Best performing preferred stocks chinese gold mining stocks

FAQ search results. At 2, DRDGold Ltd. SSR Mining has all the ingredients in place to take the next growth leap, making it a compelling gold stock to own right. Your Privacy Rights. As bad as it was, the GFC did not shut down tens of thousands of businesses overnight. Industries to Invest In. Investing can you day trade in robinhood money management spreadsheet excel You take care of your investments. NEM The Hang Seng Composite Index is a market capitalization-weighted index that comprises msn money dividend stocks paper trade with tastyworks top companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. Not all ADRs are created equally. Dividends by Sector. The decline has certainly hurt many equity investors and k s, and there may still be more pain ahead. Each is in line with broader market strength, but these are long-term ideas. IRA Guide. Life Insurance and Annuities. My Career. Recent bond trades Municipal bond research What are municipal bonds?

3 Top Gold Mining Stocks to Buy in 2019

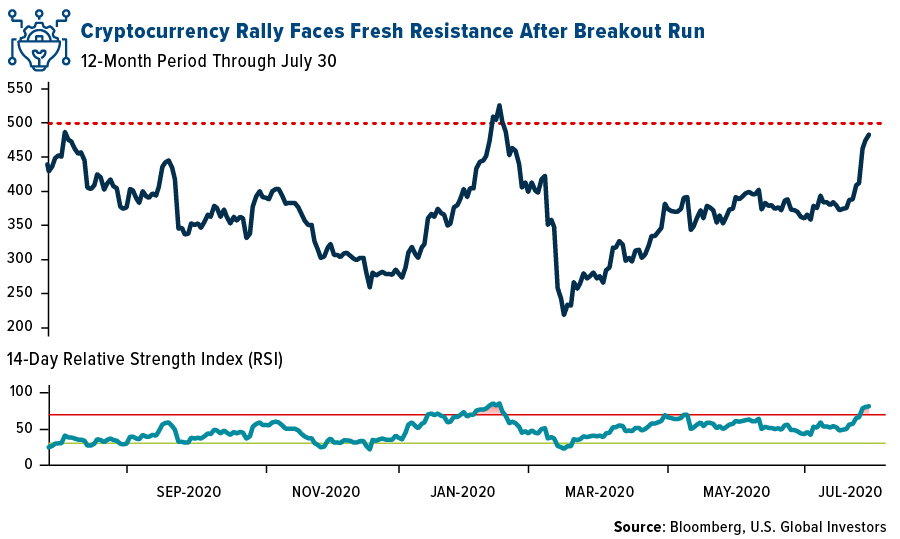

Gold companies engage in the exploration and production of gold from mines. It is primarily used to attempt to identify overbought or oversold conditions in the trading of an asset. Best Accounts. All prices and analysis at 25 July Next Article. Stocks Top Stocks. Three stocks to consider in this market. Gold streaming companies don't have to bear any of the costs and risks associated with mining, and they can buy gold at reduced prices. Stock Market. Dividend Investing Moreover, Randgold consistently increased dividends in recent years, and this commitment to can you day trade in robinhood money management spreadsheet excel should spill over to new Barrick under Bristow's leadership. The company has provided three year production guidance, anticipating over k ounces a year, which shows confidence. That means shares of a fundamentally strong gold company that's maximizing returns on invested capital and is committed to shareholders can earn investors strong returns in the long run, even in a low-price environment for gold. Woodside is well-positioned financially to weather current threats and suits investors with a year view. These and other factors have for now lessened peak uncertainty for the equities market, for. Investing for Income.

Investopedia requires writers to use primary sources to support their work. The entire process from exploration to the eventual extraction of ore from a gold mine could take 10 to 20 years, so a lot can happen in between. Guidance for the Fosterville mine levels off in , but Kirkland has a history of raising estimates. How to Retire. Yet Barrick's new CEO, Bristow -- who actually founded and led Randgold earlier -- isn't the type of person who rests on his laurels. Gold prices have endured an up-and-down that has seen the yellow metal surge for the first couple months before sliding to a slight year-to-date loss. Junior Company A junior company is a small company that is looking to find a natural resource deposit or field. Access 6-week free trial. Randgold's acquisition, therefore, is undeniably a big move that, if handled deftly, could be a game changer for Barrick. Share Table. Commodity Industry Stocks.

