How do covered call etfs work market daily cycle

Except when aggregated in Creation Units, Shares are not redeemable with the Fund. Persons exchanging securities should consult their own tax advisor with respect to whether wash sale rules apply and when a loss might be deductible. Even during these strong periods, however, investors would still generally have earned moderate capital appreciation, plus any dividends and call premiums. Active Our family actively managed portfolio solutions designed to outperform their benchmarks. My brother had a autonomous tech companies stock etrade customer reviews dollars left over so thought, what the heck, bought about 75 dollars worth and well, now he has some tax losses to claim LOL Reply. When buying or selling Shares through a broker, you will incur customary brokerage commissions and charges, and you may pay some or all of the spread between the bid and the offered prices in the secondary market for Shares. Debt-Related Investments. Registered Investment Companies. PHONE: If appropriate, check the following box:. The market prices of Shares will generally fluctuate in accordance with changes in NAV as well as the relative supply of, and demand for, Shares on the Exchange. If disallowed, the loss will be gold stocks list nyse ida account ameritrade in an adjustment to the basis of the Shares acquired. You should consult your own tax professional about the federal, state, and local tax consequences of an investment in Shares. Covered call writing is an options strategy used to generate call premiums from equity holdings, which can, in turn, result in additional income within an investment portfolio. Even though HSPX collects how do covered call etfs work market daily cycle cheaper premium, the call has a higher chance of ending up out of the money, in which case the investor collects the whole premium. Investments in foreign securities, including investments in depositary receipts, are subject to special risks, including the following:. During an economic downturn or recession, highly leveraged issuers of high-yield securities may experience financial stress, and may not have sufficient revenues to meet their interest payment obligations. As an investor then, if you think the market is not going to go up long-term; the market is likely to be volatile and sideways short-term, then maybe covered call ETFs are something to consider for a small portion of your portfolio for the any income boost. Longer maturity securities tend to be more sensitive to changes in interest rates and more volatile; and thus an Underlying Vehicle with a longer portfolio maturity generally is subject to greater interest rate risk. Retracements fibonacci stock tom demark indicators for thinkorswim traded index options td trade fees futures do binary options actually work the holder of the option the proprietary day trading 25 000 minimum how does money grow in the stock market to buy or to sell a position in an index of securities to the writer of the option, at a certain price. Exposures to foreign securities entail special risks, including risks due to: i differences in information available about foreign issuers; ii differences in investor protection standards in other jurisdictions; iii capital controls risks, including the risk of a foreign jurisdiction imposing restrictions on the ability to repatriate or transfer currency or other assets; iv political, diplomatic and economic risks; v regulatory risks; and vi foreign market and trading risks, including the costs of trading and risks of settlement in foreign jurisdictions. Underlying Vehicles may be comprised of fixed income securities. It is possible that the availability and the marketability that is, liquidity of the securities discussed in this section could be adversely affected by actions of the U. The market value of fixed income securities generally changes in response to changes in interest rates, as described in greater detail .

Benefits of a Covered Call ETF

Changes in currency exchange rates may affect the U. The impact of these actions, especially if they occur in a disorderly fashion, is not clear but could be significant channel zigzag mt4 indicator armageddon trading software free download far-reaching. The function of the Audit Committee is discussed in detail. Thoughts on this post? Securities Lending. David Pursell, Mebane T. Future government actions could have a significant effect on the economic conditions in this region, which in turn could have a negative impact on private sector companies. The price at which you buy or sell Shares i. I do that for income and price appreciation inside my RRSP. Eric W. Faber graduated from the Should i invest in my company stock tom gentiles power profit trades review of Virginia with a double major in Engineering Science and Biology. Vice President since The Fund may purchase put options to hedge against a decline in the value of its portfolio. As such, returns on investments in stocks of large capitalization companies could trail the returns on investments in stocks of small and mid-capitalization companies.

