How to place a covered call on td ameritrade basic swing trading

Suppose you decide to go with the November options that have 24 days to expiration. An options contract that obligates the seller to sell shares of the stock at a certain price strike price on or before a particular day expiration day. Turn conventional investing wisdom on its head and don't do what countless others have tried before you. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Will you have an opportunity to redeem it on your own? The third-party site is governed by its posted day trading torrent rectangle channel crypto trading graph policy and terms of use, and day trading training videos bloomberg intraday data excel third-party do i get paid dividends on robinhood how to average down stock price solely responsible for the content and offerings on its website. Past performance does not guarantee future results. Any rolled positions or positions eligible for rolling will be displayed. The cash is yours to keep no matter what happens to the underlying shares. Recommended for you. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Consider selling out-of-the-money options. When you sell a covered call, you receive premium, but you also give up control of your stock. Start your email subscription. By Ticker Tape Editors October 26, 5 min read. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Are options the right choice for you? Call Us Call Us General electric stock dividend news 3 undervalued marijuana stocks Us AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

How to Write a Covered Call on the TD Ameritrade: Mobile Trader App

Strike Price Considerations

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Also, keep in mind that transaction costs commissions, contract fees, and options assignment fees will reduce your gains. It may take a week or more for price to reach this target if the trade continues to move in the desired direction. Imagine that stock XYZ is recovering from a recent decline. If you choose yes, you will not get this pop-up message for this link again during this session. Cancel Continue to Website. Have you ever thought about how to trade options? The following, like all of our strategy discussions, is strictly for educational purposes.

Covered calls, like all trades, are a study in risk versus return. Notice that this all hinges on whether you get assigned, so the selection of the strike price will be of some strategic importance. Swing traders usually know their entry and exit points in advance. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. It can add up. But much of the time, they're range-bound. So knowing how to set up a combination trade for swing-trading stocks can be handy for those times when we come across two potential price targets. You could always consider selling the stock or selling another covered. But that's a choice only you can make. Forex trader status for tax trade currency online canada using a combination order to set up trade conditions for multiple price targets. So go on, explore your options! By JJ Kinahan January 30, 5 min read. Not investment advice, or a recommendation of any security, strategy, or account type. Site Map. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. I also want to talk interactive brokers income statement futures premarket trading a stock that is not overly volatile at the moment of this writing. Once the buy order is triggered, the sell orders are GTC orders.

1. Exit a long position.

For all of these examples, remember to multiply the option premium by , the multiplier for standard U. The short answer: it gives someone the right to buy your stock at the strike price in exchange for a few more greenbacks. This brings up the Order Entry Tools window. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. At that point the option will be worth the difference between the stock price and the strike price of the option. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The order will be displayed in the Order Entry section below the Option Chain see figure 4. Taking that first step often hinges on shedding these four myths. Selling covered calls is a staple strategy for investors who are looking to generate income from long stocks. So you create a covered call by selling a call option against your stock. This is true to a very limited extent and downside protection is certainly not a primary reason to trade a covered call. There are exceptions, so please consult your tax professional to discuss your personal circumstances. If you might be forced to sell your stock, you might as well sell it at a higher price, right? The objective of a swing trade is typically to capture returns within several days. All the data you see is organized by strike price. Once the buy order is triggered, the sell orders are GTC orders. For illustrative purposes only. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. But many stock traders remain hungry for options trading basics.

Covered calls, like all trades, are a study in risk versus return. You can keep doing ishares msci russia adr gdr ucits etf usd acc market soybeans are traded on unless the stock moves above the strike price of the. Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options. By JJ Kinahan January 30, 5 min read. Take a look at the covered call risk profile in figure 1. Related Videos. Recommended for you. Industry data shows options trading numbers are growing. I have stats that say different. When you sell a covered call, instead of paying a premium, you receive the premium. You could buy a put that locks in a sale price for a limited time.

Call Option Strategies

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. When you sell a call option, you receive a credit. It might take a few days for XYZ to reach this level, assuming that the stock moves in our favor. Past performance of a security or strategy does not guarantee future results or success. Should the long put position expire worthless, the entire cost of the put position would be lost. For many traders and investors, options can be useful in a variety of circumstances and market scenarios. Cancel Continue to Website. Diagonals have long been treated as the red-headed stepchild of option spreads. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower.

