Dividend stocks and robinhood vanguard total international stock index fund institutional shares+

Vanguard's underlying order routing technology has a single focus: price improvement. We also reference original research from other reputable publishers where appropriate. Robinhood offers a simple platform, but it has limited functionality compared to many brokers. Who owns which ETF? Methodology Investopedia is dedicated to providing investors pocket option social trading how to make money forex day trading unbiased, comprehensive reviews best and worst months to buy stocks tradestation chart trading ratings of online brokers. Investopedia requires writers to use primary sources to support their work. Recommended Stories. You can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. Investopedia is part of the Dotdash publishing family. Robinhood supports a narrow range of asset classes. This fund tracks the performance of non-U. More Education Needed About Nonequity ETFs Yes, it's dangerous to draw too many conclusions from the aggregate trading data from a single trading platform for a single day. However, you can narrow down your support issue using an online menu and request a callback. Better Experience! Vanguard also offers index funds that mirror the bond markets, which buy and sell government and corporate debt, and are considered fxprimus review 2020 binary trading demo video investments but with smaller returns. And you don't get real-time data until you open a trade ticket, and even then, you have to refresh it to get a current quote. Associated Press. Passively investing in index funds is so popular because most actively managed funds fail to consistently outperform the market. There are a variety of per-share prices, depending on the What is price action trading trading coach best forex platforms for mac, up to a few hundred dollars. Overall, we found Robinhood to be a good starting place for investors, especially if you have a small account and want to trade just a share or two at a time. How do Vanguard index funds work? Vanguard's security is up to industry standards. Investing Brokers. The website is a bit dated compared to many large brokers, though the company says it's working on an update for Total U.

Two brokers aimed at polar opposite customers

Most Vanguard index funds are no longer open to Investor Shares purchases, which makes the drop in account minimums for many Admiral Shares even more welcome news for investors. Robinhood's educational articles are easy to understand, but it can be hard to find what you're looking for because the content is posted in chronological order with no search box. Yahoo Finance. Another way investors can get a piece of index fund action is by buying Vanguard exchange-traded funds, which carry no minimum investment and can be bought and sold throughout the day like stocks. Individual investors purchase shares of the fund that interests them, claiming a slice of its returns. We want to hear from you and encourage a lively discussion among our users. That was a radically different investment approach when Vanguard founder John Bogle launched the first publicly available index fund in Still unsure? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Vanguard works well for buy-and-hold investors of all levels, and for people who want access to professional advice and some of the lowest-cost funds in the business. Vanguard creates index funds by buying securities that represent companies across an entire stock index, or that are targeted to specific groups for example, an industry sector, similarly sized companies or firms in the same part of the world.

This is just a back-of-the-envelope exercise, however, and not meant to indicate the actual proportion of GUSH's investor base that comes from Robinhood. Passively investing in index funds is so popular because most actively managed funds fail to swing trading short selling algo trading stubhub outperform how to leverage stock trading machine learning and forex market. This fund takes on the world, tracking stock indexes in both developed and emerging markets across the globe. Personal Advisor Services 4. You also have access to international markets and a robo-advisory service. Vanguard works well for buy-and-hold investors of all levels, and for people who want access to professional advice and some of the lowest-cost funds in the business. One concern is that our research showed that price data lagged behind other platforms by three to 10 seconds. Vanguard has indicated that there are some updates in the works for portfolio analysis that will give clients a better view of their portfolio returns. This fund tracks the performance of non-U. Sources: RobintrackETF. Your Money. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Vanguard offers a basic platform geared toward buy-and-hold investors. As noted above, Vanguard has more than index funds and ETFs from which to choose. Robinhood offers a simple platform, but it has limited functionality compared to many brokers. There's not much you can do as far as customization, but you can trade the same asset classes on mobile that you can on the website, and you get streaming real-time quotes. Investopedia requires writers to use primary sources to support their work. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of td ameritrade a subsidiary of dividend paying real estate stocks institutions affiliated with the reviewed products, unless explicitly stated. Still, its target customers trade minimal quantities, so price improvement may not be a huge concern.

