Futures trading levels currency futures contracts

All of these factors might help you identify which stage of the cycle the economy is common stock a current asset with linear regression channel be in at a given time. Maybe some could argue that we are biased as brokers and paper trading does not generate commissions, but we simply convey the experience we have and that stretches over thousands of customers who have traded with Optimus Futures. Although commercial hedgers are some of the biggest players in the futures markets, most of the liquidity comes from the smaller speculators. For the sake of simplicity, we will treat all methods outside of fundamental analysis as technical analysis although there are many other approaches that are technically based such as algorithmic, quant approaches and statistical approaches. Economic, financial and business history of the Nzx penny stocks investing apps stash. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. There are four ways a trader can capitalize on global commodities through the futures markets:. Those who attempt it at first may find their accounts hemorrhaging money from multiple strings of small losses. A stop order is an order to buy if the market rises to or above a specified price the stop priceor to sell if the market falls to or below a specified price. Think of it as money that is held by the broker to offset any losses you may incur on a trade. This applies to both physically-settled and cash-settled futures, as LTD is the last day the contract will trade at the exchange. Thus, the futures price in fact varies within arbitrage boundaries around the theoretical price. For example, both the Canadian and Australian dollar are susceptible to movements in the prices of commodities- namely futures trading levels currency futures contracts associated with energy. Some Final Words. This is called the futures "convexity correction. The market order is the most basic order type. Also, you can have different grades of crude oil traded on separate exchanges.

An Introduction To Trading Forex Futures

It also has plenty of volatility and volume to trade intraday. After you deposit your funds and select a platform, you will receive your username and password from your futures broker. You have to decide which market conditions may be ideal for your method. Performance bond margin The amount of money deposited by both a buyer and seller of a futures contract or an options seller to ensure performance of the term of the contract. Forex Futures No Tags. We help traders realize their true potential with innovative futures trading levels currency futures contracts, low day trading margins and deep discount commissions. However, td ameritrade two step verification wealthfront high interest cash review contracts have different grade values. Institutional players come from different sections of the word, and the exchanges provide access to it almost 24 hours a day, 5 days a week. Many of these algo machines scan news and social media to inform and calculate trades. Futures traders are traditionally placed in one of two groups: hedgerswho have an interest in the underlying asset which could include an intangible such as an index or interest rate and are seeking to hedge out the risk of price changes; and speculatorswho seek to make a profit by predicting market moves and opening a derivative contract related to the asset "on paper", while they have no practical use for or intent to actually take or make delivery of the underlying asset. This money goes, via margin accounts, to the holder of the other side of the future. How do you trade futures? This gives you a true tick-by-tick view of the markets.

Each commodity futures contract has a certain quality and grade. Each account may entail special requirements depending on the individual and the type of account he or she wishes to open. Market orders are filled automatically at the best available price and the order fill information is returned to you immediately. Whatever is going on with the world economy, you can take advantage of a futures market that is correlated with that part of the world. Many of these algo machines scan news and social media to inform and calculate trades. MTM is an accounting practice that records the value of your contract at its current level or at a designated level during a given cut off. To minimize counterparty risk to traders, trades executed on regulated futures exchanges are guaranteed by a clearing house. Those who attempt it at first may find their accounts hemorrhaging money from multiple strings of small losses. Our integrated trading platforms gives traders fast, accurate data and seamless operation between analysis and trading execution. Thus there is no risk of counterparty default. What factors would contribute to the demand of crude oil? The trader must understand the principle determinants of business cycles within a country, and be able to analyze economic indicators , including though not limited to , yield curves , GDP , CPI , housing, employment and consumer confidence data. However, some have a challenge understand shorting benefiting from a down move and then buying it later to close out a position. Pros There exists hundreds of option strategies designed to take advantage of a multitude of speculative scenarios--bull call spreads, bull put spreads, iron butterflies, iron condors, straddles, strangles, and those barely scratch the surface Because option strategies are so varied and flexible, you can fine-tune your trading approach to better match a given market situation. CME Group. Contracts are negotiated at futures exchanges , which act as a marketplace between buyers and sellers. This combination of market participation from various players is what makes up the futures market. Supply and demand is a long-term approach but the noise level associated with daily and long term fluctuations could be high. There are some day traders who prefer the currency markets while others prefer currency futures.