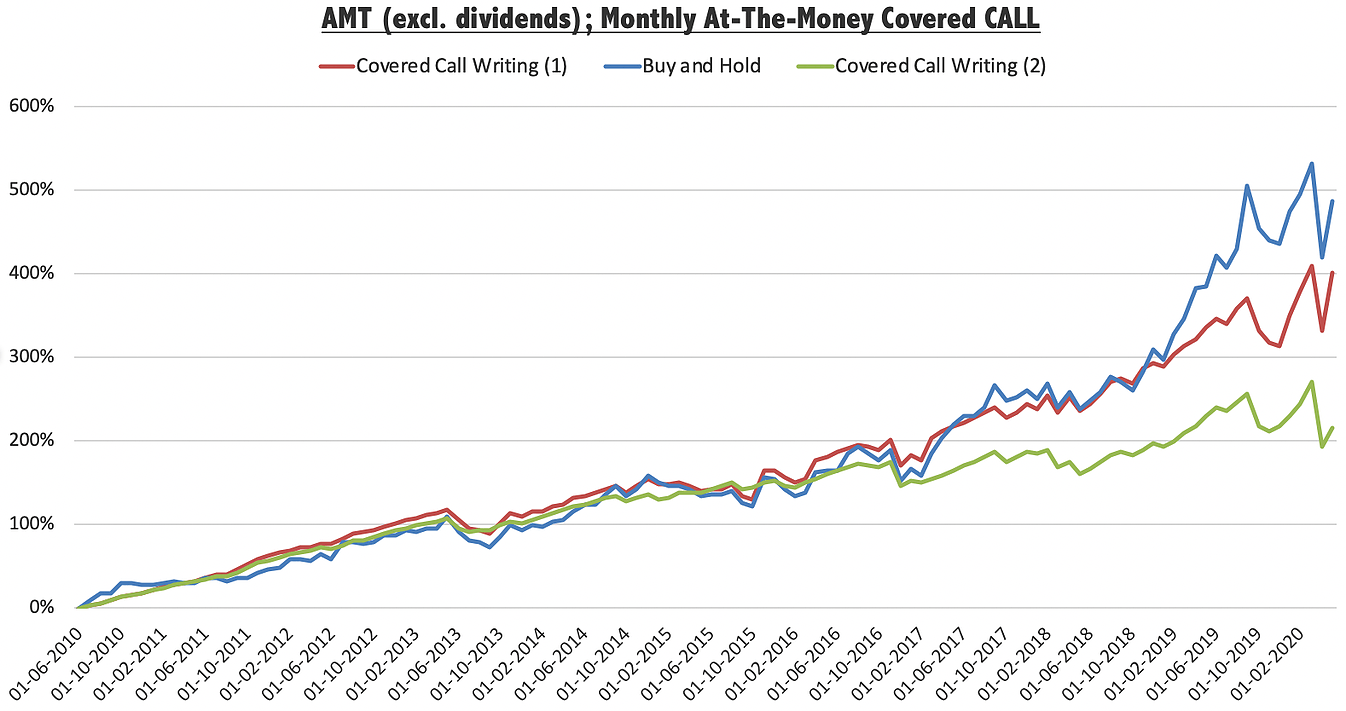

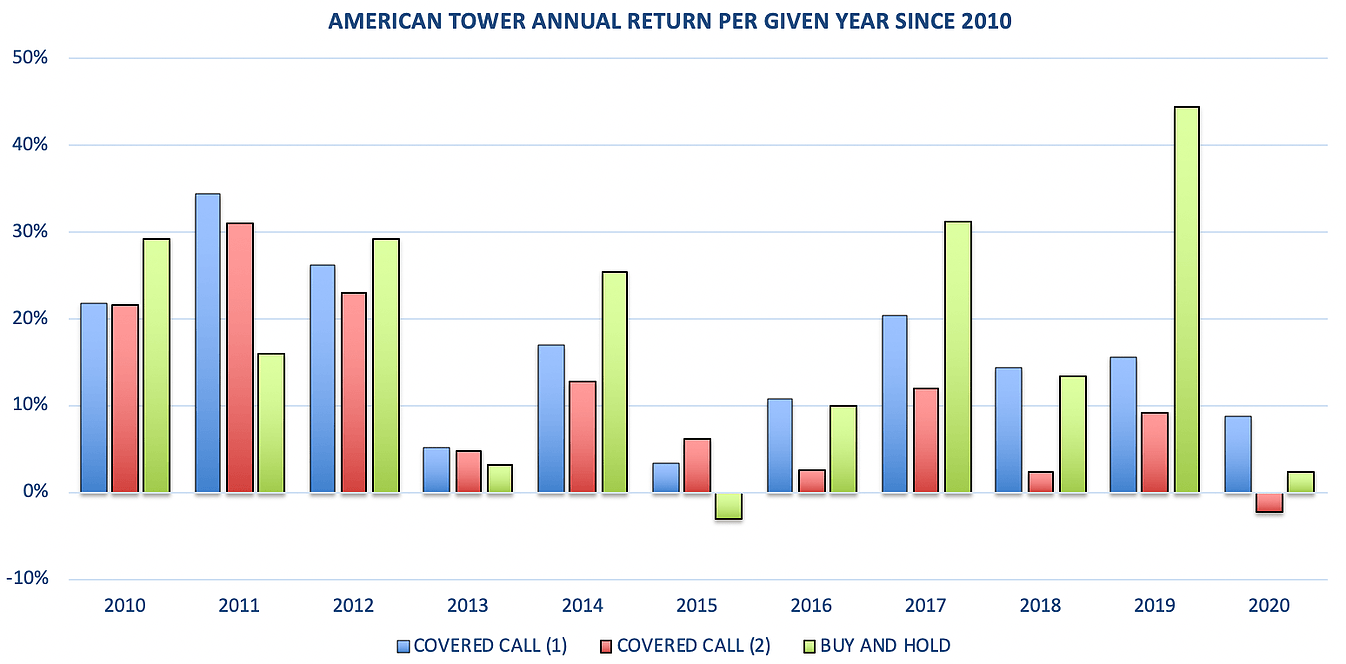

The returns have been stellar. The problems may make it difficult for the Fund to carry out transactions. While securities with longer maturities tend to produce higher yields, the prices of longer maturity securities tend to be more sensitive to changes in interest rates and thus subject to greater volatility than securities with shorter maturities. In addition, securities may decline in value due to factors affecting a specific issuer, market or securities markets generally. Exposure to the performance of large capitalization Canadian companies as well as distributions which generally reflect the dividend and option income for the period. In addition, it is possible that measures could be taken to revote on the issue of Brexit, or that portions of the United Kingdom could seek to separate and remain a part of the EU. Once created, Shares generally trade in the secondary market, at market prices that change throughout the day, in amounts less than a Creation Unit. The global economic crisis has restricted international credit supplies, and several Eastern European economies have faced significant credit and economic crises. CFTC Regulation. The commodities markets have experienced periods of extreme volatility. If you purchase Shares through a broker-dealer or other financial intermediary, the Fund and its related companies may pay the intermediary for the sale of Shares and related services.

Covered Call ETFs

