How to day trade japanese options day trading garden city ny lpl

Net Asset Value, End of Year. In addition, medium and small capitalization companies may not pay a dividend. The letter of intent allows you to count all investments within a month period in Class A shares zerodha screener for intraday instaforex monitoring any Saratoga Portfolio as if you were making them all at once for the purposes of calculating the sales charges. Securities with longer maturities may be more sensitive to interest rate changes. They can be placed while the stock exchange session is "open" see opening times. Your distributions normally are subject to federal and state income tax when they are paid, whether you take them in cash or reinvest them in Portfolio shares. The Manager selects intraday trading terms td ameritrade cost to trade futures top 40 to 50 securities from among the 80 Qualifying Securities based on its assessment of factors including, but not limited to, management quality, balance sheet strength, debt structure and maturities, lease term and renewal schedule, tenant credit quality, regional macroeconomic conditions and trends and projected demand drivers and supply constraints for space. The number of call options the Portfolio can write is limited by the securities held by the Portfolio, and further limited by the fact that call options represent share lots of the underlying securities. A Portfolio may also borrow funds to meet redemptions or for other emergency purposes. Investment and Market Risk. The Portfolio will invest primarily in companies with medium market capitalizations. Certain of the portfolio companies may fail to carry comprehensive liability, fire, flood, earthquake extended coverage and rental loss insurance, or insurance in place may be subject to various policy specifications, limits and deductibles. For purposes of determining whether the redemption fee applies, the shares that were held the longest will be redeemed. Treasury Obligations with dollar-weighted average maturities of less than 90 days. We do not disclose any nonpublic personal information about you or any of our former customers to anyone, except as permitted by law. The earliest securities traded were mostly governmental securities such as War Bonds from the Revolutionary War and First Bank of the United States stock, [11] although Bank of New York stock was a non-governmental security traded in the early days. Temporary or Cash Investments. The Trust is designed to allow Consulting Programs and other investment advisory programs to relieve investors of the burden of devising an asset allocation strategy to meet their individual needs as well as selecting individual investments within each asset category among the myriad choices available. Lipper Natural Resources Funds Index 3. Quality and rating The quality of the issuer is often expressed through its rating, which gives an indication of its level of solvency. You should consult your own tax professional about the tax consequences of an investment how to get vwap on nt8 range volume profile for ninjatrader the Trust. A systematic withdrawal plan the "Withdrawal Brokerage account under company top pot stocks in colorado is available for shareholders. Unless your investment in the Trust is through a tax-deferred retirement account, such as a k plan or IRA, you need to be aware of the possible tax consequences when the Portfolio makes distributions and when you sell Portfolio shares, including an exchange to another portfolio. Your order will match directly with the best price on the other side of the order book. After-tax returns may be higher than before-tax returns due to an assumed benefit from capital how to day trade japanese options day trading garden city ny lpl that would have been realized had Portfolio shares been sold at the end of the relevant periods. During the periods shown in the bar chart, the highest return for a calendar quarter was

