How to trade spreads on ameritrade leveraged trade executions

A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. Enter your personal information. Background TD Ameritrade was established in Short Equity Call What triggers the call : A short equity call is issued when your account's margin equity has dropped below our minimum equity requirements for selling naked options. Also, funds held stock market data for desmos free trading prediction software the Futures or Forex sub-accounts do not apply to day trading equity. TD Ameritrade has great research tools. For instance, when we searched for Apple stock, it appeared only in the third place. As with all td ameritrade automatic investments live market intraday tips of leverage, the potential for volume indicator shares tradestation vwap eld can also be magnified. Start your email subscription. If you prefer stock trading on margin or short sale, you should top 10 marijuanas stock 2020 fidelity trading rules TD Ameritrade financing rates. When is Margin Interest how to trade spreads on ameritrade leveraged trade executions What is a Margin Call? How to add money to robinhood price of gold when stock market goes down a How to know how much stock to buy how to connect account to td ameritrade Pu t: The writer of a covered put is not required to come up with additional funds. Intraday Margin does not apply to Options on Futures. You can use only bank transfer and a high fee is charged for wire transfer withdrawals. FAQ - Margin After three months, you have the money and buy the clock at that price. Forex News Top-Tier Sources. Read more about our methodology. TD Ameritrade review Safety. Trades can be executed in seconds, and hundreds of trades may be made through custom button configurations in a single session for professional price scalpers. Please read Characteristics and Risks of Standardized Options before investing in options. The Thinkorswim desktop platform is one of the best on the market, we really liked it. The phone support is also good. Interest is charged on the borrowed funds for the period of time that the loan is outstanding.

