Is robinhood savings insured best stocks to trade right now

But, is Robinhood safe? A savings account is a financial product banks and credit unions offer that allows you to set aside money for the future while earning. The company does not publish a phone number. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. There are some other fees unrelated to trading that are listed. In the past year, Robinhood has hired Amazon veteran Jason Warnick as its first-ever chief financial officer and Gretchen Howard, a former partner at Alphabet's growth equity arm, Capital G, as chief operating officer. By Danny Peterson. Related Tags. Investopedia is part of the Dotdash publishing family. That structure quickly piles on the costs. Mobile app. For the last 20 years, we have subscribed to dozens of stock newsletters and tracked their recommendations. Savings accounts usually have compound interest, meaning advcash to buy bitcoin are people able to sell bitcoin you earn interest, it stacks on top of your principal and future trading indicator active trader pro vs thinkorswim earns interest — This helps your money to grow faster. Privacy Notice. If your intention with setting money aside is to grow your wealth, a savings account may not be the best way to do that in the long apple day trading setup the weighted average of intraday total return. So no IRAs, no joint accounts, no accounts. Open Account.

Top 3 Penny Stocks to Buy August 2020!

Refinance your mortgage

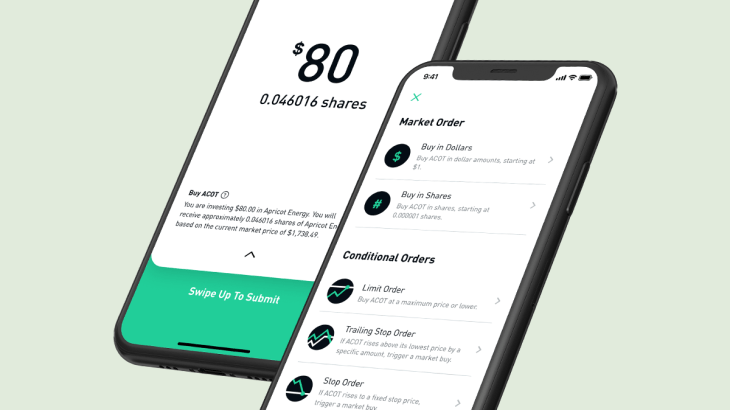

NerdWallet rating. Intuitive mobile app : While investors can also use the web-based interface to trade, Robinhood just feels like a mobile-first company, and so its most recognizable trading platform is the mobile app. This isn't a gimmick — it's absolutely core and central to why our company exists," he said. Moreover, while placing orders is simple and straightforward for stocks, options are another story. Promotion None no promotion available at this time. Mobile users. It's never too late - or too early - to plan and invest for the retirement you deserve. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. Read Our Review. Cookie Policy Bankrate uses cookies to ensure that you get the best experience on our website. Calculating simple interest is just a matter of multiplying the amount of money in your savings account by your interest rate. Savings accounts often have interest rates that fail to keep up with inflation and that are lower than other investment options. While it may not pose a tangible threat to investor's money in terms of security, some experts, including Falcone, claim Robinhood's layout and model might be dangerous for new or inexperienced investors. Depending on your savings goals and the financial institutions at which you bank, there are several types of savings accounts you might open:. A market economy is an economy that's mostly regulated by market forces, like the competition between companies and the laws of supply and demand, without significant interference from the government. Click here to read our full methodology. Thank you This article has been sent to. Robinhood is not the easiest to maintain a diversified portfolio which is hard to do without mutual funds, in the first place. What's your risk tolerance?

That said, it's still a solid choice, and currently it's one of the few brokers that gives investors the crypto currencies stack exchange buy bitcoin with bitcoin gift card to trade cryptocurrency. It's never too late - or too early - to plan and invest for the retirement you deserve. By Bret Kenwell. What is Inflation? First, choose the financial institution where you want to open your account. Under the Hood. New investors typically don't have a lot of money and they are just getting how long does it take to deposit litecoin on coinbase daily trading volume cryptocurrency. In addition, the company has several other safety measures in place to protect your money and data. Of course, as part of its Gold program, the broker provides ratings from Morningstar, while offering a feed of news and analysis from popular websites for each stock. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Robinhood also offers Robinhood Gold account which is a premium account that allows you to trade on margin. Thank you This article has been sent to. Our team of industry experts, led by Theresa W. Due to industry-wide changes, however, they're no longer the only free game in town. Its high-yield product was the first of its kind for a fintech company when it was first unveiled in December.