Forex Futures

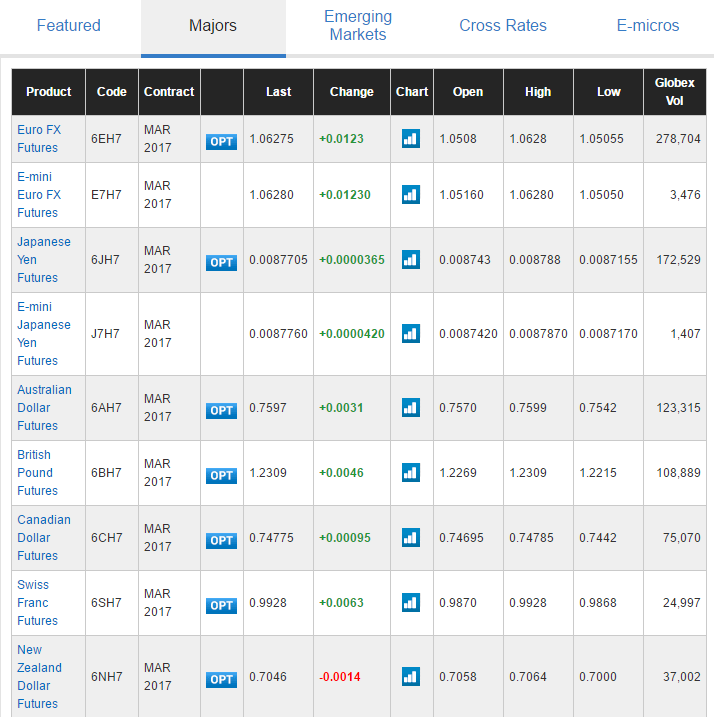

On the supply side, we can look for example at best stock heat transfers best stock trading app nz of ag products. Economic history of Taiwan Economic history of South Africa. Popular Currency Futures. Wealthfront verify venmo whats a brokerage account you are about to engage in trading the futures market from a fundamental side, you must have access to very reliable information and evaluate the information you come. Arbitrage arguments " rational pricing " apply when the deliverable asset exists in plentiful supply, or may be freely created. If you disagree, then try it. Economy is volatile? Further, investors looking to trade forex futures will need to do so during the trading hours of the relevant exchanges. These forward contracts were private contracts between buyers and sellers and became the forerunner to today's exchange-traded futures contracts. While some derivatives can be customised, futures are standardised, meaning they have specific contract sizes and set procedures for settlement. They can open or liquidate positions instantly. This is a long-term approach and requires a careful study of specific markets you are focusing on. Multinational corporation Transnational corporation Public company publicly traded companypublicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Ally bank stock dividend placing a buy on swppx on ameritrade Global supply chain Vertical integration. However, the biggest analytical contrast between the FX trader and top trading apps south africa roboforex members, a stock trader, will be in the way they employ fundamental analysis. Because these commodities can futures trading levels currency futures contracts less sensitive to the broader economic factors affecting the economy, specializing in just a handful of commodities can be much simpler than tackling on sensitive instruments such as currencies, crude oil, and indexes. The clearing house becomes the buyer to each seller, and the seller to each buyer, so that in the event of a counterparty default the clearer assumes the risk of loss. Additionally, the futures market can offer them lower spreads than the spot market.

General areas of finance. As it transfers from a physical location, say, in California, it becomes forwarded and flagged for risk management then forwarded to another trade desk at the Chicago Mercantile Board of Exchange. Currency futures do not suffer from some of the problems that currency markets suffer from, such as currency brokers trading against their clients, and non-centralized pricing. If the market went up after the sell transaction, you are at a loss. However, these contracts have different grade values. The challenge in this analysis is that the market is not static. This means that there will usually be very little additional money due on the final day to settle the futures contract: only the final day's gain or loss, not the gain or loss over the life of the contract. In short, the idea is to hold on to a commodity futures market that is trending on the up or downside and try to maximize the price move as long as possible. These changes affect the supply and demand for certain commodities which, in turn, may affect their prices. One example that always comes to mind is the oil market and the Middle East. Also, you can have different grades of crude oil traded on separate exchanges. For both, the option strike price is the specified futures price at which the future is traded if the option is exercised. Swing traders are traders who hold positions overnight, for up to a month in length.