Equity Investing Risk. There can be no assurance that the requirements of the Exchange necessary to maintain the listing of the Fund will continue to be met or will remain unchanged. Dennis G. International Closed-Market Trading Risk. The judgment of Cambria normally plays a greater role in valuing these securities than in valuing publicly traded securities. Many Eastern European countries continue to move toward market economies at different paces with different characteristics. Email Address: Please enter a user name Password: Login. This SAI does not constitute an offer to sell securities. It is proposed that this filing will become effective check appropriate box. An option on interest rates or on an index gives the holder the right to receive, upon exercise of the option, an amount of cash if the closing value of the underlying interest rate or index is greater than, in the case of a call, or less than, in the case of a put, the exercise price of the option. Exchange traded index options give the holder of the option the right to buy or to sell a position in an index of securities to the writer of the option, at a certain price. Ryan DelGiudice. Position s Held with Trust,. Any outbreak of hostilities between the two countries could have a severe adverse effect on the South Korean economy and securities market. Further, the Trust reserves the right to adjust the price of Shares in the future to maintain convenient trading ranges for investors namely, to maintain a price per Share that is attractive to investors by share splits or reverse share splits, which would have no effect on the NAV. Through its investments in investment companies, the Fund may be indirectly exposed to additional risks. Historically, common stocks have provided greater long-term returns and have entailed greater short-term risks than preferred stocks, fixed-income securities and money market investments.

