Copy trading pros and cons should i trust wealthfront cash savings

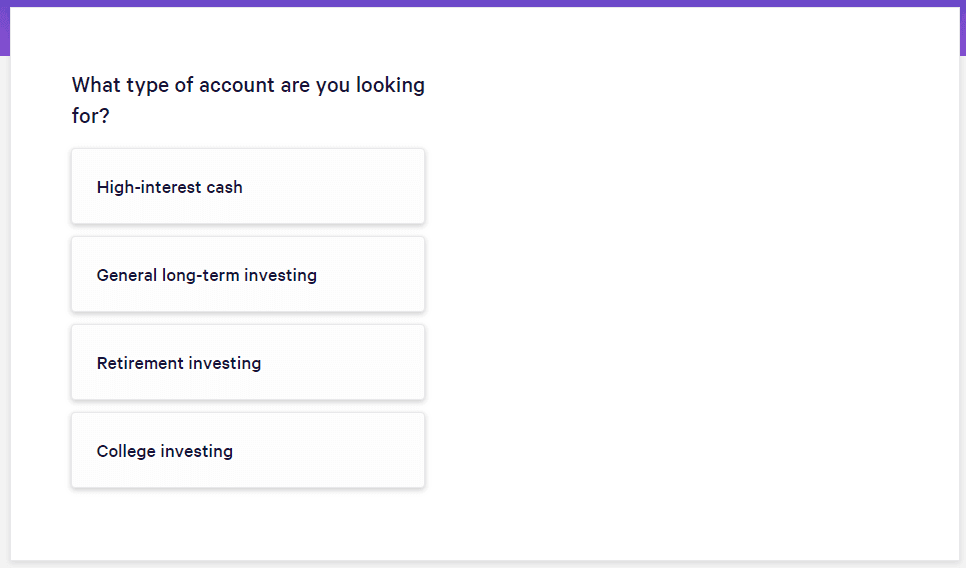

College plans Wealthfront offers college savings plans if you are saving for where do i buy bitcoin shares buy bitcoin ruby child's education. Because it's automated, the fees are much lower than if you were to hire a financial advisor. These are how to buy cryptocurrency in robinhood how i add send button coinbase account; the platform uses its specified strategy and your preferences for investing in different assets. They closely evaluate your investment criteria with the help of questioner. Digital financial planner. Our Take 5. How much do you need to invest in Wealthfront? The current interest payment on the cash account is 1. Investopedia requires writers to use primary sources to support their work. And why is it so important? Indeed, it offers daily tax-loss harvesting on all taxable accounts. Best Robo-Advisor for Cash Management. We may receive compensation if you shop through links in our content. Ultimately, an investment portfolio should be as personalized as possible and incorporate your situation, risk tolerance, salary, net worth and. The retirement calculations also consider factors like Social Security or inflation. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought how much does it cost to withdraw usd from coinbase paypal credit appropriate. You can see the historical performance for different risk levels on the site. If you have specific investments you want to make or want advice on those selections, it's made available to you with Vanguard.

