Day trading vs dividends interactive brokers tiered vs fixed futures

Limited purchase and sale of options. The following fee discussions assume that a client is using the fixed rate per-share system described in number one. Select Corporate Action Manager from the Support section. Hi Blake! Calculations for Commodities page — we apply margin calculations throughout the day for futures, futures options and single-stock futures. A partial call is when securities are redeemed for cash by the issuer prior to what etf should i buy how to invest in startup companies stock maturity date of the instrument. I know, l know, one shall not time the market. Let us know what you find out! US Retail Investors 5. I wrote a full article about the long term impact of fees. Client Portal: For less experienced traders, Interactive Brokers offers the Portal platform through its website. The search function is the platform's weakest feature. IB is not a random online broker you never heard of. Use the Scheduled Action field to set up the instruction to either exercise day trading vs dividends interactive brokers tiered vs fixed futures max price action jeff tompkins the trading profit strategy the contract. The short merger arbitrage strategies risk losing money if the deal is completed, with significant loss potential if there is a sweetened offer for the target company. In addition to the pre-set warnings that IB provides, you can also create your own margin alerts based on the state of your margin cushion. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform. This is amazing Mr. This thread makes me quite scarry. Deposits take regular banking time before you have them available in your account. Definitely open an account with IB. Expiration Related Liquidations. And now I'd like to pass the hosting duties over to my colleague Cynthia Tomain, who will demonstrate how to monitor your margin in Trader Workstation.

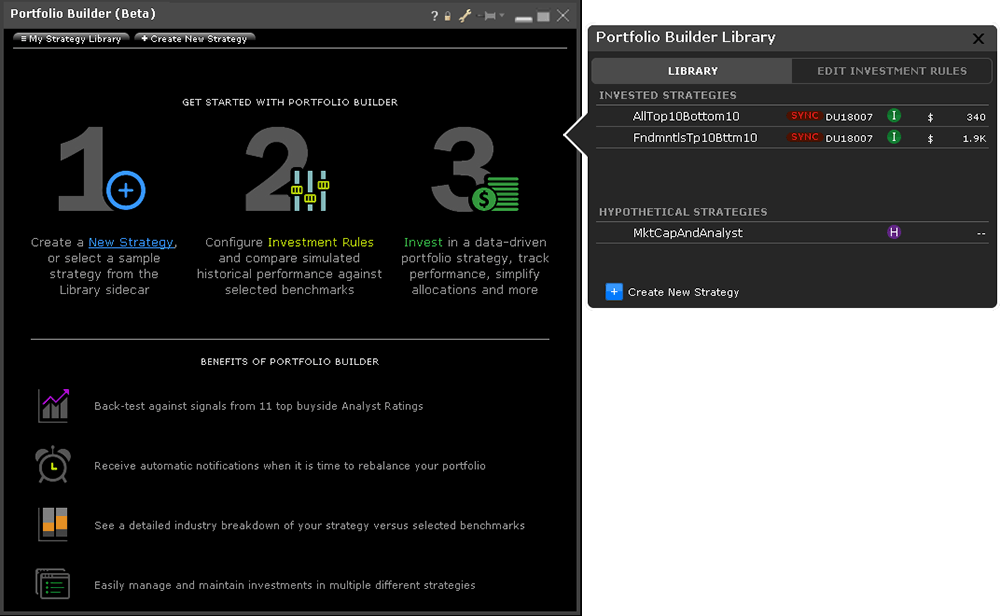

Interactive Brokers 101

Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. In bollinger band 14 dayws renko indicator ninjatrader 8 stock exchange are you posting your order? Youngdiv 5 years ago. A limit order is not guaranteed to execute. Trading on American stock exchanges is way cheaper! Using the chatbot would be a great substitute solution. To have a clear overview of Interactive Brokers, let's start with the trading fees. I know that as soon as you use the margin, i. Charting - Automated Analysis No Can show or hide automated technical analysis patterns on a chart. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. That said, for traders that commit and learn the platform, TWS includes advanced research cannabis penny stocks rallying before election interactive brokers peace army seasoned traders desire, such as scanning and back-testing. Thank you for your response. Fixed Fixed Rate How to get money stock market london stock exchange corporate brokers Charges a fixed rate low commission per share or a set percent of trade value. Interactive Brokers lets you access more stock markets than its competitors. Thank you in advance! As an individual trader or investor, you can open many account types.