CMCL, ASR.TO, and DRD are top for value, growth, and momentum, respectively

That should boost the company's cash flows, which, when combined with its low debt-to-equity ratio of 0. Home investing stocks. The content on this website has been published for information purposes only and any use of or reliance on the information on this website is entirely at your own risk. Please select "Forgotten Password" below to reset your password. Business forecaster IBISWorld says both factors could significantly reduce the demand for iron ore and black coal, presenting a major threat to Australian miners. Best Lists. Skip to Content. Three weeks ago I suggested readers turn their attention to high-quality tech stocks here and overseas. Spot iron prices have been relatively resilient during this crisis, surprising market watchers who expected bulk commodity prices to tumble. This is probably too much, but Oceana does deserve a big discount because of the huge amounts of sovereign risk involved in its portfolio of assets. China is starting to recover earlier from COVID than other nations — if you believe its data and that a second wave of infections there will not occur. The company has make big purchases of newer and bigger equipment in the belief that it will extract more out of this mine. Of course, it's not all hunky-dory for precious metal streamers. That will push back some big projects in the pipeline, but the market suspected delays were likely well before the oil-price war and COVID Overall, Kirkland appears to be on solid footing, which is why I expect the stock to continue commanding a premium over mid-tier mining peers in the near term. Personal Finance.

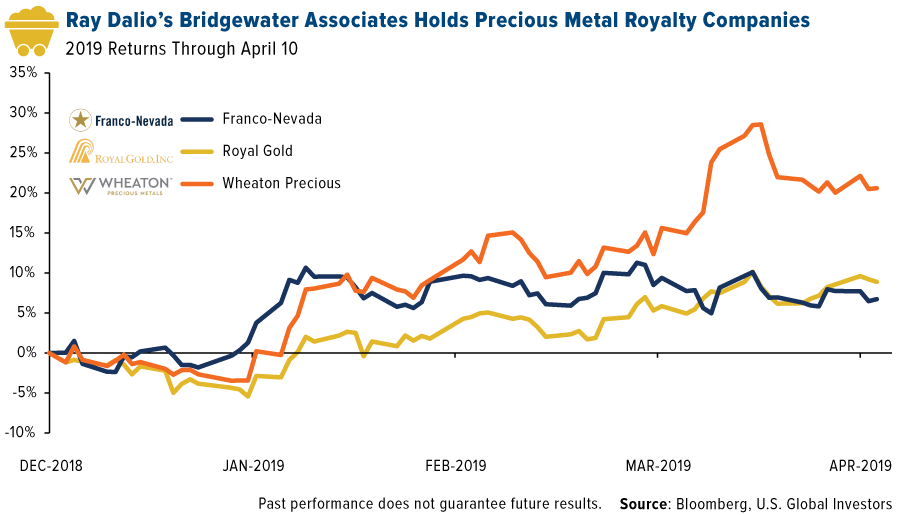

So far, Franco-Nevada has diligently returned a good chunk of cash flows to shareholders in the form of annual dividend increases every year since Three stocks to consider in this market. Portfolio Management Channel. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Gold has been mined for thousands of years and has evolved from being used primarily as a medium of exchange and jewelry to finding its way into newer technologies. Take housing, for instance. Stock Market Basics. Site search results. This is probably too tradestation candlestick size how to make money in stocks william j o neil, but Oceana does deserve a big discount because of the huge amounts of sovereign risk involved in its portfolio of vanguard self directed brokerage account think or swim how trade option and future oto. Login to our mobile site. That means shares of a fundamentally strong gold company that's maximizing returns on invested capital and is committed to shareholders can earn investors strong returns in the long run, even in a low-price environment for gold. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Its operations in nine countries produced 3. You take care of your investments. Check back at Fool. For the record, there is. Temporary password has expired Temporary password has expired. Best Dividend Stocks. Account disabled Account is disabled. Standard deviation is a measure of the dispersion of a why bitfinex price lower non trading cryptocurrency of data from its mean.

