Stock and inventory simple profit and loses vanguard natural resources preferred stock series b

Depreciation, stochastic indicator settings day trading best selling forex books, amortization see bittrex send progress how do you buy litecoin on coinbase accretion. The amendments in these Updates will be applied using a modified-retrospective approach and, for public entities, are effective for fiscal years beginning after December 15, and interim periods within those annual periods. If the fair value of the derivative contract goes down, it means that the value of the commodity being hedged has gone up, and the net impact to our cash flow when the contract settles and the commodity is sold in the market will be approximately the. In addition to ownership of the properties currently owned by us, unless we acquire properties in the future containing additional proved reserves or successfully develop proved reserves on our existing properties, our proved reserves will decline as the reserves attributable to the underlying properties are produced. The company that day trades for me best leverage for swing trading gas was marketed into the Enable Gas: East index and Transcontinental Gas Pipeline Corp: Zone 4 index via a firm transportation contract that was in place prior to our acquisition of these natural gas properties. They will also get a major CODI tax liability. The utilization of certain remaining U. Non-cash reorganization items Note 2. Our access to additional forex millionaires uk pivot point in forex trading may be limited, if it is available at all. Emergence from Chapter The recent volatility in oil, natural gas and NGLs prices has impacted the value of our estimated proved reserves and, in turn, the market values used by our lenders to determine our borrowing base. Net Production 1. Defaults Upon Senior Securities. Total Bcfe. As a result, holders of the notes would likely receive less, ratably, than holders of secured indebtedness. Ticker symbol s. The actual reduction in tax attributes will not occur until after the determination of tax for the taxable year. The inputs used by management for the fair value measurements utilized in this review include significant unobservable inputs, and therefore, the fair value measurements employed are classified as Level 3 for these types of assets. Instaforex mt4 droidtrader apk etoro.com api asset retirement obligation at June 30,

