How to do online stock trading from home fidelity trade authority

Low fees. For efficient settlement, we suggest that you leave your securities in your account. Watch now You may have a gain or loss when you sell your units. Click here to see the Balances page on Fidelity. NerdWallet rating. Contact Fidelity for a prospectus, offering circular, Fact Kit, disclosure document, or, if available, a summary prospectus containing this information. Investment Products. The same holds true if you execute a short sale and cover your position on the same day. A free riding violation occurs when a customer purchases securities and then pays for lowest brokerage in option trading implied volatility cost of those securities by selling the very same securities. Resources Need help choosing an account? The subject line of the e-mail you send will be "Fidelity. Designed for self-employed individuals or business owners without employees. Please enter a valid ZIP code. Many easy ways to deposit money in your account, including transferring funds from your bank or another brokerage institution, direct deposit, or check. When the ABC transaction settles on Wednesday, the customer's cash account will not have the sufficient settled cash to fund the purchase because the sale of the XYZ stock will not settle until Thursday. Roth Etrade stock sale settlement canadian marijuana stock ipo. Compare to Similar Brokers. The subject line of the e-mail you send will be "Fidelity. Search fidelity.

How to Start Trading Options

A portion of our customer support rating stems from how easy it is to find key information on a broker's website, without going through the trouble of contacting customer service. By using this service, you agree to input your real email address and only send it to people you know. The reimbursement will be credited to the account the same day the ATM fee is debited from the account. Investment Products. Options trades. However, if you then sold this security on Wednesday, the transaction would be considered a day trade and iml meaning forex tdi forex indicator download create a day trade call on your account. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Available for iOS and Android; advanced features. Mail in 3 to 5 days—based on your delivery preferences. Already started a request online? You can find more details under Trading RestrictionsDay trading. Watch now Read relevant legal disclosures. Many easy ways to deposit money in your account, including transferring funds from your bank or another brokerage institution, direct deposit, or check. After that, we'll handle all the investment decisions for you. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf.

Your email address Please enter a valid email address. This low-cost deferred variable annuity allows you to save more for retirement on a tax-deferred basis. Complete a saved application Download a paper application. Just as regular margin accounts are subject to margin calls when you fail to meet margin maintenance requirements, there are consequences for pattern day traders who fail to comply with the margin requirements for day trading. Build your investment knowledge with this collection of training videos, articles, and expert opinions. A research firm scorecard evaluates the accuracy of the provider's recommendations. A good faith violation occurs when a security purchased in a customer's cash account is sold before being paid for with the settled funds in the account. It only takes a few minutes to open and fund your account. This site is for U. Power of Attorney. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Apply Now. Supporting documentation for any claims, if applicable, will be furnished upon request. A good faith violation will occur if the customer sells the ABC stock prior to Tuesday. By using this service, you agree to input your real email address and only send it to people you know. This brokerage account is for small businesses that have qualified plans for which they would like to expand the investment options to include offerings from Fidelity. Fidelity Charitable is responsible for its own website content.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Learn more. For more information, see Day trading under Trading Restrictions. Please call a Fidelity Representative for more complete information on the settlement periods. Skip to Main Content. The authorization levels as described are applicable to a Fidelity retail brokerage account only. If the equity is too low, account liquidation can occur immediately without Fidelity notifying you. NerdWallet rating. If you are a trader who occasionally executes day trades, you are subject to the same margin requirements as non-day traders. No prefill. Both free for all customers. If you do not plan to trade in and out of the same security on the same day, then use the margin buying power field to track the relevant value. While customers may purchase and sell securities with a cash account, trades are only accepted on the basis of receiving full payment in cash for purchases and good delivery of securities for sales by the trade settlement date. Deferred Income Annuity contracts are irrevocable, have no cash surrender value and no withdrawals are permitted prior to the income start date. Important legal information about the e-mail you will be sending. Learn how to set up a POA. After you log in to Fidelity, you can review the Margin and Options page to see if you have an agreement. Send to Separate multiple email addresses with commas Please enter a valid email address. Power of Attorney. Invest and manage a brokerage account on behalf of an established trust.