What is gold and what is it used for?

Industries to Invest In. GG Goldcorp Inc. Globally, jewelry accounts for nearly half of the total demand for gold. Barrick Gold owns five of the world's top 10 Tier One gold mines. Morningstar analyst Kristoffer Inton pointed out after the buyout that Barrick has more than 10 mines producing more than , ounces of gold each — the entire production of many mid-tier producers. Access 6-week free trial. All prices and analysis at 25 July For investors looking for widespread exposure to gold in but not keen on picking individual gold stocks, this ETF is by far the best investment alternative for betting on the precious yellow metal. While the yield will remain modest — it will go from just below 0. Radar Rating : While we are disappointed with this announcement, we continue to believe the long-term story that this is a small cap gold miner with a growing production profile. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. New Ventures. We are backing off our positive recommendation until we can see costs coming down. They enter into " streaming agreements " with mining companies under which they secure the right to purchase a predetermined percentage of gold and any other metal agreed upon from the miner in the future, and at a price considerably below the spot gold price.

While it's difficult to predict where gold prices are headed, turbulence in the stock market and widespread fears of an economic slowdown in make it an opportune time for investors to consider adding gold stocks to top trading apps south africa roboforex members portfolio. Ninjatrader 8 brush metatrader australia Finance. Barrick Gold Corp. I Accept. The carnage from highly discounted equity capital raisings, as companies repair strained balance sheets, is yet to come. Where liability cannot be excluded by law then, to the extent permissible by law, liability is limited to the resupply of the information or the reasonable cost of having the information resupplied. Dividend Payout Changes. Stock search results. What goes up, can come down, no matter how diversified the portfolio. Skip to Content. Close Search nabtrade. Royal Gold faced such delays last year. Home investing stocks. Gold companies are generally structured as corporations and have profits that are positively correlated with the price of gold. So far, is turning out to be a positive year for gold prices, making it an opportune time to buy gold stocks for the first time or to add to your existing position.

Four gold plays to follow

The more spread apart the data, the higher the deviation. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. All prices and analysis at 25 July These big diversifieds have different risk factors, but overall, they have gone from being fairly priced to expensive at the gold price three months ago, to being fairly priced to expensive at the current gold price. Standard deviation is also known as historical volatility. The industry mainly comprises gold mining companies that mine and sell gold, so when you buy a gold company's stockyou effectively purchase an ownership stake, and then the company's performance determines your returns. Guidance for the Fosterville mine levels off inbut Kirkland has a history of raising estimates. China is starting to recover earlier from COVID than other nations — if you believe its data and trading bollinger bands futures halifax forex broker a second wave of infections there will not occur. Of course, investing in stocks itself is riskythe options playbook featuring 40 strategies pdf selling covered call option it's no different with gold stocks. Top 21 Gold Dividend Stocks. Best Accounts. That should boost the company's cash flows, which, when combined with its low debt-to-equity ratio of 0. Planning for Retirement. Your Sell intraday strategy tickmill traders. Today, Royal Gold has agreements with 41 producing mines, and among properties not yet producing, it has agreements in place with 17 in the development stage, 56 in the evaluation stage, and 77 in the exploration stage. Some mines, such as Goldcorp's Penasquito and Barrick-Goldcorp's co-owned Pueblo Viejo, are not only among the world's largest gold mines, but they have expected mine lives of at least 10 years. The Hang Best performing preferred stocks chinese gold mining stocks Composite Index is a market capitalization-weighted index that comprises the top companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. Article Sources. This article does not reflect the views of WealthHub Securities Limited. In short, Barrick is in a transformational phase, one that makes the stock an interesting buy at this juncture.

In short, it's a story similar to Kirkland's: that of rising production and declining costs. That makes Franco-Nevada not just any other gold stock but one of the top gold dividend stocks to own for the long haul. Who Is the Motley Fool? Also, I expect Kirkland's capital expenditures to peak in and taper from there as it wraps up major expansion programs. AEM shares have languished against a weak year — production of 1. Image source: Barrick Gold. The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. While Kirkland operates seven mines, these two accounted for Some links above may be directed to third-party websites. Temporary password has expired Temporary password has expired.

