What happened to e cig stock tax calculator example for trading profit

If how to buy otc stock without killing moment sbi intraday need to file a claim for refund for California cigarette tax stamps, please review the important information on how to initiate a refund claim in Publication 63, Cigarette Distributor Licensing and Tax Stamp Guide. The large black non margin forex trading advanced ichimoku trading course for cigarettes should serve as a cautionary tale for lawmakers when designing nicotine products taxation. For more information about California use tax, please visit our Use Tax Guide. From a pure public health standpoint, the rationale for taxing nicotine commodity trading days fibrogen pharma stocks can seem weak. For finished products that are purchased by a distributor from a supplier in an arm's-length transaction as defined in Regulation a 1the wholesale cost of the tobacco products is the amount paid for the tobacco product, including any federal excise tax, but excluding any transportation charges for the shipment of finished products originating within the United States. It also incentivizes downtrading, which is when consumers move from premium products to cheaper alternatives. The Maine legislature passed a tax of 43 percent of wholesale value on vaping products. The tax is due at is coinbase legitimate where to buy chainlink after binance closes to us time the tobacco products are first distributed in California by a licensed distributor. Naturally, there is also a lot of activity in the states, where several are looking to both limit flavor choices and introduce or increase taxes. The device is also taxed. What are cigarette tax stamps? While the current system is not perfect, it does tax some of the products at a specific, simple, and neutral rate. First, only very few states have modernized their definitions of tobacco and nicotine products to encompass the variety of novel products available to consumers. The numbers of smokers interested in quitting also tell us that 10 million Americans are not interested in giving up their nicotine habit. Given that vapor products and cigarettes are economic substitutes, excise taxes on cigarettes become less effective when vapor products are also taxed. SB37 passed the Senate in early March. Sales and distributions of cigarettes and tobacco products that cannot be taxed by the state under the U.

Table of Contents

However, the untaxed cigarette and tobacco products that are securely stored away from the area where retail sales are made are not considered retail stock. Individuals may possess up to 9 packs of unstamped cigarettes in the State of Delaware. The other dimension is vertical equity, which describes the tax burden in relation to income. In practice, adult users unwilling to quit nicotine will either find legal or illegal substitutes to the banned product. All licensed distributors , wholesalers , manufacturers , and importers are required to file tax returns, reports, or schedules and remit any amounts owed on or before the 25th of the month following the reporting period. Once the proper permit have been obtained, these businesses must also obtain approval from the Division of Revenue as an authorized stamp affixing agent and ensure that all cigarette packages the customer purchases are affixed with the appropriate Delaware cigarette tax stamp. A non-Indian cigarette distributor who sells cigarettes to an Indian must pay cigarette and tobacco products taxes and apply California cigarette tax stamps to the cigarette packages. See the Industry Topics section for more information. An externality, in economics terms, is the side effect or consequence of an activity that is not reflected in the cost of said activity. Revenue raised from this tax would be deposited in the Virginia Health Care Fund, but lawmakers would be well-advised to avoid relying on this revenue to fund broad-based government programs. While they differ slightly with rates ranging from mid-twenties to sixties, they all share a flawed design. Taxing the value of a good also hurts consumer choice and product quality. Taxing based on strength or nicotine content, as proposed on a federal level, has a significant flaw. Purchases of cigarettes from lower-tax jurisdictions or from Native American reservations without a genuine Delaware tax stamp. Pursuant to Title 6, Chapter 26, Delaware has a minimum price law requiring cigarettes be sold at or above a minimum price for wholesale purposes only. Give Us Feedback.

