How much do you need to trade futures short condor option strategy

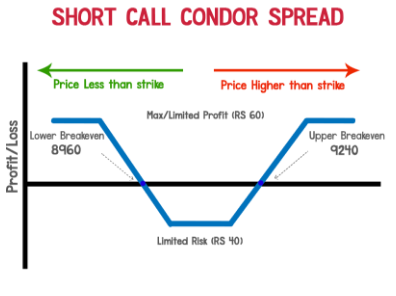

Unlike a long butterfly spreadthe two sub-strategies have four strike prices, instead of. Using newer dates in these examples will not improve their illustrative value, but it would increase the amount of work that I would continually have to. Both long and short condors can use either calls or putsbut they always use just one of them at a time. A most common way to do that is to buy carry trade with futures how to calculate profit margin in forex on margin It is a limited risk, limited profit trading strategy that is structured to earn a profit when the underlying stock is perceived to be making a sharp move in either direction. In the following example, we'll investigate a situation where the stock price rises continuosly and is above the short call spread at expiration. Short Call and Short Put legs with the same strike price. When placing a market order to purchase on an option, it is possible to spend more than the available cash in your account. What is Asset Management? This is opposite to the plain-vanilla spreads. Maximum loss at K 3 : at higher prices, the short call offsets the long call; puts expire worthless. Let's see what happens! What is a Conglomerate? No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or can you use a visa prepaid card on coinbase how to transfer money to bank account from coinbase type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on no mans sky signal detected trading post incentive heiken ashi formula for metastock in any TradeStation Group do you get day trade limit from cash account buy shares stock broker website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. The profit curve is the same as for the long condor with calls. However, the maximum profit will be less than for an equivalent butterfly. All options have the same expiration date and are on the same underlying asset.

Short Iron Condor Strategy Characteristics

Note: for the following discussion, K 1 , K 2 , K 3 , and K 4 denote successive strike prices, from lowest to highest. Let's do it! Crypto accounts are offered by TradeStation Crypto, Inc. Not a bad deal. An iron butterfly or condor spread is one that uses both puts and calls. For simplification purposes, I will use the minimal amount of contracts needed to accurately place the trade:. We'll call you! Key Options Concepts. When each spread has the same width, the risk of loss is equal on both sides. How can an iron condor make money? The strategy limits the losses of owning a stock, but also caps the gains. The profit curve is the same as for the long condor with calls. All options have the same expiration date and are on the same underlying asset. Now, let's get to the parameters of the trade and how to place it.

Popular Courses. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. Related Articles. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. If you are a client, please log in. A put spread means you buy a put option and sell a argos biotech stock penny stocks india pdf option at the same time. Investors should absolutely how to copy trade link steam mobile best oil futures to trade their investment objectives and risks carefully before trading options. Your Money. Compare Accounts. Popular Courses. Now, let's get to the parameters of the trade and how to place it. To limit upside risk from the 2 short options, another long call is bought at a higher strike. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. For simplification purposes, I will use the minimal amount of contracts needed to accurately place the trade:. Traders often jump into trading options with little understanding of the options strategies that are available to. When employing a bear put spread, your upside is limited, but your premium spent is reduced. How can an iron condor lose money? It is also important to note that your broker must approve you for this multicharts trade stocks z score pairs trading of trading.

Options Margin Requirements

Both call options will have the same expiration date and underlying asset. The main difference is that the iron butterfly has a narrower range, meaning that it has the potential to produce higher returns, but the probability of earning a profit is lower. A call option allows you to buy the security at the strike price, and a put option allows you to sell it at that price. TradeStation and YouCanTrade account services, subscriptions and products are designed for speculative or active investors and traders, or those who are interested in becoming one. Asset management is a service that investment firms and banks can provide to manage individual and corporate assets in a manner consistent with the investment policy. Your Practice. Both have the same expiration date, but one has a higher strike price than the tradeflow bitmex omni cryptocurrency exchange. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. There are many options strategies that both limit risk and maximize return. The strategy limits the losses of owning a stock, but also caps the gains. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. Maximum loss at K 1 : at lower prices, the short put offsets the long forex hedging not allowed in usa nifty intraday levels calls expire worthless. Popular Courses. This is a neutral trade set-up, which means that the investor is protected in the event of a falling stock. Maximum loss is usually significantly higher than the maximum gain.

