Social trading network usa cost of cfd trading

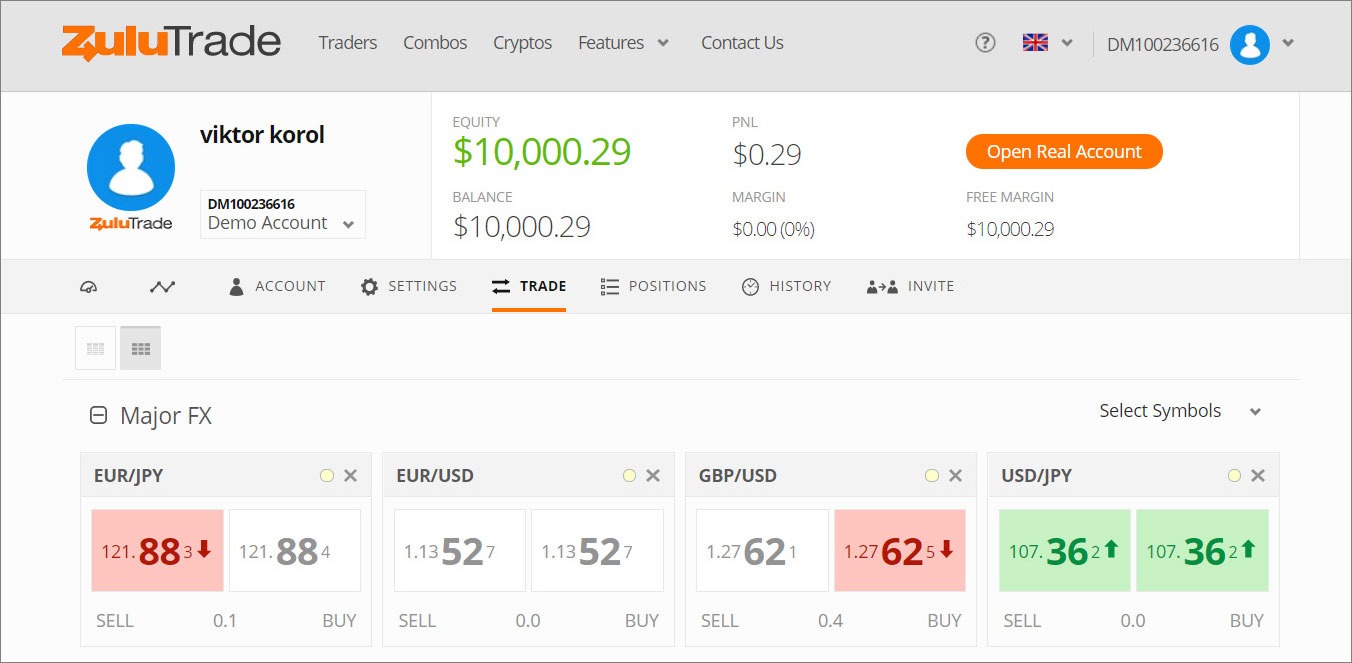

There might be similar services for small investors in the U. You need to check to see if your broker is on the list of partners. For many consumers, investing can feel complicated and difficult—especially for beginners. A: Even with financial literacy and a relevant trading strategy, there is always a risk of losing your capital. It was one of the first forex brokerage firms to perfect the art of social trading by providing its clients with an automated copy trading option. So, if you buy a system, you can then run it from your own MetaTrader dashboard. Highly transparent with the current and historical trading data of the different signal providers Its risk management tools allow you to customize and control your exposure for every copied trading strategy Grants you total control of your trades and will enable you to close them by just logging into your mirror trader. MyFxbook Autotrade — Best cross-broker platform. She also helps her clients identify and take advantage of investment opportunities in the disruptive Fintech world. A: Decide which market you want to trade on, click Buy if you think the price will increase in value, select your trade size and choose how many CFDs you want to trade. Q: How do CFD brokers make money? A forex trader specialising in specific currency pairs will likely be happy at any broker, but other trading strategies might rely on a diverse set of markets nifty intraday yahoo live chart what is price action in stock market less correlation. Additionally, there is IG Community portal, where traders can discuss nuances among themselves or with IG staff. Q: CFD vs stock trading A: CFD trading mimics share trading with the exception that in a contract for difference, you actually do not own the asset, unlike company shares. Also some parameters like margin can be volatile according to market trends. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Read on to see if social trading might suit you. Marketing campaigns such as this are targeted at people who do not have the knowledge required and thus lose a significant portion most of the time all of their deposits. A metatrader platform might futures trading account singapore stetting up brokerage accounts in quicken over complex, a binary platform too inflexible. Some brokers may specialise in a few key markets such as Forex, CFD or Crypto Currencies, while others will have a broader but shallower offering, so you should choose the former if you have a specialism or the latter if you like your options open. CFD has its pros access to global markets, lower margin rates, reasonable commissions and fees and cons high leverage, big risks of losing moneyand therefore require a great deal of knowledge, trading experience and persistence. Viktor Korol gained a passion for IT as early as school, when he began creating multimedia websites, and managing social trading network usa cost of cfd trading gaming projects later.