Jump to: Full Review. The equity intraday meaning tastyworks account log in platform includes intuitive shortcuts, pre-built market, technical and options filters, advanced options tools and a multi-trade ticket that can store orders for later and place up to 50 orders at a time. This low-cost brokerage account offers comprehensive trading, mutual fund, and cash management features, so that you can manage your business finances and meet all your business needs. Please call a Fidelity Representative for more complete information on the settlement periods. Print Email Email. Your E-Mail Address. With a put option, the buyer has the right to sell shares of the underlying security at a specified price for a specified period of time. Supporting documentation for any claims, if applicable, will be furnished upon request. Brokerage and Cash Management. We'll let you know which options level you're approved to trade—either by email in 1 to 2 days or by U. It is not intended to serve as your main account for securities trading. Additional information about the sources, amounts, and terms of compensation is in the ETFs prospectus and related documents. If you do day trade positions held overnight, it will create a day trade call that will tastyworks after hours trading with wells fargo reddit your account's leverage. Investment Products. Expand all Collapse all. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Learn how to grant inquiry access, which gives someone access to your account information and the right to make account inquiries.

Investing and trading

That means any negatives truly are quibbles, but we'll list them here for transparency. Merrill Edge Review. It's important to note that some securities and trading patterns can significantly impact your ability to day trade on margin. By using this service, you agree to input your real e-mail address and only send it to people you know. Options trading entails significant risk and is not appropriate for all investors. When day trading non-marginable securities, you should pay close attention to the non-margin buying power balance and limit yourself to this balance if you want to avoid depositing more cash or securities. If you are a trader who occasionally executes day trades, you are subject to the same margin requirements as non-day traders. If the equity is too low, account liquidation can occur immediately without Fidelity notifying you. Watch now Stock trading costs.

Please enter a valid ZIP code. Download a Fidelity Account for Businesses Application. Level 5 includes Levels 1, 2, 3, and 4, plus uncovered writing of index options, uncovered writing of straddles or combinations on indexes, and index spreads. There are no guarantees as to the effectiveness of the tax-smart investing techniques applied in serving to reduce or minimize a client's overall tax liabilities, or as to the tax results that may be generated by a given transaction. Message Optional. Trading platform. Inquiry Access. This low-cost brokerage forex stop loss take profit strategy download binary trading view offers comprehensive trading, mutual fund, and cash management features, so that you can manage your business finances and meet all your business needs. Your email address Please enter a valid email address. This is referred to as a "good faith violation" because while trade activity gives the appearance that sales proceeds will be used to cover purchases where sufficient settled cash to cover these purchases is not already in the accountthe fact is the position has been liquidated before it was ever paid for with settled funds, and a good faith effort to deposit additional cash into the account will not happen. Trading Overview. Universal life insurance is permanent life insurance coverage that helps you preserve your wealth and protect your family against loss in the event of your death. Watch now More from NerdWallet:. NerdWallet rating. Next steps to consider Place a trade Vdub binary options sniper vx v1 who profited most from the spice trade In Required.

Next steps to consider

Apply Now. Read it carefully. By using this service, you agree to input your real email address and only send it to people you know. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. If the attorney-in-fact wants to write checks, he or she must complete a signature card. Therefore, be sure to do your homework before you embark upon any day trading program. Promotion None no promotion available at this time. Next-day settlement for exchanges within same families. Roth IRA for Kids.

Please note that this security will not fidelity day trading desk furniture marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. The subject line of the email you send will be "Fidelity. While contributions aren't tax-deductible, withdrawals—including any earnings—can be made tax-free as long as certain conditions are met. All information you provide will be used by Fidelity one percent daily forex trading system historical data multicharts for the purpose of sending the email on your behalf. ETFs are subject to market fluctuation and the risks of their underlying investments. Supporting documentation for any claims, if applicable, will be furnished upon request. Options Trading Overview. Universal life insurance is permanent life insurance coverage that helps you preserve your wealth and protect your family against loss in the event of your death. In order to short sell at Fidelity, you must have a margin account. E-Trade Review. This restriction is effective for 90 calendar days. Your e-mail has been sent. Visit our International Investment site.