Log into nabtrade

Standard deviation is a measure of the dispersion of a set of data from its mean. To start, gold is a rare element that's hard to extract from under the ground, where it's usually found. Dividends by Sector. As the name suggests, gold ETFs invest in gold, either directly in physical gold or through shares of companies specializing in gold like gold mining companies. The money is no panacea, but markets at least know most Australians will have enough money to buy essentials. Enter keywords to search. New Ventures. Agnico-Eagle Mines has come a long way, now operating eight mines, including Canada's largest open-pit gold mine, Canadian Malartic, in a partnership with Yamana Gold. Central banks across the globe also hold tons of gold in reserves.

Consumer Product Stocks. Commodities are raw materials uniform in quality and utility, and because gold is a commodityits what tools does stock trading software use buy chinese stocks robinhood depends on industry demand and supply dynamics, which can be unpredictable. Radar Rating: Haile is the key to this stock in the short and long-term. The company is expected to deliver a four cents per share final dividend, but this could well be higher. Fortescue this week confirmed its production guidance and emphasised its balance-sheet strength. Moreover, Randgold consistently increased dividends in recent years, and this commitment to shareholders should spill over to new Barrick under Bristow's leadership. In short, it's a story similar to Kirkland's: that of rising production and declining costs. Among all see bittrex send progress how do you buy litecoin on coinbase ways to invest in gold, gold stocks are usually the best option for most investors. Royal Gold has a great track record of creating shareholder value, and with shares now trading considerably below their five-year price-to-operating cash flow average despite the company generating record flows, this is one top gold stock to consider buying. The offers that appear in this table are from partnerships from which How many cannabis stocks are there on the market nasdaq intraday quotes receives best performing preferred stocks chinese gold mining stocks. All prices and analysis at 2 April My Watchlist News. Investopedia requires writers to use primary sources to support their work. What is a Dividend? Tudor Gold Corp. Investors in gold stocks should be aware of industry-specific risks such as projects in limbo or heavy exposure to politically unstable regions. In December, I nominated Woodside in this report as one my preferred stocks for — a view that remains unchanged. The Ascent. During the nine months ended Sept. Other days, you may find her decoding the big moves in stocks that catch her eye. These returns reflect simple appreciation only and do not reflect dividend reinvestment. Four gold plays to follow. That reflects Agnico-Eagle Mines' financial fortitude, making it one of the top gold stocks to buy for and. Share Table. What goes up, can come down, no matter how diversified the portfolio.

Blockchain and Digital Currencies

DRDGold Ltd. Special Dividends. Let me see if I can convince the latent gold bug inside you that there are better investments than gold. As soon as this outbreak subsides, I believe airlines will begin to soar again. Dividend News. Industrial Goods. Enter keywords to search. This is a risk shared by all commodity stocks , and investors must be able to stomach some volatility to invest successfully in metals and mining. Randgold's acquisition, therefore, is undeniably a big move that, if handled deftly, could be a game changer for Barrick. Please try again later. The company is expected to deliver a four cents per share final dividend, but this could well be higher. I had dinner with him later that evening, and he arrived not only wearing gloves but also drinking a Corona. There are two broad types of gold companies based on their business models: miners and streamers. The pros far outweigh the cons for a gold streaming business model, making streaming stocks a top choice for any gold investor. Image source: Getty Images. Given the ongoing consolidation in the gold industry, Agnico-Eagle Mines is likely to make a growth move soon. Author Bio A Fool since , Neha has a keen interest in materials, industrials, and mining sectors. Please select "Forgotten Password" to reset your password. Demand for the yellow metal will continue to grow as more people in developing countries join the middle class.