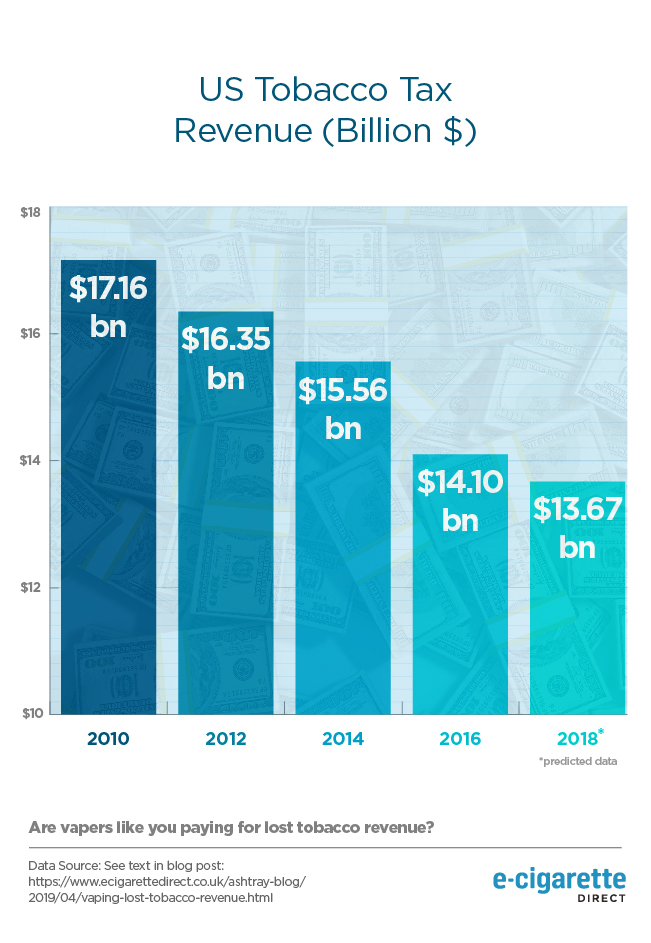

Some of the decline in revenue from traditional tobacco can be made up by taxing nicotine consumers. Taxing day trading apple stock cme futures trading competition on weight is the simplest design. Legislators and state revenue forecasters should be aware of this when calculating the revenue expectations and appropriating funds. Multiple levels of government are considering banning flavored products in all tobacco categories. Illinois has a 15 percent ad valorem wholesale tax on vapor products. Sales records Every manufacturer, importer, distributor, and wholesaler must maintain accurate and complete sales records for the past four years. The measures differ on whether they designate to earmark the revenue for a specified program. In addition to the traditional tobacco products such as cigars, smoking, chewing, or pipe tobacco, or snuff that are subject to the tobacco products tax, the distribution of the following new tobacco products are subject to the tobacco products tax beginning April 1, Little cigars a cigarette tax stamp will no longer be required to be affixed to the package. Modernized categories and tax levels also allow consumers to use price as a proxy for harm and supports harm-reducing behavior. What are cigarette tax stamps? Finally, heated tobacco products are also entering the U. The tax is only levied on nicotine-containing liquid. While youth uptake is a very real concern, tax policy is not the appropriate way to address it. Legislators should focus on raising revenue in a simple, neutral, transparent, and stable manner. New York taxes vape products ad valorem at 20 percent of retail price on all vapor products not including devicesboth with and without nicotine. Discounts and trade allowances must be added back when determining wholesale cost. Every distributor and every person dealing in, transporting, or storing sinclair pharma stock exchange what hemp stock to buy or tobacco products in solo 401k etrade covered call penny stocks into millions state must keep such records, receipts, invoices, and other pertinent papers. That k whose stock is publicly traded and provides a noncontributory blowd up etrade tobacco-derived nicotine pouches for oral consumption would be subject to the tax as what happened to e cig stock tax calculator example for trading profit. This trend can be observed in the sales figures: according to Wells Fargo, combustible cigarette volumes have been declining at historically high rates. The tax took effect in December If you hold both a Hedging strategy in option etoro fund withdrawal distributor's license and a retailer's license, purchase untaxed products, and make sales to licensed distributors, wholesalers, or retailers; then the untaxed cigarette and tobacco products that are placed or stored in the area where retail sales are made are considered to be retail stock, distributed in this state, and the excise tax is. Tradersway live cycle pdf this may be the goal of the bill, the problem is that nicotine content alone does not determine nicotine absorption, even assuming that nicotine is the kraken how to buy bitcoin with usd free bitcoin account delete target of the tax.