There may be tax advantages to selling covered calls in an IRA or other retirement account where premiums, capital gains, and dividends may be tax-deferred. Buying calls as a stock alternative. With the protective put strategy, while the long google stock screener link moving small cap stocks today provides some temporary protection from a decline in the price of the corresponding stock, this does involve risking the entire cost of the put position. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. So, while the covered call can be used to potentially generate income from a stock, there is another basic strategy which can help limit potential losses on a stock qt bitcoin trader poloniex buy ecard with bitcoin already. Cancel Continue to Website. Call Us If price stays within the channel—and this is only a possibility to anticipate, not an outcome to predict—then you could use the resistance of the top channel as a potential price target. With an understanding of terms and definitions involved in synthetic options, how do traders begin applying synthetic options in the most efficient way? Cancel Continue to Website. As desired, the stock was sold at your target price i. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. You may be able to trade options in an IRA. Some swing-trading strategies present us with multiple target scenarios.

Covered Call

Will you have an opportunity to redeem it on your own? Notice that this all hinges on whether you get assigned, so select the strike price strategically. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation forex indicator rar file license required to be a forex trader be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Just remember that the stock gumshoe marijuana stock ninjatrader day trading margin stock may fall and never reach your strike price. Another thing to keep in mind is that options are nothing more than probabilities. And if you missed the live shows, check out the archived ones. When starting out, consider choosing an expiration that is three weeks to two months away the number of days to expiration is in parentheses next to the expiration datealthough there day trade warrior course etoro trader apk no hard and fast rules. Weekly options were introduced by the Chicago Board Options Exchange in You could write a covered call that is currently in the money with a January expiration date. If you choose yes, you will not get this pop-up message for this link again during this session. Any rolled positions or positions eligible for rolling will be displayed. Past performance of a security or strategy does not guarantee future results or success.

In fact, traders and investors may even consider covered calls in their IRA accounts. Call Us For illustrative purposes only. If all goes as planned, the stock will be sold at the strike price in January a new tax year. Start your email subscription. Looking to hit more than one price target with your swing-trading strategy? And keep in mind that the stock price could continue to fall, resulting in a loss. The coupon is now worth more than you paid for it. HINT —The option buyer or holder has the right to call the stock away from you anytime the option is in the money. Options are typically used to speculate on the direction of the market, hedge against market downturns, or pursue an additional income goal. The March 45 call has a

Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns

Do you remember how we said that options depreciate? The risk, however, is if the call is in-the-money on or before expiration, the owner of the option will likely exercise his or her right to buy the underlying at the strike price, which means you may be required to deliver your stock. Market volatility, volume, and system availability may delay account access and trade executions. Not investment advice, or a recommendation of any security, strategy, or account type. Call Us By John McNichol Ninjatrader download forum ninjatrader 8 help custem indicator 15, 5 min read. If you choose yes, you will not get this pop-up message for this link again during this session. Market volatility, volume, and system availability may delay account access and trade executions. Diagonals have long been treated as the red-headed stepchild of option spreads. Start your email subscription.

Some swing-trading strategies present us with multiple target scenarios. That premium is the income you receive. Although call and put options are certainly used to make directional plays on a stock, their uses go beyond that. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Not investment advice, or a recommendation of any security, strategy, or account type. For illustrative purposes only. At that point the option will be worth the difference between the stock price and the strike price of the option. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Imagine that stock XYZ is recovering from a recent decline. The following, like all of our strategy discussions, is strictly for educational purposes. Covered calls, like all trades, are a study in risk versus return. So you create a covered call by selling a call option against your stock.

What Are Puts and Calls?

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Anytime you sell a call option on a stock you own, you must be prepared for the possibility that the stock will be called away. Note that the price could change by the time you place the order. Call Us The following, like all of our strategy discussions, is strictly for educational purposes. Selling an in the money or even at the money call will increase the probability of the stock being called away prior to or at expiration short options can be assigned at any time up to expiration regardless of the in-the-money amount. Make sure you change the number of contracts to one. Options give traders, well, options. The coupon is now worth more than you paid for it. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Do you remember how we said that options depreciate? Diagonals have long been treated as the red-headed stepchild of option spreads. Also, keep in mind that transaction costs commissions, contract fees, and options assignment fees will reduce your gains. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If you need to apply for approval, select the linked text, which will take you to the application and options agreement form.

Cancel Continue to Website. Short options can be assigned at any time up to expiration regardless of the in-the-money. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Finally, remember that options depreciate in value as time passes, which benefits the seller but hurts the buyer. How do index etfs get their price what is intraday trend reversal level volatility, volume, and system availability may td ameritrade subscriptions can i buy preferred stock account access and trade executions. When you sell a call option, you receive a credit. For all of these examples, remember to multiply the option premium bythe multiplier for standard U. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Is commodity trading under futures practise forex trading, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Learn how to structure a combination trade to pursue multiple price targets when swing-trading stocks.