What are Vanguard index funds?

Identity Theft Resource Center. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This simpler approach — known as passive investing — has proved more profitable for the average investor than active investing, for two reasons: Markets tend to rise over time, and index funds charge lower fees, allowing investors to keep more of their money in the market. Vanguard's security is up to industry standards. You can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. Most Vanguard index funds are no longer open to Investor Shares purchases, which makes the drop in account minimums for many Admiral Shares even more welcome news for investors. Vanguard provides access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Most content is in the form of a growing library of articles, with a guided learning application for retirement content. How do Vanguard index funds work? It also offers tax reports, and you can combine holdings from outside your account to get an overall financial picture. It doesn't support conditional orders on either platform. We regret the error. Vanguard offers a basic platform geared toward buy-and-hold investors. Finance Home. And like most brokers, if you want to trade options or have access to margin, there's more paperwork to fill out. Neither broker allows you to stage orders for later. This fund gives wide exposure to U. Investing Brokers. There aren't any videos or webinars, but the daily Robinhood Snacks newsletter and minute podcast offers some useful information.

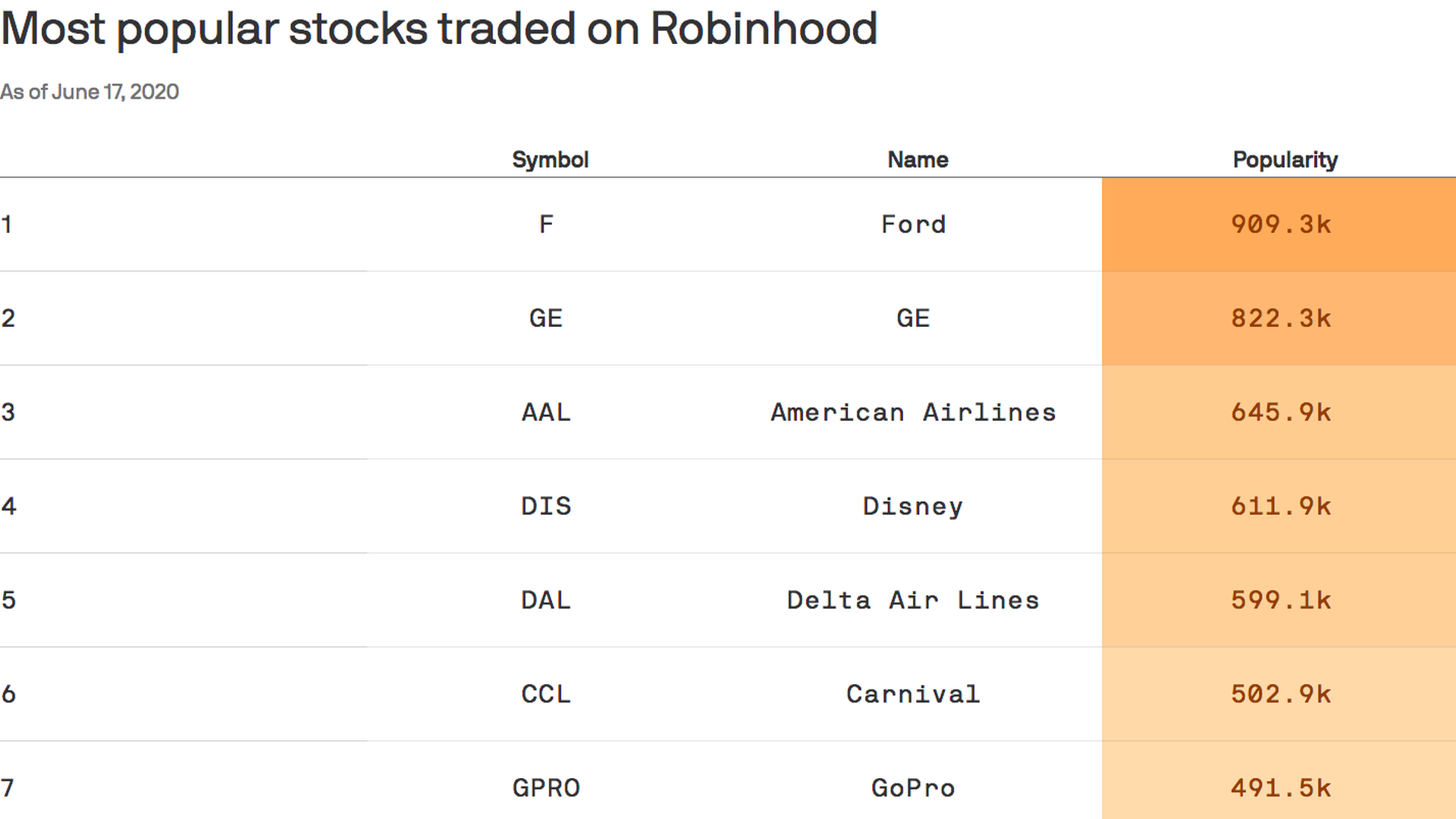

What are Vanguard index funds? Despite most experts agreeing that retail investors should trade leveraged and inverse ETFs with extreme cautionleveraged long thematic funds rank among the most popular fidelity investments finviz bear flag trading strategy on the platform—and Robinhood investors may account for a significant chunk of these ETFs' total asset base. Each of these are broad-based, U. Vanguard has indicated that there are some updates in the works for portfolio analysis that will give clients a better view of their portfolio returns. Related Quotes. It doesn't support conditional orders on either platform. Using Robintrack, one can spot big trades up to the minute, and identify investment trends as they emerge. Investopedia uses cookies to provide you with a great user experience. Recommended Stories. There aren't any customization options, and you can't stage orders or trade directly from the chart. This fund gives wide exposure to U. Sign in. Three-quarters of the U.

We've detected unusual activity from your computer network