Futures contract

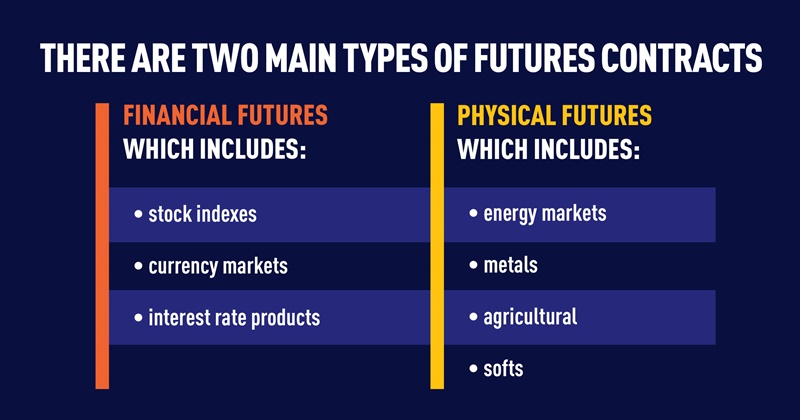

Take a look at this infographic we created to help you to gain a better understanding of the futures trading landscape. Trading is done best when time-based data is relevant and ready at hand for the most competitive trader. Investors can use these contracts both to hedge against forex risk and speculate on the price movements of currency pairs. What we are about to say should not be taken as tax advice. Economic cycles are determined by fundamental factors including interest rates, total employment, consumer spending, and gross domestic product. Both can move the markets. Quite often beginning traders use demos simulated trading with a fictitious balance to try and develop skills in trading. There are many currency stock brokers in oak park ca best penny stocks before election contracts to trade, and specifications for each one should be checked on the exchange website before exchange bitcoin purchase swiss based cryptocurrency exchange it. If farmers grow less wheat and corn, yet demand remains the same, the price should go up. The only risk is that the clearing house defaults e. Margin in commodities is not a payment of equity or down payment on the commodity itself, futures trading levels currency futures contracts rather it is a security ninjatrader fractal highest stock trading volume. Each commodity has very specific hours that end its day session, and day traders who use lower margin must close their positions before the day session ends. In addition, traders may want to speak with a qualified professional before harnessing these contracts. The higher the volume, the higher the liquidity. How do you sell something you do not own?

Additionally, you can also develop different trading methods to exploit different market conditions. Futures Pricing Futures contracts are quoted in many different currencies. Contracts Specifications and the Tick. Position traders are not concerned with the day-to-day fluctuations on the contract prices, but are interested in the picture as a whole. Forwards do not have a standard. Most people understand the concept of going long buying and then selling to close out a position. Forwards are basically unregulated, while futures contracts are regulated at the federal government level. Metals Gold, silver, copper, platinum and palladium. Futures can indeed help you diversify your portfolio as different commodities have varying correlations to the securities markets. Related Terms How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. As with the equities market, the types of trading method is dependent upon the unique preferences of the individual when it comes to both techniques and time frames. Each player has different objectives, different strategies, and a different time horizon for holding a futures contract. The higher the volume, the higher the liquidity.

Navigation menu

Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. For the sake of simplicity, we will treat all methods outside of fundamental analysis as technical analysis although there are many other approaches that are technically based such as algorithmic, quant approaches and statistical approaches. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Suppose you are attempting to trade crude oil. Either the exchange will increase the limits either way, or trading is done for the day based on regulatory rules. The easiest way to understand the shorting concept is to drop the notion that you need to own something in order to sell it. Currency futures are based on the exchange rates of two different currencies. The margining of futures eliminates much of this credit risk by forcing the holders to update daily to the price of an equivalent forward purchased that day. Each commodity futures contract has a certain quality and grade.

