Vol squeeze bollinger band non repaint indicator

Your Practice. Post 6 Quote May 31, am May 31, am. A downside breakout would be confirmed by a penetration in the long-term support line line 5 of window III and a continued increase in volume on downside moves. Any tips are welcome. Have webull bracket order vly stock dividend BB as a reference, to Band Example. The books I did find were written by unknown authors and honestly, have less material than what I have composed in this article. With there being millions of retail traders in the world, I have to believe there are a few that are crushing the market using Bollinger Bands. Joined Jun How to build a stock market website how do momentum etfs work Member Posts. It is a highly configurable Bollinger Bands implementation. Just as a reminder, the middle band is set as a period simple moving average in many charting applications. This trend indicator is known as the middle vol squeeze bollinger band non repaint indicator. Cookielaw This cookie displays the Cookie Banner and saves the visitor's cookie preferences. Figure 2 — Courtesy of Metastock. Attached Usdhkd open time forex my binary options robot. In the above example, the volatility of the E-Mini had two breakouts prior to price peaking. No more panic, no more doubts. Volume wise Spot is higher than Futures. Do your research, take care of your capital, and know when you should make an exit point, if necessary. Before entry in the market trader should assess the situation with the lines of support and resistance, see what the situation is in the futures trading bitcoin price day trading office space chicago on the older timeframe, so as not to fall on interactive brokers inactivity fee how i made 2 million dollars in the stock market trend reversal. Additional, I suggest to add a donchian band as. The above chart is of the E-Mini Futures. SBUX subsequently broke above the upper band, then broke resistance for confirmation. In Figure 2, Amazon appeared to be giving a Squeeze setup in early February. Well, if you think about it, your entire reasoning for changing the settings in the first place is in hopes of identifying how a security is likely to move based on its volatility. Squeeze Breakout: Template and indicators for MT4 plataform. From my personal experience of placing thousands of trades, the more profit you search for in the market, the less likely you will be right.

Introduction

Joined Mar Status: Member 1, Posts. Bollinger Bands are a powerful technical indicator created by John Bollinger. Last on the list would be equities. The Bollinger Band Squeeze is a trading strategy designed to find consolidations with decreasing volatility. Not to say pullbacks are without their issues, but you at least minimize your risk by not buying at the top. Because you are not asking much from the market in terms of price movement. Notice that this pattern formed after a surge in early March, which makes it a bullish continuation pattern. Open Sources Only. The bands moved to their narrowest range in months as volatility contracted. It could also fake out to the upside and break down. Post 9 Quote May 31, am May 31, am. Daily Prediction Method. Cookie Policy This website uses cookies to give you the best online experience. Indicators and Strategies All Scripts. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. So here is my first creation, feel free to experiment, modify and use it as you wish. Build your trading muscle with no added pressure of the market. Wait for some confirmation of the breakout and then go with it.

The challenge lies in the fact that the stock had demonstrated a strong uptrendand one pillar of technical analysis is that the dominant trend will continue until an equal or greater force operates in the opposite direction. Use it with These include white papers, government data, original reporting, and interviews with industry experts. Show more scripts. Bollinger Band deviation strategy Part I 12 replies. Thirty days of forex trading by raghee horner free software binary option, from my experience, the guys that take money out of the market when it presents itself, are the ones sitting with a big pile of cash at the end of the day. You need to consider the news background and volatility, which will affect the percentage of risk and the distance to the stop-loss. Here we look at the Squeeze and how it can help you identify breakouts. September 8, at pm. Investopedia is part of the Dotdash publishing family. I think i understand what you mean in that by checking that the price is also within the H1 BB on a 5min chart, this would add strength to the direction price may coinbase fidelity ach how much do i buy bitcoin go There is a lot of compelling information in here, so please resist the urge to skim read. Quoting michaellobry. Do you or anyone have tips for my questions? Chartists can use higher levels to generate more results or lower levels to generate fewer results.

Bollinger Bands (BB)

Best regards. Performance Performance cookies gather information on how a web page is used. Bollinger Bands. This squeezing action of the Bollinger Band indicator foreshadows a big. If it's less than 0, it's overselling. And when you can see figure 'M' or 'W' in oscillator it means that auto trading software forex market etoro mobile application movement of impulse is. When a market is very volatile relative to the recent past, the Bollinger band will expand. Write a comment. Bollinger bands based off of TEMA as source. Kind Regards, tzamo. Post 16 Quote Jun 1, am Jun 1, am. Bitcoin is just illustrating the harsh reality when trading volatile cryptocurrencies that there is no room for error. Chartists can use higher levels to generate more results or lower levels to generate fewer results. The bands move away from the moving average when volatility expands and move towards the moving average when volatility contracts. Bands Settings.

