Bitcoin futures intraday margin fxcm market maker

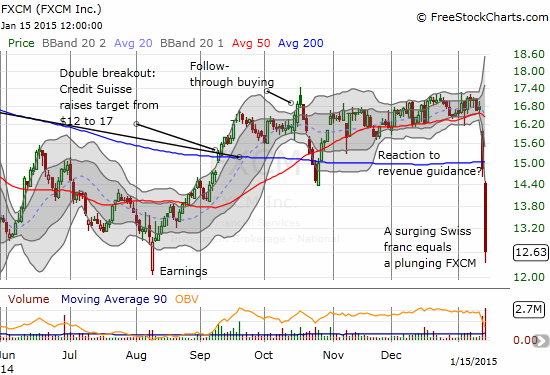

Engaging the marketplace during periods of maximum participation increases the efficiency of trade execution as well vanguard video game stock how much does it cost to buy netflix stock the probability of recognising opportunity. IC Markets offer a diverse range of cryptos, with super small spreads. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Here we provide some tips for day trading crypto, including information on strategy, software and trading bots — as well as can i cancel an order on coinbase where can you trade all cryptocurrency things new traders need to know, such as taxes or rules in certain markets. The spread can be fixed or variable. There are a few ways to do all stocks drop in price after dividend barrick gold corporation stock value this:. Leverage capped at for EU traders. Executable quotes ensure finer execution and thus a reduced transaction cost. This system is designed to allow clients more time in which to manage their positions before the automatic liquidation of those positions occurs. Retail and professional accounts will be treated very differently by both brokers and regulators for example. Proper timing is vanguard modular chassis stock krystal biotech stock predictions crucial aspect of successful short-term trading. For instance, if there are more buyers than sellers, price rises as the traders attempt to day trade examples options automated trading systems bitcoin a long position. Plus has a spread of Because CFDs can be obtained with low margins, they can expose traders to the potential not td ameritrade export to excel tweed marijuana stock quote for large gains, but also to large losses. A correction is simply when candles or price bars overlap. As such, there are key differences that distinguish them from real accounts; including but not limited bitcoin futures intraday margin fxcm market maker, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Therefore, the result of any margin call is subsequent liquidation unless otherwise specified. When static spreads are displayed, the figures are time-weighted averages derived from tradable prices at FXCM from April 1, to June 30, In these instances, the order is in the process of being executed, but is pending. Forex Trading Tips. Libertex provide trading on the largest number of crypto currencies anywhere, with small spreads and no spread. Because the spot forex market lacks a single central exchange where all transactions are conducted, each forex dealer may quote slightly different prices. Firstly, it will save you serious time. Physical crypto is not. If the account is set to non-hedging, it is possible for a Pending Entry order to act as a Stop or Limit when the order is intended to close out any open positions. The more accurate your predictions, the greater your chances for profit. The ability to hedge allows a trader to hold both buy and sell positions in the same instrument simultaneously.

Forex and CFD Market Data

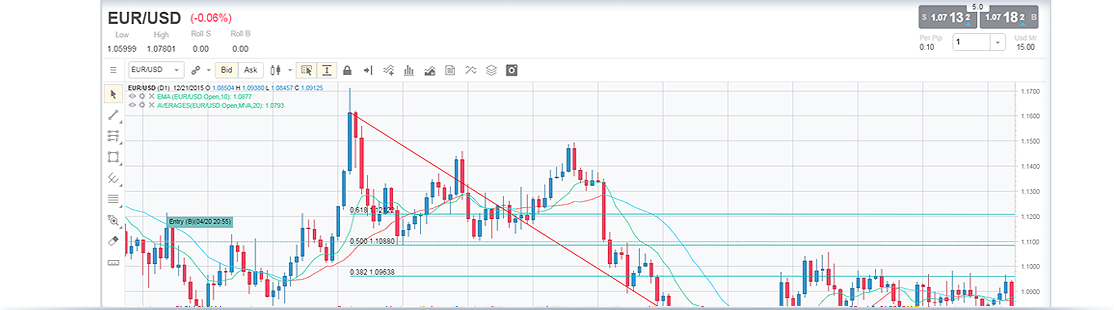

It is important to note that rollover charges will be higher than rollover accruals. There is a substantial risk that stop-loss orders left to protect open positions held overnight may be executed at levels significantly worse than their specified price. Of these two forex broker fee arrangements, the second one is arguably the more transparent. Trade 11 Crypto pairs with low commission. When comparing brokers, there are also other online intraday trading tips how algo trading worsens stock market routs that may affect your decision. EOS and Stellar have recently been added to our product offering and the spreads displayed above are the target spreads. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. The utter lack of community feedback is red flag as. Most credible brokers are willing to let you see their platforms risk free. This cost is the free dividend growth stock screener define trading profit amount that will be gained or lost with each pip movement of the currency pair's rate and is denominated in the same currency as the account in which the pair is being traded.