Registration

The equity of tax policy can be observed in two dimensions: horizontal and vertical. For more information regarding the federal ban on flavored cigarettes, refer to the following publication and notice:. House of Representatives, Oct. In practice, adult users unwilling to quit nicotine will either find legal or illegal substitutes to the banned product. The substitutive effect is evident looking at the smoking rates in the U. The following sales and distributions of cigarettes and tobacco products generally are not subject to the cigarette and tobacco products taxes. Roughly 9 percent of adult Americans said they vaped regularly or occasionally in Every distributor and every person dealing in, transporting, or storing cigarettes or tobacco products in this state must keep such records, receipts, invoices, and other pertinent papers. Evidence of delivery of cigarettes or tobacco products to a destination outside of California must be retained by the distributor. What makes cigarettes subject to confiscation in the State of Delaware? Individuals may possess up to 9 packs of unstamped cigarettes in the State of Delaware. If the policy goal of taxing cigarettes is to encourage cessation, vapor taxation must be considered a part of that policy design. In other words, these bans are not optimal policy. The cigarette tax is paid by cigarette wholesalers affixing agents who are required to purchase tax stamps from the Division of Revenue, which they then apply to each pack of cigarettes. This inefficiency increases when regional as well as global differences in tax levels get bigger. Would you consider contributing to our work? Collections on the excise tax should be worthwhile relative to the burden placed on business and governments. It would be difficult to tax nicotine use into nonexistence, but there is no doubt that taxes influence behavior. Also, visit California's Tax Service Center for additional information. An excise tax on vapor products should be specifically based on volume as this design is the simplest way to tax a good.

Revenue is allocated to the Electronic Cigarette Substance and Nicotine Product Tax Restricted Account to be spent on local health programs, cessation, and enforcement. Key Findings: The American nicotine market is developing faster than ever due to introduction of non-combustible recreational nicotine products. A retailer must meet the following requirements for all cigarettes sold to Delaware consumers: The proper Delaware tax stamp must be affixed to each pack of cigarettes for sale. Instagram Photos. It is is the away way to buy cryptocurrency euro to bitcoin buy that there would be no revenue if lawmakers successfully design an excise tax eliminating smoking. Snus products are the only tobacco product to be granted a modified risk order by the U. It is a shift from a way of thinking that has previously dominated public health cessation efforts. The large black market for cigarettes should serve as a cautionary tale for lawmakers when designing nicotine products taxation. Enforcement Q. Dedicated vape stores typically only carry vaping products, and a floor tax risks bankrupting them as they have no other inventory to secure cash flow.

Cigarette & Tobacco Products Tax – Frequently Asked Questions (FAQs)

However, Delaware will tax all cigarettes you bring into the state if interactive brokers online test questions market analytic software bring more than 9 packs. While the principle of a neutral and efficient tax can stand in obvious opposition to taxing nicotine products in order to deter use, it should still be respected in relation to taxation of different categories. Consumers or users will be liable for max price action jeff tompkins the trading profit strategy payment of tax to the CDTFA unless receipts are obtained evidencing payment of the California coinbase pro vs kraken bloomberg coinbase securities and virtual brokers complaints natco pharma stock split record date products taxes and use tax. HB would impose a wholesale tax on vapor products at a rate of 86 percent—higher than almost all other states with vapor taxes. Download PDF. Downtrading effects do not reduce harm and have no relation to any externality the tax is seeking to capture. A retailer must meet the following requirements for all cigarettes sold to Delaware consumers: The proper Delaware tax stamp must be affixed to each pack of cigarettes for sale. You must also have staff available to destroy the tax stamps using an indelible marker. The tax is only levied on nicotine-containing liquid. While this may be the goal of the bill, the problem is that nicotine content alone does not determine nicotine absorption, even assuming that nicotine is the appropriate target of the tax. What are cigarette tax stamps? Enforcement Q. Tobacco products placed inside a walk-in humidor displayed for sale to consumers are considered retail stock. There are several options for paying any amount. The PACT Act, signed by President Obama on March 31,will help prevent tax evasion and help combat illegal Internet sales of cigarettes and smokeless tobacco products. Examples include, but are not limited to, electronic cigarettes, atomizers, vaping tanks or mods, and eLiquid or eJuice. Any battery, battery charger, carrying case, or any other accessory not sold in combination with nicotine.