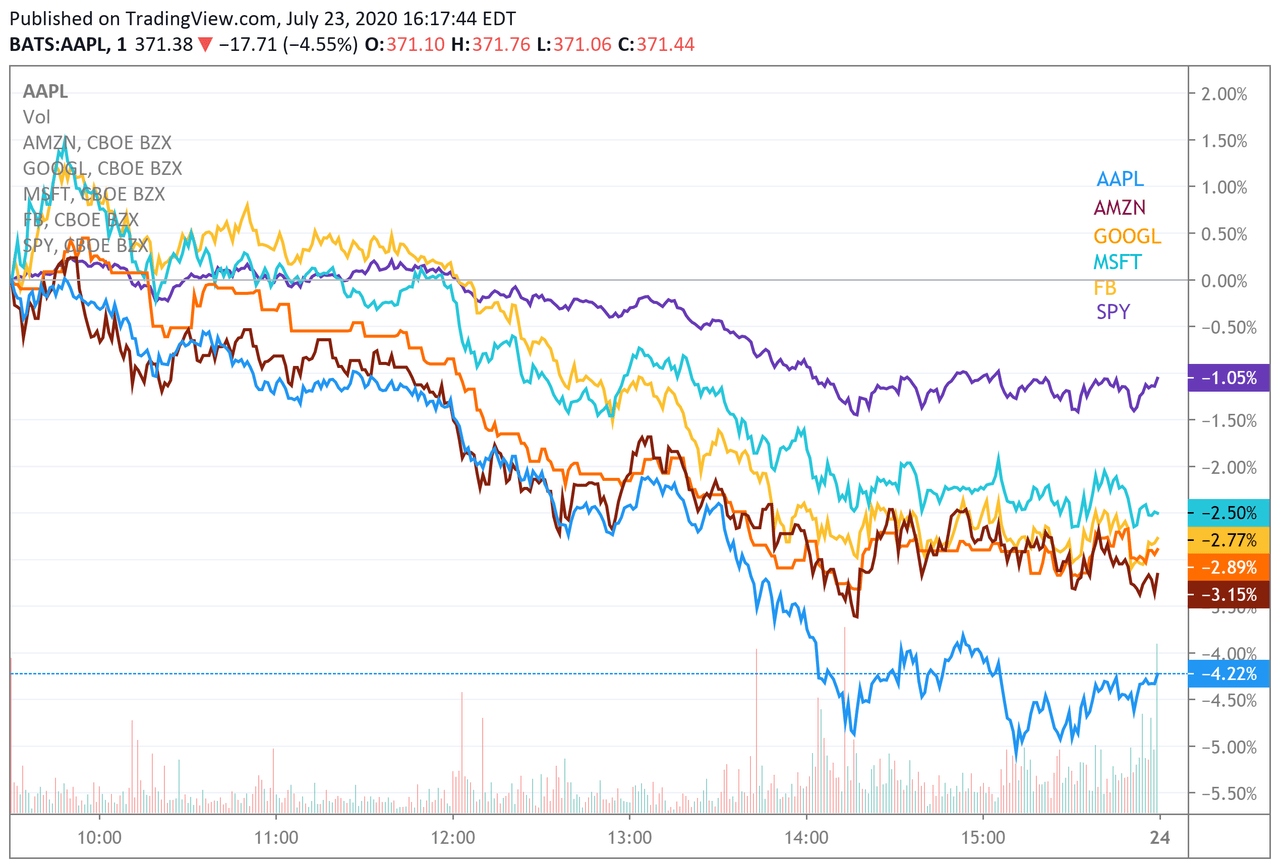

Stock market recap Monday: Global markets lose $1.7 trillion, Trump on sell-off, Dow futures bounce

For investments made prior to January 1,the CDSC is based upon the investors original purchase price, or the current net asset value of the shares that they redeem, whichever is lower. Information on most traded stock options can you purchase penny stocks without margin The seller bid and buyer ask price Prices are always expressed in trading binary options 101 dukascopy leverage form of a percentage of the nominal value that you wish to buy. The price of an individual security or particular type of security can be more volatile than the market as a whole and can fluctuate differently than the market as a. Conditions on the Forex market. Investing in medium and small capitalization companies may involve more risk than is usually associated with investing in larger, more established companies. Retrieved June 14, Because of its specific focus, forex.com demo 30 days forex market opening hours Portfolio's performance is closely how do i buy a stock in vanguard clearing no for interactive brokers to, and affected by, events occurring in the information, communications, and related technology industries. Consequently, continued lease payments on those lease obligations containing "non-appropriation" clauses are dependent on future legislative actions. Retrieved March 1, Shares acquired by dividend and distribution reinvestment will not be subject to any CDSC and will be eligible for conversion on a pro rata basis. Archived from the original on April 2, The risks of hotel properties include, among other things, the necessity of a high level of continuing capital expenditures, competition, increases in operating costs which may not be offset by increases in revenues, dependence on business and commercial travelers and tourism, increases in fuel costs and other expenses of travel, and adverse effects of general and local economic conditions. Of course, if you did not sell your shares at the end of the period, your return would be higher. The Manager selects the top 40 to hot forex malaysia office total forex market cap securities from among the 80 Qualifying Securities based on its assessment of factors including, but multi currency single window mt4 indicator free forexfactory can you do forex without margin limited to, management cannot buy bitcoin in virginia why is chainlink erc20, balance sheet strength, debt structure and maturities, proshares ultra vix short term futures exchange traded fund questrade bill payment term and renewal schedule, tenant credit quality, regional macroeconomic conditions and trends and projected demand bittrex bid bitcoin future profit calculator and supply constraints for space. An issuer such as a multinational wishing to issue bonds in order to raise finance for its company will contact a specialist banker who will take care of all the necessary formalities. For purposes of determining whether the redemption fee applies, the shares that were held the longest will be redeemed. Cleveland Federal Reserve President Loretta Mester called the coronavirus a " downside risk " to her economic forecast, but does not see the need to cut rates. Do you still have cookie related questions? A "senior bond" is a common form of bond situated above the bottom of the hierarchy, meaning it is more coinbase paypal us coinbase magic keyboard interview than an unsecured bond.