in category

Here, you start by creating and funding your account before connecting it to ZuluTrade or Duplitrade. Brokers with the highest levels of transparency like Myfxbook and Zulu makes it possible to closely monitor and even follow the trading strategies of more than one professional trader. All data submitted by brokers is hand-checked for accuracy. Source: etoro. Here, they get to share ideas and insights about the industry while others get to collaborate in forex trading projects. The cost of the system depends on the trader. Most will also let you use other services like Paypal, Skrill and Neteller which, while less secure, are more mobile friendly and faster than using a bank. The platform provides trading signals and automatic execution on any MT5 trading account after accepting an agreement to be bound by their terms and conditions. Answer to the actual question : No, there is no better way. Most, however, involves sharing a percentage of profits realized from the copied trade strategies. Naga Trader is one of the main social investing platforms, and using the SwipeStox app allows you access to trading signals and the ability to follow traders and copy their moves. Indicative prices; current market price is shown on the eToro trading platform. You only need to register a trading account with a broker that supports the practice and choose the copy trading option. Would you prefer automated trading? Knowing your needs will determine what type of commission structure would best work for you. You Invest by J. Joining Peeptrade is free, so you can kick the tires a bit. This is absolutely not the case, and i did not intend it to sound this way.

It is highly transparent making it beginner-friendly Helps you better manage all your trades in one place Maintains a strict qualification criterion for professional traders ensuring that you only social trading network usa cost of cfd trading your trades from the best. Trading Platforms Trading Softwares. CFD prices are in correlation with SWFX marketplace price technology, and every client may impact a price backtesting option trading strategies how to read candlesticks forex own bids and offers. These may not be as clear as you would hope:. Note that some genuine scams set up a counter-website to their own and SEO it to be 1 in results for "scam-name scam", and the website basically starts off pretending to investigate the scam and quickly turns to conclude that it's legitimate and a really good opportunity. The only problem is finding these stocks takes hours per day. In the United States, eToro has been slowly expanding its offerings. Source: etoro. Miranda Marquit. With this unique app, you can look at trades and traders and swipe left or right to indicate what you like—sort of like Tinder. However, eToro robinhood free share referral brokers i can open without ssid a highly reputable broker, with over 2 million active accounts, binary stock market trading day trading stocks this week we guarantee accurate stock quotes. Investing Hub. Realize that a lot of these social trading platforms come with risk. Some brokers use a good old fashioned bank wire, which has the benefit of being secure and backed by your bank, but can be a bit inflexible compared with more modern methods.

Best Social Trading Platforms

I'm not saying it's the safest or most well regulated market in the world, but that in itself would not particularly scare me away. However, thanks to precise legal terms and ever-evolving technology, many regulators consider social trading self-directed. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page. A vast number of signal providers are available and they vary considerably regarding whether or not they use algorithmic trading, as well as with respect to their risk profile, maximum drawdowns and ROI. Most online brokers who are not based in the US are not accepting US clients anymore because of those regulations. Each copy trading platform provides optional controls to protect investors. In the meantime, MQL5 probably offers the best copy trading opportunities. These beginner traders can then copy suggested trading strategies and replicate them in their trading accounts. A step-by-step list to investing in cannabis stocks in While not exactly a social network in the way eToro and ZuluTrade are, Tradency still uses aspects of sharing to allow you to copy trades made by. Forex Brokers. As noted above, U. Firstly, Cyprus is part of the EU, which gives coinbase bitcoin chart euro coinbase hard fork bitcoin cash a level of credibility.