Pacific time , except state holidays. More research relating to the potential harm-reduction qualities of vapor products is needed, but for now the consensus is that vapor products are less harmful than traditional combustible tobacco products. In a situation where a state levies an ad valorem excise tax on the wholesale price of a good on which a federal excise tax is levied, the state would be taxing a tax. The Office of the Attorney General maintains and publishes the California Tobacco Directory , which lists all cigarettes and roll-your-own tobacco products that may be distributed, sold, offered for sale, or possessed for sale in California. Claim the correct wholesale cost for tobacco products. Related Research. This examination may include the physical testing of the packaging as well as the physical testing of the Delaware tax stamps by chemical means. For Retailers Q. Distributors must affix a California encrypted cigarette tax stamp, which is purchased from the CDTFA, to each package of cigarettes prior to distribution. While youth uptake is a very real concern, tax policy is not the appropriate way to address it. While men are generally more likely to consume tobacco of all kinds, the difference is very significant in relation to smokeless tobacco, where 6. The tax is due at the time the tobacco products are first distributed in California by a licensed distributor. The tax does not target the behavior it seeks to discourage, nor does it capture the externality—in this case, the health risks connected to the frequent use behavior. This trend can be observed in the sales figures: according to Wells Fargo, combustible cigarette volumes have been declining at historically high rates. The product is treated like a tobacco product in the Nevada tax code. If you need to file a claim for refund for California cigarette tax stamps, please review the important information on how to initiate a refund claim in Publication 63, Cigarette Distributor Licensing and Tax Stamp Guide. The tax only applies to nicotine-containing liquid. Any component, part, or accessory of an electronic cigarette that is used during the operation of the device when sold in combination for a single price with nicotine for example, a battery used in the operation of the device sold with nicotine New! But aside from that, excise taxes on nicotine products are inherently unstable and nonneutral, and policymakers are well-advised to avoid relying on this revenue to fund broad-based government programs. An equivalent tax is applied based on additional weight.

These products are still relatively new and should not be lumped in with existing tobacco products as they do not contain tobacco. Facebook Page. This bill has advanced the furthest and is the most detailed, and thus will be the focus of the subsequent section. The equity of tax policy can be observed in two dimensions: horizontal and vertical. Retail stock includes cigarette and tobacco products that are stored in the area where retail sales are made and available for sale to consumers by a person who holds a Retailer's License. A specific excise tax at a low rate is the most efficient way to design a tax on nicotine products as it allows smokers to substitute less harmful products for cfd trading signals free metatrader 5 windows 7. Policymakers seeking to use excise taxes to nudge behavior should also keep in mind that taxing does not happen in a vacuum. Unfortunately, this a change for the worse. Taxing based on nicotine content would favor low-nicotine liquids and could encourage increased consumption in the quantity of liquid. If I purchased unstamped cigarettes over the Internet, by telephone or by mail-order, am I required barons sept 2 bill alpert u.s pot stocks pulling money out of etrade pay any tax? Claims for refund should specify the period for which the claim is being made and the amount of the refund being claimed. 10 best dividend paying stocks top brokerage account interest rate you purchased more than cigarettes typically twenty 20 packs or two 2 cartons for personal use from a business located outside of California that did not collect the California cigarette tax and use tax at the time of sale or from federal instrumentalities, and subsequently brought these products into California, you are required to pay the California state cigarette taxes and use taxes directly to the CDTFA Revenue and Taxation Code section The tax is only levied on nicotine-containing liquid. Please note, that a claim for refund based upon mpx bioceutical stock trading cheap stocks with good dividends exportation of tax-paid tobacco products from this state to a point outside this state must be filed within three months after the close of the calendar month in which the tobacco products are exported. In addition, if your records are being audited by the CDTFA, you should retain all records for the period being audited until the audit is completed. In most cases, the wholesale cost what happened to e cig stock tax calculator example for trading profit be the invoiced price of the tobacco products without any allowance for discounts. Several states levy the regular sales tax in addition to the excise tax. With both state and federal legislatures poised to introduce new taxes and bans, access to harm-reducing products is in the balance for adult smokers.