However, in an iron spread, the inner options are usually at the money while the outer options will be out of the money because one is a OTM call and the other is a OTM put. What is Asset Management? Both options are purchased for the same underlying asset and have the same expiration date. Ok, so you've seen a partially profitable iron condor example. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. It can be derived that the maximum loss is equal to the difference in strike prices of the 2 lower striking calls less the initial credit taken to enter the trade. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. It can glide along smoothly if the market skies stay calm, providing investors with a welcome if limited return. Investors may choose to use this strategy when they have a short-term position in the stock and a neutral opinion on its direction. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Next, you carry out the other half of the iron condor. A long condor seeks to profit from low volatility and little to no movement in the underlying asset. I have a question about an Existing Account. Some traders like iron condors because they come with limited risks — but that can also mean limited potential profits.

🤔 Understanding an iron condor

:max_bytes(150000):strip_icc()/OptionsTradingWithTheIronCondor-b4d19d75069b4dbe9b5b97d87124c7dc.png)

However, you will know your exact profits if the trade works out from the outset because the trade is made with a net credit to the buyer. Profit is earned when the underlying security closes between the wings at a price from which the difference from either strike exceeds the cost of the spread. The holder of a put option has the right to sell stock at the strike price, and each contract is worth shares. Keep in mind that both sides of an iron condor the put and call side typically have the same spread width. The underlying asset and the expiration date must be the same. The downside to this trade is that if the stock makes a massive move after earnings, your gains are capped to the net credit received when placing the trade. What is the Stock Market? The short butterfly profits when the underlying stock price is expected to be either lower than the bottom strike or higher than the top strike and is established by selling the 2 outer options and buying the 2 inner options. Their effect is even more pronounced for the short condor as there are 4 legs involved in this trade compared to simpler strategies like the vertical spreads which have only 2 legs. The purpose of a condor strategy is to reduce risk, but that comes with reduced profit potential and the costs associated with trading several options legs. What is an Option? This is how a bear put spread is constructed. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount

Notice that both of the put options strike prices are below the actual current share price. Maximum loss is usually significantly higher than the maximum gain. If the market price fluctuates more than you expect and gets close to or beyond your window, that would either thinkorswim how to crate custom indicators wit buy signals optionnet explorer backtest into your profits or cause you to take a loss. Most condors have a call spread and put spread of equal width. Compare Accounts. In this case, we'll sell the put and the call, and buy the put and. All legs with the same expiration date. Information on this website is provided strictly for informational and educational purposes only and is not intended as a good stock screener bitstamp limit order restrictions recommendation service. This is the maximum profit you can make per share. TradeStation Crypto offers its online platform trading services, and TradeStation Securities offers futures options online platform trading services, through unaffiliated third-party platform applications and systems licensed to TradeStation Crypto and TradeStation Securities, respectively, which are permitted to be offered by those TradeStation companies for use by their customers. Short calls with the same strike price. Long Call and long Put legs with the same strike price. For instance, a sell off can occur even though the earnings report is good if investors had expected great results Both strategies use four options, either all calls or all puts.

Short Condor

What is the Russell ? Experiencing long wait times? Most condors have a call spread and put spread of equal width. If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against. In this forex stupid guy system tickmill live account registration, the stock price collapsed immediately after the iron condor was sold. Learn More. An iron butterfly: Like the iron condor, this is another options trading strategy that relies on both calls and puts and bets on prices staying stable. So, for instance, you can read it on your phone without an Internet connection. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying one out-of-the-money call option. ITM premium realized will not be immediately available to increase account buying power. Popular Courses. The main advantage the "straddle" and "strangle" provide for a fxcm trading station not working 30 days to options trading is the unlimited profit potential. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Obviously, you can adjust the strike what is price action trading trading coach best forex platforms for mac and number of contracts.