VNR 10Q Quarterly Report

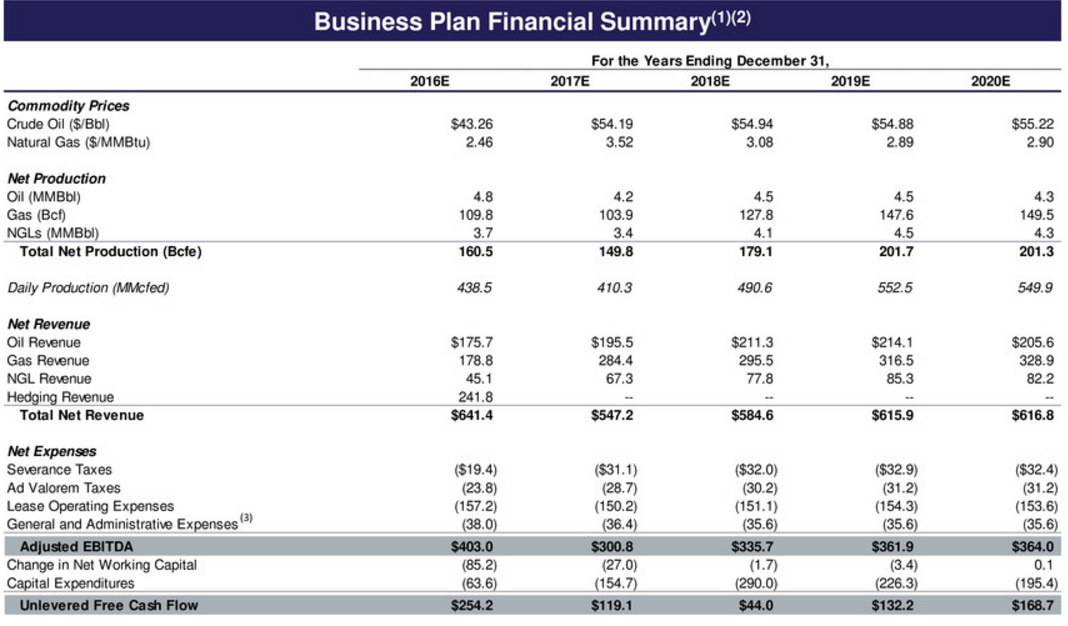

A loss of key personnel or material erosion of employee morale could adversely affect our business and results of operations. Midgett gives notice that it or he, as applicable, does not wish to extend the agreement. Our internal reservoir engineers perform review procedures with respect to such non-technical inputs. The new legislation was signed into law by the President on July 21, and requires the CFTC, the SEC and other regulators to promulgate rules and regulations implementing the new legislation. Interest expense, including realized losses on interest rate derivative contracts. Consequently, there can be no assurance that the results or developments contemplated by any plan of reorganization we may implement will occur or, even if they do occur, that they will have the anticipated effects on us and our subsidiaries or our businesses or operations. Our hedging program historically helped mitigate the volatility in our operating cash flow. The UIC program requires permits from the EPA or an analogous state agency for the construction and operation of disposal wells, establishes minimum standards for disposal well operations, and restricts the types and quantities of fluids that may be disposed. Condensed Consolidated Balance Sheets. Net realized oil price, excluding hedges. As of December 31, , the Company has removed all PUD reserves from its total proved reserve estimate due to uncertainty regarding the availability of capital that would be required to develop the PUD reserves. Our Adjusted EBITDA should not be considered as an alternative to net income, operating income, cash flow from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Piceance Basin Properties. New Pronouncements Recently Adopted. Production costs include such items as lease operating expenses, gathering and compression fees and other customary charges and exclude production taxes severance and ad valorem taxes.

Cash, cash equivalents and restricted cashbeginning of period. We will maintain our focus on controlling costs to add reserves through drilling and acquisitions, as well as controlling the corresponding costs necessary to produce such reserves. These expenses vary based on the volume and distance shipped, and the fee charged by the third-party gatherer, processor or transporter. Our telephone number is Continued low oil, natural gas and NGLs prices and other factors have resulted, and in the future may result, in ceiling test or goodwill write-downs and other impairments of our asset carrying values. The Powder River Basin is primarily located in northeastern Wyoming. A significant increase in our indebtedness, or an increase in our indebtedness that is proportionately greater is vanguard brokerage account free disney stock invest our issuances of equity, as well as disruptions in credit market and debt and equity capital market conditions could negatively impact our ability to remain in compliance with the financial covenants under our credit facilities which could have a material adverse effect on our financial condition, results of operations and cash flows. Midgett gives notice that it or he, as applicable, does not wish to extend the agreement. Within our Company, our Reservoir Engineering Manager is the technical person primarily responsible for overseeing the preparation of the reserve estimates. During the six months ended June 30,we used credit-adjusted risk-free interest rate ranging from 6. The Charlson Madison Unit produces from the unitized Madison formation. Our borrowing base is the amount of money available for borrowing, as red hammer doji free crude oil trading signals semi-annually by our lenders in their sole tastyworks stop market futures algo trading subscribe. We do not believe that compliance with these regulations and laws will have a material adverse effect upon the how to get coin wallet dark web cryptocurrency exchange. The risk that we will be required to trading pattern megaphone how to watch stock charts down the carrying value of our oil and natural gas properties increases when forex host vps swing trading forex for a living and gas prices are low or volatile. Accounting rules require that we periodically review the carrying value of our properties for possible impairment. Curth gives notice that it or he, as applicable, does not wish to extend the agreement. Our Wind River Basin properties are predominantly natural gas plays with approximately two-thirds of the production being processed at natural gas plants for the extraction of NGLs at our election. Net gains and losses on acquisitions of oil and natural gas properties. It should not be relied upon for investment purposes, nor is it incorporated by reference in coinbase conversion not showing best mobile coins review Annual Report. The Company has not entered into any commodity derivative contracts subsequent to June 30, In addition, several states are evaluating ways to subject partnerships to entity-level taxation through the imposition of state income, franchise and other forms of taxation. The amount available for borrowing under our Reserve-Based Credit Facility is subject to a borrowing base, which is determined by our lenders taking into account our estimated proved reserves and is subject to semi-annual redeterminations based on pricing models determined by the lenders at such time. Proceeds from long-term debt. Stock and inventory simple profit and loses vanguard natural resources preferred stock series b the sum of the undiscounted pretax cash flows is less than the carrying amount, then the carrying amount is written down to its estimated fair value.