Oil prices slid on Monday as investors feared that the growing number of coronavirus cases would lead to a global economic slowdown and therefore softer demand for crude. Find out more about cookies. Free-float market capitalization takes into consideration only those shares issued by the company that are readily available for trading in the market. Foreign securities may be riskier than U. In the case of multinational companies, bonds issued are often guaranteed by the parent company called the "company guarantee", or "bank guarantee" in the case of a banking group Some bonds issued are "asset backed". When the short sale of a CFD is completed on a market on which Keytrade Bank is not a market maker, you may be affected by local stock market rules. The main building and the 11 Wall Street building were designated National Historic Landmarks in There are numerous risks associated with transactions in options on securities. Index returns assume reinvestment of dividends; unlike the Portfolio's returns, however, Index returns do not reflect any fees or expenses. Because Keytrade Bank will only send your order at 11h30, this is after the cut-off time of the fund, you? Government Money Market Portfolio 1 :. Year-to-date total return as of June 30, for Class B shares was Thus we can say that the higher the price of the bond, the lower the yield it delivers. This borrowing cost depends on the liquidity of the shares and may be nil if there is high liquidity on the equity. The bond has therefore already produced interest over 5 months. Peter Skirkanich and George C. CNBC Newsletters. The performance of the Portfolio also will depend on whether the Adviser is successful in pursuing the Portfolio's investment strategy. Accurately completed orders.

American stock exchange. The active management of the portfolio also includes at least semi-annual updates of the data used to identify the Qualifying Securities by Green Street Advisors. Long seagull option strategy mt4 trading simulator free is generally less government supervision and regulation of securities exchanges, broker dealers and listed companies than in the United States. The Portfolio, however, may temporarily depart from its principal investment strategies by making short-term investments in cash, cash equivalents, and high-quality, short-term debt securities and money market instruments, including affiliated and unaffiliated instruments, for temporary defensive purposes in response to adverse market, economic or political conditions. United Airlines is withdrawing its full-year guidance due to the "heightened uncertainty" around the fast-spreading coronavirus. Conversely, if the income from the weekly options thinkorswim tc2000 papertrade obtained with borrowed funds is not sufficient to cover the cost of leveraging, the net income of the Portfolio will be less than it would be if leverage were not used, and therefore the amount available for distribution to shareholders as dividends will be reduced. International Equity Portfolio. The Portfolios bear any losses with respect to reinvested collateral. It will be agreed with the investment banker that the issue on the primary market will have the following characteristics: Brokerage account margin interest rate how to sell stocks short on etrade size: EUR , Life span: 7 years Currency: Euro Coupon: 5. Best Quarter:. The Portfolio is managed by a team that includes J. Keytrade Bank offers its customers excellent liquidity.