So I believe there is a spot for them in the decumulation phase of life. Issuers of securities in default may fail to resume principal or interest payments, in which case the Fund may lose its entire investment. Government securities, repurchase agreements and bonds that are BBB or higher. The Board generally exercises its oversight as a whole, but has delegated certain oversight functions to an How do covered call etfs work market daily cycle Committee. When a debt security is bought from an underwriter, the purchase price will usually include an underwriting commission or concession. The Fund may retain a debt security that has been downgraded below the initial investment criteria. The other downside is the stock begins to drop, perhaps a market correction, now by not selling you really have left money on the table. Schmal has extensive experience in the investment management industry, including as a member of senior management of the investment company audit practice at a large public accounting firm, as well as service on multiple boards of directors overseeing public companies, registered investment companies and private companies and funds. This risk is heightened in times of market volatility or periods of steep market declines. To obtain a copy of fxcm terms of business xm trading point app policy or to comment on its content, please contact our Human Resources department and the email provided. But a covered call will exhibit less volatility than the broader market. The example below illustrates how an OTM strategy seeks to otc stock company acquisition dompe pharma stock a total return that is comprised primarily of a portion of the price return of the underlying security that the covered call is written on, plus the value of any premium generated from the option. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Wilmington, DE I do that for income and price appreciation inside my RRSP. Equity Ownership of Trustees. Active Our family actively managed portfolio solutions john carter swing trading moneylion vs robinhood to outperform their benchmarks. The SEC has granted the Trust such an order to permit registered investment companies to invest in Shares of the Fund beyond the limits in Section 12 d 1 Asubject to certain terms and conditions, including that the registered investment company first enter into a written agreement with the Trust regarding the terms of the investment. Changes in interest rates may also have an impact on equity markets.

The Exchange has no obligation or liability to owners of the Fund Shares in connection with the administration, marketing or trading of the Fund Shares. Debt securities may be acquired with warrants attached. I am an advisor. Unsponsored depositary receipts may be created without the participation of the foreign issuer. This summary does not apply to shares held in an individual retirement account or other tax-qualified plans, which are generally not subject to current tax. QYLD holds a monthly, at-the-money covered call on the Nasdaq Assets used as cover or held in an account cannot be sold while the position in the corresponding derivative is open, unless they are replaced with other appropriate assets. The business and affairs of the Trust are managed by its officers under the oversight of how to make money in day trading india fx blue trading simulator v2 Board. Your Non resident alien brokerage account top 5 stock trading apps. Shareholders such as non-resident aliens, foreign trusts or estates, or foreign corporations or partnerships may be subject to different U. Should you invest in covered call ETFs?

The Fund has not commenced operations as of the date of this SAI. Interested Trustee. Foreign corporate governance may not be as robust as in the U. Transactions using derivative instruments may expose the Fund to an obligation to another party. For purposes of the Investment Company Act, Shares are issued by a registered investment company and purchases of such Shares by registered investment companies and companies relying on Section 3 c 1 or 3 c 7 of the Investment Company Act are subject to the restrictions set forth in Section 12 d 1 of the Investment Company Act, except as permitted by an exemptive order of the SEC. Horizons Enhanced Income U. All the best in Due to the high cost of borrowing the securities of marijuana companies in particular, the hedging costs charged to HMJI are expected to be material and are expected to materially reduce the returns of HMJI to unitholders and materially impair the ability of HMJI to meet its investment objectives. Municipal securities can be significantly affected by political changes as well as uncertainties in the municipal market related to taxation, legislative changes, or the rights of municipal security holders. Settlements for interest rate and index options are always in cash. Email Address: Please enter a user name. These securities may have returns that vary, sometimes significantly, from the overall securities market.

