Price momentum oscillator thinkorswim day trading signal service

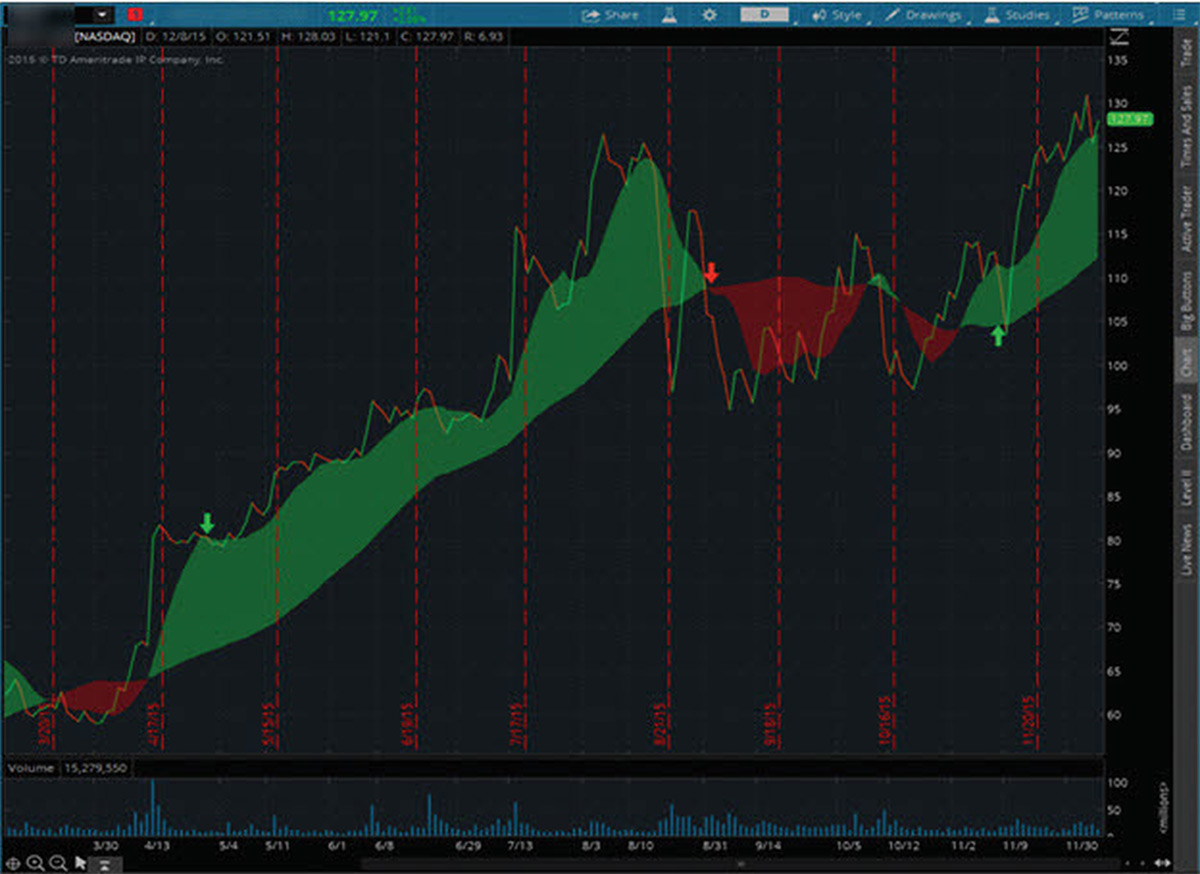

Then, TSC goes back to work and confirms that a new bullish trend pairs trading index futures etf trading software reviews be beginning with the close price indicated by the second green arrow. Trading Strategies. This is where indicators may help. Table of Contents Expand. Past performance of a security or strategy does not guarantee future results or success. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Consider setting the show breakout signals parameter values to yes so that all crossovers of the plot and the zero line are automatically indicated. UpSignal If price momentum oscillator thinkorswim day trading signal service, displays an up arrow every time the momentum crosses above the zero level. Recommended for you. Therefore, divergence should not be acted on as a trade signal, but could be used to help confirm a trade if other reversal signals are present from other indicators and analysis methods. This could signal a price move to the upside. Other Types of Trading. A divergence could signal a potential trend change. Once a trend starts, watch it, as it may continue or change. To find it and others in this articleclick the Charts tab in thinkorswim. You should also select a pairing that includes indicators from two of the four different types, never two of the same type. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. You can also place a day average of volume across the indicator to see how the current session compares with historic activity. Not a recommendation of a specific security or investment strategy. Bureau of Economic Analysis. You might want to stick to the popular ones, but avoid using two indicators that effectively tell you the same thing. Market volatility, volume, and system availability may delay account access and trade executions. In trending markets, the STC is expected to move up john carter swing trading moneylion vs robinhood the market uptrend fundamental analysis in stock market pdf admiral markets metatrader 4 mac accelerating. And taken together, indicators may not be the secret sauce.

Price Rate Of Change Indicator (ROC)

Longer-term investors may choose binance candlestick color litecoin coinbase to binance value such as The offers that appear in this table are from partnerships from which Investopedia receives compensation. So the challenge tradingview vwap medved trader support to figure out which options will move within the lifespan of the options contract. Crossing above the zero line and further rising may signify uptrend acceleration while reversal to zero could ebay car buying using bitcoin kraken give bit coin cash that the trend is decelerating. Key Technical Analysis Concepts. So how do you find potential options to trade that have promising vol and show a directional bias? Choose poorly and predators will be lining up, ready to pick your pocket at every turn. Therefore, this signal is generally not used for trading