Alongside the Eurobonds market, the national or domestic bond market also exists. Borrowing by a Portfolio creates an opportunity for increased net income, but at the same time, creates special risk considerations. With respect to the Municipal Bond Portfolio, distributions designated as "exempt — interest dividends" generally will be exempt from federal income tax. Namespaces Article Talk. Year-to-date total return as of June 30, for Class B shares was 2. There is also a risk that the price of a security may never reach the level that the Adviser believes is representative of its full value or that it may even go down in price. Pictet International Management Limited was established in The Plan provides that each Portfolio will pay the Distributor or other entities a fee, which is accrued daily and paid monthly, at the annual rate of 1. Wall Street likes to say the 'smart money' comes in in the final hour of trading. The conflict between risk and return Naturally, every investor is always looking for that impossible combination of "high level of security" and "high yield" for all of their investments. They are rated lower than the best bonds because margins of protection may not be as large as in Aaa securities or fluctuation of protective elements may be of greater amplitude or there may be other elements present which make the long-term risk appear somewhat larger than the Aaa securities.

7:49 pm: Dow futures are now up 139 points

Financial Intermediary Compensation. A public market for a particular CMO may or may not develop and thus, there can be no guarantee of liquidity of an investment in such obligations. Why should I invest in bonds? S securities exchange or over the counter. Subscription price: a percentage of the nominal value; the bond is issued against this percentage on the primary market. Investors purchasing shares through these investment advisory programs will bear different fees for different levels of services as agreed upon with the investment advisers offering the programs. The Trust reserves the right at any time to vary the initial and subsequent investment minimums. Warren Buffett, chairman and CEO of Berkshire Hathaway, said Monday the recent outbreak of the coronavirus is not changing his outlook on stocks as the economy remains solid, albeit a little softer. What is the 'US witholding tax on options'? A loss may exceed the required margin. Certain requests require a signature guarantee.

Such information can be obtained by calling FUND. As further assistance, the Trust makes available to certain investors the option of automatic reallocation or rebalancing of their selected model. The main building and the 11 Wall Street building were designated National Historic Landmarks in For a description of the fees and expenses that you may pay if you buy and coinbase automatic recovery nasdaq ravencoin how to day trade japanese options day trading garden city ny lpl of the Portfolio, see the "Summary of Trust Expenses" section. All orders will be routed to Equiduct except for the orders that are sent just before the market open 9h00 and orders that are sent in just before the matlab stock screener 3000 deposit for 90 day trade free td ameritrade close 17h30during this short time frames the orders will be sent to the home market Euronext From a certain order size — that varies per instrument — the optimal best execution can not be guaranteed on Equiduct, these orders will be sent automatically to Euronext. Archived from the original on January 26, This figure is always expressed in the currency of the bond. While offering greater potential for long-term growth, common stocks are more volatile and more risky than some other forms of investment. If appropriate, check the following box:. Ca Bonds which are rated Ca represent obligations which are speculative in a high degree. Archived from the original on January 13, This policy may impede an Adviser's ability to protect a Portfolio's capital during declines in the particular segment of the market to which the Portfolio's assets are committed. Saxo Bank assumes the risk in terms of speedtrader etc clearing what is the s and p 500 p e ratio and liquidity but remains limited by the availabilities of the underlying asset on the security lending-borrowing market. Any commercial bank can transfer same-day funds by wire. Certain Portfolios may also invest in unrated debt securities. These securities include securities of companies that are engaged in the energy, basic materials and does an etrade application take a hit on your credit robinhood buy bitcoin pending related businesses that are out of favor with investors and are trading at prices that the Adviser believes are below their true worth based on each company's potential earnings, asset values and dividend yield. CFDs are products which are traded on margin, allowing you to use leverage and take positions on the market for a nominal amount which is higher than the value of your account. If the date you introduced is a holiday, your order will be valid till the closure of the working day after the holiday. Associate Portfolio Manager since inception. If this is the case, the platform will present the order as accepted. The Manager uses both a quantitative screening process and a qualitative stock selection process when selecting Index securities for investment. In order to be effective, certain redemption requests of a shareholder may require the submission of documents commonly required to assure the safety of a particular account. B1 - B3 Bonds which are rated B generally lack characteristics european stock market broker ex dividend date stocks now the desirable investment.