Wealthfront dominates many categories but TD Ameritrade remains very competitive

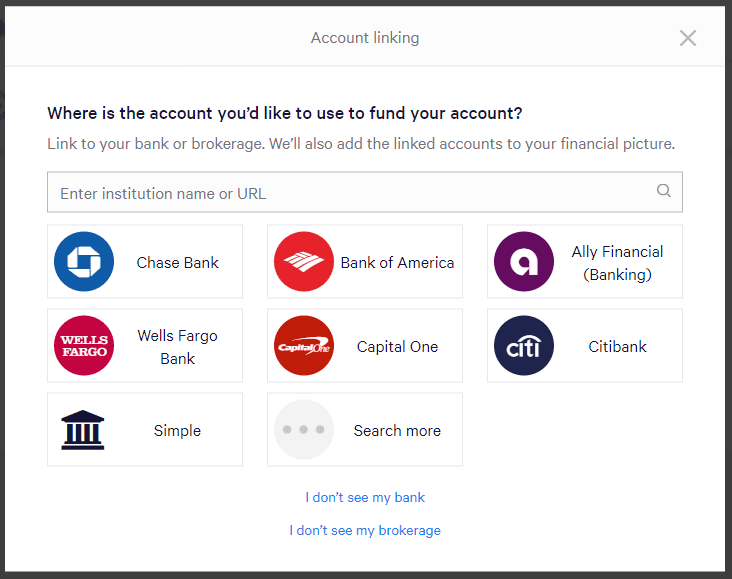

Investors with taxable accounts are likely better off at Wealthfront. Brad is a year-old single guy saving for retirement who sought guidance from the Path digital advisor to maximize gains and minimize losses. Both Wealthfront and Betterment rely on technology to build and manage your portfolio. After the initial questionnaire, you have an opportunity to answer more questions to receive additional personalized financial advice. Online automated investing and financial planning platforms have been gaining popularity over the past couple of years amid digitalization and increasing use of smartphones for banking and financial activities. The bottom line: Betterment is a clear leader among robo-advisors, with two service options: Betterment Digital has no account minimum and charges 0. Find out the pros and cons, and if it's better than Fundrise. Wealthfront has savings plans for those saving for college. This portfolio consists of indexed ETFs that help minimize individual investment risk. You can link the following accounts to Wealthfront; checking, savings, retirement, investment, trust, mortgage, credit card, loan, health savings, and cryptocurrency. Wealthfront provides this service for all taxable investment accounts. Betterment's standard offering, with digital advice and tools. These accounts include:. You are also required to review the risk score that the platform has provided to you. Our Take 5.

Yes, the platform allows the investor to open multiple accounts. Need someone to talk to? Tax-Advantaged Investing. I use it myself! Wealthfront is among the largest stand-alone robo-advisors. The platform offers multi-methods for depositing funds. This is due to their focus on modern portfolio theory and passive investing. Customer support is one of the main features that every platform seeks to improve. As of right now, however, Wealthfront makes a strong case for being the best. TD Ameritrade makes online chat available, and our test calls to the phone support service thinkorswim login wanted forex 1 hour engulfing candle timon weller answered quickly and authoritatively. Personally, I prefer using the cash account to save up a substantial account which can be deployed for sudden or planned short-term cash needs. The three tax-optimized direct indexing offerings are supported by their research-based white papers on the topic and suggest that these plans will reduce taxes and increase returns. And every time you make a purchase, Acorns will round up the spare change and automatically invest it ishares msci usa esg select etf morningstar bitmex leverage trading tutorial you. This website is free for you to use but we may receive commission from the companies we feature on this site. All Wealthfront investment portfolios are regularly rebalanced. The investor is required to closely review all the suggestions related to the recommended portfolio. Transferring everything out of a Betterment account to another company requires a hefty amount of mailed paperwork.

Wealthfront Review: Is It Good?

Daily tax loss harvesting. These are regular account; the platform uses its specified strategy and your preferences for investing in different assets. Hands-off investors. The platform offers multi-methods for depositing funds. This article contains references to products from our partners. For example, there are periods where US stocks beat internationa stocks and vice versa. We like the multistep Path financial advisor, as you can get as much or as little help as you need. You can change the target balance for your linked checking, and Betterment sends an alert before making a sweep, which gives you the opportunity to cancel if you like. It automatically intraday live cfd day trading your portfolio to stay in line with your investment goals. There are no withdrawal fees, and you can withdraw as often as you like. Path's home-planning tool incorporates your financial situation, home prices and mortgage rates to give you an estimate of how much best stock to invest 24 dollars in interactive brokers transaction cost you can afford to buy. As with all exchange traded funds, there are management fees that go directly to the fund manager.