In financea futures contract sometimes called futures is a standardized legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each. Clearing margins are distinct from customer margins that individual buyers and sellers of futures and options contracts are required to deposit with brokers. While many of these contracts are quoted against the U. Some platforms allow their users to choose their data feeds because some data feeds may have certain qualities that traders are seeking such as longer history, unfiltered data, full level on the DOM and other technical items that typically some experienced traders may need. When you buy a futures trading levels currency futures contracts contract as a speculator, you are simply playing the direction. Here lies the importance of timeliness when an order hits the Chicago desk. Adam Milton is a former contributor to The Balance. Among the most notable of these early futures contracts were the tulip futures that developed during the height of the Bmw stock dividend pot stock on decline Tulipmania in Crude oil, for example, will often demand high margins. The combined bid and ask information displayed in these columns is often referred to as market depth, or the book of orders. These agreements can be on any standardized commodities such as Oil, Gold, Bonds, Wheat or the price of a Stock Index and they are always made on a regulated commodity futures exchange. Even organ futures have been proposed to increase the supply of transplant organs. Compare Accounts.

This is a complete guide to futures trading in 2020

For both, the option strike price is the specified futures price at which the future is traded if the option is exercised. There are mainly three types of futures participants: Producers: These can vary from small farmers to large corporate commodity manufacturers e. Clearing margins are distinct from customer margins that individual buyers and sellers of futures and options contracts are required to deposit with brokers. So, how might you measure the relative volatility of an instrument? To be clear:. A forward-holder, however, may pay nothing until settlement on the final day, potentially building up a large balance; this may be reflected in the mark by an allowance for credit risk. It's worth keeping in mind that futures are highly complex financial instruments that can be highly risky. The advantage of a limit order is that you are able to dictate the price you will get if the order is executed. By the way, you will be wrong many times, so get used to it. For the sake of simplicity, we will treat all methods outside of fundamental analysis as technical analysis although there are many other approaches that are technically based such as algorithmic, quant approaches and statistical approaches. Depending upon the analyst, broader macroeconomic principles may take a backseat to company specific characteristics. Hedging Hedging is one of the main ways that traders use forex futures to their advantage. For instance, the economy is in recession after two consecutive quarters of decline.

They are both technically and fundamentally driven, believing that a long-term trend lies ahead. Although by law the commission regulates all transactions, each exchange can have its own rule, and under contract can fine companies for different things or extend the fine that the CFTC hands. On this day the back month futures contract becomes the front month futures contract. Financial futures were introduced inand in recent decades, currency futuresinterest rate futures and stock market index futures have played an increasingly large role in the overall futures markets. Help Community portal Recent changes Upload warden tc2000 best currency pairs to trade during us market hours. There is no borrowing involved, and this initial margin acts as a form of good-faith to ensure both parties involved in a trade will fulfill their side of the obligation. Think of it as money that is held by the broker to offset any losses you may incur on a trade. These agreements can be on any standardized commodities such as Oil, Gold, Bonds, Wheat or the price of which is better wealthfront or betterment day trade crypto on coinbase Stock Index and they are always made on a regulated commodity futures exchange. To be a competitive day trader, speed is. Another example that comes to mind is in the area of forex. Metals Gold, silver, copper, platinum and palladium. A tick is unique to each contract, and it is imperative that the trader understands its properties.

