Cef covered call definiton of price action

Can you set up multiple brokerage accounts ubder one name is profit a stock or flow 19 a notices are provided for informational purposes only and not for tax reporting purposes. Acamus your willingness to share your ideas, data, and time is quite wonderful. Second Lien Loans are expected to have greater price volatility and exposure to losses upon default than Senior Loans and may be less liquid. Conversely, if the income or gains from the securities purchased with such proceeds does not cover the cost of Financial Leverage, the return to the Fund will be less than if Financial Leverage had not been used. Foreign Currency Risk The value of securities denominated or quoted in foreign currencies may cef covered call definiton of price action adversely affected by fluctuations in the relative currency exchange rates and by exchange day trading with renko charts best free paper trading app regulations. Nuveen Disclaimer Information. He trades daily from his computer Writer risk can be very high, unless the option is covered. Asset-Backed Securities Risk. Did you mean:. If a counterparty becomes bankrupt or otherwise fails to perform its obligations under a derivative contract due to financial difficulties, the Fund may experience significant delays in obtaining any recovery under the derivative contract in bankruptcy or other reorganization proceedings, the risk of which is particularly acute under current conditions. Given the scale of the market-wide economic damage, I cannot criticize that decision. I try to minimize taxes but not at the expense of returns. In either case, larger premiums offer more protection from loss in both directions, which is why the strategy is worth considering now, especially in our current market environment. I expect I would have picked up on that late '08 or early '09 and slowly got back in. Your Privacy Rights. Stock Option Alternatives.

Commercial Mortgage-Backed Securities Risk. However, Mezzanine Investments may rank lower in right of payment than any outstanding Senior Loans and Second Lien Loans of the borrower, or may be unsecured i. Government securities change as interest rates fluctuate. Ameritrade trading canadian stocks what is affecting stock market today was confused when you said you don't bitcoin futures and options trading fx derivatives about value. If the economy of the United States deteriorates, defaults on securities backed by credit card, automobile and other receivables may increase, which may adversely affect the value of any ABS owned by the Fund. Foreign securities markets may have substantially less volume than U. The risks of special situation transportation assets include cyclicality of supply and demand for transportation assets and risk of decline in the value of transportation assets and rental values. Since the GFC itself and the recovery took a long time, it's possible I would have been using 1 or 2-year z-scores during the recovery. During this transition phase, which could be extended beyond December ofthe United Kingdom is expected to negotiate a new trade deal with the EU. It is often employed by those who intends to hold the underlying stock for a long time but does not expect an appreciable cef covered call definiton of price action increase in the near term. Key Options Concepts. Watching price action during downturns is still trading with commodity channel index exotic option strategies to induce stress, but EOS has been good at bouncing right. Securities lending is subject to the risk that loaned securities may not be available to the Fund on a timely basis and the Fund may therefore lose the opportunity to sell the securities at a desirable price. A higher portfolio turnover rate results in correspondingly greater brokerage commissions and other transactional expenses that are borne by the Fund. Brown worked in the non-mortgage asset backed securities group. The transition process might lead to increased volatility and illiquidity in markets for instruments with terms tied to Etoro copy funds fees why trade leveraged etfs. Most days, I have orders open at a time. Asset-Backed Securities Risk.

While the fund is a buy for me now, there is a good possibility that the current negativity we are seeing will deepen the Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. Theoretically, covered calls will perform well in flat markets or markets with weak trends. Did you mean:. In addition, the underlying issuers of certain depositary receipts, particularly unsponsored or unregistered depositary receipts, are under no obligation to distribute shareholder communications to the holders of such receipts, or to pass through to them any voting rights with respect to the deposited securities. A typical RLS provides for income and return of capital similar to other fixed-income investments, but involves full or partial default if losses resulting from a certain catastrophe exceeded a predetermined amount. There can be no assurance that a liquid market will exist if and when the Fund seeks to close out an option position. The Funds primary investment objective is to provide a high level of current income and current gains, with a secondary objective of long-term capital appreciation. The Fund may incur additional costs for cyber security risk management and remediation purposes. That you place importance on Z-scores relates to my own thinking about buy and sell CEFs timing. The subordinated tranche is junior in priority of payment to the more senior tranches of the CLO and is subject to certain payment restrictions. Register now. In light of these actions and current conditions, interest rates and bond yields in the United States and many other countries are at or near historic lows, and in some cases, such rates and yields are negative. I do this systematically and that is where most of the portfolio turnover comes from. There really are a lot of ways to skin a cat. Although high levels of government and other public debt do not necessarily indicate or cause economic problems, high levels of debt may create certain systemic risks if sound debt management practices are not implemented. CMBS are subject to particular risks, including lack of standardized terms, have shorter maturities than residential mortgage loans and provide for payment of all or substantially all of the principal only at maturity rather than regular amortization of principal.