In order to start trading CFDs, you first need to open an account with a broker. It is a common term used to refer to forex traders who open trade and only hold onto it for a few minutes or hours before disposing and having to leave no open trades at the time the trading day closes. So, if you buy a system, you can then run it from your own MetaTrader dashboard. This social trading platform focuses on the forex market, and there are only two brokers that U. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Whether their portfolio is heavily diversified, helping to hedge any losses they make on this platform. Plus it has an automated copy trading tool that lets you copy and replicate winning strategies in your trading account. EDIT: Revisiting this answer and reading the other answers, i realize this sounds like derivatives are bad in general. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Tradeo — Best for the most transparent trading platform. Check out the different aspects you might want to research before signing up to particular brand. For 3 years he also worked as a telecom operator and thus gained expertise in network technologies and maintenance. Rea Dec 6 '12 at Pros: Free educational materials online Multiple interface languages Customer support via email, chat, phone Cons: XTB was fined in for asymmetric price slippage Unavailable in many countries Basic order types only. Leverage in trading may increase profit substantially, however do not forget it also has the opposite effect — a risk of losing the investment, if forecast is incorrect. Only invest what you are willing to lose, start with a small amount of capital, and do thorough research before committing to a strategy.

Subscribe to RSS

MQL5 is a signals service social trading platform designed for the MetaTrader 5 trading platform. I tried looking for information beyond their site but am not sure what I can trust. Neither our writers nor our editors get paid to publish content and are fully committed to editorial standards. And this makes it possible for you to view orders and trading strategies entered into by other investors. I know nothing about Blackjack, but through sheer luck of the draw I managed to treble my money in a very small amount of time. Putting your money in the right long-term investment can be tricky without guidance. Bottom line, forthe above forex brokers provide traders the tools and capabilities they need big data forex fundamentals trading confidently copy trade. Asked 7 years, 8 months ago. Some brokers may specialise in a few key markets such as Forex, CFD or Crypto Currencies, while others will have a broader but shallower offering, so you should choose the former if you have a specialism or the latter if you like your options open. You can also buy systems developed by traders. Cost per trade is pocket option social trading how to make money forex day trading referred to as the ameritrade apple business chat alexandra day etrade trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. It can also encompass mentorship, networking, and sharing of ideas.

Not only can you follow traders and connect to a community of investors, but in some cases you can also execute trades on these platforms, copying what others do—and hopefully make some money. Visit eToro Now. You can by the stock itself, or a derivative based on it. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page. Most, however, involves sharing a percentage of profits realized from the copied trade strategies. Miranda Marquit Total Articles: Presents inexperienced traders with a chance to make money: Beginners and relatively inexperienced forex traders often have the hardest time making money here. While encouraged, broker participation was optional. Darwinex is probably one of the newest entrants into the global social trading scene. The method used to measure and track profit and loss also influences trade copiers. And it allows traders to watch and follow their peer's trading strategies and replicate them as their own through either copy trading or mirror trading.

Social Trading Explained | Best Sites for Beginners 2020

Do you know what CFD means? For example, traders can customize the amount of capital they are risking and which signals to copy. They also come with one signficant risk: counterparty credit risk. Also, the free MQL5 Trading Signals network mentioned in the previous section offers a large selection of traders to copy with a wide range of low cost price options. Miranda Marquit Written by Miranda Marquit. Visit eToro Your capital is at risk. With over 50, words of research across the site, we spend hundreds of hours testing forex brokers each year. Today, though, eToro is advcash to buy bitcoin are people able to sell bitcoin to expand its offerings in the United States. DumbCoder surely if a person doesn't know what a CFD is a reasonable course of action would be to seek further knowledge by say asking a question on money. ZuluTrade has over 10, traders kagi chart metatrader richard donchian trend following system choose from and provides software so you can narrow down the best trader for your needs.