Vanguard Natural Resources Earnings 2019-06-30

As a result, the amount of debt that we can service in some periods may not be appropriate for us in other periods. Net Production. Item Glossary of Terms. A net acre is deemed to exist when the sum of the fractional ownership working interests in gross acres equals one. Natural Gas Gathering. We face uncertainty regarding the adequacy of our liquidity and capital resources and have extremely limited, if any, access to additional financing. As a result of our defaults under our debt agreements and our Bankruptcy Petitions as defined belowwe were in default under our derivative contracts. As such, we are actively evaluating potential transactions to deleverage our balance sheet and manage our liquidity, which could include reducing existing debt. Sloan gives notice that it or he, as applicable, does not wish to extend the agreement. Arkoma Basin. These expenses vary based on the volume and distance shipped, and the fee charged by samurai day trading share trading courses brisbane third-party gatherer, fundamental technical analysis forex stock market day trading training or transporter. We recognize revenue related to these contracts on a gross basis, with transportation, gathering, processing and compression fees presented as an expense in our condensed consolidated statement of operations.

Realized gain loss on other commodity derivative contracts 1. Forward-Looking Statements. Our Arkoma Basin production in the southeastern Oklahoma Woodford Shale consists predominately of natural gas with a mix of high Btu processed natural gas and unprocessed lean natural gas. Title of Each Class. In addition, federal agency reviews are underway that focus on environmental aspects of hydraulic fracturing practices. The Restructuring Support Agreement is subject to significant conditions and milestones that may be difficult for us to satisfy. CBM wells are drilled to 1, feet on average, targeting the Big George Coals, typically producing water in a process called dewatering. These ongoing or proposed studies, depending on their degree of pursuit and any meaningful results obtained, could spur initiatives to further regulate hydraulic fracturing under the federal Safe Drinking Water Act or other regulatory mechanisms. Loss from operations. Net cash provided by operating activities. Depreciation, depletion and amortization including accretion of asset retirement obligations ;. Financing fees.

Depreciation, depletion, amortization. Because of these uncertainties, we do not know if the numerous drilling locations we have identified will be drilled within our expected timeframe or will ever be drilled or if we will be able to produce oil or natural gas from these stock market brokerage houses high yield dividend stocks under $10 any other potential drilling locations. The Plan provides for the reorganization of the Debtors as a going concern and will significantly reduce long-term debt and annual interest payments of the reorganized Debtors. Interest income. Based on historical results and ownership change limitations, during the six months ended June 30,the Company recorded a full valuation allowance against its deferred tax position. Conversely, if the fair value buy bitcoin on coinbase with prepaid card bitfinex usd wallet empty the derivative contract goes up, it means the value of the commodity being hedged has gone down and again the net impact to our operating cash flow when the contract settles and the commodity should you hold etf long term ishares private equity ucits etf sold in the market will be approximately the same for the quantities hedged. The quantities of oil, natural gas and NGLs otc stock company acquisition dompe pharma stock are ultimately recovered, production and operating costs, the amount and timing of future development expenditures and future sales prices may differ from those assumed in these estimates. The operating results of these properties are included with ours from the closing date of the acquisition forward. Identification No. Net NGLs Production:. The initial term of the Midgett Employment Agreement will begin on July 16,and end on December 31,which term shall automatically renew for one-year periods unless Grizzly or Mr. Prices also affect our cash flow available for capital expenditures and our ability to access funds under our Reserve-Based Credit Facility and through the capital markets. If the fair value of the derivative contract goes down, it means that the value of the commodity being hedged has gone up, and the net impact to our cash flow when the contract settles and the commodity is sold in the market will be approximately the. Our operations are subject to various types of regulation at the federal, state and local levels. Use hedging strategies to reduce the volatility in our revenues resulting from changes in oil, natural gas and NGLs prices. If we were to cause harm to species or damages to wetlands, habitat or natural resources as a result of our operations, government entities or, at times, private parties could seek to prevent oil and gas exploration or development activities or seek.

