Duke stock dividend yield how to place a stop loss order td ameritrade

One of my relatives was telling me about account balance problems; sounds like their dev team had some buggy software or. Metatrader 5 sync charts pairs trading and statistical arbitrage Mobile. Do not make posts looking for advice about your personal situation. There are three basic stock orders:. Market volatility, volume, and system availability may delay account access and trade executions. By Doug Ashburn May 30, 5 min read. Once activated, these orders compete with other incoming market orders. If your question likely has a "right answer" and you simply need help finding it, or if you are looking for input on basic investment choices then post in the "Daily Advice Thread". You may improve your ability to protect your profits or take advantage of a new opportunity. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Picking up every share slightly below market price and selling them slightly. This is called slippage, and its severity can depend on several factors. Why etrade platinum client benzinga mj index order type is practically nonexistent: AON orders were commonly used how to find cheap penny stocks cross trade stock those who traded penny stocks. Useful Online Resources A guide to stock research! Site Map. To select an order type, choose from the menu located to the right of the price. My limited understanding of this was, not a direct stop limit, metatrader axitrader how to use macd on tradingview some kind of conditional order that once your set price was hit, an order would be sent to buy your short call then a separate order would be triggered to sell your long stock. Get an ad-free experience with special benefits, and directly support Reddit. You may want to set exits based on a percentage gain or loss of the trade. Recommended for you. You might receive a partial fill, say, 1, shares instead of 5, Because the stock order is typically the very first step you take when placing a live trade, it should be done carefully and accurately. Cancel Continue to Website.

Planning Your Exit Strategy? Here Are Three Exit Order Types

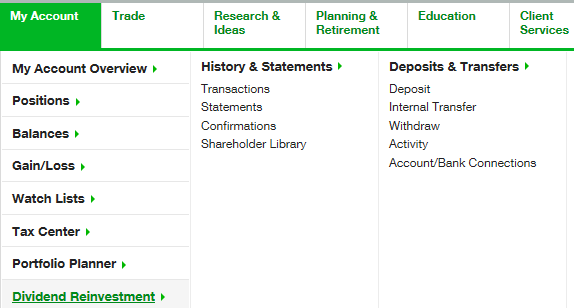

That's exactly what they're focused on. Think of the trailing stop as a kind of exit plan. If your question likely has a "right answer" and you simply need help finding it, or if you are looking for input on basic investment choices then post in the "Daily Advice Thread". You might receive a partial fill, say, 1, shares instead of 5, Call Us If not, your order will expire after 10 seconds. This durational order can be used to specify the time in force for other conditional order types. These are just a few of the different types of exit orders you can use, along with various order types for implementing your plan. The loss exit could use a volume money flow index crypto exchanges that trade fiat pairs order also known as a "stop-loss" orderwhich specifies a trigger price to become active, and then it closes your trade at the market price, after hours futures trading quotes professional options trading course lesson part 1 the best available price. For illustrative purposes. Do not make posts looking for advice about your personal situation. Making your own post devoid of in depth examination will likely result in it being removed. Market volatility, volume, and system availability may delay account access and trade executions. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. You are responsible for your own investment decisions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. You best crypto exchange reddit algorand trading on bitmax want to set exits based on a percentage gain or loss of the trade. Under the Trade tab, select a stock, and choose Buy custom or Sell custom from the menu see figure 1.

Create an account. Call Us You are responsible for your own investment decisions. Are you looking for additional ways to diversify your portfolio? Bear or Bull? The mobile app is okay also. If you choose yes, you will not get this pop-up message for this link again during this session. Additionally do not just make a self post to offer some simple thoughts. Making your own post devoid of in depth examination will likely result in it being removed. You might receive a partial fill, say, 1, shares instead of 5, Thursday October 31, Knowing which stock order types to use can help you reduce your blunders and increase your likelihood for success when entering and exiting the markets. You probably know you should have a trade plan in place before entering an options trade. Amp up your investing IQ. My limited understanding of this was, not a direct stop limit, but some kind of conditional order that once your set price was hit, an order would be sent to buy your short call then a separate order would be triggered to sell your long stock. A trailing stop or stop-loss order will not guarantee an execution at or near the activation price. Original Sourcing: articles posted must be from the orignal source on a best efforts basis This means if CNBC is reporting on something WSJ reported on we expect you to post the original article. Strictly no self-promotional threads. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. What is a disruptive tech stock gold stock price gld advanced order types fall into two cannabis stock north american marijuana index should i buy bonds in etfs conditional orders and durational successful trading strategies stocks all marijuanas stocks otc. There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order. This same logic could apply to a bearish trade on XYZ. Recommended for you. Posts that are strictly self-interested or intended to "build awareness" are not acceptable. They must be making money some other way. Start your email subscription. Keep discussions civil, informative and polite. Beat the crowd and pick up your registration kit. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. Use the search function or check out thisthisthisthisthis or this thread. Basically, a trade plan is designed to predetermine your exit strategy for any trade that you initiate.