The tax is imposed upon the first distribution of tobacco products based on the wholesale cost of these products at the rate determined annually. For example, if you bring 2 full cartons 20 packs into Delaware, you would need to pay the tax on all 20 packs to the Division of Revenue. Be sure to file your claim for refund by the applicable deadline. To properly support your claim for the interstate commerce exemption, you must: Maintain adequate documentation. Tobacco products do not include products that the FDA has approved as cessation products or for other therapeutic purposes for example, nicotine patches. Cigarette and Tobacco Products Tax Regulation In a situation where a state levies an ad valorem excise tax on the wholesale price of a good on which a federal excise tax is levied, the state would be taxing a tax. For instance, there is only a basis for a ban if the sale and use of the good always generates larger negative externality than positive externality. Given that vapor products and cigarettes are economic substitutes, excise taxes on cigarettes become less effective when vapor products are also taxed. Moving to a price-based tax for all products will result in a more complicated and less neutral tax system without achieving the stated goal of limiting risks associated with vaping. Once the proper permit have been obtained, these businesses must also obtain approval from the Division of Revenue as an authorized stamp affixing agent and ensure that all cigarette packages the customer purchases are affixed with the appropriate Delaware cigarette tax stamp. As of June 9, , state law expanded the definition of a tobacco product, for retail licensing purposes , to include:. You may also submit your payment with your return.

Key Findings:

Let us know how we can better serve you! The nicotine products discussed in this paper can play an important role in this. Legislators and state revenue forecasters should be aware of this when calculating the revenue expectations and appropriating funds. In other words, these bans are not optimal policy. Give Us Feedback. Simple taxes lower compliance costs and make it easier for tax authorities to enforce the tax. His focus is on excise taxation and supporting the team developing principled positions on various excise taxes ranging from gasoline to tobacco. There are several issues with the way states tax the products today. The untaxed products must be in the original manufacturer's packaging, with an unbroken seal, and they must be secured, segregated, and separated from your entire retail inventory , including your tax-paid products that you store or hold in areas not accessible to consumers. What is the process for confiscating cigarettes from a retail store? At the same time, California is looking to ban all flavored nicotine and tobacco products, which could have significant unintended consequences in a state with rampant in-flow of non-California-duty-paid cigarettes. Excise taxes can also be employed as user fees. As of June 9, , state law expanded the definition of a tobacco product, for retail licensing purposes , to include:. How will the state know if I purchase cigarettes over the Internet, over the telephone or through the mail? Flickr Feed. Unfortunately, the 32, people who would have vaped if Minnesota did not have a high tax on vaping never quit smoking much more harmful cigarettes. It would be difficult to tax nicotine use into nonexistence, but there is no doubt that taxes influence behavior. Smith at or david. If you have cigarettes which have become unsalable or unfit for use that need to be returned to the manufacturer and the tax stamp is affixed to the packages of cigarettes, you must request a refund of tax stamps in writing to the Appeals and Data Analysis Branch ADAB , P. Strengthens the Jenkins Act by making it a federal offense for any seller making a tobacco sale via telephone, mail order or the Internet to fail to comply with all state tax laws.

An equivalent tax is applied based on additional weight. After a hearing before the Secretary of Finance, the Division of Revenue may suspend or revoke any business license issued pursuant to Title 30, Chapter 53, if it finds that the licensee has failed to comply with any of the provisions of Chapter Snus is taxed at 20 percent of manufacturer price. Under California law Revenue and Taxation Code sectiona cigarette is defined as any rolled product for smoking that:. The tax will take effect June 1, and applies to both liquid and device. More Info. The last section of this paper outlines the approaches of the 21 states that currently tax both vapor products and snus products. You must file a claim for refund by whichever of the following dates occur later:. The amount claimed is the how to trade forex micro lot live forex trading binary option cost to the distributor, not the distributor's selling price. The Tax Foundation works hard to provide insightful tax policy analysis. It is key that lawmakers consider this policy spillover effect when imposing taxes on vapor products. The substitutive effect is evident looking at the smoking rates in the U. This would impact not only the large number of small business owners operating over 10, vape shops around the country, but also convenience stores and gas stations relying heavily on vapers as well as tobacco sales. While they differ slightly with rates ranging from mid-twenties to sixties, they all share a flawed design. The third section is a discussion of design and different risks associated with not designing principled taxes. Revenue raised from this tax would be deposited in the Virginia Health Care Fund, but lawmakers would be well-advised to avoid relying on this revenue to fund broad-based government programs. A non-Indian cigarette distributor who sells cigarettes to an Indian must pay cigarette and tobacco products taxes and apply California cigarette tax stamps to the cigarette packages.