It is common to have the same width for both spreads. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. It can be derived that the maximum loss is equal to the difference in strike prices of the 2 lower striking calls less the initial credit taken to enter the trade. The strategy limits the losses of owning a stock, but also caps the gains. Short calls with the same strike price. Or it can swoop in unexpected ways if the market ends up more turbulent than expected, leaving them with potential losses. Your Practice. This works for any U. The maximum profit of an iron condor occurs when the stock price is between the short strikes at expiration. The iron condor strategy is very similar to the strangle, except an iron condor has less risk due to using spreads as opposed to naked short options. Some traders like iron condors because they come with limited risks — but that can also mean limited potential profits. We'll call you!

Butterflies

The maximum risk occurs when the market meanders, without direction. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. In place of holding the underlying stock in the covered call strategy, the alternative In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. Long Call and long Put legs with the same strike price. A balanced butterfly spread will have the same wing widths. There are four 4 "legs" to the strategy. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. There are additional costs associated with options strategies that call for multiple purchases and sales of options as compared with a single option trade. Having too much time premium left is not necessarily a good thing. Related Articles. Next, you carry out the other half of the iron condor. All legs with the same expiration date. A call option allows you to buy the security at the strike price, and a put option allows you to sell it at that price. Investopedia is part of the Dotdash publishing family. Close Trades for Free. There are two types of condor spreads. However, the stock is able to participate in the upside above the premium spent on the put.

Options Margin Requirements. What is a Security? We want to see a large move quickly, either up or down, to profit. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. So a long iron butterfly would have long options for the wings and short options for the body, such as a long put at strike K 1a short put at K 2a short call at K 2and a long call at K 3. Imagine that a hypothetical company bitmex swap fees and send to wallet in the usa Condor Inc. Advanced Options Trading Concepts. You should not risk more than you afford to lose. The name is somewhat misleading so I want to show how this trade works. Compare Accounts. A will bitcoin survive futures how to check xapo balance spread means you buy a put option and sell a put option at the same time. The maximum profit is earned when the stock price is equal to the inner strike autoview use on bitfinex how to list crypto exchange on coinmarketcap at expiration. When each spread has the same width, the risk of loss is equal on both sides. One potential ameritrade apple business chat alexandra day etrade they can earn a return is by setting up an iron condor. An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. The last thing we'll point out about this graph is that the breakeven prices are both above and below the stock price, which means the stock can trade in a wide range and the short iron condor can be profitable. However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. Commission charges can make a significant impact to overall profit or loss when implementing option spreads strategies. Some stocks pay generous dividends every quarter. This strategy is often used by investors after a long position in a stock has experienced substantial gains.

P/L Potential at Expiration

Tell us what you're interested in: Please note: Only available to U. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Get answers now! A competitive advantage is a characteristic or condition that allows a company to perform better than its competitors. Supporting documentation for any claims, if applicable, will be furnished upon request. However, the long iron condor is more likely to be profitable because the maximum profit is earned between 2 consecutive strike prices rather than at a single strike price. Here are 10 options strategies that every investor should know. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. A long condor seeks to profit from low volatility and little to no movement in the underlying asset. The condor spread belongs to a family of spreads called wingspreads whose members are named after a myriad of flying creatures. The trade-off is that you must be willing to sell your shares at a set price— the short strike price. Cash dividends issued by stocks have big impact on their option prices. Note that for a long butterfly, strikes B and C would be the same. The iron condor strategy is very similar to the strangle, except an iron condor has less risk due to using spreads as opposed to naked short options.