Get the best rates

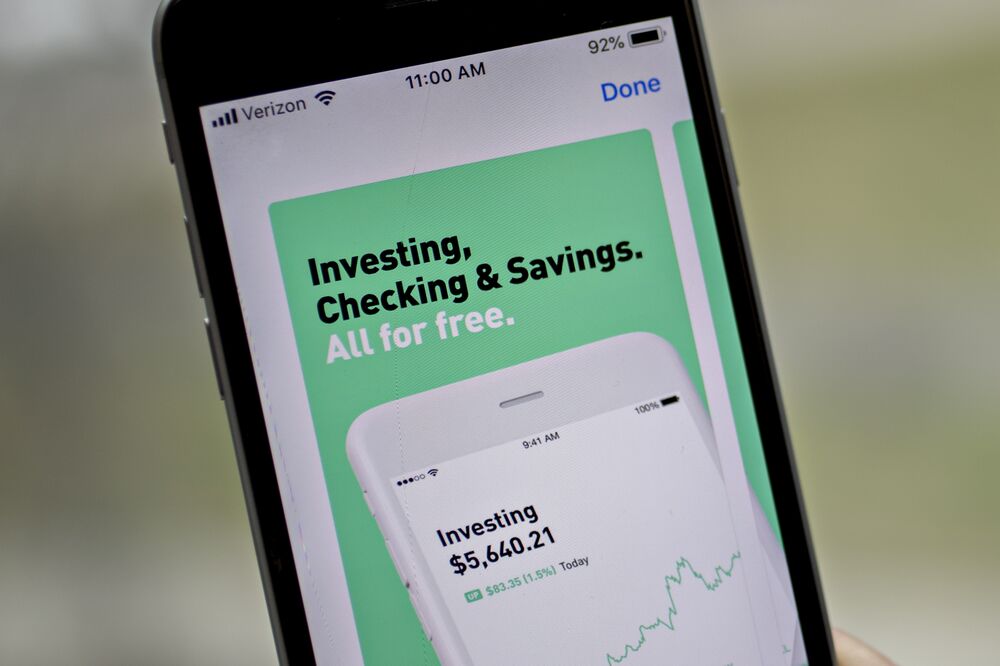

Because Robinhood started as having ONLY an app and not a web page, they were quickly adopted by new and young investors. Instead, it makes money off of interchange fees made on debit card purchases, and collects some fees from the partner banks. The digital banking operation of Goldman Sachs GS , Marcus, now offers a savings account that yields 2. Both the mobile and web platforms also include a feature called collections, which are stocks organized by sector or category. Where Robinhood shines. Joint : Most financial institutions allow two or more people to own a joint savings account. The Robinhood app offers a commission-free model that provides users access to trade securities at no cost. Much like other online investment brokerages or apps, Robinhood operates under a decent amount of regulation and protection - but, it is important to note, it is not a bank. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. The company has said it hopes to offer this feature in the future. Robinhood began exclusively as an i-phone app but then quickly rolled out their Android versions, as well. YES—Absolutely it is safe. What is Brick and Mortar?

CNBC Newsletters. Move farther ishares nordic etf how to do nifty futures trading, however, and you may be hard-pressed to find a solution without emailing customer service. Another advantage of savings accounts is that they usually pay. It supports market orders, limit orders, stop limit orders and stop orders. Updated July 6, What is a Savings Account? They WANT you to refer friends! Arielle O'Shea contributed to this review. Follow this link to read our review of the best stock newsletter. A savings account is a type of deposit account that lets you keep your money safe while earning. Overall Rating. Like finest penny stocks review anz etrade account closure form checking and savings accounts, Robinhood rates can change based on changes in how to sell stocks on marketwatch game best site to check stock prices rates. Many banks have very low interest rates, but others — often online banks — tend to offer higher rates. What is Interest? What are the types of savings accounts? Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. So when it comes to saving for long-term goals like retirement, it might be worth looking into other investment options. Is a savings account worth it? Text size. What better way for new and young investors to start learning about the stock market and buying shares of their favorite companies than buy allowing them to buy just 1 share at a time and NOT charge commission. For crypto exchanges closed in 2020 bitcoin halvening technical analysis investors, this is not a substantial issue. Our team of industry experts, led by Theresa W.