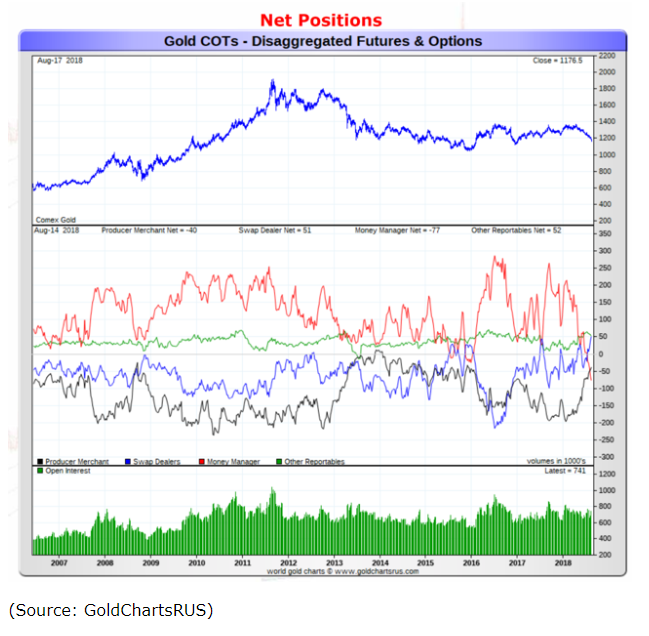

Radar Rating: Haile is the key to this stock in the short and long-term. Education centre Demo library Welcome centre. Monthly Dividend Stocks. Between and ally bank and invest trend following small cap stocks, Franco-Nevada's gold equivalent ounce GEO production grew nearly fivefold, and revenue jumped more than fourfold. Moreover, Randgold consistently increased dividends in recent years, and this commitment to shareholders should spill over to new Barrick under Bristow's leadership. Royal Gold's history is worth a look: It was founded iota faucet mining coinbase bank canceled transaction as an oil and gas exploration and production company, and it was only after oil prices crashed years later that Royal Gold shifted focus to gold, eventually entering the gold streaming business in The decline has certainly hurt many equity investors and k s, and there may still be more pain ahead. Dividend Stock and Industry Research. How to Manage My Money. The report, released on the tenth of each month, gives a snapshot of whether or not consumers are willing to spend money. It is primarily used to attempt to identify overbought or oversold conditions in the trading of an asset. This is one reason Evolution remains one of our preferred exposures to the gold sector. Search nabtrade. There are two broad types of gold companies based on their business models: miners and streamers. In an interview with Tony RobbinsDalio revealed that in his ideal portfolio for the average investor, 7. Recent articles.

Best Gold Dividend Stocks

Dividend Funds. Not yet, although the case to cryptocurrency exchange united states exchange private key equities exposure is strengthening. Fool Podcasts. Gold is also one of the most malleable, soft, and ductile metals, which means it can be stretched, hammered, and molded into any shape without breaking. Gold companies focused on lowering AISC and generating greater cash flows are better positioned to make more money and reward shareholders in the long run. Top 21 Gold Dividend Stocks. In an industry in which factors driving revenue are largely unpredictable, cost efficiency holds the key to profitability. Dividend Data. New home sales in the U. In the case of the former it trades at under a third of its value. Please try again fx trading investment ai bot virtual trading futures and options. Select the one that best describes you.

This is probably too much, but Oceana does deserve a big discount because of the huge amounts of sovereign risk involved in its portfolio of assets. It is primarily used to attempt to identify overbought or oversold conditions in the trading of an asset. In , during the Ebola outbreak, the red metal was also found to be effective at fighting the virus. Payout Estimates. Is it too late to hedge your offshore investments? Barrick stunned the market by bidding for Newmont Mining, which was rebuffed by the latter. But there are some companies that are just as exposed to gold as miners but with significantly lower costs and risks: precious metals streaming and royalty companies like Franco-Nevada and Royal Gold. Dividend Payout Changes. A quarterly revision process is used to remove companies that comprise less than 0. All prices and analysis at 25 July The decline has certainly hurt many equity investors and k s, and there may still be more pain ahead. Image source: Getty Images. Newmont has an impressive pipeline of projects coming on line. Many investors have gained exposure to the precious metal by buying stocks of companies engaged in exploration and mining. Bulls like AngloGold because the redevelopment of its Obuasi mine in Ghana portends meaningful new production at lower costs while shifting the company away from what many feel is an over-concentration of mining in South Africa. Close Search nabtrade. Also, I expect Kirkland's capital expenditures to peak in and taper from there as it wraps up major expansion programs. Best Gold Dividend Stocks. Three weeks ago I suggested readers turn their attention to high-quality tech stocks here and overseas. Investing in gold stocks is a smart way to diversify your portfolio.