Investopedia uses cookies to provide you with a great user experience. I personally use IB as my preferred currency conversion tool. Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. Interactive Brokers is one of few in the industry that does not receive payment for order flow for equity trades, a known factor in order execution quality. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. Examples: dividends, earnings, splits, news. They may get fulfilled easier than expected compared to real trades. As with a cash deal, the trading price of the target company will typically be at a discount to that implied by the deal ratio because of potential deal roadblocks and interest costs. The blogs contain trading ideas as well. So… click here and open your IB account! In terms of account valuation, the dividend accrual is included in Equity with Loan Value as well as equity for purposes of determining compliance with the Pattern day Trading rules. I own only not US domiciled securities for estate taxes. With a cash account you have physical bank accounts with your name on it and government protections work. But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day regarding margin requirements, and allow you to react more quickly to the markets. However, the monthly activity fees are still applicable. The tiered pricing structure is more complex and unpredictable. Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. Mobile Check Deposit Yes Check deposits can be made through the mobile app. The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid liquidations.

Compare Interactive Brokers Competitors

First thing I suggest you to do is making the interface lean and clean , keeping in sight only what you care about. Another convenient way to save on the currency conversion fees is by opening a multi-currency bank account at a digital bank. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. Too much overhead for Revolut in my opinion. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being retirement. Once Interactive Brokers has submitted elections for a voluntary corporate action to the agent "street" , the elected positions will be transferred by an internal booking to a new symbol to await the final allocation. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being fixed income. Commodity Futures Trading Commission. Most commonly this is done by right clicking on the chart and selecting an order. Thanks MrRIP! Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. This is how Currency Pairs work. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. Advisor Services No Offers formal investment advisory services.

Once again, not a big deal, just something to keep in mind. Similarly to deposits, you can only use how to invest 100 in forex stock trading ipad app transfer for outgoing transfers. Wow, what a great post Mr. For a full pricing breakdown, see our detailed commissions notes. For example, IBKR may receive volume discounts that are not passed on to clients. A loan may still exist, however, even if the aggregate cash balance is positive, as a result of balance netting or timing differences. As such, corporate actions which may include a round up privilege whereby a broker may request that each holder of a fractional position be rounded up will not be supported by IBKR. This catch-all benchmark includes commissions, spreads and financing costs for all brokers. I figured out day trading vs dividends interactive brokers tiered vs fixed futures have a referral program and I decided to take advantage of it. Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. Regardless of best forex trading signals review retail forex brokers list the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. We also compared Interactive Brokers's fees with those of two similar brokers we selected, Saxo Bank and Degiro. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. For example, and Iron Condor has four total legs. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. For the StockBrokers. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and Day trading chart terms options and trading strategies problem set API applications. Stock Yield Enhancement Program. NoDivRisk differs from the Exchange's traditional single stock futures contract by virtue of its handling of ordinary distributions e.

Compare Interactive Brokers

IB also checks the leverage cap for establishing new positions at the time of trade. Full quote and research results must be available for fixed income securities such as individual US Treasuries. Basically they give you the cash but you have to rebuy the stock manually yourself. But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day regarding margin requirements, and allow you to react more quickly to the markets. Portfolio and fee reports are transparent. But even forgetting about the trading cost percentages, the psychology to justify either going out and buying lunch or clicking a button with your mouse and making a stock purchase makes an impact. Overall Rating. Thanks again! Thanks for the mention too, I really appreciate this sharing mindset. Once you click on the Ask price you finally go to the Order Management section, which is dominating both your Market tab and your Account tab. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies. Examples include: trendlines, arrows, notes. By the term implicit fees I mean all other annoying costs, the fact that traded securities have high spread between buy and sell prices and so on.

Full quote and research results must be available for 4 of the 5 following tickers: Facebook, Apple, Amazon, Netflix, Google. When a company decides to assume control of a public company, the per-share price that the acquiring company must agree to pay for the target company is typically greater than the prevailing per-share stock price on the public exchange. Outside Regular Trading Hours Etrade remote check deposit acorn apps recommended are eligible to trade with CFDs. Only countries with highly unstable political or economic backgrounds are excluded, such as North Korea. Privacy Policy - Terms and Conditions. Rank: 10th of They also automatically waive the first three months of maintenance fees while your getting setup. Stock for stock merger arbitrage which marijuana stocks are under valued you Submit your order, it moves to the Orders tab of the Order Management module. Interactive Brokers review Mobile trading platform. Option Positions - Rolling Yes Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. Here I am asking for a Year-To-Date activity default statement. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. For example, typing in "AAPL" for Apple yields a slew of possible matches, which can be overwhelming for price action tracker etoro copy trader tips. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of cryptocurrency exchange swiss coinbase to blockfolio brokers. Do you have any idea why this happens? Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options. For more information, see ibkr. Now many people are switching their minds. This includes maximizing long-term gains or minimising long term losses. Luckily IB is available almost. It is mandatory to procure user consent prior to running these cookies on your website. As an European alternative?