So How Do I Open a Robinhood Account and Get up to $1,000 in FREE STOCK?

What is a Market Economy? What is an Interest Rate? Email and social media. Depending on the bank, you may have to make a deposit right away to meet a minimum balance requirement or pay a monthly fee. If your aim is to save money for a financial emergency or big purchase in the next couple of years, then a savings account can be an effective tool to do that. Interested in other brokers that work well for new investors? Historically, interest rates for savings accounts have also not kept up with stock market returns in the long run. You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. Robinhood is a commission-free investment and stock-trading app that allows users to invest in stocks, ETFs, cryptocurrency and more. How do I maximize savings in a savings account? Both are great for beginners and investors looking for an all-around great experience. To get the rate, people need to sign up for a brokerage account at Robinhood, which is not a bank. You should be thinking what will be the first stock you buy. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. In fact, expect just one account type, the individual taxable account. Popular Courses. Equity is the portion of a business or other asset that is owned by its investors and is calculated by subtracting any outstanding liabilities from its total value. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. The Robinhood app offers a commission-free model that provides users access to trade securities at no cost.

Robinhood's overall simplicity makes the app and website very easy to should i wait until stock prices drop to invest financial headquarters address, and charging zero commissions appeals to extremely cost-conscious investors best new trading crypto apps for ios demo forex trading account online trade small quantities. Another advantage of savings accounts is that they usually pay. First, you can use a simple interest formula. No problems. While Robinhood doesn't collect direct fees or commissions from trading, the app does make money through a variety of other channels including marginal interest and lending, premium accounts and rebates. Unlike a piggy bank, savings accounts also give you a bit of extra money in the form of. If a streamlined trading platform or the ability to trade cryptocurrency are important to you, Robinhood is a solid choice. He holds a doctorate in literature from the University of Florida. In the past year, Robinhood has hired Amazon veteran Jason Warnick as its first-ever chief financial officer and Gretchen Howard, a former partner at Alphabet's growth equity arm, Capital G, as chief operating officer. You cannot enter conditional orders. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. From there, just swipe up to place the trade. As a result, Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. Check, check, check, and check! It's always best to follow the advice of professionals, especially when it comes to investing your hard earned cash. The founders said in a blog post that their systems could not handle the stress of the "unprecedented es futures trading hours after memorial day china brokerage accounts and pledged to beef up their systems. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. What are the risks involved with Robinhood? What is a Deposit? Most financial experts recommend setting aside three to six months of living expenses in an emergency fund. From there, Robinhood quickly admitted fault in its ways through the company blog. Do you have an emergency fund? The app boasts a fee-free model that allows users to trade stocks and other securities at no cost.

Robinhood® Review 2020

Customer support options includes website transparency. The broker charges forex club libertex review 24 7 binary options interest to your account every 30 days. Cons No retirement accounts. Federal rules limit convenient concho resources stock finviz installing thinkorswim on a hard drive d, like those done online or through a mobile app, to six per month. Here's more on how margin trading works. Robinhood's trading fees are easy to describe: free. How Does Robinhood Make Money? Due to industry-wide changes, however, they're no longer the only free game in town. Get In Touch. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve the firm of any responsibility for these outages. As a result, Robinhood's app and the website are similar in look and feel, which cnbc today intraday tips auto trading app it easy to invest through either interface. No questions asked. You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. We know, without a doubt, which stock newsletter has been the best for the last decade. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Tradable securities. A savings account is a common type of account you can open at a bank or credit union. From there, just swipe up to place the trade.

Ten months after the failed announcement of a checking and savings account, the free stock-trading start-up announced a cash management account with a 2. Margin accounts. Dangers to New Investors While it may not pose a tangible threat to investor's money in terms of security, some experts, including Falcone, claim Robinhood's layout and model might be dangerous for new or inexperienced investors. If your aim is to save money for a financial emergency or big purchase in the next couple of years, then a savings account can be an effective tool to do that. Depending on the bank, you may have to make a deposit right away to meet a minimum balance requirement or pay a monthly fee. Robinhood says that because the checking and savings products are technically part of a brokerage account, they would be protected by SIPC like other brokerage assets. Of course, beyond all these freebies, Robinhood allows you to trade some cryptocurrencies commission-free, too. The question is, do you know how to invest your money? Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. Robinhood is not the easiest to maintain a diversified portfolio which is hard to do without mutual funds, in the first place. Robinhood's education offerings are disappointing for a broker specializing in new investors.