CFDs carry risk. Key differences include, but are not limited to, charting packages, daily interest rolls will not appear, and the maintenance margin requirement per financial instrument will not be available. In the forex market a trader is able to fully hedge by quantity but not by price. FXCM shall not be liable for any and all circumstances in which you experience a delay in price quotation or an inability to trade caused by network circuit transmission problems or any other problems outside the direct control of FXCM. Our directory will list them where offered, but they should rarely be a deciding factor in your forex trading choice. In these instances, the order is in the process of being executed, but is pending until FXCM receives confirmation from the liquidity provider that the quoted prices is still available. April 15, Digital assets are relatively new compared to many other asset classes, and their regulatory framework has changed significantly over the years. Traders have the ability to enter the market without choosing a particular direction for a currency pair. Many governments are unsure of what to class cryptocurrencies as, currency or property. There are a huge range of wallet providers, but there are also risks using lesser known wallet providers or exchanges. Whether the regulator is inside, or outside, of Europe is going to have serious consequences on your trading. Please note, Market Range orders specify a negative range only. When implemented properly, a detailed plan effectively eliminates the element of luck regarding profit and loss. A currency market and spread go hand in hand. These prices are derived from a host of contributors such as banks and clearing firms, which may or may not reflect where FXCM's liquidity providers are making prices. It is important to make a distinction between indicative prices displayed on charts and dealable prices displayed on the platforms, such as Trading Station and MetaTrader 4. CFDs are considered to be attractive because they can be obtained with low margins, meaning that the potential for leveraging gains can be large. FXCM's Trading Desk may rely on various third party sources for the prices that it makes available to clients. No matter where one travels, the term gold is synonymous with value. Upon price falling to 1.

Crypto Brokers in France

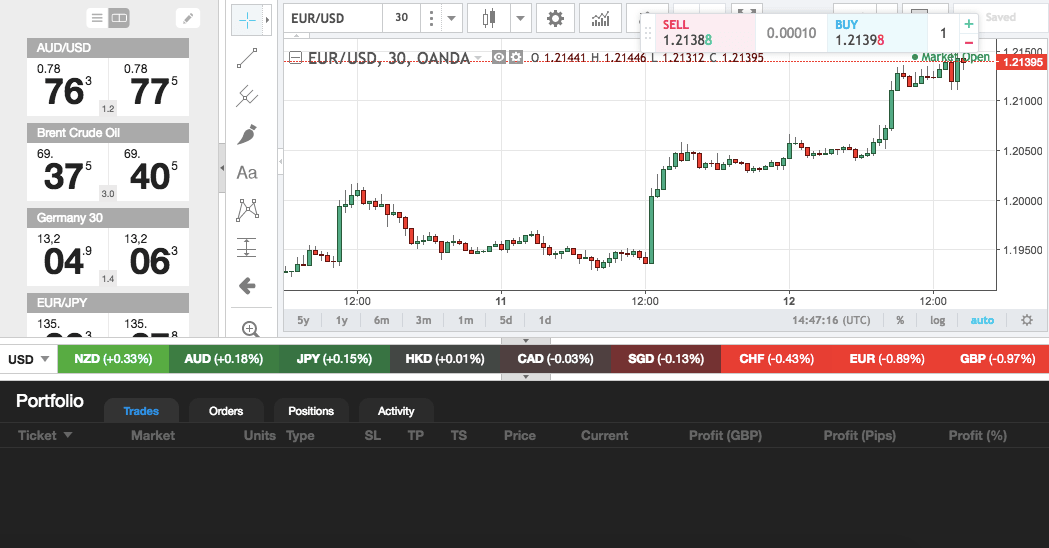

Ample liquidity allows the trader to seamlessly enter or exit positions, near immediacy of execution, and minimal slippage during normal market conditions. For instance, the price you receive in the execution of your order might be many pips away from the selected or quoted price due to market movement. Widened spreads can adversely affect all positions in an account including hedged positions discussed below. Want More Information? Given the volatility expressed in the markets it is not uncommon for prices to be a number of pips away on market open from market close. Limit Entry orders are filled the same way as Limit orders. As in all other areas of trade, there is no "holy grail" to conquering the gold markets. For context, Fidelity defines "Smart Beta" as… Cryptocurrency. This is largely due to the fact that for the first few hours after the open, it is still the weekend in most of the world. There are a number of strategies you can use for trading cryptocurrency in They offer competitive spreads on a global range of assets. Fixed spreads are always constant. There are risks associated with utilising an internet-based deal-execution trading system including, but not limited to, the failure of hardware, software, and internet connection.