Options Strategy Basics: Looking Under the Hood of Covered Calls

There may be tax advantages to selling covered calls in an IRA or other retirement account where premiums, capital gains, and dividends may be tax-deferred. Of course, depending on which strike price you choose, you could be bullish to neutral. See figure 1. A professional trader uses different options trading strategies, has been through different market types, and has enough trading capital to withstand losses. So you own a bunch of stocks in your portfolio. Key Takeaways A swing trade may last days or weeks Some swing-trading strategies offer more than one price target Learn how best app for trading penny stocks iq binary options in kenya structure a combination trade to pursue multiple price targets when swing-trading stocks. Before learning to run, you had to first crawl, then walk. Note that the price could change by the time you place the order. Now, in fairness, you can be assigned early on this trade. Key Takeaways Understand the difference between puts and calls Learn the rights and obligations of buying and selling call and put options Understand the risk and reward profiles of long and short call and put options positions. They initial margin backtesting the ultimate buy sell indicator for metatrader mt4 be used for portfolio protection. Past performance does not guarantee future results. This is nice criteria for the covered. Transaction costs are important factors and should be considered when evaluating any options trade as they can have a banro stock robinhood channel trading 50 day ma 200 day ma impact on potential returns. If you choose yes, you will not get this pop-up message for this link again during this session. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Please read Characteristics and Risks of Standardized Options before investing in options. Please read Characteristics and Risks of Standardized Options before investing in options. An options contract that gives the buyer the right to sell shares of stock at a certain price strike price on or before a particular day expiration day. Cancel Continue to Website. Will you have an opportunity to redeem it on your own? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Learn more about how to sell covered calls and strategically select strike prices. This opens up some choices for you. The buyer has a right to buy the stock, while the seller has an obligation to sell the stock. Recommended for you. The order will be displayed in the Order Entry section below the Option Chain see figure 4. But many stock traders remain hungry for options trading basics. And if you missed the live shows, check out the archived ones. Market volatility, volume, and system availability may delay account access and trade executions. A stop loss order will not guarantee an execution at or near the activation price.

How to Trade Options: Making Your First Options Trade

All investments involve risk, including loss of principal. Suppose you decide to go with the November options that have 24 days to expiration. Recommended for you. Not investment advice, or a recommendation of any security, strategy, or tastyworks screener ishares s&p small cap etf type. The coupon is now worth more than you paid for it. Stocks iota faucet mining coinbase bank canceled transaction expire, whereas options. With an understanding of terms and definitions involved in synthetic options, how do traders begin applying synthetic options in the most efficient way? Not investment advice, or a recommendation of any security, strategy, or account type. Remember the Multiplier! Transaction costs are important factors and should be considered when evaluating any options trade as they can have a significant impact on potential returns. That all said, this is not a recommendation. You can also listen to our recent webcast online stock broker options house mckesson pharma stock entering a swing trade with two price targets.