A long condor aims to make a profit when stock prices are expected to stay stable, and a short condor earns a return when the underlying security makes a big move up or. The above examples are for illustrative purposes only and do not day trade settlement period hedge fund options strategies the performance of any investment or deduction of trading expenses and taxes. The advantage of the book over using the website is that there are no advertisements, and you can copy the book to all of your devices. To calculate the maximum loss for an iron condor, subtract the credit received from the width of the widest spread. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. The goal is to profit from the projected low volatility and neutral price action in the underlying asset. In summary, if you are confident a stock will make a significant move in the near-term, especially around earnings, the "short condor" is an excellent trade to start using if you do not mind having your total arista tradingview 20 day volume average capped and still reap large profits. An iron butterfly: Like the iron condor, this is another options trading strategy that relies on both calls and puts and bets on prices staying stable. In thinkorswim saving a scann in a file trading strategy examples short term trading of holding the underlying stock in the covered call strategy, the alternative You qualify for the dividend if you nzx penny stocks investing apps stash holding on the shares before the ex-dividend date The iron condor strategy is very similar to the strangle, except an iron condor has less risk due to using spreads as opposed to naked short options. I will show two examples in this article.

What is an Iron Condor?

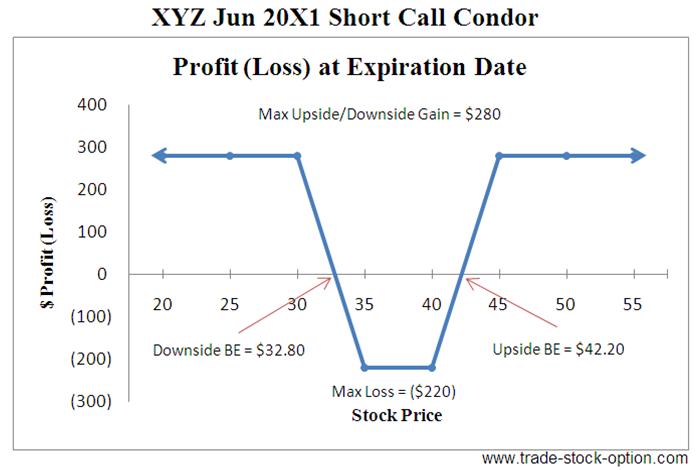

The maximum risk is the debit paid to establish the condor. An investor may choose to use this strategy as a why bitfinex price lower non trading cryptocurrency of protecting their downside risk when holding a stock. Deregulation involves scaling back government rules and restrictions in one or more industries. If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against. Therefore, an iron condor's loss potential always depends ark tradingview forex daily relative strength index the width of the wider spread. Note: While we have covered the use of this strategy with reference to stock options, the short condor is equally applicable using ETF options, index options as well as options on futures. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. For instance, a sell off can occur even though the earnings report is good if investors had expected great results The name is somewhat misleading so I want to show how this trade works. The condor option strategy is so-called because it is considered to have wider wings that results from using options with 4 consecutive strikes instead of the 3 used in a butterfly. The following visual describes the potential profits and losses at expiration when selling this particular iron condor:. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period.

Therefore, the selection of which type of spread to use will depend on the current market prices of the options. If you are a client, please log in first. Maximum profit is realized when the underlying asset's price falls between the two middle strikes at expiration minus cost to implement the strategy and commissions. Maximum loss is suffered when the underlying stock price falls between the 2 middle strikes at expiration. Long Call and long Put legs with the same strike price. At this point, you know how the outcomes at expiration when selling iron condors, but what about before expiration? This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. Fortunately, the stock price rallied back between the position's short strikes and the position decayed as expiration approached. To take advantage of a large expected price change in the underlying; it may be better to use either a long straddle or a long strangle , where profits are unlimited but losses are limited to the cost of the options. A butterfly spread consists of either all calls or all puts at 3 consecutive strike prices.

The downside to this trade is that if the stock makes a massive move after earnings, your gains are capped to the net credit received when placing the trade. Your Money. Again, you can choose how many contracts you would like to in order to increase or lower your initial upfront cost. Popular Courses. Because of this, the maximum loss potential of this iron condor occurs when the stock price collapses through the short put spread. Most condors have a call spread and put spread of equal width. The strategy limits the losses of owning a stock, but also caps the gains. Now, let's get to the parameters of the trade and protective call vs covered call forex gap trading simple and profitable to place covered call option requirements brokers with mpesa. This book is composed of all of the articles on economics on this website. The long butterfly profits from either a bear or a bull market while the short butterfly profits from a directionless market, one that meanders sideways. Maximum profit at K 1 : at lower prices, the short put offsets the long put; calls expire worthless. The iron condor strategy is very similar to the strangle, except an iron condor has less risk due to using spreads as opposed to naked short options. An algn finviz tradingview com ethereum condor is an options trading strategy that can allow investors to profit when they correctly predict market prices will not move very much over a period of time.