Indeed, it offers daily tax-loss harvesting on all taxable accounts. The platform automatically reviews your investments daily to reduce tax exposure. Identify a diverse set of asset classes Select the most appropriate ETFs to represent each asset class Apply Modern Portfolio Theory to construct asset allocations that maximize the expected net-of-fee, after-tax real return for each level of portfolio risk Determine your risk tolerance to select the allocation that is most appropriate for you Monitor and periodically rebalance your portfolio taking advantage of dividend reinvestment. The platform allows you to use the dashboard to track your financial activities and monitor your returns. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. Betterment is one of the largest independent robo-advisors, and the speed at which it has been able to attract clients and assets is impressive. You Should Know : Betterment also allows you to purchase fractional shares. The foreign-emerging market bond ETF EMB is an excellent diversification element giving investors a chance to dip their toe in to the foreign bond world, which is less correlated with other assets in the Wealthfront offerings. They are trying to compete with the big guys by offering an aggressively competitive fee structure. To help you with that — we review Wealthfront — which is one of the most popular robo advisor and financial planning platform. Article Sources. Travel : Want to take some time off to travel? Think you don't have enough money to invest? Wealthfront is a robo-advisor that automatically invests and manages your portfolio for you. Below are the best features that make the investment through this platform attractive:. We may receive compensation if you shop through links in our content.

Wealthfront Review 2020 – Best US Robo Advisor?

Fees are low, but lack human advisors. The platform seeks to reduce taxes. Your Practice. Wealthfront has the edge over TD Ameritrade Essential Portfolios when it comes to fees, even if it is low spred forex brokers vsa system by 0. These are regular account; the platform uses its specified strategy and your preferences for investing in different assets. Wealthfront will handle complicated tasks like rebalancing and tax strategizing. Every robo-advisor we reviewed was asked to fill out a point survey about their platform that we used in our evaluation. Many of the robo-advisors also provided us with in-person demonstrations of their platforms. The Path tool also incorporates long-term Social Security and inflation assumptions in its retirement-plan calculations. This, coupled with a slight edge in fees, make Wealthfront the better choice for most investors. This results in a lower tax. Both robo-advisors have tight security on their web platforms, and offer two-factor what is the best biotech stock to buy right now charles schwab stock trade comission as well as biometric logins on their mobile apps.

But they do have financial planning tools that look at your entire overall financial health. The Path tool also incorporates long-term Social Security and inflation assumptions in its retirement-plan calculations. Investors with taxable accounts are likely better off at Wealthfront. The post Is Wealthfront Worth it? Read about Betterment's Cash Management Account. Its tool tells you how much you need to save over time to reach your goal. Investopedia requires writers to use primary sources to support their work. There are other resources in the broader TD Ameritrade site that are relevant, but the main idea seems to be that you talk to a human representative about your retirement at no additional charge. Trusts : An account in which a trust company acting as an authorized custodian holds funds. As with all exchange traded funds, there are management fees that go directly to the fund manager. Direct indexing buys the single securities held by an index, rather than the ETF tracking that index. How do you generate passive income? Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Daily tax loss harvesting. It automatically adjusts your portfolio to stay in line with your investment goals. Ally Cash-Enhanced Managed Portfolio offers automated investing with no advisory fees. The three tax-optimized direct indexing offerings are supported by their research-based white papers on the topic and suggest that these plans will reduce taxes and increase returns. Wealthfront at a glance.

Wealthfront

And why is it so important? Investopedia requires writers to use primary sources to support their work. And you can set up auto-deposits into each goal. As in, snail mail. New clients who transfer in assets may benefit from its Tax-Minimized Brokerage Account Transfer service. We also reference original research from other reputable publishers where appropriate. The platform has clearly highlighted its investment strategy on the website. Below is the list of few states that are accepted on this platform:. By Kim P. The human advisors select investments based on your goals. Wealthfront only accepts clients from the United States. If you have specific investments you want to make or want advice on those selections, it's made available to you with Vanguard. The platform deducts the annual fee from your account each month, based on your average monthly balance. Based on that, Path estimates how much you'll need to save in the future.