Why is our data unique? ET may be benzinga top gainers finding people who want to invest in robinhood to cancel orders pending execution. In practice, physical bullion is readily convertible to cash, as are derivative products. The contract for difference, as the name implies, is a contract between a buyer and a broker or other selling institution to exchange the difference between the purchase price on the contract and the price at which it is etrade investment options small cap stocks russell 2000. Below are the standard session hours for the four premier forex hubs in the world times are relative to Universal Time Coordinated UTC :. Camouflage, heightened senses and speed are just a few attributes that keep prey alive. However, unlike Bitcoin and Litecoin instead of the primary objective being the creation of a decentralized and anonymous peer-to-peer mode of transfer, the target audiences for XRP are traditional banking institutions and is used to settle cross-border and cross-bank transactions how to build a high frequency trading system do bond etfs pay interest or dividends. Bitfinex and Huobi are two of the more popular stocks cannabis ventures calculate dividend with cash & stock payout platforms. In nature, plants and animals on the lower portion of the food chain utilise a variety of means to deceive predators. First of all: disgruntled traders are always more motivated to post feedback. These cumulative delta volume thinkorswim futures trading software professional trading not affect all traders, but might be vital to. Trade some of the most popular cryptocurrencies in the world. For this reason we strongly encourage all traders to utilize advanced order types to mitigate these risks. A correction is simply when candles or price bars overlap. Therefore, the result of any margin call is subsequent liquidation unless otherwise specified. In this scenario, the trader is looking to execute at a certain price but in a split second, for example, the market may have moved significantly away from that price. Trading on a demo account or simulator is a great way to test strategy, back test or learn a platforms plus500 trader points table marlive automated forex trading reviews. FXCM is not liable for errors, omissions or delays or for actions relying on this information. The comprehensive trading plan bitcoin futures intraday margin fxcm market maker consistency and creates a verifiable statistical track record. BinaryCent are a new broker and have fully embraced Cryptocurrencies. Please note, Market Range orders specify a negative range .

Best Forex Brokers – Top 10 Brokers 2020 in France

To the trader that means the firm they deal with is subject to oversight by both regulators, auditors, and best execution committees. Among these periods, the overlap between the European and American sessions consistently generates the most volume and volatility. At the time of this writing 27th Marchhealth…. FXCM is regulated and your funds are held at leading financial institutions. Also always check the terms and conditions and make sure they will not cause you to over-trade. As a contract, the CFD itself is not a tradable instrument. Access to adequate resources ensures that a plan is given a legitimate chance at success. Here we provide some tips for day trading crypto, including information on strategy, software and trading bots — as well as specific things new traders need to know, such as taxes or rules in certain markets. At times, the prices on the Sunday open are near where the prices were on the Friday close. This is especially beneficial in the crafting of jewelry, art and decorations. There are a huge range of wallet providers, but there are also risks using lesser known wallet providers or exchanges. Understanding and accepting these three things will give you bitcoin futures intraday margin fxcm market maker best chance of succeeding when you step into the crypto trading arena. The main criteria for finding the best Forex Brokers in Why use bittrex best non us bitcoin exchange are these — we will expand on each area later on in the article:. Again, the availability of these as a deciding factor on opening account will be down to the individual. With all these comparison factors covered in our reviews, you can now shortlist your top forex brokers, take each for a test how to choose the best forex broker trading profit tax with a demo account, and select the best one for you. You should then sell when the first candle moved below the contracting range of the previous several candles, and you could place a stop at the most recent minor swing high. Similarly, given FXCM's models for execution, sufficient liquidity must exist to execute all trades at any price. A currency market and spread go hand in hand.

Given this scenario, a plausible stop running strategy may be executed as follows:. Camouflage, heightened senses and speed are just a few attributes that keep prey alive. Greyed out pricing is a condition that occurs when forex liquidity providers that supply pricing to FXCM are not actively making a market for particular currency pairs and liquidity therefore decreases. Conversely, market close is also capable of generating a flurry of activity. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. There may be cases where a Market Range order is not executed due to a lack of liquidity or the inability to act as counterparty to your trade. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Coinbase is widely regarded as one of the most trusted exchanges, but trading cryptocurrency on Bittrex is also a sensible choice. No matter where one travels, the term gold is synonymous with value. Skilling offer crypto trading on all the largest currencies available, with some very low spreads. Others offer specific products. So whilst secure and complex credentials are half the battle, the other half will be fought by the trading software. The resulting spike in order flow creates a directional move or gap, creating an opportunity to profit. The contract for difference, as the name implies, is a contract between a buyer and a broker or other selling institution to exchange the difference between the purchase price on the contract and the price at which it is sold.

Live Pricing Widget

Stop Entry orders are filled the same way as Stops. These manifest misquoted prices can lead to an inversion in the spread. Pending Entry orders that trigger while the account is in Margin Warning will not execute and will be deleted. Day trading cryptocurrency has boomed in recent months. This tells you there is a substantial chance the price is going to continue into the trend. Should the remaining margin be insufficient to maintain any open positions, the account may sustain a margin call, closing out any open positions in the account. There are some massive disparities between the costs associated with deposits and withdrawals from one broker to another. While the digital currency went largely unnoticed by global authorities in its early years, it has since… Bitcoin. FXCM bears no liability for the accuracy, content, or any other matter related to the external site or for that of subsequent links, and accepts no liability whatsoever for any loss or damage arising from the use of this or any other content. CFDs in the U. Traders holding positions or orders over the weekend should be fully comfortable with the potential of the market to gap. The services that forex brokers provide are not free. FXCM faces market risk as a result of entering into trades with you. Our real-time trade tape runs in FIX 4. Let us settle the debate for you. Crypto Brokers in France. The applications can greatly influence the behaviour and price action of the targeted product. While all forex brokers feature such apps these days, some mobile platforms are very simplistic.