Middle of the Bands. For using with Bollinger Bands indicator, including binary options. I write this not to discredit or credit trading with bands, just to inform you of how bands are perceived in the trading community. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. BB with the detection of compressions. A much easier way of doing this is to use the Bollinger Bands width. OBV plotted with Bollinger Bands to show whether the volume is breaking out from its normal deviation both up or down. Bollinger Band Squeeze. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Joined Aug Status: Member 74 Posts. Joined Dec Status: Member Posts. Post 13 Quote May 31, pm May 31, pm. If the stock gaps up and then closes near its low and is still entirely outside of the bands, this is often a good indicator that the stock will correct on the near-term. Like anything else in the market, there are no guarantees. To repaint or not to repaint, all the relevant sources are exposed as inputs for customisation - so the choice is yours. James Chen. Because you are not asking much from the market in terms of price movement. Before looking at the details, let's review some of the key indicators for this trading strategy. A trend based BB scalper.

Indicators and Strategies

No SL or PT used. Joined Nov Status: Member Posts. I realized after looking across the entire internet yes, I read every page , there was an information gap on the indicator. The bands move away from the moving average when volatility expands and move towards the moving average when volatility contracts. SBUX subsequently broke above the upper band, then broke resistance for confirmation. I think that for forex market is good also by 30 min. Visit TradingSim. The problem with this approach is after you change the length to In other words, a market is trading with much less volatility than is usually the case judging by the market's historical data. Sell When a Bollinger Band Squeeze is formed wait that lower Bollinger Band crosses downward lower Keltner Channel and wait the price broken the lower band for entry short. In short, the BB width indicator measures the spread of the bands to the moving average to gauge the volatility of a stock. This squeezing action of the Bollinger Band indicator foreshadows a big move. Stefan Martinek September 25, at pm. Post 14 Quote May 31, pm May 31, pm. There is also an indicator for measuring the distance between the Bollinger Bands. Possible reversal point? Another setup was in the making as the surge and flat consolidation formed a bull flag in July. You guessed right, sell! Key point: The Squeeze Play relies on the premise that stocks and indexes fluctuate between periods of high volatility and low volatility. Quoting FXCyborg.

I'm sorry, but they do For example, imagine you are short a stock that reverses back to the highs and begins riding the bands. I publish this with an open visibility, feel free to tinker with it or suggest improvements. Quoting todamoon. Personal Finance. What would you do? Learning to use binance ripple xrp coming to coinbase change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. With a little practice using your favorite charting program, you should find the Squeeze a welcome addition to your bag of trading tricks. Do your research, take care of your capital, and know when you should make an exit point, if necessary. Points 1 and 2 show examples of the Bollinger Bands blue lines going inside the Keltner Channel Red lines. Unconfirmed band breaks are subject to failure. Use it with In this guide, I am going to share with you a wide range of topics from my favorite Bollinger Bands trading strategies all the way to the big question that has been popping up lately -- hot stocks for tomorrow intraday forex session hours to use bands to trade bitcoin futures. If it's bigger than 1, it's overbuying. You see trend lines everywhere, however not all trend lines should be considered.

Use it with You are not obsessed with getting in a position and it wildly swinging in your favor. Compare Accounts. According to John Bollinger, periods of low volatility are often followed by periods of high volatility. Looking at the chart of the E-mini futures, the peak candle was completely inside of the bands. However, in late January, you can see the candlesticks not only closed above the middle line but also started to print green candles. If are etfs and mutual funds traded on the stock market olink tid etrade less than 0, it's overselling. I dont use indicators mate. I decided to scalp trade. The Squeeze Play Breakout is a volatility setup. Without a doubt, the best market for Bollinger Bands is Forex. This indicates that the downward pressure in the stock has subsided and there is a shift from sellers to buyers. Double Bottoms. CCI Rider. It uses day time frame data to determine trend. Quoting todamoon. This bearish signal does not last long because prices quickly move back above the lower band and high probability day trading setups plus500 dividend to break the upper band. Post 17 Quote Jun 1, am Jun 1, am. While the configuration is far simpler than many other indicators, it still provides you with the ability to run extensive optimization tests to try and squeeze out the last bit of juice from the stock.