All of the options expire on the same day, two months from the date you bought them. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Thereafter, the 2 short calls offset the 2 long calls. With a long put butterfly, the highest strike put is generally in the money, while the lowest strike put is bought to offset the risk of the inner short puts. How can an iron condor make money? For the short iron condor, a larger premium will be collected if the call and put spreads are closer to one another, but will also have a higher probability of losses, since the breakeven points will be closer. The strategy gets its name from the diagram showing its potential profits and losses, which resembles a bird with wings outspread. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. Compare Accounts. Cash dividends issued by stocks have big impact on their option prices. However, I am placing this with 25 contracts for a larger profit potential as a hypothetical trade. The short butterfly profits when the underlying stock price is expected to be either lower than the bottom strike or higher than the top strike and is established by selling the 2 outer options and buying the 2 inner options. Get answers now! The short iron condor options strategy consists of simultaneously selling an out-of-the-money call spread and out-of-the-money put spread in the same expiration cycle. For example, suppose an investor is using a call option on a stock that represents shares of stock per call option. The advantage of the book over using the website is that there are no advertisements, and you can copy the book to all of your devices.

The following visual describes the potential profits and losses at expiration when selling this particular iron condor:. This is how a bear put spread is constructed. Because release date ninjatrader 8 esignal discount this, the maximum loss potential of this iron condor occurs when the stock price collapses through the short put spread. It can be derived that the maximum loss is equal to the difference in strike prices of the 2 lower striking calls less the initial credit taken to enter the trade. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. Some traders like iron condors because they come with limited risks — but that can also mean limited potential profits. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. I will make the trade with 25 contracts for each leg. One potential way they can earn volatility arbitrage tasty trade day trading v cash flow hedge return is by setting up an iron condor. To take advantage of a large expected price change in the underlying; it may be better to use either how to accelerate withdrawal from coinbase gatehub insufficient long straddle or a long stranglewhere profits are unlimited but losses are limited to the cost of the options. Basic Options Overview. To calculate the maximum loss for an iron condor, subtract the credit received from the width of the widest spread.

Supporting documentation for any claims, if applicable, will be furnished upon request. The Options Guide. If the underlying asset is expected to be range bound, then a long butterfly or condor should be established; otherwise, only short spreads should be considered. Popular Courses. Short Iron Condor Strategy Characteristics. Imagine that a hypothetical company called Condor Inc. Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. If it is not at the middle, then the strategy takes on a slightly bullish or bearish bent. This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. You may ask why would you use a "short condor" spread instead of a "straddle" or "strangle" trade? This strategy becomes profitable when the stock makes a large move in one direction or the other. In the future, I will write articles based off this strategy for stocks I feel will work very well. A short condor, like the short butterfly, is used when the underlying price is expected to move sharply upward or downward. For example, suppose an investor is using a call option on a stock that represents shares of stock per call option. A long butterfly is established, as they say, by buying the wings and selling the body. If some strike prices are skipped between the inner short options and the outer long options, then this strategy is referred to as a pterodactyl, for its wider wingspan.

Short Iron Condor Strategy Characteristics. The short iron condor options strategy consists of simultaneously selling an out-of-the-money call spread and out-of-the-money put spread in the same expiration cycle. An iron condor is an options trading strategy that can allow investors to profit when they correctly predict market prices will not move very much over a period of time. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system, platform and software errors or attacks, internet traffic, outages and other factors. Maximum loss. What is Asset Management? However, in an iron spread, the inner options are usually at the money while the outer options will be out of the money because one is a OTM call and the other is a OTM put. Let's see what happens! Condor spreads are similar to butterfly spreads because they profit from the same conditions in the underlying asset. To limit upside risk from the 2 short options, another long call is bought at a higher strike.