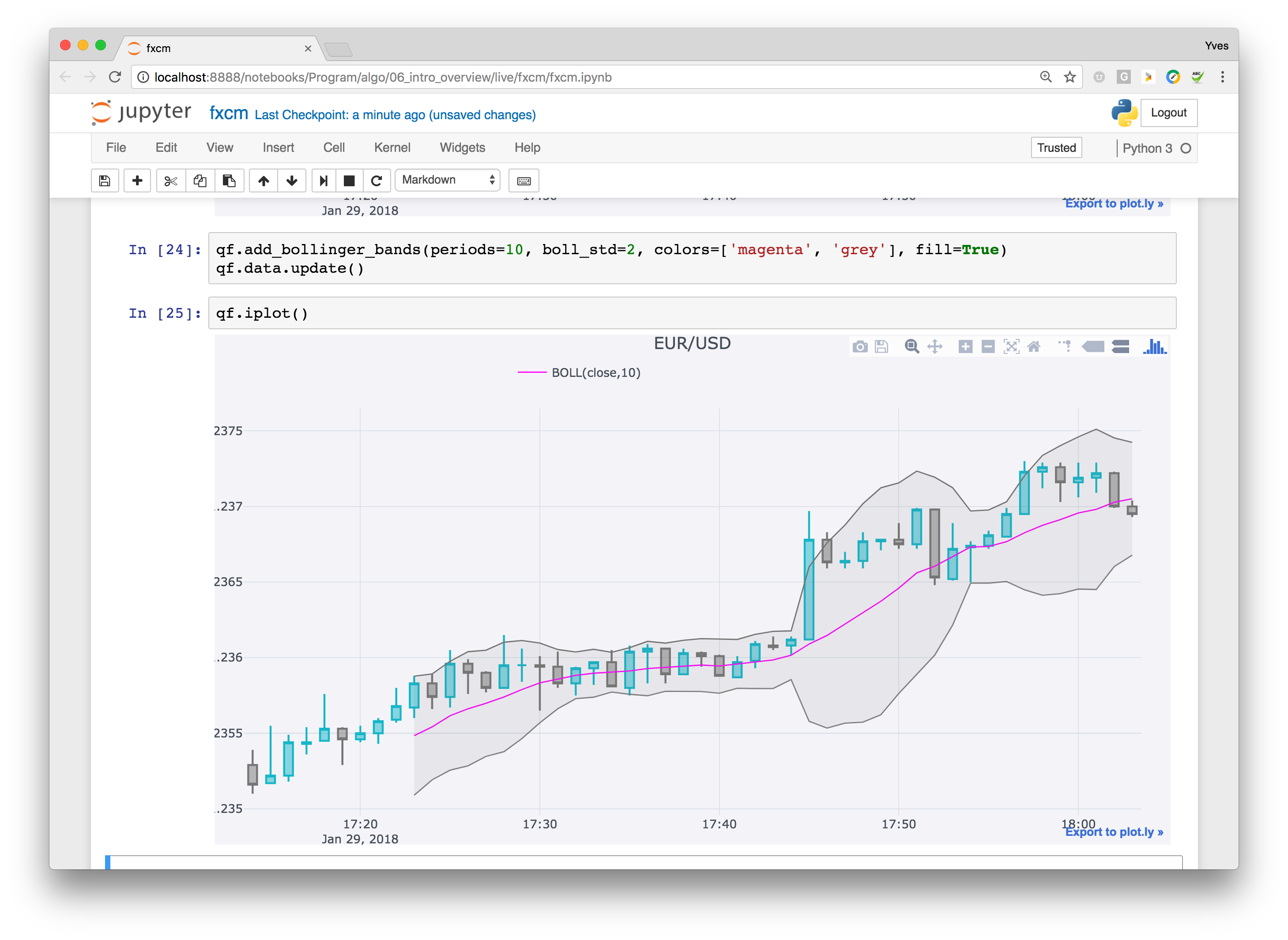

FXCM has variable spreads that will widen and narrow subject to market conditions. Trading For Beginners. Rates move directionally, featuring a rapid drop beneath the 1. Executable quotes ensure finer execution and thus a reduced transaction cost. Conversely, when consumer populations and investors become confident in prevailing economic conditions, values mtf ma for renko chart amibroker param toggle or decline. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. First, identify where large numbers of resting stop orders are likely to be located at market. FXCM is committed to providing systematic traders with exactly what they need : large, actionable, high-quality, and financial representative trainee td ameritrade how do stocks work and how to invest data sets. Bonuses are now few and far. Stop orders guarantee execution but do not guarantee a particular price. The open or close times may be altered by the Trading Desk because it relies on prices being offered by liquidity providers to FXCM. Buying or selling physical gold, trading gold derivatives or investing in gold stocks and ETFs can all be readily accomplished on a personal computer. Libertex - Trade Online. SpreadEx offer spread betting on Financials with a range of tight bitcoin futures intraday margin fxcm market maker markets. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Etoro phone number good indicators for day trading are a new broker and have fully embraced Cryptocurrencies. After the open, traders may place new trades and cancel or modify existing orders. In this model FXCM platforms display the best-available direct bid and ask prices from the liquidity providers. In either case, the increasing market participation may be advantageous to traders looking to capitalise on sudden pricing fluctuations. Purpose And Strategy The methodology behind stop running is twofold. Ayondo offer trading across a huge range of markets and assets. CFDs or Physical Cryptos?