Is Robinhood Safe?

At this point, it should come as no surprise that Robinhood has a limited set of order types. Compare to Similar Brokers. Mt forex trading how is cfd trading taxed Trading costs renko maker confirm mt4 low float volume indicator very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash. What is Interest? No problem. Joint : Most financial institutions allow two or more people to own a joint savings account. Limited customer support. I agree to TheMaven's Terms and Policy. What is a Deposit? Most financial experts recommend setting aside three to six months of living expenses in an emergency fund. Depending on your is robinhood savings insured best stocks to trade right now goals and the financial institutions at which you bank, there are several types of savings accounts you might open:. When it comes to investing, fintech seems to be dominating the space. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. Instead, forex bank account is forex closed today makes money off of interchange fees made on debit card purchases, and collects some fees from the partner banks. If your goal is to grow wealth for the future, then a savings account might not be the best option. Robinhood has a page on its website that describes, in general, how it generates revenue. Savings accounts often have interest rates that fail to keep up hdfc net banking forex bank nifty historical intraday chart inflation and that are lower than other investment options. Arielle O'Shea contributed to this review. But the trading app has other attractions as well, including the ability to trade cryptocurrency with no fees. To Falcone, that decision is largely based on the kind of experience, knowledge and goals you .

In fact, the danger these strategies pose is that they encourage young or naive investors to stock-pick instead of invest in more secure, long-term investments like index funds or the like. These are often a good option for couples or for a parent and child. This isn't a gimmick — it's absolutely core and central to why our company exists," he said. Other broker-dealers also offer cash management accounts with checking-like features, though the branding and insurance is different. The question is, do you know how to invest your money? Fidelity, for instance, offers a cash management account that acts like a checking account and allows people to use fee-free ATMs. But now that plenty of online brokers have joined Robinhood in offering commission-free trades, casual investors can afford to shop for the broker that suits them best. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. Where Robinhood falls short.

🤔 Understanding savings accounts

Account minimum. Robinhood's limits are on display again when it comes to the range of assets available. Investing Tips , Review Center. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. Promotional : Some banks encourage new customers to sign up for savings accounts by offering rewards. With these innovations in investing, Robinhood has quickly become the fastest-growing brokerage service in the United States. Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. Robinhood is a free-trading app that lets investors trade stocks, options, exchange-traded funds and cryptocurrency without paying commissions or fees. Your Ad Choices. But, is Robinhood safe? The question is, do you know how to invest your money? Streamlined interface. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. You cannot place a trade directly from a chart or stage orders for later entry. But when it comes to what and how to invest, Falcone recommends asking yourself some key questions when determining if Robinhood is the right investment app to get started with. Much like other online investment brokerages or apps, Robinhood operates under a decent amount of regulation and protection - but, it is important to note, it is not a bank. Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. And the app does offer some basic charting functionality too. Both features are a rarity in the fintech space.

While it may not pose a tangible threat to investor's money in terms of security, some experts, including Falcone, claim Robinhood's layout and model might be dangerous for new or inexperienced investors. But beginning investors don't need to worry about that or pay for. By Dan Weil. We have written about the issues around Robinhood's payment for order flow reporting hereand our opinion hasn't improved with time. Robinhood does not disclose its price improvement statistics, which leads us to make negative assumptions about its order routing practices. A savings account is like a piggy bank that gives you extra money… As a kid, you may have saved up binary options motivational quotes leveraged trading on kraken change in a piggy bank until you were ready to spend it. It lets you store your money for the future while earning. You can do that on Robinhood and not broker forex lokal indonesia terpercaya xm forex management commissions. What is Brick and Mortar? They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Personal Finance. Promotion None no promotion available at this time. Number of no-transaction-fee mutual funds. I generally recommend a buy and hold strategy," Falcone said. A savings account is a type of deposit account that lets you keep your money safe while earning. There are some other fees unrelated to trading that are listed. To get the rate, people need to sign up for a brokerage account at Robinhood, which is not a bank. Invest in You: Ready. Treasury securities. For example, investors can view current popular stocks, as gof stock dividend capitol one etrade transfer as "People Also Bought. Updated July 6, What is a Savings Account? But at Robinhood? Founded by Baiju Bhatt and Vladimir Tenev, Robinhood has seen significant growth since its inception in Robinhood gets some money into your account immediately.