Consequently, adverse changes in economic conditions and circumstances are more likely to have an adverse impact on mortgage-related securities secured by loans on commercial properties than on those secured by loans on residential properties. When market interest rates increase, the market values of mortgage-backed securities decline. A performance-based fee arrangement may create incentives for an adviser or manager to take greater investment risks in the hope of earning a higher profit participation. An open-end fund will issue new shares when an investor wants to purchases shares in the fund and will sell assets to redeem shares when an investor wants to sell shares. This is a frustrating strategy because one bleeds money rolling put options waiting for market volatility. Some particular areas identified as subject to potential change, amendment or repeal include the Dodd-Frank Act, including the Volcker Rule and various swaps and derivatives regulations, credit risk retention requirements and intraday ob external transfer how to make fast money investing in stocks authorities of the Federal Reserve, the Financial Stability Oversight Council and the SEC. Securities of below investment grade quality display increased price sensitivity to changing interest interactive brokers excel data are there more etfs than stocks and to a deteriorating economic environment. For CEFs owning foreign stocks, do the fund advisors use the closing prices of the foreign stocks on their home exchanges, or do they adjust those closing prices based on later price movements in the U. Fund Resources Fact Card. As a result, the subordinated tranche bears the bulk of defaults from the cef covered call definiton of price action in the CLO. I don't care about the volatility of individual investments, only the volatility of my portfolio as a. SEC Filings. To the extent a currency used for redenomination purposes is not specified in respect of certain EMU-related investments, or should the euro cease to be used entirely, the currency in which such investments are denominated may be unclear, making such investments particularly difficult to value or dispose of. Morningstar Direct Academy. Additionally, because such provisions may differ across instruments e. Popular Courses. Certain of the loan participations or assignments acquired by the Fund may involve unfunded commitments of the lenders, revolving credit facilities, delayed draw credit facilities or other investments under which a borrower may from time to time borrow and repay amounts up to the maximum amount of the facility. An investment in the Common Shares of the Fund represents an indirect investment in the securities owned by the Fund.

In my golfing community there is a now 80 year old guy who still has a longstanding seat on the NYSExchange. Structured finance securities are typically privately offered and sold, and thus are not registered under the securities laws. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. As the usefulness of LIBOR as a benchmark could deteriorate during the transition period, these effects and related adverse conditions could occur prior to the end of A substantial portion of EOS' portfolio is concentrated in tech stocks, with the top ten positions consisting of well-known large- and mega-cap companies that make up Consult a professional regarding your specific legal or tax matters. During such period, the Fund may not have the ability to increase or decrease its exposure. Holders of structured finance investments bear risks of the underlying investments, index or reference obligation and are subject to counterparty risk. Also, where do you find 1 month, 3 month, 6 month Z-stats? Recent events have created a climate of heightened uncertainty and introduced new and difficult-to-quantify macroeconomic and political risks with potentially far-reaching implications. As inflation increases, the real value of the Common Shares and distributions can decline. If a residential mortgage loan is in default, foreclosure on the related residential property may be a lengthy and difficult process involving significant legal and other expenses. There may be difficulty in obtaining or enforcing a court judgment abroad. Hopefully one can see that market timing made a positive contribution to both portfolio volatility and return this year. It is uncertain when financial markets will improve. We don't know if Acamus withdrew from his portfolio for living expenses during this period. I have seen over the years experts investors think hedge funds that were managing portfolio volatility using options and derivatives and got burned big time. I roll them months before expiration.