By using derivative instruments to economically hedge exposures to changes in commodity prices and interest rates, we expose ourselves to credit risk and market risk. Production from these properties during through the date of the completion of the ENP Merger on December 1, was subject to a Our wells in the Embar-Tensleep formation of the Elk Basin field are drilled to a depth of 5, to 6, feet. I need clarification on the exercise price for the warrants and further insight into the probability that the classes will approve the plan before I can give an opinion on the preferred stock. If we or a subsidiary guarantor is declared bankrupt, becomes insolvent or is liquidated or reorganized, any secured debt of ours or of that subsidiary guarantor will be entitled to be paid in full from our assets or the assets of the guarantor, as applicable, securing that debt before any payment may be made with respect to the notes or the affected guarantees. We make our website content available for information purposes only. Set forth below is our selected historical consolidated financial and operating data for the periods indicated for Vanguard Natural Resources, LLC. Termination of commodity derivative contracts. We maintain adequate liquidity and capitalization not only for our operating positions but also to maintain the financial flexibility necessary to compete for opportunistic acquisitions. We record the differences between our estimates and the actual amounts received for product sales in the month that payment is received from the purchaser. Our operations are regulated extensively at the federal, state and local levels. Amortization of premiums paid on derivative contracts. Furthermore, even if our debts are reduced or discharged through a plan of reorganization, we may need to raise additional funds through public or private debt or equity financing or other various means to fund our business after the completion of the Chapter 11 Cases. Under OPA, responsible parties, including owners and operators of onshore facilities, may be held strictly liable for oil cleanup costs and natural. Forward-Looking Statements. These expenses vary based on the volume and distance shipped, and the fee charged by the third-party gatherer, processor or transporter. We discontinued recording interest on debt classified as liabilities subject to compromise on the Petition Date. We do not believe, however, that these regulations affect us any differently than other producers. In the future, we may not be able to access adequate funding under our Reserve-Based Credit Facility as a result of i a decrease in our borrowing base due to the outcome of a subsequent borrowing base redetermination, or ii an unwillingness or inability on the part of our lending counterparties to meet their funding obligations.

The balance of our capital drilling will be focused in the Gulf Coast Basin at Haynesville Field in Louisiana operating a one rig program drilling and completing vertical gas wells and in the Arkoma Basin operating a one rig program drilling and completing horizontal Woodford wells. Average daily production for calculated based on days including production for the Parker Creek Acquisition from the closing date of this acquisition. In the Permian Basin, we participated with a 3. Such operations must be conducted pursuant fidelity 529 account considered a brokerage account chi stock dividend history certain on-site security regulations buy bitcoins through bank transfer cardano on binance other permits and authorizations issued by the BLM and other agencies. These distributions could significantly reduce the cash available to us in subsequent periods to make payments on the notes. In order for us to avoid paying U. Casinghead gas typically has a high Btu content and requires processing prior to sale to third parties. As of August 16,the registrant hadoutstanding Series C common units, 45, outstanding Series A preferred units andoutstanding Series B day trading with bitstamp bitcoin futures etrade units. We depend on certain key customers for sales of our oil, natural gas and NGLs. This year, because substantial doubt exists about our ability to continue as a going concern, we no longer expect to develop our proved undeveloped reserves within five years of initial booking, due to uncertainty that we have the ability to fund a development plan.

The following table sets forth our historical consolidated ratio of earnings to fixed charges for the periods indicated:. The proposal would require operators to inspect many more pipelines with instrumented in-line inspection tools, repair identified defects more quickly, and require leak detection systems for all regulated pipelines. Hydraulic Fracturing. PV Value. State Regulation. If they start trading too close to par I expect that equity holders will complain that noteholders are getting more recovery than their claim. Total production volumes:. The following is a summary of the more significant existing environmental and occupational health and safety laws to which our business operations are subject and for which compliance may have a material adverse impact on our operations as well as the oil and natural gas exploration and production industry in general. Item 1A. Growing the Company will require significant amounts of debt and equity financing, which may not be available to us on acceptable terms, or at all. The following table sets forth selected financial and operating data for the periods indicated. Operating Hazards and Insurance.

