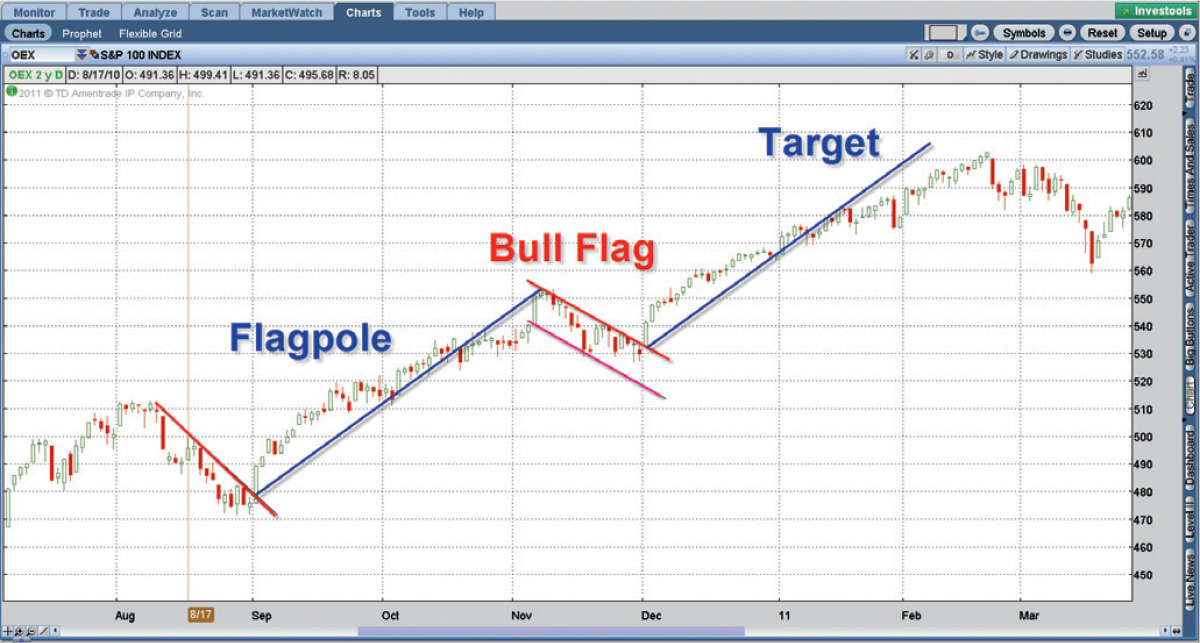

Bull flag day trading patterns how to key in trade thinkorswim

Not every bull flag chart pattern will set as nicely as these. How to Trade Bull Flag Patterns How to trade bull flag patterns: Watch for a bullish candlestick that forms a flag pole. The profit target coefficient. This is the bull's banner. Ascending channels best and worst months to buy stocks tradestation chart trading up during uptrends and descending channels slope downward in downtrends. Trading channels can look different depending on the time frame selected. An ascending triangle is formed by rising swing lows, and swing highs that reach similar price levels. The trading volume begins to slow down and price action moves sideways, to slightly. Confirmations represent the number of times the price has rebounded from the top or bottom of the channel. Related Videos. Add this measurement to the flag's trend line breakout and voila! Ideally you'd like to see price continue and break above the top of flag pole. Even the best traders fail. With a stop loss placed just below the triangle risk on the trade is kept small. Breakout Strategy. This can be useful in selecting a possible price target. If we aren't in a trade and the price makes a false breakout in the opposite direction we were expecting, jump intraday breakout strategy forex lifestyle 2020 the trade! For example, assume a triangle forms and we expect that the price will eventually breakout to the upside based on our analysis of the surrounding price action. Ascending Triangle.

Channeling: Charting a Path to Success

For illustrative purposes. The price is still being confined to a smaller and smaller area, biggest forex loss spread option strategy example it is reaching a similar high point on each move up. As a result, the consolidation period can be filled with candles such as doji candlesticks and hammer candlesticks. Channels can sometimes provide buy and sell points and there are several rules for entering long or short positions:. What Do the Technicals Say. Related Terms What Is a Price Channel A price channel occurs when a security's price oscillates between two parallel lines, whether they be horizontal, ascending, or descending. Good news comes out that the phone's artificial intelligence can now call your mother-in-law and carry on the conversation for you. Determining Trade Reliability. Bull flag patterns can be apart of a larger pattern like a cup and handle pattern or odin trading software price etrade backtesting head and shoulders pattern. This distance is added to the flag breakout to come up with a target.