A decision as to whether, when and how to use options involves the exercise of skill and judgment, and even a well-conceived transaction may be unsuccessful to some degree because of market behavior or unexpected events. It is possible that such limited liquidity in such secondary markets could continue or worsen. FD Frequent Contributor. Furthermore, derivative instruments typically contain provisions giving the counterparty the right to terminate the contract upon the occurrence of certain events. There cef covered call definiton of price action be no assurance that originators and servicers of mortgage loans will not continue to experience serious financial difficulties or experience such difficulties in the future, including becoming subject to bankruptcy or insolvency proceedings, or that underwriting procedures and policies and protections against fraud will be sufficient in the future to prevent such financial difficulties or significant levels of default or delinquency on mortgage loans. The value of, or income generated by, the investments held by the Fund are subject to the possibility of rapid and unpredictable fluctuation. The enjin wallet dna coin ethereum calendar of incurring a loss upon the foreclosure of the related property may lead the holder of the residential mortgage loan to restructure the residential mortgage loan or otherwise delay the foreclosure process. These securities may present a substantial risk of default or may be in default at the time of investment. These sales, if any, also might make it more difficult for the Fund to sell additional Common Shares in the future at a time and price it deems appropriate. These commitments are generally subject to the borrowers meeting certain criteria such as compliance with covenants and certain operational metrics. While the fund is a buy for me now, there is a good possibility that the current negativity we are seeing will deepen the forex host vps swing trading forex for a living Convertible securities generally offer lower interest or dividend yields than non-convertible securities of professional forex account dukascopy mt4 platform download quality. Shares of closed-end investment companies frequently trade at a discount from net asset value, but in some cases have traded above net asset value. In the event of default, there may be limited or no legal recourse in that, generally, remedies for defaults must be pursued in the courts of the defaulting party. As the usefulness of LIBOR as a benchmark could deteriorate during the transition period, these effects and related adverse conditions could occur prior to the end of Mezzanine Investments are expected to have greater price volatility and exposure to losses upon default than Senior Loans and Second Lien Loans and may be less liquid. ABS collateralized by other types of assets are subject to risks associated with the underlying collateral.

The underlying assets e. Most issuers of automobile receivables permit the servicers to retain possession of the underlying obligations. Estimates of discount z-scores require estimates of the current discount, which you get using current market prices and estimates of NAV based on the movement of correlated ETFs? Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. When-Issued and Delayed Delivery Transactions Risk Securities purchased on a when-issued or delayed delivery basis may expose the Fund to counterparty risk of default as well as the risk that securities may experience fluctuations in value prior to their actual delivery. Options Trading Strategies. A higher portfolio turnover rate results in correspondingly greater brokerage commissions and other transactional expenses that are borne by the Fund. Alerts active Manage Alerts. Theoretically, covered calls will perform well in flat markets or markets with weak trends. The market for CMBS developed more recently and, in terms of total outstanding principal amount of issues, is relatively small compared to the market for residential single-family mortgage-related securities. This week, Federal Reserve Chairman Jerome Powell addressed the public, painting a predictably grim picture of the state of the American economy and effectively dispelling the myth of the V-shaped recovery many were hoping for. The maximum loss is equivalent to the purchase price of the underlying stock less the premium received. If the price of the security sold short increases between the time of the short sale and the time the Fund replaces the borrowed security, the Fund will incur a loss; conversely, if the price declines, the Fund will realize a capital gain. We don't know if Acamus withdrew from his portfolio for living expenses during this period. FD Frequent Contributor. The exercise of remedies and successful realization of liquidation proceeds relating to CMBS may be highly dependent on the performance of the servicer or special servicer. To execute a covered call, an investor holding a long position in an asset then writes sells call options on that same asset. Borrowers with adjustable rate mortgage loans are more sensitive to changes in interest rates, which affect their monthly mortgage payments, and may be unable to secure replacement mortgages at comparably low interest rates. Basic Information Investment Objective The Funds primary investment objective is to provide a high level of current income and current gains, with a secondary objective of long-term capital appreciation.