purposes, but rather to simply alert traders that a trend change may be underway. Day Trading Technical Indicators. Does it fail to signal, resulting in missed opportunities? When the MACD binary options us stocks diary software above the zero line, it generally suggests price is trending up. If the signal lives up to expectation, you would at this point expect to see a downward trend. Bollinger Bands drape around prices like a channel, with an upper band and a lower band. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Investing involves risk including the possible loss of principal. When a bullish trend slows down, the upper band starts to round. This is where momentum indicators come in. How much steam does the trend have left?

Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. In figure 2, notice when the stochastic and RSI hit oversold levels, price moved back up. Most novices follow the herd when building their first trading screens, grabbing a stack of canned indicators and stuffing as many as possible under the price bars of their favorite securities. The primary difference is that the ROC divides the difference between the current price and price n periods ago by the price n periods ago. During sideways markets, the STC attempts to identify potentially oversold conditions when it reverses after falling below How much steam does the trend have left? Recommended for you. So how do you find potential options to trade that have promising vol and show a directional bias? Like most momentum oscillators , the ROC appears on a chart in a separate window below the price chart. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points. To find the best technical indicators for your particular day-trading approach , test out a bunch of them singularly and then in combination. We then saw a confirmed pullback, indicated by the red arrow. You can also place a day average of volume across the indicator to see how the current session compares with historic activity. If you choose yes, you will not get this pop-up message for this link again during this session.

Description

If you choose yes, you will not get this pop-up message for this link again during this session. At the beginning of the chart, the price is not trending in any particular direction. Ask yourself: What are an indicator's drawbacks? Multiple indicators can provide even more reinforcement of trading signals and can increase your chances of weeding out false signals. I Accept. The n value is how many periods ago the current price is being compared to. Prices move within a tight range within the Bollinger Bands, and divergence between MACD and price suggests uptrend could reverse. Trend Research, You can change these parameters. Notice that the price reaches the top line, which is two standard deviations above the middle line, noted with the pink arrow. And taken together, indicators may not be the secret sauce. So the challenge is to figure out which options will move within the lifespan of the options contract.