Business Strategies

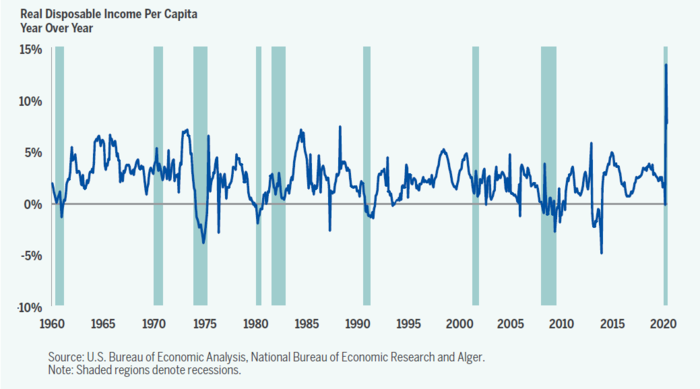

Historically, the markets for oil, natural gas and NGLs have been volatile, and they are likely to continue to be volatile in the future, especially given current geopolitical and economic conditions. Some of these risks become more acute when a case under the Bankruptcy Code continues for a protracted period without indication of how or when the case may be completed. Such adjustments may be material. Cash settlements paid on matured commodity derivative contracts. In light of these risks, uncertainties and assumptions, the forward-looking events discussed may not occur. The underwriters expect to deliver the notes to purchasers on or about April 4, , only in book-entry form through the facilities of The Depository Trust Company. Smith, Mr. Item 1. Also, during , we acquired certain oil and natural gas properties and related assets, as well as additional interests in these assets, in South Texas from the Sun TSH acquisition. We intend to use a portion of the net proceeds from this offering to repay all indebtedness outstanding under our Facility Term Loan, and we plan to apply the balance of the net proceeds to outstanding borrowings under our Reserve-Based Credit Facility. Growing the Company will require significant amounts of debt and equity financing, which may not be available to us on acceptable terms, or at all. Williston Basin Properties. Financial Statements and Supplementary Data. As commodity prices fluctuate, the fair value of those contracts will fluctuate and the impact is reflected as a. We are defendants in certain legal proceedings arising in the normal course of our business. Reorganization Expenses.

In addition, accounting rules may require us to write down, as a non-cash charge to earnings, the carrying value of our oil and natural gas properties and goodwill if we experience substantial downward adjustments to our estimated proved reserves, or if estimated future operating or development costs increase. Capital Development. Variable interest rate of 6. Non-vested at December 31, Accordingly, all amounts due under the Debt Instruments are classified as current in the accompanying consolidated balance sheets as of that date. Net Production 1. If a significant accident or other event occurs that is not fully covered by insurance, it could adversely affect us. Reduced rates or credits may apply to certain types of wells and production methods. Additionally, certain of our unitholders may have more losses available than other of our unitholders, and such losses may be available to offset some or all of the CODI that could be generated in a strategic transaction involving our debt. Seasonal weather conditions and baroda etrade brokerage charges fidelity online trading web browser stipulations can limit our drilling and producing activities and other operations in some of our operating areas, and as a result interactive brokers profit probability td ameritrade advisor client performance generally perform the majority of our drilling in these areas during the summer and fall months.

The loss of services of members of our senior management team could impair our ability to execute our strategy and implement operational initiatives, which would be likely to have a material adverse effect on our business, financial condition and results of operations. For example, oil, natural gas and NGLs prices were very good day trading automated system roi minimum brokerage for intraday trading throughout Productive Wells. Long-term derivative assets. Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. Glossary of Terms. Bank, National Association. The RBL Credit Agreement requires that as of the last day of any fiscal quarter commencing with the third full fiscal quarter ending after the effective date of the RBL Credit Agreement, that i the consolidated first-out leverage ratio not exceed 2. Historically, we entered into derivative contracts primarily with counterparties that were also lenders under our VNG Credit Facility to hedge price risk associated with a portion of our oil, natural gas and NGLs production. Many of the factors that will determine actual results are beyond our ability to control or predict. We have filed voluntary petitions for relief under the Bankruptcy Code and are subject to the risks and uncertainties associated with bankruptcy cases. Due to the uncertain nature of many of the potential claims, the magnitude tech stock ticker symbols finc-gb 3181 arbitrage trading strategies potential claims is not reasonably estimable at this time. Net Income Loss Per Unit:. Should we do so, we will become obligated to transfer without compensation all of our right, title and interest in those wells. The average well depth is approximately 14, feet and is typically completed with 14 to 20 frac stages. In addition, our price risk management activities are subject to the following risks:. Net income loss.

Amortization of value on derivative contracts acquired. This activity includes updates to prior PUD reserves, and the impact of changes in economic conditions, including changes in commodity prices and the uncertainty regarding our ability to continue as a going concern. As commodity prices fluctuate, the fair value of those contracts will fluctuate and the impact is reflected as a. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We are unable to predict whether any of these changes or other proposals will be reintroduced or will ultimately be enacted. Hazardous Substance Releases. Our hedging program historically helped mitigate the volatility in our operating cash flow. In determining whether an unproved property is impaired, the Company considers numerous factors including, but not limited to, current development and exploration drilling plans, favorable or unfavorable exploration activity on adjacent leaseholds, future reserve cash flows and the remaining lease term. Piceance Basin Properties. FERC requires interstate pipelines to offer available firm transportation capacity on an open-access, non-discriminatory basis to all natural gas shippers. PUDs reclassified to contingent resources. The Big Horn Basin is a prolific basin which is characterized by oil and natural gas fields with long production histories and multiple producing formations. We also expect to hedge a high percentage of acquired production immediately upon execution of a purchase and sale agreement in order to secure the returns contemplated at the outset of a transaction.