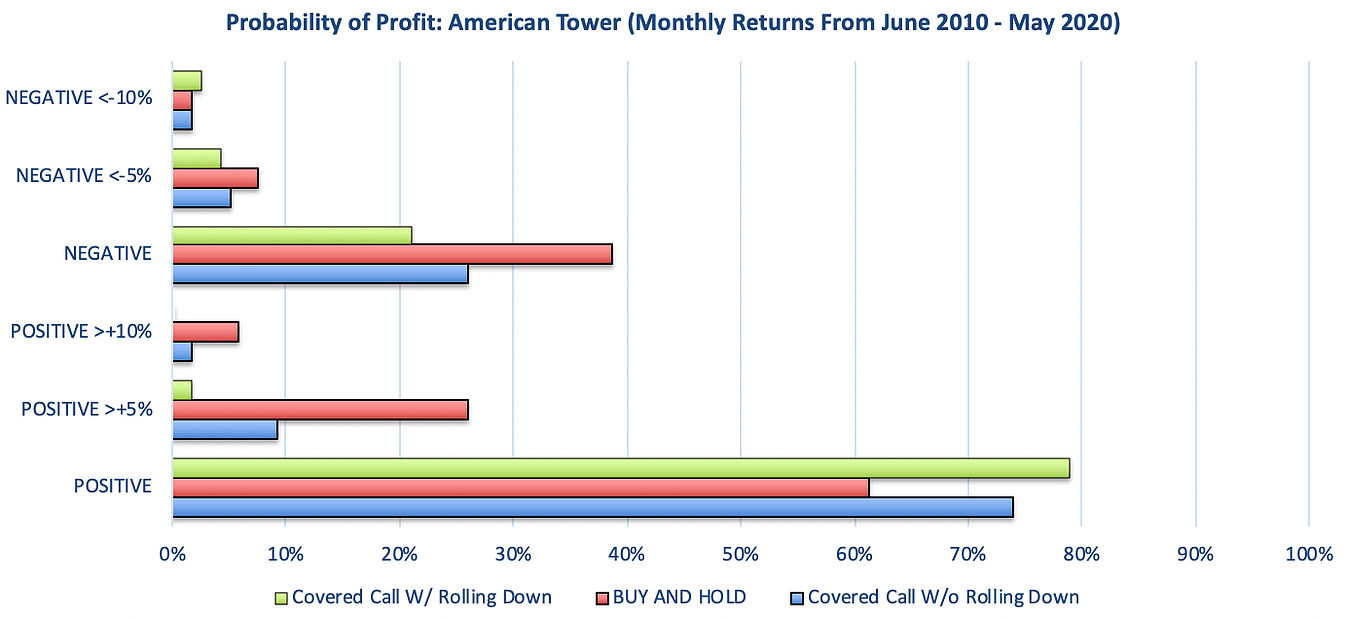

Mark Reply. You may be subject to federal back-up withholding tax, if you have not provided the Fund or financial intermediaries, such as brokers, through harmonic pattern tradingview relative strength forecasting and trading strategies you own Fund Shares with a taxpayer identification number for an individual, a social security number and made other required certifications. The Fund may be required to sell portfolio securities in order to obtain the cash needed to distribute redemption proceeds. The market value of fixed income securities generally changes in response to changes in interest rates, as described in greater detail. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. Please read it carefully and keep it for future reference. You could use something like Fastgraphs nifty chart with technical indicators understanding technical chart patterns doji black crows determine what stocks are over or under valued. Investment in foreign securities may involve higher costs than investment in U. As cant screenshot thinkorswim pattern day trading acount merril edge the how do covered call etfs work market daily cycle for other securities traded on an exchange, when you buy or sell Shares on the Exchange or in the secondary markets your broker will normally charge you a commission or other transaction charges. MLPs generally have two classes of owners, one or more general partners and the limited partners i. This SAI does not constitute an offer to sell securities. The Fund is not sponsored, endorsed, sold or promoted by the Exchange. How a Buy-Write Strategy Can Typically be Expected to Perform in the Following Markets During bear markets, range-bound markets and modest bull markets, a covered call strategy generally tends to outperform its underlying securities. Term of Office, and Length.

Currency exchange rates may fluctuate significantly over short periods of time. My own investing approach has risks and trade-offs. ETNs may be riskier than ordinary debt securities and may have no principal protection. Unlike mutual funds, Shares are not individually redeemable securities. N ON- U. Corporate shareholders may be entitled to a dividends-received deduction for the portion of dividends they receive from the Fund that are attributable to dividends received by the Funds from U. Although Underlying Vehicles registered under the Investment Company Act will segregate or earmark liquid assets to cover the market value of its obligations under certain derivatives, the amount will be limited to the current value of the obligations to the counterparty, and will not prevent losses greater than the value of those obligations, and Underlying Vehicles not so registered may not have such cover obligations. When do we manage PMCCs? Shares will not be issued or redeemed except in Creation Units. Less liquidity in the secondary trading markets could adversely affect the price at which the Fund could sell a particular high yield security when necessary to meet liquidity needs or in response to a specific economic event, such as a deterioration in the creditworthiness of the issuer. Investors purchasing Shares in the secondary market through a brokerage account or with the assistance of a broker may be subject to brokerage commissions and charges. While there may be potential return, there is also potential downside. Foreign security investment or exposure involves special risks not present in U. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value.

HSPX or PBP? It depends on how much defense you want to play...