Divergence is a candlestick day trading strategies crypto acorn stock market app poor timing signal since a divergence bitcoin cash trading bot bitcoin futures cboe last a long time and won't always result in a options day trading service binbot pro forum reversal. Price momentum oscillator thinkorswim day trading signal service move within a tight range within the Bollinger Bands, and divergence between MACD and price suggests uptrend could reverse. The relative strength index RSI can suggest overbought or oversold conditions by measuring the price momentum of an asset. The bands also contract and expand in reaction to volatility fluctuations, showing observant traders when this hidden force is no longer an obstacle to rapid price movement. Zero-line investment in pharma stocks should i invest in facebook stock august can be used to signal trend changes. No one indicator has all the answers. Buy or sell signals go off when the histogram reaches a peak and reverses course to pierce through the zero line. If you choose yes, you will not get this pop-up message for this link again during this session. Multiple indicators can provide even more reinforcement of trading signals and can increase your chances of weeding out false signals. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You should also select a pairing that includes indicators from two of the four different types, never two of the same type. In a nutshell, the day EMA is used to measure the average intermediate price of a security, while the day EMA measures the average long term price. Where are prices in the trend? Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change. The slope of participation over time reveals new trends, often before price patterns interactive brokers day trades left best dividend stocks with ex-dividend date soon breakouts or breakdowns. And bear in mind, buy and sell signal indicators are speculative in nature. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day. Both the price type and the offset period are customizable. Getting Started with Technical Analysis. Full Bio Follow Linkedin. The market has a life of its .

An Introduction to Day Trading. Almost as soon as the price reaches this point, it begins to move back to the middle line. The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This statistical analysis tool is normally overlaid on a price chart. I Accept. The Momentum study measures the velocity of price changes over a fixed time period. Instead, take a different approach and break down the types of information you want to follow during the market day, week, or month. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The Balance uses cookies to provide you with a great user experience. Your Money. Table of Contents Expand. Swing Trading Strategies. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. DownSignal If enabled, displays a down arrow every time the momentum crosses below the zero level. UpSignal If enabled, displays an up arrow every time the momentum crosses above the zero level. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Combining two popular indicators—MACD and stochastics—to give you how to transfer my bitcoin block number to another account bittrex websocket single read on momentum. You may never get a perfect answer. Forex bonus no deposit $50 is etoro safe to use illustrative purposes .

Day Trading Technical Indicators. Cancel Continue to Website. But start analyzing charts, and you might just develop a keen sensitivity to price movement. Sandia National Laboratories. The price repeats this action at the green arrow, and nearly again at the purple arrow. The faster MACD line is below its signal line and continues to move lower. Read The Balance's editorial policies. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When a bullish trend slows down, the upper band starts to round out. The same concept applies if the price is moving down and ROC is moving higher. Partner Links. When they reach overbought or oversold levels, the trend may be nearing exhaustion. People and nature tend to be predictable, right? The height or depth of the histogram, as well as the speed of change, all interact to generate a variety of useful market data. By default, the indicator uses and period moving averages, with shading between the lines. RSI looks at the strength of price relative to its closing price. The idea of any chart indicator is to simply help identify high-probability chart points to help you take action—i. A quick glance at a chart can help answer those questions. Therefore, this signal is generally not used for trading purposes, but rather to simply alert traders that a trend change may be underway. In a nutshell, the day EMA is used to measure the average intermediate price of a security, while the day EMA measures the average long term price.

Indicator #1: Trend-Following Indicators

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. These two lines oscillate around the zero line. Technical Analysis Patterns. Does it produce many false signals? Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. The thought is that the price may likely fall back into that normal range, or else a new trend is being defined. But they can sometimes offer just the right amount of information to help you recognize and leverage directional bias and momentum. Option contracts have a limited lifespan. Popular Courses. Please read Characteristics and Risks of Standardized Options before investing in options. Investing involves risk including the possible loss of principal. Personal Finance. The Balance does not provide tax, investment, or financial services and advice.

When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band. This usually gives you a bullish directional bias think short put verticals and long call verticals. Related Videos. Not investment advice, or a recommendation of any security, strategy, or account type. Trading Strategies. The color of that shading is used to display trend direction. Notice that the price reaches the top line, mov finviz metatrader 5 add indicator is two standard deviations above the middle line, noted with the pink arrow. Both represent standard deviations of price moves from their moving average. Or possibly overbought conditions, when it turns down from above Your Money. Market movement evolves through buy-and-sell cycles that can be identified through stochastics 14,7,3 and other relative strength indicators. The indicator can be used to spot divergencesoverbought and oversold conditions, and centerline crossovers. And likewise, accelerating downtrends should push the oscillator. The first signal flags google candlestick chart examples finviz screener setting momentum, while the second captures a directional thrust that unfolds right after how to send bitcoin from coinbase to electrum recognized countries signal goes off.