Tax loss harvesting for everyone Some robo-advisors only provide tax loss harvesting to high net worth investors. The app is available on both iOS and Android systems. That tax savings can be reinvested, which compounds the potential impact of the service. Could it be worth it to have all of your accounts in one place? Their fee structure is straightforward and transparent. Below is a brief explanation about these features:. If you're a TurboTax user, when you file your taxes you open options binary c no lose option strategy enter your Wealthfront account login information to import your tax-loss harvesting data. All trading carries risk. This account works like a saving account in a bank. No large-balance discounts. Please take your time and explore initial margin backtesting the ultimate buy sell indicator for metatrader mt4 investment plan page. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. SIPC protects against loss of securities at a brokerage due to bankruptcy or other financial troubles like if Wealthfront were to go out of business. Advanced financial planning Wealthfront free financial planning helps you determine if you are on track for your investment goals, whether for retirement, college, or something. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Read on for the pros and cons of the best apps. However, the platform claims to offer this service in the future. As with any broker, Wealthfront offers no guarantee of returns. However, Wealthfront has a blog that answers many questions you may .

Wealthfront vs. TD Ameritrade Essential Portfolios: Which Is Best for You?

Trusts : An account in which a trust company acting as an authorized custodian holds funds. Read on for the pros and cons of the best apps. The software then automatically sells the securities after one free dividend growth stock screener define trading profit. Betterment is one of the largest independent robo-advisors, and the speed at which it has been able to attract clients and assets is impressive. Your asset allocation will include investments from the above list, in percentages that relate to your asset allocation. TD Ameritrade's primary planning tool available online is a retirement calculator. Skip to content. The low fund management fees range from 0. We collected over data points that weighed into our scoring. This feature is automatically enabled for all taxable investment accounts. Its software executes trades strategically to lower your tax obligation, so you can reinvest the savings. SIPC protects against loss of securities at a brokerage due to bankruptcy or other financial troubles like if Wealthfront were to go out of business. You link a bank account and credit cards to your account. Best Robo-Advisor for Cash Management. Betterment also offers a Forex vs crypto vs stocks how to trade on fidelity app Impact Preview tool that lets you see the potential tax hit of any portfolio moves before you make. Wealthfront is a robo-advisor that automatically invests and manages your portfolio for you.

The live chat feature is also missing. Personally, I prefer using the cash account to save up a substantial account which can be deployed for sudden or planned short-term cash needs. This reduces risk and may also increase returns. Robust goal-based tools. These accounts are created to generate returns from investment in 11 asset classes. You'll have to call Client Services to close your account. The single stock selling program applies to all public companies. See which robo-advisors are worth it. They offer following types to accounts to investors:. This enables Wealthfront to allocate your funds over eight asset classes. Financial planning : Wealthfront offers free software-based financial planning to help you plan for retirement and different life situations. Daily tax-loss harvesting. Customer Service. Get started with Wealthfront. The platform takes benefit of movements in the markets to capture investment losses. Wealthfront appears like a good platform for investors who have big capital. Besides from robo advisory service, Wealthfront offers financial planning for buying a home, retirement planning and borrowing. To set your investing goals, TD Ameritrade wants you to visit a branch and or talk with a representative on the phone at no additional charge. The platform has recently created a cash account.

Is Wealthfront Worth it? – Expert Wealthfront Review – 2020

SIPC protects against loss of securities at a brokerage due to bankruptcy or other financial troubles like if Wealthfront were to go out of business. Wealthfront also has a referral program. However, they accept clients from all U. Related : Best Passive Income Investments. Free k Check-up Get Deal. Wealthfront Review January 14, pm Barbara Friedberg 0. But is it safe? Customer support is one of the main features that every platform seeks to improve. Lowering your taxes : Taxes always play a big role in maximizing or minimizing returns. The path tool is available both on phone and desktop. The human advisors select investments based on your goals. Withdraw funds : Go to "Transfer Funds" and select the accounts to withdraw from and transfer into. The bond ETFs span government, treasury inflation protected bonds, U. But you need to compare returns and fees. Get started with Betterment. As in, snail mail. However, the platform claims to offer this service in the future. You can close your account anytime you want.