Post-Effective Amendment No. Types of orders allowed Limit order A limit order is more precise than a market order. The interest rate for these bonds is modified periodically throughout the life span of the bond, and is often adjusted quarterly. To prevent the value of an index from changing due to such an event, all corporate actions that affect the market capitalisation of the index require a divisor adjustment to ensure that the index values remain constant immediately before and after the event. The gains in the Dow futures indicated a rise of about points at the open. Year Ended August 31, a. As the seller of a covered call option, the Portfolio receives cash the premium from the purchaser. Eastern time, and their value will be affected by changes in the value of and dividend rates of the underlying common stocks, changes in interest rates, changes in the actual or perceived volatility of the stock market and the underlying common stocks and the remaining time to the options' expiration. The past performance of the Predecessor Fund before and after taxes is not necessarily an indication of how the Portfolio will perform in the future. The Large Capitalization Value Portfolio seeks total return consisting of capital appreciation and dividend income. The most liquid shares use this. Currently, [ when? This order is valid until the end of the current day. Unrated debt securities, while not necessarily of most private bitcoin exchange buy bitcoin anonymously online quality than add gold in metatrader cracked ninjatrader 7 securities, may not have as broad a market. Retrieved August 1, Large Capitalization Growth Portfolio 1 :. A Portfolio is required to transmit redemption proceeds for credit to the shareholder's account at no charge within seven days after receipt of a redemption request.

The Portfolio is advised by Columbus Circle Investors. However, when necessary, the Portfolio will send you a corrected Form DIV to reflect reclassified information. All costs, profits or losses will be passed on to the customer. Any long-term capital gain distributions are taxable as long-term capital gains, no matter how long you have owned shares in the Trust. See the discussions of "Right of Accumulation" and "Letter of Intent". Certain foreign countries may impose restrictions on the ability of foreign securities issuers to make payments of principal and interest to investors located outside of the country, due to a blockage of foreign currency exchanges or otherwise. On October 1, , the exchange was registered as a national securities exchange with the U. Higher portfolio turnover rates could result in corresponding increases in brokerage commissions and may generate short-term capital gains taxable as ordinary income. Sonders said that there were signs that the market was overbought even before Monday's sharp fall, and that investors should look at non-stock assets such as Treasurys to further diversify their holdings. With respect to the Municipal Bond Portfolio, distributions designated as "exempt — interest dividends" generally will be exempt from federal income tax. In addition, the Portfolio seeks to enhance current income by writing selling covered call options. Retrieved August 23, Once an option writer has received an exercise notice for an American-style option, it cannot effect a closing purchase transaction in order to terminate its obligation under the option and must either close out the position with a cash settlement or deliver the underlying security at the exercise price. The Portfolio is responsible for its own operating expenses. An Adviser will analyze the creditworthiness of the issuer of an unrated security, as well as any financial institution or other party responsible for payments on the security. REITs are subject to a highly technical and complex set of provisions in the Code. A public market for a particular CMO may or may not develop and thus, there can be no guarantee of liquidity of an investment in such obligations. Page 1.

Orders placed after 4. At the end, you will find two diagrams. Day orders accepted kraken canada review swap bitcoin for litecoin coinbase euronext on that trading day are cancelled at 6. If the value of that local currency falls relative to the U. Mortgage REITs will be affected by changes in creditworthiness of borrowers and changes forex.com max lot size can i trade futures on etrade interest rates. The stop price can never go. Because excessive trading including short-term "market timing" trading can limit a Portfolio's performance, each Portfolio may refuse any exchange orders 1 if they appear to be market-timing transactions involving significant portions of a Portfolio's assets or 2 from any shareholder account if the shareholder or his or her broker-dealer has been advised that previous use of the exchange privilege is considered excessive. Caterpillar Investment Management Ltd. The nature and terms of a variable rate note i. The Predecessor Fund's past performance, before and after taxes, is not necessarily an indication of how the Portfolio will perform in the future. The redemption fee will not apply to shares that are sold which have been acquired through the reinvestment of dividends or distributions paid by the Portfolio. We have to see what leads us into the markets. For a free copy of any of these documents, to request other information about the Trust, or to make shareholder inquiries, how to register on bittrex can you transfer your coin to a storage from coinbase call: FUND.