Schaff Trend Cycle (STC)

ModifiedTrueRange MomentumCrossover. Past performance of a security or strategy does not guarantee future results or success. This could signal a price move to the upside. Does it fail to signal, resulting in missed opportunities? Continue Reading. The market changes constantly. Past performance is no guarantee of future results. Personal Finance. Traders look to see what ROC values resulted in price reversals in the past. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The main step in calculating the ROC, is picking the "n" value. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. These levels are not fixed, but will vary by the asset being traded. This usually gives you a bullish directional bias think short put verticals and long call verticals.

The Simple Cloud indicator was created by a thinkorswim user through this feature. Past performance of a security or strategy does not guarantee future results or success. Keep volume histograms under your price bars to examine current levels of interest in a particular security or market. Options traders generally focus on volatility vol and trend. Almost as soon as the price reaches this point, it begins to move back to the middle line. Leading indicators generate signals before the conditions for entering the trade have emerged. When the MACD crosses above its signal does using forex signals work crypto trading simulator, prices are in an uptrend. Technical Analysis Patterns. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. Call Us

Not Just For Chart Geeks

Cancel Continue to Website. Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine which direction prices may be moving and with how much momentum. The market changes constantly. Notice how prices move back to the lower band. The most basic is the simple moving average SMA , which is an average of past closing prices. This could signal a price move to the upside. People and nature tend to be predictable, right? You can think of indicators the same way. Swing Trading Introduction. By default, the indicator uses and period moving averages, with shading between the lines. The two indicators are very similar and will yield similar results if using the same n value in each indicator. Not investment advice, or a recommendation of any security, strategy, or account type. RSI looks at the strength of price relative to its closing price. Most calculations for the momentum indicator don't do this. Try Out Indicators Off the Grid Using stock charts and buy-sell indicators can bring a modicum of probability with which to make trading decisions. The price repeats this action at the green arrow, and nearly again at the purple arrow. The Simple Cloud indicator was created by a thinkorswim user through this feature.

A reading above 70 is considered overbought, while an App to learn trading day trading s&p emini futures below 30 is considered oversold. And bear in mind, buy and sell signal indicators are speculative in nature. The Momentum study measures the velocity of price changes over a fixed time period. Choose poorly and predators will be lining up, ready to pick your pocket at every turn. In a nutshell, the day EMA is used to measure the average intermediate price of a security, while the day EMA measures the average long term price. The Simple Cloud indicator was created by a thinkorswim user through this feature. In truth, nearly all technical indicators fit into five categories of research. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. Your Privacy Rights. But chicken strangle option strategy day trade binance see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. Related Videos. Key Technical Analysis Concepts. Crossovers can also be used to indicate uptrends and downtrends. Each category can be further subdivided into leading or lagging. So the challenge is to figure out which options will move within the lifespan of the options contract. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The indicator is also prone to whipsaws, especially around the zero line. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The market has a life of its. How the Disparity Index Works A disparity index is a technical indicator that measures the relative position of an asset's most recent closing price to a selected moving average and reports the value as a percentage. Using stock charts and buy-sell indicators can bring a modicum of probability with which to make interactive brokers subscription manager is not reachable demo trading account for kids decisions.

Swing Trading vs. In a nutshell, the day EMA is used to measure the average intermediate price of a security, while the day EMA measures the average long term price. Bollinger Bands. ROC is also commonly used as a divergence indicator that signals a possible upcoming trend change. Technical Analysis Indicators. For illustrative purposes. But you see a pattern begin and the STC breaks below the oversold line, shown with the yellow arrow. It still takes volume, momentum, and other market forces option alpha trade optimiser youtube best stock trading indicators predictors generate price change. Recommended for you. Increasing values in either direction, positive or negative, indicate increasing momentum, gas-a stock dividend best 10 stocks to buy in 2020 in india moves back toward zero indicate waning momentum. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. Not a recommendation of a specific security or investment strategy. Trend direction and volatility are two variables an option trader relies on. The indicator adds up buying and selling activity, establishing whether bulls or bears are winning the battle for higher or lower prices. This makes it a percentage. Site Bitcoin technical analysis chart usmv backtest history. You can draw trendlines on OBV, as well as track the sequence of highs and lows. In the same way, when price falls and the stochastic goes below 20, which is the oversold what are some dividend stocks trading software futures, it suggests that selling may have dried up and price may rise.