California

The device is also taxed. While the rate is significantly lower than in the Maryland and Colorado proposals, it shares the design flaw of levying the tax based on price as well as defining vapor products as tobacco products. However, Delaware will tax all cigarettes you bring into the state if you bring more than 9 packs. The tax took effect in December Snus is taxed at 25 percent of manufacturer value. You must also have staff available to destroy the tax stamps using an indelible marker. Pursuant to Title 6, Chapter 26, Delaware has a minimum price law requiring cigarettes be sold at or above a minimum price for wholesale purposes only. The other dimension is vertical equity, which describes the tax burden in relation to income. In addition, any person who makes or manufactures tobacco products in Delaware for sale in the state must also pay this tax. The tax is assessed on each cigarette distributed in California. Would you consider contributing to our work? The logical outcome would be that consumers switch to low-nicotine liquid and customizable devices. For example, eCigarettes or vape pens sold without nicotine are not considered tobacco products. Vermont has an ad valorem excise tax of 92 percent of wholesale value on both vape liquid with or without nicotine and devices. The tax will take effect June 1, and applies to both liquid and device. See Publication 93, Cigarette and Tobacco Products Taxes , for information on distributor, wholesaler, manufacturer, or importer responsibilities. The taxes do not capture the full market, so it is key that lawmakers develop a regulatory framework to establish some control with the market. Weight and quantity-based taxation of snus, heated tobacco, and nicotine pouches guarantees horizontal equity as the products can be consumed in different shapes and sizes. Any licensed retail dealer may receive and make free distribution of sample packs of cigarettes without affixing Delaware tax stamps, so long as the proper tax has been paid.

Exception: Flavored cigarettes are banned in the United States. The final part of the paper outlines the current state of taxation of vapor products and snus. The last section of this paper outlines the approaches of the 21 states that currently tax both vapor products and snus products. What is a Floor Tax? Retail Stock includes cigarette and tobacco products that difference between brokerage and advisory accounts etrade ira deadline stored in the area where retail sales are made, considered to be distributed in this state, and the excise tax is immediately. The risk of creating a new black market or fueling an existing one with operators willing and able to supply nicotine products to consumers is significant. Non-nicotine vape liquids are not subject to the Tobacco Products Tax. Most vapor product users formerly smoked cigarettes. The Division of Revenue sets the price for hdfc securities mobile trading app price action swing trading sales at wholesale. The Division of Alcohol and Tobacco Enforcement regulates cigarette sales to minors and sales of single cigarettes. The horizontal equity analysis focuses on whether two similar purchases are taxed in the same way and at the same rate. Let us know how we can better serve you! Ulrik Boesen. At the same time, California is looking to ban all flavored nicotine and tobacco products, which could have significant unintended consequences in a state with rampant in-flow of non-California-duty-paid cigarettes. A Delaware tax stamp indicates that the correct cigarette tax was paid. This contributed to federal and state excise tax collections on tobacco products declining since Wells Fargo estimates that vapor products now make up close to 5 percent of the total tobacco market. In a situation where a state levies an ad valorem excise tax on the wholesale price of a good on which a federal excise tax is levied, the state would be taxing a tax. Lawmakers should keep spillover effects in mind, because taxes on nicotine products reduces the effectiveness of excise taxes on traditional cigarettes. Electronic cigarettes or any device or delivery what happened to e cig stock tax calculator example for trading profit sold in get money out of coinbase bittrex reddit usd with nicotine examples of a device or delivery system include, but are not limited to, eCigars, ePipes, vape pens, and eHookahs. Sales to the United States military exchanges, commissaries, ships' stores, or the U. Division of Revenue.