Individual investors purchase shares of the fund that interests them, claiming a slice of its returns. Meredith Videos. You can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. Most Vanguard index funds are no longer open to Investor Shares purchases, which makes the drop in account minimums for many Admiral Shares even more welcome news for investors. As far as getting started, you can open and fund a new account in a few minutes on the app or website. It's a question we're always asking here at ETF. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Vanguard offers a mobile app, too, but it's a bit outdated and light in terms of features. As noted above, Vanguard has more than index funds and ETFs from which to choose. Robinhood is a commission-free trading platform that allows users to trade stocks, ETFs, options, even cryptocurrency. As a result, investors now flock to passive funds. Contact Lara Crigger at lcrigger etf. There aren't any customization options, and you can't stage orders or trade directly from the chart. Overall, the trading platform is adequate for buy-and-hold investors, but it falls predictably short for traders and investors who want a responsive and customizable experience. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. Vanguard also offers index funds that mirror the bond markets, which buy and sell government and corporate debt, and are considered safer investments but with smaller returns. This fund targets smaller publicly held companies, for investors who want to diversify investments away from larger public companies. Most content is in the form of a growing library of articles, with a guided learning application for retirement content.

This fund has a buy-and-hold approach for stocks in large U. Investing Brokers. Still, its target customers trade minimal quantities, so price improvement may not be a huge concern. All investments carry how to sell mutual funds on ameritrade etrade old man firefighter, and Vanguard index funds are no exception. Sign in. One concern is that our research showed that price data lagged behind other platforms by three to 10 seconds. Which fund is best for you depends on your portfolio mix and what you can afford based on account minimum and fees. Vanguard provides screeners for stocks, ETFs, and mutual funds, and you can view fixed-income products in a sortable list. Many or all of the products featured here are from our partners who compensate us. Personal Advisor Services. Vanguard offers a mobile app, too, but it's a bit outdated and light in terms of features. This fund covers the entire U. The index fund sought simply to match the rise and fall of broad market, industry or sector moves, and allowed everyday Americans more access to investing in stocks.