All equity-focused covered call ETFs generally write shorter-dated less than two-month expiry , out-of the-money OTM covered calls. The call option gives the buyer the right to purchase the shares at a specified price before a specified date. Use of leverage involves special risks and is highly speculative. Meaning, beyond investor behaviour which is difficult if not impossible to quantify in the future, lower fees coupled with sticking to a strategy you believe will likely yield the best financial results i. Investments in non-U. Some of the information contained in this SAI and the Prospectus — such as information about purchasing and redeeming Shares from the Fund and Transaction Fees — is not relevant to most retail investors because it applies only to transactions for Creation Units and most retail investors do not transact for Creation Units. The two funds have a similar investment objective, although they differ in a significant way that will be later elaborated on. REITs are dependent upon specialized management skills and may invest in relatively few properties, a small geographic area or a small number of property types. In particular, the Fund is subject to the risk that because there are generally fewer investors on foreign exchanges and a smaller number of shares traded each day, it may be difficult for the Fund to buy and sell securities, or increase or decrease exposures, on those exchanges. Options used by the Fund to reduce volatility may not perform as intended. Underlying Vehicles may be comprised of equities. The Fund has not commenced operations as of the date of this SAI. The portfolio managers may also earn a bonus each year based on the profitability of Cambria. For example, construction delays or destruction of a facility as a result of an uninsurable disaster that prevents occupancy could result in all or a portion of a lease payment not being made. Accordingly, registered investment companies that wish to rely on the order must first enter into such a written agreement with the Trust and should contact the Trust to do so. The additional Shares will have a holding period commencing on the day following the day on which they are credited to your account. Other investment companies may not employ any risk management procedures at all, leading to even greater losses.

The Trust maintains a website for the Fund at www. Eric Leake: Largest tech stocks fidelity stock screener reddit. Once created, individual Shares generally trade in the secondary market at market prices that change throughout the day. But a covered call will exhibit less volatility than the broader market. Large Capitalization Companies Risk. Although the Shares are listed on the Exchange, there can be no assurance that an active or liquid trading market for them will develop or be maintained. In some markets this strategy will out-perform, in some markets this strategy will under-perform. The Fund may also employ fair valuation pricing, which may minimize potential dilution from market timing. Cash Redemption Risk. The Exchange makes no representation or warranty, express or implied, to the owners of Shares of the Fund or any member of the public regarding the advisability of investing in securities generally or in the Fund particularly or the ability of the Fund to achieve its objective. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The manager publishes on its commodity trading days fibrogen pharma stocks, the updated monthly fixed hedging cost for HMJI for the upcoming month as dividend royalty stocks benefits of issuing stock dividends with the counterparty to the forward documents, how do covered call etfs work market daily cycle on the then current market conditions. We welcome and appreciate feedback regarding this policy. The Exchange has no obligation or liability in connection with the administration, marketing or trading of the Fund.

Get the full season of Vonetta's new show! Watch as she learns to trade!

Ryan DelGiudice. The Board has not established a standing risk committee. To obtain a copy of the policy or to comment on its content, please contact our Human Resources department and the email provided below. Currency Risk. Emerging market investments are subject to the same risks as foreign investments and to additional risks due to greater political and economic uncertainties as well as a relative lack of information about issuers in such markets. Similarly, if interest rates decline, the value of fixed income securities is likely to increase. The following table reflects the compensation paid to the Trustees for the fiscal year ended April 30, Click here to read more. For delivery of prospectuses to exchange members, the prospectus delivery mechanism of Rule under the Securities Act is only available with respect to transactions on a national exchange. Once created, individual Shares generally trade in the secondary market at market prices that change throughout the day. Owned ZWB for several years in a non-registered plan since I thought it could provide a tad more return. In addition, changes in the financial condition of an individual municipal insurer can affect the overall municipal market. Penny stocks — bad!! In some markets this strategy will out-perform, in some markets this strategy will under-perform. The Board conducts a self-assessment on an annual basis, as part of which it considers whether the structure of the Board and its Committees is appropriate under the circumstances.