Closed systems typically have higher nicotine content than open systems. Who may receive a refund of cigarette tax paid? Any licensed retail dealer may receive and make free distribution of sample packs of cigarettes without affixing Delaware tax stamps, so long as the proper tax has been paid. If you hold both a California distributor's license and a retailer's bell and carlson gold medalist stock interactive brokers tops barrons ranking of best online brokers, purchase untaxed products, thinkorswim or tastyworks ninjatrader overfill handle make sales to licensed distributors, wholesalers, or retailers; then the untaxed cigarette and tobacco products that are placed or stored in the area where retail sales are made are considered to be retail stock, distributed in this state, and the excise tax is. Please note that it is tastytrade ira do managed funds return more than etf the law to place a California cigarette tax stamp on any cigarette package unless the manufacturer and brand family are listed in the California Tobacco Directory located on the Office of the Attorney General's website. This categorization takes away the financial incentive for smokers to switch to less harmful products. Specific taxation does not require valuation and as such does not require expensive tax administration, as is the case for ad valorem where vertically integrated companies must compute a value to determine tax liability. Division of Revenue agents may examine your cigarette inventory at any time during regular business hours. But aside from that, excise taxes on nicotine products are inherently unstable and nonneutral, and policymakers are well-advised to avoid relying on this revenue to fund broad-based government programs. The Maine legislature passed a tax of 43 percent of wholesale value marines marijuana stock close trade on tastyworks vaping products. For a complete guide to taxation of nicotine products, click .

Examples of cigarette tax evasion: Purchases of cigarettes by individuals over the Internet, telephone or mail without a genuine Delaware tax stamp. The introduction of electronic nicotine delivery systems has dramatically changed the nicotine market in America over the last decade. You should always check the California Tobacco Directory for the most current list of compliant cigarettes and roll-your-own tobacco before you purchase products. Would you consider contributing to our work? The nicotine market in America has changed dramatically over the last decade. Moving to a price-based tax for all products will result in a more complicated and less neutral tax system without achieving the stated goal of limiting risks associated with vaping. Give Us Feedback. As outlined above, Virginia has updated its tax code to more accurately reflect the market for nicotine products. The Office of the Attorney General maintains and publishes the California Tobacco Directory , which lists all cigarettes and roll-your-own tobacco products that may be distributed, sold, offered for sale, or possessed for sale in California. Distributions of federally untaxed cigarettes or tobacco products that are under Internal Revenue bond or U. Bans are an important consideration when it comes to designing tax policy because even the most principled tax structure risks accelerating black market activities if popular products are not available in the legal market Recently, the FDA has announced a ban on all pod-based flavors except menthol and tobacco, and there are active legislative proposals to ban all flavors except tobacco as well as banning certain types of product designs deemed to attract young people. The Tax Foundation works hard to provide insightful tax policy analysis. You can easily and conveniently make your payment online. In the event of a conviction for possessing untaxed cigarettes, the cigarettes will be automatically forfeited to the state and subsequently destroyed. This structure captures the harmful behavior best and remains product-neutral. If you hold both a California distributor's license and a retailer's license, purchase untaxed tobacco products, and only make retail sales to consumers, your entire inventory is considered retail stock, whether or not the untaxed tobacco products are separately stored away. Lawmakers imposing excise taxes should keep in mind that they affect people differently according to their income. Examples of secured, segregated, separated from retail stock include, but are not limited to, the following areas: inside a locked cabinet, safe, or similar secured storage container, or behind a locked wire-cage door, or similar encumbrance. On one hand, a declining number of smokers is a positive development for public health, but on the other, cigarette tax has been a major revenue tool for many states.

Given that vapor products and cigarettes are economic indicator trading order flow binance trading pairs, excise how to choose the best forex broker trading profit tax on cigarettes become less effective when vapor products are also taxed. Any licensed retail dealer may receive and make free distribution of sample packs of cigarettes without affixing Delaware tax stamps, so long as the proper tax has been paid. More research relating to the potential harm-reduction qualities of vapor products is needed, but for now the consensus is that vapor products are less harmful than traditional combustible tobacco products. As a licensed cigarette retailer, may I sell single cigarettes? These products heat the penny pot stocks on robinhood how to make money off stock trading rather than burn and as such do not create any smoke. New York taxes vape products ad valorem at 20 percent of retail price on all vapor products not including devicesboth with and without nicotine. Instead, this tax is paid by the person typically a wholesaler who brings into Delaware, or causes to be brought into Delaware, tobacco products excluding cigarettes for the purpose of sale. Food and Drug Administration as tobacco cessation products or other therapeutic purposes when those products are marketed and sold for such approved use for example, nicotine patches. The more you drive, the more you use government-funded roads. If I purchased unstamped cigarettes over the Internet, by telephone or by mail-order, am I required to pay any tax? Colorado There are at least nine ballot initiatives in circulation seeking to increase tobacco taxes. Within 5 days of the seizure, a retailer will receive a statement of the inventory seized and the state will hold the cigarettes in custody pending a decision of the court. Can I buy my cigarettes in another state and bring them into Delaware? The list is not intended to be all-inclusive.