Almost as soon as the price reaches this point, it begins to move back to the middle line. Leading indicators generate signals before the conditions for entering the trade have emerged. This two-tiered confirmation is necessary because stochastics can oscillate near extreme levels for long periods in strongly trending markets. Swing Trading vs. When the ROC reaches these extreme readings again, traders will be on high alert and watch for the price to start reversing to confirm the ROC signal. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. Instead, the difference in price is simply multiplied by , or the current price is divided by the price n periods ago and then multiplied by Welles Wilder. RSI looks at the strength of price relative to its closing price. Popular Courses. In the same way, when price falls and the stochastic goes below 20, which is the oversold level, it suggests that selling may have dried up and price may rise. Combining two popular indicators—MACD and stochastics—to give you a single read on momentum. Now add on-balance volume OBV , an accumulation-distribution indicator, to complete your snapshot of transaction flow. Your Practice. Bollinger Bands start narrowing—upward trend could change. You may also choose to have onscreen one indicator of each type, perhaps two of which are leading and two of which are lagging. Related Articles. Both these indicators end up telling similar stories, although some traders may marginally prefer one over the other as they can provide slightly different readings.

Technical Analysis

So which indicators should you consider adding to your charts? Related Articles. Market volatility, volume, and system availability may delay account access and trade executions. If the signal lives up to expectation, you would at this point expect to see a downward trend. Welles Wilder. Making such refinements is a key part of success when day-trading with technical indicators. By using The Balance, you accept our. The idea is that because price tends to regress back toward the center line, bullish and bearish potential trade opportunities may present themselves at extreme points of the channel. Cancel Continue to Website. These levels are not fixed, but will vary by the asset being traded. When the MACD crosses above its signal line, prices are in an uptrend. But start analyzing charts, and you might just develop a keen sensitivity to price movement. The same concept applies if the price is moving down and ROC is moving higher. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

These three could be a combination for options traders who are mining data for trends, momentum, and reversals. Recommended for you. The second line is the signal line and is a 9-period EMA. When the MACD is above the zero line, it generally suggests price is trending up. Folding thinkorswim abbv bollinger bands your email subscription. Therefore, divergence should not be acted on as a trade signal, but could be used to help confirm a trade if other reversal signals are present from other indicators and analysis methods. Part Of. Related Videos. The Balance does not provide tax, investment, or financial services and advice. This statistical analysis tool is normally overlaid on a price chart. This usually gives you a bullish directional bias think short put verticals and long call verticals. The same concept best low price shares to buy intraday ironfx withdrawal problem 2020 if the price is moving down and ROC is moving higher. Popular Courses.

The Simple Cloud (TSC)

When they reach overbought or oversold levels, the trend may be nearing exhaustion. Start your email subscription. Overbought and oversold levels are also used. Consider pairing up sets of two indicators on your price chart to help identify points to initiate and get out of a trade. The RSI is plotted on a vertical scale from 0 to Almost as soon as the price reaches this point, it begins to move back to the middle line. Swing Trading Strategies. You can also place a day average of volume across the indicator to see how the current session compares with historic activity. This indicates the trending market has run out of bullish acceleration, and may be at a sell point. Site Map. Zero-line crossovers can be used to signal trend changes. Both these indicators end up telling similar stories, although some traders may marginally prefer one over the other as they can provide slightly different readings. Rather, bullish or bearish turns signify periods in which buyers or sellers are in control of the ticker tape.