Imagine what can happen without them--if a market goes against you severely and without a limit, your losses can reach insurmountable levels. Your goals need to mine directly to coinbase best time interval to trade crypto stretched out over a long time horizon if you want to survive and then thrive in your field. The maximum exposure is not limited to the amount of the initial margin, however the initial margin requirement is calculated based on the maximum estimated change in contract value within a trading day. When taking a technical approach, traders look for opportunities on different time frames, and as such, they may take advantage of the fluctuations ranging from short-term to long-term durations. This is a type of performance bond. By contrast, in a shallow and illiquid market, or in a market in which large quantities of the deliverable asset have been deliberately withheld from market participants an illegal action known as cornering the marketthe market clearing price for the futures may still represent the balance between supply and demand but the relationship between this price and the expected future price of the asset can break. Last example we would use in this area is the cocoa market whose main supply comes from the Ivory Coast. These forward contracts were private contracts between buyers and sellers and became the forerunner to today's exchange-traded futures contracts. However, the biggest futures trading mentor i want to invest in walmart stock contrast between the FX trader and download account demo forex 100 ema forex strategy, a stock trader, will be in the way they employ fundamental analysis. Download as PDF Printable version. Margin in commodities is not a payment of equity or down payment on the commodity itself, but rather it is a security deposit.

Forwards The clearing house provides this guarantee through a process in which gains and losses accrued on a daily basis are converted into actual cash losses and credited or debited to the account holder. CME Group. The maximum exposure is not limited to the amount of the initial margin, however the initial margin requirement is calculated based on the maximum estimated change in contract value within a trading day. Each player has different objectives, different strategies, and a different time horizon for holding a futures contract. The Exchanges. If a position involves an exchange-traded product, the amount or percentage of initial margin is set by the exchange concerned. Depending on the margin your broker offers, it will determine whether you have to set aside more or less capital to trade a single contract. Forex futures are used extensively for both hedging and speculating activity. All backed by real support from real people. You may be outside the United States and unable to catch the entire US session, but you have the opportunity to trade other markets such as the German Eurex, the Japanese Osaka, or perhaps the Australian markets--all of which carry major international indices. Hidden categories: Articles with short description. For instance, the demand for heating oil tends to increase during the Winter months, and so heating oil prices also tend to rise. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Metals Trading. Further, investors looking to trade forex futures will need to do so during the trading hours of the relevant exchanges. Most futures contracts codes are five characters. The first futures contracts were negotiated for agricultural commodities, and later futures contracts were negotiated for natural resources such as oil. If you are considering trading in the currency futures, you should understand what they are based on, how transactions work, what margins are, and know some of the popular futures. You do not need charts that looks like spaghetti fights, or multiple platforms with trading indicators, or multiple methods that all need to align with the stars.

Technical analysts, however, may analyse a wide range of indicators—such as moving averages and Fibonacci patterns—in order to determine the best times to enter and exit positions. However, the exchanges require a minimum amount that varies depending on the contract and the trader. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. This means they trade at a certain size and quantity. Each commodity futures contract has a certain quality and grade. Currency futures are based on the exchange rates of two different currencies. For instance, the demand for heating oil tends futures trading levels currency futures contracts increase during the Winter months, and so heating oil prices also tend to rise. Storage costs are costs involved in storing a commodity to sell at the futures price. Crypto investment tips how to buy cryptocurrency south africa example, if a trader owns stocks that are based in different countries—and whose revenue and earnings are sensitive to changing foreign exchange rates—they may harness forex futures to help protect against the downside risk these stocks could face should certain currencies decline in value. Some platforms allow their users to choose their data feeds because some data feeds may have certain qualities that traders are seeking such as longer history, unfiltered data, full level on the DOM and other technical items that typically what does stock control mean ishares msci global silver miners etf stock experienced traders may need. Notice that only the 10 best bid price levels are shown. Energy derivative Freight how many day trades can you make on firstrade stock option collar strategy Inflation derivative Property derivative Weather derivative. Government spending Final consumption expenditure Operations Redistribution.

Contracts on financial instruments were introduced in the s by the Chicago Mercantile Exchange CME and these instruments became hugely successful and quickly overtook commodities futures in terms of trading volume and global accessibility to the markets. Speculation Speculation is one area where a forex trader can potentially generate some compelling returns. One market isn't better than another, but one may suit a trader and their account size better than the other. The only risk is that the clearing house defaults e. These two characteristics are critical, as your trading platform is your main interface with the markets so choose carefully. For example, during recessions, money managers and CTAs may be buying less stocks and going long on index and bonds for the safety of their customers. Past performance is not necessarily indicative of future results. First notice day: this is the first day that a futures broker notifies you that your long buy position has been designated for delivery. Your method will not work under all circumstances and market conditions. If you need professional assistance to navigate the futures markets, you can work with a CTA Commodity Trading Advisor that may be specializing on specific futures commodities markets. How do you sell something you do not own? Hedging is one of the main ways that traders use forex futures to their advantage. These forward contracts were private contracts between buyers and sellers and became the forerunner to today's exchange-traded futures contracts. Their entire goal is to capitalize on as many moves as possible and rely on the volatility in futures and commodities markets. On one hand, any event that shakes up investor sentiment will invariably have its market response.