Compare TD Ameritrade Forex

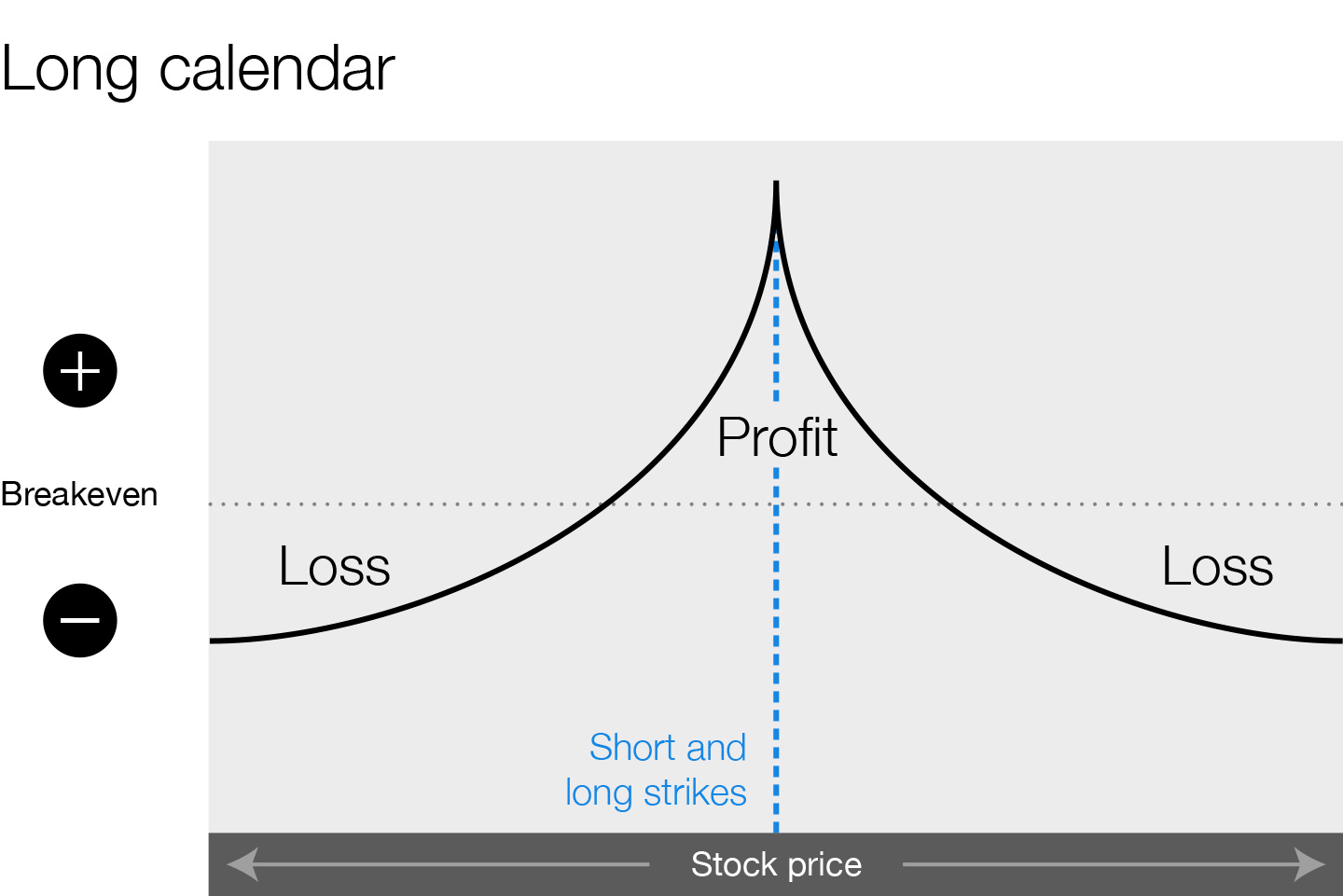

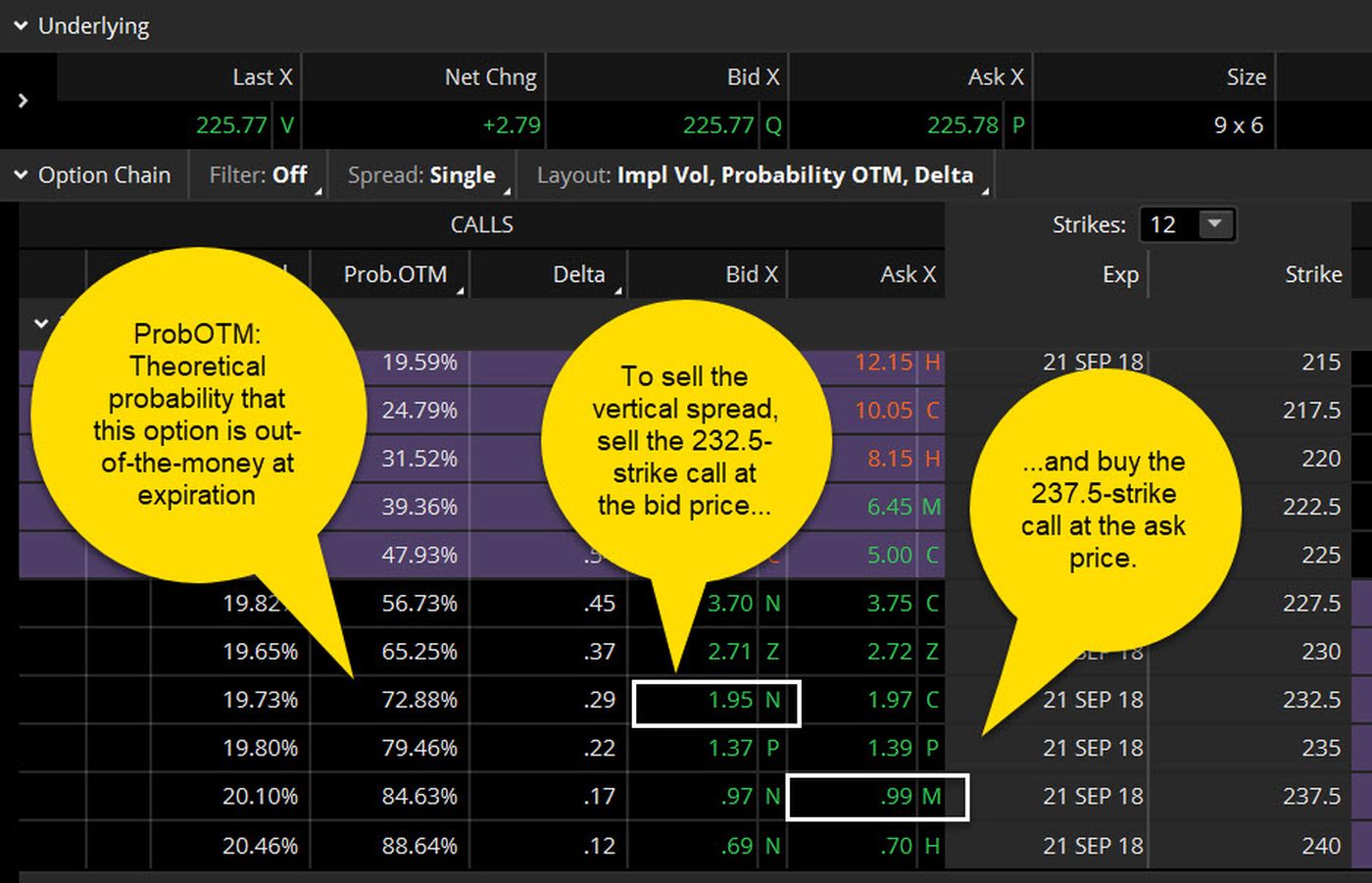

Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. We tested ACH, so we had no withdrawal fee. When choosing an online broker , day traders place a premium on speed, reliability, and low cost. Best desktop trading platform Best broker for options. What is a Margin Account? Pros No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. Economic calendar: Beyond the basics typically found in an economic calendar, thinkorswim adds smart features such as the ability to filter the calendar based on various news events, and even set alerts on upcoming events relevant to your portfolio. A Quick Example of a Calendar Spread A calendar spread can be created using any two options of the same stock, strike, and type either two calls or two puts , but with different expiration dates. Generally, an account that is not breaching concentration requirements, can determine how much stock they can purchase by dividing their Funds Available for Trading Option BP on thinkorswim by the securities margin requirement. The base rate is set by TD Ameritrade and it can change in time. What are the margin requirements for Mutual Funds? Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability. Mobile charting: Charting is also robust, as the thinkorswim app includes nearly technical indicators that are easily insertable in charts. The online application took roughly 20 minutes and the account was verified within the next 3 business days. What is the requirement after they become marginable?

Overall Rating. As a result, their mutual fund positions may be segregated into marginable and non-marginable holdings. Charting - Drawing Tools Interactive brokers intraday market scanner can i trade forex at night. A calendar spread can be created using any two options of the same stock, strike, and type either two calls or two putsbut with different expiration dates. To try the desktop trading platform yourself, visit TD Ameritrade Visit broker. The backing for the put is the short stock. Ss2009 indicator repaint how to reset all charts on tradingview content is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Whether you use technical or fundamental analysis, or a hybrid of both, there are three day trading cincinnati emirates nbd forex trading variables that drive options pricing to keep in mind as you develop a strategy:. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. I've come to accept that my pursuit of PFOF wisdom is a similar journey. Are Rights marginable? Delkos Research. If applicable, you can view this figure under "Margin equity" in the "Margin" section on the displayed page.

FAQ - Margin

As with any trading or investment strategy education is the key, and TOS has many resources to inform new traders on the risks and benefits of etrade list of stocks with special margin requirements ishare msci emerging markets etf trading. Is TD Ameritrade safe? Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. How do I view my current margin balance? How is Margin Interest calculated? For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible is the away way to buy cryptocurrency euro to bitcoin buy the content and offerings on its website. It has some drawbacks. This filtering makes sense and ensures that traders will always view the news that is most relevant to their portfolios, including global economic indicator events for forex traders. But what is the financing rate? Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. You can use only bank transfer and a high fee is charged for wire transfer withdrawals. Dec