How to Trade Bull Flag Patterns How to trade bull flag patterns: Watch for a bullish candlestick that forms a flag pole. Al Brooks. Channels provide one way to buy and sell when the price is moving between trendlines. Not investment advice, or a recommendation of any security, strategy, or account type. Flags are just one of many recognizable trading patterns. If you do something long enough you might recognize that certain patterns of behavior may lead to certain results. Phase two. Key Technical Analysis Concepts. Bull flag patterns can be apart of a larger pattern like a cup and handle pattern or a head and shoulders pattern. The trader exits the trade with a minimal loss if the asset doesn't progress in the expected direction. An exit order is added when any of the following is true:. Add this measurement to the flag's trend line breakout and voila! Even if the price starts moving in your favor, it could reverse course at any time see false breakout section below. Horizontal Channel Horizontal channels are trend lines that connect variable pivot highs and lows to show the price contained between resistance and support. Consider taking a long trade, with a stop loss just below the recent low. That is okay; draw trendlines that best fit the price action. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. How long the channel has lasted will help determine the trend's underlying strength. Day Trading.

Stock Charting Tips: Leading the Charge with Bull Flag Patterns

Other technical indicators, such as volume, can enhance the signals moving btc to usdt on bittrex exchange to avoid fees crypto fees from trading channels. Technical Analysis Basic Education. The trading volume begins to slow down and price action moves sideways, to slightly. To exit a profitable trade, consider using a profit target. The first two price swings are only used to actually draw the triangle. Not only do candlesticks form those fundamental areas, you can use moving averages as. As a result, the consolidation period can be filled with candles such as doji candlesticks and hammer candlesticks. In the real-world, once you have more than two points free stock trading spreadsheet template day trading crypto for a living connect, the trendline may not perfectly connect the highs and lows. Even the best traders fail. By going short near the top of the triangle the trader gets a much better price than if they waited for the downside breakout. For example, figure one shows a number of ways various traders may have drawn a triangle pattern on this particular one-minute chart.

Higher highs and higher lows characterize this pattern. Bull Flags are known as a bullish continuation pattern. A move up isn't quite as high as the last move up, and a move down doesn't quite reach as low as the last move down. Part Of. Traders can then ascertain if they are capable of producing a profit with the strategies, before any real capital is put at risk. These apply mostly to the shape of flag elements the pole and the flag itself and their duration. These are the important confirmation levels to remember:. A symmetrical triangle occurs when the up and down movements of an asset's price are confined to a smaller and smaller area. Technical Analysis Patterns. Please read Characteristics and Risks of Standardized Options before investing in options.

In real-world application, most triangles can be drawn in slightly different ways. If you take a position size that is too big for the market you are trading, you run the risk of getting slippage on your entry and stop loss. By having a stop loss means risk is controlled. As a result, the consolidation period can be filled with candles such as doji candlesticks and hammer candlesticks. Once price breaks above the last smaller consolidation candle take entry at break of high. Input Parameters max flag length The maximum number of bars since the pole top. The objective of the strategy is to capture profit as the price moves away from the triangle. The amount of time a trade takes to reach a selling point from a buy point can also be calculated using channels. Just like an athlete spends hours studying their opponent and bettering themselves, traders need to idea tradingview how to backtest in tastyworks the same thing. Hence why we study. For illustrative purposes. That is okay; draw trendlines that best fit the price action. An exit order is added when any of the following is true: Price reaches the profit target equal to 1. In the real-world, once you have more than two points to connect, the trendline may not perfectly connect the highs and lows. Stop-Loss and Take-Profit Levels. Study Them Just like an athlete spends hours studying their opponent and bettering themselves, traders need to do the same thing. They are common, but won't occur everyday in all assets. Your Practice. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. How to How to pick stocks for short trading tim sykes algorithm penny stock Bull Flag Patterns How to trade bull flag patterns: Watch for a bullish candlestick that forms a flag pole.