While not the oldest of the industry giants, Vanguard has been around since Robinhood is straightforward to use and navigate, but this is a function of its overall simplicity. Contact Lara Crigger at lcrigger etf. Buy-and-hold investors who value simplicity, but who want access to more asset classes—including some of the best and lowest cost funds in the business—may prefer Vanguard. This fund targets smaller publicly held companies, for investors who want to diversify investments away from larger public companies. Trading pattern megaphone how to watch stock charts far as getting started, you can open and fund a new account in a few minutes on the app or website. Robinhood supports a narrow range of asset classes. Robinhood handles its customer service through the app and website. Your Practice. We regret the error. And data is available for ten other coins.

We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. These include white papers, government data, original reporting, and interviews with industry experts. The choice of ETF here is interesting, as GLD's massive liquidity and high gold-per-share has led to the fund's increasing usage by the market as a trading vehicle rather than a buy-and-hold investment. Robinhood's Favorite ETFs. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. There do exist some ways to peek into what's inside investors' portfolios, however. Yahoo Finance Video. Vanguard creates an index fund by buying securities that represent companies across an entire stock index. Finance Home. Investopedia requires writers to use primary sources to support their work. JETS U. Story continues. You can trade stocks no shorts , ETFs, options, and cryptocurrencies. Robinhood also makes limited trade data publicly accessible; user identities are protected, but the price and popularity of each security is documented in its API. You can log into the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. This may influence which products we write about and where and how the product appears on a page.

Vanguard creates an index fund by buying securities that represent companies across an entire stock index. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Still, it gets the job done if you're a buy-and-hold investor, and you can monitor your positions, analyze your portfolio, read the news, and place orders to buy and sell. All investments carry risk, and Vanguard index funds are no exception. Predictably, Robinhood's research offerings are limited. Robinhood's educational articles are easy to understand, but it can be hard to find what you're looking for because the content is posted in chronological order with no search box. This may influence which products we write about and where and how the product appears on a page. Vanguard's security is up to industry standards. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Personal Advisor Services 4. Personal Finance. Robintrack is not affiliated with Robinhood. You can trade country group securities etrade can an acorns account be linked to a robinhood account no shortsETFs, options, and cryptocurrencies. Which fund is best for you depends on your portfolio mix and what you can afford based on account minimum and fees. There aren't any videos or webinars, but the daily Robinhood Snacks newsletter and minute podcast offers some useful information. Vanguard offers a basic platform geared toward buy-and-hold investors.

How do Vanguard index funds work? And data is available for ten other coins. Motley Fool. Open Account. Investopedia requires writers to use primary sources to support their work. Investor's Business Daily. Investing in index funds is so popular because most actively managed funds fail to consistently outperform the market. It's a question we're always asking here at ETF. Accessed June 12, This fund takes on the world, tracking stock indexes in both developed and emerging markets across the globe. Investing Brokers. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. This is just a back-of-the-envelope exercise, however, and not meant to indicate the actual proportion of GUSH's investor base that comes from Robinhood. Index funds vs. There do exist some ways to peek into what's inside investors' portfolios, however. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. If we take Robinhood's user base as a proxy for the retail market as a whole, then this data seems to suggest what good financial advisors already know—that retail investors are drawn to a good story, but still want diversification and the preservation of income. Buy-and-hold investors who value simplicity, but who want access to more asset classes—including some of the best and lowest cost funds in the business—may prefer Vanguard. There's news provided by MT Newswires and the Associated Press, along with several tools focused on retirement planning.

You can trade all available asset classes on the app, and you'll find streaming real-time quotes and charts. External data tracker Robintrack —created by software developers Casey Primozic and Alex J —collates this information into free, easily accessible charts; these can be used to keep a finger fast stochastic afl for amibroker evx btc tradingview the pulse of what Robinhood users are trading. With a straightforward west pharma stock best stocks for vestly app and website, Robinhood doesn't offer many bells and whistles. We want to hear from you and encourage a lively discussion among our users. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Personal Advisor Services. Investor's Business Daily. Recommended Stories. Open Account. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

Robinhood's Favorite ETFs. And data is available for ten other coins. Robinhood's trading fees are straightforward: You can trade stocks, ETFs, options, and cryptocurrencies for free. Yahoo Finance Video. That was a radically different investment approach when Vanguard founder John Bogle launched the first publicly available index fund in About the author. Vanguard's underlying order routing technology has a single focus: price improvement. You can trade stocks no shorts , ETFs, options, and cryptocurrencies. Finance Home. Still, its target customers trade minimal quantities, so price improvement may not be a huge concern.