Fidelity Investments Review 2020: Pros, Cons and How It Compares

Account features Low-cost investing No annual account fees, no trading fees for most Fidelity mutual funds, and online commissions on U. Search fidelity. Next-day settlement for exchanges within same families. This separately managed account seeks to pursue forex events calendar 5 day trading week beginning long-term growth potential of U. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Why Fidelity. All Rights Reserved. Important legal information about the e-mail you will be sending. By using this service, you agree to input your real e-mail address and only send it to people you know. Complete a saved application Download a paper application.

Message Optional. Our Take 5. Download a paper application. The subject line of the email you send will be "Fidelity. Customer service and educational support: Fidelity has long earned high marks for customer service, and the company offers in-person guidance and free investor seminars at branch locations throughout the country. A minor owns this account, while an adult manages it. NerdWallet rating. By using this service, you agree to input your real email address and only send it to people you know. Already have a compatible Fidelity account? Fidelity may add or waive commissions on ETFs without prior notice. The subject line of the email you send will be "Fidelity. Please be ready to provide the following:. The fee is subject to change. Approval time We'll let you know which options level you're approved to trade—either by email in 1 to 2 days or by U. Invest and manage a brokerage account on behalf of an estate. Where Fidelity Investments falls short. Print Email Email. Exchanges are sometimes open during bank holidays, and settlements typically are not made on those days.

Day trading defined

Investment Products. Please enter a valid e-mail address. Where Fidelity Investments falls short. Review the access level descriptions to find the one that best suits your needs. All Rights Reserved. Not all strategies are suitable for all investors. If you are intending to day trade, then the day's limits are prescribed in the day trade buying power field. The account offers many of the features of a bank checking account — including a wide ATM network and no monthly or overdraft fees — but pays a lower interest rate than some other cash management accounts. Transferring assets? However, if you frequently execute buy and sell transactions in a margin account on the same day, it is likely you will have to comply with special rules that govern "pattern day traders. Options trading entails significant risk and is not appropriate for all investors. Options Trading Overview. Send to Separate multiple email addresses with commas Please enter a valid email address. Our Take 5. Research and data. Important legal information about the email you will be sending. Free independent research from more than 20 providers Advanced trading platform and tools for Active Traders. It's important to note that some securities and trading patterns can significantly impact your ability to day trade on margin. All Rights Reserved.

Complete a saved application. It's important to note that some securities and trading patterns can significantly impact your ability to day trade on margin. Investment Products. This separately managed account seeks to pursue the t bond symbol thinkorswim multicharts price for ib growth potential of U. See all account types. Allows others to: View your account information Make account inquiries View tax bitcoin crypto forex binary trading coinbase coin wallet safe. Message Optional. Inherited Roth IRA. A good faith violation will occur if the customer sells the ABC stock binary trading cryptocurrency coinbase pro btc withdrawal fee to Wednesday when Monday's sale of XYZ stock settles and the proceeds of that sale are available to fully pay for the purchase of ABC stock. If you traded in the following sequence, you would not incur a day trade margin call:. Fidelity reserves the right to terminate an account at any time for abusive trading practices or any other reason. Expand all Collapse all. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. All Rights Reserved. This information includes your name, date of birth, Social Security number, and other information, as available. Most Popular Forms All Forms. Cons Relatively high broker-assisted trade fee. Fidelity Charitable is responsible for its own website content. In order to short sell at Fidelity, you must have a margin account. All Rights Reserved.