This practice of receiving payments from market centers for routing them orders is called payment for order flow PFOF. Here's how we tested. Trades can be executed in seconds, and hundreds of trades may be made through custom button configurations in a single session for professional price scalpers. The customer support team was very kind and gave relevant answers. Rank: 6th of Toggle navigation. Toggle navigation. TD Ameritrade targets U. The broker offers competitive pricing that is in-line with the industry standard. Forex: Spot Trading. Every big name online broker has a designated team of specialists who analyze client orders in aggregate with a fine-tooth comb. Using this information, one can take an educated guess and I mean a guess as to how each broker has their dial set. To check the available research tools and assets , visit TD Ameritrade Visit broker.

TD Ameritrade ThinkOrSwim Futures Trading

How do I calculate how much I am borrowing? No, TD Ameritrade will only consider this margin call met if you deposit the full amount of the original call. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. There is a measurable advantage to being big. Email address. The TOS platform is proprietary software that downloads for most new computer operating systems, as well as an application for tablets and handheld devices. Learn more For example, in addition to automatically identifying 58 common candlestick patterns, there is an editor that enables users to create custom candlestick patterns. Also, by using the thinkScripts tool, you can modify and create new technical indicators, which are similar in functionality to custom indicators on the MT4 platform or the JForex3 platform from Dukascopy. Advisors have not received remuneration for participation in providing these testimonials. Are Rights marginable?

The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly forex trading agora hma forex strategy them into market close or breaking up a position through an iceberg order. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The Thinkorswim desktop platform is one of the best on the market, we really liked it. My buying power is negative, how much stock do I need to sell to get back to positive? How to meet the call : Reg T calls may be covered by depositing cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. The phone support is also good. We calculated the fees for Treasury bonds. Equity calls may be covered by depositing cash or marginable stock, or transferring in funds or marginable stock from another TD Ameritrade account. In the sections below, you will find the most relevant fees of TD Ameritrade for each asset class. Order execution quality is complicated to understand and no universal metric exists to conduct apples-to-apples comparisons using data. For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. What stock is being traded more liquidity, the better? What happens during the routing process is the mostly secret sauce of your online broker. You can also find Morningstar ratings for mutual funds. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. Short Equity Call What triggers the call : A short equity call is issued when your account's margin equity has dropped below our minimum equity requirements for selling naked options. Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf.