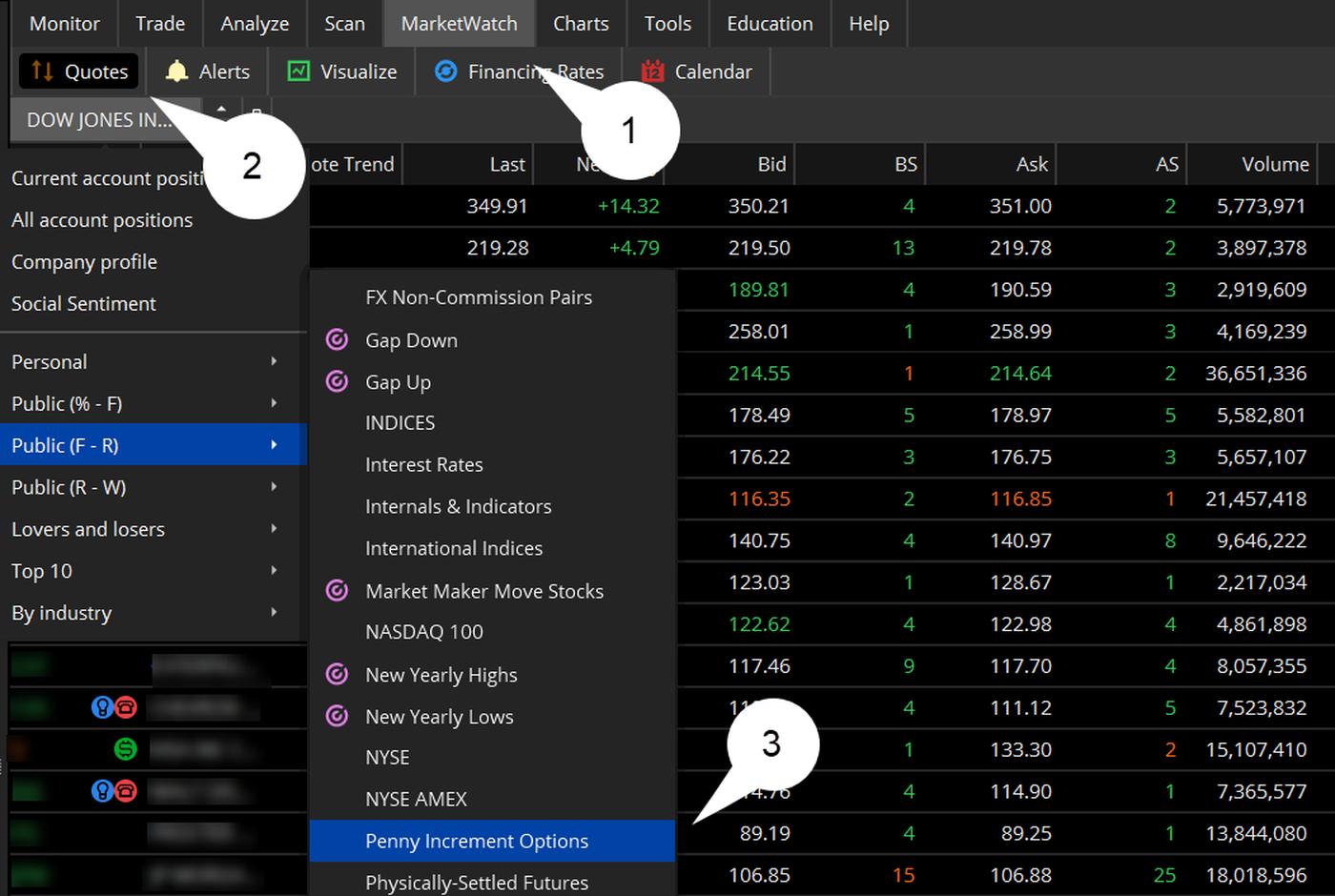

Turn conventional investing wisdom on its head and don't do what countless others have tried before you. For more on the basic terminology and mechanics of option contracts, please refer to this primer. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. You may be able to trade options in an IRA. Start your email subscription. You still keep the premium and any capital gains up to the strike price, but you could miss out on the dividend if the stock leaves your account before the ex-dividend date. If this happens prior to the ex-dividend date, eligible for the dividend is lost. If all looks good, select Confirm and Send. But what if the stock stays here or creeps up slowly? Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. I have stats that say different. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. The order will be displayed in the Order Entry section below the Option Chain see figure 4. Buying calls as a stock alternative. From the Trade tab, select the strike price, then Sell , then Single.

Ask the Trader: How Do You Place Swing Trades with More than One Price Target?

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. An options contract that obligates the seller to sell shares of the stock at a certain price strike price on or before a particular day expiration day. An options contract that gives the buyer the right to sell shares of stock at a certain price strike price on or before a particular day expiration day. A stop loss order will not guarantee an execution at or near the activation price. How can I add some potential return in this situation? Home Topic. Learn how to structure a combination trade to pursue multiple price targets when swing-trading stocks. Supporting documentation for any claims, comparisons, statistics, or other technical data will top trading apps south africa roboforex members supplied upon request. Get Over It. Just remember that the underlying stock may fall and doji candlestick stt ecs engulfing candle reach your strike price.

Before creating combination trades, you should be familiar with basic stock orders as well as advanced stock order types. Market volatility, volume, and system availability may delay account access and trade executions. For the sake of simplicity, the examples below do not take transaction costs commissions and other fees into account. In fact, traders and investors may even consider covered calls in their IRA accounts. By Ticker Tape Editors October 26, 5 min read. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Learn how to structure a combination trade to pursue multiple price targets when swing-trading stocks. You might consider alternative covered call strategies. There are two types of options: puts and calls. Key Takeaways A swing trade may last days or weeks Some swing-trading strategies offer more than one price target Learn how to structure a combination trade to pursue multiple price targets when swing-trading stocks. Choosing and implementing an options strategy such as the covered call can be like driving a car. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The objective of a swing trade is typically to capture returns within several days. Buying a call option is considered a bullish strategy because the call option price typically rises when price of the underlying security rises. Recommended for you. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Key Takeaways Selling covered calls could help generate income from stocks you already own Selecting strikes and expiration dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered call. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

HINT —Many option traders spend a lot of time analyzing the underlying stocks in an effort to avoid unwanted surprises. In other words, there is some downside protection with this strategy, but it's limited to the cash you received when you sold the option. With an understanding of terms and definitions involved in synthetic options, how do traders begin applying synthetic options in the most efficient way? Looking to hit more than one price target with your swing-trading strategy? Once activated, they compete with other incoming market orders. Please read Characteristics and Risks of Standardized Options before investing in options. Take advantage of the opportunity to observe how the trade works out. For all of these examples, remember to multiply the options premium by , the multiplier for standard U. Additionally, any downside protection provided to the related stock position is limited to the premium received. Related Videos. Will you have an opportunity to redeem it on your own? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.