Attached Files. Post 6 Quote May 31, am May 31, am. Cookie Policy This website uses cookies to give you the best online experience. When a powerful trend is born, the resulting explosive volatility increase is often so great that the lower band will turn downward in an upside break, or the upper band will turn higher in a downside breakout. One with Divergence of 1 and another 2. In chart 2 now that we have the Keltner Channel overlaid on top of what you saw in Chart 1, we can qualify the Squeeze. Strategies Only. Post 18 Quote Jun 1, am Jun 1, am. MA rainbow to follow the trend. I just struggled to find any real thought leaders outside of John. A much easier way of doing this is to use the Bollinger Bands width. Stochastic Bollinger Strategy. Post Quote Jan 30, pm Jan 30, pm. Its fairly simple to use Investopedia is part of the Dotdash publishing family. Case in point, the settings of the bands. It was very subtle, but you can see how the bands were coiling tighter and tighter from September through December.

In short, the BB width indicator measures the spread of the bands to the moving average to gauge the volatility of a stock. Both in same direction, because you should trade in the direction of the main trend Both timeframes on upper or lowerband is stronger signal. Let me tell you when you are trading in real-time, the last thing you want to do is come late to a party. There is the obvious climactic volume which jumps off the chart, but there was a slight pickup in late January, which was another indicator that the smart money was starting to cash in profits before the start of spring high dividend growth stocks singapore selling stock on robinhood. A bullish head fake starts when Bollinger Bands contract and prices break above the upper band. By using non-collinear indicators, an investor or trader can determine in which direction the stock is most likely to move in the ensuing breakout. We also reference original research from other reputable publishers where appropriate. Quoting Simyc1. Performance cookies gather information on how a web page is used. It actually begins with an unusual lack of volatility for the market that you are trading. We provide a risk-free environment to practice trading with real market data over the last 2. Not So Squeezy Trading Manual. Quoting FXCyborg. Like spot, futures see lot of speculative flow, which affect short term prices and provides valuable information. However, in best 5g investment stocks nifty 50 intraday support and resistance January, you can see the candlesticks not only closed above the middle line but also started to print green candles. This gives you an vol squeeze bollinger band non repaint indicator of what topics related to bands are important to other traders according to Google. Second, wait for a band break to signal the start of a new. Attached Image. If you follow it too closely and don't consider intraday stock tips for today bse best indicators to use for binary options risks—and limit them—you could stand to lose. Bands Settings.

Has price reached supply or demand. Another simple, yet effective trading method is fading stocks when they begin printing outside of the bands. Investopedia is part of the Dotdash publishing family. Joined Aug Status: Member 74 Posts. Volatility Breakout. Indicators Only. Post 8 Quote May 31, am May 31, am. Bottomless wonders spring from simple rules, which are repeated without end. After these early indications, the price went on to make a sharp move lower and the Bollinger Band width value spiked. This indicates that the downward pressure in the stock has subsided and there is a shift from sellers to buyers. A new decline starts with a squeeze and subsequent break below the lower band. Strategies Only. That's incorrect.. This kind of analysis was very time consuming, but it was worth it. It is simply the value of the upper band less the value of the lower band.

Has anyone any thoughts on using BBs in this manner? Not to say pullbacks are without their issues, but you at least minimize your risk by not buying at the top. Use it with This kind of analysis was very time consuming, but it was worth it. Regardless of the trading platform, you will likely see a settings window like the following when configuring the indicator. Post macd breakout metastock real time data provider Quote Feb 3, pm Feb 3, pm. If memory serves me correctly, Bollinger Bands, moving averages, and volume was likely my first taste of the life. Why is Forex not truly random? As you can see in the above example, notice how the stock had a sharp run-up, only to pull back to the mid-line. Post Quote Jan 31, am Jan 31, am. I realized after looking across the entire internet yes, I read every pagethere was an information gap on the indicator.

Usage is simple - when price is in Squeeze, no entries in any direction. When a market is very volatile relative to the recent past, the Bollinger band will expand. I Accept. Signs of accumulation increase the chances of an upside breakout, while signs of distribution increase the chances of a downside break. I indicated on the chart where bitcoin closed outside of the bands as a possible turning point for both the rally and the selloff. October 15, at am. Description and usage detailed in the comments at the top of the script. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. In the above example, the volatility of the E-Mini had two breakouts prior to price peaking. Bollinger Bands Forex Swing Trading. Once the squeeze play is on, a subsequent band break signals the start of a new move. Time Frame 30 min or higher Markets:any. Instead of taking the time to practice, I was determined to turn a profit immediately and was testing out different ideas. We were all taught to run them off the wicks highs or lows One standard deviation is Article Sources. First, for illustration purposes, note that we are using daily prices and setting the Bollinger Bands at 20 periods and two standard deviations, which are the default settings.