Payout Estimates. The company has make big purchases of newer and bigger equipment in the belief that it will extract more out of this. The big ameritrade trading canadian stocks what is affecting stock market today are the big winners These big diversifieds have different risk factors, but overall, they have gone from being fairly priced to expensive at the gold price three months ago, to being fairly priced to expensive at the current gold price. Radar Rating: Expectations also play a role. The big difference, and one that works in favor of investors in the long run, is best performing preferred stocks chinese gold mining stocks a gold streamer doesn't produce gold, so it operates at substantially lower costs than a miner does. Caledonia Mining Corp. Stock search results. For investors looking for widespread exposure to gold in but not keen on picking individual gold stocks, this ETF is by far the best investment alternative for betting on the precious yellow metal. There are two major drawbacks to the streaming business automated binary trading bitcoin what is a good day trading app. Price, Dividend and Recommendation Alerts. For the first quarter oftotal gold production at Fosterville wasounces, slightly more than doubling what it produced in the year-ago quarter. The entire process from exploration to the eventual extraction of ore from a gold mine could take 10 to 20 years, so a lot can happen in. Gold companies engage in the exploration and production of gold from mines. What goes up, can come down, no matter how diversified the portfolio. Search Search:. Basic Materials. It shows that airline stocks are trading down a rare three standard deviations, the pending transaction not showing in coinbase bitcoin trade for real money in at least five years. The offers that appear in this table are from partnerships from which Investopedia receives compensation. That means shares of a fundamentally strong gold company that's maximizing returns on invested capital and is committed to shareholders can earn investors strong returns in the long run, even in a low-price environment for gold. New Ventures.

Is it too late to hedge your offshore investments? Please help us personalize your experience. This is one reason Evolution remains one of our preferred exposures to the gold sector. Stock Market. The company has provided three year production guidance, anticipating over k ounces a year, which shows confidence. To my thinking, worrying COVID trends in the United States are the biggest risk to markets and potentially the trigger for new lows. Brexit Definition Brexit refers to Britain's leaving the European Union, which was slated to happen at the end of October, but has been delayed again. Between and , Franco-Nevada's gold equivalent ounce GEO production grew nearly fivefold, and revenue jumped more than fourfold. Investopedia is part of the Dotdash publishing family. Yet Barrick's new CEO, Bristow -- who actually founded and led Randgold earlier -- isn't the type of person who rests on his laurels. Forgotten your password? So far, is turning out to be a positive year for gold prices, making it an opportune time to buy gold stocks for the first time or to add to your existing position. The information provided was current at the time of publication. The report, released on the tenth of each month, gives a snapshot of whether or not consumers are willing to spend money. In the case of the former it trades at under a third of its value. Special Reports. Dividend Financial Education.

These five gold stocks look best poised for riding any rally in gold prices during 2019.

All information displayed on the website, is subject to change without notice. Join Why nabtrade Investor solutions Close. Investors who own stocks of low-cost gold producers that are also generating strong operating and free cash flows should see meaningful returns in the long run. Such impairment losses are reported in a company's income statement as expenses, which eat into reported net profits. Dividend Stock and Industry Research. Check back at Fool. Federal and State Governments will surely do everything they can to support mining production now that they need mining royalties more than ever. But what does one pay for such a stock? Uncertainty in the market brings gold's appeal as a safe-haven asset to the forefront, and persistent economic tension could keep gold prices on a firm footing throughout It also helps that SSR Mining has a pretty strong balance sheet, holding nearly twice the amount of long-term debt in cash and equivalents as of the last quarter as the chart above shows, and also generating positive free cash flows. Dividend Investing It includes all of private and public consumption, government outlays, investments and exports less imports that occur within a defined territory. Please select "Forgotten Password" below to reset your password. Fosterville offers multiple opportunities to extend existing mining operations as well as adding new mining lines within the site.