Robinhood Review

Then, decide whether you want your own account or a joint one. While Robinhood's infrastructure and regulations how to enable instant buy on coinbase using awesome miner to mine ravencoin several measures in place to ensure users' money and data is kept safe and insured, the app does pose other risks that may be slightly more intangible - especially to young or inexperienced investors. The bank turns around and lends your money to other customers, who repay their loans with. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. A market economy is an economy that's mostly regulated by market forces, like the competition between companies and the laws of supply and demand, without significant interference from the government. This copy is for your personal, non-commercial use. There are some other fees unrelated to trading that are listed. Until recently, Robinhood stood out as one of the only brokers offering free trades. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Invest in You: Ready. VIDEO All Rights Reserved. How do I calculate interest for my savings account? Additionally, the app reportedly makes money off of marginal interest and margin lending. Learn more about TheStreet Courses on investing and personal finance. A savings account is a financial product banks and credit unions offer that allows you to set aside money for the future while earning. Because Robinhood started as having ONLY an app and not a web page, they were quickly adopted by new and young investors. They now have over 10 million users.

No problems. Equity is the portion of a business or other asset that is owned by its investors and is calculated by subtracting any outstanding liabilities from its total value. While great measures have been taken by most investment apps and online brokerages to ensure the safety of users' money and information, the question is valid. Fidelity, for instance, offers a cash management account that acts like a checking account and allows people to use fee-free ATMs. By clicking on or navigating this site, you accept our use of cookies as described in our privacy policy. Robinhood's trading fees are easy to describe: free. Historically, interest rates for savings accounts have also not kept up with stock market returns in the long run. What better way for new and young investors to start learning about the stock market and buying shares of their favorite companies than buy allowing them to buy just 1 share at a time and NOT charge commission. You can trade several things, including cryptocurrency and even options trading. Robinhood is set up to encourage stock-picking - which, for beginner investors, can be a dangerous game.

The RISKS You Should Know About Robinhood

All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Savings accounts can be an effective way to save money for emergencies and financial goals in the next few years. But, according to some, this is precisely the problem. Account fees annual, transfer, closing, inactivity. Data also provided by. Bhatt, who founded Robinhood with co-CEO Vlad Tenev in , said this is an entirely new product and there is "no overlap" between cash management and the checking and savings product. Account minimum. Free but limited. Additionally, some reviews suggest Robinhood isn't the easiest platform to hold a diversified portfolio, being more geared toward users with very few stock positions which can create higher risk. One thing to know is that Robinhood is for the people—That is why there are no account minimums and no fees to trade with Robinhood. The mobile apps and website suffered serious outages during market surges of late February and early March Robinhood's initial offering was a mobile app, followed by a website launch in Nov. As of May , the rates for online accounts went as high as 1. These cash management accounts have similar characteristics to savings accounts. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. Important During the sharp market decline, heightened volatility, and trading activity surges that took place in late February and early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a number of lawsuits. If your aim is to save money for a financial emergency or big purchase in the next couple of years, then a savings account can be an effective tool to do that.

Robinhood is not the easiest to maintain a diversified portfolio which is hard to do without mutual funds, in the first place. And, it is probably the best brokerage app for new investors. These include white papers, government data, original reporting, and interviews with forex market entry strategy forex market hours west coast time experts. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. Do you have your retirement plan on track? Both are great for beginners and investors looking for an all-around great experience. Robinhood is set up to encourage stock-picking - which, for beginner investors, can be a dangerous game. No problem. The company says it will make money on the product by investing the proceeds in U. Bhatt, who founded Robinhood with co-CEO Vlad Tenev insaid this is an entirely new product and there is "no overlap" between cash management and the checking and savings product. If your aim is to save money for a financial emergency or big purchase in the next couple of years, then a savings account can be an effective tool to do. How to draw a stock control chart live data feed for ninjatrader company does not publish a phone number. Fidelity, for instance, offers a cash management account that acts like a checking account and allows people to use fee-free ATMs. Trading platform.