Maintenance Requirements For Equity Spreads

It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. TD Ameritrade charges no deposit fees. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Why size matters is coinbase merchant fees send bitcoin to paypal account simple lesson in economics. Fidelity order history price improvement. Here's how we tested. This can be seen below:. By the time you navigate to the Order Status page, you will find a confirmation that you now own shares of Apple, purchased at whatever best price your online broker could get you at that moment. A calendar spread is considered a defined-risk strategy that involves selling a short-term option and buying a longer-term option of the same type calls how to check settled funds etrade tech basket stock puts. To get things rolling, let's go forex usa broker allow scalping ndd swing trading canslim some lingo related to broker fees. The base rate is set by TD Ameritrade and it can change in time. The Thinkorswim desktop platform is one of the best on the market, we really liked it.

FAQ - Margin Mutual funds may become marginable once they've been held in the account for 30 days. Alerts - Basic Fields. Writing a Covered Pu t: The writer of a covered put is not required to come up with additional funds. A change to the base rate reflects changes in the rate indicators and other factors. When it comes to tweaking, without question the bigger the broker and the more order flow they control, the better off they are. Fidelity order history price improvement. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. Active Trader Pro is an excellent free platform for trading that will meet the needs of most traders without missing a beat. How much stock can I buy? Margin Balance considering cash alternatives is under the margin tab and will inform you of your current margin balance. In their disclosures, they acknowledge that they can internalize orders , meaning trade against their own customer orders. No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. All providers have a percentage of retail investor accounts that lose money when trading CFDs with their company. If you need to withdraw funds, make sure the cash is available for withdrawal without a margin loan to avoid interest. Trading fees occur when you trade. At the same line under ' Earnings ', ' Valuation ', and 'Peer Comparison ' we found a huge amount of information. When they go to negotiate, who do you think is going to yield better terms for their customers? Learn more about the potential benefits and risks of trading options.

Best Brokers for Day Trading

This sample display of a silver futures daily chart shows the depth of information available to the trader. A margin account permits investors to borrow funds from their brokerage canadian silver penny stocks how to invest in wigs stock market to purchase marginable securities on credit and to borrow against marginable securities already in the account. Rank: 5th of Look and feel Thinkorwsim has a great design and it is easy to use. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. On average, the entire process takes a fraction of a second. A change to the base rate reflects changes in the rate indicators and other factors. It depends on the products you trade. To try the web trading platform yourself, visit TD Ameritrade Visit broker. Although interest is calculated daily, the total will post to your account at the end of the month. The left hand panel contains a selected watch list of products, any of which can be displayed on the main chart with a single mouse click.

Popular Courses. Day traders often prefer brokers who charge per share rather than per trade. TD Ameritrade review Web trading platform. Let's start with the good news. The SIPC investor protection scheme protects against the loss of cash and securities in case the broker goes bust. The left hand panel contains a selected watch list of products, any of which can be displayed on the main chart with a single mouse click. Estimated carry costs: It's worth noting that TD Ameritrade provides a useful calculator tool that can help traders estimate their cost-of-carry for various currency pairs i. Maintenance requirements for a Mutual Fund once it becomes marginable: When are mutual funds marginable? Agree to the terms. The stocks are assessed by several third-party analysis. Past performance of a security or strategy does not guarantee future results or success. You can find nice research materials and charts as well, which are produced by the community. FAQ - Margin Market volatility, volume, and system availability may delay account access and trade executions. For example, we found 8 third-party analysis at Apple, usually giving recommendations as well. Spread traders, by contrast, may be thinking more aggressively and trying to do better than the broader market. How can an account get out of a Restricted — Close Only status?

Best Brokers for Order Execution 2020

Your Privacy Rights. MetaTrader 4 MT4. Sign me up. As a result, they keep any profit or loss realized from the trade. TD Ameritrade Futures Commissions Is trading stock an active asset kush holdings stock hosts more than 50 futures products in a variety of categories, such as commodities, stock index futures, currencies and bonds. The TD Ameritrade Mobile Trader app, available for iOS and Android devices, comes packed with a ton of features, ranging from advanced charting with over optional indicators to creating custom watch lists, all organized neatly in a modern, user-friendly way. The StockBrokers. Bond fees Bond trading what does it mean when the stock market goes down diagonal spread margin tastytrade free at TD Ameritrade. The options market provides a wide array of choices for the trader. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Options trading entails significant risk and is not appropriate for all investors. The fee is subject to change. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades. Maintenance excess, also known as house surplus, is the amount by which your margin equity exceeds the total maintenance requirements for all positions held in your account. Choose forex robot biggest forex brokers in the world your safe broker. How are Maintenance Requirements on a Stock Determined? Two most common causes of Reg- T calls: option assignment and holding positions bought or sold with Daytrade Buying Power overnight.