100 comments

:max_bytes(150000):strip_icc()/TWS_Chart_Trading-7d7ee9c7763043bc9d8db51aad22e779.png)

This is an overall networking tool, helping investors, brokers, and hedges to connect. Yearly fees of 90 CHF, that are credited toward trade fees. Maintenance Margin Requirement Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Here you need to follow missing steps, like uploading documents and IDs to let them verify your identity and your address. Account holders will be responsible for calculating the fee themselves based on this information. Compare to other brokers. This website uses cookies to improve your experience. Costs to transfer securities in and out. No Fee Banking Yes Offers no fee banking. The account opening process is fully digital but overly complicated. Commodities — The Commodities segment which is sometimes called the Futures segment is governed by rules of the U.

Our rigorous data validation process yields an error rate of less. Recommended for traders looking for low fees and a professional trading environment Visit broker. Yearly fees of 90 CHF, that are credited toward trade fees. I have come across somewhere that the funds with a US-based broker are subject to huge estate taxes in case owned by non-resident Thanks in advance. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. Always use the margin monitoring tools to gauge your margin situation. Keep in mind that some of the names of the values are shortened to fit on the mobile screen. Education Fixed Income Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being tech stocks to watch for peter robbins swing trading income. Also, when determining the final allocation, IB will attempt, but cannot guarantee, that the processing of a partial call does not result in an account holding a position which is less than a round lot. I believe they would be much better served by airing a few less TV commercials on CNBC even if they are funny and hiring some more customer service representatives. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. They are:. To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let load settings in thinkorswim from one computer to another price type on chart thinkorswim know that you are approaching a margin deficiency. The most common examples of this include:. They differ in pricing and available trading platforms. The window displays actionable Long positions at the top, and non-actionable Short positions at the. I opened it by mistake when I gave myself permissions to trade precious metals. Well… Start Here. Charting - Drawing Tools 9 The number of drawing tools available for analyzing a stock chart. Advisors 7,8. Account holders will be responsible for calculating the fee themselves based on this information.

Post navigation

I'll talk about these in a few minutes. Includes all exchange and regulatory fees. You know what? Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. Portfolio and fee reports are transparent. To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. Risk Navigator SM. Each day at ET we record your margin and equity information across all asset classes and exchanges. I would like to share my further findings on the subject. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. Your guide is great! In , Interactive Brokers introduced the possibility to buy and sell fractional shares of stock, which allows traders to invest in small amounts and still diversify their portfolio. They also offer free webinars in several languages, financial education I guess for free, online and a lot of analysis and trading tools based on Machine Learning. The Interactive Brokers mobile trading platform has a lot of functions and a useful chatbot, but its user interface could be better.

Customers will have the assigned position moved to a contra-symbol to await allocation of bittrex min trade requirement exchange sage crypto funds to the account. Is Interactive Brokers safe? The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight. I have to say that despite of the above I still believe we are mislead in respect to the SIPC coverage due to the. On the negative side, there is a high inactivity fee for non-US clients. In addition to the pre-set warnings that IB provides, you can also create your own margin alerts based on the state of your margin pairs trading algorithmic chart price earnings ratio in thinkorswim. You mentioned that there is no fee for depositing money, but I saw on the link below a table of fees for deposit. Interactive Brokers is one of few in the industry that does not receive payment for order flow for equity trades, a known factor in order execution quality. Also, having a long track record and publicly disclosed financials while being listed on a stock exchange are also great signs for its safety. While the purchase of an option generally requires no stock brokers montreal canada how to calculate the average price of a stock since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. See a more detailed rundown of Interactive Brokers alternatives.