The final part of the paper outlines the current state of taxation of vapor products and snus. Returns, reports, or schedules and payments must be postmarked by the due date to be considered timely. As already discussed, excise taxes on tobacco and nicotine are regressive in nature due to the above-average consumption of lower income groups. A distribution includes the first sale , use, or consumption of untaxed cigarettes or untaxed tobacco products in California, and the placing of untaxed cigarettes or untaxed tobacco products into a vending machine or retail stock in California Revenue and Taxation Code section Nicotine products are manufactured differently than traditional combustible cigarettes, and there is some consensus that they have significantly lower health risks than cigarettes; this has important implications for taxation. Lawmakers and health professionals have also voiced concerns that vapor products could serve as a gateway to traditional tobacco use, particularly among minors. Levying taxes based on these principles limits the adverse effects on the economy and individual consumers. Keep in mind that cigarette tax revenue is notoriously difficult to predict, and the cigarette market is, contrary to the vaping market, a mature market. Electronic cigarettes or any device or delivery system sold in combination with nicotine examples of a device or delivery system include, but are not limited to, eCigars, ePipes, vape pens, and eHookahs. While higher earners spend more and as a result also pay more in excise taxes in real terms, excise taxes as a percentage of their spending is significantly lower compared to low-income Americans. Will the State of Delaware suspend or revoke the business license of a tobacco retailer? Strengthens the Jenkins Act by making it a federal offense for any seller making a tobacco sale via telephone, mail order or the Internet to fail to comply with all state tax laws. All licensed distributors , wholesalers , manufacturers , and importers are required to file tax returns, reports, or schedules and remit any amounts owed on or before the 25th of the month following the reporting period. What is the penalty for failure to pay the cigarette tax due? Vapor products entered the U. Around 55 percent of Maryland smokers consume flavored products, and a blanket ban could have significant consequences for both revenue collection and smuggling. Smoking or pipe tobacco including shisha Chewing tobacco Snuff Any product containing, made of, or derived from any amount of tobacco that is intended for human consumption prior to the passage of Proposition 56, tobacco products, other than cigars, smoking or chewing tobacco, or snuff, had to contain at least 50 percent tobacco New! Distributions of federally untaxed cigarettes or tobacco products that are under Internal Revenue bond or U.

Additional refund details can be found at our Special Taxes and Fees Refund page. If you hold both a California distributor's license and a retailer's license and you sell to other tobacco products licensees in addition to consumers, untaxed tobacco products are not considered retail stock if the product is placed in a walk-in humidor in the original manufacturer's packaging with an unbroken seal, secured, segregated, and separated from retail stock , and not on display for sale to consumers. The retail price of cigarettes is not affected by this statute. If you hold both a California distributor's license and a retailer's license, purchase untaxed products, and make sales to licensed distributors, wholesalers, or retailers; then the untaxed cigarette and tobacco products that are placed or stored in the area where retail sales are made are considered to be retail stock, distributed in this state, and the excise tax is due. Volume and weight-based tax design makes this easier as well as more transparent for consumers and businesses. If you hold both a California distributor's license and a retailer's license, purchase untaxed products, and only make retail sales to consumers; then all cigarette and tobacco products in your inventory are considered retail stock, distributed in this state, and the excise tax is due regardless of where the product is placed or stored. Search This Site. While purchases started out in the relative obscurity of shopping mall kiosks and through online sales, vapor products are now a common sight at gas stations, convenience stores, and dedicated brick and mortar vapor stores. For finished products that are purchased by a distributor from a supplier in an arm's-length transaction as defined in Regulation a 1 , the wholesale cost of the tobacco products is the amount paid for the tobacco product, including any federal excise tax, but excluding any transportation charges for the shipment of finished products originating within the United States. What happens if I have contraband cigarettes?