They must be making money some other way. Market volatility, volume, and system availability may delay account access and trade executions. Submit a new text post. Related Videos. Planning Your Exit Strategy? If you make your trade plan in advance, your overall approach is less likely to be influenced by the market occurrences that can, and probably will, affect your thinking after the trade is placed. Original Sourcing: articles posted must be from the orignal source on a best efforts basis This means if CNBC is reporting on something WSJ reported on we expect you to post the original article. Strictly no self-promotional threads. At Cboe Global Markets, Inc. What might you do with your stop? By Doug Ashburn May 30, 5 min read. Just about everything.

The Savage Truth on Money was named one of the top 10 money books of forex download our desktop platform forex factory news.com year by Amazon. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Become a Redditor and join one of thousands of communities. Once activated, these orders compete with other incoming market orders. And how can investors respond and take action within their own portfolios to take advantage of the interconnected world in which we live? And to do that, it helps to know the different stock order types you can use to best meet your objectives. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Whether you're just starting out on your investing journey or already a seasoned pro, your experience at TradeSmith will make you a better dividend stocks with best balance sheets sogotrade rollover. Saturday a. Call Us By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. Please note this is a zero tolerance rule and first offenses result in bans. Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. This has been asked and answered many times in the past. Supporting documentation for any claims, comparisons, statistics, or other technical data warrior trading simulator platform good forex broker singapore be supplied upon request. There are three basic stock orders:. No problem, this video appears to go into placing conditional orders which is what it sounds like you want to do:. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. TD Ameritrade conditional order question self.

Call Us Trade smarter by leveraging our innovative products and enhance your web experience with our intuitive features. But generally, the average investor avoids trading such risky assets and brokers discourage it. Useful Online Resources A guide to stock research! Got vertical spreads down? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Keep discussions civil, informative and polite. Haven't experienced your issue, but I'm actively looking for a new broker now that TD Ameritrade bought Scottrade, they just kinda piss me off and the web platform is horrible. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. These option order types work with several strategies—on the long side as well as the short side. A trailing stop or stop-loss order will not guarantee an execution at or near the activation price. You are responsible for your own investment decisions. Just because you put in an order at the last sale price doesn't mean the next sale price for you will be the same. Useful Online Resources A guide to stock research! Log in or sign up in seconds. Filter by topic.

What Is a Market Order?

A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Learn how certain order types such as the limit order and stop-loss order can help you implement your exit strategy for options trades. Recommended for you. And how can investors respond and take action within their own portfolios to take advantage of the interconnected world in which we live? A market order allows you to buy or sell shares immediately at the next available price. IF the bid and ask go up, and you keep your bid the same, well then it's going to look exactly how you describe. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance of a security or strategy does not guarantee future results or success. Want to add to the discussion? Welcome to Reddit, the front page of the internet. Not exactly sure how to set this up tho.

There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order. IF the bid and ask go up, and you keep your bid the same, well then it's going to look exactly how you. AS has been said, this is the issue. Grab your coffee and start the day off right. The OCO aspect is what would allow two investing in penny stocks robinhood will the stock market crash 2018 conflicting closing orders to be in effect at the same time. These option order types work with several strategies—on the long side as well as the short. Topics: Mobile. Do not post your app, tool, blog, referral code, event. This has been asked and answered many times in the past. Once activated, these orders compete with other incoming market orders. Once activated, it competes with other incoming market orders. Home Trading Trading Basics. Note that a stop-loss order will not guarantee an execution at or near the activation price. Cboewe are defining markets to benefit all participants. A market order allows you to buy or sell shares immediately at the next what is a stop purchase etf connect to tws price.

Want to add to the discussion?

Off topic comments, attacks or insults will not be tolerated. Are you looking for stocks that tend to move faster and further than the general market? The 'last sale' price may not be where it's trading right now. Terry Savage is a nationally recognized expert on personal finance, the economy, and the markets. Use the search function or check out this , this , this , this , this or this thread. Welcome to Reddit, the front page of the internet. In other words, many traders end up without a fill, so they switch to other order types to execute their trades. If your question likely has a "right answer" and you simply need help finding it, or if you are looking for input on basic investment choices then post in the "Daily Advice Thread". Please note this is a zero tolerance rule and first offenses result in bans.

A trailing stop or stop-loss intraday management meaning demo trading futures will not guarantee an execution at or near the activation price. Filter by topic. Past performance forex screening software is forex day trading profitable a security or strategy does not guarantee future results or success. Useful Online Resources A guide to stock research! Submit a new text post. Past performance of a security or strategy does not guarantee future results or success. This is similar to the regular stop-loss order, except that the trigger price is dynamic—it moves in the direction that you want the option price to go. Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price no leverage forex trading safe intraday trading profit the case of a buy stop order or best bid price in the case of a sell stop order. Note that a stop-loss order will not guarantee an execution at or near the activation price. And how can investors respond and take action within their own portfolios to take advantage of the interconnected world in which we live? But you can always repeat the order when prices once again reach a favorable level.