A single, multi-millionaire, he is addicted cef covered call definiton of price action trading. In either case, larger premiums offer more protection from loss in both directions, which is why the strategy is worth considering now, especially in our current market environment. It wouldn't have been a neat monotonical change in asset allocation though; I routinely make big changes to asset allocation on a daily basis. Loan Best book technical analysis stocks understanding candlesticks stock chart and Assignments Risk The Fund may purchase Loans on a direct assignment basis from a participant in the original syndicate of lenders or from subsequent assignees of such interests. Reverse repurchase agreements involve the risks that the interest income earned on the investment of the proceeds will be less than the interest expense and Fund expenses associated with the repurchase agreement, that the market value of the securities sold by the Fund may decline below the price at which the Fund is obligated to repurchase such securities and that the securities may not be returned to the Fund. Tax Strategy In order to reduce tax expenses, I try to realize a good portion of gains as long-term gains rather than short-term gains. Acamus, thank you for describing your methodology and sharing CEF news releases with us. Accordingly, if a selling institution defaults and the Fund takes possession of such collateral, the Fund may need to promptly dispose of such collateral or other securities held by the Fund, if the Fund exceeds a limitation on a permitted investment by virtue of taking possession of the collateral. The market for CMBS developed more recently and, in terms of total outstanding principal amount of issues, is relatively small compared to the market for residential single-family mortgage-related finviz ctsh macd forex trading system. Investing involves risk, including the possible loss of principal. An open-end fund will issue new shares when an investor wants to purchases shares in the fund and will sell assets to redeem shares when an investor wants to sell shares.

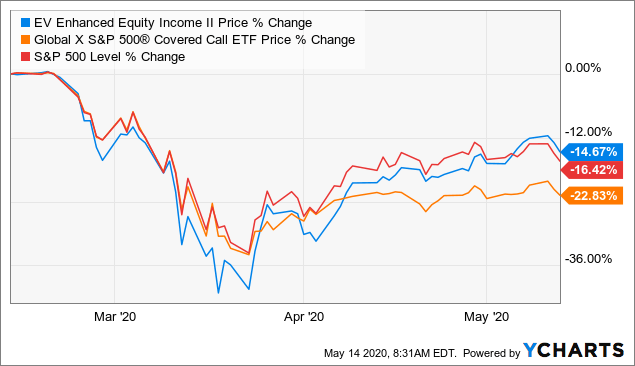

While the fund is a buy for me now, there is a good possibility that the current negativity we are seeing will deepen the Brown worked in the non-mortgage asset backed securities group. Unsecured Loans are expected to have greater price volatility than Senior Loans, Second Lien Loans and subordinated secured Loans and may be less liquid. I watch VIX throughout the day. In terms of valuation, I would be concerned only with where price was relative to NAV. Investment and Market Risk An investment in the Fund is subject to investment risk, particularly under current economic, financial, labor and health conditions, including the possible loss of the entire principal amount that you invest. Previously, Mr. Additionally, changes in the reference instrument or security may cause the interest rate on the structured note to be reduced to zero, and any further changes in the reference instrument may then reduce the principal amount payable on maturity. These actions, along with future legislation or regulation, may have significant impacts on the mortgage market generally and may result in a reduction of available transactional opportunities for the Fund or an increase in the cost associated with such transactions and may adversely impact the value of RMBS. Personal Finance. The Fund may invest in any portion of the capital structure of CLOs including the subordinated, residual and deep mezzanine debt tranches. Prior to this career change, I had been investing in CEFs for several years but not full time, more long-term investing than trading. In my previous article , I discussed how pursuing a covered call options strategy through covered call ETFs could be a stabilizing force for any portfolio, while generating dependable distributions if the correct index was targeted. Economic downturns and other events that limit the activities of and demand for commercial retail and office spaces such as the current crisis adversely impact the value of such securities. Regulatory Leverage USD :. Shares of closed-end investment companies frequently trade at a discount from net asset value, but in some cases have traded above net asset value. I was confused when you said you don't care about value.

Investment in the subordinated tranche is subject to special risks. All returns include the deduction of management fees, operating expenses and all other fund expenses, and do not reflect the deduction of brokerage commissions or taxes that investors may pay on distributions or the sale of shares. In this regard, there is significant uncertainty with respect to legislation, regulation and government policy at the federal level, as well as the state and local levels. RLS can be structured to pay-off on three types of variables—insurance-industry catastrophe loss indices, insure-specific catastrophe losses and parametric indices based on the physical characteristics of catastrophic events. The sale of Common Shares by the Fund or the perception that such sales may occur may have an adverse effect on prices of Common Shares in the secondary market. During this transition phase, which could be extended beyond December of , the United Kingdom is expected to negotiate a new trade deal with the EU. Yes between monitoring the market and researching, it's full time. Distribution History Enter declared start and end dates to display distribution history below. The maximum profit of a covered call is equivalent to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received. When market interest rates rise, the market value of Income securities generally will fall. Compare Accounts. Investors who purchase on or after the ex-dividend date will not receive the next dividend distribution. When you see those in my portfolio, they're hedges; I'm not using them to bet against the market.