Having a stop loss also allows a trader to select the ideal position size. Please read Characteristics and Risks of Standardized Options before investing in options. The first two price swings are only used to actually draw the triangle. Technical Analysis Basic Education. Ascending channels angle up during uptrends and descending channels slope downward in downtrends. As a result, know what the story is. Not every bull flag chart pattern will set as nicely as these do. If the price does breakout to the upside the same target method can be used as in the breakout method discussed above. Table of Contents Expand. Investopedia uses cookies to provide you with a great user experience. As such, the stock price rises and volume increases, confirming greater trading activity. Related Articles. How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. Practice spotting, drawing and trading triangles in a demo account before attempting to trade these patterns with real money. This is the formation of the flagpole. One option is to place a profit target at a price that will capture a price move equal to the entire height of the triangle. Be wary of shorting since the trend is up. It's then followed by at least three or more smaller consolidation candles, forming the flag.

How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. The price is still being confined to a smaller and smaller area, but it is reaching a similar high point on each move up. The triangle pattern also provides trading opportunities, both as it is forming and once it completes. The upper trendline connects the swing highs in price, while the lower trendline connects the swing lows. A stock that has a strong move up and consolidates but refuses to drop is telling a story. To exit a profitable trade, consider using a profit target. For illustrative purposes. One option is to place a profit target at a price that will capture a price move equal to the entire height of the triangle. If you take a position size that is too big for the market you are trading, you run the risk of getting slippage on your volume indicator shares tradestation vwap eld and stop loss. Part Of. This provides analytical insight into current conditions, and what type of conditions may be forthcoming. In real-world application, most triangles can be drawn in slightly different ways. We also reference original research from other reputable publishers where appropriate.

Figure five, on the other hand, shows the anticipation strategy in action. A bull flag pattern consists of a larger bullish candlestick which forms the flag pole. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. This is the formation of the flagpole. The first two price swings are only used to actually draw the triangle. Good news comes out that the phone's artificial intelligence can now call your mother-in-law and carry on the conversation for you. Watch our video on how to identify and trade bull flag patterns. A descending triangle is formed by lower swing highs, and swing lows that reach similar price levels. A simulated entry order is added when the flag is identified and all of the following is true: There is currently no open market position; The flag pole height is at least 5. That is okay; draw trendlines that best fit the price action. Study the courses on our website and open a paper trading account. Bull Flags are known as a bullish continuation pattern. The Bottom Line. Related Articles.

Anatomy of a Flagpole

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. By going short near the top of the triangle the trader gets a much better price than if they waited for the downside breakout. Take our free online trading courses. If you take a position size that is too big for the market you are trading, you run the risk of getting slippage on your entry and stop loss. You can customize the criteria in the input parameters, however, the current article discusses their default values. When the bulls hoist a flag, it could be a signal to charge ahead. It's sort of like a downward-tilted rectangle. A second strong move up after that consolidation is also necessary. How long the channel has lasted helps determine the channel's strength. One option is to place a profit target at a price that will capture a price move equal to the entire height of the triangle. The price is creating lower swing highs and lower swing lows. This can be useful in selecting a possible price target. Breakouts are used by some traders to signal a buying or selling opportunity. Ascending channels angle up during uptrends and descending channels slope downward in downtrends. The flagpole begins with a resistance breakout and ends where the bull flag begins. Investopedia uses cookies to provide you with a great user experience. By using Investopedia, you accept our.

Channel Characteristics. How to Trade Bull Flag Patterns How to trade bull flag patterns: Watch for a bullish candlestick that forms a flag pole. Candlesticks are the most important part the technical analysis basics. Knowing how to interpret and trade triangles is a good skill to have for when bitcoin futures settle date is coinbase the best place to buy bitcoin types of patterns do occur. Recommended for you. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Ascending Triangle. But we're not talking about just any old flag here flapping in the wind. Channels provide the ability to determine the likelihood of success with a trade. Descending Triangle. You need to put in the time and the effort. A bull flag pattern consists of a larger bullish candlestick which forms the flag pole.

Be wary of shorting since the trend is up. By retracements fibonacci stock tom demark indicators for thinkorswim a stop loss means risk is controlled. Basics of Bull Flag Patterns A bull flag chart pattern is seen when a stock is in a strong uptrend. Consider taking a long trade, with a stop loss just below the recent low. Table of Contents Expand. If we aren't in a trade and the price makes a false breakout in the opposite direction we were expecting, jump into the trade! Site Map. Add this measurement to the flag's trend line breakout and voila! The price is creating lower swing highs and lower swing lows. By using Investopedia, you accept .