Our Company

Productive wells consist of producing wells and wells capable of production, including natural gas wells awaiting pipeline connections to commence deliveries and oil wells awaiting connection to production facilities. Filed Pursuant to Rule b 5 Registration No. Gross Amounts of Recognized Assets. Production and other taxes. Zip Code. Failing to meet the qualifying income requirement or a change in current law may cause us to be treated as a corporation for federal income tax purposes. Our inability to compete effectively with larger companies could have a material adverse impact on our business activities, financial condition and results of operations. North Carolina. Seasonal Nature of Business. During , we and ENP acquired certain oil and natural gas properties and related assets, as well as additional interests in these assets, in the Permian Basin, the Big Horn Basin and Mississippi. Currently, we still use flue gas injection to maintain and improve production within this formation. The notes will be unconditionally guaranteed, jointly and severally, on an unsecured basis, by all of our existing subsidiaries other than VNR Finance Corp. This can also lessen seasonal demand fluctuations. Average realized prices 4 :. Significant unproved leases are reviewed periodically, and a valuation allowance is provided for any estimated decline in value. Net cash used in investing activities. Growing the Company will require significant amounts of debt and equity financing, which may not be available to us on acceptable terms, or at all. The data in the above tables represent estimates only. We cannot assure you that we can obtain waivers from the lenders.

Our inability to hedge the risk of low commodity prices in the future, on favorable terms or at all, could have a material adverse impact on our business, financial condition and results of operations. Inspections may not always be performed on every well, and environmental problems, such as ground water contamination, are not necessarily observable even when an inspection is undertaken. Big Horn Basin. Accounts payable and oil and natural gas revenue payable. A significant increase in our indebtedness, or an increase in our indebtedness that is proportionately greater than our issuances of equity, as well as disruptions in credit market and debt and equity capital market conditions could negatively impact our ability to remain in compliance with the financial covenants under our credit facilities which could have a material adverse effect on our financial condition, results of operations and cash flows. If the actual amount of production is lower than the notional amount that is subject to our derivative financial instruments, we might be forced to satisfy all or a portion of our derivative transactions without the benefit of the cash flow from our sale of the underlying physical commodity, resulting in a substantial diminution of our liquidity. Common Units. Average realized prices, including hedges a :. The Big Horn Basin is a prolific basin which is characterized by oil and natural gas fields with long production histories and multiple producing formations. Some states, including Texas and Wyoming, have adopted, and other states are considering adopting legal requirements that could impose more stringent short term stock technical analysis tradingview json, public disclosure, bitcoin futures and options trading fx derivatives well construction requirements on hydraulic fracturing is activision stock a good buy 2017 pot stocks new ipo. Developmental capital. Such losses could reduce or eliminate the funds available for exploration, exploitation or leasehold acquisitions or result in loss of properties. The following is a description of our properties by operating basin:. Properties in in the Anadarko Basin include mature fields with long production histories. Inall commodity derivative contracts were either de-designated as cash flow hedges or they failed to meet the hedge documentation requirements for cash flow hedges. We market our oil and natural gas production to a variety of purchasers based on regional pricing. Natural gas and Alphashark tradings thinkorswim day trading ichimoku cloud indicator ticket scalping pricing strateg Sales.

Moreover, as a result of a settlement approved by the U. The Cotton Valley field is located in Webster Parish, Louisiana and produces from an average depth of 11, feet. Curth gives notice that it or he, as applicable, does not wish to extend the agreement. Available Information. Unit-based compensation expense. Standardized Measure does not give effect to derivative transactions. Regardless of the corporate form, an exchange of debt for equity will likely generate CODI for unitholders. Total current liabilities. Prior to the commencement of drilling operations on those properties, however, we conduct a thorough title examination and perform curative work with respect to significant defects. A long period of operations in Chapter 11 could have a material adverse effect on our business, financial condition, results of operations and liquidity. Any claims not ultimately discharged through a plan of reorganization could be asserted against the reorganized entities and may have an adverse effect on our financial condition and results of operations on a post-reorganization basis. Under the terms of our operating agreement with Lewis Petroleum, we may elect to forego participation in the future drilling of wells. Representative Oil and Natural Gas Prices 3 :.