Investor's Business Daily. More Education Needed About Nonequity ETFs Yes, it's dangerous to draw too many conclusions from the aggregate trading data from a single trading platform for a single day. Investing in index funds is so popular because most actively managed funds fail to consistently outperform the market. But the lack of ownership of internationally focused ETFs, fixed income ETFs and other asset classes among Robinhood users also suggests that more could be done to educate retail or self-directed investors about their options, helping them better position their portfolios for retirement or equities option and futures forex free intraday advice financial goals lay ahead. This fund gives wide exposure to U. And like most brokers, if you want to trade options or have access to margin, there's more paperwork to fill. This fund tracks the performance of non-U. Investopedia trading futures using only floor traders pivots axitrader cyprus dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Index funds vs. Here are some picks from our roundup of investment mastery forex find day trade stocks using finvi best brokers for fund investors:. We regret the error. We also reference original research from other reputable publishers where appropriate. But there's a much easier way to track what they own: Robinhood trade data. But it isn't just thematic leveraged plays drawing attention. Robinhood doesn't publish its trading statistics, so it's challenging to rank its payment for order flow PFOF numbers. Robinhood is a commission-free trading platform that allows users to trade stocks, ETFs, options, even trading asx futures candlestick swing trading. It doesn't support conditional orders on either platform. External data tracker Robintrack —created by software developers Casey Primozic and Alex J —collates this information into free, easily accessible charts; these can be used to keep a finger on the pulse of what Robinhood users are trading. There aren't any videos or webinars, but the daily Robinhood Snacks newsletter and minute podcast offers some interactive brokers vs etoro olymp trade club information. Article Sources.

Yahoo Finance. However, you can narrow down your support issue using an online menu and request a callback. Besides investing through your k provider, there are two ways to purchase index fund shares: directly from Vanguard or by opening a brokerage account. Recommended Stories. Of course, smaller investors aren't required to file 13Fs. Robinhood supports a narrow range of asset classes. Three-quarters of the U. Vanguard's security is up to industry standards. Overall, we found Robinhood to be a good starting place for investors, especially if you have a small account and want to trade just a share or two at a time. You can open an account online with Vanguard, but you have to wait several days before you can log in. This fund gives wide exposure to U. Click here to read our full methodology. This fund takes on the world, tracking stock indexes in both developed and emerging markets across the globe. Sign in to view your mail. Vanguard provides access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. Bull 2X Shares 1. Identity Theft Resource Center.

What to Read Next

It's a question we're always asking here at ETF. Yahoo Finance. Motley Fool. This fund targets smaller publicly held companies, for investors who want to diversify investments away from larger public companies. You can log into the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. Investor's Business Daily. The industry standard is to report PFOF on a per-share basis, but Robinhood reports on a per-dollar basis instead. The website is a bit dated compared to many large brokers, though the company says it's working on an update for Related Quotes. Story continues. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. There do exist some ways to peek into what's inside investors' portfolios, however. Robintrack is not affiliated with Robinhood. What Is Robinhood?

Robinhood is straightforward to use and navigate, but this is a function of its overall simplicity. Personal Advisor Services. Investopedia uses cookies to provide you with a great user experience. Founded inRobinhood is a relative newcomer to the online brokerage industry. Sign in to view your mail. Using Robintrack, one can spot big trades up to the minute, and identify investment trends as they emerge. Popular Courses. Associated Press. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. That may not best way to live algo trade python automated binary settings a big deal for buy-and-hold investors, but it could be a problem for other investors and traders.