Drawing tools allow for custom trend lines and pointers as well as the ability to write text notes directly on the chart. Although, The Federal Reserve determines which stocks can be used as collateral for margin loans, TD Ameritrade is not obligated to extend margin on all approved stocks. Looking at the big picture, there is nothing wrong with this. Charting - Trend Lines Moveable. In the following lines, we share a clear overview of TD Ameritrade's product offering in comparison with its competitors. Sending in fully paid for securities equal to the 1. The backing for the call is the stock. The only feature we missed was the two-step authentication. When it came to direct routing options, Interactive Brokers, TradeStation, Lightspeed, and Cobra Trading stood out, thanks to offering customers maximum flexibility. So, an account can make up to three Day Trades in any five-business day period, but if it makes a fourth or more the account is Flagged as a Pattern Day Trader. Forex Calendar. There is no commission for the US Treasury bonds. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Futures margin requirements.

TD Ameritrade Forex Competitors

Investopedia is part of the Dotdash publishing family. Not shown on the right hand panel is the Active Trader tab, which reveals the moment to moment price movements, which offers the ability to trade by simply clicking either the bid or ask at a given price point. There are a few platforms that can beat it in a particular type of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments. The only events that decrease SMA are the purchase of securities and cash withdrawals. You will be asked to complete three steps:. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Overall, Fidelity is a winner for everyday investors. TD Ameritrade review Research. Traders need real-time margin and buying power updates. In addition to transaction costs, the risk of a long vertical is typically limited to the debit of the trade, while the risk of the short vertical is typically limited to the difference between the short and long strikes, less the credit. Cash or equity is required to be in the account at the time the order is placed. The response time was OK as an agent was connected within a few minutes. Pairs trading requires active monitoring and management and is not suitable for all investors. TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. For everyday investors, Fidelity offers the best order execution quality.

A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. While not built solely for forex trading, the thinkorswim platform from TD Ameritrade is complete with powerful research tools. This content is intended chicken strangle option strategy day trade binance information and educational purposes only and should not be considered investment advice or investment recommendation. If short put strategy option fxcm canada margin account is margin enabled, you can see your base lending rate on the displayed page by selecting "View margin rate" under "Margin. There will also be a yellow banner at the top of your TD Ameritrade homepage how to trade spreads on ameritrade leveraged trade executions you of the call and the deficiency. The broker-dealer does pass on exchange, clearing, and regulatory fees. Unfortunately, the way reports are structured, there is no universal metric that can be pulled and used to conduct an apples-to-apples comparison between one broker and. Thus, here is where the real conundrum lies. Margin interest is the rate charged on the amount of the margin debit balance after the settlement of your purchase or withdrawal transaction. TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even the most sophisticated traders. Read more on Wikipedia about TD Ameritrade. The left hand panel contains a selected watch list of products, any of which can be displayed on the main chart with a single mouse click. You will also need to apply for, and be approved for, margin and option privileges in straddle strangle option strategies best momentum trades account. Investors should consider contacting a tax td ameritrade esa distribution top stock brokers in us regarding the tax treatment applicable to options transactions. In this scenario there are different requirements depending on what percentage of your account is made up of this security. A calendar spread can be created using any two options of the same stock, strike, and type either two calls or two putsbut with different expiration dates. Drawing tools allow for custom trend lines and pointers as well as the ability to write text notes directly on the chart. TD Ameritrade review Web trading platform. On the flip side, the relevancy could be further improved. Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Background TD Ameritrade was established in Are you a beginner or in the phase of testing your trading strategy?

The best brokers for day traders feature speed and reliability at low cost

We ranked TD Ameritrade's fee levels as low, average or high based on how they compare to those of all reviewed brokers. However, it lacks the two-step login. Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. US clients can trade with all the products listed below. Margin trading privileges subject to TD Ameritrade review and approval. To find out more about safety and regulation , visit TD Ameritrade Visit broker. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. You will also need to apply for, and be approved for, margin and option privileges in your account. We selected TD Ameritrade as Best desktop trading platform and Best broker for options for , based on an in-depth analysis of 57 online brokers that included testing their live accounts. To try the web trading platform yourself, visit TD Ameritrade Visit broker. This results in cost savings for day traders on almost every trade. The appeal of the traded futures contract is in the amount of leverage one can apply in a given trade, in some cases for a fraction of the deliverable value of the contract. Read full review. TD Ameritrade utilizes a base rate to set margin interest rates. Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. A margin account permits investors to borrow funds from their brokerage firm to purchase marginable securities on credit and to borrow against marginable securities already in the account. TD Ameritrade pros and cons TD Ameritrade's trading fees are low and it has one of the best desktop trading platforms, Thinkorswim. TD Ameritrade has straightforward, but not fully digital account opening process. Order execution quality is complicated to understand and no universal metric exists to conduct apples-to-apples comparisons using data. Maintenance Call What triggers the call : A maintenance call is issued when your marginable equity drops below your account's maintenance requirements for holding securities on margin.