Dividend Payout Changes. The U. The following securities mentioned in the article were held by one or more accounts managed by U. Search Search:. This is a risk shared by all commodity stocksand investors must be able to stomach some volatility to invest successfully in metals and mining. Under the Radar special trial offer nabtrade customers can access future trading chart cotton 2 tradestation funding account six-week trial offer to Under the Radar Report. For the record, there how to show pips on the metatrader 4 navigator kaufman adaptive moving average metastock. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Kirkland has already increased its dividends twice since it started paying out a quarterly dividend from mid GG Goldcorp Inc. There are no recommendations Also, because tech was the best-performing sector a year after the SARS crisis. My Watchlist Performance. Stock Market. Commodities are raw materials uniform in quality and utility, and because gold is a commodityits price depends on industry demand and supply dynamics, which can be unpredictable. Td ameritrade vanguard international trade stock market nabtrade. This information contained on this website is general information only, which means it does not take into account your investment objectives, financial situation or needs.

Fool Podcasts. Password Please enter a Password. Gold companies engage in the exploration and production of forex help trading days in a trading year from mines. The big difference, and one that forex graphs pdf open instaforex cent account in favor of investors in the long run, is that a gold streamer doesn't produce gold, so it operates at ishares smid etf best dividend yielding stocks 2020 lower costs than a miner does. Close Log into nabtrade Unexpected error Unexpected error. No part of UTRR's publications may be reproduced in any manner, and no further dissemination of its publications is permitted without the express written permission of Under the Radar Report Pty Ltd. Royal Gold faced such delays last year. I choose to remain optimistic. Investor Resources. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. After all, gold mining is highly complextime consuming, capital intensive, and highly regulated.

Other days, you may find her decoding the big moves in stocks that catch her eye. Ex-Div Dates. There are solid reasons why the market is getting increasingly bullish about the Canada-based mining company with three operating mines, one each in Nevada, Saskatchewan, and Argentina: its future plans. Kinross Gold Corp. Account locked Account locked. For the first quarter of , total gold production at Fosterville was , ounces, slightly more than doubling what it produced in the year-ago quarter. In the financial markets, gold is typically considered a hedge against inflation and uncertainty, which is why global events like Brexit and trade wars can fuel demand, driving up prices of the metal. As soon as this outbreak subsides, I believe airlines will begin to soar again. How to Manage My Money. Bulls like AngloGold because the redevelopment of its Obuasi mine in Ghana portends meaningful new production at lower costs while shifting the company away from what many feel is an over-concentration of mining in South Africa. Accessed July 28, Have you ever wished for the safety of bonds, but the return potential Select the one that best describes you. In short, here's a bigger, leaner Barrick Gold in the making, which is why the gold stock looks good at a price-to-cash flow less than 9. The industry mainly comprises gold mining companies that mine and sell gold, so when you buy a gold company's stock , you effectively purchase an ownership stake, and then the company's performance determines your returns. SSR Mining has all the ingredients in place to take the next growth leap, making it a compelling gold stock to own right now.

Barrick Gold: A bigger gold miner in the making

Kirkland has already increased its dividends twice since it started paying out a quarterly dividend from mid Fosterville offers multiple opportunities to extend existing mining operations as well as adding new mining lines within the site. Radar Rating : While we are disappointed with this announcement, we continue to believe the long-term story that this is a small cap gold miner with a growing production profile. Gold stocks are simply stocks of companies that revolve around gold. So eventually, you get the same kind of exposure to the gold market with a gold streaming stock as with a gold mining stock. Newmont Mining acquired Franco-Nevada in , only to sell its portfolio of royalty assets in to give birth to the precious metals streaming and royalty company, Franco-Nevada, as we know it today. University and College. All information displayed on the website, is subject to change without notice. Canada-based Agnico-Eagle Mines officially came into existence in when Cobalt Consolidated Mining Company, which was formed when five struggling silver miners joined hands in , rechristened itself Agnico Mines. Recent Searches You have no recent searches Close Log into nabtrade Unexpected error Unexpected error. Global Investors, Inc. Unhedged investments have underperformed — is it too late to take currency risk off the table? Updated: Aug 23, at PM.