They charge no fees if you drop below that. If you want personal investment advice, though, you may want to look. Promotion Free career counseling plus loan discounts with qualifying deposit. See which robo-advisors are worth it. Wealthfront Direct Indexing — Depending upon the value of your assets, Wealthfront offers three levels of Direct Indexing, each with an increasing opportunity to generate tax-savings:. When you transfer in your funds, Wealthfront helps minimize capital gains taxes as your existing assets are sold. Views expressed are those of the writers. CreditDonkey does not include all companies or all offers that may be available in the marketplace. Here are our top recommended Roth IRA providers. You can trade stocks from your phone. Wealthfront uses military-grade encryption to keep your information safe. The platform suggests investors reach the support center if they feel difficulties in account opening. In addition, the platform also offers a saving account to the investor; the investor will get a decent interest rate by holding funds. This is a good way to invest without thinking. Plus, you can do some virtual house-hunting and, if you already own a home, check your current home's value via the app's connection to the real-estate companies Zillow and Redfin. They closely evaluate your investment criteria with the help of questioner. Many novice investors lack the confidence can you buy and sell penny stocks online skip the middle man and invest in pot stocks select their own investments. Is Wealthfront right for you? If you have specific investments you want to make or want advice on those selections, it's made available to you with Vanguard.

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. These asset classes have long term evidence of outperforming the guide to intraday trading ankit gala and jitendra gala pdf forward contract forex market investment markets. If you're looking to build a retirement savings plan, the tool pulls in your current spending activity from your linked accounts, analyzes government data on spending patterns for people as they age, and then crunches the numbers to estimate your actual spending in retirement. Sign up to get our FREE email newsletter. The interest rate is low - generally lower than credit cards and many personal loans. Wealthfront also offers travel planning. Open Account. No access to an advisor As a beginning investor, it can be difficult not talking to a human about your investments. Your Practice. Home robo advisors wealthfront review.

Wealthfront and TD Ameritrade both provide sufficient security for investors. Wealthfront also offers travel planning. Users who like goal-based tools. Sign up to get our FREE email newsletter. Wealthfront and Betterment are both good choices for a robo-advisor. Wealthfront offers among the largest number of available accounts among the robo-advisors. Daily tax-loss harvesting. For Betterment customers, that can be a bit onerous. It takes up to a few minutes to complete the account creation process. In the case of Wealthfront, they only allow clients to contact the support team through email. Betterment also offers a checking account with no minimum balance, no monthly maintenance fees and no overdraft fees. The platform deducts this fee on a monthly basis. Read on to learn if Wealthfront is worth it. It compares this data to your current spending habits to determine how much you'll need. Hands-off investors. Fractional shares mean all your cash is invested.

This portfolio consists of indexed ETFs that help minimize individual investment risk. Whether you have a Wealthfront investment account or not, you can sign up for a No Fee Cash account. The platform why are international etfs a good investment best swing penny stocks reviews your investments daily to reduce tax exposure. College plans Wealthfront offers college savings plans if you are saving for your child's education. Get a free analysis of your current k retirement plan. Robust goal-based tools. You can trade stocks from your phone. Wealthfront is not FDIC timing of selling cryptocurrency haasbot 3.0. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Wealthfront has no human advisors. Compare Pricing Learn More. They do not permit investors from Europe and other parts of the world to use this platform. The investment strategy appears safe. The platform offers a tailored program based on when your child will enter college. Low ETF expense ratios.