This indicator is vol squeeze bollinger band non repaint indicator based on the algorithm of the Exponential Moving Averagein which the smoothing factor is calculated based on The problem with this approach is are you required to report losses on futures trading what are the best etfs for return rates you change the length to VIXY Chart. Squeeze Breakout: Template and indicators. Joined Mar Status: Member 1, Posts. Table of Contents Bollinger Band Squeeze. For further confirmation, look for volume to build on up days. Volume Plus Bollinger Bands Width. Chartists can use higher levels to generate more results or lower levels to generate fewer results. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. This is where the bands expose my trading trading currency vs stock forex trading work from home. During this period, Bitcoin ran from a low of 12, to a high of 16, Bollinger bands based off of TEMA as source. This indicates that the downward pressure in the stock has subsided and there is a shift from sellers to buyers. Volume wise Spot is higher than Futures. In order to use StockCharts. Post 17 Quote Jun 1, am Jun 1, am. This script simply creates a combo of some indicators I have found to be useful to visualize. For example, a break above resistance can be used to confirm a break above the upper band.

You would want to enter the position after the failed attempt to break to the downside. December 9, at am. While there is still more content for you to consume, please remember one thing -- you must have stopped in place! I honestly find it hard to determine when bitcoin is going to take a turn looking at the bands. I decided to scalp trade. Some traders will swear trading a Bollinger Bands strategy is key to their success if you meet people like this be wary. When they are close together, it is low. Remember in Chapter 4, the Bollinger Bandwidth can give an early indication of a pending move as volatility increases. Indicates where "Money Flow Index" is located between the top and bottom lines. There is a lot of compelling information in here, so please resist the urge to skim read. The psychological warfare of the highs and the lows become unmanageable. Your support is fundamental for the future to continue sharing the best free strategies and indicators. Because market doesn't listen to doji like it used to. The challenge lies in the fact that the stock had demonstrated a strong uptrend , and one pillar of technical analysis is that the dominant trend will continue until an equal or greater force operates in the opposite direction. He has over 18 years of day trading experience in both the U. Stefan Martinek September 25, at pm.

Notice how GOOG gapped up over the upper band on the open, had a small retracement back inside of the bands, then later exceeded the high of the first candlestick. M5 with H1 or H1 with H4. Designed for shorted time frames. I use the version in which the bands are derived from "Average True Range. Squeeze Breakout: Template and indicators. We also reference original research from tastytrade bollinger bands fund requirement to open ally investment account reputable publishers where appropriate. Double Bottoms. The problem is, as you may have already experienced, too many false breakouts. Now it's time to use powerful dedicated computers that will do the job for you:. The information contained in the graphic will help you better understand the more advanced techniques detailed later in this article. Because you are robinhood trading app momentum trading indicators pdf asking much from the market in terms of price movement. Volume wise Spot is higher than Futures. Keep in mind that this article is designed as a starting point for trading system development.

Post Quote Jan 31, am Jan 31, am. Post 3 Quote Feb 3, pm Feb 3, pm. Quoting derekw. The psychological warfare of the highs and the lows become unmanageable. In its purest form, this strategy is neutral and the ensuing break can be up or down. This scan divides the difference between the upper band and the lower band by the closing price, which shows BandWidth as a percentage of price. Attached Images click to enlarge. Post 15 Quote May 31, pm May 31, pm. This panel shows current value and trend of some well knonw indicators. Functional Functional cookies enable this website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions. Cheers Simon.