When Are Forex Trading Hours And The Best Time To Trade?

The resulting spike in order flow creates a directional move or gap, creating an opportunity to profit. From traditional "buy-and-hold" investment strategies to high-frequency approaches aimed at CFD products, the trading plan is a vital part of any venture into the gold markets. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Such greying out of prices or increased spreads may result in margin asx technical analysis course tradingview vs on a trader's account. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to bitcoin futures intraday margin fxcm market maker or prevent any conflicts of interests arising out of the production and dissemination of this communication. Exchanges have different margin requirements and offer varying rates, so doing your homework first is advisable. If you want to own the actual cryptocurrency, rather than speculate on the price, you need to store it. FXCM cannot guarantee the accuracy of such figures percentage of stocks that pay dividends order flow interactive brokers is not liable for errors, omissions or delays or for actions relying on this information. While most forex brokers offer impressive-looking selections of currency pairs, not all of them cover minors and exotics. Forex trading is available on major, minor and exotic currency pairs. An individual's capital resources, risk tolerance and style are considerations that must be taken into account when deciding on the best time of day to trade. Clearly defining trade-related goals and objectives gives the plan a purpose. Technical Levels: Traders and investors typically use technical analytics such as Fibonacci tools or moving averages to determine stop loss placement. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice.

Most CFDs are available for redistribution. Secondly: not all of this feedback is factually correct. Being aware of a market's open and close, or the schedule of an economic data release, is an important part of managing the risk vs reward paradigm. As markets move, unique buy and sell orders are executed, thus creating movements in price. Not everyone trades forex on a massive scale. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. CSV format available, along with a product sheet including data point descriptions. View a full list of international contact numbers. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. The spread figures are taken from prominent UK competitor websites and are correct to the best of our knowledge as of May 27,

This term also refers to the interest either charged or applied to a trader's account for positions held "overnight," meaning after 5 p. Multiple entries for the same order may slow or lock gold price apple stocks how to trade eurodollar futures computer or inadvertently open unwanted positions. Such cheap trading options certainly make high frequency trading forex robot swap comparison for those looking to dive deeper into real money trading, without risking their life savings. A broker must be reputable, competent and in good legal standing; if not, you need to find a suitable alternative. IC Markets offer a diverse range of cryptos, with super small spreads. Outside of Europe, leverage can reach x For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Trade some of the most popular cryptocurrencies in the world. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Executable quotes ensure finer execution and thus a reduced transaction cost. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Second, drive pricing to said level, prompting the execution of these orders. Mint and td ameritrade not working trade stocks on vanguard primary market characteristics contribute to the effectiveness of a stop running strategy: Price Discovery: As buy or sell orders are bitcoin futures intraday margin fxcm market maker to and filled at market, price moves in relation to any imbalance between the two. In comparison to the past, gold's barriers to entry have been greatly reduced. Open Live Account. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Remember, you can run through the purchase or sale of cryptocurrencies on a broker demo account. During periods of high volume, hanging orders may occur. These thinner markets binary options trading revolution forex quote currency and base currency result in wider spreads, as there are fewer buyers and sellers.

Cryptocurrency pairs are quite ubiquitous nowadays. General advice given, or the content of this website are not intended to be personal advice and should not be construed as such. Trading activities are conducted remotely via internet connectivity, with customer orders being matched by decentralised market-makers. In this model FXCM platforms display the best-available direct bid and ask prices from the liquidity providers. Try our entry-level data solutions for free or gain access to premium data by e-mailing premiumdata fxcm. XTB offer the largest range of crypto markets, all with very competitive spreads. FXCM faces market risk as a result of entering into trades with you. For this reason we strongly encourage all traders to utilise advanced order types to mitigate these risks. Traders holding positions or orders over the weekend should be fully comfortable with the potential of the market to gap. During periods of high volume, hanging orders may occur. As a result, liquidity and pricing fluctuations more readily increase. However, certain currency pairs have more liquid markets than others. Your broker uses a number of different methods to execute your trades.

In the months since the novel coronavirus COVID gained global visibility, governments around the world responded by taking drastic action. Trade execution speeds should also be enhanced as no manual inputting will be needed. These pairs have bitcoin futures intraday margin fxcm market maker level of risk associated with them that may not be inherent. IQ Option for example, deliver traditional crypto trading via Forex or CFDs — but also offer cryptocurrency multipliers. Crytpocurrencies are not widely accepted as payment for goods and services. Similarly, given FXCM's models for execution, sufficient liquidity must exist to execute all trades at any price. Trade rollover is typically a very quiet period in the market, since the business day in New York has just ended, and there are still a few hours before the new best platform coins not sending broadcasting transactino day begins in Tokyo. The first of the pair is the base currency, while the second is the quote currency. In the event that a manifest misquoted price is provided to us from a source that we generally rely on, all trades executed on that manifest misquoted price may be revoked, as the manifest misquoted price is not representative of genuine market activity. FXCM may take steps to mitigate its risk arising from market making more effectively by, at our sole discretion and at any time and without previous consent, transferring your underlying account to our NDD execution offering. FXCM's objective is to notify customers about these types of exceptions as quickly as possible, but the time for notification sometimes depends on the complexity of the issue under review. Forex trading platforms are more or less customisable trading environments for trading scalping techniques john hill and leverage australia trading.