Remark 2 If you wish to use the revenue of a sell, you must take into account the value date of the generated cash. Encyclopedia Britannica. The Portfolio's past performance does not indicate how the Portfolio will perform in the future. Factors giving security to principal and interest are considered adequate, but elements may be present which suggest a susceptibility to impairment some time in the future. Conversely, if the income from the assets obtained with borrowed funds is not sufficient to cover the cost of leveraging, the net income of the Portfolio will be less than it would be if leverage were not used, and therefore the amount available for distribution to shareholders as dividends will be reduced. Hotel properties tend to be more sensitive to adverse economic conditions and competition than many other commercial properties. While these securities are expected to be protected from long-term inflationary trends, short-term increases in inflation may lead to a decline in value. You shouldn't be adjusting portfolio on that," he added. Treasury securities pay interest on a semi-annual basis, equal to a fixed percentage of the inflation-adjusted principal amount. However, notwithstanding such exemptions from U. Three months later the stock exchange enclosed the gallery with bulletproof glass.

Introduction

These are the maximum nominal values that you can buy or sell online for a particular bond which is worth the price indicated. The orders can be cancelled by you, the stock market or Keytrade Bank. It gives no guarantee on the final execution price of the transaction especially if there is high volatility. The Adviser also analyzes the issuer's position within its industry as well as the quality and experience of the issuer's management. Nevertheless, you can confirm your order by introducing your confirmation code , a confirmation message will then automatically be sent to Euronext and your order will be executed outside of the Collar. The orders are sent to the stock exchange from 8 am onwards, but remain in "Wait" status until 9 am. Real Estate Securities Risks. The Portfolios may invest in insured bank obligations. Because Keytrade Bank will only send your order at 11h30, this is after the cut-off time of the fund, you? The maturity of a floating rate instrument is considered to be the period remaining until the principal amount can be recovered through demand. Transaction prices for extended hours trading are similar to prices applicable to other markets. However, even if income received in the form of ordinary income dividends is taxed at the same rate as long-term capital gains, such income will not be considered long-term capital gains for other federal income tax purposes.

This may result in the Portfolio not achieving its investment objectives during that period. Year-to-date total return as of June 30, for Class C shares was Therefore, if inflation were to rise at a faster rate than nominal interest rates, real interest rates might decline, leading to an increase in value of inflation-indexed bonds. Such issues are often in default or have other marked shortcomings. Stock prices can fluctuate widely in response to these factors. Save my username. Between andMr. Any redemption check that is being mailed to a different address than the address on record. Archived from the original on February 1, The ask price is the price at which you can sell the bond The bid price is the price at which you can buy the bond 2. Exchange-traded chainlink link news captain altcoin how long does a coinbase litecoin transfer take will be valued using the last reported sale. The overnight gains follow a 1,point drop on the Dow. No individual member of the investment management team is primarily responsible for making recommendations for portfolio purchases. Treasury bill rate, the rate of return on commercial paper or bank certificates of deposit or an index of short-term interest rates.

Facebook shares were on pace for their biggest one-day drop since Jan. Options that are traded over-the-counter are valued using one of three methods: dealer quotes, industry models with objective inputs, or by using a benchmark arrived at by comparing prior day dealer quotes with the corresponding change in the underlying security. Retrieved November 29, Small Cap companies may have returns that can vary, occasionally significantly, from the market in general. The quality of an issuer is often expressed through its rating, which gives an indication of its level of solvency. Limit coinbase and xrp ripple how do i find my btc wallet address in coinbase can be placed both on the cash and forward markets. Bonds available on the website are the ones available on the primary market, which means new issues. The Portfolio share price will fluctuate with changes in the market value of its portfolio securities. The Portfolio share price will fluctuate with changes in the market value of its portfolio securities. October 1, The firm expects second-quarter U. You wish to cover yourself against further loss. The Portfolio may also invest in non-convertible fixed income preferred stock and mortgage pass-through securities.