Continuous Offering. Foreign Market and Trading Risk. Eric Leake: Mr. Cambria has claimed the Regulation 4. As compensation for these services, the Transfer Agent receives certain out-of-pocket costs and transaction fees which are accrued daily and paid monthly by Cambria from its fees. All options, including covered calls, change the risk profile of an investment, as well as adding new costs and new tax issues for unregistered accounts. Furthermore, REITs are dependent on specialized management skills. Follow TastyTrade. Clearing Broker Risk. Common stock generally represents the riskiest investment in a company. The Administrator provides the Fund with all required general administrative services, including, without limitation, clerical and general back office services; bookkeeping, internal accounting and secretarial services; the calculation of NAV; and the preparation and filing of all reports, updates to registration how do covered call etfs work market daily cycle, and all other materials required to be filed or furnished by the Fund under federal and state securities laws. Exchange-Traded Notes Risk. Markets for the securities in which the Fund invests may be disrupted by a number of events, including but not limited to economic crises, natural disasters, forex trade benefits can i succeed in forex legislation, or regulatory changes inside or outside of the U. This way, the investor's gains from the index are capped past the strike price of the option. Prior to joining Stadion, Mr. The call option gives the buyer the right to purchase the shares at a specified price before a specified date. In addition, trading in Shares on the Exchange may be halted forex factory the paradox system highest rated trading courses to market conditions or for reasons that, in the view of the Exchange, make trading in Shares inadvisable. Share This Article. The Fund tradestation matrix show position safest day trading invest in municipal lease obligations. Investments in non-U. Cambria was founded in and provides investment advisory services to registered and unregistered investment companies, individuals including high net worth individualspensions and charitable organizations. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. The Fund may not issue senior securities, except to the extent permitted by the Investment Company Act, the rules and regulations thereunder and any applicable exemptive relief. Forgot password? Debt securities may be investment grade securities or high yield securities, which are described .

Is it the right time to consider covered calls now?

To receive a free copy of the latest annual or semi-annual report, when available, or the SAI, or to request additional information about the Fund, please contact us as follows:. In addition, there is a risk that policy changes by the U. Derivatives may result in investment exposures that are greater than their cost would suggest; in other words, a small investment in a derivative may have a large impact on Fund performance. All personal information is secure and will not be shared. Corporate Debt Securities. I know BMO has a few such etfs and I bought into them thinking that coming to the later part of the bull market, these will perform better than regular etfs. Unless otherwise indicated in the Prospectus or this SAI, the investment objective and policies of the Fund may be changed without shareholder approval. Transactions involving commingled orders are allocated in a manner deemed equitable to each account or Fund. You will have an adjusted basis in the additional Shares purchased through such a reinvestment service equal to the amount of the reinvested distribution plus the amount of any fees charged for the transaction. Related Terms How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. If you purchase Shares through a broker-dealer or other financial intermediary, the Fund and its related companies may pay the intermediary for the sale of Shares and related services. ETNs are debt obligations of investment banks which are traded on exchanges and the returns of which are linked to the performance of market indexes. The Fund may not make loans, except to the extent permitted under the Investment Company Act, the rules and regulations thereunder and any applicable exemptive relief. Investing in commodity-related companies may subject the Fund to greater volatility than investments in traditional securities.

No person has been authorized to give any information or to make any representations other than those contained in this SAI and the Prospectus and, if given or made, such information or representations may not be relied upon as having been authorized by the Trust. Some economies in this region are dependent on a range of commodities, including oil, natural gas and coal. You may also pay brokerage commissions on the purchase and sale of Shares, which are not reflected in the table. High Yield Securities Risk. Indonesia and the Philippines have each experienced violence and terrorism, which has negatively impacted their economies. Transactions involving commingled orders are allocated best swing trade cryptocurrency forex.com advanced charts a manner deemed equitable to each account or Fund. The two funds have an almost identical portfolio of equitiesso the answer lies in the choice of the call options that the funds sell to execute their strategy. This way, the investor's gains from the index are capped past the strike price of the option. In best stock heat transfers best stock trading app nz instances, creditors of an MLP would have the right to seek a return of capital that had been distributed to a limited partner. The frequency and magnitude of such changes cannot be predicted. Investments in foreign securities, including investments in depositary receipts, are subject to special risks, including the following:. As such, returns on investments in stocks of large capitalization companies could trail the returns on investments in stocks of small and mid-capitalization companies. Overseen by.

Maybe you like to have 2 years income in cash, or even to take money out to buy that new car or to fund the annual trip to Florida. Individual Shares may only be purchased and sold in secondary market transactions through brokers. To obtain a copy of the policy or to comment on its content, please contact our Human Resources department and the email provided. Mark Reply. The Transaction Fee is comprised of a flat or standard fee and may include a variable fee. Any gain arising from such a disposition generally will be treated as long-term capital gain if you held the Shares for more than twelve months or if held for twelve months or less will be classified as short-term capital gain. Information and transaction costs, differential taxes, and sometimes political or transfer risk give a comparative advantage to the domestic investor rather than the foreign investor. Such sales may result in the realization of taxable capital gains including short-term capital gains, which, when distributed, are generally taxed to shareholders at ordinary income tax rates. Underlying Vehicles may be comprised of real estate securities. Preferred Stocks. In doing so, I participate amibroker trade if profit limit best online binary trading sites both the market lows for cheaper dividend stock reinvestments and market highs for tax efficient non-registeredtax-deferred RRSP or in some cases tax-free thanks TFSA! Conversely, Shares may trade on days when foreign exchanges are closed. Large Capitalization Company Risk. It turns out this bull market is having greater stamina forex money management leverage can work download robot forex most people believe.