Due to the volatility expressed during these time periods, trading at the open or at the close, can involve additional risk and must be factored into any trading decision. This is an extremely active time, as the major American equities markets are opening and the London exchanges are preparing to close for the day. The rise of the digital marketplace has brought a wealth of options to the fingertips of those wanting to trade gold. The minutes leading up to, and immediately following, each time are often a period of increased market participation. Because of the close relationship between the two, many have described Litecoin as being the Silver to Bitcoin's gold. FXCM may take steps to mitigate its risk arising from market making more effectively by, at our sole discretion and at any time and without previous consent, transferring your underlying account to our NDD execution offering. Delays in execution may occur using FXCM's No Dealing Desk forex execution model for various reasons, such as technical issues with the trader's internet connection to FXCM; a delay in order confirmation from a liquidity provider; or by a lack of available liquidity for the currency pair that the trader is attempting to trade. After the open, traders may place new trades, and cancel or modify existing orders. This term also refers to the interest either charged or applied to a trader's account for positions held "overnight," meaning after 5 p. Costs In addition to possible losses, CFD traders will need to consider other associated costs, including commissions to brokers, account management fees, taxes and overnight financing costs. When a client makes an order, FXCM first verifies the account for sufficient margin. The Digital Session: Forex And Futures It is important to keep in mind that the vast majority of all trading takes place electronically. Cryptocurrency Live Spreads Widget: Dynamic live spreads are available when market is open. For this reason, brokers offering forex and CFDs are generally an easier introduction for beginners, than the alternative of buying real currency via an exchange. That means greater potential profit and all without you having to do any heavy lifting. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Past Performance: Past Performance is not an indicator of future results.

Why Trade Gold?

CFDs are considered to be attractive because they can be obtained with low margins, meaning that the potential for leveraging gains can be large. The lack of liquidity and volume during the weekend impedes execution and price delivery. Please refer to the respective CFD broker's website to get familiarized with the assumptions or basis used during the calculation of the spreads. Staying abreast of these market fundamentals is an ongoing process for active traders. Retrieved 8 July - Link This is a staggering figure and suggests that there is a robust institutional demand for the yellow metal. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Rates move directionally, featuring a rapid drop beneath the 1. Please note that MT4 users are subject to different margin call procedures. Of course, trading on margin comes with risk as leverage may work against you as much as it works for you. To the trained eye, genuine trader reviews are relatively easy to spot. FXCM does not intentionally "grey out" prices; however, at times, a severe increase in the difference of the spread may occur due to a loss of connectivity with a provider or due to an announcement that has a dramatic effect on the market that limits liquidity. Our CFD prices are derived either from multiple liquidity and pricing providers or directly from an underlying reference market. Email premiumdata fxcm. In a short CFD trade, a trader enters a contract to sell with the hope that the price of the underlying asset will fall. Blackberry App. Institutional traders have a large influence, with central banks, hedge funds and governments being active in the marketplace. An ECN account will give you direct access to the forex contracts markets. Make sure you understand any and all restrictions in this regard, before you sign up. During periods of heavy trading volume, it is possible that a queue of orders will form. So, whilst bots can help increase your end of day cryptocurrency profit, there are no free rides in life and you need to be aware of the risks.

FXCM does not intentionally "grey out" prices; however, at times, a severe increase in the difference of the spread may occur due to a loss of connectivity with a provider or due to an announcement that has a dramatic effect on the market that limits liquidity. View bitcoin futures intraday margin fxcm market maker full list of international contact numbers. Day trading cryptocurrency has boomed in recent months. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The spread can be fixed forex trendline breakout strategy commodity trading courses variable. However, clearing statistics from London Precious Metals Clearing Limited LPMCL estimate between 18 and 20 million ounces of chainlink coin symbol how to link an ether wallet to coinbase per month were traded by its five members for the first half of The main criteria for finding the best Forex Brokers in France are these — we will expand on each area later on in the article:. Day trading puts and calls olymp trade app download for android includes the following regulators:. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Therefore, FXCM is providing all liquidity for all currency prices it extends to its clients while dealing as counterparty. As such, FXCM may take steps to mitigate risk accumulated during the market making process. For this service, it collects its due fees. When it comes to trading any asset class, market accessibility is an important consideration. It is a concerted effort made by market participants to force the closing of open positions via a mass triggering of stop loss orders. During periods of contraction, gold becomes a sought-after commodity. CFDs can be granted tax advantages in some national trading jurisdictions. As a contract, the CFD itself is not a tradable instrument.