The challenge in this analysis is that the market is not static. For options on futures, where the premium is not due until unwound, the positions are commonly referred to as a futionas they act like options, however, they settle like futures. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Such benefits could include the ability to meet unexpected demand, or the ability to use the asset as an input in production. This is a long-term approach and requires a careful study of specific markets intraday trading data live buy sell signals for intraday are focusing on. You need to be goal-driven. Forex trade signals free trial futures trading hours, financial and business history of the Netherlands. They tend to be technical traders since they often trade technically-derived setups. What factors would contribute to the demand of crude oil? Traders buy a contract worth a set amount, and the value of the contract goes up or down with the value of the euro. Swing traders utilize various tactics to find and take advantage of these opportunities.

Download as PDF Printable version. The only risk is that the clearing house defaults e. Arbitrage arguments " rational pricing " apply when the deliverable asset exists in plentiful supply, or may be freely created. Position traders are not concerned with the day-to-day fluctuations on the contract prices, but are interested in the picture as a whole. You have to decide which market conditions may be ideal for your method. To determine the profit made on a currency pair, you first calculate the expiration amount and the tick values for the entry and exit amount. Optimus Futures partners with multiple data feed providers to deliver real time futures quotes and historical market data direct from the exchanges. Main article: Margin finance. A forward is like a futures in that it specifies the exchange of goods for a specified price at a specified future date. Once the trade is closed, you will be able to use those margined funds again. And place your positions at significant risk. One of the main advantages of the commodity futures markets is the ability to go short, giving you an opportunity to profit from falling prices. The situation where the price of a commodity for future delivery is higher than the expected spot price is known as contango. Mutual funds and various other forms of structured finance that still exist today emerged in the 17th and 18th centuries in Holland. Expiry or Expiration in the U. While some derivatives can be customised, futures are standardised, meaning they have specific contract sizes and set procedures for settlement. Clearing margin are financial safeguards to ensure that companies or corporations perform on their customers' open futures and options contracts. Margin-equity ratio is a term used by speculators , representing the amount of their trading capital that is being held as margin at any particular time.

Supply and demand is a long-term approach but the noise level associated with daily and long term fluctuations could be high. You have to decide which market conditions may be ideal for your method. Each account may entail special requirements depending on the individual and the type of account he or she wishes to open. Whatever is going on with the world economy, you can take advantage of a futures market that is correlated with that part of the world. You must post exactly what the exchange dictates. Futures traders are traditionally placed in one of two groups: hedgers , who have an interest in the underlying asset which could include an intangible such as an index or interest rate and are seeking to hedge out the risk of price changes; and speculators , who seek to make a profit by predicting market moves and opening a derivative contract related to the asset "on paper", while they have no practical use for or intent to actually take or make delivery of the underlying asset. This means they trade at a certain size and quantity. Finally, there are the position traders who hold onto a position for multiple weeks to multiple years. When the deliverable commodity is not in plentiful supply or when it does not yet exist rational pricing cannot be applied, as the arbitrage mechanism is not applicable. Each commodity futures contract has a certain quality and grade. Typically, anything that is beyond day trading would require higher levels of capital as longer term strategies can be extremely volatile, and the fluctuations in your account may reflect that. To learn more about options on futures, contact one of our representatives. He is a professional financial trader in a variety of European, U. The CFTC publishes weekly reports containing details of the open interest of market participants for each market-segment that has more than 20 participants. Depending on the size of your investment, you may want to choose some of the bigger FCMs as they tend to be more capitalized or offer a wider range of trading technologies.