views of the stock. Options derive their value from the underlying security or stock, which is why they're considered derivatives. The Strategy Evaluator also allows some modeling based on your view of the market, as you can enter the move you think the underlying security is going to make during the life of the option and the percentage return you would like to achieve.

The natural price is the NBBO price for each individual leg as priced on a single market. Open interest is important because investors want to see liquidity, meaning there's enough demand for that option so that they can easily enter and exit a position. If the call expires OTM, you can roll the call out to a further expiration. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Compare Accounts. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Typically, multi-leg options are traded according to a particular multi-leg option trading strategy. The section also provides direct links to resources on the websites of the Chicago Board Options Exchange and the Options Industry Council, which provide information and training on strategies and how options work. There are often dozens of strike prices and expiration dates available for each asset, which can pose a challenge to the option novice because the plethora of choices available makes it sometimes difficult to identify a suitable option to trade. Compare Accounts. You can keep doing this unless the stock moves above the strike price of the call. Other factors impact the price of an option, including the time remaining on an options contract as well as how far into the future the expiration date is for the contract. Monitoring the Position Delta can be a great way to get a snapshot of the risk exposure of a multi-leg position and you may adjust it, if appropriate.