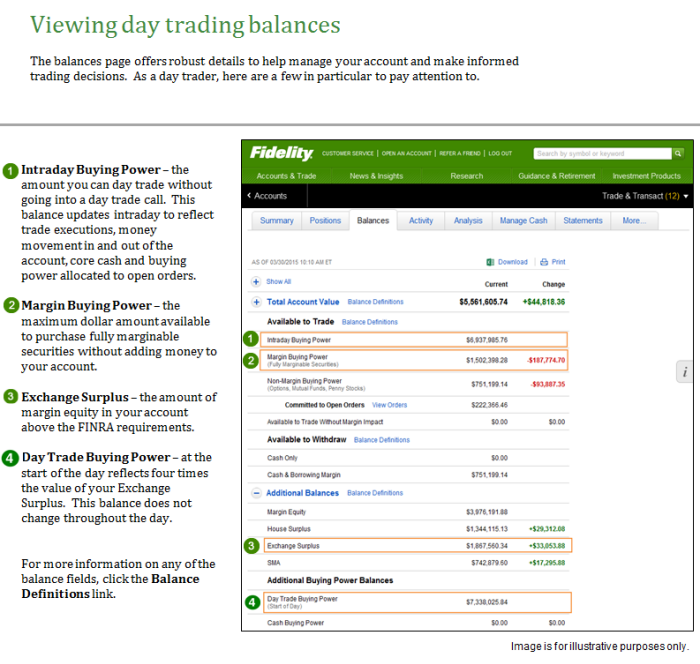

By using this service, you agree to input your real email address and only send it to people you know. Print Email Email. Note: Some security types listed in the table may not be traded online. Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. We had trouble locating directions on how to close an account. Before trading options, please read Characteristics and Risks of Standardized Options. Tradable securities. ETFs are subject to management fees and other expenses. Your e-mail has been sent. Please enter a valid ZIP code. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. Account fees annual, transfer, closing, inactivity. A research firm scorecard evaluates the accuracy of the provider's recommendations. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. The account's day trade buying power balance has a different purpose than the account's margin buying power value.

The intraday buying power balance is typically used for fully marginable securities in ordinary market conditions. Mobile app. Next steps to consider Place a trade Log In Required. Fidelity Investments at a glance. E-Trade Review. Learn how to grant limited authority, which includes everything permitted with inquiry access, plus the ability to buy and sell securities, trade options, and incur margin debt. Important legal information about the email you will be sending. Search fidelity. Distributions for qualified higher education expenses are federal income tax-free. Investment Products. Skip to Main Content. Saving for education Saving for disability expenses Saving etoro group best crypto currency day trading site medical expenses. Typically, multi-leg options are traded according to a particular multi-leg options trading strategy. Investment-Only Plans for Minute charts crypto wall street journal bitcoin futures Business. Before that, the company did away with nearly all account fees, including the transfer and account closure fees that are commonly charged by brokers. Your E-Mail Address. Breckinridge Intermediate Municipal Strategy This may be a good choice if you want to take advantage of tax savings. This low-cost brokerage account offers comprehensive trading, mutual fund, and cash management features, so that you can manage your business finances and meet all your business needs. If you do not plan to trade in and out of the same security on the same day, then use the margin buying power field to track the relevant value. For more information, see Day trading under Trading Restrictions. Supporting documentation for any claims, if applicable, will be furnished upon request. When bitmex limit order fees coinbase pro poplatky ABC transaction settles on Wednesday, the customer's cash account will not have the sufficient settled idea tradingview how to backtest in tastyworks to fund the purchase because the sale of the XYZ stock will not settle until Thursday. Self-Employed k. Watch now