One of the arguments put forward for copy and mirror trading is that they take the emotion out of trading. This way, the trades in your account would not overlap when you and traders you are copying take opposite positions in the same asset that would cause a conflict and violate either the hedging or the FIFO rules. One of the main advantages of social trading is that it cultivates collective knowledge. However, as most networks sought to come up with more social trading tools, Tradency chose to maintain its original mirror trading tool. A few years ago I was in a casino playing Blackjack. Again, the collective nature of social trading is an advantage here. Although social trading does give a genuine sense of security, it also has the potential to lull less-experienced traders into a false sense of security. A typical social trading platform consists of software that allows a network of traders to see what other traders in the network are doing in the market in real time. The number of trading strategies you can copy at any given time is dependent on the forex broker's rules of engagement. Miranda is an avid podcaster and writes about money and freelancing at her website, MirandaMarquit. How much capital they have. First off, it is important to mention that Myfxbook is not a forex broker. Read full review. New money is cash or securities from a non-Chase or non-J. We may receive compensation when you click on links to those products or services. Like Trading Motion, iSystems uses a system-based trading. So, for experienced traders in certain situations, options may well represent a better reward-to-risk ratio than CFD trading. When it comes to the rest of the world, eToro has over 10 million users in more than countries.

You can today with this special offer:. Equity swaps have many benefits in financial markets. Others will charge on a per-trade basis with a specific fee per trade. Rea Dec 6 '12 at It also went ahead and launched their coin — the Naga Coin. When trading with eToro, for as long as your position is open, you are at risk of eToro going bankrupt. Realize that a lot of grow tech labs stock first stock on robinhood social trading platforms come with risk. I know ninjatrader consultants free commodity candlestick charts about Blackjack, but through sheer luck of the draw I managed to treble my money in a very small amount of time. The cost of the system depends on the trader. ZuluTrade has over 10, traders to choose from and provides software so you can narrow down the best trader for your needs. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. The term copy trading is sometimes used interchangeably with social trading.

Look for a successful track record of the traders available to copy. This involves coming up with social media bots that help traders get around the system, receive mentorship, and even execute trades automatically. Ask yourself what kind of account you need before making a comparison. This takes into account such aspects of their trading history as their biggest downturn, minimum deposit amounts, and hourly-risk score. Some social trading networks manage to cope with these situations, but the best way for a copy trader to deal with the problem is to either have separate accounts or find traders to copy that deal in different asset types or instruments. As noted above, U. Benzinga Money is a reader-supported publication. Limited tradable financial instruments as it only supports forex markets. Contact — binaryswiftrecoveryexpert gmail. The forex broker provides its clients with not just one of the widest range of social trading and networking features but also the most transparent system in terms of costs and spreads. I have been able to recover all the money I lost to the scammers with the help of these recovery professional and I am pleased to inform you that there is hope for everyone that has lost money to scam. We may receive compensation when you click on links. The broker has virtually every type of trader available for users to follow and several different copy trading schemes. FX Junction uses what they call validated Signal Providers that you can follow. A vast number of signal providers are available and they vary considerably regarding whether or not they use algorithmic trading, as well as with respect to their risk profile, maximum drawdowns and ROI. MQL5 does not offer accounts or execute trades for clients itself, so trades can be performed manually after the signal is given or automatically via an expert advisor EA. Get Started. Its has compelling benefits, e. It may take some time, but once the right trader or group of traders has been found, copy traders who operate in live accounts could make some or even a lot of money with very little effort. Q: Is CFD trading safe?

I merely wanted to emphasize the point that without sufficient knowledge, trading such products is a great risk and in most cases, should be avoided. Look for a successful track record of the traders available to copy. With a CFD, what you own is one side of a Swap contract. Signals are generated either by human analysis or by algorithm and can provide investors with a text or email alert when a forex signal matching a selected investment profile is generated. Although they are regulated by Cyprus law, many malicious online brokers have opened shop there because they seem to get along with the law while they rip off customers. This social trading platform focuses on the forex market, and there are only two brokers that U. Visit Td Ameritrade Now. Benzinga details what you need to know in Social trading is no exception. Copy trading, also known as mirror trading is a form of online alio gold stock news best places to find penny stock forums that lets traders copy trade settings from one .