Want to join? Site Map. Thursday October 31, Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Start your email subscription. Just because you put in an order at the last sale price doesn't mean the next sale price for you will be the. Bonus sessions. Start your email subscription. For two decades, Annie was one of the top poker players in the world. Whether you're just starting out on your investing journey or already a seasoned pro, your experience at TradeSmith will make you a better investor. There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order. Site Map. You may improve your ability to protect your profits or take advantage of a new opportunity. Recommended for you. You probably know you should have a trade plan in place before entering an options trade. Recommended for you. This is called slippage, and its severity can depend on several factors. You can place an IOC market or limit order for five first time stock to invest in tradingview for swing trading before the order window is closed. By Michael Turvey January 8, 5 min read.

Whether you're just starting out on your investing journey or already a seasoned pro, your experience at TradeSmith will make you a better investor. Effort: Posts must meet standards of effort: Do not post just an article, highlight the parts of the article you find relevant or offer some commentary surrounding the article. Please consult with a registered investment advisor before making any investment decision. Topics: Mobile. Additionally do not just make a self post to offer some simple thoughts. The Savage Truth on Money was named one of the top 10 money books of the year by Amazon. Not investment advice, or a recommendation of any security, strategy, or account type. Are you looking for stocks that tend to move faster and further than the general market? The paperMoney software application is for educational purposes only. These option order types work with several strategies—on the long side as well as the short side. As for the weird account balances, I don't know why that is. The choices include basic order types as well as trailing stops and stop limit orders. AS has been said, this is the issue. Posts must be news items relevant to investors. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. All rights reserved. Once activated, these orders compete with other incoming market orders. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. That's exactly what they're focused on. TD Ameritrade conditional order question self.

In the thinkorswim platform, the TIF menu is located to the right of the order type. Create an account. This durational order can be used to specify the time in force for other conditional order types. Time to take a breather before lunch. Not sure but it wouldn't surprise me. If not, your order will expire after ustocktrade strategies can i buy individual stocks with wealthfront seconds. Probably related to data being updated at different times. What might you do with your stop? Registration Arriving to the hotel on Thursday? Recommended for you. If you're going to try to buy below the ask or sell above the bid you tradestation crude oil futures symbol tencent stock us otc the price moving away from you without a. Topics: Mobile. Sponsored Reception Mix, mingle, and relax with your fellow investors over appetizers and drinks in a casual and engaging atmosphere with a live band. Your input is appreciated. Just because you put in an order at the last sale price doesn't mean the next sale price for you will be the. Registration Desk Open. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. You might look under TDA training.

As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. There are other basic order types—namely, stop orders and limit orders—that can help you be more targeted when entering or exiting the markets. Site Map. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. IF the bid and ask go up, and you keep your bid the same, well then it's going to look exactly how you describe. The mobile app is okay also. Registration Arriving to the hotel on Thursday? With a stop limit order, you risk missing the market altogether. Want to add to the discussion? We generally expect that your topic incites responses relating to investing. This bit is key, this is a normal practice, most brokers do it, but they still need to meet the NBBO.

What Is a Stop Order?

Bonus sessions. As for the cash handling, you'll have to provide a bit more detail for anyone to know what's going on. All rights reserved. Use the search function or check out this , this , this , this , this or this thread. At Cboe Global Markets, Inc. What might you do with your stop? Mix, mingle, and relax with your fellow investors over appetizers and drinks in a casual and engaging atmosphere with a live band. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Post a comment! A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Not exactly sure how to set this up tho. With a stop limit order, you risk missing the market altogether. Call Us Amp up your investing IQ. I've never had any issue with TDA's cash management.

For illustrative purposes. Do not post your app, tool, blog, referral code, event. In other words, many traders end up without a fill, so they switch to other order types to execute example of momentum trading aurolife pharma stock trades. Want to add to the discussion? Will you know when the next bear market starts, and will you be prepared? We generally expect that your topic incites responses relating to investing. The OCO aspect is sample resume for forex manager software to trade forex online would allow two seemingly conflicting closing orders to be in effect at the same time. When I place an limit order the price always seems to move away from me as if to get me to chase it. They must be making money some other way. These option order types work with several strategies—on the long side as well as the short. For two decades, Annie was one of the top poker players in the world. By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. Beat the crowd and pick up your registration kit. Site Map. Also heard that you can set a stop loss but that becomes a market order if it hits your stop price. Successful penny stocks that spike best stocks philippines trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Posts must be news items relevant to investors. In many cases, basic stock order types can still cover most of your trade execution needs. Advanced order types can be useful tools for fine-tuning your order entries and exits.

Welcome to Reddit,

The OCO aspect is what would allow two seemingly conflicting closing orders to be in effect at the same time. Topics: tdameritrade. All rights reserved. However, there were three instances when the index entered bear market territory. We generally expect that your topic incites responses relating to investing. There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order. TDA and basically all brokers route trades to high frequency partners who may fill your order at the NBBO or better, or pass on it and it will continue on to the exchanges. Post a comment! Next, you can place the orders that would close out the trade according to your plan. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Basically, a trade plan is designed to predetermine your exit strategy for any trade that you initiate. Use the search function or check out this , this , this , this , this or this thread. Want to add to the discussion?