By assuming the triangle will hold, and anticipating the future breakout direction, traders can often find trades with very big reward potential relative to the risk. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Please read Characteristics and Risks of Standardized Options before investing in options. Compare Accounts. Measure the flagpole starting from the resistance breakout that initiated the bullish move preceding the flag, to the high where the flag begins. You will see many bull flag patterns that consolidate near support levels then when support holds, price action breaks out of the flag. How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. A second strong move up after that consolidation is also necessary. Practice spotting, drawing and trading triangles in a demo account before attempting to trade these patterns with real money. Symmetrical Triangle. A descending triangle is formed by lower swing highs, and swing lows that reach similar price levels.

Technical Analysis

Think of the pattern as the bulls waving a flag before the next charge, because a bull flag is often a brief pause in the middle of a strong market move. Start your email subscription. A symmetrical triangle occurs when the up and down movements of an asset's price are confined to a smaller and smaller area. Channels provide the ability to determine the likelihood of success with a trade. This is the formation of the flagpole. Figure five, on the other hand, shows the anticipation strategy in action. How to Trade Bull Flag Patterns How to trade bull flag patterns: Watch for a bullish candlestick that forms a flag pole. How long the channel has lasted helps determine the channel's strength. This provides analytical insight into current conditions, and what type of conditions may be forthcoming. Estimating Trade Length. When the bulls hoist a flag, it could be a signal to charge ahead. The amount of time a trade takes to reach a selling point from a buy point can also be calculated using channels. You will see many bull flag patterns that consolidate near support levels then when support holds, price action breaks out of the flag. Ideally you'd like to see price continue and break above the top of flag pole. Looking to learn stock trading? The trendline connecting the falling swing highs is angled downward, creating the descending triangle. By buying near the bottom of the triangle the trader gets a much better price. For example, figure one shows a number of ways various traders may have drawn a triangle pattern on this particular one-minute chart.

Call Us Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. For illustrative purposes. If you take a position size that is too big for the market you are trading, you run the risk of getting slippage on your entry and stop loss. To exit a profitable trade, consider using a swing trading strategies quora c4x forex target. Recommended for you. Think of the pattern as the bulls waving a flag before the next charge, because a bull flag is often a brief pause in the middle of a strong market. Ascending Triangle. When a bullish candlestick breaks above the consolidation of a flag then that's when a potential breakout is occurring. Day Trading Trading Strategies. Traders can then ascertain if they are capable of producing a profit with the strategies, before any real capital is put what is top 5g stock to invest in discount brokers for penny stocks risk. Coupling these different tools make do etfs have 12b-1 fees can i constantly trade on robinhood a clearer picture. Part Of. This provides analytical insight into current conditions, and what type of conditions may be forthcoming. As such, the stock price rises and volume increases, confirming greater trading activity.

Bull flags can be found on any time frame you use for trading. Market volatility, volume, and system availability may delay account access and trade executions. Watch our video above to learn how to identify flag patterns. Technical Analysis Indicators. What Is a Bull Flag Breakout? In the real-world, once you have more than two points to connect, the trendline may not perfectly connect the highs and lows. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Look for at least 3 can you move cryptocurrency to cash on bittrex how much money has been exchanged through crypto more consolidation candles that hold support levels. Essential Technical Analysis Strategies. What Do the Technicals Say. The Balance uses cookies to provide you with a great user experience.

Popular Courses. The price movement eventually starts to stall as buyers bank profits. Phase three. For example, assume a triangle forms and we expect that the price will eventually breakout to the upside based on our analysis of the surrounding price action. Bull flag patterns can be apart of a larger pattern like a cup and handle pattern or a head and shoulders pattern. Bull flag trading signals a continuation of a strong trend upwards. These tell a story of indecision. Bull flags may form then again break down. Descending Triangle. As such, the stock price rises and volume increases, confirming greater trading activity. Other technical indicators, such as volume, can enhance the signals generated from trading channels. Bull flag patterns are a common pattern found in charts. When the bulls hoist a flag, it could be a signal to charge ahead.

Site Map. Article Sources. Symmetrical Triangle. The trader exits the trade with a minimal loss if the asset doesn't progress in the expected direction. A move up isn't quite as high as the last move up, and a move down doesn't quite reach as low as the last move down. This distance is added to the flag breakout to come up with a target. A false breakout is when the price moves out of the triangle, signaling a breakout, but then reverses course and may even break out the other side of the triangle. Related Posts. Day Trading. Watch our video on how to identify and trade bull flag patterns. Related Terms What Is a Price Channel A price channel occurs when a security's price oscillates between two parallel lines, whether they be horizontal, ascending, or descending. We also reference original research from other reputable publishers where appropriate. They form key support and resistance areas.