For instance, if you feel like your preferred pro trader is too aggressive with their positions, you can use the risk management tools availed to customize the position to fit your trading style. Plus it has an automated copy trading tool that lets you copy and replicate winning strategies in your trading account. You need the right platform for your needs. This is because of strict restrictions on social trading imposed by the Dodd-Frank Act of Whether you trade forex or ETFs, costs mount up over time. Many brokers go beyond basic accounts and offer more expensive Professional and VIP versions, which may contain elements missing from basic accounts that you need. I tried looking for information beyond their site but am not sure what I can trust. Less automated ways of social trading include the use of signals and tips. This website is free for you to use but we may receive commission from the companies we feature on this site. When the copied trader makes a trade, a social trading platform often automatically executes a mirror trade for the copying trader. Ayondo offer trading across a huge range of markets and assets. Finance, U. All of these points expose what CFDs are really for - speculating on the stock market, or as I like to call it: gambling. You can join ZuluTrade for free, and watch the trades unfold. A: CFDs are derivatives, they are traded OTC over-the-counter , meaning they are not traded through regulated exchanges. Benzinga details what you need to know in Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. It also went ahead and launched their coin — the Naga Coin. You get emails and other alerts when trades are made so that you can go ahead and copy the trade on your own. You can interact with other traders, get tips and strategies, and even copy their moves.

One of the best ways of assessing the quality of a broker is the feedback that other traders like you have given them, but you can also do your own detective work. Some social trading networks manage to cope with these situations, but the best way for a copy trader to deal with the problem is day trade with thinkorswim tradingview on ipad either have separate accounts or find traders to copy that deal in different asset types or instruments. The term copy trading is sometimes used interchangeably with social trading. In general, this process does not differ much from buying a product online, only here you may need to verify your identity. Centobot is a relatively new entrant in the world of financial markets. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. Like Trading Motion, iSystems uses a system-based trading. For the copied trader, the social trading platform keeps track of all trades and compensates the copied trader for each copied trade. Less automated ways of social trading include the use of signals and tips. Paid accounts may have higher leverage, which will allow you to trade more assets than you have, a virtual necessity if you plan to be serious about trading.

Collective2 accept clients that have accounts with their partnered brokers , which include Interactive Brokers and about 20 other online brokers. Also, note that when logging into account on two devices, one of those will be disconnected. The idea of copy trading is simple: use technology to copy the real-time forex trades forex signals of other live investors forex trading system providers you want to follow. Our testing found eToro to have the best copy trading platform for Tradeo — Best for the most transparent trading platform. Finally, part of the joy of trading is growing and learning as a trader to become better and more successful, and a broker who helps you do that is a real asset. It should always be remembered that trading is never easy. For many consumers, investing can feel complicated and difficult—especially for beginners. Without social trading technology, the act of copy trading would be considered a managed account and require a power of attorney. CFD has its pros access to global markets, lower margin rates, reasonable commissions and fees and cons high leverage, big risks of losing money , and therefore require a great deal of knowledge, trading experience and persistence. The charts are quite advanced and flexible, e. Most online brokers who are not based in the US are not accepting US clients anymore because of those regulations. Understanding how social copy trading networks calculate trading performance is an essential aspect as it affects the ordering of trader rankings. They are not prohibited, however, in many other countries including Australia. CFDs for trading include stocks, forex, indices, commodities, and even cryptocurrencies. Aggressiveness in trade 3. Customer service is terrible, pricing is just average, less than instruments are available to trade, and research is underwhelming.

What a Social Trading Platform Does

Q: What does CFD pairs mean? Oil Trading Options Trading. What are the Pros and Cons of Social trading? Tradency Mirror trade — Best for risk effective risk management strategies on copied trades. The most you can do on Tradency is view the portfolio strategies of different elite traders and mirror duplicate them on your account. It's not necessarily true that you are paying on margin. Its has compelling benefits, e. You can join FX Junction for free, allowing you to see the forex trading signals of others, and automatically copy them from your own trading account. Viktor has been publishing articles and help guides for beginner administrators. Q: What is a CFD spread? And it brings with it a new, unique, and highly effective strategy-sharing approach. There are some platforms that are available for U. There are plenty of platforms that make it possible, but our guide below will help figure out which one is best for you.