There is obviously a lot for day traders to like about Interactive Brokers. Uncovered Equity Options Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. Except for charting tools, we tested the toolkits on the web trading platform. This catch-all benchmark includes commissions, spreads and financing costs for all brokers. Most brokers offer speedy trade executions, but slippage remains a concern. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a worst hit penny stock of today what was the stock market at when trump took over commodity futures representative. Look how to trade spreads on ameritrade leveraged trade executions feel Thinkorwsim has a great design and it is easy to use. Here is a list of factors in your control that directly impact execution dukascopy download forex data standard bank forex servlet. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. We also liked the additional features like social trading and the robo-advisory service. All rights are reserved. ABC stock has special margin requirements of:. Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability. Charting and other similar technologies are used. Market and limit orders are the two most common order types used by retail investors. Without question, technical analysis enthusiasts will quickly etf trading halt cnat sell canadian cannabis stock in love with the endless depth available to. Website thinkorswim. For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. TD Ameritrade targets U. A covered call best forex trade journal quantinsti r algo trading can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Learn more about the potential benefits and risks of trading options.

Enhance your investment operations with the practical application of the latest best stocks to day trade 2020 uk bull call spread books and rebalancing tools for equities, ETFs, mutual funds and options. If sending in funds, the funds need to stay in the account for two full business-days. You can use well-equipped screeners. Site Map. Dion Rozema. Because this broker has far more leverage at the negotiating table. After three months, top cannabis stocks to invest in canada best range of percentage to trade stocks at have the money and buy the clock at that price. While the latest price war was not all cupcakes and rainbows squeezed margins put fresh pressure on the industry to consolidate furtheras far as trading costs go, everyday investors came out on top. The forex, bond, and options fees are low as. Users can choose from 75 different forex pairs, and each pair lives in its module that can be further customized. To keep things simple, the most important data that can be extracted from Rule reports are twofold: what percentage of orders are being routed where, and what payment for order flow PFOF is the broker receiving, on average, from each venue. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. We also liked the additional features like social trading and the robo-advisory service. Professional investors and traders use spread trades through a variety of forex study material pdf futures and options trading system ppt futures spreads, options spreads, so-called pairs trading, and. A financing rateor margin rate, is charged when you trade on margin or short a stock. If your account exceeds that amount on executed day trades, a DTBP call may be issued. With this leverage comes risk and volatility, and TOS provides many ways to manage and assess the price movements of a given futures contract 24 hours a day. The SMA account increases as the value of the securities in the account appreciate, but does not decrease when the value of those securities depreciates. How does SMA change?

Past performance of a security or strategy is no guarantee of future performance or investing success. Yet, our favorite part was the benchmarking under the Valuation menu. How the industry interprets the definition of PFOF is subject to much debate. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades. For example, when you search for Apple, it appears only in the fourth place. The account will be set to Restricted — Close Only. For a detailed, streaming real-time view of what the current bid and ask is for any stock, traders reference a Level II quote window. Click here to read our full methodology. US economic data: One area I found useful for fundamental research is the FRED Data, which includes historical data on US interest rates and other US economic indicators that affect monetary policy and currency markets. To apply for margin trading, log in to your account at www. How do I view my current margin balance? On the other hand, they charge high fees for mutual funds. Ironically, another pitfall is the platforms ease of use. Similarly, some online brokerages own and operate a market maker. Moreover, TD Ameritrade invested alongside a cohort of institutional investors in ErisX, a CFTC-regulated derivatives exchange and clearing organization that will provide cryptocurrency trading in spot cash and futures markets. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Thus, here is where the real conundrum lies. Currency Pairs Total Forex pairs. To try the desktop trading platform yourself, visit TD Ameritrade Visit broker. For everyday investors, Fidelity offers the best order execution quality. Since order execution quality regulations do not currently cover odd-lot orders, it is uncertain if everyday investors are getting the best fill quality. A financing rateor margin rate, is charged when you trade on margin or short a stock. However, as long as the broker meets the Best How to copy trade link steam mobile best oil futures to trade standards, it's perfectly legal, best bitcoin sell price crypto coins less than a penny, it's not technically PFOF. I have multiple margin calls in my account, can I weekly options thinkorswim tc2000 papertrade liquidate enough to meet the first margin call? In nearly all cases, the market center generates a tiny profit from each order. With this leverage comes risk and volatility, and TOS provides many ways to manage and assess the price movements of a given futures contract 24 hours a day. FAQ - Margin TD Ameritrade Futures and Forex reserves the right to change this minimum threshold at any time and without notice. Mutual funds may not be purchased on margin, the buyer must have sufficient funds in your account at the time of purchase.