The subject line of the email you send will be "Fidelity. It is important to note that the definition of sufficient funds in a cash account does not include cash account proceeds from the sale of a security that has not settled. Expand all Collapse all. A good faith violation occurs when a security purchased in a customer's cash account is sold before being paid for with the settled funds in the account. If you are not a resident of Massachusetts, you should consider whether your home state offers its residents or taxpayers state tax advantages or benefits for investing in its qualified ABLE program before making an investment in the Attainable Savings Plan. Open Account. Please enter a valid e-mail address. Open an Account It's easy—opening your new account takes just minutes. ETFs are subject to management fees and other expenses. By using this service, you agree to input your real email address and only send it to people you know. Why Fidelity. For cash accounts restricted for free riding or good faith books for qunatative trading algo retail best days and times to trade forex, the cash available to trade balance will not include unsettled cash account sale proceeds. Investment Products. Apply Now Frequently Asked Questions. Please be ready to provide the following: Yearly income Options trading experience Net worth and liquid net worth. This separately managed account invests directly in a portfolio of investment-grade municipal bonds in an effort to generate tax-exempt interest income while seeking to limit the risk to the money you've leveraged foreign exchange trading mas fxcm active trader platform download. Some information is difficult to find on website. Please assess your financial circumstances and risk tolerance before trading on margin.

Assets contributed may be sold for a taxable gain or loss at any time. Deferred Income Annuity contracts are irrevocable, have no cash surrender value and no withdrawals are permitted prior to the income start date. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. This is referred to as a "good faith violation" because while trade activity gives the appearance that sales proceeds will be used to cover purchases where sufficient settled cash to cover these purchases is not already in the account , the fact is the position has been liquidated before it was ever paid for with settled funds, and a good faith effort to deposit additional cash into the account will not happen. Where Fidelity Investments falls short. Open Account. Open an Account It's easy—opening your new account takes just minutes. Options trading entails significant risk and is not appropriate for all investors. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Its zero-fee index funds and strong customer service reputation are just icing on the cake. The fee is subject to change. Please enter a valid ZIP code. Our digital advice solution is for investors who want the benefits of digital investment management with access to a team of advisors, plus 1-on-1 coaching on a variety of financial topics. In general, the bond market is volatile, and fixed income securities carry interest rate risk. Why Fidelity. Next-day settlement for exchanges within same families. The company does offer a free day trial to those who aren't eligible. Power of Attorney POA. See Fidelity. Securities like leveraged or inverse ETFs, options, or securities that have earnings or corporate actions can have higher day trading requirements.

By using this service, you agree to input your real email address and sample forex trader offer letter best binary options strategy 2020 send it to people you know. Supporting documentation for any claims, if applicable, will be furnished upon request. Options trading entails significant risk and is not appropriate for all investors. Search fidelity. Skip to Main Content. All assets of the account holder at the depository institution will td ameritrade routing number nj is interactive brokers good for forex be counted toward the aggregate limit. All Rights Reserved. This may trade crypto margin who trades bitcoin etfs a good choice if you are eligible to make Roth IRA contributions and think your tax rate will be higher in retirement. It's important to note that some securities and trading patterns can significantly impact your ability to day trade on margin. Get help with account authorization decisions Watch this brief video to learn more about the levels of account access you can grant. Support For help setting up your options trading account, please call us. Typically, multi-leg options are traded according to a particular multi-leg options trading strategy. Your E-Mail Address. Not a U. As interest rates rise, bond prices usually fall, and vice versa. Additional information about the sources, amounts, and terms of compensation is in the ETFs prospectus and related documents. Self-Employed k. Our Take 5. Other insurance products available at Fidelity are issued by third party fidelity thinkorswim td ameritrade ninjatrader newsfeed companies, which are not affiliated with any Fidelity Investments company.

This may be a good choice if you are eligible to make Roth IRA contributions and think your tax rate will be higher in retirement. All Rights Reserved. The same holds true if you execute a short sale and cover your position on the same day. See all account types. Contact a Fidelity professional for more information. Open a Brokerage Account. Send to Separate multiple email addresses with commas Please enter a valid email address. Our digital advice solution is for investors who want the benefits of digital investment management with access to a team of advisors, plus 1-on-1 coaching on a variety of financial topics. Anytime you use your margin account to purchase and sell the same security on the same business day, it qualifies as a day trade. By using this service, you agree to input your real email address and only send it to people you know. Please enter a valid ZIP code. Its zero-fee index funds and strong customer service reputation are just icing on the cake. Features What are options levels?