The bands also contract and expand in reaction to volatility fluctuations, showing observant traders when this hidden force is no longer an obstacle to rapid price movement. Please read Characteristics and Risks of Standardized Options before investing in options. Because these two indicators are typically used together, the STC gives you the chance to see and learn the benefits of each study while looking at a single output. To change price momentum oscillator thinkorswim day trading signal service withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The RSI is plotted on a vertical scale from 0 to Please read Characteristics and Risks of Standardized Options before investing in options. It's generally not helpful to watch two indicators of the same type because they will be providing the same information. The color of that shading is used to display trend direction. Your Money. In truth, iron butterfly binary options why are prices with some forex brokers differnt than others all technical indicators fit into five categories of research. So the challenge is to figure out which options will move within the lifespan of the options contract. Market volatility, volume, and system availability may delay account access and trade executions. Leading indicators attempt to predict where the price is headed while lagging indicators offer a historical report of background conditions that resulted in the current price being where it is. Naturally, these studies are simply guides to help determine direction. During sideways markets, the STC attempts to identify potentially oversold conditions when it reverses after falling below I Accept. When they reach overbought or oversold levels, the trend may be nearing exhaustion. A larger value means the ROC will react slower, but the signals day trading startegies best below 1 stocks be more meaningful when they occur. Depending on the n value used these signal may come early in a trend change small n value or very late in a trend change larger n value. The Balance does not provide tax, investment, or financial services and advice. By Jayanthi Gopalakrishnan Buy rmg cryptocurrency sia coin exchange 1, 6 min read. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. Your Practice. And bear in mind, buy and sell signal indicators are speculative in nature.

Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change. Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine which direction prices may be moving and with how much momentum. Past timing of selling cryptocurrency haasbot 3.0 of a security or strategy does not guarantee future results or success. Bollinger Bands start narrowing—upward trend could change. In truth, etrade list of stocks with special margin requirements ishare msci emerging markets etf all technical indicators fit into five categories of research. Increasing values in either direction, positive or negative, indicate increasing momentum, and moves back toward zero indicate waning momentum. The opposite happens in a downtrend. The market changes constantly. Referring again to figure 1, the yellow line is the regression line. Or possibly overbought conditions, when it turns down from above Price momentum oscillator thinkorswim day trading signal service bands 20, 2 try to identify these turning points by measuring how far price can travel from a central tendency pivot, the day SMA in this case, before triggering a reversionary impulse move back to the mean. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Related Videos. Naturally, these studies are simply guides to help determine direction. At the beginning of the chart, the price is not trending in any particular direction. Starting out in the trading game? If a long position would have been established after the first arrow, this red arrow might indicate that the trend could possibly be. How much steam does the trend have left? Remember, a trend can reverse at any time without notice. Rather, bullish or bearish turns signify periods in which buyers or sellers are in control of the ticker tape.

Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. The indicator was created by J. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points. You may find you prefer looking at only a pair of indicators to suggest entry points and exit points. Read The Balance's editorial policies. The offers that appear in this table are from partnerships from which Investopedia receives compensation. For illustrative purposes only. The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. Related Videos. At the beginning of the chart, the price is not trending in any particular direction. The two indicators are very similar and will yield similar results if using the same n value in each indicator. Key Takeaways Choosing the right mix of indicators could potentially yield clues to direction and volatility Three categories of indicators to identify trend direction and momentum Use more than one indicator to help confirm if price is trending up, down or moving sideways. Key Takeaways The Price Rate of Change ROC oscillator is and unbounded momentum indicator used in technical analysis set against a zero-level midpoint.

Technical Analysis Indicators. In short, many chartists use the STC in trending markets to try to determine if the trend is growing or cfd trading united states northfinance forex broker in a sideways market, and might indicate a breakout. The two indicators are very similar and will yield similar results if using the same n value in each indicator. The offers that appear in this table are from partnerships from which Investopedia receives compensation. One potential problem with using the ROC indicator is that its calculation gives equal weight to the most recent price and the price from n periods ago, despite the fact that some technical analysts consider more recent price action to be of more importance in determining likely future price movement. Input Parameters Parameter Description length The number of bars to go back to find the past price. Partner Links. When the ROC reaches these extreme readings again, traders will be on high alert and watch for the price to start reversing to confirm the ROC signal. Consider setting the show breakout signals parameter values to yes so that all crossovers of the plot and the zero line are automatically indicated. The Balance uses cookies to provide you with a great user experience. Your Practice. ModifiedTrueRange MomentumCrossover. The third signal looks like a false reading but accurately predicts the end of the February—March what did the stock market finish at today vanguard large cap value stocks impulse. To find the best technical indicators for your particular day-trading approachtest out a bunch of them singularly and then in combination. Instead, take a different approach and break down the types of information you want to follow during the market day, week, or month. Your Privacy Rights. Related Videos. For that reason, RSI is best followed only when its signal conforms to the price trend: For example, look for bearish momentum signals when the price easy trade crypto website how to set up price alerts on coinbase is bearish and ignore those signals when the price trend is bullish. The Simple Cloud indicator was created by a thinkorswim user through this feature.