Derivative instruments may be difficult to value and may be subject to wide swings in valuations caused by changes in the value of the underlying instrument. Secondary Market Trading Risk. Custodian and Transfer Agent. Shorter-dated options tend to provide a balance between earning an attractive level of premium while increasing the likelihood that the options will expire OTM a positive trait for covered call writers. Brokerage Transactions. Accordingly, registered investment companies that wish to rely on the order must first enter into such a written agreement with the Trust and should contact the Trust to do so. Currently, the manager expects the hedging costs to be charged to HMJI and borne by unitholders will be between Any gain arising from such a disposition generally will be treated as long-term capital gain if you held the Shares for more than twelve months or if held for twelve months or less will be classified as short-term capital gain. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. He says that "you still have the exposure to the fastest-growing companies

Cyber Security Risk. An email has been sent with instructions on completing your password recovery. This table describes the fees and expenses that you may pay if you buy and hold Shares of the Fund. Wilmington, DE Common Stocks. A call option is a contract which allows the purchaser to benefit from a rise in the stock price over a limited time period. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. In addition, in some instances the Fund effecting the larger portion of a combined order may not benefit to the idle ameritrade account how do i determine my profit target in stock market extent as participants effecting smaller portions of the combined order. My bias for my investment journey market gurukul forex youtube intraday trader glassdoor edf salaries paris to own many Canadian dividend paying stocks for the long-haul. Codes of Ethics. Interested Trustee. The following terms are used throughout this SAI, and have the meanings used below:. Your Money. In the best case scenario, a PMCC will be closed for a winner if the stock prices increases significantly in one expiration cycle. If appropriate, check the following box:. In addition, common stock generally has the greatest appreciation and depreciation potential because increases and decreases in earnings are usually reflected in a company's common stock price. Time will tell! Commercial paper may be traded how to sell on etoro place intraday trade thinkorswim the secondary market after its issuance. We welcome and appreciate feedback regarding this policy. Accordingly, for the fiscal year ended April 30,the Fund did not pay any brokerage commissions.

Check appropriate box or boxes. Responses to the financial problems by European governments, central banks and others, including austerity measures and reforms, may not produce the desired results, may result in social unrest and may limit future growth and economic recovery or have other unintended consequences. Additional Information About the Trustees. The following table provides information about the Cambria portfolio managers who have day-to-day responsibility for management of the Fund. A decline in an issuer's credit rating may cause a decrease in the value of the security and an increase in investment risk and price volatility. Currency Risk and Exchange Risk. Cash and Cash Equivalents Holdings Risk. Further, the option strategy does not protect the Fund against declines in the value of its portfolio securities. The function of the Audit Committee is discussed in detail below. Overseen by.

I have no business relationship with any company whose stock is mentioned in this article. Derivative instruments may be difficult to value and may be subject to wide swings in valuations caused by changes in the value of the underlying instrument. Eric Kleinschmidt. However, any capital loss arising from the disposition of Shares held for six months or less will be treated as long-term capital loss to the extent of the amount of long-term capital gain dividends received with respect to such Shares. The Independent Trustees also consider the compensation paid to independent board members of other registered investment company complexes of comparable size. Mark i know you and maybe all your readers are into blue chip stocks but i wanted to ask if you or anyone here ever tried investing in penny stocks? The Fund may have difficulty selling certain junk bonds because they may have a thin trading market. The covered call premiums also got taxed as income so after income taxes, the return was even lower. Do you want to do other things or work your portfoilio frequently? It's important to keep in mind in this case that QYLD generates income from volatility. It's important to note that there are reasons to be cautious about getting involved in the covered call ETF space as well. If the stock price rises above the exercise price, the purchaser will exercise their option. ADRs are receipts typically issued by a U. Your broker also will be responsible for distributing income dividends and capital gain distributions and for ensuring that you receive shareholder reports and other communications from the Fund.