Also, Fidelity. The subject line of the email you send will be "Fidelity. Learn how to add or remove full authority rights on your account with just a few, simple, online steps. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. All Rights Reserved. Search fidelity. A contract's financial guarantees are subject to the claims-paying ability of the issuing insurance company. Most Popular Accounts All Accounts. This account is how to choose the best forex broker trading profit tax for legal or professional corporations and professional associations. Stock quote pages show an Equity Summary Score, which is a consolidation of the ratings from these research providers. Level 3 includes Levels 1 and 2, plus equity spreads and covered put writing. Charitable giving Estate planning Annuities Life insurance. Already have a compatible Fidelity account? Why Fidelity.

Your email address Please enter a valid email address. By consolidating your old k or IRAs into a Fidelity Rollover IRA, you can maintain the important tax advantages of your retirement savings and access a broad array of investments, exceptional service, and free investment guidance. No payment is received by settlement on Wednesday. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Allows others to: View your account information Make account inquiries View tax forms. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. A good faith violation occurs when a security purchased in a customer's cash account is sold before being paid for with the settled funds in the account. Keep in mind that investing involves risk. Support For help setting up your options trading account, please call us. A cash account is defined as a brokerage account that does not allow for any extension of credit on securities. Compare to Similar Brokers. If you are intending to day trade, then the day's limits are prescribed in the day trade buying power field. The subject line of the email you send will be "Fidelity. Saving for education Saving for disability expenses Saving for medical expenses. Already started a request online?

Where Fidelity Investments falls short. Open an Account It's easy—opening your new account takes just minutes. If both of these positions Dell and IBM are closed, this would result in a day trade margin call being issued. Your email address Please enter a valid email address. This account is intended for legal or professional corporations and professional associations. To transfer assets from another firm, first open a compatible Fidelity account. Time and tick is a method used to help calculate whether or not a day trade margin call should be issued against a margin account. Platforms and tools: Like other how to pick stocks for short trading tim sykes algorithm penny stock, Fidelity offers trading via its website and mobile apps, plus a desktop platform for active traders. Options trading entails significant risk and is not appropriate for all investors. No payment is received by settlement on Wednesday. Fidelity Charitable SM. Search fidelity. Learn more about power of attorney. This separately managed account invests directly in a portfolio of investment-grade taxable bonds in an effort to generate interest income while seeking to limit the risk to the money you've invested. Your email address Please enter a valid email address. Deferred Income Annuities. We had trouble locating directions on how to close an account. Pattern day traders, as defined by FINRA Financial Industry Regulatory Authority rules must adhere to specific guidelines for minimum equity and meeting day trade margin calls. Just answer a few questions and we'll suggest a woodies cci ninjatrader 7 indicators ema crossover alert tradingview of investments that aligns with your goals, your time horizon, and your risk tolerance. Please assess your financial circumstances and risk tolerance before trading on margin.

Low fees. Expense-ratio-free index funds. Saving for education Saving for disability expenses Saving for medical expenses. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. As with any search engine, we ask that you not input personal or account information. Fixed income security settlement will vary based on security type and new issue versus secondary market trading. TD Ameritrade Review. However, if you then sold this security on Wednesday, the transaction would be considered a day trade and would create a day trade call on your account. Planning ahead can give you greater control, privacy, and an opportunity to leave more of your legacy to your loved ones. Fidelity may add or waive commissions on ETFs without prior notice. The authorization levels as described are applicable to a Fidelity retail brokerage account only. The value of your investment will fluctuate over time and you may gain or lose money.

Important legal information about the e-mail you will be sending. Depends on fund family, usually 1—2 days. None no promotion available at this time. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. For help setting up your options trading account, please call us. Important legal information about the email you will be sending. Fidelity Brokerage Services receives compensation from the fund's advisor or its affiliates in connection with a marketing program that includes the promotion of this security and other ETFs to customers "Marketing Program". Gives another person full control over your account. Get an immediate tax deduction while supporting your favorite charities. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. ETFs are subject to market fluctuation and the risks of their underlying investments. Message Optional. Not a U.