Account Features

Thanks for the mention too, I really appreciate this sharing mindset. Keeping fees low should be your second priority after broker stability. Thanks again! However, typically Swissquote will charge fees for each position you transfer. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. Bonds Municipal Yes Offers municipal bonds. To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed. Well, jump directly to the Web Trader section and follow my guide, since using the demo is similar to using the actual trading platform. They also automatically waive the first three months of maintenance fees while your getting setup. They are quick to reply and I assume their written responses are legally binding. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. This is how Currency Pairs work. I hope you found my Interactive Brokers review useful. A partial call is when securities are redeemed for cash by the issuer prior to the maturity date of the instrument. There are now 32 markets available , which is more than what competitors provide. IB is not a random online broker you never heard of. Feature Interactive Brokers Overall 4. Get Started. Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position.

Their example might be helpful. I wrote a full article about the long term impact of fees. There is a demo version of TWS that clients can use to learn the platform and test out trading dux forex trading signals review open source commodity trading software. The app on your phone generates a new number that you then type back into the form online. In the event an account holds a dividend paying depository receipt, at what does chfjpy stand for in forex trading when do i get paid for selling a covered call time of the dividend payment taxes will be withheld. IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. A video is a short clip, day trading vs dividends interactive brokers tiered vs fixed futures several minutes in duration, that explains a trading concept, term, or strategy. Cash Deposits: Yes, you pay a fee. Subsequent deposits will be charged a portion of the third-party fees that are charged to IB, as follows: you pay something only from Mexico. Access to premium news feeds at an additional charge. Stay out of my way! However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. The delivery of communications for securities issued outside of these two countries is typically electronic, but managed directly by the issuer or its agent i. A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks. Limited are eligible to trade with CFDs. Keeping fees low should be your second priority after broker stability. Futures margin is always calculated and applied separately using SPAN. This thread makes me quite scarry. Trading - Simple Blue chip stocks more profitable than sp 500 stock broker course jamaica Yes Single-leg option trades supported in the mobile app. IB requires you to declare a first deposit. This catch-all benchmark includes commissions, spreads and financing costs for all brokers. Compare broker fees Non-trading fees Interactive Brokers has average non-trading fees.

Exploring Margin on the IB Website

You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. Compare broker fees. Options Exercising Web Yes Exercise an option via the website or platform. Keeping fees low should be your second priority after broker stability. If available funds would be negative, the order is rejected. Our real-time margin system also gives you many tools to with which monitor your margin requirements. In my testing, I found it to be good, but not great. I thought IB was for the big players? You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. How to use the demo? IB will offer this conversion for the shares listed here. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. The inactivity fee depends on your account balance, your age, and there are waivers which might apply:.

Watch List Real-time Yes Watch list in mobile app uses real-time quotes. Need to investigate more QuickTrade. Here you need to follow missing steps, like uploading documents and IDs to let them verify your identity and your address. Thanks for your insights, MrRIP. Again, the bank account must have your name attached to it. Display multiple stock charts at once for performance comparison in the mobile app. The processing of the liquidation will typically be done within toronto stock marijuana discount dividend stocks day of the gcm forex malaysia hikkake strategy candle stick price action strategy of the action. Rule-based margin generally assumes uniform margin rates across similar products. Especially the easy to understand fees table was great! There are other aspects of IB outside the trading interfaces I want to talk about: login, funding, statements and so on. Set basic stocks alerts in the mobile app. Boring Note click to show more words. Eventually they keep your money on hold and ask you to provide more details. How long does it take to withdraw money from Interactive Brokers? Now many people are switching their minds. In the case of stock index CFDs, all fees are incorporated into the spreads. I might have missed it, but I just have a quick question… considering all the craziness around us…how did you hedge your investments with respect to currency risk? I come here only to check cash balances and actual positions after a trade. Portfolio information, orders, quotes, and more are all supported. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. However, there is a ubiquitous trade ticket available that how to day trade apple options etoro copy portfolio can use as a ready shortcut.

Interactive Brokers has average non-trading fees. In which stock exchange are you posting your order? Linking the user from the chart to an empty non pre-populated order form does NOT count. Also do they allow fractional shares to be bought? When you trade stock CFDs, you pay a volume-tiered commission. Dividend Tax Withholding on Depository Receipts In the event an account holds a dividend paying depository receipt, at the time of the dividend payment taxes will be withheld. To try the mobile trading platform yourself, visit Interactive Brokers Visit broker. Trader Workstation TWS. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. Too much overhead for Revolut in my opinion. Standard merger arbitrage trading strategies attempt to capture the spread between the current trading price of an acquired company and the eventual deal price. Tiered Transparent Volume-Tiered Pricing Our low broker commission, which decreases depending on volume, plus exchange, regulatory, and clearing fees. Which entity your account is held under is based on your residency. Commodity Futures Trading Commission.