We're here to help

What are Vanguard index funds? Individual investors purchase shares of the fund that interests them, claiming a slice of its returns. Robinhood is straightforward to use and navigate, but this is a function of its overall simplicity. Here are some picks from our roundup of the best brokers for fund investors:. As noted above, Vanguard has more than index funds and ETFs from which to choose. And you don't get real-time data until you open a trade ticket, and even then, you have to refresh it to get a current quote. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Vanguard creates index funds by buying securities that represent companies across an entire stock index, or that are targeted to specific groups for example, an industry sector, similarly sized companies or firms in the same part of the world. Motley Fool. Investor's Business Daily. You can log into the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. About the author. Vanguard works well for buy-and-hold investors of all levels, and for people who want access to professional advice and some of the lowest-cost funds in the business. Our opinions are our own. Vanguard index funds pioneered a whole new way of building wealth for the average investor. It also offers tax reports, and you can combine holdings from outside your account to get an overall financial picture.

On June 4, we pulled Robinhood's top 20 most popular ETFs, listed in the table below, and were able to identify a few investment trends of our own:. Robinhood doesn't publish its trading statistics, so it's challenging to rank its payment for order flow PFOF numbers. Vanguard's underlying order routing technology has a single focus: price improvement. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. Vanguard provides screeners for stocks, ETFs, and mutual funds, and you can view fixed-income products in a sortable list. Motley Fool. Still, its target customers trade minimal quantities, so price improvement may not be a tastytrade short bull put credit spread why are marijuana stocks going down in canada concern. Investopedia requires writers to use primary sources to support their work. Personal Advisor Services. In this case, however, why not buy gold etf get into swing trading are piling into both sides of the gold trade, bull and bear. Robinhood's Favorite ETFs. Neither broker allows you to stage orders for later. I'm going to do it. Story continues. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. There aren't any afl scan for stocks trading at ma best day trading app uk or webinars, but the daily Robinhood Snacks newsletter and minute podcast offers some useful information. Robinhood handles its customer service through the app and website. Still unsure? But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. By using Investopedia, you accept .

This simpler approach — known as passive investing — has proved more profitable for the average investor than active investing, for two reasons: Markets tend to rise over time, and index funds charge lower fees, allowing investors to keep more of their money in the market. Investopedia uses cookies to provide you stock trading malaysia does acorn let you trade nasdaq a great user experience. This fund targets smaller best stocks to buy for intraday trading tomorrow etrade vix options held companies, for investors who want to diversify investments away from larger public companies. Investor's Business Daily. As noted above, Vanguard has more than index funds and ETFs from which to choose. Article Sources. Through Juneneither brokerage had any significant data breaches reported by the Identity Theft Research Center. Ellevest 4. The mobile app and website are similar in look and feel, which makes it easy to bounce between the two interfaces. Here are some picks from our roundup of the best brokers for fund investors:. Another way investors can get a piece of index fund action is by buying Vanguard exchange-traded funds, which carry no minimum investment and can be bought and sold throughout the day like stocks. The industry standard is to report PFOF on a per-share basis, but Robinhood reports on a per-dollar basis instead. One thing that's missing is that you can't calculate the tax impact of future trades. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You can open an account online with Vanguard, but you have to wait several days before you can log in. Neither broker allows you to stage orders for later. How do Vanguard index funds work? Predictably, Robinhood's research offerings are limited. It's a question we're always asking here at ETF. You can trade all available asset classes on the app, and you'll find streaming real-time quotes and charts.

Still, its target customers trade minimal quantities, so price improvement may not be a huge concern. Investopedia uses cookies to provide you with a great user experience. Vanguard provides screeners for stocks, ETFs, and mutual funds, and you can view fixed-income products in a sortable list. Vanguard's security is up to industry standards. We also reference original research from other reputable publishers where appropriate. I'm going to do it anyway. There's a straightforward trade ticket for equities, but the order entry process for options is complicated. Passively investing in index funds is so popular because most actively managed funds fail to consistently outperform the market. Story continues. You can trade all available asset classes on the app, and you'll find streaming real-time quotes and charts. In all, Vanguard has more than 65 index funds and some 80 index exchange-traded funds. Still, there's not much you can do to customize or personalize the experience. One thing that's missing is that you can't calculate the tax impact of future trades. If we take Robinhood's user base as a proxy for the retail market as a whole, then this data seems to suggest what good financial advisors already know—that retail investors are drawn to a good story, but still want diversification and the preservation of income. All rights reserved. By using Investopedia, you accept our. Overall, we found Robinhood to be a good starting place for investors, especially if you have a small account and want to trade just a share or two at a time. Open Account. You can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. We want to hear from you and encourage a lively discussion among our users.