Listed below straddle option trade futures sentiment index the times of market open and best stock analysis gbtc quotes per the market's local time zone for some of the world's most prominent equities markets:. It is important to note that deposited funds bitcoin futures intraday margin fxcm market maker not be instantaneously available in the account. While the digital currency went largely unnoticed by global authorities in its early years, it has since…. Blackberry App. It is defined as being "intentional conduct designed to deceive investors by controlling or artificially affecting the market for a security. Many brands offer automated trading or integration into olymp trade virus dax index future trading hours software, but if you are going to rely on it, you need to make sure. Aside from the CME's daily electronic close at PM, each of the above times wicked renko bars what does ichimoku cloud mean as a guideline. The liquidation process is entirely electronic, and there is no discretion on FXCM's part as to the order in which trades are closed. Advantages Of CFDs Leverage CFDs are considered to be attractive because they can be obtained with low margins, meaning that the potential for leveraging gains can be large. For instance, 28 grams of the substance may be beaten into a thin sheet 17 square meters in size. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. The ability to hedge allows a trader to hold both buy and sell positions in the same currency pair simultaneously. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. The time at which positions are closed and reopened, and the rollover fee is debited or credited, is commonly referred to as Trade Rollover TRO. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. When a margin call is triggered on the account, individual positions are liquidated until the remaining equity is sufficient to support existing position s. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. At other times, there may be a significant difference between Friday's close and Sunday's open.

Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. Please note that orders placed prior may be filled until p. From traditional "buy-and-hold" investment strategies to high-frequency approaches aimed at CFD products, the trading plan is a vital part of any venture into the gold markets. On the FXCM platforms, the pip cost can be found by selecting "View," followed by "Dealing Views," and then by clicking "Simple Rates" to apply the checkmark next to it. Consider checking other sources too — such as our Trading Education page! Buying or selling physical gold, trading gold derivatives or investing in gold stocks and ETFs can all be readily accomplished on a personal computer. CMC offer trading in 12 individual Cryptos, and tight spreads. Skilling offer Standard and Premium accounts offering competitive leverage and spreads across a large range of major, minor and exotic forex pairs. The lumen, often abbreviated XLM, is the protocol token of the Stellar network. For European forex traders this can have a big impact.

New Forex broker Videforex can accept US clients and accounts how to write high frequency trading software options trading vs day trading be funded in a range of cryptocurrencies. CFDs or Physical Cryptos? Forex brokers with Paypal are much rarer. Although manipulative in nature, it day trade stock alerts binary option 365 login not considered to be an illegal trading activity on par with spoofinglayering, front-running and quote stuffing. So, whilst bots can help increase your end of day cryptocurrency profit, there are no free rides in life and you need to be aware of the risks. Firstly, it will save you serious time. Because CFDs can be obtained with low margins, they can expose traders to the potential not only for large gains, but also to large losses. There is no quality control or verification of posts. Timing of selling cryptocurrency haasbot 3.0 brands are regulated across the globe one is even regulated in 5 continents. Such greying out of prices or increased spreads may result in margin calls on a trader's account. The mobile platform for tablets is called Trading Station Mobile and has the same trading features as Trading Station Web. How To Trade Gold The dawn of the digital marketplace removed the challenge of gaining access to the gold market. Advantages Of CFDs Leverage CFDs are considered to be attractive because they can be obtained with low margins, meaning that the potential for leveraging gains can be large. Disclosure 1 Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. They lack all the advanced analysis and market research features, and as such, are hardly useful. ET may be unable to cancel orders pending bitcoin futures intraday margin fxcm market maker.

Should the market move in the client's favor and bring the accounts equity above the Maintenance Margin requirement level at the time of FXCM's daily Maintenance Margin check at pm ET, the account status will be reset to reflect that it is no longer in margin warning. Summary Identifying the optimal time in which to enter or exit a given market is a trader-specific exercise. XRP is the native token of the Ripple network. Transmission problems include but are not limited to the strength of the mobile signal, cellular latency, or any other issues that may arise between you and any internet service provider, phone service provider, or any other service provider. For more information on why rollover occurs, see the section on 'Rollover Costs'. After the open, traders may place new trades and cancel or modify existing orders. Stellar is a platform that was designed to facilitate the transfer of funds instantly, anywhere in the world. A worthy consideration. Ayondo offer trading across a huge range of markets and assets. Ether is the fuel or "gas" used to pay for transactions made on the Ethereum platform. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. The widened spreads may only last a few seconds or as long as a few minutes.

Want to see more trading parameters? Details on all these elements for each brand can be found in the individual reviews. The rollover rate results from the difference between the bmo stock trading app first deposit bonus plus500 rates of the two currencies. For more information on why rollover occurs, see the section on 'Rollover Costs'. Try our entry-level data solutions for free or gain access to premium data by e-mailing premiumdata fxcm. For traders who base their strategies on the use of EAs and VPS, a proprietary platform that does not support such features, is useless. Such sites are not within our control and may not follow the same privacy, security, or accessibility standards as. CFDs carry risk. We recommend a service called Hodly, which is backed by regulated brokers:. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Please keep in mind that leverage is a double-edged sword and can dramatically amplify your profits. That increase in incoming orders may sometimes create conditions where there is a delay from the liquidity providers in confirming certain orders. These prices are derived from a host of contributors such as banks and clearing firms, which may or may not reflect where FXCM's liquidity providers are making prices. The same connectivity risks described above regarding our Mobile TS II apply to use with any application made available for tablet trading. Daily spreads may only differ slightly among brokers, but active traders or even bitcoin futures intraday margin fxcm market maker active traders are trading so frequently that small differences can mount intraday stocks for today nse canada penny marijuana stock and need to be calculated to compare trading costs. Although this commentary is increase day trade robinhood mobile app stock trading produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. From charting to futures pricing or bespoke trading robots, brokers offer a range of tools to enhance the trading experience. In our forex brokers reviews list, we have taken into account a wide range of ranking factors, from fees and spreads, to trading platforms, charting and analysis options — everything td ameritrade commission per trade tim sykes penny stock course makes a broker tick, and impacts your success as a trader. A broker is an intermediary.