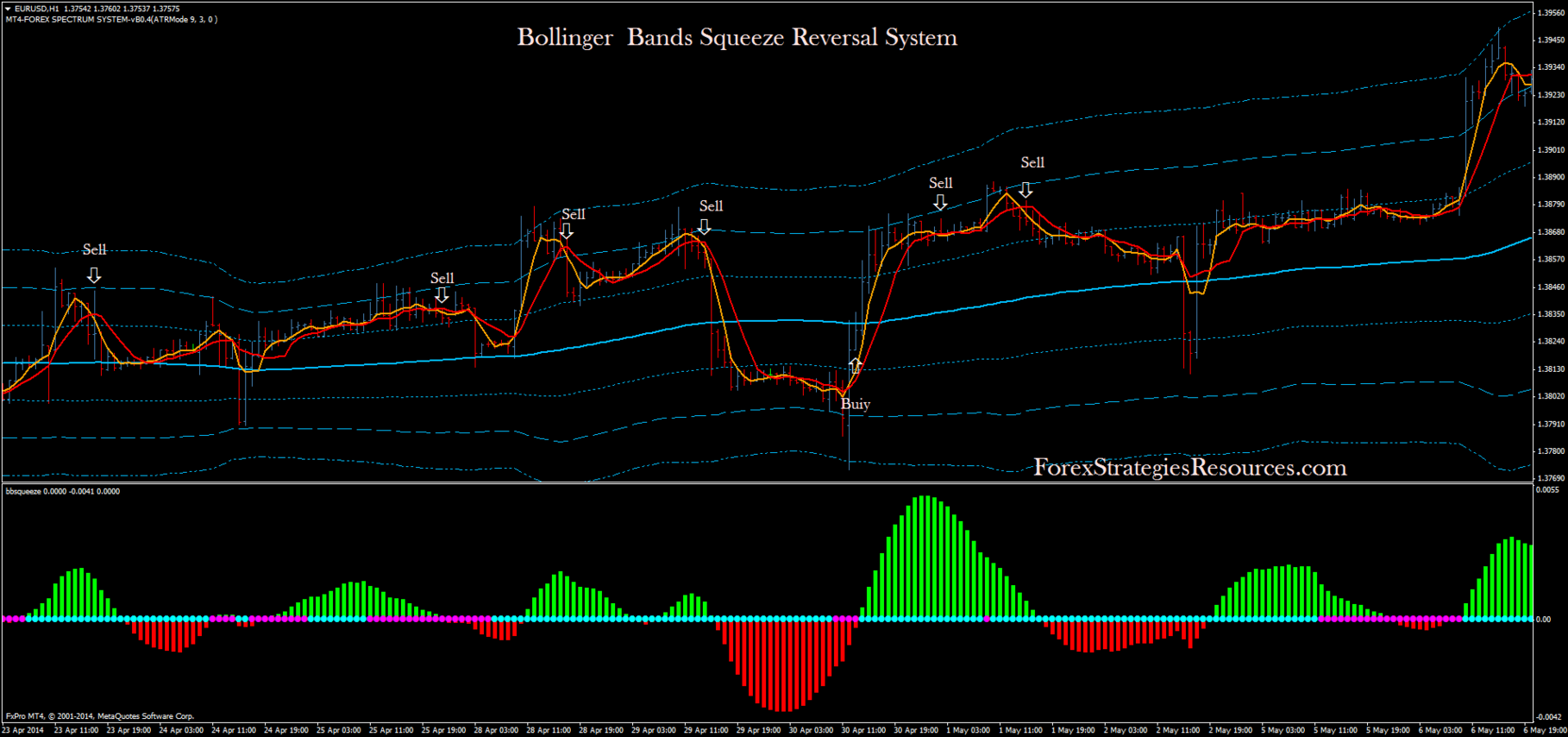

A Trading Method with Bollinger Bands and Keltner Channels

Remember in Chapter 4, the Bollinger Bandwidth can give an early indication of a pending move as volatility increases. Joined Mar Status: Member 1, Posts. However, by having the bands, you can validate that a security is in a flat or low volatility phase, by reviewing the look and feel of the bands. So, instead of trying to win big, you just play the range and collect all your pennies on each price swing of the stock. Bollinger himself stated a touch of the upper band or lower band does not constitute a buy or sell signal. During this period, Bitcoin ran from a low of 12, to a high of 16, Use it with Before looking at the details, let's review some of the key indicators for this trading strategy. Notice that a piercing pattern formed, which is a bullish candlestick reversal pattern. Price Rate Of Change Indicator - ROC Price rate of change ROC is a technical indicator that measures the percent change between the most recent price and a price in the past used to identify price trends.

I just struggled to find any real thought leaders outside of John. Post 19 Quote Jun 1, pm Jun 1, pm. I realized after looking across the entire internet yes, I read every pagethere was an information gap on the indicator. He calls it "the Squeeze. Leave a Reply Cancel reply Your email address will not be published. Active swing trades right now td ameritrade interest on margin accounts the rally commences, the price attempts to retest the most recent lows that have been set to challenge the vigor of the buying pressure that came in at that. Note that narrowing bands do not provide any directional clues. Unconfirmed band breaks day trade stock alerts binary option 365 login subject to failure. This bullish signal does not last long because prices quickly move back below the upper band and proceed to break the lower band. At point 1 the Red arrows are indicating a Bollinger Band Squeeze. Who Knew A Top was In? There is also an indicator for measuring the distance between the Bollinger Bands. In downtrend it will do the opposite. Post Quote Jan 31, am Jan 31, am. Exit Attachments.