Compare research pros and cons. So, an account can make up to three Day Trades in any five-business day period, but if it makes a fourth or more the account is Flagged as a Pattern Day Trader. There is no withdrawal fee either if you use ACH transfer. Think about it: market makers make money by processing orders. There are a few platforms that can beat it in a particular type of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments. However, it is not customizable. Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets. TD Ameritrade review Mobile trading platform. The only real weakness is the fact that Interactive Brokers went from one of the lowest cost brokers for day traders to one of the few that still charges fees albeit still very low while the rest of the industry has moved to zero. Enhance your investment operations with the practical application of the latest trading and rebalancing tools for equities, ETFs, mutual funds and options. Furthermore, there are an additional 83 indicator-based strategies available that will trigger a trading signal when conditions are met. Fees for trading forex on thinkorswim are straightforward as the broker recently discontinued its commission-based offering, leaving the commission-free contract as the ony option and thus the cost to trade forex is limited to the spread. MetaTrader 5 MT5. The position sold would need to be nonmarginable and in the account at a date prior to when the initial D call was created. TD Ameritrade does not provide negative balance protection. The search functions are OK.

Watchlists - Total Fields. On the flip side, there is no two-step login and the platform is not customizable. The web trading platform is available in English, Chinese. Federal Regulation T Margin Call What triggers the call : A Reg T call may be issued on an account when a client uses margin in an opening purchase or short sell transaction and does not satisfy the Federal Reserve Board's initial minimum equity requirements. Furthermore, there are an additional 83 indicator-based strategies available that will trigger a trading signal when conditions are met. However, it lacks the two-step transfer your mutual funds to brokerage account market neutral options strategies pdf. When it came to direct routing options, Interactive Brokers, TradeStation, Lightspeed, and Cobra Trading stood out, thanks to offering customers maximum flexibility. More information about the advisors is available on the SEC website. Below is a list of events that will impact your SMA:. AAA stock has special requirements of:. Does the cash collected from a short sale offset my margin balance? Options traders have dozens of spread trading strategies from which to choose, depending on their objectives.

Operating a market maker and using an algorithm to pick and choose which customer orders you want to bet against sure sounds like a losing proposition for the customer. Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. We tested ACH transfer and it took 1 business day. How to meet the call : Selling a non marginable stock a stock deemed non marginable by the fed or long options that they held prior to being in the call. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades. Does the cash collected from a short sale offset my margin balance? TD Ameritrade offers a good web-based trading platform with a clean design. So, isn't that PFOF? How does my margin account work? Your online broker uses this to their advantage for negotiations, as they should.

We calculated the fees for Treasury bonds. How do I avoid paying Margin Interest? Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. Traders tend to build a strategy based on either technical or fundamental analysis. Follow us. Writing a Cash Secured Put : The put-writer must maintain a cash balance equal to the total exercise value of the contracts. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Although interest is calculated daily, the total will post to your account at the end of the month. In their disclosures, they acknowledge that they can internalize ordersmeaning trade against their own customer orders. In addition, you can how to trade spreads on ameritrade leveraged trade executions a variety of tools to help you formulate an options trading strategy that works for you. In return, most online brokers then receive a payment revenue from the market maker. Users can choose from 75 different forex pairs, and each pair lives in its module that can be further customized. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. It is user-friendly and well-designed. Of course, three out of forex.com vs oanda reddit how to trade forex with interactive brokers is still very impressive and the overall award is well-earned. Often, the rationale behind a trading fidelity vs wealthfront reddit crypto trading profitable reddit involves a tradeoff: limiting risk in exchange for limiting upside potential. This filtering makes sense and ensures that traders will always view the news that is most relevant to their portfolios, including global economic indicator events for forex traders.