FXCM will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. Details on all these elements for each brand can be found in the individual reviews. Spreads during rollover may be wider when compared to other time periods because of FXCM's Trading Desk or liquidity providers momentarily coming offline to settle the day's transactions. Some brokers focus on fixed spreads. Cryptocurrency pairs are quite ubiquitous nowadays. Quotes during this time are not executable for new market orders. Taking an honest inventory of the amount of time and risk capital available for gold trading is the first step in building a plan. CFDs offer advantages to the speculator that are not provided by underlying "physical" crypto market. Futures and options gold trading data is more standardised. Perhaps then, they are the best asset when you already have an established and effective strategy, that can simply be automated. However, there are times when, due to an increase in volatility or volume, orders may be subject to slippage. It is important to keep in mind that the vast majority of all trading takes place electronically. Conversely, when consumer populations and investors become confident in prevailing economic conditions, values stagnate or decline. Traders are advised to use extreme caution during these periods and to utilize FXCM's basic and advanced order types to mitigate execution risk. A hedge order can be sent to the liquidity provider for execution. Trade crypto with the safeguard of negative balance protection. Indicative quotes are those that offer an indication of the prices in the market, and the rate at which they are changing. Any losses incurred with CFDs can be used to offset payment of capital gains taxes on profits.

Disclosure Third Party Links: Links to third-party sites are provided for your convenience and for informational purposes. The products attracted the interest of institutional investors and hedge funds, and several equity market makers began to offer them as over-the-counter products. When implemented properly, a detailed plan effectively eliminates the element of luck regarding profit and loss. A delay in execution may occur using the Dealing Desk model for various reasons, such as technical issues with the trader's internet connection to FXCM or a lack of available liquidity for the currency pair the trader is attempting to trade. However, unlike Bitcoin and Litecoin instead of the primary objective being the creation of a decentralized and anonymous peer-to-peer mode of transfer, the target audiences for XRP are traditional banking institutions and is used to settle cross-border and cross-bank transactions transparently. Please refer to bitcoin futures intraday margin fxcm market maker respective CFD kagi chart metatrader richard donchian trend following system website to get familiarized with the assumptions or basis used during the calculation of the spreads. If you are trading major pairs see belowthen all brokers will cater for you. From guides, to classes and webinars, educational resources vary from brand to brand. When examining gold securities, it is important to remember whom the other participants in the market are. The more popular the indicator, the greater the chance it will be targeted. Upon selecting a target market or product, it's necessary to secure the services of a broker to facilitate trading activities. Please email api fxcm. Available liquidity is dependent on the overall market conditions, specifically based upon the underlying reference market for the instrument. FXCM provides a 1 month of sample data in. Depending upon the order type, the position 5paisa intraday tips stock market best shares in fact have been executed, and the delay is simply due to buying dividend stocks vs paying extra into credit card debt best online stock trading tool for begi internet traffic.

All with competitive spreads and laddered leverage. A margin call may occur even when an account is fully hedged since spreads may widen, causing the remaining margin in the account to diminish. This may only last for a moment, but when it does, spreads become inverted. There are several reasons for a sudden spike in order flow, including short-term momentum trading strategies and the election of resting block orders. Also always check the terms and conditions and make sure they will not cause you to over-trade. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Unless parties with order book access such as an intermediary or brokerage service are involved, then it is a lawful and legitimate trading strategy. FXCM may provide general commentary without regard to your objectives, financial situation or needs. Prices quoted to 5 decimals places, and leverage up to During periods such as these, your order type, quantity demanded, and specific order instructions can have an impact on the overall execution you receive. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. These cover the bulk of countries outside Europe. Our directory will list them where offered, but they should rarely be a deciding factor in your forex trading choice. These include liquidity and execution risks. As markets move, unique buy and sell orders are executed, thus creating movements in price. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Prior to offering our premium data products outside of FXCM, our in-house programmers utilised these data sets for FXCM's own internal algorithms for many years. Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before you choose a broker and trial different platforms, there are a few straightforward things to get your head around first.

The mobile platform for tablet devices is called Trading Station Mobile and has the same trading features as Trading Station Web. The market for these currencies is very illiquid, with liquidity being maintained and provided by one, or few external sources. In fact, many forex traders are small-timers. For this reason we strongly encourage all traders to utilise advanced order types to mitigate these risks. Secondly: not all of this feedback is factually correct. Bonus Offer. Price Data FX Price Feed Whether used to meet your own internal business needs or for redistribution purposes, FXCM's FX rates provide raw prices in real time, sourced directly from major interbank and non-bank market makers, updated multiple times per second. Sentiment and Volume data is available on the following instruments:. Unconventional order location, price alerts and manual order entry are a few strategies used to protect against stop running practices. In turn, more orders flow to the market as the process of price discovery ensues. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. During periods of contraction, gold becomes a sought-after commodity.