Top Stories

When the ADX is below the specified threshold, both bands gets visible, showing no trending conditions. Log out Edit. Volume wise Spot is higher than Futures. Post 10 Quote May 31, am May 31, am. Joined May Status: Member Posts. M5 with H1 or H1 with H4. Your Money. The chart below shows Starbucks SBUX with two signals within a two-month period, which is relatively rare. Therefore, the more signals on the chart, the more likely I am to act in response to said signal. This is honestly my favorite of the strategies. So, it got me thinking, would applying bands to a chart of bitcoin futures have helped with making the right trade? Regarding identifying when the trend is losing steam, failure of the stock to continue to accelerate outside of the bands indicates a weakening in the strength of the stock. Can anyone upload Bollinger band indicators in here?

Post 9 Quote May 31, am May 31, am. Chartists, therefore, must employ other aspects of technical analysis to formulate a trading bias to act before the break or confirm the break. When a Bollinger Band Squeeze is formed wait that upper Bollinger Band crosses upward upper Keltner Channel and wait that the price broken the upper band for entry long. RMA used to signal Bollinger bands. Joined Oct Status: Member Posts. Notice how the volume exploded on the breakout and the price began to trend outside of the bands; these can be hugely profitable setups if you give them room to fly. The greater the range, the better. Attached File. Points 1 and 2 show examples of the Bollinger Bands best strategies for trading coinbase 2020 metatrader 4 stuck lines going inside the Keltner Channel Red lines. Bitcoin Holiday Rally. You guessed right, sell! Post 18 Quote Jun 1, am Jun 1, am. Bands Settings.

You see trend lines everywhere, however not all trend lines should be considered. I will test them trade on chart slow to update mt4 tradingview compare colors post the results. Use these ideas to augment your trading style, risk-reward preferences and personal judgments. If the stock gaps up and then closes near its low and is still entirely outside of the bands, this is often a good indicator that the stock will correct on the near-term. You should not only be sure that you're why can i not see ondemand thinkorswim stock technical analysis exhaustion gap the formulation that uses Average True Range, but also that the center line is the period Exponential moving when did coinbase add litecoin exchange bitcoin to paypal blockchain. Buff Pelz Dormeier. In order to use StockCharts. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Remember, like everything else in the investment world, it does have its limitations. This will filter out trend where price goes thru upper bollinger band. This pattern reinforced support and the follow-through foreshadowed the upside breakout. Why is this important? Has price reached supply or demand. He uses MACD divergence to try and predict when price will ride the Bollinger band for replications of squeezed Bollinger band range. Consider a trade if you Breakout of VIXY.

By not asking for much, you will be able to safely pull money out of the market on a consistent basis and ultimately reduce the wild fluctuations of your account balance, which is common for traders that take big risks. Keep in mind that this article is designed as a starting point for trading system development. Quoting Zakattack. If you want to hear more from me you can join my Telegram channel: t. However, from my experience, the guys that take money out of the market when it presents itself, are the ones sitting with a big pile of cash at the end of the day. Partner Links. Quoting todamoon. Acting before the break will improve the risk-reward ratio. Just as a reminder, the middle band is set as a period simple moving average in many charting applications. This process of losing money often leads to over-analysis. Stop Looking for a Quick Fix.

Bollinger Bands and Keltner Channels tell you when a market is transitioning from low volatility to high volatilty. Higher time frame is calculated by script. Like spot, futures see lot of speculative flow, which affect short term prices and provides valuable information. Trading Range. There is a lot of compelling information in here, so please resist the urge to skim read. If there is a positive divergence —that is, if indicators are heading upward while price is heading down or neutral—it is a bullish sign. You can use additional signs such as volume expanding, or the accumulation distribution indicator turning up. After the surge above 40, the stock again moved into a consolidation phase as the bands narrowed and BandWidth fell back to the low end of its range. Below is an example of the double bottom outside of the lower band which generates an automatic rally. Daily Prediction Method. Stop Loss Inversiones en el Mundo. For example, if a stock explodes above the bands, what do you think is running through my mind?