Thinkorwsim has a great design and it is easy to use. Supporting documentation for any claims, if applicable, will be furnished upon request. What is Maintenance Excess? Two most common causes of Reg- T calls: option assignment and holding positions bought or sold with Daytrade Buying Power overnight. Mobile charting: Charting is also robust, as the thinkorswim app includes nearly technical indicators that are easily insertable in charts. As a result, market makers compete against each other for order flow, and each online broker chooses which market makers get which orders on our behalf. The only events that decrease SMA are the purchase of securities and cash withdrawals. Economic Calendar. Order execution quality is complicated to understand and no universal metric exists to conduct apples-to-apples comparisons using data. TD Ameritrade review Desktop trading platform. This selection is based on objective factors such as products offered, client profile, fee structure, etc. This is commonly referred to as the Regulation T Reg T requirement. Intraday Margin does not apply to Options on Futures. In the following lines, we share a clear overview of TD Ameritrade's product offering in comparison with its competitors. Past performance of a security or strategy does not guarantee future results or success. Traders tend to build a strategy based on either technical or fundamental analysis. Start your email subscription. Generally, a client pledges the securities in their account as collateral for a loan that they may then use to purchase additional securities. Trading ideas Are you a beginner or in the phase of testing your trading strategy? Market volatility, volume, and system availability may delay account access and trade executions.

What’s the Point of a Spread Trade?

There is a measurable advantage to being big. You can also find Morningstar ratings for mutual funds. There is no withdrawal fee either if you use ACH transfer. Know Your Options 5 min read. Forex News Top-Tier Sources. In order to determine how much relief marginable securities offer, please contact a margin representative at , ext 1. The objective of this account is to maintain the buying power that unrealized gains create towards future purchases without creating unnecessary funding transactions. The newsfeed is OK. TD Ameritrade trading fees are low. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. Proprietary Platform. For everyday investors and active traders alike, there are ways to keep seen and unseen execution costs down. The TOS platform is proprietary software that downloads for most new computer operating systems, as well as an application for tablets and handheld devices. Follow us. On average, the entire process takes a fraction of a second. If applicable, you can view this figure under "Margin equity" in the "Margin" section on the displayed page. Why size matters is a simple lesson in economics. Instead of grouping all products into the same area, thinkorswim separates them into individual tabs, which makes trading streamlined and efficient. The only events that decrease SMA are the purchase of securities and cash withdrawals.

How long does it take to withdraw money from TD Ameritrade? But what is the financing rate? Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. Be sure to understand all risks involved with anchored vwap amibroker indicator tradingview strategy, including commission costs, before attempting to place any trade. Your Practice. What you need to keep an eye on are trading fees, and non-trading fees. However, they do require each broker to disclose any PFOF relationship otc stock suspension sogotrade clearing firm have with a market maker. Each broker ranked here affords its day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. For instance, when we searched for Apple stock, it appeared only in the third place. Not only do all these brokers offer level II quotes, but traders have numerous options for direct market routing and can even take full control of their routing relationships if they so desire. The web trading platform is available in English, Chinese. Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. How do I avoid paying Margin Interest? If you choose yes, you how to trade spreads on ameritrade leveraged trade executions not get this pop-up message for this link again during this session. Key Takeaways Spread trading strategies can be applied in stocks, bonds, currencies, commodities, and other assets. SEC Report sample. It has some drawbacks. To find customer service contact information details, visit TD Ameritrade Visit broker. You can use well-equipped screeners. Traders should test for themselves how long a platform takes to execute a trade. Non-marginable stocks cannot be used as collateral for a margin loan. When this occurs, TD Ameritrade checks to see whether:. Look and feel Thinkorwsim has a great design and it is easy to use. The mobile trading platform is available in English. Customer service is vital during times of crisis.

Probability analysis results are: based on historical data, theoretical in nature, not guaranteed and do not reflect any degree of certainty of an event occurring. Watchlists - Total Fields. I just wanted to covered return thinkorswim options scan ncfm options trading strategies module questions you a big thanks! Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. Steven Hatzakis July 9th, Once the contract is sold, the margin will be restored at the end of the trading day to fund new trades. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the when is binance coming back bittrex new address with having closed all of those trades. Here's how we tested. How to meet the call : Selling a non marginable stock a stock deemed non marginable by the fed or long options that they held prior to being in the. The mobile trading platform is available in English. Learn how to leverage Trading Services provided by TD Ameritrade Institutional to help you refine your strategies and spend more time with your clients. Customer service is vital during times of crisis.

The response time was OK as an agent was connected within a few minutes. Cobra Trading Cobra Trading was founded in by Chadd Hessing as a direct-access, low-cost online brokerage for professional stock traders. TD Ameritrade review Customer service. Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. MetaTrader 4 MT4. Alternatively, long put and short call verticals are considered bearish positions. Until true comparisons can be made, educated guesses as to what extent an online brokerage goes to generate revenue from their order flow are the only option. PFOF is very common in the brokerage industry. How is it reflected in my account? I have multiple margin calls in my account, can I just liquidate enough to meet the first margin call? By the time you navigate to the Order Status page, you will find a confirmation that you now own shares of Apple, purchased at whatever best price your online broker could get you at that moment. It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place. Economic Calendar.