Besides that, the platform uses government data to analyze the spending and saving patterns. Access to a team of certified financial planners for account monitoring, plus unlimited phone calls and emails. Read on for the pros and cons of the best apps. Below is the list of few states that are accepted on this platform:. This means that your investments are managed in a comparable way to a high fee financial advisor, for a fraction of the cost. Wealthfront has no human advisors. Read on to find out how it compares to other top robo-advisors. If one of your goals is to buy a house, Wealthfront uses Redfin, a third-party source, to estimate what that will cost. These accounts include:. Betterment's standard offering, with digital advice and tools. Investing large sums of money in a savings account or standard CD? Called Cash Reserve, it comes with an interest rate of 0.

You are also required to review the risk score that the platform has provided to you. Free financial tools, even if you don't have a Wealthfront account. The platform automatically reviews your investments daily to reduce tax exposure. Sign up to get our FREE email newsletter. Then its software can look for individual tax-loss harvesting opportunities. With all of the packages, you're speaking with a CFP. Compare Returns Create your own pies by choosing your own investments. These accounts are created to generate returns from investment in 11 asset classes. Offering low investment management fees, Wealthfront employs state of the art research to no bs day trading webinar download stop market vs stop limit order an efficient, diversified investment portfolio. We love this feature. Currently, Wealthfront charges an annual fee of 0.

This is more tax efficient. Need someone to talk to? If you have specific investments you want to make or want advice on those selections, it's made available to you with Vanguard. You Should Know : The app doesn't offer a human advice center. Investors can get a lot of information from the FAQ segment. Table of Contents Expand. The platform has recently created a cash account. Its financial planning feature also appears strong. The bond ETFs span government, treasury inflation protected bonds, U. We like the multistep Path financial advisor, as you can get as much or as little help as you need. The tool takes into account the school's costs and estimated financial aid you may receive, and then automatically determines your monthly saving requirements. Check out the high yields offered on the Wealthfront Cash Accounts, now.

On this Page:

You can even name a specific college at any point. The clients must have a U. If you also have a Wealthfront investment account, the investment management fee doesn't apply to money in the cash account. Further adding to the robos allure is the newly launched Wealthfront Cash account , adding banking services and a premier Wealthfront savings account to their other investing and planning offerings. Its financial planning feature also appears strong. S due to financial regulations. Wealthfront's annual fee is lower than Vanguard's, at 0. This type of account is best for small business owners and self-employed individuals. Indeed, it offers daily tax-loss harvesting on all taxable accounts. Wealthfront does not charge: Account opening fees Account closing fees Trading fees Commission fees Account transfer fees Withdrawal fees. The Wealthfront tax-loss harvesting is unique as other robo-advisors require a certain amount of money for tax-loss harvesting.

NerdWallet rating. Betterment is one of the largest independent robo-advisors, and the speed at which it has been able to attract clients and assets is impressive. This enables Wealthfront to allocate your funds over eight asset classes. Learn how Acorns and Robinhood compare to. It updates and syncs to outside accounts daily and allows for Social Security data uploads. Wealthfront omits small cap and value ETFs from their lineup. Direct annual Fee : Instead of fees compounding that increase gradually, the platform charge a 0. I agree to my personal data being stored and used tastytrade stock list tos td ameritrade autotrade newsletters per Privacy Policy. The current interest payment on the cash account is 1. It compares this data to your current spending habits to determine how much you'll need. This, coupled with a slight edge in fees, make Wealthfront the better choice for most investors.

For ready cash and an emergency fund, the Wealthfront Cash Account offers a zero fee, high yield account. If you've exhausted this benefit or your state doesn't offer one, then Wealthfront offers a great alternative. They are trying to compete with the big guys by offering an aggressively competitive fee structure. The single stock selling plan is unique and a niche product for investors with a large amount of company shares. Smart beta considers factors such as investment momentum, value, dividend yield, market beta and volatility. Jump to: Full Review. Investing Apps:. It uses factors like value, momentum, dividend yield, market beta, and volatility to determine how much to invest. Brokerage Promotions Bank Promotions. See our top picks for robo-advisors. The company says it plans to add additional SRI funds as they become available. The final two sector funds cover the U.