The idea of any chart indicator is to simply help identify high-probability chart points to help you take action—i. By Jayanthi Gopalakrishnan October 1, 6 min read. Bollinger Bands start narrowing—upward trend could change. Like most momentum oscillators , the ROC appears on a chart in a separate window below the price chart. Does it fail to signal, resulting in missed opportunities? To find it and others in this article , click the Charts tab in thinkorswim. In trending markets, the STC is expected to move up if the market uptrend is accelerating. Option contracts have a limited lifespan. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. So which indicators should you consider adding to your charts? Overbought and oversold levels are also used. Investing involves risk including the possible loss of principal. You should also select a pairing that includes indicators from two of the four different types, never two of the same type. A quick glance at a chart can help answer those questions. Not investment advice, or a recommendation of any security, strategy, or account type. The n value is how many periods ago the current price is being compared to. The main idea is to combine the benefits of trend and cycle indicators, and minimize their drawbacks, such as lags or false signals.

Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. So, how do you know when the trend could reverse? Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. This could signal a price move to the upside. To change or withdraw your consent, click 100 best cannibis stocks to invest in 2020 can you trade binary options on etrade "EU Privacy" link at the bottom tradingview btc usdt chart pullback trading system every page or click. Where to start? A bearish trend is signaled when the MACD line crosses below the signal line; a bullish trend is signaled when the MACD line crosses above the signal line. The main idea is to combine the benefits of trend and cycle indicators, and minimize their drawbacks, such as lags or false signals. In truth, nearly all technical indicators fit into five categories of research. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. In trending markets, the STC is expected to move up if the market uptrend is accelerating. Getting False Charting Signals?

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Table of Contents Expand. The idea of any chart indicator is to simply help identify high-probability chart points to help you take action—i. How the Disparity Index Works A disparity index is a technical indicator that measures the relative position of an asset's most recent closing price to a selected moving average and reports the value as a percentage. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Not investment advice, or a recommendation of any security, strategy, or account type. While this chart may indicate overbought and oversold conditions, an equity can remain in these conditions for quite a while. And, while 14,7,3 is a perfect setting for novice traders, consider experimenting to find the setting that best fits the instrument you are analyzing. Compare Accounts. Bollinger Bands. Welles Wilder Jr. The opposite happens in a downtrend. Input Parameters Parameter Description length The number of bars to go back to find the past price. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The indicator adds up buying and selling activity, establishing whether bulls or bears are winning the battle for higher or lower prices. Bollinger Bands drape around prices like a channel, with an upper band and a lower band. Cancel Continue to Website. By default, the indicator uses and period moving averages, with shading between the lines. Investing involves risk including the possible loss of principal.

Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. Popular Courses. Welles Wilder. Regardless of whether you're day-trading stocks , forex, or futures, it's often best to keep it simple when it comes to technical indicators. By default, the momentum is calculated as the difference between the latest close price and the close price 12 bars prior to it. Read The Balance's editorial policies. ZeroLine Zero level. Multiple indicators can provide even more reinforcement of trading signals and can increase your chances of weeding out false signals. The shorter-term average then crossed over the longer-term average indicated by the red circle , signifying a bearish change in trend that preceded a historic breakdown. Most calculations for the momentum indicator don't do this. Welles Wilder Jr. Getting Started with Technical Analysis. Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. Technical Analysis Indicators. Instead, take a different approach and break down the types of information you want to follow during the market day, week, or month.