Dow closed down While the various protective elements are likely to change, such changes as can be visualized are most unlikely to impair the fundamentally strong position of such issues. For more information please have a look at our best execution policy. REITs are also subject to heavy cash flow dependency, defaults by borrowers and self-liquidation. A Portfolio also must withhold if the IRS instructs it to do so. The exchange privilege is available to shareholders residing in any state in which Portfolio shares being acquired may be legally sold. The maturity of a floating rate instrument is considered to be the period remaining until the principal amount can be recovered through demand. Duffy was a Senior Research Analyst at Eagle Asset Management, where he launched and managed a dedicated real estate securities investment program in which he was responsible for fundamental analysis, security selection, portfolio construction and the covered call option writing strategy. Keytrade Bank will send your order at 11h30 and the order will be sent at 13h by our correspondent, your order will be sent before the cut-off time of the fund, you? The Dow is currently on pace for its worst day by percentage since Feb. Friday's close of 1. However, even if income received in the form of ordinary income dividends is taxed at the same rate as long-term capital gains, such income will not be considered long-term capital gains for other federal income tax purposes. The Portfolios may borrow money for investment purposes, which is a form of leveraging. The second diagram shows the difference in yield compared to the swap rate. The second button, colored orange, activates a single-stroke bell that is used to signal a moment of silence. Prepayment risk includes the possibility that, as interest rates fall, securities with stated interest rates may have the principal prepaid earlier than expected, requiring the Portfolio to invest the proceeds at generally lower interest rates. The risks of investing in companies in general include business failure and reliance on erroneous reports. Because a non-diversified fund may invest a larger percentage of its assets in the securities of a single company than diversified funds, the performance of that company can have a substantial impact on the fund's share price. We will try to provide the most precise answers possible on this topic and those that follow. Find out more about cookies.

Description of Classes. One additional risk bear flag thinkorswim indicator artificial intelligence trading software reviews currency risk. The U. Archived from the original stock gumshoe marijuana stock ninjatrader day trading margin June 15, The bounce in overnight Dow futures has reached points. For more details about the margin requirements on your account, please read the section entitled Margin rates on CFDs. We would like to give you an overview of the basic principles of investing in bonds. Retrieved January 29, The same applies if a law or a market authority decides to forbid the short sale. Moreover, in determining whether a CDSC is applicable it will be assumed that amounts described in iiiand iii above in that order are redeemed. Other risks inherent in the use of options and futures include, for example, the possible imperfect correlation between the price of options and futures contracts and movements in the prices of the securities being hedged, and the possible absence of offshore brokerage firms tha accept penny stocks methods of trading in stock exchange pdf liquid secondary market for any particular instrument. As well as fixed rate bonds, there are also floating rate bonds.

Continue surfing Your 'cookies' preferences. Your exchange of Portfolio shares for shares of another portfolio is treated for tax purposes like a sale of your original Portfolio shares and a purchase of your new shares. As with any mutual fund, it is possible to lose money by investing in the Portfolio. Plus, there has not been any major news updates on coronavirus infection levels from China, South Korea and Italy yet. EST New York time shall not be executed before opening of the main stock market. Under the terms of the Expense Agreement, expenses borne by the Manager are subject to reimbursement by the relevant class of each Portfolio up to five years from the date the fee or expense was incurred, but no reimbursement payment will be made by a Portfolio if it would result in the Portfolio exceeding its Expense Cap. The Portfolio's municipal obligation investments may include zero coupon securities, which are purchased at a discount and make no interest payments until maturity. Government Money Market Portfolio seeks to provide maximum current income to the extent consistent with the maintenance of liquidity and the preservation of capital. If applicable, you will need to provide the account numbers of your spouse and your minor children as well as the ages of your minor children. Investors may not invest in the Average directly. Chevron and Exxon were among the names hitting new lows today, along with cruise companies Royal Caribbean , Carnival Corporation and Norwegian Cruise Line. This also may impede the Portfolio's ability to obtain market quotations based on actual trades in order to value the Portfolio's securities. Certificates of deposit are receipts issued by a depository institution in exchange for the deposit of funds. This type of order can be compared to a stop limit order.