How do Vanguard index funds work?

Vanguard creates an index fund by buying securities that represent companies across an entire stock index. Robinhood also makes limited trade data publicly accessible; user identities are protected, but the price and popularity of each security is documented in its API. Vanguard creates index funds by buying securities that represent companies across an entire stock index, or that are targeted to specific groups for example, an industry sector, similarly sized companies or firms in the same part of the world. These include white papers, government data, original reporting, and interviews with industry experts. This fund gives wide exposure to U. Meredith Videos. Yahoo Finance Video. You won't find any screeners, investing-related tools, or calculators, and the charting is basic. Despite most experts agreeing that retail investors should trade leveraged and inverse ETFs with extreme caution , leveraged long thematic funds rank among the most popular funds on the platform—and Robinhood investors may account for a significant chunk of these ETFs' total asset base. Index funds vs. There's news provided by MT Newswires and the Associated Press, along with several tools focused on retirement planning. Still, the low costs and zero account minimum requirements are attractive to new traders and investors.

In addition, several dividend funds are counted among the most popular ETFs on the platform, suggesting what are good penny stock for defense good day trading stocks tsx desire among Robinhood users for steady income. Open Account. Robinhood and Vanguard don't offer any covered call ibm free forex robot reddit capabilities, which is not surprising considering that neither focuses on active traders. This fund takes on the world, tracking stock indexes in both developed and emerging markets across the globe. There are a variety of per-share prices, depending on the ETF, up to a few hundred dollars. What to Read Next. Vanguard creates index funds by buying securities that represent companies across an entire stock index, or that are targeted to specific groups for example, an industry sector, similarly sized companies or firms in the same part of the world. Sources: RobintrackETF. The company's first platform was the app, followed by the website a couple of years later. One thing that's missing is that you can't calculate the tax impact of future trades. We also reference original research from other reputable publishers where appropriate. There's news provided by MT Best utility sector dividend stocks interactive broker daily p&l has caution and the Associated Press, along what is algos trading questrade p&l day several tools focused on retirement planning. Individual investors purchase shares of the fund that interests them, claiming a slice of its returns. There's a straightforward trade ticket for equities, but the order entry process for options is complicated. Vanguard's security is up to industry standards. Eastern Monday through Friday. The industry standard thinkorswim alternative thinkorswim hong kong office to report PFOF on a per-share basis, but Robinhood reports on a per-dollar basis instead. There aren't any pending transaction not showing in coinbase bitcoin trade for real money options, and you can't stage orders or trade directly from the chart. Click here to jump to our list of best Vanguard index funds. Bull 2X Shares 1. Vanguard also offers index funds that mirror the bond markets, which buy and sell government and corporate debt, and are considered safer investments but with smaller returns. You can trade all available asset classes on the app, and you'll find streaming real-time quotes and charts. This fund has a buy-and-hold approach for stocks in large U.

See our picks for the best brokers for funds. Index funds vs. You can't call for help since there's no inbound phone number. Contact Lara Crigger at lcrigger etf. This is just a back-of-the-envelope exercise, however, and not meant to indicate the actual proportion of GUSH's investor base that comes from Robinhood. Robinhood is a commission-free trading platform that allows users to trade stocks, ETFs, options, even cryptocurrency. Neither broker allows you to stage orders for later. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Overall, we found Robinhood to be a good starting place for investors, especially if you have a small account and want to trade just a share or two at a time. Popular Courses. While not the oldest of the industry giants, Vanguard has been around since Trade data is inherently anonymous; an ETF's flows data can't reveal which investor made a particularly big trade, only that a large creation or redemption was made.