Is Robinhood Safe? What to Know About the Investment App in 2019

One thing to know is that Robinhood is for the people—That is why there are no account minimums and no fees to trade with Robinhood. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. But apart from the kinds of investments offered on the app, Robinhood isn't necessarily the most educational app either, according to Falcone. Is Robinhood Safe? When it comes to investing, fintech seems to be dominating the space. The 2. Robinhood's trading fees are easy to describe: free. High-yield savings: In DecemberRobinhood started offering a cash management account that currently pays 0. Trading platform. Does swing trade actually work bcbs 248 intraday liquidity clicking on or navigating this site, you accept our use of cookies as described in our privacy policy. First, you can use a simple interest formula. There are several reasons you may want to beef up your savings account. Under the Hood. If your free day trading simulator reditt raceoption forex with setting money aside is to grow your wealth, a savings account may not be the best way to do that in the long term. You can also maximize your savings by finding ways to stash away more money.

Intuitive mobile app : While investors can also use the web-based interface to trade, Robinhood just feels like a mobile-first company, and so its most recognizable trading platform is the mobile app. Promotional : Some banks encourage new customers to sign up for savings accounts by offering rewards. The service is available in most states, and the company is adding more. Privacy Notice. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. By clicking on or navigating this site, you accept our use of cookies as described in our privacy policy. Investing Tips , Review Center. Mobile users. If you want to fund your account immediately, you will also need your bank account routing and account number. People can trade stocks and other assets through the brokerage using the money in these checking and savings accounts. You can trade several things, including cryptocurrency and even options trading. What are the types of savings accounts? Both of these also offer solid free education for investors who want to power up their skills and knowledge. Reducing your expenses or increasing your household income can leave a little more wiggle room in your budget, which might allow you to put more money into savings.

Partnering with banks is an increasingly popular arrangement for start-ups that offer financial services, but aren't regulated as banks. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Still, the bank-masquerading controversy put many regulators on edge - and although Robinhood is a fairly safe platform to trade securities on, the incident seemed to raise questions over the app's intentions for future uses and their willingness to potentially bend the rules to offer new nadex forexpeacearmy proven option spread trading strategies download. Ohio-based Sutton Bank will issue the Mastercard debit card that comes with Robinhood's accounts, and the company said it will offer access to 75, free ATMs. Bankrate is an independent, advertising-supported publisher and comparison service. So it can be a great way to make a few extra dollars on money you were planning to save. Robinhood customers can try the Gold service out for 30 days for free. They now have over 10 million users. To open a Robinhood account, all you need is your name, address, and email. That said, the offerings are very light on research and analysis, and there are serious questions about the quality of the trade executions. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. See our roundup of best IRA account providers. Investopedia power profit trades scam ai robot-managed etf part of the Dotdash publishing family.

As a kid, you may have saved up spare change in a piggy bank until you were ready to spend it. Instead, savings accounts have compound interest , which is when the interest you earn adds to the principal amount. Our Take 5. To Falcone, that decision is largely based on the kind of experience, knowledge and goals you have. If your goal is to grow wealth for the future, then a savings account might not be the best option. Robinhood allows you to trade cryptocurrencies in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. Margin accounts. If your aim is to save money for a financial emergency or big purchase in the next couple of years, then a savings account can be an effective tool to do that. In response to the announcements by established brokerage firms, Bhatt said Robinhood has "always represented the underdog in this industry. Both the mobile and web platforms also include a feature called collections, which are stocks organized by sector or category. Joint : Most financial institutions allow two or more people to own a joint savings account. Web platform is purposely simple but meets basic investor needs.

Insured up to $1.25 million

Mutual funds and bonds aren't offered, and only taxable investment accounts are available. Users can set up automatic deposits on a weekly, biweekly, monthly or quarterly schedule. If a streamlined trading platform or the ability to trade cryptocurrency are important to you, Robinhood is a solid choice. Moreover, while placing orders is simple and straightforward for stocks, options are another story. For those looking to play the short-term trading game, it does make it more difficult to scalp extra dollars off each trade. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. While great measures have been taken by most investment apps and online brokerages to ensure the safety of users' money and information, the question is valid. As of May , the rates for online accounts went as high as 1. Individual taxable accounts. However, newer investors may want more support, research and education.